Abstract

The growth of the Islamic finance in Malaysia has increased enormously and consistent with the Malaysia determination to become a regional hub of Islamic finance. This paper will empirically observe the nexus between the Islamic banking performance and economic growth in Malaysia. The objectives of this study are to investigate the co-integration and short-run relationships between Islamic bank performance and economic growth. The data was collected using quarterly data from the Monthly Bulletin Statistics of Bank Negara Malaysia (BNM) and Department of Statistic Malaysia from 2007 to 2015. The autoregressive distribution lag (ARDL) method is utilized in this study. The findings show the financial development of the Islamic bank has a positive influence on the growth in Malaysia in the short run and long run. Based on the results, total Islamic financing and investment have a positive association with economic growth. This paper also provides clear evidence that the improvement in Islamic banking development in Malaysia may encourage economic growth.

Keywords: Islamic banksARDL approacheconomic growth

Introduction

Currently, the Islamic financial industry is growing worldwide. Even though, the global economy facing an instable year affected by a series of occasions ranging from unpredicted political changes and geopolitical conflicts, volatility in energy prices, uncertainties of global interest rates and exchange rate depreciations in a number of countries. These unpredictable issues had negatively influence business confidence and create investor sentiment in year 2016 and had an intense impact on the performance of the financial markets. However, according to IFSI Stability Report (2017), the Islamic Financial industries have an increase total worth across its three main sectors (banking, capital markets and takāful) estimated at USD1.89 trillion in 2016. Meanwhile, the global Islamic banking assets are approximately USD1.5 trillion at the end of 2016.

Based on the Malaysia experience, the growth of the Islamic finance industry since 2005 has increased enormously and it is consistent with the ambition to make Malaysia a regional Islamic financial hub (10th Malaysian Plan). The increasing number of local and foreign financiers in this industry, in conjunction with the accumulative demand from local and international customers, has further improved the opportunity for Malaysia to achieve this target. As stated by the Malaysia Islamic Financial Report (2015), Malaysia is the global leading market for Islamic financial assets that consists of Islamic banks, Islamic insurance (takaful), and Islamic capital market, with a value of US$423.39 billion, which represents 25.6 % of global Islamic financial assets. In terms of Islamic banking assets, Malaysia with assets valued at US$8.60 billion, is the third biggest providers to international Islamic banking.

Problem Statement

There are very limited studies done in measuring the impact of Islamic banks towards economic growth (Furqani & Mulyany, 2009; Goaied & Sassi, 2010; Abduh & Omar, 2012; Manap et al., 2012). Previous studies indicated Islamic financial development had positive correlation with growth and investment (Furqani, & Mulyany, 2009; Goaied & Sassi, 2010). Additionally, Manap et al., (2012) showed there is a Granger causality between financing and economic growth in Islamic banks by utilizing Toda and Yamamoto Wald Test. Moreover, Abduh and Omar, (2012) found there was a ‘bidirectional’ association between Islamic financing and growth in Indonesia revealing the expansion in Islamic banking stimulates growth.

Studies on the role of financial intermediaries as indicator that promote economic growth have been carried out by many researchers (Schumpeter, 1911; Shaw, 1973; McKinnon, 1973 and King & Levine, 1993). Recent studies from Beck et al. (2000), Levine et al. (2000), Abu-Bader and Abu-Qarn (2008) and Barakat and Waller (2010) on the nexus between financial intermediaries and economic growth have found a significant positive relationship between finance and growth. According to King and Levine (1993) an efficient distribution of funds from financial intermediaries to the prospective capitalists with productive investment, especially through innovation production, can accelerate economic growth. Moreover, financial reform can improve the efficiency of the financial institutions and boost savings as well as investment, thus, result in long run economic performance (Abu-Bader & Abu-Qarn, 2008).

