Abstract

Sukuk yields mimic those of conventional bonds due to having similar features. This motivated the study. Sukuk are shariah-compliant securities that offer different structures to those of conventional bonds. Therefore, it is believed that the spreading of yields should also be different. The presence of key institutional investors/owners and certain BOD characteristics as highlighted by the Malaysian Code on Corporate Governance (MCCG) may influence the yield to maturity (YTM) of conventional bonds and sukuk. Thus, the main objective of this study is to investigate the relationship between these two yield spreads instruments with corporate governance mechanisms. The data is obtained from firm issuers’ annual reports, the Bondinfo Hub of the Malaysian Central Bank, the Rating Agency Malaysia (RAM), the Malaysian Department of Statistics and Bloomberg databases for the period beginning 2000 to 2014 for 256 and 405 tranches of long-term and medium-term issuances of conventional bonds and sukuk respectively. The most significant findings show that the presence of top-six and other institutional ownerships as corporate governance mechanism proxy insignificantly and significantly reduce yield spreads within the firm revealed by OLS and random effects models in long-term and medium-term issuances. With respect to BOD characteristics, only BOD role duality and BOD size have a significant relationship with yield spreads. The study, therefore, proposed that the higher presence of institutional investors and BOD compliance to MCCG are able to reduce the risk of default risk.

Keywords: Institutional ownershipboard of directorsyield spreadsrobustdefault risk

Introduction

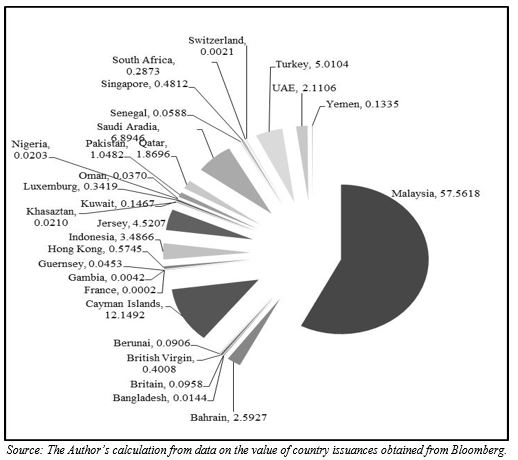

Firms and even governments are sometimes faced with the problem of scarcity of funds to finance profitable investments and promote economic development. The massive amount of funding required for these purposes is unlikely to be serviced by commercial banks. One way to raise funding is from financial institutions and public through the issuance of debt instruments. The instruments used are the sale of bonds, shares, and other forms of debt and equity, both in conventional and Islamic systems. The source of funding for such projects is from the public via the capital market which is a platform for trading of these financial instruments. The increasing demand from the public sector for innovative forms of finance continues to fuel the development of Malaysia’s debt securities market. Growth has also been spurred by the increasing presence of institutional investors, such as pension funds, unit trust funds and insurance companies. Another notable achievement is the successful promotion of the Islamic capital market in the form of sukuk securities which comply with shariah principles, have played a major role in Malaysia’s capital market development, contributing to the significant growth of the country’s Islamic financial system. This market has enjoyed enormous growth whereby USD1.814 trillion of assets are being managed in a shariah-compliant manner as of the year 2014 with the potential to increase to USD3.247 trillion by the year 2020. Out of this value, there was USD295 billions of sukuk outstanding as of the end of 2014 (Thomson Reuters, 2015). Also, the Malaysian corporate bond market represented 37% of the country’s Gross Domestic Product (GDP) in 2004 and by this measure; it becomes one of the largest in the world (IMF, 2005). In 2014, Malaysia had a total sukuk issuance for MYR657 billion and leads the market with 57.6% of total sukuk issued from among 28 countries (Bloomberg data, 2015). Even though the sukuk market is relatively new as opposed to the bond market for public listed firms with the first issued in 1990 by Shell MDS through issuing Al-bai Bithaman Ajil (BBA) sukuk worth MYR125 million in Malaysia (IIFM, 2012), it has recorded significant growth from year to year. This growth has raised the question whether sukuk can play the role of an alternative source of financing and investment which might replace or substitute conventional bonds (Said & Grassa, 2013; Naifar, 2016). The decision for the choice of debt financing needs to be analysed further on the yield to maturity (YTM) spreads (the difference in yield between the issuance tranche with Malaysian Treasury Bills for the same maturity of year period) for lesser risk in terms of default risk to the issuer.

