Abstract

The article deals with the functions of the basic subjects of special regional economic zones of agro-industrial type. So the main task of the state is to carry out the protectionist policy addressing the resident companies that involves: income tax relief if the company uses the general taxation scheme; unified agricultural tax relief if the company uses a special taxation scheme. Also minimization of contributions to social funds and possibility of accelerated capital allowances used in the production process are provided. The basic residents of special economic zones of regional level of agro-industrial type are peasant (individual) farms, organizations producing or processing agricultural goods, trading companies and scientific institutions. Their functioning within one special zone will allow providing the organizations with raw material and producing goods with the high level of profitability. This will positively influence the competitiveness of the domestic production and agricultural enterprises will become more attractive for investors. Besides, scientific institutions are of high importance for the functioning of the residents of special economic zones; on the one hand, they will produce innovative ideas and, on the other hand, they will have the possibility to test all the proposed innovations very quickly. The Irkutsk region can be used for locating special economic zone of regional level of agro-industrial type, as it is considered as a zone of risk farming; therefore, the agriculture production is accompanied by additional risks and needs to be supported.

Keywords: Special economic zonesagriculture development

Introduction

When preparing for the 25th APEC summit, V.V. Putin mentioned that the problems of food security should be solved collectively, and the Russians should think how to meet the rapidly growing region’s demands for good healthy foodstuff. He said that Russia was going to become the leading supplier of the organic foodstuff for our neighbours in APR and they took measures to boost the agricultural production and its productivity (Putin, 2017, para. 12).

Currently, Russia is really a leader in export of corn, oils, fish and other goods in the world; however, the problem of ensuring food security has not been solved yet. The implemented food embargoes in response to the sanctions give the domestic agricultural companies a “chance”, but some factors prevent them from taking it: low income rate and, consequently, outdated inventory and logistics management, lack of skilled employees and innovations. This situation is especially characteristic of Siberia and the Far East.

Problem Statement

Crisis phenomena appeared in September of 2015 continue to undermine the country’s economy as a whole and the agriculture in particular. It is expressed by the reduction of wages and workplaces, lower production and investments, deficit of the federal and regional budgets. Under these conditions, direct promotion of the production is impossible due to such objective reasons as lack of budget funds, high production and financial risks, low level of innovations etc. Therefore, the state must find some stimulus measures to boost the growth of agricultural production via creation of the agro-industrial growth areas, namely, special economic zones of regional level of agro-industrial type.

Research Questions

The agricultural growth is of great interest in many countries of the world as this very industry is the key factor of ensuring the food security. Many scientists agree that the perspective mechanism of solving this problem is Public Private Partnership, among them there is Chimhowu (2013), Spielman, Hartwich & Grebmer (2010), Ferroni & Castle (2011), Ponnusamy (2013). The influence of special economic zones on agriculture was studied in the scientific works by (Singh) (2009), Pakdeenurit, Suthikarnnarunai, and Rattanawong (2014), Nada Farid, (2009), Farole (2008), Bernstein, (2012), Milberg & Amengual, (2008), Murray (2013), Chaudhuri (2010), More (2015) and others.

Despite the significant number of scientific studies in Russia this issue was not fully researched, therefore, the question of agricultural development by means of creation of special economic zones of agro-industrial type remains open. Thus, it is necessary to take into account the natural climatic conditions of the entire country and of its regions, specificity of law and taxation systems, the level of interrelation between the producers and processers of the agricultural produce. All the above-mentioned aspects prove the topicality of the research.

Purpose of the Study

The purpose of the research is to propose special economic zone of regional level of agro-industrial type as an instrument of the agricultural development including tax reliefs.

Research Methods

In the given research the methods of scientific cognition were used, particularly, comparative analysis, time-series study, an analytical smoothing method; they were used when characterizing the structure and dynamics of tax payments to the budget.

Findings

A special economic zone (SEZ) is a part of the territory having a special scheme of business activity performance (Federal Law, 2015).

Nowadays, there are 24 special economic zones of four types in the territory of the Russian Federation: industrial production zones, technology development zones, port zones, tourism and recreation zones.

