Abstract

The article examines prospects for presence of Russian natural gas in the gas market of China when confronted with growing competition and the changing geopolitical situation. Analysis of gas market of China includes review of its challenges and prospects for its future development. Assessment of prospects for the complex and lengthy negotiation process between China and Russia regarding the presence of Russian pipeline gas in the People’s Republic of China (PRC) market was undertaken. Benefits of Russian gas presence in PRC for both Russia and China are identified. The main benefit for China in the Russian gas import is the differentiation of the market and increased competition in the spot LNG market. The main benefit for Russia is entering a growing market and developing regions bordering China. Risks of “Sila Sibiri / Strength of Siberia 1,2,3” pipeline projects are also identified. What kind of policy in the negotiation process should Russia adhere to in the face of growing competition? To solve this problem, the article evaluated China's natural gas market under different scenarios of gas supply: extension of LNG imports, increased imports from existing pipelines, a ‘50:50’ scenario, and introduction of Russian pipeline gas. It is concluded that Russia and its largest gas companies need to constantly monitor forecasts related to Chinese gas market and analyse them carefully. Russia needs to pursue its flexible policy, not forgetting the need to develop eastern regions of Russia and to reduce cost of its export projects in every way.

Keywords:

Introduction

Russian-Chinese relations have a long and complex history. The expansion of Russian-Chinese trade relations began in the early 2000s and over the past few years (with the exception of 2015 due to the low price of energy), China has become Russia's second most important partner after the EU (however Russia is only the sixteen’s largest supplier of China).

The high rate of China's economic growth (7-15% per year), led the country to the 2nd place in the world in terms of nominal GDP, and as a consequence the first by consumption of primary energy resources (see Table

The trade balance of Russia with China is dominated by the export of hydrocarbons, which is more than 60% of the total trade. The key energy resources in trade with China are oil, oil products and coal. Gas trade takes place in small volumes (with Sakhalin- 2 LNG project). Deliveries by pipeline are planned for the end of 2019.

The purpose of this study is to assess the extent of possible changes in the gas market of China and to identify the factors that Russia and its gas companies must first take into account in building their strategy in China. The task of this work is to study the development of bilateral cooperation between China and Russia on the export of Russian networked natural gas, assessment of the prospects for a complex and lengthy negotiation process, in which, up to the present time, both Russia and China are trying to find compromise solutions on a wide range of commercial and political issues. The most acute issues of the gas talks is the issue of a ‘fair’ price from the perspective of the long-term nature of investments in the gas project; as well as investment of China in gas projects in Russia (including production, pipelines and infrastructure).

The following conclusions are drawn from the studies carried out. Despite mutual interests, the development of a full strategic partnership between Russia and China is rather unlikely. Winning in the fierce competition for the share of the Chinese gas market without taking into account the transformation of Gazprom's pricing model and contract terms is practically impossible. Among the long-term risks for Russia in the current course of negotiations, it is necessary to note the excessive dependence on one importer and one investor.

Problem Statement

The importance of the gas industry for the Russian economy is difficult to overestimate. It is about 10% of the country's exports, the oil and gas industry has a significant impact on the Russian balance of payments and the state budget. After the transformation of the European gas market, Russia needs to develop Asian markets. The share of Russia in the gas market of China is less than 1% (LNG with Sakhalin-2). The development of the world's gas markets follows the path of increasing consumption of LNG. However, for Russia the development of pipeline gas export is the most urgent and the Chinese market should become the key segment for it. What are the barriers to entry to this market segment? What factors need to be taken into account in the negotiation process for the ‘Sila Sibiri (Siberian Power)’ projects? An analysis of the trends in the development of China’s gas market shows that Russia has a competitive advantage in pursuing a sizeable share in this market. Entry into the Chinese market will be of fundamental importance, both for development of the eastern territories of Russia, and as a strategic bargaining tool in the medium term.

Research Questions

The share of total Russian energy exports to China remains stable and is about 8%. Although this figure seems relatively low, it reflects a relatively recent change in Russia's priority for diversifying primary energy exports. The reason for changing export priorities is not only the state of political relations between Russia, the EU and the US, but also economic interests: the traditional markets for Europe and the West are now mature and the prospects for their growth are limited; the cyclical drop in demand for energy resources in the global market due to stagnation since 2008; the growing excess supply of LNG. Another key element of "reliance on Asia" for Russia is the development of its own eastern regions.