The remainder of this introductory section is organised as follows. Section

Problem Statement

Sukuk, a relatively new asset class in global capital market, is facing a new challenge in the form of sukuk defaults like conventional bonds (Naifar & Mseddi, 2013), rather than structural problems or compliance with shariah law (Mat-Radzi & Muhamed, 2012). Therefore, an analysis of debt yield spreads as a measure of default risk is an important issue in investment since this is one, if not the only, key factor in determining the cost of external financing borne by the issuer of debt securities. The inabilities to meet interest obligations and the redemption of the principal when they become due will not only tarnish the issuing firm’s corporate image, but more importantly, this will project a crisis of confidence among investors on the financial performance of the firm managed by the BOD. This situation leads to the discussion on the agency theory with respect to the separation of control and ownership and the issues arising from the agency cost of debt. Typically, higher cost of debt is associated with higher yield spreads which intuitively denote higher default risk among the issuer firms. In listed issuer firms, the growing dominance of equity holdings by institutional investors, both domestic and international, has recently sparked a debate on their role as effective shareholders in the monitoring of firms’ performance and enforcing good corporate governance (Davis, 2002). Here, many researchers focused on the impact of corporate governance mechanisms on bonds yield spreads performances whereby most studies did not distinguish them from sukuk (for instance; Bhojraj & Sengupta, 2003; Shailer & Wang, 2015; Akdogu & Alp, 2016). Thus, the outcome of these analyses may not be appropriate considering that the sukuk market has greatly developed and has come out with various sukuk products with unique features which are clearly distinguish its structure from conventional bonds. Therefore, the impact of corporate governance mechanisms on the yield spreads of sukuk might be different from conventional bonds in medium-term and long-term issuances if the yield spreads between the two debts are not the same. Moreover, the presence of institutional ownerships and the BOD in corporate governance mechanisms will likely have a significant relation with medium-term and long-term conventional bonds and sukuk yield spreads among public listed issuers in Malaysia. Alternatively, one may also expect that the way corporate governance mechanisms impact the yield of sukuk is no difference to that of conventional bonds.

Research Questions

Two main research questions can be asked to achieve the research objectives as follows

Does the presence of institutional ownerships have any relationship with the yield spreads of both medium-term and long-term conventional bonds and sukuk?

Does BOD characteristics of the issuer have any relationship with the yield spreads of both medium-term and long-term conventional bonds and sukuk?

Purpose of the Study

Considering the issues raised in the preceding section, this study focuses on the differences in yield spreads between conventional bonds and sukuk and the relationship of institutional ownerships and BOD in corporate governance mechanisms towards yield spreads as a default risk for public listed issuer in Malaysia. The research objectives are summarised as follows:

To examine the relationship between the presence of institutional ownerships in conventional bonds and sukuk issuers with their yields spreads in medium-term and long-term issuances.

To examine the relationship between BOD characteristics of the issuer with conventional bonds and sukuk yields spreads in medium-term and long-term issuances.

Research Methods

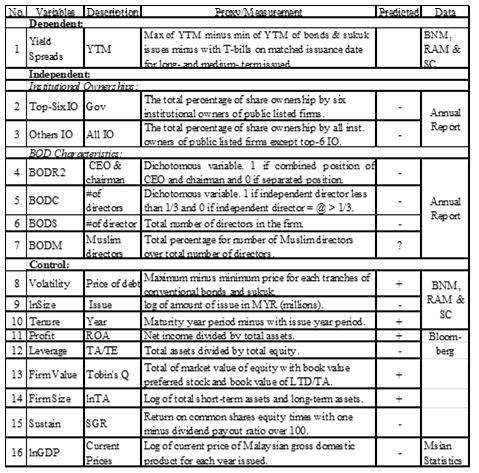

This study uses secondary data. The data gathered from various sources including Bank Negara Malaysia, RAM, SC, Bloomberg and Department of Statistics, Malaysia. Specifically, Data are retrieved from Bondinfo Hub’s website from BNM for issue characteristics for conventional bonds and sukuk including yield, number of tranches, issuer name, price of debt, issue date, maturity date, issue amount in MYR’ million and debt instrument categories. The detailed of the variables used and its measurement as well as the data sources is presented in the Figure

