Abstract

The authors of the article are seeking to describe the current conditions of the innovation activities of the Russian enterprises. This purpose can be realised by studying the dynamics and the structure of the volume of the innovation products, works and services. In addition, it is necessary to analyze the costs of the funding sources to solve the problem posed by the authors of the article. Despite this, the numerous obstacles to implementation of the development of the innovation activity have been identified. Besides, the authors have suggested some certain solutions aimed at elimination of the mentioned obstacles and improvement of the situation. The research object is innovation products of Russian enterprises, which can be used to monitor financial conditions of enterprises in innovation and investment areas. The problem to be solved is lack of owned funds for carrying out innovation activities. The article describes funding methods for innovation activities of manufacturing enterprises. It has been found that the most common funding method is leasing. However, it has some drawbacks preventing it from being an efficient investment tool in Russia.

Keywords: Innovation activityinnovation projectenterprisesinnovationfundingrisks

Introduction

Innovation activities of enterprises are a number of measures aimed to search for, commercialize and implement scientific knowledge, new technology and inventions.

Currently, innovation activities influence the Russian economy by enhancing efficiency of resource management, creating new industries, infrastructure and jobs. Under the global competition, the effects of innovation activities on national development and competitiveness are becoming more intensive.

Due to this fact, it is necessary to analyze the current financial state of innovation activities of Russian enterprises as follows: (Wakelin, Otheno, & Kinyua, 2003)

For the comprehensive analysis, it is necessary to study structural changes of data presented in Table

The data presented in Table

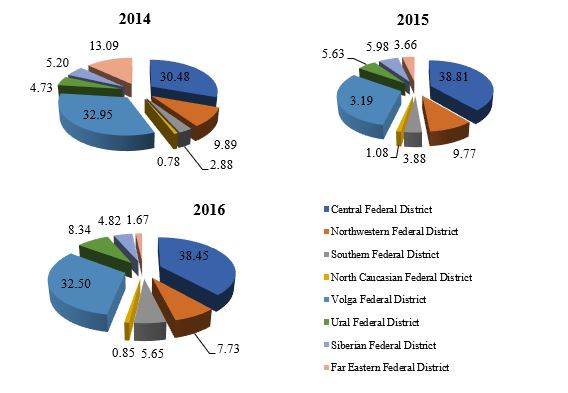

The distribution of innovation products and services by Russian regions is as follows: most innovation products were produced in the Central Federal District (increase by 400 365.8 million rubles (8.33%) in 2015 and by 186 379.5 million rubles (-0.36%) in 2016), and Volga Federal District (increase by 19 336.1 million rubles (-1.76%) in 2015 and in 219 422.4 million rubles (1.3%) in 2016) (Nechaev & Antipina, 2015a).

Thus, the efficiency of innovation activities has positive growth dynamics, however their share in the total volume of shipped goods and services is less than 9% which speaks for a low level of research development of the Russian economy. A high level of innovation development is typical of the Central and Volga Federal Districts.

Problem Statement

To carry out innovation activities, significant financial resources are required (owned or debt funds). [United Nations Organization for Culture and Science]

Table

Research Questions

Despite the total increase in indices of innovation activities, their quality level does not correspond to world trends. Therefore, it is necessary to identify obstacles to innovation activity development. They are as follows: (Sergeev, Kipcharskaya, & Podymalo, 2014)

1) Shortage of funds:

It causes the need for new funding sources and rationalization of owned resources by selecting promising innovation activities which can result in abandoning of some research.

2) Unbalanced distribution of resources:

Resource disbalance of current and strategic innovation projects can be observed.

3) High level of risks:

The cause is due to a small scale of innovation activities (e.g., start-ups) and uncertainty of final results. Innovation projects are often venture activities which are characterized by a high level of costs and risks.

4) High level of costs:

The cause is due to the need for systematic and technological re-equipment by purchasing / replacing equipment (for projects implemented by large companies).

5) Limitations on marketing activities:

The cause is due to high costs of marketing researches and challenges to predict the market response to innovation products, services or works.

6) Low team motivation

Many founders of start-ups are idea-driven employees as distinct from project participants interested in financial remuneration.

Innovation enterprises need significant investment funds. Innovation and investment are interrelated in current manufacturing processes regardless of business scales. Investment in innovation activities aims to introduce new technology in company activities. However, it is necessary to understand that project profitability should be a priority. There are two investment purposes: purchasing of innovation products, licenses, patents; development of innovation products. Unfortunately, the investment structure is homogenous enough and depends on its raw material component. In developed countries, innovation activities are funded by public and private organizations. It is typical of many Western European countries and the USA.