Benhabib and Spiegel (2000) discovered that financial intermediaries encourage economic growth by increasing the total factor productivity. This is matched with the findings of Beck et al. (2000) which indicate that the productivity as a proxy of economic growth positively influence the financial sector development. Yusifzada and Mammadova (2015) further investigated the contribution of financial development, especially through four aspects of the financial system namely, financial depth, access, efficiency and stability. Their findings showed that financial depth does not affect economic growth. Conversely, the financial access, efficiency and stability have positive significant relationship with economic development.

From the Islamic finance perspective, there are still very limited studies done that measuring the role of Islamic banks to economic performance (Furqani & Mulyany, 2009; Goaied & Sassi, 2010; Abduh & Omar, 2012; Manap et al., 2012). The expansion of the banking industry is favourable to economic development due to the banks’ effort to increase savings, managing resources efficiently and inspire innovation. As mentioned by Furqani and Mulyany (2009), they discovered that in the short run, capital accumulation as a proxy of fixed investment granger cause Islamic bank development between 1997-2005. Meanwhile, there is a bidirectional effect between economic growth and financial development in the long-run. This result is consistent with “demand following” hypothesis where upsurge in growth causes Islamic banking to foster and vice versa. Moreover, improvement in Islamic financial infrastructure can encourage the economic development as well as the country’s economic welfare in the long run. Duasa (2014) supported the findings of Furqani and Mulyany (2009) which showed that there is a strong bi-directional correlation between financial development and economic growth in Malaysia supported by ‘supply-leading’ or ‘demand-following’ views.

Goaied and Sassi (2010) investigated the impact of the amount of credit issued to the private sector as a proxy of Islamic financial development to the economic progress in 16 MENA region countries. However, contrary to other studies, the empirical results showed that there is insignificant relationship between banking and economic development. This reinforces the idea that banks don’t spur economic growth in the MENA region due to financial instability and repression.

Meanwhile, a study by Khoutem and Nedra (2012) investigates from microeconomic perspective, on how Islamic banks’ product can enhance economic growth, especially by promoting, a profit and loss sharing (PLS) instruments namely mudarabah and musyarakah contract. This study is line with the findings of Sapuan et al. (2015). Based on the profits and loss principle, Islamic banks can reduce the asymmetric information and transaction costs and encourages risk sharing. With less asymmetric information problem, saving and investment process can be optimized. Due to this, the Islamic banking seems as an effective and competitive institution to promote growth.

Research Questions

In view of the statement above, the research question of this study are twofold: first, what is the cointegration between total Islamic financing as a proxy of Islamic banking development and investment in relation to economic growth? and second, what are the short-run relationship and the speed of adjustment among total Islamic financing, investment and economic growth?

Purpose of the Study

In line with the above research questions, the objectives of this study are twofold: first, to find the co-integration between total Islamic financing as a proxy of Islamic banking development and investment in relation to economic growth, and second, to examine the short-run relationship and the speed of adjustment among total Islamic financing, investment and economic growth.

Research Methods

Model Specification

The model can be written as follows:

lnGDPt = β0 + β1lnFINC + β2lnCFt+ εt(1)

Where lnGDP is the natural logarithm of real GDP as a proxy of economic growth; lnFINC is the natural logarithm of Islamic banks’ total financing as a proxy for Islamic banking development; lnCF is the gross capital formation as a proxy of investment; β0is the intercept; βi is the coefficient of independent variables and ε is the error term,