Next, all the data was sorted screened and matched. For missing data are then omitted. Therefore, the total usable observation data for the long-term debt instruments are 140 issuer firms with 256 tranches which cover from 2000 until 2014. In medium-term debt instruments, the total usable observation data are 160 issuer firms with 395 tranches from 2003 until 2014. Data on 2000 to 2002 were omitted due to being incomplete.

Theories and Hypotheses Development

First, separation of decision and risk-bearing functions becomes an effective common approach to controlling the agency problems (Fama & Jensen, 1983) whereby the practise has been documented in the firms’corporate governance code (MCCG, 2000; 2007; 2012; 2016). This code of best practise provides such recommendations to institutional investor for active monitoring and controlling cost direct to firms’ management through BOD. These good recommendations of best practice are in consistent with the shariah law of Islamic principles (Abu-Tapanjeh, 2009). Second, institutional ownership theory posits that institutional investors can act as a monitoring and control agents to overcome the agency problem that arise from the issue of separation and control (Demestz, 1983) through their controlling and monitoring activities (Alireza & Ali Tahbaz, 2011). Thus, institutional investors are capable of influencing management performance which is driven by their ownership rights and ability to carry out share trading (Gillan & Starks, 2003). Third, resource dependency theory is a major grounded theoretical in explaining about the BOD function that have an authority power on top management decision making for financing decision in reducing agency cost of debt (Pfeffer & Salancik, 1978; Marlin & Geiger, 2012).

In line with the agency and ownership theorists as well as the aforementioned empirical evidence, a hypothesis 1 and 2 is suggested as follows:

Then, this study developed the hypotheses 3 to 6 on the relationships between BOD characteristics with yield spreads of conventional bonds and sukuk to satisfy the third objective of the study. Many researchers remark that those board members who hold two positions face numerous problems. Judge et al. (2003) mentioned that CEO chairs the group of people in monitoring and evaluating the CEO’s performance. Here, the conflicts of interest in the agency theory arise whereby the CEO monitors and evaluates his/her performance in that particular company. Furthermore, combined leadership structure in role duality is negatively related to firm performance (Judge et al., 2003) which supports the predictions of agency theory. Liu & Jiraporn (2010) found that the CEO who has more decision-making power was associated with higher yield spreads. Based on the abovementioned theoretical views and empirical evidence, it is hypothesised as follows:

Multivariate Panel Robust Regressions (MPRR)

Testing the relationship among these variables considered as an estimations models for the MPRA used in this study. This model is developed based on debt instrument categories for long-term and medium-term conventional bonds and sukuk. Different types of issuances have a different effect on default risk. Besides, the effect in pooled OLS, within the firm as fixed effect or random effect is tested for each panel observation in conventional bonds and sukuk.

The OLS model has treated standard error of estimations represented by as identically and independently distributed disturbances that are uncorrelated with the correlations of standard error for independent variables, , or . In this case, the data can be pooled, and OLS can be used to estimate the model with denoting the estimator of the slope by . The intercept and slope coefficients are constant across N and T represented by tranche issuances of each issuer which postulates that both the intercept and the slope are the same across observations. However, these assumptions might be restrictive and lead to heterogeneity bias needed to handle the robustness checks analysis. Otherwise, the model does not require any additional technique for such estimations. The regression model equation for pooled OLS can be represented as follows:

Then, the fixed effect model used is when the constant value for each tranche of issuances, is correlated with the independent variables of the issuers for the year, and within variation in the data only, but is the most flexible in that it allows for the endogeneity of regressors. This model also treats as a constant value for each tranche of issuances. Where:

= the coefficient estimates in fixed effect of the explanatory variables

= the intercept for fixed effect, and

= the error term for fixed effect.