From the point of view of China, the attraction of natural gas imports from Russia is mainly due to an increase in the diversification of supplies for economic security. This is also due to Chinese concerns about the import of gas by sea through narrow shipping routes, for example, in the Malacca Strait.

Pipeline shipments from Russia offer an obvious solution to this problem. Gas cooperation between Russia and China aroused much discussion and led to radically different estimates.

The relevance of the analysis of Russia's role and place in China's current energy policy and the prospects for China's cooperation with Russia is determined by a number of factors, namely, the problems of the European gas market, the increasing influence of LNG on the gas market, and the "shale revolution". These factors need to be taken into account both in the energy strategy of Russia and China.

Purpose of the Study

The analysis of scenarios for the development of China's gas market and assessment of the presence of Russian pipeline gas in this market, taking into account the possible impact of LNG and the price factor.

Research Methods

The theoretical and methodological basis of the research is the application of the principles and methods of scientific knowledge, the use of the provisions of comparative analysis, abstraction and logical generalization. In the study of development of the gas market, the authors used the works of national and foreign authors. The key source for the cooperation in the gas sector between Russia and China is the work of Henderson and Mitrova (2016).A number of other authors have contributed to the study of the prospects for the development of the global gas market: the forecast for the development of world energy – Makarov, Mitrov, Veselov, Galkin, and Kulagin, (2017), the forecast for the development of the gas market of China - Kulagin (2016), a study of gas import competition issues - Pang Mingli (2014). Mironova's works (2015) are devoted to the issues of gas pricing. We have also analysed in detail the opinions of various specialists on the problem of the presence of Russian gas in the Chinese market: Aleksashenko (2015), Bryl (2018), Gabuev (2016), and others.

Findings

China Gas Market Analysis

Changes occurring in the global gas market are associated with the expected introduction of significant new LNG capacities, a slowdown in energy consumption growth, and an increase in inter-fuel competition. However, China's gas market has its own characteristics. First of all, the growth of energy consumption and, especially, the gas component. The high growth rate of the Chinese economy (even taking into account the slowdown in the last 2 years) has led to an even higher demand for energy resources. Table

The world leader in demand for primary energy resources since 2009, China currently consumes about ¼ of the world’s resources (see Table

Consumption capacity is supplied by both own extraction and import. Natural gas accounts for only 6.3% in the structure of PRC energy consumption (against 23% in the world and 50% in Russia). The share of coal, despite a slight decrease, continues to be high (65%). By 2020, the share of coal will be reduced to 55%, and the share of gas will increase to 10%, but it will not reach global levels.

China possesses significant gas reserves and is increasing its own gas production.

However, own gas production is not growing as fast as the demand. Import dependence on gas is currently 34% and by 2020 is expected to peak at 49%, but will subsequently decline.

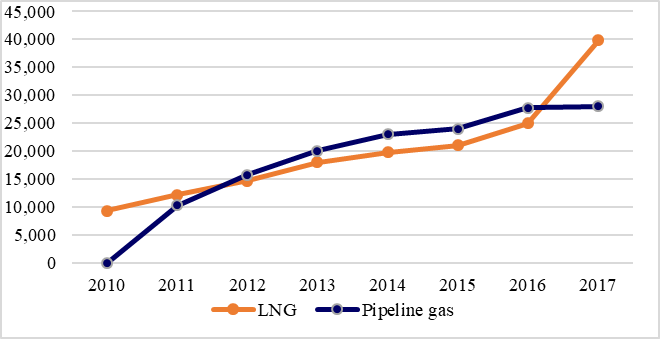

The dynamics of gas imports to the PRC is shown in Fig 01. At the end of 2017, China's gas imports amounted to 67 million tons, which is more than a quarter above the previous year. LNG imports alone grew by more than 50%.