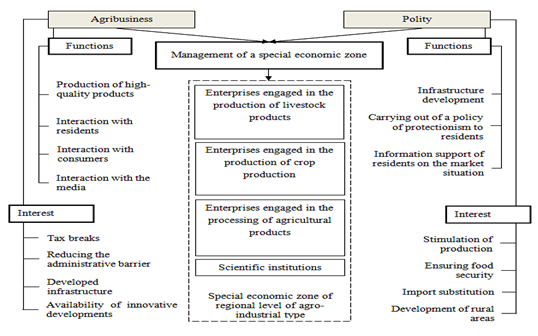

It should be mentioned that in a situation of budget funds deficit, it is quite difficult to create special economic zones of the federal level; that is why it is necessary to develop special economic zones of the regional level that must be extremely specialized. Thus, it makes sense to create a special economic zone of regional level of agro-industrial type (SEZ RL AIT) – such territory where the participants’ activity is aimed at the development of high-profitable, competitive agricultural producers and processers of the agricultural goods. This form of PPP has a number of advantages and the functions are divided between the polity and business (Fig.

Agricultural production is a risky type of activity as the natural climatic conditions have a significant impact both on crop and animal productions. When producing crop, the main obstacle for high and sustainable yields is bad weather conditions: droughts, frosts, strong winds, hot winds, hail, little snow, floods etc. Poor crop will have a negative impact on animal breeding; the fodder will be of low quality and in small quantity. Lack of warmness will lead to additional expenditures for supporting the life of animals via the construction of the stout farms, heating systems, etc. It will cause the growth of the cost price of the agricultural produce that will have a negative impact on the financial indicators of the company’s performance. The scientific advances allow weakening the impact of the natural climatic conditions up to certain limits (for example, irrigation under the arid conditions).Therefore, it is essential to create special economic zones of regional level of agro-industrial type primarily in the areas of risk farming as it will allow decreasing the business risks by the following means: close interaction between the parties themselves and between the parties and the state; different insurances and reinsurances arising on this basis; avalized promissory notes; hedging of investment risks, etc. This type of close cooperation will help to attract investors.

It should be mentioned that the entire territory of the Russian Federation is an area of risk farming and the Irkutsk region is a part of this area. In this region, the agricultural production increases insignificantly. To stimulate the agricultural production, the regional public task-oriented program “Development of Agriculture and Support of Development of Markets of Agricultural Produce, Raw Materials and Food for 2014-2020” was implemented but it is too early to speak about its efficiency.

In the Irkutsk region as well as in Russia, agriculture relates to the industries where the share of processing and skilled labour is large and there is no possibility to sell the produce at a higher price. Consequently, the companies are doomed to terminate their activity, otherwise, they must hide their gains from taxation by paying the employees “black money”, creating fly-by-night companies and cashing in of money via them with the help of sham contracts, etc. It is done to pay the employees decent wages for their labour.

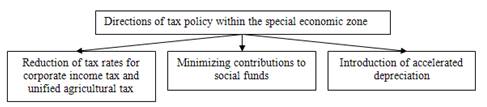

It should be noted that the main incentive of the agricultural development within the proposed special economic zone is tax reliefs. So one of the priorities of the tax policy related to the residents of SEZ RL AIT must be reduction of tax rates with simultaneous stimulation of the investing activity. This policy should cover three main directions (Fig.

The first direction is related to the reduction of tax rates for corporate income tax (if the company uses the general taxation scheme) and for unified agricultural tax (if the agricultural producers use a special taxation scheme).

In Russia the rate of income tax is 20%; 3% of them go to the federal budget and 17% (in 2017-2020) – to the budgets of the RF regions. The legislative bodies of the RF regions can reduce the tax rate for the definite categories of taxpayers but not more than to 13.5% (12.5% in 2017-2020). The rate may be even lower: for residents (parties) of special economic zones and free economic zones (item 1.7, para.1, art. 284 of Tax Code of the Russian Federation).

By results of 2016, it should be noted that payments of corporate income tax grew by 13.9 bln roubles or by 48.5% in comparison with the previous year. The basic amount of the higher summed-up payments was paid by the oil-production enterprises (5.7 bln roubles) and subsidiaries of banks and financial institutions (5.49 bln roubles). Besides, the companies of other types of activity administrated at the regional level also ensured the growth of the income tax payments – by 1.06 bln roubles or by 11.2%, the share of income tax payments increased by 5.5 percentage points. However, in 2015-2016 the income tax payments of the agricultural companies were not more than 167 bln roubles reflecting their small contribution to the budget revenues.

The federal legislation implies the possibility of reducing the rate of corporate income tax for residents of special economic zones (Federal Law, 2014), so the author proposes the terms similar to the terms offered for resident companies of priority social and economic development areas whose activity is regulated by the Law of the Irkutsk region, №91-OZ of 3 November 2016, namely, 0% during the first five fiscal periods and 10% - during the next five fiscal periods.

