Abstract

The article displays relevance of the Russian Arctic shelf field development despite the oil market imbalance and uncertainty of medium-term and long-term forecasts. Russian oil companies expand their activities in the Timan-Pechora oil and gas province, located in the Nenets Autonomous Area and Komi Republic. In the north-western Arctic, petroleum accumulation zones of the Timan-Pechora offshore extension contain from 360 to 1063 million tonnes of geological resources. Given the high environmental and economic risks are associated with the Northern macro-region, further development and implementation of new projects in this region, involving transport infrastructure improvement, demand enhanced methodology to assess environmental and economic risks in operations, to produce algorithms for identifying effective routes of oil transportation. The article presents the algorithm defining the most optimal transport structure for the Arctic shelf field development and production. Given high environmental and economic risks are associated with the Arctic shelf hydrocarbon fields development and exploitation, further development and implementation of new projects, involving transport infrastructure improvement, demand enhanced methodology to assess environmental and economic risks in operations, devising of algorithms for identifying effective routes of oil, gas and condensate transportation. Major tasks of the research deal with devising environmental and economic assessment of the Arctic shelf hydrocarbon field development and operation considering main factors in region’s oil resources development. Assessment of the overall effect considering major factors associated with three alternatives to transport the Timan-Pechora oil and gas was conducted.

Keywords: Exploitation of deposits in the northern Arctic regionoil market conditionsoil transportation alternativesanalysis and significance of factorsintegrated assessment of project efficiency

Introduction

The oil industry is a major component of the Russian economy; its large scale is retained in the Russian Federation and defines the country's development and geopolitical significance in the world. Russia maintains its position in the global energy market. Oil production was 547.5 million tonnes in 2016 and decreased by 0.1 per cent in 2017 (546.8 million tonnes or 10981 million barrels per day) (The decision of OPEC can raise the price of oil to $60, 2017). Russia has maintained its position as the leading oil exporting country. Over the last two years the Russian oil export has been more than 254 and 257 million tonnes (around 46-47 per cent of oil production output) (Oil and Oil Products Market, 2018). This stability relies on the sufficient hydrocarbon raw material base, which was formed in the Soviet time, but since 1994-1995 the replenishment of hydrocarbon reserves has been facing problems (Labys, 1998). The majority of proven oil reserves (91 per cent) are given to subsoil users. The share of vertically integrated companies accounts for 77 per cent of oil reserves. At present it is necessary to reassess oil resources and reserves on a completely new methodology and classification base, taking into account the changed economic conditions, and it is evident now that the results of the raw material base appraisal are slightly exaggerated. Small deposits account for 82 per cent of the proven deposits in total. Depletion of reserves in Russia has reached around 50 per cent (Oil and Oil Products Market, 2018). Therefore, concerns over sustaining hydrocarbon production volume and exploiting oil fields in a financially viable way are rising. One of prospects for oil and gas advancements is the development of the Arctic shelf reserves, the estimate of which is 66 billion tonnes of oil equivalent. Sustaining hydrocarbon production demands continued well drilling. Many experts forecast that the number of the Arctic shelf wells should reach 25 by 2030 (Konoplyanik, 2018, 46-57);

Problem Statement

In accordance with the Russian energy strategy, which is being developed, hydrocarbon production is going to continue in every existing oil and gas production region, as well as in new regions of eastern Siberia, Far East and the Russian shelf. However, at present some decrease in production is predicted for extracting parts of the European Russia and Sakhalin, so to maintain the required oil production level after 2018 it is necessary to discover new deposits and commence their development. The geological and economic analysis of the oil production raw material base in western Siberia shows that it is capable of achieving the maximum level of 211–217 million tonnes if developed and explored oil deposits are involved. However, the level is forecast to decrease to 175 million tonnes in 2020 and 145 million tonnes - in 2030 for oil and gas (Konoplyanik, 2018).

