Abstract

In conditions of tough competition and an unstable economic situation in the country, one of the important problems is a low corporation’s investment activity. The article gives the review of the investment activity role in the formation process and corporation capital increment in Russian economy. The authors represent the definition of “corporation investment activity” based on the process approach and reflecting the transformation of accumulated financial resources in investment spending, and eventually forming the capital gains in the profit form. There are described stages of the corporation investment process, which allow one to study the investments object in detail, adjust the indicators of economic efficiency, determine the level and opportunities to minimize the financial risks for each stage of planning and investment. Economic efficiency is estimated at the final stage of the corporation investment activity process, the conclusion level of which is the application determination of direction of accumulated capital (consumption, accumulation, reinvestment). Hence, the authors prove substantiation of the relevance and effectiveness of the created and presented corporation investment activity process, which contributes to the preservation of the corporation capital structure in positive dynamics and maximizing of economic benefits for investors. Internal and external factors that affect development of the corporations’ investment activity process are studied. The main tools, which contribute to its activation and development, are also presented;

Keywords: Corporationsinvestmentsinvestment capitalfinancial resourceinvestment projectreinvestment

Introduction

In the modern economic conditions, the role of corporations investment activity is rising. The strengthened corporation structures is one of the most important trends of development of the Russian Federation economy; these are large economic structures that form the base of industrialized countries worldwide, act as state partners and make it possible and implement a strategic direction in the economy modernization process. The development of the economy of any country is impossible without effective tools and mechanisms of modernization. The most important purpose of the Russian Government in our days is increasing quality indicators of high-tech corporations and improvement of the climate for investment and innovation activities.

Problem Statement

The investments are completely (partially) irreversible, which increases the probability of inefficient investment, which in turn increases the risk of insolvency (bankruptcy) of a corporation. However, incomplete information in the investment decisions making leads to risks increasing during the increasing payback period of the project and dependence on the radical innovation, on which it is based. Private capital incentive to the investment activity is determined by the expected return level concerning the capital and increase of the company’s value. Growth of value added in the economy as a whole for an investor is an external factor, which is not considered in the calculation of the project payback (Igonina, 2005). In the context of globalization and increasing competition, necessity of integration and activation of corporations investment activity is obvious.

Research Questions

This science research is dedicated to development of investment activity in the Russian Federation. Referring to the experience of European countries and also to the effective experience of China, we can suggest that it is necessity to create a new production based on the non-oligarchic capital by extensions of rights and strengthening protection of the interests of corporations representatives, their properties, their investments with the aim to solve the existing problems. This will result in shaping the real demand for constant upgrade and innovation (Bodrunov, 2015).

Purpose of the Study

The aim of this study is the theoretical bases development of the corporations’ investment activities as one of the driving factors of the domestic economy. For this, it is necessary to consider the features of the definition “the corporation investment activity” at the present stage of development, determine the main stage of the corporation investment activity process, which allows one to study the investments object in detail, adjust the indicators of economic efficiency, determine the level and opportunities to minimize the financial risks for each stage of planning and investment. And also to study internal and external factors, influencing the process of the corporation investment activity developing and tools, which contribute to its revitalization and development.

Research Methods

Theoretical aspects of the investment activity of corporations

Under today’s conditions in Russia, there is a necessity to define the single term “corporation”. A single definition, which may be determined by the legal framework in the Russian Federation, has not existed yet. Most authors have referred to the foreign experience. The amendments, which allowed one to define the term “corporation”, to denote the position of the corporations among other organizational-legal forms of the enterprises, to classify them as commercial and non-commercial, have been made in the Civil code of the Russian Federation since 2014.

According to the Civil code of the Russian Federation, corporations are the legal entities, where the founders (participants) have the rights to participate (to be a member) in them, and the supreme management body is the board of its participants (The Civil code of the Russian Federation of 30.11.1994. No 51-FZ).

