Abstract

This paper aims at evidencing how the European countries are bond to a technocratic policy that is more orientated towards an analysis of a numerical balance than an analysis of the current difficult social and economic reality. A monetary policy curried out centrally through the BCE institution, whilst fiscal policy is decentred within the single countries. These are targeted at ʽʽfacilitated flexibilityʼʼ to limit the levels of balance deficit. Moreover, the BCE will be unable to finance the public deficit until 2012 (

Keywords: DemocracyEU/European UnionGovernancepolitical economynational identity

Introduction

The current European policy is connected to two important elements, democracy and the national state, which are the bases of modern Western societies. The global economic and financial system may have to face a trilemma i.e. complete political and economic integration of worldwide economies and there may be an incompatibility between nation states and democracy (De Grauwe, 2011). The definition of this trilemma, connected to worldwide economy, was given by Dani Rodrik (Dani Rodrik is an

The frontiers of the states are becoming a very debated topic for studies on international commerce. One such example is trading carried out between two Canadian provinces, which is twenty times larger than the trading than trading between one of these two provinces and a province of the United States of America, despite the fact that they are at the same distance one from the other and have the same income levels (Krugman, 2015). This is known as the ʽʽfrontier effectʼʼ or ʽʽmissing tradeʼʼ (Ohlin, 1933) and a question can be posed i.e. why a frontier between two countries with a similar culture that speak the same language can discourage commerce? The answer is linked to a different system of rules and the nations' institutions, the presence of different rules means costs i.e. specific bureaucratic procedures must be followed, information is to be gathered and, last but not least, contracts are to be enforced.

The aforementioned topics are connected to the strategies of the political international institutions' that define rules for the liberalization and harmonization of standards for trading in the global economic system i.e. the World Trade Organization (WTO) is interested in defining agreements on foreign investments, intellectual property rights etc. Rodrik evidences that the process of negotiation to integrate and harmonize the institutional rules of the market cannot achieved due to three factors i.e. two connected to need and one to convenience (Rodrik, Subramanian, & Trebbi, 2002). The first factor is linked to the embeddedness of the national institutions in cultural models, rules and values that are connected to national frontiers. For example, Italians believe in destiny, whilst Americans in individual efforts. Indeed, the former chose redistribution systems of wealth connected to the public health, whilst the latter refuse this system. The second factor is linked to institutional differences that reinforce each other, because Italian citizens would not do without public health and the American doctor and health insurers' lobby do not support an alternative system to private health care. There is another factor connected to convenience i.e. although there is no single institutional platform compatible with the economies of the market and there are different institutional dynamics, the same levels of development may be created. Despite there being enormous differences between the United States of America, Japan and Europe they have produced similar levels of wealth and development (Friedman & Schwartz, 1961). Indeed, they have different institutions for the job market, corporate governance, social security and financial markets. This analysis becomes more complex if the developing countries' systems are evaluated. In this case if the aim is that of encouraging the development of market economy, gradual institutional reforms and innovations must be introduced, which are however, at times, very far from Western standards. A necessary condition recognized by everyone for a good operation of the economy of market is the guarantee to the right of ownership. However, China is one example of the contrary as it was able to attract large amounts of private national and foreign investments although it does not have a system of right of ownership. It introduced institutional innovations such as businesses clusters in villages, neighbourhood businesses and specific economic areas to create sufficient spaces and conditions to attract private investments without dismantling the existing political and social system (Eichengreen Hausmann, & Panizza, 2005).

Another development technique is connected to the political possibility to divide the economic jurisdiction from all governments at the costs of democratic processes, thus making economic policy rules. This topic is debated also in Europe with the ʽʽstability pactʼʼ reform, but it becomes more complex when this analysis evaluates the operation of the global political and economic system and the integration of the developing countries, that differ greatly from the Western countries.

Rodrik's analysis raises important questions, both for the global economic governance and for the definition of development strategies i.e. is it possible to continue within the economic process of integration without harmonizing rules and institutions? Rules and institutions are produced by laws and national values, thus how is it possible to distinguish between good and bad institutions? Rodrik aims at defining a positive and achievable project, connected to a global economic and political system. This system is linked to two important principles i.e. the international exchange of goods and productive factors that produce wealth, economic growth and global development. The market economy needs to work on some goals e.g. clear property rights, the application of contracts, appropriate incentives and the use of good macroeconomic trends to guarantee a monetary and financial stability, social protection and systems of wealth redistribution. These goals may be reached in different ways, depending on the single country’s preferences.