Insufficient funding of geological exploration works precludes large-scale surveying that causes some decrease in new hydrocarbon deposits. At present oil production and reserves maintenance are aggravated by the fact that oil reserves have been declining in Russia and have not compensated production. In addition, the raw material base quality is declining, as the share of difficult-to-recover reserves exceeds 55 per cent. One third of oil reserves have a low level of depletion (70 - 80 per cent) (Braginsky, 2009). It refers to the European part of the country producing one third of Russian oil (around 155 million tonnes): the Urals and the Volga Region, the North Caucasus, the Timan-Pechora filed. Figure

Keeping the Russian oil production at the level of 10.8 million barrels per day and subsequent increasing to 565 million tonnes per year will be possible if new projects are implemented and new oil deposits are developed, which represents the direct interest for the state as the subsoil owner. The Russian natural resources ministry forecasts that by 2035 by undertaking geological exploration works Russia will be able to increase oil reserves by at least 13-15 billion tonnes, gas reserves – by 25-27 trillion m3 (Research of the state and prospects of the directions of oil and gas processing, oil and gas chemistry, 2011). Sustaining oil production will be achievable by involving not only more accessible sources, but also tight reservoirs, which incorporate northern Arctic deposits. The northern Arctic region is viewed as a significant centre of hydrocarbon production, demanding large-scale investments in infrastructure and transport communications development. American experts’ estimate of oil in the Arctic tundra is more than 2.5 billion tonnes (Energy outlook peace and Russia until 2040, 2013). It should be noted that for Russia the northern Arctic region is becoming prioritized due to several emerging processes. Processes such as a high depletion of producing oil fields and growth of difficult-to-recover reserves (they account for 60 per cent of Russian reserves) lead to a fall in the oil recovery rate, which is not more than 30 per cent today (in the mid-80s it was more than 40 per cent) (The decision of OPEC can raise the price of oil to $60, 2017). Enhancing oil recovery demands investment and more expensive innovation technologies. For Russian oil producers to increase investment with ongoing sanctions and restrictions on Russia’s access to the capital and technology markets is getting more challenging. For instance, in 2015 investment in oil products fell by 8.8 billion roubles and in oil transportation by pipeline by 14.9 billion roubles. Most Russian oil companies had used foreign equipment and technologies, access to which was restricted in 2015, when the US introduced tough restrictions on American companies’ participation in Russian difficult-to-recover oil projects (deep-sea areas, the Arctic shelf). «As a result the first sample drilling of Rosneft in the Kara Sea in cooperation with American ExxonMobil was stopped». Despite the tension growth in the oil market Russian oil producers expand their activities in the Timan-Pechora oil and gas province, located in the Nenets Autonomous Area and Komi Republic (area of 350 thousand square km). At present more than 180 fields are found in the Timan-Pechora province, 136 of which contain oil, 4 - gas condensate, 2 - oil and gas, 13 - oil and gas condensate, 12 - gas condensate, and 16 - gas. LUKOIL and Rosneft have been developing and exploiting the Timan-Pechora basin, where they began operations in 1998 and 2003 respectively (Energy outlook peace and Russia until 2040, 2013).

Research Questions

Further advancement and introduction of new projects are connected with, foremost, the transport infrastructure development, Given the high environmental and economic risks are associated with this macro-region, it is necessary to enhance methodology to assess environmental and economic risks in future operations, to produce algorithms for identifying effective routes of oil transportation. Therefore, the next stage of our research is to conduct factor analysis in order to select indicators, essential for developing models, which are components of expertise and analysis systems to study possibilities, related to transport infrastructure establishment in the northern Arctic region.

The undertaken calculations of the volume needed for deep drilling, being major cost-intensive works, in main Russian oil and gas provinces show that for proper replenishment of the planned production levels with discovery additions to 2020, it is necessary to drill not less than 50 million m of exploratory, prospecting and parametric wells or 2.5 million m per year on average (Melnikov, 2010, pp.250). According to forecast estimates, the overall expenditure on all kinds of geological exploration works till 2020 should amount to 1 trillion roubles or 50 billion roubles per year on average (Lui & Chong, 2013). It is evident now that economic mechanisms should be developed, which would motivate subsoil users to finance works at their own expense, as well as provide for more effective development of blocks which they were granted. In accordance with the Arctic zone development strategy, enacted by the Russian President Putin, efficient use and development of the resource base found in the Arctic zone, focused on stable meeting of Russian needs in hydrocarbon resources, represent a relevant economic target. To achieve it the development of northern territories within the Timan-Pechora oil and gas province, the Barents, Pechora and Kara Seas’ continental shelf hydrocarbon deposits will be continued, as well as large infrastructure projects to integrate the RF Arctic zone with the developed regions of the country. This document states the necessity to enhance the transport infrastructure in the Arctic continental shelf development regions in order to diversify major routes of Russian hydrocarbon delivery to the global markets.

