Abstract

At present, the issues of investment climate and investment attractiveness are of decisive importance for regional authorities, as the economic growth of regions depends on the volume of investment resources. In the conditions of the economic crisis and fierce competition, it is necessary to develop new methods of increasing the investment attractiveness of the region. For this, it is necessary to take the following measures: - selection of priority projects with short-term results and implementation of long-term regional development programs on their basis; - change the incentive system to encourage national investors; - Development of the internal market through the effective management of the region and the introduction of changes in regional laws. The purpose of the article is to develop and justify measures to stimulate national enterprises and regional authorities to invest in the regional economy. The object of the study are investment mechanisms designed for the development of territories. The methodological basis is a comprehensive approach to economic phenomena in the regional investment policy. The article compares two regions of the Siberian Federal District (SFD), analyzes the dynamics of investments in fixed assets of territories, the structure of investment resources, the negative impact on the dynamic development of remote areas. The recommendations that can improve the investment attractiveness of the Siberian regions (by the example of the Irkutsk region) and significantly increase the various economic indicators, which, in the context of the general crisis, are paramount objectives for maintaining economic growth in remote regions and securing qualified personnel.

Keywords: Investment climaterisksinvestment attractivenessstrategy

Introduction

Investment is the allocation of money or another resource, in anticipation of benefits. In an economic crisis, investment in the regional economy is a complex process. This is due to the public production and transformation of investor's income into capital. The volume of investments, their dynamics are characteristics of the regional management system. Using these indicators, you can determine the prospects and rates of regional growth. The macroeconomic impact on the dynamics of investment should also be taken into account (Brymer, Molloy, & Gilbert, 2014). In general, increasing the investment attractiveness of the region is a complex task that requires special development programs, changes in legislation, etc. As the regions are different, factors that reduce investment attractiveness are different. When developing long-term directions of investment policy, it is necessary to take into account the interests of the population and regions. For many regions of Russia, the support of the federal government is crucial. In remote regions there are no federal budgetary investment resources. Among the factors of weak development of remote areas - weak control over the timing of the implementation of regional development projects, an inefficient approach to the selection of investors and investment programs. In these conditions, public control and the introduction of changes in legislation, in particular tax legislation, are of paramount importance in order to create a favorable investment climate for domestic investor.

Problem Statement

Under current conditions, the key factor of regional development is real investment in various projects aimed to upgrade and expand reproduction of manufacturing facilities, improve competitiveness of products and solve many social and economic problems of national and regional development. Investment in real projects is carried out irrespective of the availability of owned funds. However, in any case, preliminary evaluation of the efficiency of decisions made and performance indices with regard to risk factors is required (Voronov, 2003).

In remote (Siberian) regions of Russia, deficient investment resources are a challenge. These regions have low positions in the national and international markets. Today, it is necessary to overcome these challenges for efficient development of regions.

Research Questions

In modern conditions, investment activity is aimed at the development of enterprises, industries, territories and is designed to ensure economic growth. The main factors for achieving the objectives are: analysis, prompt elimination of problems through the introduction of new management methods, using statistical data (Kretova, Tsaregorodtseva, & Khohlova, (2017);

Purpose of the Study

The purpose of the study is to develop and justify measures to stimulate domestic entrepreneurs and the leadership of the regions to active investment activities.

Research Methods

The methodological basis of the scientific article is a comprehensive approach to the study of organizational and economic phenomena in the field of investment policy in the region.

The rationale for the introduction of additional actions for the effective development of the region and investment climate in the region

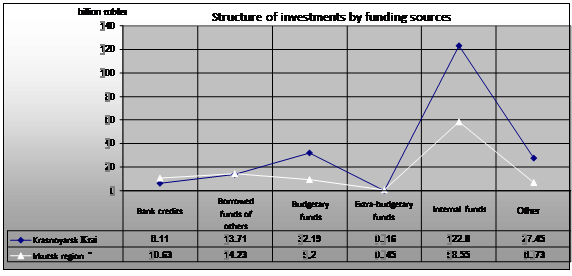

Consider the problem of investment attractiveness of the example of two regions: Irkutsk region and the Krasnoyarsk territory. As for the Irkutsk region – its location and natural resources is the basis to determine the most attractive region of the country, for any investor, in fact, it is not. One of the main problems of economic growth in the region is the lack of dynamic development (a process investing today – delayed). According to the press service of the government of Irkutsk region – the region ranks 2nd in terms of investment, yielding first place to the Krasnoyarsk territory in the Siberian Federal district (SFD).