The development of the corporation is impossible without parallel development effective investment policy (Kharitonov & Shamin, 2002). Investments are one of the most important aspects of the financial and economic activities of the corporations; their management is aimed to secure profitability in the long-term prospective.

Dolan and Lyndei (1980) define investments at the macro level as “the increase of a capital stock, which functions in the economic system, which means an increase of the production resources supply provided by people” (Dolan & Lyndsey, 1980). According to Keynes (2011), investments can be understood as “increment of the value of the capital assets with no dependence on the fact that if the latter consists of the main, working or liquid capital”. According to the Russian Federation legislation, investments are monetary resources, securities, other property, including property rights, other rights with monetary value, which are invested in the objects of entrepreneurial and/or other activities in order to make a profit and/or to achieve another useful effect.

So, investment is a continuous process with consecutive succession of various forms of value aimed to reproduction of fixed assets and the increase of inventories.

Investing in investment objects to gain profit (effect) is called investment activities (Igonina, 2005). According to the Federal law "About investment activity in the Russian Federation implemented in the form of capital investments" (article 1), the investment activities are determined as investments and implementation of practical action in order to make profit and (or) to achieve another useful effect (Gosudarstevennaya Duma, 1994).

Based on the analysis of terms of “investment”, “corporations” and “investment activity”, it is possible to offer the author's definition of “the investment activities of the corporation” at the present stage of development of the economy.

The corporation investment activity is the process of realization of corporation economic activity, which is associated with the investment of financial resources in an investment object with the aim to appreciate capital, receive economic benefits (the effect). Efficient economy activity in the long-term prospective, provision of sustained growth corporations and their competitiveness rise are determined by the level of the investment activity and the range of corporation investment activities. In order to substantiate the capital investments economic efficiency, they design an investment project, which allows one to evaluate the possible financial criteria risk of investors and corporations in corpore.

Formation and realization features of the corporation’s investment activity process

The corporations’ investment activity process is a focused coherent set of interrelated actions, which contributes to increasing a level of economic efficiency of investors and corporation as a whole.

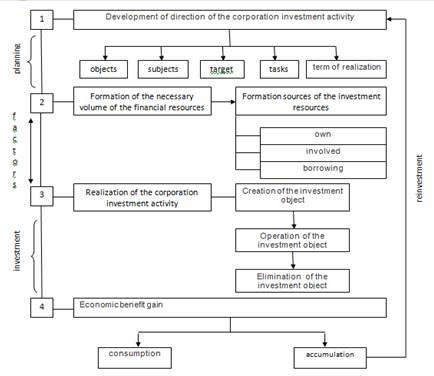

During the process of the corporation investment activities, it is possible to divide them into four stages: 1. The development of the investment corporation activities directions. 2. The formation of the necessary financial resources volume. 3. The realization of the corporation investment activity. 4. The economic benefits gain.

The necessity of the stage division formation allows one to study the proposed corporation investment activities direction more closely, as well as to provide the possibility of the adjustment performance indicators, minimize investor’s financial risks at each stage of the investment activity process, so that this contributes to corporation capital structure security in positive dynamics and maximizes economic benefits for investors.

The corporation investment activity process, its main stages and characteristics are presented by the authors in figure

The direction of the corporation investment activity is developed at the first stage of the process. Herewith, at the first step, the purpose, the object, the tasks and the deadlines are determined.

The main target of the corporation investment activity is maximum economic benefit in the future brought by investment activities.

Based on the set target, it is necessary to determine a number of tasks of the corporation investment activity: supervision over targeted rational financial resources, achievement of the project economic efficiency indicators, sustains of the project competitiveness at all stages of the corporation’s investment activity process. These also include justification of efficiency application of investment formation sources and their optimization, achievement of the maximum financial productivity and quality, risk minimization, identification of the factors, which negatively influence the corporation investment activity process and methods of their optimization, acceleration of investment capital transformation into the real fund, an increase of the investment activities efficiency in the future, and others.