Unified agricultural tax (UAT) is a local tax and it goes only to the regional budget. The tax rate is 6%. In 2016 in the structure of the revenues of the Irkutsk region’s consolidated budget, the share of UAT was 6.8%, it was 0.3 percentage points higher than the similar indicator of the previous year, upon that the payments decreased 0.3 bln roubles and amounted 107.3 bln roubles. For resident agricultural producers using UAT, the same terms are proposed, namely, 0% during the first five fiscal periods and 3% during the next five fiscal periods.

In the author’s opinion, the given tax reliefs are affordable for the region as, firstly, the share of the given tax payments to the budget by the agricultural companies is not big and, secondly, not all of the agricultural producers of the region will be residents of special economic zone of regional level of agro-industrial type.

Therefore, the share of the tax bites of the legal bodies’ income will reduce and be directed to income growth and investing activity.

The second direction of decreasing the tax burden involves minimization of contributions to social funds (pension capital fund, social insurance fund and compulsory medical insurance fund).

According to art. 426 of the RF Tax Code in 2017-2019, the contribution rates are as follows: for the compulsory pension insurance – 22%, for the compulsory social insurance – 2.9%, for the compulsory medical insurance – 5.1%. Though art. 427 of the RF Tax Code involves decreased contribution rates. As residents of special economic zone of agro-industrial type will produce strategic goods, it makes sense to create for them conditions that are the same as for the taxpayers mentioned in item 3, para. 1 of the given article (Russian organizations than work in the field of information technologies): for the compulsory pension insurance – 8%, for the compulsory social insurance – 2%, for the compulsory medical insurance – 4%.

This direction will help to reduce the tax burden of the organizations and to allocate funds released to higher employees’ wages that will increase their interest and productivity.

The third direction involves stimulation of the investing activity by means of implementing accelerated capital allowances used in the production process (according to art. 259.3 of the RF Tax Code the increase coefficient cannot be more than 2). As a result of this, not only the reduction of taxable profit will occur (by 20-30%), but the faster replenishment of depreciation fund as well. It will allow avoiding the inflation influence partially and renewing and replenishing the material and technical basis regularly.

Thus, the proposed tax reliefs in the context of protectionist policy related to residents of special economic zone of regional level of agro-industrial type will allow reducing the price cost of the produce that will make it more competitive both at the domestic and foreign markets. Therefore, such policy is aimed at import substitution and stimulation of food export. Under these conditions, the growth of commodities turnover and profitability of general activity can be observed and this, consequently, will cause the growth of payments of corporate income tax and UAT regardless of the given tax reliefs.

The possibility of using the accelerated depreciation will create favourable conditions for the residents’ re-investment of their profit and this will lead to the growth of production volumes and quantity of the well-paid workplaces. Therefore, tax reliefs are a perspective instrument of creation of the favourable conditions and development of agriculture. Besides, taxation policy is an indirect method of the public regulation as it does not contradict the requirements of WTO.

One of the public functions when creating special economic zone of regional level of agro-industrial type is infrastructure construction. Primarily, a business and administrative center should be built; there will be residents’ offices, exhibit halls, meeting halls in it. It will help to create the conditions for solving of the majority of problems related to business activity without leaving the territory of special economic zone. Besides, it is necessary to house administration offices of the regional Ministry of Agriculture, banks, insurance companies, scientific institutions rendering definite services to the organizations. It should be noted that at this very stage the workplaces are created.

Significant investments should be made by both the public and businesses as to get the status of a resident of special economic zone of regional level of agro-industrial type, one must make the definite contribution and additional investments for the construction of manufacturing entities.

There are the following agricultural producers in the territory of the region: private (subsidiary) farms, peasant farms and agricultural enterprises. Primarily, creation of a special economic zone of regional level of agro-industrial type addresses the last two groups of producers. Though private (subsidiary) farms may unite to create a production or processing cooperative and get the status of resident.

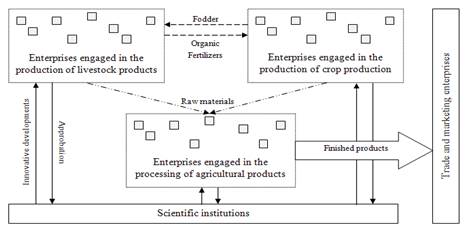

Peasant farms usually produce the raw material. The status of the resident of a special economic zone will help them to sell the produce to the organizations processing the agricultural goods. Agricultural organizations that do not have their own processing lines may get the similar advantageous possibilities.

