Abstract

Networks among the business firms that own complementary resources have been identified as one of strategic means for win the today’s market. This study examines the relationship between network ties, absorptive capacity and innovativeness of SMEs in Sri Lanka. Data were collected through a structured and self-administered questionnaire directed to 350 manufacturing firms located in the Western province in Sri Lanka. Hierarchical linear regression analysis reveals that knowledge and resources embedded in network ties help focal firms to promote their innovative activities. Absorptive capacity of the SMEs is found to be as a key driver that assimilates, transforms, acquits and exploits knowledge passes through the network ties into commercial ends. Therefore, managerial attention is necessary important in developing absorptive capacity within the firms to capture the knowledge and resources embedded in the intuitional and personal networks for better innovative movements. Public policy should also be focused to address the information barriers and resource poverty of the SMEs. Such attempts would help SMEs in finding new paths for innovative activities with external knowledge comes from wider links and enhanced in-house capacities.

Keywords: Absorptive capacityinnovativenessnetwork tiesSMEs

Introduction

Innovativeness of the business firms is essentially required to meet the challenges created by the increasing competition in the today’s world and to find a competitive position in the marketplace. Network ties with various institutions that possess complementary resources are often necessary for creating a competitive position for SMEs which are generally bounded with resource poverty (Gruber, 2003; Howells, James & Malik, 2003). Networks bring important resources to the business firms in order to explore and exploit business opportunities (Dussauge, Garrette, & Mitchell, 2000; Stokes, 2003). Networks help SMEs to develop their knowledge base and minimize their exposure to technological uncertainties by bringing knowledge and resources developed by others (Lane & Lubatkin, 1998; Whittington, Johnson, & Scholes, 2005).

Although networks bring valuable knowledge and resources to the focal firms, research shows that firms with similar ties end up with differential learning and knowledge capturing (Premaratne, 2002; Wu & Cavusgil 2006). This is mainly due to the capacities that firms have in absorbing the knowledge and resources passed through the networks. Hamel (1991) shows that networks would be much benefited when focal firms have adequate capabilities to absorb the knowledge. Although prior studies (Premaratne, 2002; Thrikawala, 2011) have examined the network dynamism on the SMEs growth and development, no empirical studies have to date attempted to explore the role of abortive capacity in the Sri Lankan context. Thus, this study attempts to explore the effect of absorptive capacity on the relationship between networks and competitiveness of SMEs in Sri Lanka.

Literature Review and Theoretical Framework

Business firms may have various motives to form networks with other institutes. This is primarily motivated by the potentiality in creating competitive advantage in the marketplace (Wu & Cavusgil 2006; Premaratne, 2002; Chell & Baines, 2000). More specially, SMEs may find it beneficial to make closer ties with other firms in order to get access to the resources and opportunities which make better landscape for creating competitive advantage.

Networks play strategic role in acquisition of new knowledge and capabilities which facilitate for increasing the market power (Mowery, Oxley, & Silverman, 1996; Powell & Brantley, 1992; Colombo, Grilli & Piva, 2006; Sivadas & Dwyer 2000). More specifically,

Absorptive capacity refers the firm’s capacity to learn and is defined as “the ability of a firm to recognize new external information, assimilate it, and apply it to commercial ends” (Cohen & Levinthal, 1990). Firms that are better able to capture and apply the new external knowledge appear to have higher levels of innovation activities (Withers, Drnevich, & Marino, 2011; Flatten, Greve, & Brettel, 2011). Absorptive capacity would help firm in the fast identification and evaluation of the information and knowledge embedded in the networks. A firm without such an understanding, knowledge cannot be transferred, integrated, and developed in a meaningful manner (Withers et al., 2011; Flatten et al., 2011; Das & Kumar 2007; Inkpen, 2000; Inkpen & Currall, 2004; Kale & Singh, 2007; Liu, Ghauri, & Sinkovics, 2010).

When a firm uses networks to internalize new knowledge, it must have considerable in-house technical expertise, which can assist the firm in understanding, interpreting and realizing the benefits of knowledge gained (Larsson, Bengtsson, Henriksson, & Sparks, 1998; Das & Kumar 2007; Inkpen, 2000; Inkpen & Currall, 2004). In other words, without having sufficient absorptive capacity, formation of networks is no guarantee desired benefits (Mody, 1993; Schoenmakers & Duysters, 2006). Thus, it is postulated that absorptive capacity would mediates the relationship between network ties and innovativeness of SMEs.

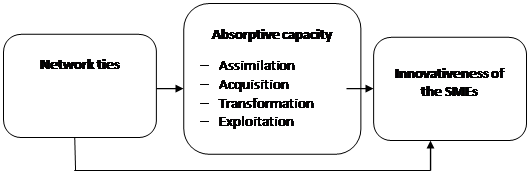

With the support of the above literature following conceptual framework and hypotheses are formulated for the present study.