However, the recognition of specific national institutions is not in opposition to the economic process of integration. Indeed, a world without rules or laws is not a positive concept and it is important to preserve the principles connected to grant funding aimed at development only to those who recognize the basic goals of a market economy (Goodhart & Gerhard, 2002).

Literature Review and Theoretical Framework

Efficiency Market and the European Economic Policy

The European economic policy is built on a theory that evidences the negation of relationship between public spending and economic growth and a possible active role of monetary policy that is able to influence the level of income equilibrium (Arestis, 2009). An institutional asset which included countries with different levels of economic growth was made. Indeed, this economic and political area is linked to three factors i.e. 1) the separation between fiscal and monetary policies; 2) fiscal policies that manage some criteria of public spending containment; 3) a monetary policy with a single goal to keep price increases constant. Moreover, there are two more extraordinary factors in Europe i.e. a single monetary and fiscal policy which are managed by single states on a rigid budget discipline (Gros & Mayer, 2010).

This model has brought to light all the limits in managing situations such as those produced by the financial crisis of 2007. It is based on two hypothesis i.e. a) the economic system has a deterministic nature to create a spontaneous trend aimed at defining an equilibrium with full use of production capacity and labour (less than the rate of ʽʽfriction unemploymentʼʼ); b) the capacities of financial markets to anticipate the future economic trends (Smaghi, 2011).

The first hypothesis shows how the assessment of systemic shocks are not important to evaluate the operation of the economic system. If this scheme is to be followed, it is necessary to guarantee the flexibility of the market defining a convergence towards the equilibrium of full employment. Indeed, the market rigidity is evaluated has been blamed for the high unemployment rate (Delpla & Von Weizsäcker, 2010) . The second hypothesis is defined as ʽʽefficiency market hypothesisʼʼ and it evidences that financial markets are always able to evaluate the different risks connected to an excessive accumulation of private and public debt so as to anticipate the future value of the economic, financial and industrial assets, establishing the prices of bonds and shares (Corsetti & Dedola, 2011)

The financial and economic crisis of 2007 evidenced that these thesis are not valid and its effects have been shown both through the bank budgets and the real effects within the economic system, granting less credits and involving the decrease in aggregate demand. The economic and financial crisis emphasised the greater economic fragility of some countries than others and shown that the economic policy model is unbalanced (De Grauwe, 2011). The PIIGS countries do not have sufficient tools to reduce the gap in economic indices connected to territorial competiveness, public deficit and debt. They have only an economic tool connected to the possibility to modify the internal demand through wage cuts and the reduction of public shares and funds within the economic activities. However, these economic strategies may produce a worse social environment in times of crisis. In this context, the fiscal gaps and the increasing of spreads evidence the weakness of the economic systems but not the cause of the crisis. Spain is an example as its ratio debt/GDP (Gross Domestic Product) was lower than the German one between 2005-2011, but Spain was classified as a peripheral country. Indeed, an economic dynamic that shows a trend connected to the decrease in GDP and the increase in public deficit is evidenced. This pushes PIIGS to produce conservative market reforms and apply tax restrictions simply to meet European requests (De Grauwe, 2011).

However, it is important to evidence that this European Monetary Union policy may fail if it is not modified. Indeed, it is a efficient tool to restore autonomy on national economic policies to each state rather than to bear such high social costs. This strategy may provide each country with the opportunity to make democratic decisions about democratic policies. This position is supported by some countries that are at economic advantage, as they are afraid of being damage by the peripheral countries. Then, there is another political front that evidences the necessity to build a new Europe making a union policy. The real anomaly is that there is no link between the European Union and each single state that would allow them to resolve economic shocks as common problems (Winkler, 2014).

A Europe with a Common Currency but without an Economic Policy

The project linked to the European Union is an interesting case study of the globalization process. Although, there were different experiences connected to make integrated markets on a supranational political level i.e. the North American Free Trade Agreement (NAFTA), the European Economic Community (CEE) before the founding of the European Union made deleting and simplifying some tariff barriers and trade regulations easier to facilitate the free movement of goods. Instead, the European political project is connected to the deletion of the monetary union aimed at also breaking down the exchange rate barriers and the use of different currencies, making today’s political experience of the European countries unique. This economic process is connected to a creation of a single economic market diminishing the political economy tools of each country which also facilitates the free movement of goods, productive factors, European citizens and the business companies’ economic competition.