Enterprises that produce and process the agricultural goods can buy the raw material from the other residents and process it when their own production does not allow making use of their capacities in full. This form of interaction is very important for the Irkutsk region as the capacity utilization of processing the agricultural produce is rather low, for example, the capacity utilization related to milk was not more than 60% during the last decade.

The possibility of making contracts for the raw material delivery with several companies will make the latter compete; therefore, the price of the agricultural produce will increase and it will be another incentive for small agricultural companies and peasant farms.

The possibility of increased specialization should be also paid attention to if the companies produce livestock products, as in the context of special economic zone of regional level of agro-industrial type it is easier to find fodder suppliers among the residents.

The status of resident for the companies producing agricultural goods will allow producing the goods under a single brand; it will make the goods recognizable not only at the market of the Irkutsk region but at the markets of the Siberian Federal District. Besides, the expenditures for advertisements will be minimized and it will boost the profitability growth. The scheme of interaction between the residents of special economic zone of regional level of agro-industrial type is shown in Figure

The dynamic development of special economic zone of regional level of agro-industrial type is impossible without the innovative component ensured by scientific institutions. Interaction between the residents and science will make the modern inventions in agricultural production methods and technology available for the companies and it will allot new tasks for the scientists. So this interaction will allow testing innovative approaches and implementing them rapidly if they are efficient. Besides, there is a possibility of training skilled workers with regard to specificity of the industry and definite resident company. All the above-mentioned factors will help to boost the productivity and to reduce the cost price of the produce (Nechaev, Antipin & Antipina 2014; Tyapkina, Ilina & Mongush, 2016).

There are many scientific institutions (agricultural university, technical university etc.) in the Irkutsk region that have innovations, inventions and are ready to offer them to the companies; they can also improve the existing technologies and offer new ideas addressing the needs of the definite company. The positive experience of such interaction can be used by other agricultural producers of our region, of the Siberian Federal District and of our country.

Conclusion

The main advantage of creation and functioning of special economic zones of regional level of agro-industrial type is stimulation of the agriculture development by means of tax reliefs. As a result, the residents produce their agricultural goods with less expenditures; consequently, the profitability of these companies increases, the produce becomes more competitive both at the domestic market and at the foreign one. This policy implemented within the territory of a single region allows increasing its food provision and exporting the produced goods.

Besides, one of the main advantages of the proposed form of interaction between the state and agribusiness is reduction of administrative barriers that, in the companies’ opinion, will help to solve the problems quickly and decrease the transactional expenses.

It should be mentioned that when creating special economic zones, the synergistic effect is achieved; it implies the achievement of economic and social effects. Particularly, the production volume growth will cause the increase of tax payments despite the proposed tax reliefs. Social effect means the development of rural infrastructure, creation of workplaces, wages growth that will boost the consumption of the produce.

So to develop the agro-industrial sector, accelerate the re-equipment, modernize the agricultural production and create new workplaces it is necessary to establish the areas of agro-industrial growth, namely, special economic zones of regional level of agro-industrial type that facilitate the interaction between the state, science and companies engaged in producing, processing and selling the agricultural produce.

This type of interaction will help to decrease the financial risks and to increase the profitability of agricultural enterprises; it will attract investments and facilitate the growth of the regional economy. The innovations proposed by scientific institutions will allow the enterprises to improve the soil condition and its fertility, to implement the innovative technologies in crop and animal productions within the shortest possible time and, besides, this interaction will help to solve the recruitment problems.

References

- Bernstein, A. (2012). Special Economic Zones: Lessons for South Africa from international evidence and local experience. Johannesburg: The Centre for Development and Enterprise. Retrieved from https://issuu.com/cdesouthafrica/docs/sezs_full_report__1_

- Chimhowu, A. (2013). Aid for Agriculture and Rural Development: a Changing Landscape with New Players and Challenges. World Institute for Development Economic Research (UNU-WIDER), 2013-014, Retrieved from https://www.wider.unu.edu/sites/default/files/WP2013-014.pdf

- Dharminder, S. (2009). Impact of Special Economic Zones on the Agriculture Sector. Mainstream, 38, Retrieved from http://www.mainstreamweekly.net/article1603.html