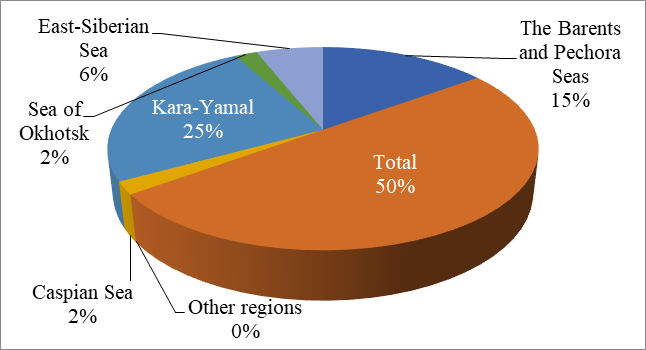

The latest estimates show that the Arctic shelf has up to 80 per cent of potential Russian hydrocarbon reserves (Fig. 1). The overall initial recoverable hydrocarbon resources of the Russian offshore periphery amount to about 100 billion tonnes of oil equivalent (toe) or, as some experts state, tonnes of reference fuel (trf) expressed in terms of oil (of which oil is 13.5 billion tonnes and gas is more than 73 trillion m3). Recoverable oil reserves are more than 400 million tonnes; gas reserves are more than 8 trillion m3 (Research of the state and prospects of the directions of oil and gas processing, oil and gas chemistry, 2011).

There is a commonly accepted view that the shelf of the Barents, Pechora and Kara Seas is the most promising region for the oil and gas resource development in the Arctic shelf area. With the resource potential of almost 31 billion tonnes of oil equivalent the Barents and Pechora Seas are one of the most prospective areas for the oil and gas industry development in the future. Among the Arctic seas of significant importance are the Barents (together with the Pechora Sea) and the Kara Seas, which contain more than 75 per cent of the Russian Arctic shelf oil and gas resources. By the end of 2014, 19 oil and gas fields were discovered in the Barents, Kara, Pechora Seas and the Gulf of Ob. Today two gas condensate deposits – Shtokman and Ledovoye – and three gas deposits – Ludlov, Murmansk and North-Kildinskoye are discovered in the Russian sector of the Barents Sea. The commenced oil production at the Prirazlomnoye field is supposed to be followed by other fields in a gradual way.

In the northwestern Arctic, oil and gas accumulation zones of the Timan-Pechora shelf extension contain from 360 to 1063 million toe of geological resources. Unique in its length and area, the Russian shallow marine transit area with the 20-metre sea depth can be compared with a large and prolific oil and gas province by its overall parameters: oil and gas promising area is more than 630 thousand km2, TIRrecovered are about 30 billion toe, that is one fourth of the offshore hydrocarbon potential for Russia. At present the transit zone has 9 discovered coastal-marine and 19 marine deposits, 13 of which are classified as large ones with recoverable reserves of more than 60 million toe; other 10 fields are discovered in the adjacent zone where depth ranges from 20 to 50 m; beyond the 50 m isobath 9 fields are discovered. Involving the coastal transit zone in the resource priority development is the first stage, establishing the coastal base necessary for the large-scale development of Russian marine periphery hydrocarbon resources.

In a short-term perspective (to 2030-2035), the Arctic shelf liquid hydrocarbon production level for five discovered fields (Yurkharovskoye, Prirazlomnoye, Dolginskoye, Medyn-More and Varandey-more) will not exceed 13 million tonnes (2.4 per cent of the total Russian production in 2016) even in the best case scenario, suggested by RAS Institute of Oil and Gas Problems (Resource-innovative development of the Russian economy, 2013). Given there is the economic crisis and falling hydrocarbon prices, primary development objects in the Arctic and other Russian offshore areas appear to be offshore fields in regions with developed onshore infrastructure (Kharasaveyskoye, Kruzenshternskoye, Kamennomysskoye-More, Semakovskoye, etc.). Such fields can be developed successfully with horizontal onshore wells, which are cheaper and environmentally safer than offshore ones. NOVATEK’s experience in developing the large Yurkharovskoye oil-gas condensate field proves that, the major part of the field resources being under the seabed of the Tazovsky Gulf.