Data and methodology

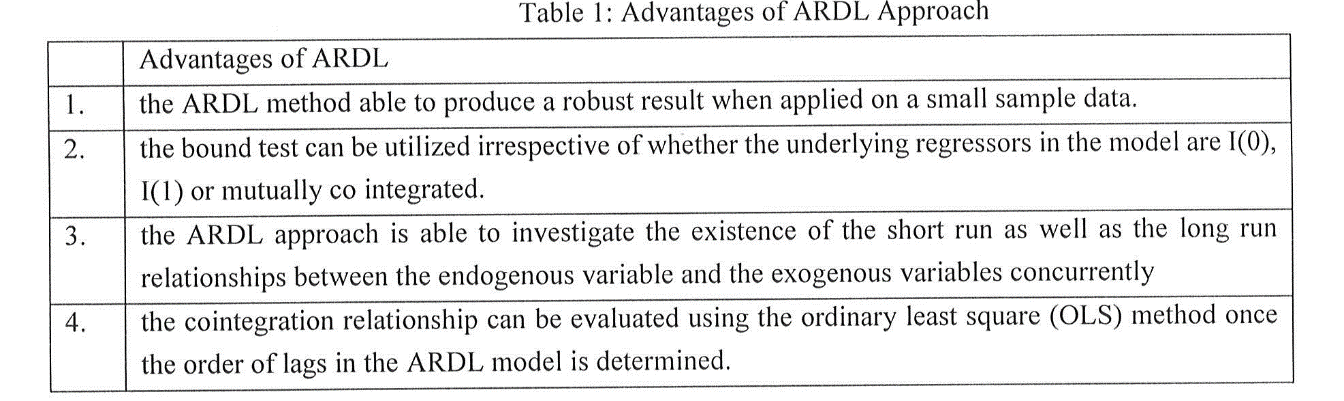

This study will employ quarterly data from 2007 to 2015. The data was obtained from the Monthly Bulletin Statistics of Bank Negara Malaysia (BNM) and Department of Statistic Malaysia. The ARDL bound testing approach is used to investigate the co-integration of the variables. The ARDL method has several fortes as compared to other types of co-integration approach (Johansen & Juselius, 1990) as listed in Figure