-

Hypothesis I (H1): Network ties have a positive effect on innovativeness of the SMEs in Sri Lanka -

Hypothesis II (H2): Absorptive capacity mediates the relationship between network ties and innovativeness of the SMEs in Sri Lanka

Research Method

In 2017, SME sector in Sri Lanka accounts for 75 percent of total establishments while contributing 53 percent to the GDP and employing 45percent of total employments. In the last few decades, the sector was identified, by the governments, as one of key economic drivers in developing the country. With that understanding, successive governments as well as policy making bodies have implemented various programmes in empowering the sector to ensure the suitable economic growth of the country. Manufacturing SMEs in the country are the major players in the sector and they account for 96 percent of the total establishments in year 2017 (Central Bank of Sri Lanka, 2017). Thus, manufacturing SMEs of the country were identified as the study population in which 250 SMEs were drawn as the sample through a purposive sampling. The sample selection was limited only to the Western Province of the country. Key motives behind this decision are that majority of the SMEs as well as larger establishments are located in this province. In addition, key economic activities of the country are also cantered to the region and it is evident that firms in this region face high competition and dynamism when compared with SMEs in other regions of the country.

A survey method was administered with use of a structured questionnaire. The questionnaire consists of four sections. The first section was devoted to gather the demographic information about the responding firms including basic information of the owner/s and firms. The second section comprised 10 items inventory on Likert type five scale ranging from 1 (to no extent) to 5 (to greatest extent) to measure the network capacity of firms. Networking strength with a list of potential actors in the field was measured through this construct. The third section includes 8 statements on a similar scale ranging from 1 (completely disagree) to 5 (completely agree). These items were developed to measure the key capabilities associated with knowledge assimilation, acquisition, transformation and exploitation. Final section measures the innovativeness of the firms by focusing product, process, market and organizational innovation that have been done by the focal firms in recent past. A five point Likert scale was also used in this inventory included 12 items. Validity and reliability of the each constructed were ensured by performing test for construct validity and internal consistency. All the constructs met the criteria for convergent and discriminant validity as well as internal consistency of the multi-item constructs.

Hierarchical linear regression was performed to examine the effect of network ties on the innovativeness of the SMEs as well as mediating effect of the absorptive capacity in the relationship between network ties and innovativeness of the SMEs.

Findings

The hypotheses of the study were examined using hierarchical regression analysis. The analysis was performed in two stages. In the first stage, the direct effect of network ties on the competitiveness was examined. Table

In the second stage, network ties were regressed against absorptive capacity. The result (Model II) shows that the predator has ability to explain a significant variance of absorptive capacity (R2=.301). Next, the network ties and absorptive capacity were added to the regression model. The result reveals (Model III) that the model accounted significance variance of innovativeness (ΔR2 change= .190, p<.05). Moreover, network ties is insignificant when absorptive capacity was entered into the model. This implies that absorptive capacity fully mediates the relationship between network ties and innovativeness of the SMEs. Sobel test also confirms this effect (Z=9.32, p<.01). Thus, Hypothesis II is supported, indicating role of absorptive capacity in the relationship between network ties and innovativeness of the SMEs.

Conclusion and Discussions

The present study finds that knowledge come from institutional networks and personal networks pay a vital role in promoting innovative activities of the SMEs. Such networks also bring resources that are necessarily important in developing knowledge acquisition, assimilation, transformation and exploitation capacities of the SMEs. The result further indicates that firms managing wider network ties and higher absorptive capacity perform well over others in innovative activities.

Thus, it is managerial responsibility of the SMEs to look for knowledge sources by participating in institutional and personal networks. At the same time, their increasing attention should be drawn to develop in-house capabilities that can absorb the knowledge embedded in the network ties. Public policy should also focus the potential information barriers for SMEs while empowering them for innovation. Future studies are necessary for validating the findings of the present studies.

References

- Chell, E., & Baines, S. (2000). Networking, entrepreneurship and microbusiness behavior. Entrepreneurship & Regional Development, 12(3), 195-215.

- Cohen, W. M., & Levinthal, A. D. (1990). Absorptive capacity: A new perspective on learning and innovation. Administrative Science Quarterly, 35, 128–152.

- Colombo, M. G., Grilli, L., & Piva, E. (2006). In search of complementary assets: The determinants of alliance formation of high-tech start-ups. Research Policy, 35(8), 1166-1199.

- Das, T. K., & Kumar, R. (2007). Learning dynamics in the alliance development process. Management Decision, 45(4), 684-707.

- Davidsson, P., & Honig, B. (2003). The role of social and human capital among nascent entrepreneurs. Journal of Business Venturing, 18(3), 301-331.

- Dussauge, P., Garrette, B., & Mitchell, W. (2000). Learning from competing partners: Outcomes and durations of scale and link alliances in Europe, North America and Asia. Strategic Management Journal, 99-126.

- Elfring, T., & Hulsink, W. (2003). Networks in entrepreneurship: The case of high-technology firms. Small Business Economics, 21(4), 409-422.