With respect to the random effect model model, it assumes that the tranche of issuances has their intercepts while restricting the slope to be homogenous for yield spreads. Their spread is probably in random-effect as liquidity movement which required technique of these regressions as applied by Said, W.Suhaimi & Haris (2013) in their study. To accommodate such heterogeneity, the random-effect model decomposes the into two composite error term as , .

Statistical Tests For Panel Model Selection

As discussed earlier, pooled OLS estimator is easy to use for estimating regression model but it does not capture the unobservable individual heterogeneity. In this case, fixed effect and random-effect estimators are used. This variety of approaches leaves the question about which model is the most appropriate in explaining the result for findings. This can be solved by performing two statistical tests on the regression model. These are the Breusch and Pagan Lagrangian Multiplier Test (BP-LM) and Hausman Test. The BP-LM test tests for the existence of individual specific variance component or heterogeneity whether the pooled OLS is an appropriate model or not in interpreting the result. This test is important to discriminate between the pooled OLS and Generalized Least Squared (GLS) or random-effect model. The presence of the individual specific term, which distinguishes between these models, is based on the following statistical hypotheses:

…(Pooled OLS), and … (Random effects)

The Lagrangian Multiplier (LM) statistic follows the chi-squared distribution with one degree of freedom as shown by equation as follows:

(2)

Where:

= the

= the goodness-of-fit measure or R-squared of the pooled OLS regression,

= the correlations of standard error for independent variables,

= the total periods, and

= the number of periods.

Therefore, if the null hypothesis is rejected whereby the p-value is less 0.01, 0.05 or 0.1, means that the random-effect model in unbalanced panel data is more appropriate than pooled OLS estimations since it is able to deal with heterogeneity (Breusch & Pagan, 1980; Baltagi, 2001). Even if they are uncorrelated with the regressors, the random-effect estimator will deliver a consistent estimator that is also efficient. However, the results may be inconsistent or biased. In such a case, the study runs the Hausman test. The test was developed by Hausman (1978) for the purpose to distinguish between random-effect and fixed-effect model. Therefore, the hypotheses can then be modified as follows:

, and

Findings

Descriptive Statistical Results

The minimum value trend demonstrates a similar pattern to the mean value. Meaning that all the issuances tranche have competitive rate of yields during the contract initiated. However, only MTCBS, LTB, MTCB and MTS show a similar pattern for maximum value. But, the LTCBS and LTS show different patterns indicating a very high cost showed by value of yield spreads from LTS at 18.06%. Notably, the yield is refers to the different of maximum and minimum value for YTM which indicates the range of yield spreads. The finding is consistent with the theory of term structure of interest rate whereby longer periods have higher interest rate hence wider range of spreads are associated with higher default risks.

Statistical Selection Tests Results

As a result of LTCB, the BP-LM test show that chibar-squared is 1.290 with the probability is an insignificant result. Thus, the null hypothesis failed to be rejected suggesting that the pooled OLS model is more appropriate than random-effect model. This denotes that pooled OLS model is better suited for such analysis whereby the assumption of pooled OLS model about the error term leading to have serial correlation between observations and might be in the presence of unobservable individual heterogeneity are applied in this sample. Since the pooled OLS model has been selected, the model does need to be compared with the fixed effects model using the Hausman test. It is also not required to perform heterokedasticity diagnostic check test since the model has the ability to rectify the presence of unobservable individual heterogeneity. Therefore, the results from pooled OLS model are better suited for the analysis in LTCB. As for LTS, the null hypothesis is rejected suggesting that the random-effect model is more appropriate than pooled OLS model. Consequently, BP-LM test confirms that RE robust model estimator is the selection model and as regards to the result of Hausman test, the chi-squared is 22.120 indicates insignificant result lead the decision to reject the null hypothesis.