Figure

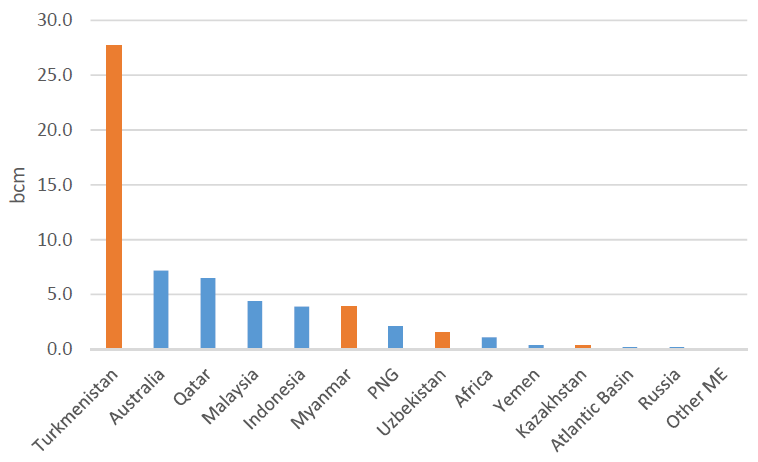

Its current capacity is about 55 billion m3, expected to grow by 2020 to 65 billion m3 per year, which is close to the level of all gas exports to Russia in the recent past. The pipeline currently provides about 50% of gas imports of China. Supplies via the pipeline are mainly carried out from Turkmenistan (28 billion m3 / year), as well as Uzbekistan and Kazakhstan

The gas production in Turkmenistan is under full control of the Chinese side, as the main operator and investor there is a Chinese state company, CNPC. China buys pipeline gas from Turkmenistan at a price below the market price.

Figure

The main suppliers of LNG to the Chinese market are: Qatar (15.71% of the volume of natural gas imports), Australia (5.96%), Malaysia (6.98%), Indonesia (5.96%). In 2017, the US played a significant role in the Chinese LNG market (7%) and took the third place.

The rapid growth in LNG supplies to PRC at the end of 2017, combined with the fact that the Chinese companies predominantly buy LNG on the spot market. Procurement of gas at the spot market can not guarantee the stability of supply (Bryl, 2018).

Russian LNG companies are still outsiders in the competition for China's natural gas market.

The existing infrastructure for LNG reception in PRC (in 2017 nominal capacity of LPG terminals in China was 70 million tons p.a.) for the most part is focused in the areas of central and southern China. The southern and south-eastern coastal provinces receive LNG by sea, mainly from Australia and Qatar. Northeast China (Dongbei), for the most part is cut off from these routes. At the same time, the gasification of this part of China is most acute due to its geographical and climatic characteristics (cold winter), and also because of the presence of advanced energy-intensive industry in the region. Location of this region in the immediate vicinity of the gas-rich Irkutsk region of Russia is a strong argument in favour of gas supply from Russia to North-East China.

China's need for natural gas will increase - due to the implementation of the program of gasification, as well as the fulfilment of the terms of the Paris Agreement on Climate Change.

Summarising the analysis of China's gas marketб let us note: considering its dynamism, rapid growth and future prospects, what problems can be predicted in this market? First, the problem of the growth itself. Second, the competition between different types of fuels. Third, energy security. The proportion of gas in the energy in 2040 will reach 30%. With such forecast, China will need 2 trillion m3 of natural gas (the world’s production of gas is currently 3.5 trl). Despite the fact that China controls the production of gas of countries occupying the second (Iran) and 3rd place (Turkmenistan) in the world (by reserves), and actively develops its own energy, without Russian gas (1st place in reserves) reaching supply to satisfy the forecasted demand of 2 trillion m3 p.a. is not possible. To ensure energy independence due to geopolitical tensions, China is creating additional incentives for importing countries, promoting all technologies that can maintain their energy independence. One such technology is the import of natural gas by pipeline from Russia.

The prospects for the presence of Russian pipeline gas in the Chinese market

The projects for deliveries of Russian gas to China at the present time include:

The main gas pipeline (IHL) Power of Siberia-1 (“Sila Sibiri”-1, SP-1): supply of gas from the Eastern Siberia and Yakutia; the volume of supply - 38 billion cubic meters per year; supply agreement was signed in May 2015. Supply term - 30 years; the price of gas is tied to the oil basket; delivery conditions of "take and pay".

