Abstract

Intellectual property is one of the most important assets of an enterprise. At the same time, the commercialization of various items of intellectual property, which means their usage in production, selling or exchange, is an independent field of economic relations. Nowadays the problem of the tangible embodiment of innovational projects, developed on the basis of the university, is especially acute. Any breakthrough idea, taking the form of an innovational project, requires serious innovational investments. Strategically, the development of the innovational ecosystem of the university is a factor, which equally contributes to the improvement of both the scientific reputation of a higher education institution and its financial stability.

Keywords: Commercializationinnovationsmethods of evaluation

Introduction

The university can take part in the following destinations of implementation and commercialization of innovational projects:

establishing the new scientific research laboratories, centers, departments of innovational processes management and modernization of the existing ones;

consolidation of the material and technical basis of the existing laboratories, centers and departments;

advanced training of the university’s staff with the purpose of providing the scientific support of innovational projects implementation;

searching for and training of students, postgraduate students, young researchers – potential target residents (specialists of the innovational business);

participation of the higher education institutions in the implementation of innovational projects.

Besides, the universities should be offered the activity of creating small enterprises on their basis. In this regard, a special role is assigned to already existing business incubators at the largest higher education institutions of the region, which are an important part of innovational infrastructure. In particular, over 60 small innovational enterprises have been created and are working on the basis of a BSTU business incubator (Nikitina, 2013). This is one of the best results among the higher educational institutions. These small innovational enterprises carry out their activities in the sphere of energy-saving, nanotechnologies, IT and information technologies, designing new materials and equipment. Almost all these enterprises have already completed the stage of design and experimental documentation; some of them already have the samples of experimental products and industrial designs. At present, the negotiations about the further commercialization at the enterprises of the region are being conducted.

Problem Statement

With the increase of the national innovational system’s (NIS) maturity level, the accumulation of the intellectual capital becomes an important activity area of the companies, which implement the strategy of innovation-driven growth with the purpose of business capitalization. The elements of intellectual property (IP) as the industrial assets, as objects of investment and various market transactions, provide the connection between the scientific and technological activities and the economic relations system. So, in our opinion, the economic activity of the IP market is an essential indicator of the NIS development. But there is still no unified and generally accepted methodology of its evaluation (Williamson, 2001; Zak, 2011).

To evaluate the integrated socio-economic categories, a certain structured set of criteria is always used. It appears that the methods of integral assessment and rating are the best for monitoring the business activity of the IP market. Their usage allows, on the one hand, evaluating according to different parameters, and on the other hand, – forming an integrated index, which would make it possible to compare the situations in various regions. Nowadays a considerable difference of the innovational activity level in different regions of the Russian Federation is observed. The comparative analysis of the regional IP markets allows obtaining a true informational basis to evaluate the regional innovational policy and identify the most efficient measures of regulating and distributing the positive experience.

Research Questions

To analyze the business activity of the IP markets, a methodical approach, oriented to using the public data, formed by Rosstat and Rospatent, and characterized with rather simple calculations, has been suggested in this work.

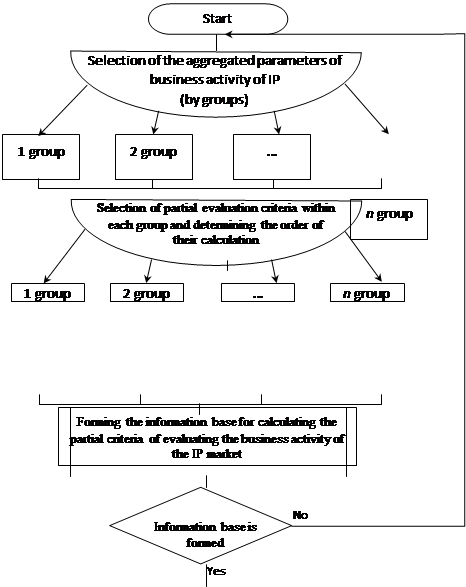

The general algorithm of the methodical approach is presented in Fig.

Purpose of the Study

Let us consider the main stages of the suggested methodology.

At the first stage, it is necessary to choose the aggregated parameters of the business activity of the IP market and to form them into groups. For example, the following groups of parameters can be used:

creation and usage of IP (this group includes the quantitative indices of the state registration of exclusive rights for the industrial property and means of individualization, as well as the contracts about the disposition of the exclusive rights, and these parameters directly characterize the activity of the IP rights economic turnover);

innovation activity (this group includes the indices, which characterize the intensity of intellectual activity);

institutions and regulation (this group deals with the institutional environment quality, which influences motivation of economic entities to register the objects of IP and to make deals with them).

It is assumed that there is a positive correlation between the innovation activity and the number of registered IP objects and transactions with them, as the intellectual property is, by definition, a set of intellectual activity results and means of individualization, which are provided with legal protection. So, at the low indices of innovation activity there cannot be high indices of the number of IP objects and transactions with them (Uci, 2007; Williamson, 1996; Seliverstov, 2013).