Thus, the test confirms that random-effect for regression estimations model is the most appropriate compare with fixed-effect model in analysing the relationship of yield spreads towards their determinants. Pertaining to the selection model tests result for MTCB, the BP-LM test show that the chibar-squared is 1.290 with the probability is insignificant result. Thus, the null hypothesis failed to be rejected suggesting that the pooled OLS model is more appropriate than random-effect model. The result concludes that the RE robust model is the most appropriate model in analysing the relationship between yield spreads and its explanatory variables for MTS.

Robust Regression Analysis

Table

The overall results of relationship between BOD characteristics with the yield spreads for all terms of conventional bonds and sukuk issuances have significant impact. With respect to the BOD role duality, its show a significant relationship with panel B and C. Vindicating that, the separation role between chairman of directors and CEO are important determinants towards sukuk in long term, otherwise conventional bonds for medium-term issuances. Otherwise, this separate position is significant to the issuer in mitigating default risks when themedium term sukuk and long term conventional bond’ issued. Next, BOD composition shows insignificant relationships towards yield spreads in all types of debt issuances for conventional bonds or sukuk. Thus, the hypothesis 4 is rejected. As regards to BOD size shows that panel C and D have significant relationships towards yield spreads. Means, BOD size becomes very important determinants to yield spreads especially in medium-term for both issuances either conventional bonds or sukuk. With respect to the BOD Muslim, unpredictably, higher numbers of Muslim directors have significant relation with yield spreads of conventional bonds issuances for both long-term and medium-term. In contrast, sukuk’ yield spreads indicate insignificant relationship with BOD Muslim.

Conclusion

In the overall category, the presence of top-six institutional ownerships is unable to reduce default risks facing the issuer; however, the presence of other institutional ownerships can reduce default risks among issuers who issue sukuk for long-term issuances and conventional bonds for medium-term issuances. BOD characteristics such as role duality, the number of directors and director’s religion appear to be significant determinants in influencing yield spreads except for the composition of independent directors in the firms. These findings offer recommendations to the issuer as well as institutional investors and the BOD. Firstly, recommendations focus on public listed issuer since they are actively involved in the capital market by issuing debt to the public. In long-run investment, they are encouraged to issue sukuk as compared to conventional bonds since the default risk is low. This justifies that the cost of sukuk is lower than the cost of debt in long-term issuances since spreading in sukuk yields is lower as riba or uncertainty elements is avoided. Secondly, the presence of institutional ownerships in the issuer firms has a relationship with high-low yield spreads. Their presence would enhance effective monitoring and control in the firm’s decision-making, especially in financing matters. Thirdly, to avoid abuse of power, biased decision and conflict of interest, the separation role between chairman and CEO to a different person is important even though the duties and responsibilities of this position are clearly highlighted in the MCCG. If it is still required, they not only need to follow the job descriptions of the position respectively but more importantly need to comply with Islamic principles especially Muslim BOD.

References

- Abu-Tapanjeh, A.M. (2009). Corporate governance from the Islamic perspective: A comparative analysis with OECD principles. Critical Perspectives on Accounting, 20, 556-567.

- Alireza, F., & Ali Tanbaz, H. (2011). The examination of the effect of ownership structure on firm performance in listed firm of Tehran Stock Exchange based on the type of industry. International Journal of Business and Management, 6(3), 249-266.

- Akdoğu, E., & Alp, A. (2016). Credit risk and governance: Evidence from credit default swap spreads. Finance Research Letters, 17, 211-217.

- Baltagi, B.H. (2001). Econometric Analysis of Panel Data. Wiley.

- Bhojraj, S. & Sengupta, P. (2003). Effects of corporate governance on bond ratings and yields: The role of institutional investors and outside directors. Journal of Business, 76, 455–476.

- Bloomberg (2015). Available at: https://www.bloomberg.com/markets.

- Breusch, T. S. & Pagan, A. R. (1980). The lagrange multiplier test and its applications to model specification in econometrics. The Review of Economic Studies, 47(1), Econometrics Issue, 239-253.