According to the Federal law "About investment activity in the Russian Federation implemented in the capital investments form", the subjects of the corporations investment activities are investors, customers, users of investment activity objects, contractors, suppliers and other participants of the investment activity process, such as the government, companies and citizens. The investment activity subjects can be classified as international, national, regional and local; that is, the investment activity subjects can be individuals, legal entities, and the government. Among the objects of investment activity, there are the main (created and upgraded) and current assets of corporations. This can include securities, intellectual and proprietary property and other objects. Financial recourses investment in the investment objects allow corporations to employ new techniques and technologies and thus creating the basis for expansion of production capacity and economic growth.

The basic stages and sub stages of the investment activity form corporation’s investment project portfolio.

The first stage determines the implementation period of investment project. Herewith, all investment projects can be classified depending on the implementation period as: short-term investment projects – up to 3 years; medium-term projects –– from 3 up to 5 years; long-term projects – over 5 years.

Positive financial decision according to the evaluation of the first stage results of the corporation’s investment activity process encourages the second stage advance, where the required resources volume is formed for the investment object.

Allocation of the second stage of the corporation investment activity is caused by necessity of the exact investment resources volume, which allows minimizing the cost of production and implementation of the investment project. It is also important to define the investment resources formation sources, which can include:

own sources (sources, which are formed during the corporation financial and economic activities, to which the investor has the right of ownership); such sources can include the company's undistributed profits, depreciation fund and etc;

attracted sources (sources, which are formed by third participants and to which the investor has also the right of ownership); such sources can include additional contributions of founders to the authorized capital, additional issuance and placement of shares, financial resources, received in the order of redistribution (insurance compensation, dividends and interest on third party issuers’ securities, etc.); the budgetary inflow (only in the case of implemented projects, providing economic and social impact and etc.);

debt sources (sources, which are formed by the urgency, repayment and interest payment, to which the investor has no right of ownership); such sources include credit (commercial, banking), loans, borrowings, proceeds from the issuance and placement of bonds, lease – in comparison with other types. These sources allow attracting large amounts of needed resources.

The third stage of the corporation investment activity suggests three steps of its realization.

The first step is creation of the investment object: attachment of the accumulated financial resources to an investment object (financing equipment purchase, materials, rows, transportation, shipping, rent and other such expenses as part of statement). This step supposes formation of the corporation assets, conclusion of contracts for the supply of raw materials and components, recruiting workers and employees, forming the order portfolio (Lyakin, 2013). The set timeframe for creation of an entrepreneurial activity object and the size of the costs, provided by the estimation, should be strictly followed. Indexes can lead to negative results, and even bankruptcy.

The second stage is exploitation of the investment object: implementation of measures to realize the investment activity object. The total duration of this stage influences significantly the economic efficiency indicators of the investment activity: the further stage of the exploitation will take place, the larger the net income will be gained. This period can not be established randomly because there are the economically feasible limits of application fixed capital elements, which are dictated mainly by their obsolescence.

The third stage is liquidation of the investment activity object: termination of the corporation investment activities without transfer of the rights and obligations to other persons. Liquidation of the investment object can occur due to following reasons: a) in connection with the expiry of the implementation period of the investment activities object and the main target; b) in connection with inconsistency of the corporation investment activity project and impossibility of the main target achievement (the reasons can be misuse of financial resources, lack of funds for investment activities, errors in calculations, etc.).

The fourth last stage of the corporation investment activity necessitates estimation of the economic benefit of investors and corporations. This demands the analysis and comparison of the projected investment and future revenues.

The necessary of the stages allocation allows one to study the proposed direction of the corporation investment activities more detail, to ensure the possibility of adjustments the performance indicators, to minimize financial risks of investors at each stage of the investment process. Thus, it promotes the preservation of corporation capital structure in positive dynamics and maximize economic benefits for investors.