Currently, there are the following funding sources for innovation activities:

federal and regional budget funds;

special non-budgetary funds;

owned funds of enterprises;

debt funds of financial and commercial organizations (investment funds, commercial banks, insurance companies, etc.);

conversion loans of research and manufacturing defense enterprises;

foreign investment funds;

national and foreign research funds.

Purpose of the Study

Federal budgetary funds are an important funding source. They are used to support high-impact innovation projects on a competitive basis and federal innovation projects.

Types of budget funding are as follows: (Nechaev, Barykina, & Puchkova, 2017)

base budgetary

target

grant

Development of federal target programs (FTP) is a key form of budget funding of priority innovation projects.

Support programs involve different activities: development of innovation infrastructure, commercialization of research and development results, pilot studies, development of critical technologies, improvement of legislation and expert training for innovation activities.

Grant funding is the most transparent funding form as far as financial resources are distributed through the system of public research funds. Public non-budgetary funds support innovation projects using non-budgetary financial resources.

Resources of non-budgetary funds can be used for the following purposes: (Nechaev & Antipina, 2015b)

funding of R&D, standardization, certification, marketing researches, advertising, sales of new products (services);

provision of state standards, methods, instructions and other documents for analysis, prediction, optimization, economic reasoning of innovation projects, development of research and engineering documents;

funding of labor protection and improvement of working conditions.

To support innovation activities, the government establishes privileges, includes innovation projects in complex federal innovation investment programs, creates a legislative and methodological basis for innovation management, helps investors repair equipment, consults on certification, marketing issues, and creates federal non-budgetary innovation support funds, unions, associations (Basova & Nechaev, 2013)

The current level of innovation development in Russia is lower than the one in developed countries. Decreasing volumes of public funding, the lack of owned funds development strategies cannot be compensated for private investment.

Research Methods

There are different forms of financing of innovation activities:

leasing involves purchasing of capital assets by enterprises or expensive goods by individuals. It is a long-term rent which contains an option to purchase the leased property at a bargain price and decrease a tax load (Ries, 2011)

factoring is a financial transaction in which a bank purchases debt recovery rights.

forfeiting is a financial transaction involving the purchase of receivables from exporters by a forfeiter.

Despite the advantages of leasing transactions as an important financing source, there are some obstacles to leasing development in Russia: (Molchanova, 2013)

short loan terms and high loan rates;

high tax rates;

if a company purchases equipment at full cost, it lacks sufficient seed capital;

lack of information about offers of leasing services;

underdeveloped leasing market infrastructure;

financial risks of leasing activities;

macro-economic and political uncertainty in Russia.

Currently, leasing is a promising and flexible economic tool attracting investment funds in real economic sectors, providing support for development of national industries, ensuring reliable long-term income of credit institutes, and providing business support.

The most attractive industries for Russian leasing development are transport (e.g., air transportation), machine building, agriculture, and small business. (Wiley, 2004)

To eliminate obstacles to leasing development, the following measures can be taken:

Market restructuration and reforming to control risks and prevent defaults in the leasing industry.

Expansion of benefits for long-term financing of leasing deals.

Insurance.

Attraction of foreign investment in the leasing industry.

Development of the leasing market infrastructure (e.g., leasing counselling, qualified staff in the leasing industry).

Currently, new leasing companies appear. They have high positions in the national market.

The current level of innovation development in Russia is lower than the one in developed countries. Decreasing volumes of public funding, the lack of owned funds development strategies cannot be compensated for private investment (Boobyer, 2003).

According to the Global Innovation Index 2017 published by the World Intellectual Property Organization (UN WIPO), Russia ranks 45th out of 127 countries. In 2016, it ranked 43rd.

Switzerland, Sweden, the Netherlands, the USA and the UK are the world’s most-innovative countries. In 2016, Switzerland was also at the top of the ranking. Singapore ranks 7th, China – 22nd, Turkey - 43rd, Ukraine - 50th. Togo, Guinea and Yemen hit rock bottom. Greece (44), Chile (46) and Russia (45) have similar innovation achievements. Such Asian countries as Indonesia, Malaysia, Singapore, Thailand, Philippines and Vietnam, which are successfully improving their innovation ecosystems and have high education and research development levels, high labor performance and a high technology products exportation volume, are approaching China, Japan and Korea (Krishnan & Moyer, 2004).