- Farole, T. (2008) Special Economic Zones: Performance, Lessons Learned, and Implications for Zone Development. The multi-donor investment climate advisory service managed (FIAS) by the International Finance Corporation (IFC) and supported by the Multilateral Investment Guarantee Agency (MIGA) and the World Bank (IBRD), The World Bank, Washington DC

- Federal law on public-private partnership, municipal-private partnership in the Russian Federation, 224-FZ (2015). Retrieved from http://www.consultant.ru/document/cons_doc_LAW_182660/

- Federal law on the territories of advanced social and economic development in the Russian Federation, 473-FZ (2014). Retrieved from http://www.consultant.ru/document/Cons_doc_LAW_172962/

- Ferroni, M., & Castle P. (2011). Public-Private Partnerships and Sustainable Agricultural Development. Open Access Journal, 3, 1-10

- Milberg, W., & Amengual, M. (2008). Economic Development and Working Conditions in Export Processing Zones: A Survey of Trends. International Labour Office, Geneva, Switzerland, 72.

- More, J. B. (2015). Impact of Special Economic Zone in India. IRACST – International Journal of Commerce, Business and Management (IJCBM), Vol. 4, No.1, 873-879.

- Murray, M. (2013, May 10). What Are Special Economic Zone. Retrieved from http://ebook.law.uiowa.edu.

- Nada Farid (2009). Towards Best Practice Guidelines for the Development of Economic Zones. A Contribution to the Ministerial Conference by Working Group 1: MENA-OECD Investment Program, Marrakech, 1-15. Retrieved from https://www.oecd.org/mena/competitiveness/44866585.pdf

- Naumkin, A. (2011). Forms of the state-private partnership in the implementation of agrarian policy. Economics of agricultural and processing enterprises, 2, 17-21.

- Nechaev, A.S., Antipin, D.A. & Antipina, O.V. (2014). Efficiency estimation of innovative activity the enterprises. Journal of Mathematics and Statistics, 10 (4), 443-447.

- Pakdeenurit, P., Suthikarnnarunai, N. & Rattanawong W. (2014). Special Economic Zone: Facts, Roles, and Opportunities of Investment. Proceedings of the International MultiConference of Engineers and Computer Scientists, Vol II, IMECS 2014, March 12-14, Hong Kong Retrieved from http://www.iaeng.org/publication/IMECS2014/IMECS2014_pp1047-1051.pdf

- Ponnusamy, K. (2013). Impact of public private partnership in agriculture: A review. Indian journal of agricultural sciences, 83 (8): 803-8, 3-8, Retrieved from https://www.researchgate.net/publication/290059190_Impact_of_public_private_partnership_in_agriculture_A_review

- Putin, V. (2017) XXV APEC summit in Danang: together with prosperity and harmonious development. Retrieved from: http://kremlin.ru/events/president/news/56023

- Sarbajit Chaudhuri, Shigemi Yabuuchi. (2010). Formation of Special Economic Zone. Liberalized FDI Policy and Agricultural Productivity. International Review of Economics & Finance, 19, 4, 779-788

- Spielman, D.J, Hartwich, F. & Grebmer, K. (2010). Public–private partnerships and developing-country agriculture: Evidence from the international agricultural research system. Public Administration and Development, 30, 4, 261–276.

- Tax Code of the Russian Federation (2017). Retrieved from http://www.consultant.ru/document/cons_doc_LAW_19671/

- Tyapkina, M.F., Ilina, E.A., & Mongush, J.D. (2016). The effect of innovative processes on the cyclical nature of economic development. IEJME: mathematics, 1, 6, 1519-1527.

- Zaruk, N., & Nosov, A. (2008). Special economic zones of the regional level as the mechanism of state support of innovative activities. Economics of agricultural and processing enterprises, 6, 8-10

- .

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

17 December 2018

Article Doi

eBook ISBN

978-1-80296-049-5

Publisher

Future Academy

Volume

50

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1464

Subjects

Social sciences, modern society,innovation, social science and technology, organizational behaviour, organizational theory

Cite this article as:

Ilina, E. (2018). Special Economic Zones Of Regional Level As Instrument Of Agricultural Development. In I. B. Ardashkin, B. Vladimir Iosifovich, & N. V. Martyushev (Eds.), Research Paradigms Transformation in Social Sciences, vol 50. European Proceedings of Social and Behavioural Sciences (pp. 486-494). Future Academy. https://doi.org/10.15405/epsbs.2018.12.58