However, there were historical backgrounds connected to monetary unions i.e. the monetary union of Italy and Germany of the nineteenth century and then German monetary unification of the twentieth century. Each of these historical experiences were, at the same time, linked to a political unification process. Indeed, the European case is anomalous and unique i.e. the unification of the monetary union was not followed by a political union.

The language, flag and currency were always the marks of a national community. The former is connected to long-term dynamics but are not influenced by policy. The latter is a symbol with rhetorical meanings, whilst the last one is an important economic policy tool able to define economic and social strategies. It emphasizes how, today, economic policies of national states are classified as being less important, or even more negative than the market’s ability to self-regulate.

Free Market and European Monetary Policies

One of the European goals is that of making a free market. However, this project involved subtracting the possibility of choice within economic policies i.e. for trade and industrial policies, for monetary and exchange rate policies. Instead, agreements were used as the ʽʽTreaty on Stability, Coordination and Governance in the Economic and Monetary Unionʼʼ known as the ʽʽFiscal Compactʼʼ, linked to a resizing of national political autonomy. The Fiscal Compact is an agreement associated to fiscal policy signed by the countries in the European Union. It enforces some limits on the GDP debt ratio and the deficit to GDP ratio. There are three principal elements in the treaty i.e. the balance of the budget that is an equilibrium between fiscal revenue and outcomes, a public debt limit of 3% of GDP and then a debt to GDP ratio of 60%. It is important to evidence how the budget balance was transposed like a constitutional law because it is a strategy to strengthen its legal value surpassing ordinary laws (De Grauwe & Ji, 2013).

However, the main question is connected to the transfer of national sovereignty to a communitarian institution of a higher political level, in as much as a lot of countries do not use the available tools of micro and macro economy. The European communitarian area transferred the monetary policy to the European Central Bank (ECB) (De Grauwe, 2012). This strategy was in error as firstly the ECB is not a political or democratic institution and does not have popular consent, it is more a technical institution and independent from policy. The division between ECB and policy is founded on a specific need linked to a separation between ECB's medium-long term goals and those of the Government (Cohen, 1991). This division has the scope of obtaining the government’s consensus, which risks a weakening of the monetary and financial stability (It is the application of the principle of power division in the economic policy branch.) (Von Hagen, 2007; Von Hagen & Wolswijk, 2010). The ECB foundation differs from the other financial and economic systems such as the Federal Reserve because the ECB does not dialogue with a government as the Federal Reserve does. Thus, ECB was founded without having all the powers that a lot of national banks have, which is yet another anomaly of the European economic and financial system. This European institution followed the rules of the ʽʽmonetarism theoryʼʼ and its statute assigns it only one task i.e. the defence of the price stability (Buiter, 2008; Wyplosz, 2012).

The monetarism theory evidences how the monetary policy is not efficient in modify the income and employment level and unable to define an anticyclic policy to contrast the negative effects of recession (Barro & Gordon,1983). The only effect of a monetary policy is that of increasing or decreasing inflation. Indeed, this scheme is connected to the monetary policy that is able to maintain the inflation level low, thus guaranteeing price stability. Section 2A of the FED's statute is important because it evidences how ʽʽthe Board of Governors of the Federal Reserve System and the Federal Open Market committee shall maintain long run growth of the monetary and credit aggregates commensurate with the economy's long run potential to increase production, so as to promote effectively the goals of maximum employment, stable prices, and moderate long-term interest rates (http://www.federalreserve.gov/aboutthefed/fract.htm) However, it must be said that the FED's policy has not always been aimed at obtaining full employment, and rather applied policies linked to a strong monetary contraction. Indeed, this had recessive effects on incomes and employment. The FED always maintained a dialectical relationship with the President in office, choosing the best compromise between its two main goals, something which is not allowed in the ECB (Goodfreind, 2011).

These two strategies led to different actions between the ECB and the FED i.e. the former has had a more conservative policy than the latter over the last twenty years, placing more importance on the stability of prices than contrasting the economic cycle trends (De Grauwe, 2014).