The readiness of a company to conduct business, based on using rights for the IP, depends not only on economic benefits forecast, but also on the understanding if it would be easy or difficult to provide and to ensure compliance to rules and standards, which determine the functioning of the IP market. The creation of favorable conditions for the IP market participants means the existence of such «rules of the game» (regulatory norms), which would ensure: simple and understandable procedures of the state registration of rights; making deals concerning the IP with the lowest expenses and time consumption; the predictable results of economic transactions and the trust of contractors; protection of proprietary rights of the owners and users of IP.

At the second stage, the partial criteria of evaluation within the framework of each parameter of business activity are selected and the order of their calculation is determined.

A set of criteria of the IP market business activity must meet the universal principles of indices systems formation (the purposefulness of formation; conformity to the actual phenomena and processes; the informational completeness, but not redundancy; the uniform coverage of all the analytical areas in the system; noncontradiction; univocacy and understandability of calculation methodologies). It should be pointed out that after the implementation of the third stage of the suggested methodology, the initial set of evaluation criteria can undergo some changes as the viability of any indices system depends on the information support. In Table

Then, at the third stage, it is necessary to form an information base for calculating the partial criteria of evaluating the business activity of the IP market.

The experience has shown that the data collection is often a labor-consuming stage of socio-economic phenomena and processes evaluation.

Nowadays the statistical observation embraces a wide range of indices in the section «Science and innovations» (tab. 5.3), which simplifies the performance of an analytical task of matching according to the parameters «Patent dynamics and investments into IP» and «Innovation activity».

The statistics of the science and innovations situation in different federal regions and territories of the Russian Federation is presented in the collected volume «Regions of Russia. Socio-economic indicators». Probably the most significant drawback of using statistical data is the long time of obtaining the results of the statistical survey (over a year). At the same time, a representative time series of data has been already accumulated – for more than 10 years. This allows performing a full-scale dynamic analysis of the regional IP markets’ business activity (Filippov, 2009; Khadiullina, 2010; Khubiev, 2012).

Another problem, associated with use of the statistics data, is a narrow range of inventive activity indices and the property rights economic turnover indices, published by Rosstat. In the above-mentioned statistical book, only two indices are presented: «patent applications submitted» and «patents granted» in the context of inventions and utility models. To expand the information base and, consequently, the composition of the IP markets’ business activity evaluation criteria, it is necessary to use the annual reports and other analytical materials of Rospatent (FIPS, 2010; Rosstat, 2016).

The indices of the third group of parameters «Institutions and regulation» are the most labor consuming to calculate as they require cooperation with a representative experts group, presenting various regions. At the same time, the gathering of expert estimations is quite accomplishable in practice. More than that, expert estimations are an essential part of the methodology of the above-listed rankings, as well as of many others. They allow obtaining quantitative evaluations of qualitative phenomena and processes. Some of the indices of this group require gathering information about the presence or absence of certain elements of institutional environment in the region. For other indices, the gathering and the statistical processing of point scoring are required.

The composition of an expert group is worth a separate discussion. We assume that it is not exactly correct to confine it only to the representatives of the companies, which carry out innovation activity, as they often provide judgment based on only the occasional experience; though their opinion is certainly very important. It is reasonable to include into the expert group also the representatives of regional authorities, responsible for the innovation policy of the regions; members of research establishments and universities; lawyers; representatives of reference entities of Rospatent in the region (Anand, 2000); patent lawyers and other consultants in the sphere of legal protection of IP. The above-mentioned categories of specialists deal with the problems under study on a regular basis, which increases the objectiveness of expert estimations of the IP market institutional environment's state.

At the

The economic analysis methodology includes various methods of the integral assessment of complex economic phenomena and processes.

Research Methods

For the suggested methodical approach, any method of criteria normalization can be chosen. Let us consider some basic relations, used in each method of normalization, and develop them in detail.

,

where

where – average value for each optimization criteria.

or

where – the maximum criterion value for the alternative; – the minimum criterion value for the alternative.

There are also alternative ways of the linear transformation, which are used depending on the purpose of normalization.

For example, proportionality coefficients: , , , , then:

.

Then the selection of a criteria convolution method should be substantiated. Let us consider various schemes of scalarization to evaluate particular competitive potentials [****].

,

where

- normalized value of indices;

;

,

where - minimum value of target index; - maximum value of target index.

;

;

.

;

.

Within the framework of this methodology, a method of level evaluation is suggested, which is easy-to-use and convenient in terms of obtained values interpretation.

,

where

– the normalized against the minimum and the maximum level value of the

Normalized values vary within the range of [0; 1]; for the subject with the worst actual value of the index, the normalized value amounts to zero, and for the region with the best actual value of the index it amounts to one.