IHL Power of Siberia - 2 : sets out a route for the supply of gas from Western Siberia through the pipeline "Altai" to China and India; supply volume of circa 30 billion m 3 per year (with a potential increase to 100 billion m3); initial contract was signed in 2015; in February 2017 a memorandum of understanding to start commercial negotiations on gas supplies via the Western route. In December 2017, China resumed negotiations with Gazprom on this project. However, the fate of this project remains vague as China questions the need to buy gas at a price higher than that of Turkmen.

IHL Power of Siberia - 3 : Gas from the Far East of Russia and the shelf of Sakhalin island - 38 billion m3. At the end of December 2017, Gazprom signed a heads-of-terms with CNPC on the main supply terms for the project. The two companies identified the main parameters of future supplies. The master contract is to be signed in 2018. The transport arm of the Power of Siberia -3 is shorter than the western route, respectively, and supply conditions may be more attractive for China.

Which of the three projects is to be implemented first, and whether or not implemented at all is still to be seen. Henderson and Mitrova (2016), called the negotiation process between Gazprom and Chinese CNPC “playing Chess with the Dragon”. Indeed the process of negotiations on deliveries of pipeline gas from eastern Siberia to China began in June 2009 but it was not until May 2015 that a framework agreement "Power of Siberia" was signed. At present, Gazprom is focused on the delivery of Power of Siberia- 1 project. Pipeline "Power of Siberia -1" will be used to supply gas to the eastern provinces of China. Arguments for the import of Siberian gas include geographic proximity, participation in BRICS, the Agreement between Russia and China on the integration of the economic belt of the Silk Road and the Eurasian Economic Union, insufficient supply at the Chinese gas market and China's non-adherence to the American and European sanctions in relation to Russia.

Despite of the assurances of both the Russian and the Chinese sides at the Eastern Forum (September 2016), and Mr Miller 's (Gazprom CEO) statement in December 2017 regarding expected start of supply on 20 December 2019, Siberian gas is having a difficulty in breaking into the Chinese market: China currently imports gas at a price below the market prices.

Obstacles to the implementation of the project Power of Siberia -1

The factors impeding the implementation of the project Power of Siberia -1 (in addition to LNG competition to the Russian pipeline gas, which we examined above) include:

Russia missed the first advantage to enter Chinese gas market and now faces stiff competition from other suppliers of natural gas;The re-focus of the Russia-China gas pipeline from Kovykta deposit (Irkutsk Oblast) to Chayandinskoe deposit (Sakha Yakutia).

The exports via PS-1 should be 38 billion m3 p.a. under the master contract, yet the Chayandinskoye condensate field, prior to accessing the oil rim (ie the next 10-15 years), is not expected to exceed 12-15 billion m 3 of gas production per year. The reasons as to why Gazprom had not started it as a priority, let alone parallel, development of the much larger Kovykta field, will probably "only be answered by the future generation of researchers who will be able to access the archives of the company" (Aleksashenko, 2015).

The reality of implementation of the project Power of Siberia -1 in the agreed timeline is considered as doubtful by many experts. The effectiveness of the project depends on the price of natural gas and gaseous minor fluctuations in the market. While China currently buys gas at a price below the market price, it makes no sense to Gazprom to sell its gas ‘on the cheap’.

Helium problem is not solved.

The peculiarity of the Kovykta gas condensate field is high helium content (0.3%). Before exporting gas from this deposit, it is necessary to separate helium as helium is a ‘strategic’ raw material. The construction of helium separation plant in the Far East of Russia has not yet started.

Gazprom’s monopoly for pipeline access.

Representatives of Gazprom have repeatedly stated that they rely solely on gas produced by Gazprom to fulfil the supply under the PS-1 contract. Yet independent producers can begin deliveries to the pipeline when the giant eastern fields of Gazprom - Kovykta and Chayanda are exhausted.