Research Method

European Spaces between Wage Deflation and Structural Unemployment

The European Union is an Optimal Currency Area (OCA), which is an economic model produced by Robert Mundell (1961) that won the Nobel Prize in 1999. He evidences some necessary features of countries with the aim of creating an optimal currency area where economic advantages would be higher than the costs (Bagnai, 2012). It analysed whether it was advantageous for a group of countries to adopt only one currency. The theory is simple, for example if you consider two countries, X and Y, the main cost connected to their monetary union is the loss of their exchange rate instrument that would be useful if these two countries were affected by an external asymmetric economic shock such as if one of theme is more affected then the other or if they have dissimilar economic levels and productive factors producing different reactions to the external shock (Von Hagen & Hammond, 1998). Thus, if the competiveness level of X were to increase and that of Y decrease, then the income and employment of Y would decrease whilst the income and employment of X would take the opposite direction. Indeed, it would produce a trade imbalance in favour of X i.e. the trade balance - the difference in value between export and import - of Y worsens whilst that of X improves. Then, the short term result would be that Y could devalue its exchange rate to contrast the economic crisis to automatically increase the price levels of X leading the competiveness towards pre-crisis levels and rebalancing the trade balance. However, if X and Y take part in an OCA the strategy of devaluation cannot be carried out. It is important to evidence that the loss due to devaluation is low if the countries are integrated with one another and have similar economic factors using alternative instruments to play the same role of the exchange rate. However, there are some advantages for the countries that use this economic strategy i.e. lower transaction costs for the economic traders, lower foreign exchange risk costs to make investments or exchanges and a more transparent price system which can increase the level of competition and trade flows between the OCA countries. This model reports another positive effect connected to the a single currency that should be able to increase commerce in the European area, even if some studies emphasise that the influence monetary union has a low impact (Glick & Rose, 2015).

There are fewer economic benefits linked to the European Union than disadvantages. Mundell’s analysis states that the condition of integration is not verified i.e. some European countries have more similar economic trends than others within the same area so that they have asymmetric economic dynamics compared to the crisis or divergent levels of competiveness over time (De Grauwe, 2014).

However, it is important to note that there are other instruments able to contain the monetary union costs i.e. the economic system structure and the economic policy. If the employment and goods markets were sufficiently flexible both for prices and workers' mobility there would be no need for exchange rate variation i.e. the contraction of economic demand in Y would lead to a decrease in prices and wages whilst it would be the opposite in X. The relative prices of Y goods compared to those of X is E (Py/Px) i.e. the real exchange rate, where Py is the level of prices in Y, Px is the level of prices in X and E is the nominal exchange rate. Then, it reduces the economic shock effects lowering the ratio of the real exchange rate to make the goods cheaper than those of X i.e. it is a strategy to redistribute the demand between the two countries in opposite direction in reaction to the initial shock. As the exchange rate is fixed in a monetary union, it can decrease only if there is an internal devaluation (There is also the external devaluation connected to a variation in the exchange ratio.) through the decrease in Py or an increase in Px i.e. there is a variation of internal prices. It must be a symmetric system i.e. when Y decreases, on the contrary wages and prices in X increase. If X were to decide to apply economic policies it cannot increase prices or wages in Y, that would have to decrease prices and wages in more absolute terms so as to obtain the same relative effect. However, this strategy would create some problems, such as a decrease in the internal demand in the monetary union and an increase in the recessive effects of the initial shock. Therefore, X strategy would transform the effects of the initial economic shock into a permanent shock in the trade balance. Therefore, it is important to emphasise that the workforce mobility can facilitate economic adjustment because the Y workforce i.e. where the job demand is decreased would move into X where the job demand is increased so as to reduce the effects of the economic shock.

However, the European countries currently do not have these levels of flexibility in wages and prices and there is a low mobility of the workforce, also due to linguistic barriers and other non-monetary costs. The ʽʽstructural reformsʼʼ are connected to these economic systems which have a scarcity of flexible laws for the job market able to decrease wage levels. This strategy is also aims at making the goods and service markets more competitive, thus activating liberalization and privatization processes.

It must be noted that the disciplinary role of a single currency forces the European governments to produce numerous political reforms, that they would not otherwise have done, which mainly affect the countries in deficit. The Monetary Union is founded on a ʽʽmonetarist ideologyʼʼ that provides the European governments with two strategies (Calvo, 1988). The first is connected to the inefficiency of the monetary policy to contrast the negative economic cycle phases. The second is linked to the market capacities i.e. the free competition between companies and workers within the European Union. This model discusses the problems in the OCA theory that states would have been overcome thanks to the economic market capacities to reduce the economic and social gaps. Another goal of this model is that of increasing the economic symmetries between the different European countries and the competitiveness of the economic policies through economic structural reforms, leading to internal devaluation processes (Krugman, 2010).