Purpose of the Study

The purpose of the study is to develop an algorithm for determining the optimal transport structure for the development and operation of the Arctic offshore deposit. Based on the developed algorithm, it is possible to assess the overall effect of developing three alternatives for transporting oil and gas from the Timan-Pechora province: Usinsk, Varandey, Indiga, taking into account the main factors.

Research Methods

The economic assessment of the Russian Arctic shelf oil, gas, and condensate resources is conducted on the basis of securing the maximum potential overall effect from their development, considering restrictions, caused by technological capabilities, geological work requirements, the environment conditions, and other factors. To assess hydrocarbon resources an information database is formed as a result of collecting, analysing, and integrating multiple data for the Arctic shelf fields from the following resources: statistics, deposit development projects, programmes of geological exploration works, research reports (FAOstat, 2018). On the basis of the database, the comparative analysis and forecasting of technical and economic indicators for developing and exploiting the Arctic hydrocarbon deposits were conducted, hydrocarbon transportation routes and the priority alternative to deliver to customers were identified as well. The economic effect calculation should cover every stage of resource development, from identification and preparation of structures for deep exploration drilling to raw material delivery to users. One should consider disparities between costs and results, delivered and obtained in different periods, which is achieved by their adjusting to a common time.

Findings

The economic assessment of hydrocarbon resources is based on the calculation of the overall effect associated with developing three alternatives to transport oil and gas from the Korotaikhinskaya depression of the Timan-Pechora province – Usinsk, Varandey, Indiga – with consideration of major factors Sushko, Plastinin & Sarychev, 2017). The effect assessment involves analyzing uneven costs for every stage of deposit development and operation, finishing with oil delivery to customers. The hydrocarbon resources assessment period includes time from the development start to the field complete depletion. Time for exploration is defined with established methods which consider the number of wells, their depth, drilling speed and other parameters. The economic assessment of hydrocarbon production is based on providing the maximum overall effect of development and operation and taking into account the environmental and economic factors.

The overall calculation of hydrocarbon resources overall effect cost value associated with three alternatives of some field development is given by the following classic formula (Goryachev, 2014). This classic variant of calculating the economic effect from income does not take into account the influence of various environmental and economic factors, therefore, we have devised the following economic result assessment:

– economic effect, money measure

– the aggregate value of hydrocarbons (oil and gas) at any given year

- current expenditure on hydrocarbon production, money measure,

- capital expenditure on hydrocarbon development, money measure,

- discount factor,

T – timescale of hydrocarbon resources development for the 1st, 2nd, 3rd fields, years,

t – the current period, years,

– the integral coefficient of quantitative assessment of factor value.

The integral coefficient of assessing the value of factors influencing the transport infrastructure for the Arctic oil production and field appraisal is defined on the basis of the integrated environmental and economic model. This model was used to conduct the systemic analysis of assessment done for seven groups of factors and the matrix development and analysis. The expert analysis of matrices demonstrates the planned probability of external strategic factors emergence and the degree of their potential impact when developing fields (Plastinin, Sarychev & Sushko, 2017). Quantitative assessment of the factors is done by defining their weighting coefficients, which are calculated with the analytical hierarchy process, used in multi-criteria analysis problems. The analytical hierarchy process is applied to quantify factor impact. As a result, the weighting coefficients are found, the total sum of which equals one (or 100 per cent) (Energy outlook peace and Russia until 2040, 2013). The analysis resulted in the economic factors’ parity of more than 65 per cent (current and capital expenditure, income) over the environmental and natural factors, that is explained by their high uncertainty and significant risk, influencing the project success directly. The financial and economic factors, ranging widely in relation to the market situation, geopolitical situation, changing legislation and other conditions, can have a drastic effect on a project’s profitability and returns. The total contribution of these factors is only 5.1 per cent. The contribution of environmental and natural factors is 3.9 per cent (2.17 per cent on average). The least significant factors (in ascending order) are wind conditions, precipitation, the environment pollution degree, level and temperature regimes. These indicators are environmental and natural ones, three of them are climate factors, which is not surprising given the low estimate of climate factors significance by experts. In addition, the comparison of absolute values of weighting coefficients, adjusted to a common scale, shows that the contribution of some of them to the final result is low – about 1 per cent or less; therefore, some factors can be disregarded when developing the expert analytical systems. The integral coefficient is calculated for schemes associated with developing three alternatives to transport oil and gas from the Korotaikhinskaya depression of the Timan-Pechora province.