Findings

Innovation activities are crucial for sustainable development. To this end, it is important to monitor investment in knowledge, technology and ideas contributing to innovation development.

Investment management tools in innovation enterprises should be system-based which requires development of an investment management system. Even under limited investment resources, an efficient investment management system can create possibilities for national innovation sector development.

Under existing economic conditions, mobilization of new development sources and utilization of global innovation opportunities are a priority for all subjects concerned.

Conclusion

To conclude, let us suggest some solutions to the issue of innovation development: (Izyumov & Mironova, 2015)

1)ensuring a resource balance:

It is relevant for current and strategic innovation activities. A resource balance can be ensured by enhancing reasonability of budget formation, in particular, at the innovation potential assessment stage.

2)ensuring risk reduction conditions:

It is relevant for innovation activities of small and medium-size business which are the most unprotected entities.

3)regulation of activation conditions:

It involves identification of rational financial and temporary conditions of innovation development.

4)development of an efficient management system:

It involves development of an efficient innovation activity management system by attracting highly qualified specialists.]

References

- Basova, A.V., & Nechaev, A.S. (2013). Taxation as an instrument of stimulation of innovation-active business entities. World Applied Sciences Journal, № 22 (11), 1544-1549.

- Boobyer, C. (2003). Leasing and Asset Finance: The Comprehensive Guide for Practitioners 86, (р. 35-48).

- Izyumov, D.B., Mironova, D.S., (2015). Analysis of the current state of innovative activity of the state and business: foreign experience and Russian realities. Innovation and expertise, 1, 14, 40-49.

- John Wiley & Sons, 22 oct. 2004. Copula Methods in Finance, 310 Kihara, E. (June 17, 2013). Private Sector Welcomes Government Leasing Route. Retrieved from http://www.capitalfm.co.ke/business/2013/06/private-sectorwelcomes-govt-leasing-route/ (Accessed October 11, 2013).

- Krishnan, V. S., & Moyer, R. C. (2004). Bankruptcy Costs and the Financial Leasing Decision. Journal of Financial Management, 23, 31-42.

- Molchanova, O.P., (2013). Innovative management: a textbook for universities. M.: Vita-Press.

- Nechaev, A.S., Antipina, O.V. (2015a). Tax stimulation of innovation activities enterprises. Mediterranean Journal of Social Sciences, 5, 42-47.

- Nechaev, A.S., Antipina, O.V. (2015b). Technique of tax rates and customs duties updating as the tool of enterprises innovative activity stimulation. Modern Applied Science. 9 (2), 88-96.

- Nechaev, A.S., Barykina, Y.N., Puchkova, N.V. (2017). Analysis of Articles of Fixed Assets Renewal of Russian Business Enterprises, Advances in Economics, Business and Management Research. Proceedings of the International Conference on Trends of Technologies and Innovations in Economic and Social Studies, 38.

- Ries, E. (2011). The Lean Startup: How Constant Innovation Creates Radically Successful Businesses

- Sergeev, V.A., Kipcharskaya E.V., & Podymalo D.K., (2014). The fundamentals of innovative design: the manual. Ulyanovsk: UlSTU.

- UN WIPO. (2017). World Intellectual Property Organization. Retrieved from http://www.wipo.int/pressroom/ru/articles/2017/article_0006.html

- Wakelin, O., Otheno, O., Kinyua, K. (2003). Leasing Equipment for Business: A Handbook for Kenya. September 2003. Retrieved from http://practicalaction.org/microleasing/leasing.htm (Accessed October 10, 2013).

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

17 December 2018

Article Doi

eBook ISBN

978-1-80296-049-5

Publisher

Future Academy

Volume

50

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1464

Subjects

Social sciences, modern society,innovation, social science and technology, organizational behaviour, organizational theory

Cite this article as:

Barykina, Y., Puchkova, N., & Budaeva, M. (2018). Analysis Of Innovation Activity Financing Methods In Russian Economy. In I. B. Ardashkin, B. Vladimir Iosifovich, & N. V. Martyushev (Eds.), Research Paradigms Transformation in Social Sciences, vol 50. European Proceedings of Social and Behavioural Sciences (pp. 120-127). Future Academy. https://doi.org/10.15405/epsbs.2018.12.16