Phillips’ Curve – a Scientific Model to Explain the European Policy

The inflation limit is fixed up to 2% in the European Union, because it is linked to the historical German experience (Gerner-Beuerle, Kücük, & Schuster, 2014)

The introduction of the Phillips’ curve shows how the worker's contractual strength changes on the basis of the income and unemployment levels i.e. if the unemployment level is high, the workers' contractual strength is reduced, because they compete with one another for an occupation, creating a situation of low offers. Instead, when the unemployment rate is low the workers' contractual strength is stronger and the variation wage rate is high. Therefore, the job is the only variable productive factor in the macroeconomic models, introducing a direct relationship between

rate, accepting an increase in inflation. The economic policy authorities cannot obtain full employment or stabile prices without a high inflation rate, it is a trade-off.

The dynamics that make up inflation are connected to two factors, the first is the mechanism that creates wages and prices and the second is linked to the economic authority policy that must increase the currency quantity to the same level as the inflation rate. The Phillips' model is connected to a stagflation economic trend that evidences a low income increase and a high inflation, showing a direct relationship between income and inflation.

Indeed, some European policies are linked to these dynamics, because if the inflation is to be kept at a level of 2%, the market is to be connected to two social and economic factors, the first is the creation of a market with a wage deflation trend to re-establish competitiveness within the European economic system. The second is the creation of a flexible job market, the creation of instruments of law aimed at obtaining a structural unemployment (Fig.

Conclusion and Discussions

As Rodrik evidenced, it is impossible to reconcile globalization, democracy and national independency from economic policies. Indeed, the markets are ever more globalised, leading the socio-economic policies to define a more ample political level, emphasising the need not to have a national management of economic policies. There can be no relationship between democracy, independency and globalization. Indeed, if the current economic and financial system is accepted, democracy has to pay the price. As aforementioned, the globalization system reduces the contractual power of national democracies, leading to a economic and social pauperisation. An inefficient European project may accentuate the crisis rather than contrast it, leading to some countries making do with a national strategy in an attempt to save their democracies and economies (Watson, 2001).

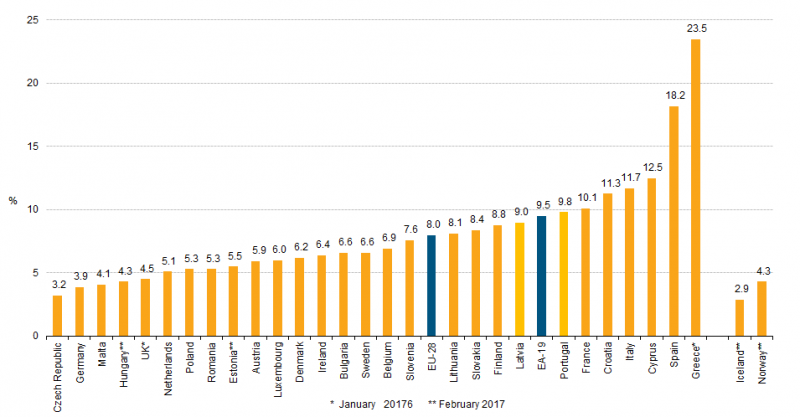

In this context, the trend towards fiscal imbalance and the increase in the spread are clear signs of economic weakness. The current economic dynamics produce a decrease in GDP and an increase in deficit, leading the PIIGS (Portugal, Ireland, Italy and Greece) to legislate economic and political laws involving tax restrictions and structural job reforms, simply to respond to European demands. In this way, these countries produce heavy economic costs and their citizens must pay the price of these policies that will most likely prove to be useless, in the absence of a monetary policy able to help them i.e. one aimed at introducing liquidity through the banking chain into the economic markets to help the productive system and stabilize the interest rates of public debt securities. However, a different political strategy could reverse the trend created by the current political strategy. Such a new political strategy should include a larger political plan for the national environment, redefining the globalised market roles (Kopf, 2011).

The different forms of globalization can produce political conflicts, the intensity of the conflict depends on the stage of globalization, state of the business cycle, and other factors. The basic economics of trade and financial integration, the politically conflictive nature of globalization are not a surprise. The models with which international economists work tend to have strong redistributive implications. Indeed, the real strategy is that the world economy could achieve such high levels of openness in recent decades and maintain it for so long (Reinhart & Rogoff, 2009).

