Abstract

Researchers argue that a leading role of innovation activities is a determinant feature of the current economy. Dynamic social and economic development of many countries is based on innovations in different fields of knowledge which improve living standards. The relevance of innovation economy development is supported at all government levels by developing, adopting and implementing legislative, program and regulation acts. Innovation development as a manufacturing basis can move the Russian economy from extensive economic development to intensive one. It will enhance efficiency of all industries, competitiveness of the national economy and living standards. Analysis of economic researches showed that federal and municipal bodies and municipal communities pay insufficient attention to innovation development of municipal entities. As a rule, innovation development is typical of a limited number of territories possessing a special innovation status. That approach increases development disproportions and decreases standards of living of the population. Taking into account that social and economic development is rather slow in most municipal entities, innovation development is crucial for them. It should be noted that innovation development requires investment. The article analyzes general issues of investment innovation development of Russian municipal entities. Assessment methods for innovation and investment potentials of municipal entities are also dealt with. Problems of financing of innovation activities at the municipal level are identified. One of the regions of the Siberian federal district was analyzed as an example.

Keywords: Investmentinnovative developmentpotential of territoriesregion

Introduction

The concept of innovation development has been applied since people became aware of the need to accelerate implementation of new knowledge in practical activities. Some researchers believe that the environment withstands changes because of lack of information, internal communication barriers in the organization structure, depreciation of the problem or disregard of propaganda activities.

Factors influencing efficiency of innovation and investment processes

According to the authors, there are social psychological and economic factors which prevent innovation activities (Shumpeter, 1961; Oulasvirta, 2017).

Social psychological factors concern any innovation activity. People have bias against innovations because of a fear of changes. Some age groups are passive and conventional. Besides, any professional groups do not want to alter status quo. They resist to undesirable changes directly or indirectly. Need for retraining and requalification due to innovations implementation cause a sense of insecurity of the future and make people irresponsive to transformations of conventional social and economic structures and group values.

As for municipal entities, the main social psychological factor preventing innovation activities is unwillingness of municipal bodies to support innovation activities.

Economic factors are also important as innovation activities involve both expenses and results. From the economic perspective, some innovation activities are unreasonable. However, from the social perspective, they will have positive results.

Economic factors preventing innovation development are as follows: low potential of most organizations; a lack of own funds for carrying out innovation activities; a lack of methods for assessing the level of innovation investment development of municipal entities; a lack of collaboration with research organizations and companies; a lack of the federal government financial support.

Investment component of innovation development of municipal entities.

To develop an innovation economy ensuring the efficient economic growth and a new level of manufacturing equipment for producing new generation products, a sharp increase in investment in innovation development is required.

It should be noted that the innovation economy has its own structure of wealth and special profit efficiency assessment criteria. The current economic growth differs from the one in the industrial society as not any economic growth results in innovation development and is based on innovations.

Besides, the market economy involves risks and cannot exist without investment which depends on two basic conditions: investor’s trust in authorities and clear innovation policies.

Hence, not any investment activity can be innovative. This feature is typical of the innovation investment economy where investment aims to develop and implement technological processes, mechanisms, equipment, new knowledge-intensive ideas and management systems (Koc, 2017; Salamonsen, 2015).

Thus, one of the main factors of innovation activities is investment. Efficiency of innovation activities depends on availability of resources, including investment ones. An increase in investment without innovation activities contributes to reproduction of obsolete technologies and conservation of the economic weakness.

Problem Statement

Innovation and investment relationship means that without simultaneous stimulation of innovation activities, efficiency of investment activities and their contribution to economic development increase.

During the years of reformation, a lot of complex economic, social and organization problems occurred in the Russian investment area. The economy having unique natural resources, highly-qualified workers and significant innovation potential has been experiencing depression for many years. Government attempts to stimulate investment activities were inefficient.

Investment activities result from the effects of all components on the economic behavior of businesses. For this purpose, economic incentives to accumulate capital and accelerate scientific and technical progress are required: a competitive market of investment products; adequate legislation; manufacturing and market infrastructure development.