Conclusion

Given there are the high environmental and economic risks associated with the Arctic shelf hydrocarbon fields development and exploitation, further development and implementation of new projects, involving transport infrastructure improvement, demand enhanced methodology to assess environmental and economic risks in operations, the devising of algorithms for identifying effective routes of oil, gas and condensate transportation. The major tasks of the present research deal with devising the environmental and economic assessment of the Arctic shelf hydrocarbon field development and operation with the consideration of the main factors in the region’s oil resources development. The conducted research will allow the major results and findings to be applied as the theoretical and methodological basis to develop new oil fields in Russia’s Arctic shelf.

The study of three alternatives for the Timan-Pechora province development – Usinsk, Varandey, Indiga – was conducted; the priority alternative is being selected. To consider field development and operation investment risks, the integral coefficient of assessing the value of factors influencing the oil transportation infrastructure and field operation variants has been developed and introduced in calculations. The coefficient is defined on the basis of the integrated environmental and economic model. The final stage of the economic appraisal of field development is calculation of profitability options with the consideration of hydrocarbon price volatility.

References

- Braginsky, O. B. (2009). Petrochemical complex of the world. Moscow: Academia.

- Energy outlook peace and Russia until 2040. (2013). Retrieved from: https://www.eriras.ru/files/prognoz-2040.pdf.

- FAOstat (2018). Retrieved from: http://faostat.fao.org/.

- Goryachev, A. O. (2014). Forecasting of the world markets development of liquid fuels until 2040 by using an optimization model Problems of Economics and management of oil and gas complex, 2, 34-41.

- Konoplyanik, A. A. (2018). Model aspects of the European Commission project on reforming the EU gas market "Quo Vadis" Energy Policy, 2, 46-57.

- Konoplyanik, A. A. (2018). The fourth energy package of the EU? Why Gazprom should be prepared in Europe Oil and Gas Vertical, 3, 26-36.

- Labys, W. C. (1998). Recent Developments in Commodity Modeling. The World Bank. Working Papers, 358.

- Lui, K. M., & Chong, T. T.L. (2013). Do Technical Analysts Outperform Novice Traders: Experimental Evidence Economics Bulletin, 33(4), 3080-3087.

- Melnikov, R. M. (2010). The Influence of changes in oil prices on macroeconomic indicators of the Russian economy. Economic Issues, 1. 17-23.

- Oil and Oil Products Market. (2018). Retrieve from:http://bullion.ru/reports/otkritie/week/oil.pdf.

- Plastinin, A, Sarychev, V, & Sushko, O. (2017). Investments in the Timan-Pechora Province oil production and development in the conditions of oil price stagnation Advances in Economics, Business and Management Research, Proceedings of the International Conference on Trends of Technologies and Innovations in Economic and Social Studies, 38, 653-659.

- Research of the state and prospects of the directions of oil and gas processing, oil and gas chemistry. (2011). Moscow, Econ-inform.

- Resource-innovative development of the Russian economy. (2013). Moscow: Institute of computer science.

- Sushko, O., Plastinin, A., & Sarychev, V. (2017). Trends in the northern Russian oil fields in the light of global changes Petroleum & Coal, International Journal, VÚRUP, a. s., Slovak Republic, 5 9(4), 543-552.

- The decision of OPEC can raise the price of oil to $60. (2017). Retrieve from: http://www.oilexp.ru/news/reshenie-opek-mozhet-podnyat-cenu-na-neft-do-60/111339.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

17 December 2018

Article Doi

eBook ISBN

978-1-80296-049-5

Publisher

Future Academy

Volume

50

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1464

Subjects

Social sciences, modern society,innovation, social science and technology, organizational behaviour, organizational theory

Cite this article as:

Plastinin, A., & Sushko, O. (2018). Economic Aspect Of Russian Arctic Shelf Hydrocarbon Reserves Assessment. In I. B. Ardashkin, B. Vladimir Iosifovich, & N. V. Martyushev (Eds.), Research Paradigms Transformation in Social Sciences, vol 50. European Proceedings of Social and Behavioural Sciences (pp. 950-957). Future Academy. https://doi.org/10.15405/epsbs.2018.12.116