One conclusion is that the simple economics of globalization is not particularly auspicious compare to its political sustainability. This is true of the advanced phases of globalization – what Rodrik called elsewhere ‘‘hyperglobalization’’ (Rodrik, 2011), in which the connections between political/distributive costs and economic gains is principally unfavourable. Historically, the unification of national markets has required an unequivocal political project led by a strong central executive. Nothing comparable exists globally, and the European experience provides ample reason to be skeptical that something like that can be achieved even regionally. In a world divided politically, markets face strong centrifugal forces as well (Rodrik, 2018).

The globalization benefits are distributed unequally because our current model of economic system is built on an asymmetry. Our trade agreements and global regulations are planned largely on the needs of capital in mind (Obstfeld, 1989, 1995). Trade agreements are designed with a business-led agenda. The implicit economic model is linked to the concept of trickle-down: make investors happy and the benefits will eventually flow down to the rest of society. The interests of labor – good pay, high labor standards, employment security, voice in the workplace, bargaining rights – get little lip service (Rodrik, 2018).

References

- Arestis, P. (2009). The new consensus in macroeconomics: a critical appraisal, in G. Fontana & M. Setterfield (Eds.), Macroeconomic Theory and Macroeconomic Pedagogy, Houndmills: Palgrave Macmillan.

- Bagnai, A. (2012). Il tramonto dell'Euro, Reggio Emilia: Franco Aliberti.

- Barro, R., J. & Gordon, D., B. (1983). Rules, Discretion and Reputation in a Model of Monetary Policy. National Bureau of Economic Research, 1079, 1-35.

- Bindseil, U., Manzanares, A. & Weller, A. (2004). The Role of Central Bank Capital Revisited, Working Paper Series, European Central Bank, Paper no. 392.

- Buiter, W. (2008). Can Central Banks Go Broke?, Retrieved from https://voxeu.org/epubs/cepr-reports/can-central-banks-go-broke.

- Calvo, G. (1988). Servicing the Public Debt: The Role of Expectations, American Economic Review, 78 (4), 647‐661.

- Cohen, D. (1991). Private Lending to Sovereign States: A Theoretical Autopsy, Cambridge, Massachusetts: MIT Press.

- Corsetti, G.C. & Dedola, L. (2011). Fiscal Crises, Confidence and Default. A Bare-bones Model with Lessons for the Euro Area, Cambridge: Cambridge University.

- De Grauwe, P., & Moesen, W. (2009). Gains for All: A Proposal for a Common Eurobond, Intereconomics,1-4.

- De Grauwe, P. (2011). The Governance of a Fragile Eurozone. Retrieved from http://www.ceps.eu/book/governance-fragile-eurozone.

- Delpla, J., & Von Weizsäcker, J. (2010). The Blue Bond Proposal. Retrieved from http://bruegel.org/wp-content/uploads/imported/publications/1005-PB-Blue_Bonds.pdf.

- De Grauwe, P. (2011). Balance budget fundamentalism. Retrieved from https://www.ceps.eu/publications/balanced-budget-fundamentalism.

- De Grauwe, P. (2011). Euro-zone bank recapitalization: pouring water in a leaky bucket, Retrieved from https://www.ceps.eu/publications/eurozone-bank-recapitalisations-pouring-water-leaky-bucket.

- De Grauwe, P. (2012). The European Central Bank: Lender of Last Resort in the Government Bond Markets?. In F. Allen F, E. Carletti & S. Simonelli, Governance of the Eurozone: Integration or Disintegration, Wharton Financial Institutions Center, Philadelphia, PA: FIC Press, 17-28.

- De Grauwe, P. & Ji, Y. (2013). Panic-driven austerity and its implication for the Eurozone, VoxEU. Retrieved from http://www.voxeu.org/article/panic-driven-austerity-eurozone-and-its-implications.

- De Grauwe, P. (2014). Economic theories that influenced the judges of Karlsruhe, VoxEU. Retrieved from http://www.voxeu.org/article/economic-flaws-german-court-decision.

- Eichengreen B., Hausmann, R., & Panizza, U. (2005). The Pain of Original Sin. In B. Beichengreen & R. Hausmann (Eds.), Other people’s money: Debt denomination and financial instability in emerging market economies, Chicago: Chicago University Press.

- Friedman, M. & Schwartz, A. (1961). A Monetary History of the United States 1967-1960, Princeton: Princeton University Press.