Development of the world economy proves that innovation activities are a basis for the national economic growth (Bencivenga, 1991). The strategic purpose for the Russian economy is transition to innovation-based development, creation of national and regional innovation systems. A regional segment of the national innovation system cannot exist without an active role of municipal institutes.

Economic problems of innovation development program implementation in municipal entities

The economic potential of municipal entities is limited. Their revenues are too small to finance expenditures for performing their functions which discourages municipal bodies to develop territories. Transition to innovation-based development, innovation investment program development requires financial implementation mechanisms (Lorincová, 2016; Coutinho, 2014). To this end, the article analyzes key financing sources for municipal entities.

The main investment and innovation source is a municipal budget. According to the Russian legislation, municipal budgetary revenues consist of personal property taxes and land taxes. Besides, federal and regionals taxes are assigned to municipal budgets as provided for in legislation acts.

Non-tax revenues of local budgets are municipal property use and disposition revenues; revenues from commercial services provided by municipal budgetary institutions; after-tax profit of municipal unitary enterprises.

Analysis of own and debt revenue sources of local budgets

Local taxes, non-tax revenues and revenues assigned to local budgets by the federal laws are less than half of all the municipal budgetary revenues. Other municipal revenues are grants, subsidies and subventions from the federal and regional budgets.

Grants are inter-budgetary transfers designed to adjust budget revenues of settlements, municipal areas and urban districts (Malkova, 2017).

Subventions are inter-budgetary transfers designed for financing of expenditure obligations of the municipal entities performing federal or regional duties.

Subsidies are inter-budgetary transfers designed for co-financing of expenditure obligations of the lower budgets.

The subsidies play an important role for innovation and investment development of municipal entities. Local bodies should develop innovation investment programs in order to obtain subsidies for their implementation.

There is one more issue. The transfer system is not based on priorities of social and economic policies, including their territorial aspects. Inter-budgetary transfers are regarded as a special financing tool designed to neutralize a vertical disbalance of revenue and expenditure obligations of the local budget and serve purposes of regional authorities.

Research Questions

Expenditure obligations of the local budget can be divided into current expenditure obligations (current budget) and investment budgets (development budgets). Budget investment funds are designed for capital construction, capital repairs and innovation activities. In the context of critical budget deficiency, most municipal entities are not able to draw up their own budgets of development. It should be noted that in developed countries, budgetary expenditures on development are small and the main share of financial resources are loans. For the Russian economy, it is also a reasonable scheme. According to the authors, in the long-run perspective, taking into account the efficiency assessment of investment projects, a lot of municipal entities are creditworthy enough (Usmanova, 2017).

Investment dynamics analysis in the region

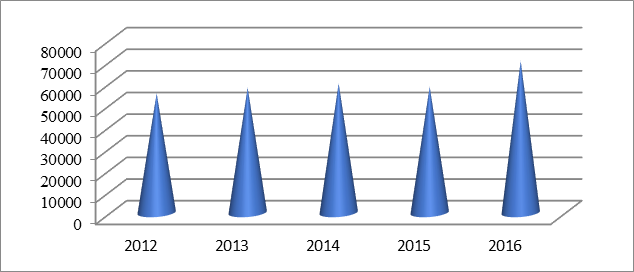

Figure

The dynamics volume for per capita investment in the region is positive. In 2016, the volume of per capita investment increased by 21%.

Innovation aspects of municipal entity development

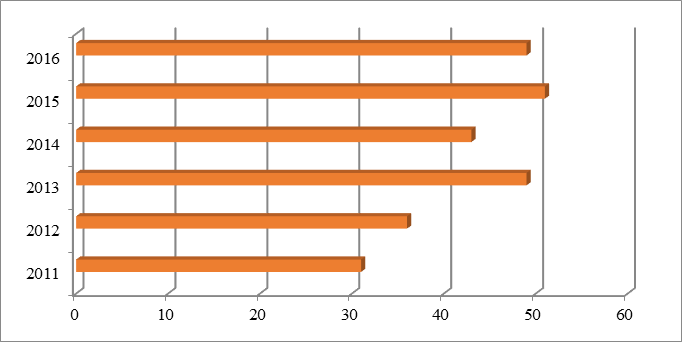

One of the main assessment criteria for the level of municipal innovation development is analysis of innovation activities of businesses. The article describes statistical data on the dynamics of regional innovation active businesses

For the period under study, the total number of regional innovation active businesses is more than 50. In 2016, the total number of innovation active businesses increased by 20% in comparison with 2011.