- Flatten, T. C., Greve, G. I., & Brettel, M. (2011). Absorptive capacity and firm performance in SMEs: The mediating influence of strategic alliances. European Management Review, 8(3), 137-152.

- Gruber, M. (2003). Research on marketing in emerging firms: Key issues and open questions. International Journal of Technology Management, 26(5-6), 600-620.

- Hamel, G. (1991). Competition for competence and interpartner learning within international strategic alliances. Strategic Management Journal, 12(S1), 83-103.

- Howells, J., James, A., & Malik, K. (2003). The sourcing of technological knowledge: distributed innovation processes and dynamic change. R&D Management, 33(4), 395-409.

- Inkpen, A. C. (2000). Learning through joint ventures: A framework of knowledge acquisition. Journal of Management Studies, 37(7), 1019-1044.

- Inkpen, A. C., & Currall, S. C. (2004). The coevolution of trust, control, and learning in joint ventures. Organization Science, 15(5), 586-599.

- Kale, P., & Singh, H. (2007). Building firm capabilities through learning: the role of the alliance learning process in alliance capability and firm‐level alliance success. Strategic Management Journal, 28(10), 981-1000.

- Koza, M., & Lewin, A. (2000). Managing partnerships and strategic alliances: Raising the odds of success. European Management Journal, 18(2), 146-151.

- Lane, P. J., & Lubatkin, M. (1998). Relative absorptive capacity and inter-organizational learning. Strategic Management Journal, 19, 461-477.

- Larsson, R., Bengtsson, L., Henriksson, K., & Sparks, J. (1998). The inter-organizational learning dilemma: Collective knowledge development in strategic alliances. Organization Science, 9(3), 285-305.

- Liu, C. L. E., Ghauri, P. N., & Sinkovics, R. R. (2010). Understanding the impact of relational capital and organizational learning on alliance outcomes. Journal of World Business, 45(3), 237-249.

- Mody, A. (1993). Learning through alliances. Journal of Economic Behavior & Organization, 20(2), 151-170.

- Mowery, D. C., Oxley, J. E., & Silverman, B. S. (1996). Strategic alliances and inter-firm knowledge transfer. Strategic Management Journal, 17(S2), 77-91.

- Powell, W., & Brantley, P. (1992). Competitive cooperation in biotechnology: Learning through networks?” In networks and organizations: Structure, form and action. Eds. N. Nohria and R. Eccles.Boston, MA: Harvard Business School Press, 365–394.

- Premaratne, S. P. (2002). Entrepreneurial networks and small business development: The case of small enterprises in Sri Lanka Eindhoven: Technische Universiteit Eindhoven.

- Raz, O., & Gloor, P. A. (2007). Size really matters—new insights for start-ups’ survival. Management Science, 53(2), 169-177.

- Renzulli, L. A., Aldrich, H., & Moody, J. (2000). Family matters: Gender, networks, and entrepreneurial outcomes. Social Forces, 79(2), 523-546.

- Schoenmakers, W., & Duysters, G. (2006). Learning in strategic technology alliances. Technology Analysis & Strategic Management, 18(2), 245-264.

- Schweizer, R. (2013). SMEs and networks: Overcoming the liability of outsidership. Journal of International Entrepreneurship, 11(1), 80-103.

- Sivadas, E., & Dwyer, F. R. (2000). An examination of organizational factors influencing new product success in internal and alliance-based processes. Journal of Marketing, 64(1), 31-49.

- Stoke, D. (2003). Small Business Management, 4th edn, Thomson Learning, London

- Thrikawala, S. (2011). Impact of strategic networks for the success of SMEs in Sri Lanka. World Journal of Social Sciences, 1(2), 108-1119.

- Whittington, R., Johnson, G., & Scholes, K. (2005). Exploring corporate strategy. Pretince Hall, Harlow.

- Withers, M. C., Drnevich, P. L., & Marino, L. (2011). Doing more with less: the disordinal implications of firm age for leveraging capabilities for innovation activity. Journal of Small Business Management, 49(4), 515-536.

- Wu, F., & Cavusgil, S. T. (2006). Organizational learning, commitment, and joint value creation in interfirm relationships. Journal of Business Research, 59(1), 81-89.

- Yoo, S. J., Sawyerr, O., & Tan, W. L. (2016). The mediating effect of absorptive capacity and relational capital in alliance learning of SMEs. Journal of Small Business Management, 54(S1), 234-255.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

28 January 2019

Article Doi

eBook ISBN

978-1-80296-053-2

Publisher

Future Academy

Volume

54

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-884

Subjects

Business, Innovation, Strategic management, Leadership, Technology, Sustainability

Cite this article as:

Jayathilake, P. B. (2019). Network Ties, Absorptive Capacity And Innovativeness Of The Smes In Sri Lanka. In M. Özşahin, & T. Hıdırlar (Eds.), New Challenges in Leadership and Technology Management, vol 54. European Proceedings of Social and Behavioural Sciences (pp. 229-234). Future Academy. https://doi.org/10.15405/epsbs.2019.01.02.20