- Davis, E.P. (2002). Institutional investors, corporate governance and the performance of the corporate sector. Economic Systems, 26, 203–229.

- Demsetz, H. (1983). The structure of ownership and the theory of the firm. The Journal of law & economics, 26(2), 375-390.

- Fama, E.F. & Jensen, M.C. (1983). Separation of ownership and control. Journal of Law and Economics, 26, 301-325.

- Gillan S. L. & Starks L.T. (2003). Corporate governance, corporate ownership and the role of institutional investors: A global perspective. Journal of Applied Finance, 13(2), 4-22.

- Hausman, J. A. (1978). Specification tests in econometrics. Econometrica, 46(6), 1251-1271.

- International Islamic Financial Market (2012). Available at: http://www.iifm.net/published-standards.

- Islamic Finance Information Service (IFIS), (2008). Islamic bonds issuance continues to rise despite slow down. Available at: http://www.tradingmarkets.com/.site/news/stock.

- Judge, W. Q., Naoumova, I., & Koutzevol, N. (2003). Corporate governance and firm performance in Russia: An empirical study. Journal of World Business, 38, 385-396.

- Liu, Y., & Jiraporn, P. (2010). The Effect of CEO power on bond ratings and yields. Journal of Empirical Finance, 17(4), 744-762.

- Malaysian Code on Corporate Governance 2000 (MCCG 2000). Available at: https://www.sc.com.my/malaysian-code-on-corporate-governance-2000/.

- Malaysian Code on Corporate Governance 2007 (MCCG 2007). Available at: https://www.sc.com.my/malaysian-code-on-corporate-governance-2007/.

- Malaysian Code on Corporate Governance 2012 (MCCG 2012). Available at: https://www.sc.com.my/malaysian-code-on-corporate-governance-2012/.

- Malaysian Code on Corporate Governance 2016 (MCCG 2016). Available at: https://www.sc.com.my/malaysian-code-on-corporate-governance-2016/.

- Marlin, D. & Geiger, S.W. (2012). The composition of corporate boards of directors: Does industry matter? Journal of Business & Economics Research, 10(3), 157-162.

- Mat-Radzi, R. & Muhamed, N.A. (2012). An international comparative study on Shariah governance supervision of sukuk defaults. Journal of Islamic Economics, Banking and Finance, 8-22(3), 20-43.

- Naifar, N., & Mseddi, S. (2013). Sukuk spreads determinants and pricing model methodology. Afro-Asian Journal of Finance and Accounting, 3(3), 241-257.

- Pfeffer, J., & Salancik, G. R. (1978). The design and management of externally controlled organizations. The external control of organizations, 257-287.

- Said, A. & Grassa, R. (2013). The determinants of sukuk market development: Does macroeconomic factors influence the construction of certain structure of sukuk? Journal of Applied Finance & Banking, 3(5), 251-267.

- Shailer, G. & Wang, K. (2015). Government ownership and the cost of debt for Chinese listed corporations. Emerging Markets Review, 22, 1–17.

- Thomson Reuters (2015). Available at: https://www.thomsonreuters.com/en/press-releases/2015/april/thomson-reuters-reports-first-quarter-2015-results.html

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

31 July 2018

Article Doi

eBook ISBN

978-1-80296-043-3

Publisher

Future Academy

Volume

44

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-989

Subjects

Business, innovation, sustainability, environment, green business, environmental issues, industry, industrial studies

Cite this article as:

Saad, N. M., Haniff, M. N., & Ali, N. (2018). The Encumbrance Of Institutional Investor And Bod In Reducing Risk Of Default. In N. Nadiah Ahmad, N. Raida Abd Rahman, E. Esa, F. Hanim Abdul Rauf, & W. Farhah (Eds.), Interdisciplinary Sustainability Perspectives: Engaging Enviromental, Cultural, Economic and Social Concerns, vol 44. European Proceedings of Social and Behavioural Sciences (pp. 670-681). Future Academy. https://doi.org/10.15405/epsbs.2018.07.02.72