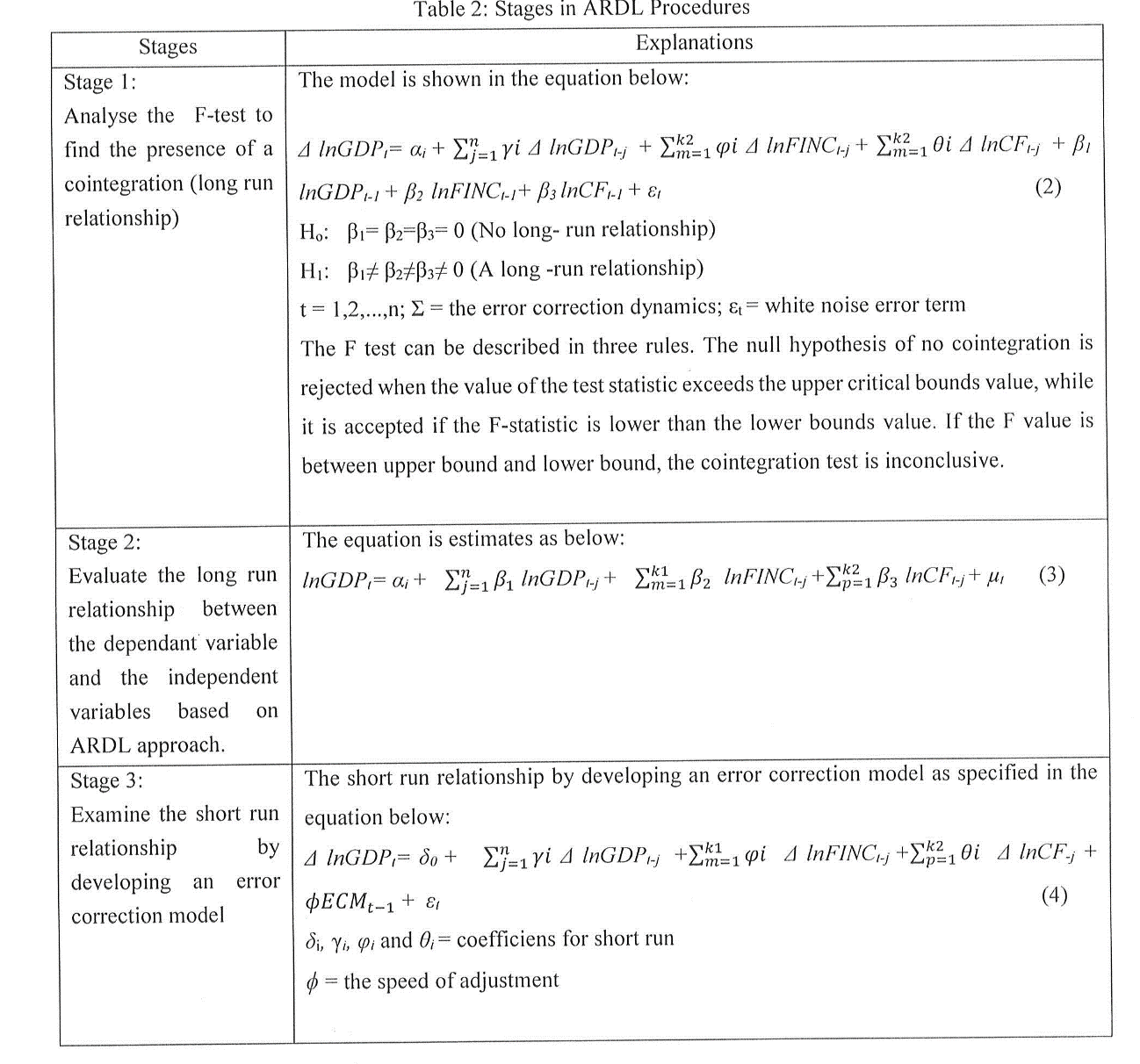

The bound testing technique can be examined through three stages as shown in Figure