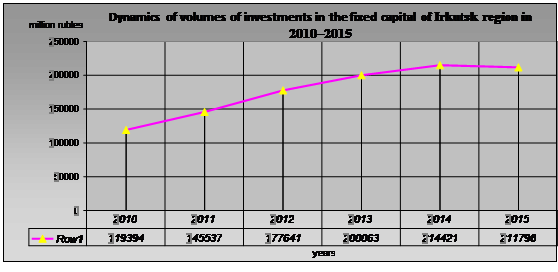

The investment growth rate Irkutsk oblast in 2016 has become a leader in the Siberian Federal district (growth was -17.7%) but in 2015 the situation was much worse (the volume of investments in main capital dropped to 2014 – 12.4%), table

Figure

Figure

Insufficient demand for products;

Lack of financial resources;

Availability of foreign substitutes;

Lack of qualified staff. This problem is both serious and surprising as in Irkutsk oblast, there are enough universities and colleges. A question arises why qualified workers leave Irkutsk for other regions (e.g., Krasnoyarsk krai). Among main migration factors are low living standards (salary levels, living conditions, available services) and dynamics of regional development (Becker & Dietz, 2004).

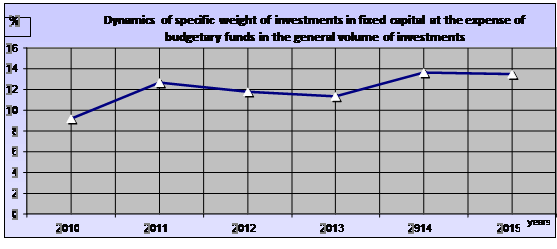

Based on figure

Despite the existing difficulties, the leadership of the Irkutsk region in 2016 set a goal to enter the TOP-30 investment-attractive regions of Russia.

Methodological approaches to assessing the effectiveness of the investment climate in the region

The opportunities for attracting investments in the economy of the regions are determined by socio-economic, financial, organizational, legal and natural-geographical factors. The Irkutsk region is a powerful industrial region of the Russian Federation, which has a number of serious advantages for investing foreign capital. In the Doing Business ranking of the World Bank in 2012, among the 30 Russian cities, Irkutsk ranked 10th in terms of ease of doing business (Israfilov, 2016). At the same time, the advantages are ease of registering enterprises (8th place), obtaining construction permits (6th place) and connecting to the power supply system (10th place). The disadvantage is the timing and cost of property registration (18th place for ease of property registration) (Nechaev Ognev, & Antipina, 2017). In the rating of the agency "RA Expert" Irkutsk region in 2015 fell into the group 2B "Medium Potential - moderate risk. "From the components of the ranks of the investment potential, the region took the highest place:

on natural resource potential (7th place),

the lowest - on the infrastructure (74th place) (Rysukhina & Korovin, 2016; Campbell, 2012).

Therefore, it is necessary to take prompt measures to change the situation with the infrastructure component, in order to create a greater investment attractiveness of the region.

Findings

The analysis showed that one of the areas provided with natural resources, skilled personnel, and industrial potential has a rather low indicator in the rating of regions.

However, the investment potential of the region remains high, as in any territory, the region has significant advantages and disadvantages affecting the investment climate:

The advantages of the region include:

natural resource potential, including Lake Baikal,

proximity to the Asia-Pacific countries

high industrial potential,

low level of electricity cost,

developed network of scientific and educational organizations,

a significant amount of investment projects,

Negative factors include:

relatively difficult climatic conditions,

depreciation of fixed assets in industry,

relatively high production costs,

insufficiently developed infrastructure,

To solve all existing problems in the region, it is necessary, first of all:

to give the city of Irkutsk (as the regional center) a new look and status.

In order to increase the investment attractiveness of the territory (Irkutsk region), it is possible to identify the main factors:

1. Development of advertising of this territory - in the form of symbols, prospectuses, video films, using photographs of the unique Lake Baikal (the value of advertising is underestimated today).

2. Given the shortage of investors in such a remote area, it is necessary to create conditions for attracting domestic investors, it is necessary to create conditions under which investments in the region will be beneficial for everyone, for example, by changing the system of granting benefits to exporting enterprises. If the exporter directs part of the refundable VAT to the development of the territory, in this case the refund of VAT remains. With this approach to the system of existing benefits, significant economic growth in the region can be achieved (Tayurskaya, 2011, 2017).

3. In the Tax Code, it is necessary to expand the range of benefits for existing investors-for example, by reducing tax payments by 10% for them, while increasing by 15-20% tax payments for organizations that do not participate in the development of territories.

4. A more significant effect in the development of the territory can be achieved through the introduction of public-private partnerships. [eleven].

5. The division of investment projects into main (basic) and less urgent will allow to focus attention and funds on those projects, the effect of which will be obtained in the near future, first of all, this is the operational development of the tourist infrastructure and effective advertising.

According to the authors, it is the tourism industry that should become the basis for the development of the territory. The development of tourism should become one of the leading sectors, thanks to which it is possible to change the image of the territory.

6. An important direction for creating an investment attractiveness of the region is the development of the domestic market, this requires new incentives for small businesses through a system of additional benefits, but with the participation of entrepreneurs in investment projects.

That is, in a crisis it is necessary to find and use the internal reserves of the territory (2015).