Step 2. The rating assessment for each of the three-parameter groups is calculated as an arithmetical average of the normalized values of the criteria:

,

where

– rating assessment of the

The rating assessment values of the region for parameters group 2 «Innovational activity» ( ) and for parameters group 3 «Institutions and regulation» ( ) are calculated in a similar way. Such stepwise approach to the integral assessment of the regional IP markets’ business activity allows not only obtaining the overall rating of the regions, but also comparing the evaluations of the regions in the context of three groups of parameters.

Step 3. The total rating assessment of region ( ) is calculated as an arithmetical average of rating assessments by the parameter groups:

.

At this stage, as well as during calculating the rating assessments, the significance coefficients of parameter groups or the particular criteria of business activity can be introduced. But, in our opinion, the subjective values of significance coefficients, set by an analyst, can garble the rating assessments values and hinder their interpretation. So we suggest considering the above-mentioned groups of parameters as the equally important indices of an IP market business activity.

At the

At the

The following analytical cross-sections are suggested for usage:

the total rating structure: number of regions, the aggregate GRP and the cumulative resident population of regions, included in each rating class;

the regions rating structure in criteria group 1 «Creation and usage of IP»: a number of regions, the aggregate amount of granted patents and signed agreements about the disposal of rights for IP;

the regions rating structure in criteria group 2 «Innovational activity»: a number of regions, the class average intensity of expenses for technological innovations, the class average share of innovative products;

the regions rating structure in group 3 «Institutions and regulation»: a number of regions; the aggregate number of innovatively active organizations; the aggregate amount of patent applications;

the dynamics of regions’ ranking positions: a number of regions that have increased/decreased their position in each of the above-mentioned rankings.

Findings

Possession and disposal of the intellectual property result in obtaining the monopoly profit. This allows the business entities to familiarize with innovations, which in its turn stimulates the development of various technical and technological processes of their operation. This is the basis for organizational-managerial decisions. The business potential of economic entities is to a great extent determined by the amount of intellectual property objects, which they possess.

The potential competitive advantages are ensured due to the qualitative and quantitative composition of inventions, patents, industrial prototypes and utility models. Their commercialization is risky, so it is necessary to make calculations and to take them into account during the implementation and usage of intellectual property objects in production.

Conclusion

Recently the increase of the importance of intellectual property as an economic category has been observed. This is, first of all, due to the accelerating pace of intellectual property objects trade in comparison with the trade of other types of property.

The activation of the intellectual property commercialization process depends on the growing tendencies of information economy in Russia and all over the world.

Acknowledgments

The article is published within the framework of the strategic development program of BSTU named after V.G. Shukhov.

References

- Anand, B.N. (2000). The Structure of Licensing Contracts. Journal of Industrial Economics, 48, 1, 103-135.

- FIPS. (2010). Federal Institute of Industrial Property. Cooperation with regions. Resieved from: http://www1.fips.ru/wps/wcm/connect/content_ru/ru/regions/.

- Filippov, R.I., (2009). Franchising as a factor of business dynamic stability in network relations. Vlast, 5, 22-25.

- Khadiullina, G.N. (2010). Transformation of intellectual property in the modern Russian economy. Bulletin of Kazan Law Institute of the RF Ministry of Internal Affairs, 1, 97-100.

- Khubiev, K.А. (2012). Innovation economy and the genesis of new relations in the innovation economy. Economist, 3, 62-67.

- Nikitina, E.A., (2013). Correlation of the competitiveness of the enterprise and competitiveness goods. Bulletin of BSTU, 4, 125-129.

- Rosstat. (2016). Regions of Russia. Socio-economic indicators. Statistical book. Rosstat: М.

- Seliverstov, Y.I. (2013). The Analysis of Intellectual Property Use in the Economic Turnover of Russian Enterprises. World Applied Sciences Journal, 25, 12, 1763-1769.

- Williamson, О.I. (1996). Economic institutions of capitalism. Firms, markets, «relational» contracting. St.Petersburg.: Lenizdat.

- Williamson, О. I. (2001). Logic of an economic organization. Nature of a company. М.: Delo.

- Uci, B. (2007). Sources and consequences of the embeddedness for the economic efficiency of organizations: the influence of networks. Economic sociology, 8, 3, 44-60.

- Zak, Yu.А. (2011). Taking multi-criteria decisions. Moscow: Economics.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

17 December 2018

Article Doi

eBook ISBN

978-1-80296-049-5

Publisher

Future Academy

Volume

50

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1464

Subjects

Social sciences, modern society,innovation, social science and technology, organizational behaviour, organizational theory

Cite this article as:

Seliverstov, Y., Nikitina, E., & Gavrilovskaya, S. (2018). Commercialization Of Intellectual Property Of University: Stages And Methods Of Evaluation. In I. B. Ardashkin, B. Vladimir Iosifovich, & N. V. Martyushev (Eds.), Research Paradigms Transformation in Social Sciences, vol 50. European Proceedings of Social and Behavioural Sciences (pp. 1035-1046). Future Academy. https://doi.org/10.15405/epsbs.2018.12.127