- Gerner-Beuerle, C., Kücük, E., & Schuster, E. (2014). Law meets economics in the German Federal Constitutional Court, London School of Economics, unpublished.

- Glick, R., Rose, K. (2015). Currency Unions And Trade: a Post-Emu Mea Culpa, National Bureau of Economic Research. Retrieved from http://www.nber.org/papers/w21535.

- Goodfriend, M. (2011). Central Banking in the Credit Turmoil: An Assessment of Federal Reserve Practice. Retrieved from http://www.carnegie-rochester.rochester.edu/April10-pdfs/Goodfriend.pdf.

- Goodhart, C. & Gerhard I. (2002). Financial Crises, Contagion, and the lender of last resort, a Reader, Oxford: Oxford University Press.

- Gros, D. & Mayer, T. (2010). Towards a European Monetary Fund. Retrieved from https://voxeu.org/article/towards-european-monetary-fund.

- Kopf, C. (2011). Restoring financial stability in the Eurozone. Retrieved from https://www.ceps.eu/publications/restoring-financial-stability-euro-area.

- Krugman, P. (2010). Debt Deleveraging and the Liquidity Trap. Retrieved from: http://www.voxeu.org/article/debt-deleveraging-and-liquidity-trap-new-model.

- Krugman, P. (2015). Economia Internazionale, Milano: Pearson.

- Mundell, R. (1961). A Theory of Optimum Currency Area. The American Economic Review, 51, 657-665.

- Obstfeld, M. (1986). Rational and self-fulfilling balance-of-payments crises, American Economic Review, 76, 72-81.

- Obstfeld, M. (1995). International capital mobility in the l990s. In P.B. Kenen (Eds.), Understanding interdependence: The macroeconomics of the open economy, Princeton: Princeton University Press.

- Ohlin, B. (1933). Interregional and International Trade, Cambridge: Harvard University Press.

- Reinhart, C. M., & Rogoff, K. (2009). This Time is Different, Princeton: Princeton University Press.

- Rodrik, D., Subramanian, A., & Trebbi, F. (2002). Institutions rule: the primacy of institutions over geography and integration in economic development national. Bureau of Economic.

- Rodrik, D. (2011). The Globalization Paradox: Democracy and the Future of the World Economy, New York and London: W.W. Norton.

- Rodrik, D. (2018). Populism and the economics of globalization. Retrieved from https://drodrik.scholar.harvard.edu/files/danirodrik/files/populism_and_the_economics_of_globalization.pdfSchuknecht.

- Smaghi, B. L. (2011). The challenges facing monetary policy. Retrieved from http://lorenzobinismaghi.com/documents/interventi/2011/Bologna.

- Von Hagen, L. J. & Wolswijk G. (2010). Government Bond Risk Premiums in the EU Revisited the impact of the financial crisis. Retrieved from https://www.ecb.europa.eu/pub/pdf/scpwps/ecbwp1152.pdf.

- Von Hagen, J. (2007). Achieving Economic Stabilization by Sharing Risk within Countries. In R. Broadway & A. Shah (Eds.), Intergovernmental Fiscal Transfers, Washington: World Bank.

- Von Hagen J., & Hammond G. (1998). Regional Insurance against Asymmetric Shocks: An Empirical Study for the European Community, The Manchester School, 66, 331-353.

- Watson, M. (2001). International capital mobility in an era of globalisation: adding a political dimension to the 'Feldstein–Horioka Puzzle', Politics (Oxford), 21, 81-92.

- Winkler, A. (2014). The Federal German Constitutional Court Decides Which Theory of Finance is Correct, New York: Mimeo.

- Wyplosz, C. (2012). The ECB’s trillion Euro bet, Retrieved from http://www.voxeu.org/article/ecb-s-trillion-euro-bet.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

28 January 2019

Article Doi

eBook ISBN

978-1-80296-053-2

Publisher

Future Academy

Volume

54

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-884

Subjects

Business, Innovation, Strategic management, Leadership, Technology, Sustainability

Cite this article as:

Rosati, U. (2019). The European Economic And Financial System Between Wage Deflation And Structural Unemployment. In M. Özşahin, & T. Hıdırlar (Eds.), New Challenges in Leadership and Technology Management, vol 54. European Proceedings of Social and Behavioural Sciences (pp. 204-216). Future Academy. https://doi.org/10.15405/epsbs.2019.01.02.18