Purpose of the Study

To enhance efficiency of investment processes of municipal innovation development, a municipal potential assessment method should be developed. It will identify strengths and weaknesses of investment processes. To this end, let us determine indices which can be used for development level assessment.

Analysis of investment and innovation development indices.

The indices can be divided into several groups by their potentials (Table

A set of indices characterizing innovation and investment development can be analyzed in each potential (Nechaev, 2014, 2017; Demidenko, 2016).

Rationale for choosing innovation and investment development indices.

In each potential, we use such indices as a population size, an amount of businesses, a corporate profit volume, a total volume of innovation products. Indices are selected on the basis of econometric methods.

Research Methods

To select most significant innovation and investment indices, the authors justified the need for correlation and regression analysis.

Econometric methods for assessing the potential of municipal entities

The correlation and regression method involves the following stages:

Problem statement: identification of indices whose relationship is assessed, formulation of economically reasonable relationship assumptions;

Development of a list of factors, their logical analysis: selection of an optimum number of most significant variables affecting the dependent index;

Specification of a regression function: relationship assumption is formulated;

Regression function assessment and model adequacy check: calculation of numerical values of regression parameters and analysis accuracy indices;

Economic interpretation: comparison of results with assumptions formulated at the first stage, assessment of their accuracy from the economic perspective, making conclusions (Janeway, 2012).

Accounting for risks when assessing a municipal development level

When assessing a development level for municipal entities, a risk component should be taken into account (Stosic, 2017). We suggest assessing such risks as

Economic risk characterizing regional unprofitable businesses;

Social risk characterizing an unemployment level in the region;

Financial risk characterizing financial indices of businesses;

Environmental risk characterizing an environment pollution level.

Findings

All municipalities can be divided into three groups. The first group is territories with a low development level. The second group is territories with a middle development level. The third group is territories with a high development level.

Criteria for territory classification by innovation and investment development levels.

Territory classification is based on criteria in Table

where - investment and innovation development index in relevant measurement units;

– mean value of the investment and innovation development index in relevant measurement units.

Recommendations on adjustment of territory development control systems

Adjusting of development programs with regard to identified features is a final stage of innovation and investment development assessment.

To this end, development directions for each group of municipal entities are determined by the following formulas:

where - development direction for relevant groups of municipal entities;

- minimum value of the index for a group of municipal entities with a middle development level;

– mean value of the investment and innovation development index;

- maximum value of the index for a group of municipal entities with a middle development level (Antipin, 2017; Nechaev, 2014; Weimer, 2016).

Analysis of calculated deviations helps develop recommendations for municipal entities with a low development level. The recommendations cover development and implantation of a development strategy, innovation and investment development programs, local legal acts aiming to enhance competency of municipal officials who are responsible for decision-making in this area.

For municipal entities with a middle development level, improvement of investment and innovation management, including project support (investment fairs, promising project presentations, specialized website development, territory investment passport adjustment, etc.) is recommended.

Thus, development assessment and identification of desirable directions based on the model developed allows development of measures aimed to improve specific indices for transition of municipal entities to innovative economic development.

Conclusion

The main conclusions of the research are as follows.

First, the correlation and regression method helped select innovation and investment development indices for municipal entities.

Second, municipal entities were divided into three groups by investment and innovation development levels.

Third, deviations of real directions from target ones were calculated. Existing levels of development control were described for each group of municipal entities, and recommendations on investment and innovation development control system improvement were suggested.

Acknowledgments

The authors acknowledge receiving support from state-funded research program of Irkutsk National Research Technical University. We are responsible for all errors as well as heavy style of the manuscript.

References

- Antipin, D.A., Pakholchenko, V.M. & Tauryanskaya, O.V. (2017). Banking supervision: current trends and prospects. Retrieved from: https://www.atlantis-press.com/proceedings/ttiess-17/25885403.