The basic indicator for efficiency estimation of the corporation investment activity

Efficiency estimation of the corporation investment activity could not be based just on economic efficiency of the individual investment project, as well as on increasing of corporation overall cost capital. This task is achieved by a “synergistic effect” estimation from realization of the company investment project (Gorbachevskaya, 2018). At this stage of development of the synergistic effect estimation system, there are such basic allocated forms of the synergy manifestation as revenue growth cost reduction or combined effect.

The calculation procedure of the synergy effect with the cash flow discounting method can be presented in the following way:

(1)

(2)

where, – the company income for the i-th period; - revenue growth; - savings of the expenses; - savings of the taxes; - savings of the investments in the working capital; - savings of the vested interests; - changing of the net debt (with the financial synergy); - company capital profitability.

Generally, determination of the economy efficiency will allow estimating an effectiveness of applied investment capital in the corporation’s investment activity process. One of the most important directions of the getting income distribution from corporation’s investment activity is reinvestment.

Summing up this section, it is necessary to note that corporation in the process of its activity must estimate changes in value on the whole and individual direction full time. This will allow determining inefficient directions and closing it, directing a released investment in more attractive activities.

The factors influencing the corporations’ activity effectiveness

A significant influence on the corporation investment activity process is provided by external and internal factors, which affect the process duration, the costs for the creation and implementation of the investment object, the final economic effect. A comprehensive study and monitoring allow determining positive trends and identifying their negative consequences, which in future will provide an opportunity with the positive dynamics to increase corporation investment activity efficiency and with the negative dynamic to take timely measures to overcome the negative effects and reduce investment risks (Nechaev, Antipina & Prokopyeva, 2014). Thus, the efficiency of the realizing corporation’s investment activity process is impossible without systematization and analysis of external and internal factors.

Along with the external factors, it is indispensable to analyze the internal factors. They allow one to estimate the efficiency of the investment capital, predict the prospects of its development. Let us discuss the main internal (microeconomic) factors: the structure of the management staff, the corporation dividend policy, the competitiveness of the investment project (Prokopyeva & Nechaev, 2013), the corporation financial condition (business activity, liquidity, profitability, solvency, financial stability, etc.) (Rybakov, 2013).

The presented factors are significant for contribution to a decrease or increase of the economic benefits from realizing of an investment activity object. A timely registration of certain factors influencing the investment activity process allows reducing financial risk of corporations’ investors appreciably.

The main tools of the level profitability increasing in the corporation investment activity process are the development of the interaction between the state and corporation (public-private partnership), what allow one to enhance the capacity of possible public investment flow.

For the efficient development of the corporation investment activity, it is necessary to attract external source of financing. One of such sources, according to the author opinion, must become an investment tax credit.

The investment tax credit is a tax relief reducing payments for taxes (Assibey-Yeboah & Mohsin, 2011) (on profit, as well as regional and local taxes) with a further payment under the contract of the amount of principal and accrued interest, which is realized by the taxpayer in connection with a spent amount on the economical-effective directions for a period from 1 to 5 years (Pastukhov, 2013). The tax benefits has been becoming as a tool, which helps to realize an attraction of investments in a production (Nikityuk & Korotkova, 2017).

Another way of the achievement a positive effect in the corporation investment activity is a developing of the insurance system of the investment project, which allow reducing risks and providing a confidence to investors in the completion of the investment process. The aim of the corporation investment activity insurance is a compensation of damages from investment type of activities, provision of the insurance contract, which allow one to create a safe environment for an investor and prevent their possible loss due to changes of external and internal factors.

The elimination of the above-mentioned negative impacts a permit to accelerate an investment activity process, whereupon the Russian corporation will become more attractive for investors, more competitive on the domestic and foreign economic markets. In addition, it allows one to increase a corporation capital and make a significant contribution to the realizing of the strategy important areas in the domestic economy re-industrialization process.

Findings

The conducted research allowed drawing the following conclusions. A development of any country economy is directly connected with financial and economic activity of corporations. The states, acting as partners, permit a corporation to develop and implement a strategic direction in an economy modernization process. That is why it is relevant to develop a formation mechanism and tools of an effective system of financial management, which allow a corporation to increase financial stability, liquidity and profitability, which eventually help to raise gross domestic product and create a stable developing economy.