Conclusion

The research revealed the reasons for the low investment attractiveness of a specific region (Irkutsk region), proposed a methodology for stimulating investment activities of exporting enterprises to participate in investment projects based on changes in the existing system of advantages.

In general, the Irkutsk region is a region that can reach a different level of investment attractiveness, the basis of which should be:

Effective investment policy,

federal budget funds,

introduction of a tax regulation system to attract small businesses to the number of investors.

In the economic literature, the main criteria for the investment attractiveness of the territories are defined, which include:

the standard of living of the population, the level of consumer prices, the unemployment rate, the average monthly wage, external turnover, per capita production. In our opinion, the growth of some indicators (standard of living, wages, production volumes) and reduction of others (price level and unemployment) is a program that will automatically increase the investment attractiveness of the region.

For the dynamic development of any region, it is necessary to follow well-known principles:

Improvement of legislative support in the field of investment;

concentration of investment policy on the most important projects;

constant interaction with enterprises (in order to maximize the mobilization of equity in investments) (Federal Service of State Statistics, 2016). ];

continuous monitoring, identification of both positive and negative factors in the development of the region (Ekspert, 2015)

References

- Becker, W., & Dietz, J., (2004). R&D cooperation and innovation activities of firms-evidence for the German industry. Research Policy 33, 209–223.

- Brymer , R.A., Molloy, J.C., & Gilbert, B.A. (2014) Human Capital Pipelines. Journal of Management, 40, 2, 483-508.

- Campbell, B. A. (2012). Rethinking sustained competitive advantage from human capital. The Academy of Management review: AMR, 37(3), 376-395

- Ekspert. (2015). Reytingovoye agentstvo. Retrieved from http://raexpert.ru/rankingtable/region_climat/2015/tab01

- Federal Service of State Statistics (2016). Retrieved from http://www.gks.ru/bgd/regl/B11_04/IssWWW.exe/Stg/d04/2-p12.htm

- Israfilov, N.T. (2016). The nature of bankruptcy institute development under transition to the market economy. The Chicago Journals in Liberal Arts The Collection of Scholarly Papers, 24-33.

- Kretova, N. V., Tsaregorodtseva, E.Y., & Khohlova, G.I. (2017). Department of Economic Theory and Finance National Research Irkutsk State Technical University Irkutsk, Russia - Applying advanced methods of evaluation of level of innovative development for industrial sector. Advances in Economics, Business and Management Research, 38. Trends of Technologies and Innovations in Economic and Social Studies (TTIESS 2017).

- Loukil, K. (2016). Foreign direct investment and technological innovation in developing countries. Oradea Journal of Business and Economics, 1(2), 31–40.

- Nechaev, A.S, Ognev, D.V., & Antipina, O.V. (2017). Innovation risks: challenges and prospects, Advances in Economics, Business and Management Research, 38. Trends of Technologies and Innovations in Economic and Social Studies (TTIESS 2017), 7-12 doi:10.2991/ttiess-17.2017.2,

- Nechaev, A.S., Antipina, O.V., & Prokopyeva, A.V. (2014). The risk of innovation activities in enterprises. Life Science Journal (LSJ). USA, 11(11), 574-575.

- Rysukhina, D.V., & Korovin, V.E. (2016). Modern issues of improvement of the investment attractiveness of the Russian economy. Young researcher, 8.8, 28-30

- Mani, S. (2010). Financing of industrial innovations in India: how effective are tax incentives for R&D Int. J. Technological Learning, Innovation and Development, 3, 2.

- Tatuev, A.A., Kerefov, M.A., Lyapuntsova E.V., Rokotyanskaya V.V., & Valuiskov N.V. (2015). Economic policy of russia in the context of macroeconomic instability. The Social Sciences (Pakistan), 10, 6, 1054-1061

- Tayurskaya, O.V. (2017). VAT on export: problems and options for improvement. Economics and entrepreneurship, 8-1, 92-96,

- Tayurskaya, OV. (2011). Total debt control as a factor financial stability of a company. Bulletin of Irkutsk State technical University, 4, 187-193

- Voronov, V.V. (2003). Transformation of the economic awareness and economic practice. (Doctoral dissertation).

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

17 December 2018

Article Doi

eBook ISBN

978-1-80296-049-5

Publisher

Future Academy

Volume

50

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1464

Subjects

Social sciences, modern society,innovation, social science and technology, organizational behaviour, organizational theory

Cite this article as:

Tayurskaya, O., Okladnikova, D., & Solodova, N. G. (2018). Investment In The Regional Economy: Challenges And Prospects. In I. B. Ardashkin, B. Vladimir Iosifovich, & N. V. Martyushev (Eds.), Research Paradigms Transformation in Social Sciences, vol 50. European Proceedings of Social and Behavioural Sciences (pp. 1161-1168). Future Academy. https://doi.org/10.15405/epsbs.2018.12.142