The government is considering two ways of access of independent producers to the "Power of Siberia -1 ". The first - the construction by independent producers of facilities to export gas to end buyer at the own expense. The second - the sale of gas to Gazprom at export prices on net-back basis (Gazprom has offered "Rosneft" to buy its gas at domestic prices; yet offered the RF Ministry of Energy to buy at export price minus transportation costs). As follows from the Ministry of Energy plans, independent gas producers can gain access to the "Power of Siberia" two years after the start of the project, that is, in 2020 (interfax.ru 19/4/2016 ).

Gazprom" price policy.

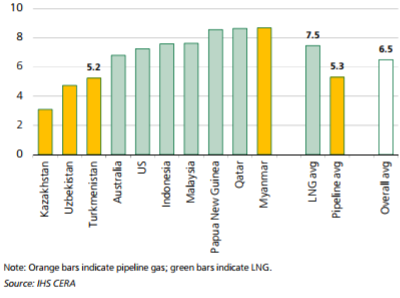

Figure

-

Lack of financial resources at Gazprom for the construction of a gas pipeline.

The Chinese side proposes joint participation in the project. Binding potential suppliers by multi-billion dollar loans (so that they do not to change their mind) is a common strategy of the Chinese – exemplified by the full control by the Chinese of the Turkmen gas supplies and significant control of Iranian gas. Gazprom, for ‘strategic purposes’ declined this offer and de-facto uses budget funds to finance the project. In addition, Gazprom is granted tax breaks by the Russian state. But Russia’s budget is not limitless and already has a budget deficit problem. Disruption of the timing of the contract with lead to high fines to the Russians and will give China an opportunity to re-export gas (to India – which, as shown in Table

Questionable financial return of "Power of Siberia -1" pipeline.

Despite the non-refundable state loan and tax reliefs, the payback period is very sensitive to the price of gas and will reach as much as 30 years in an unfavourable scenario.

The lack of Chinese internal pipeline network in the eastern regions.

Although the Chinese side has repeatedly stated that building work is progressing according to schedule, China has signed an agreement with "Rosneft" on the joint construction of internal pipeline, yet it is only a heads-of-terms rather than a full commercial contract.

The famous Chinese unpredictability.

Given there are issues outlined above and combined with the fact that the development of Chayandinskoye or Kovykta deposit fields has hardly yet begun, the prospects for the deployment of PS-1 can be described as a ‘

The Analysis of scenarios of China's gas market

The analysis of China's natural gas market has allowed us to simulate several scenarios for the future development of this market. In 2017, China consumed 235.8 billion m3 (see. Fig. 1), of which imports amounted to 67 billion m 3. To ensure meeting the gas requirement of 350-670 billion m3 (pessimistic and optimistic scenario), while its own domestic level of production of 200-250 billion m3 , China would need to import of 150 - 520 billion m3 per annum. Competitors for meeting this potential import requirement are Turkmenestan (up to 75 billion .m 3 ), Australia (LNG output can be increased by 95 billion m 3 ) and Russia. The hypothetical scenarios that China may choose to create the imports mix are as follows:

implementing projects to maximise capacity loads of the existing pipelines (increasing supplies from 55 to 85 billion .m 3 ), including new pipelines Power of Siberia 1 and 2;

implementing Power of Siberia - 1 and, for the remainder, LNG imports from Australia and others. (Qatar and Australia are the main LNG suppliers in the Chinese market. However, Qatar is approaching export levels close to its maximum production capabilities. Australia also restricts the export opportunities due to domestic demand growth);

50:50 scenario - where 50% of demand is met by LPG and 50% by pipeline gas; the realism of this scenario is comparatively high and is determined by the current structure of China's gas imports (see Figure

LNG contracts are implemented and the remaining demand is met by pipeline gas imports.

Conclusion

There is currently a high uncertainty about the future growth of the Chinese gas market and the competitiveness of Russian gas in it. Entering the Chinese market has become much tougher as there is high competition both between gas suppliers and with other fuels meeting demand for energy. However, the gas markets, unlike oil, are regional rather than global, and Russia fro China is not only the largest exporter, but also to the nearest regional neighbour.