Conclusion

The possible reasons of the deceleration and inefficient development of the corporation’s investment activity process in Russia are the following. Firstly, the global economic crises significantly increase the corporation financial risks. Secondly, an imperfect mechanism of interaction between the state and corporations reduces the potential flow of possible public investment. Thirdly, there is a lack of conditions for the developing of the corporation’s foreign economic relations and an effective mechanism of the transition of the domestic companies to international standards of corporate governance. Fourthly, undeveloped investment projects insurance system does not fully meet the interests of the insured. The elimination of the above-mentioned reasons permits the domestic corporation to be more attractive for investors (domestic and foreign) and increase the level of competitiveness in world economic markets. In addition, the increment of the corporation financial capital contributes to the effective implementation of strategic directions in the economy reindustrialization process.

The main tools which stimulate the corporation investment activity efficiency are the interaction between state and corporation (public-private partnership), attraction of an external sources (investment tax credit, ITC), developing of the investment project system insurance and other.

References

- Assibey-Yeboah, M., & Mohsin, M. (2011). Investment tax credit in the open economy with external debt and imperfect capital mobility, Economic Record, 87, 629-642.

- Bodrunov, S.D. (2015). Formation of Russian industrialization strategy (monograph.). St. Petersburg, INIR.

- Dolan, E.J., & Lyndsey, D. (1980). Market: Microeconomic model. Dryden Press.

- Gorbachevskaya, E. Y., Timchuk, O.G., & Nikityuk, L.G. (2018). Diversification of enterprises. Irkutsk, IRNITU.

- Gosudarstevennaya Duma RF, (1994). The civil code of the Russian Federation (part one) 30.11.1994. No 51-FZ. Retrieved from: https://www.consultant.ru/document/cons_doc_LAW_5142/.

- Igonina, L.L. (2005). Investment. Moscow, Economist.

- Keynes, J.M. (2007). The General Theory of Employment, Interest and Money. The Selected Works, Moscow: Eksmo.

- Kharitonov, A.V. & Shamin, A.E. (2002). Problems of development of investment activity in Russia. Vestnik Nizhegorodskogo universitetaim. N. And. Lobachevsky. 1, 262.

- Lyakin, A.N. (2013). Structural shifts in the Russian economy and industrial policy. Vestnik of Saint Petersburg University. 5, 39.

- Nechaev, A.S, Antipina, O.V., & Prokopyeva A.V. (2014). The risks of innovation activities in enterprises. Life Science Journal, 11, 574-575.

- Nikityuk, L., & Korotkova, G. (2017). Investment tax credit as instrument to stimulate investment-innovative activity of housing and public utilize. Advances in Economics, Business and Management Research, 38, (pp 482-487) (TTIESS 2017).

- Pastukhova, N. Yu. (2013). Features of investment policy of Russia at the present stage. Volga trade and economic journal, 74-78.

- Prokopyeva, A.V., Nechaev, A.S. (2013). Key features of risks of company innovative activities. Middle East Journal of Scientific Research, 17, 233-236.

- Rybakov, F.F. (2013). Industrial policy of Russia: discussion questions. Vestnik of Saint Petersburg University, 5, 33-38.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

17 December 2018

Article Doi

eBook ISBN

978-1-80296-049-5

Publisher

Future Academy

Volume

50

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1464

Subjects

Social sciences, modern society,innovation, social science and technology, organizational behaviour, organizational theory

Cite this article as:

Nikityuk, L., & Korotkova, G. (2018). Formation Features Of Corporations Investment Activity Process In Russian Federation. In I. B. Ardashkin, B. Vladimir Iosifovich, & N. V. Martyushev (Eds.), Research Paradigms Transformation in Social Sciences, vol 50. European Proceedings of Social and Behavioural Sciences (pp. 891-899). Future Academy. https://doi.org/10.15405/epsbs.2018.12.109