Findings

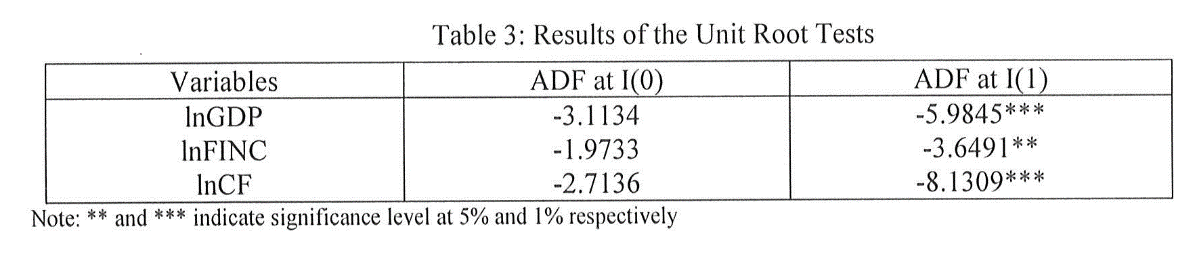

The unit root test are shown in Figure

Figure

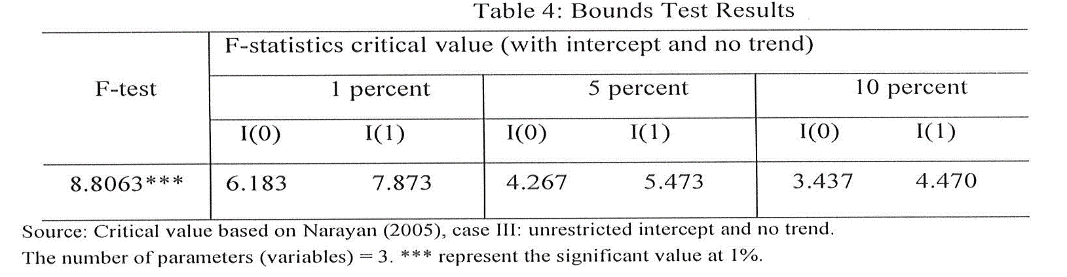

The results in Figure

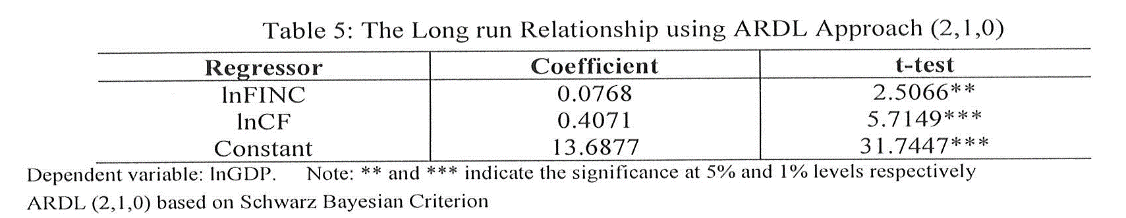

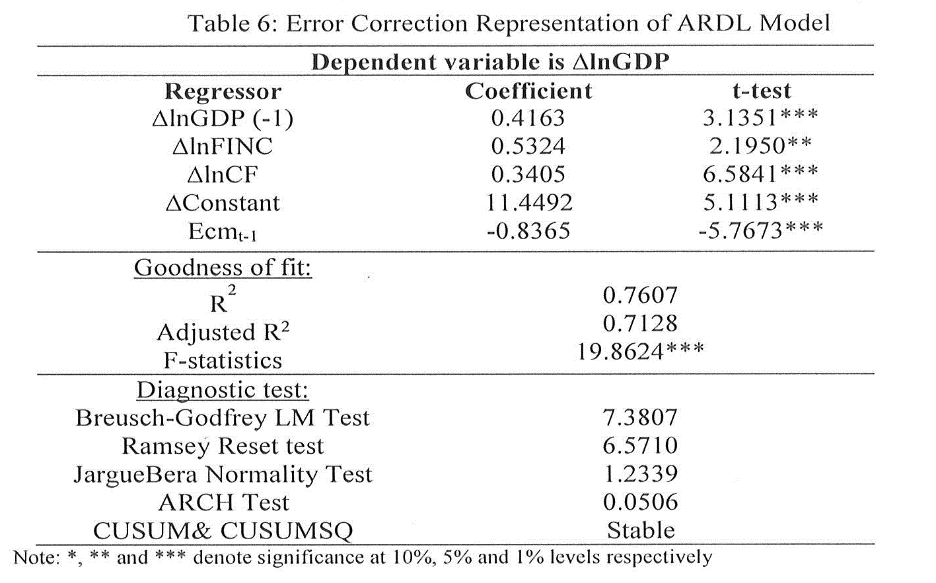

Based on the results in Figure

Figure

Conclusion

As a conclusion for this study, we can conclude that financial development of the Islamic bank has positively and significantly influence growth in Malaysia in the short-run and long-run. Based on the results, total Islamic financing and investment effect growth positively. Hence, it indicated that the expansion of Islamic financial transactions and financing activities in Malaysia may enhance economic growth in the long run. There is show by the continued expansion of Islamic financial institutions can position Islamic finance to be well-anchored to serve the real economy.

Despite a global competitive and challenging financial environment, the Islamic banking industry, especially in Malaysia, has continued to expand its potential as a sustainable tool of financial intermediation as compared to conventional financial system. The Islamic banking system’s is on the close association with financial transactions and economic activity of this country. There is an evidence that the Islamic financial market has positioned itself to be sound and secure to serve the real economy. Therefore, Islamic banking development is a strong indicator to boost the economic growth.

References

- Abduh, M. & Omar, M. A. (2012). Islamic banking and economic growth: the Indonesian experience, International Journal of Islamic and Middle Eastern Finance and Management, 5 no.1, 35-47.

- Abu-Bader S. & Abu-Qarn S. A. (2008). Financial Development and Economic Growth: Empirical Evidence from Six MENA Countries. Review of Development Economics, Vol. 12, no.12, 803-817.

- Barakat M. & Waller E. (2010). Financial Development and Growth In Middle Eastern Countries. International and Economics Research Journal, Vol. 9, no 2, 121-130.