China clearly has to grow gas imports. The markets of southern and central provinces in China are supplied by LNG and pipe gas from Turkmenistan, yet Eastern China continues to be a segment free from material competition. Gasification of this part of China is a most acute issue due to its geographical and climatic characteristics (cold winter), and also because of the presence of advanced energy-intensive industry in the region. Pipeline "Power of Siberia -1 " is designed specifically to address demand in these areas. Location of the region in the immediate vicinity of the Irkutsk region and the Far East is a strong argument in favour of Russian gas supply to North-East China. BP (British Petroleum) experts have no doubt of the benefits of Russian pipeline gas for Chinese market (that is not to say it equates to reality of actual delivery of it). However, as has been shown above, the project has been stalling due to a dozen reasons outlined above. Its future is dependent on a large number of unknowns, which include not only geopolitics and the economic conditions, but also the policy re energy consumption structure.

Analysis of scenarios for China's gas market has shown the feasibility and benefits for presence of Russian pipeline gas in it.

Analysis of scenarios for the development of the Chinese gas market showed the mutual interest of countries in the implementation of the gas project. Russia is interested in developing the productive capacities of the eastern regions of the country and exporting gas to its main strategic partner and other countries of Asia. China is interested in strengthening its competitive positions in the spot LNG market and in solving the country's environmental problems.

References

- Aleksashenko, S., (2015). Siberian impotence: why to "Gazprom" too late to build a gas pipeline to China. Retrieved from: rbc . ru > opinions United / economics ACTUALITY / 07/12/2015 /

- Bryl, R., (2018). Tupik named Putin. Why China does not need Russian gas. Retrieved from: http://www.dsnews.ua/economics/tupik-imeni-putina-pochemu-kitayu-ne-nuzhen-russkiy-gaz-29112017220000

- Gabuev, A., (2016) Turning to nowhere: the realities of the Russian Asian policy. Carnegie Moscow Center. . Retrieved from: http://carnegie.ru/commentary/2016/04/22/pivot-to-nowhere-realities-of-russia-s-asiapolicy/ixfw

- Gedich, T.G. (2016). LNG Competition and the Russian pipeline gas to the European market. Archivist, the XIII International scientific conference "Science in the modern world» number 13, October 20, 138-143, Kiev

- Henderson, J., Mitrova, T. (2016). Energy Relations for Between Russia and China: Playing Chess with the Dragon. Oxford Institute for Energy Studies August 2016.

- Kulagin, V. (2016). The VA Russian exports file of Hydrocarbons: Challenges and Opportunities. Roundtable "The of gas market in China," July 7, 2016 Irkutsk

- Makarov, A.A., Mitrov, T.A., Veselov, F.V., Galkin, A., Kulagin, V. (2017). Prospects for the electricity in the conditions of transformation of the global energy markets. Thermal Engineering number 10.

- Mironova, I. (2015). Natural gas pricing in the Asia pacific regional market: prospects and problems. Bulletin SPbGU , Ser .5, 4, 66-85

- Mingli, P. (2014). Dynamics imports of natural gas in China. Retrieved from: http://www.wusuobuneng.com/archives/16453

- Popov, S.P., (2013). Gas industry in China: a new resource for development. Spatial Economics, №2. pp. 22-48

- Ruban, L., (2015). Chinese alternative for Russia. Oil of Russia. Number 4, 15-2

- Sinitsyn, V., (2015). China: competitive scenario of pipeline gas and LNG. Energy Research Center IMEMO. December 4. Moscow, IMEMO. Scenario forecasts for natural gas demand. Retrieved from: https://www.imemo.ru/files/File/ru/conf/2015/04122015/1-07%20_Sinitsin.pdf

- Wan, Ts., (2016). China Import natural gas market. The young scientist. 29. 374-376.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

17 December 2018

Article Doi

eBook ISBN

978-1-80296-049-5

Publisher

Future Academy

Volume

50

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1464

Subjects

Social sciences, modern society,innovation, social science and technology, organizational behaviour, organizational theory

Cite this article as:

Gedich, T. (2018). Gas Market Of China: Barriers And Prospects For Russian Pipeline Gas. In I. B. Ardashkin, B. Vladimir Iosifovich, & N. V. Martyushev (Eds.), Research Paradigms Transformation in Social Sciences, vol 50. European Proceedings of Social and Behavioural Sciences (pp. 419-429). Future Academy. https://doi.org/10.15405/epsbs.2018.12.51