- Bencivenga, V.R., Smith B.D. (1991). Financial intermediation and endogenous growth. Review of Economic Studies, 58 (2), 195-209.

- Coutinho, C., Jardim-Goncalves, R. & Cretan, A. (2014). Methodology for negotiation in collaborative working environment for innovation in services design International Mechanical Engineering Congress and Exposition, 2B, 1-7.

- Demidenko, D.S., & Malevskaia-Malevich, E.D. (2016). Features of optimal control of dynamic processes in enterprise economics Proceedings of the 27th International Business Information Management Association Conference - Innovation Management and Education Excellence Vision 2020: From Regional Development Sustainability to Global Economic Growth, 1606-1612, Milan: IBIMA.

- Janeway, W.H. (2012). Doing Capitalism in the Innovation Economy: Markets, Speculation and the State. Cambridge, University Press.

- Koc, T., & Bozdag, E. (2017). Measuring the degree of novelty of innovation based on Porter's value chain approach. European Journal of Operational Research, 257, 559-567.

- Lorincová, S., Potkány, M. (2016). The proposal of innovation support in small and medium-sized enterprises Production Management and Engineering Sciences - Scientific Publication of the International Conference on Engineering Science and Production Management, 157-162.

- Malkova, T.B., Khalezov, A.V., Vypolskova, E.N. & Masyuk, N.N. (2017). Topical issues of investment-innovation mechanism in the Ivanovo region. Izvestiya Vysshikh Uchebnykh Zavedenii, Seriya Teknologiya Tekstil'noi Promyshlennosti, 2, 9-14.

- Nechaev, A., & Antipina, O. (2014). Taxation in Russia: Analysis and trends. Economic Annals-XXI, 1-2, 73-77.

- Nechaev, A.S., Barykina, Y.N. & Puchkova, N.V. (2017). Analysis of Articles of Fixed Assets Renewal of Russian Business Enterprises. Retrieved from: https://www.atlantis-press.com/proceedings/ttiess-17/25885492.

- Nechaev, A.S., Antipin, D.A. & Antipina, O.V. (2014). Efficiency estimation of innovative activity the enterprises. Journal of Mathematics and Statistics, 10(4), 443-447.

- Oulasvirta, L., & Anttiroiko, A.-V. (2017). Adoption of comprehensive risk management in local government. Local Government Studies, 43, 451-474.

- Salamonsen, K. (2015). The Effects of Exogenous Shocks on the Development of Regional Innovation Systems. European Planning Studies, 23(9), 1770-1795.

- Shumpeter, J. (1961). The Theory of Economic Development. New York, Oxford University Press.

- Stosic, B., Mihic, M., Milutinovic, R. & Isljamovic, S. (2017). Risk identification in product innovation projects: new perspectives and lessons learned. Technology Analysis and Strategic Management, 29, 133-148.

- Usmanova, Kh.T., & Eroshkin, Yu.S. (2017). Strategic modeling of innovative development within the framework of ensuring economic security of the regions of the Russian Federation in conditions of integration in the world economy Proceedings of 2017 10th International Conference Management of Large-Scale System Development, 1-4, Piscataway: IEEE.

- Weimer, M., & Marin, L. (2016). The role of law in managing the tension between risk and innovation: introduction to the special issue on regulating new and emerging technologies. European Journal of Risk Regulation, 7, 469-474.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

17 December 2018

Article Doi

eBook ISBN

978-1-80296-049-5

Publisher

Future Academy

Volume

50

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1464

Subjects

Social sciences, modern society,innovation, social science and technology, organizational behaviour, organizational theory

Cite this article as:

Ognev, D. V., & Antipina, O. V. (2018). Investment Aspects Of Innovation Development Of Municipal Entities In Current Economic Conditions. In I. B. Ardashkin, B. Vladimir Iosifovich, & N. V. Martyushev (Eds.), Research Paradigms Transformation in Social Sciences, vol 50. European Proceedings of Social and Behavioural Sciences (pp. 33-41). Future Academy. https://doi.org/10.15405/epsbs.2018.12.5