- Beck, T., Levine, R. & Loayza, N. (2000). Finance and the Sources of Growth, Journal of Financial Economics, 58(1,2), 261-300.

- Benhabib, J. & Spiegel, M. M. (2000). The Role of Financial Development in Growth and Investment, Journal of Economic Growth, 5(4), 341-360.

- Duasa, J. (2014). Financial Development and Economic Growth: The Experiences of Selected OIC Countries. International Journal of Economics and Management. 8(1), 215 – 228.

- Engle, R.F. & Granger, C.W.J., (1987). Cointegration and Error Correction: Representation, Estimation and Testing. Econometrica, 55, No. 2, 251-276.

- Furqani, H. & Mulyany, R. (2009). Islamic Banking and Economic Growth: Empirical Evidence from Malaysia. Journal of Economic Cooperation and Development, 30, No. 2, 59-74.

- Goaied, M. & Sassi, S. (2010). Financial Development and Economic Growth In The MENA Region: What About Islamic Banking Development? Journal of Economic Cooperation, Vol. 1, No.2, 29-88.

- Johansen, S. & Juselius, K. (1990). Maximum Likelihood Estimation and Inference on Cointegration - With Application to Demand for Money. Oxford Bulletin of Economic and Statistics, 52 no. 2, 169-210.

- Khoutem, B. J. & Nedra, B. A. (2012). Islamic Participative Financial Intermediation and Economic Growth. Journal of Islamic Economics, Banking and Finance, Vol. 46 8 No. 3, 44-59.

- King, R. G. & Levine, R. (1993). Finance, Entrepreneurship and Growth: theory and evidence. Journal of Monetary Economics, 32, No. 3, 513–42.

- IFSI Stability Report (2017). Islamic Financial Services Board, Kuala Lumpur, Malaysia

- Levine, R., Loayza, N. & Beck, T. (2000). Financial Intermediation and Growth: Causality and Causes. Journal of Monetary Economics, 46 no. 1, 31–77.

- Malaysia Islamic Financial Report (2015). Islamic Research and Training Institute (IRTI), Jeddah, Kingdom of Saudi Arabia.

- Manap, T. A. A., Abduh, M. & Omar, M. A. (2012). Islamic Banking-Growth Nexus: Evidence from Toda-Yamamoto and Bootstrap Granger Causality Test. Journal of Islamic Finance, 1 no. 1, 59–66.

- McKinnon, R. I. (1973). Money and Capital in Economic Development, Washington, D.C.: Brookings Institution.

- Narayan, P.K. (2005). The saving and investment nexus for China: evidence from cointegration test. Applied Economics, 37, no.17, 1979-1990.

- Sapuan, N. M., Sanusi, N. A., Ismail, A. G., & Wibowo, A. (2015). Optimal profit sharing contract and principal-agent value in islamic bank. Advanced Science Letters, 21(6), 1837-1841.

- Schumpeter, J.A. (1911). The Theory of Economic Development, Cambridge: Harvard University Press.

- Shaw, E. S. (1973). Financial Deepening in Economic Development, New York: Oxford University Press.

- Yusifzada, L. & Mammadova, A. (2015). Financial intermediation and economic growth. William Davidson Institute Working Paper Number 1091.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

31 July 2018

Article Doi

eBook ISBN

978-1-80296-043-3

Publisher

Future Academy

Volume

44

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-989

Subjects

Business, innovation, sustainability, environment, green business, environmental issues, industry, industrial studies

Cite this article as:

Sapuan, N. M., & Roly, M. R. (2018). Islamic Banking-Growth Nexus In Malaysia. In N. Nadiah Ahmad, N. Raida Abd Rahman, E. Esa, F. Hanim Abdul Rauf, & W. Farhah (Eds.), Interdisciplinary Sustainability Perspectives: Engaging Enviromental, Cultural, Economic and Social Concerns, vol 44. European Proceedings of Social and Behavioural Sciences (pp. 630-637). Future Academy. https://doi.org/10.15405/epsbs.2018.07.02.67