Abstract

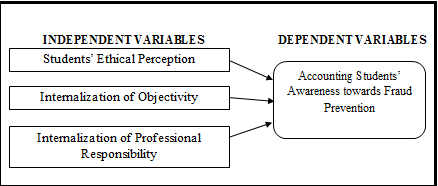

This study is aim to evaluate the awareness of accounting students towards fraud prevention. This research examines the relationship between i) the student’s ethical perceptions, ii) internalization of objectivity and iii) internalization of professional responsibility with accounting students awareness towards fraud prevention. This study was conducted in one of Government-Linked University, University Tenaga Nasional, Sultan Haji Ahmad Shah Campus (UNITEN KSHAS). The total number of population is 944 students, hence the sample of 285 accounting students are selected to test the objective of the study. Accounting students were selected as the sample because of they are more likely to work in accounting profession which requires them to be aware of this fraud issue. This study was conducted by using primary data by using questionnaires that adopted from Istiningrum (

Keywords: Accounting studentsobjectivityprofessional responsibilitystudents’ ethical perceptionstudents’ awarenessfraud prevention

Introduction

Fraud can be defined as any act of deception which was intentionally made for personal gains or needs. It can also be used to deceit and rescind oneself. It is any act of deception which is intentional act of a person for their own benefit. In order to determine fraud activities have taken place, based on common law, the elements that must be present: (i) a material false statement made with concentrating to deceive, (ii) a victim reliance on the statement and (iii) damages have befell. There are other type of fraud which are the embezzlement of funds, fake claims for hours worked, accounts manipulation, false documentation, theft, check forgery and forging (Ghazali, Rahim, Ali, & Abidin, 2014).There are ways to detect fraud such as, employee notification, accidental discovery and external audit. However, the combination of opportunity, pressure and rationalization are the causes for fraud occurrence. When this situation arises, the person thought that the act was not completely wrong, and the person attempt to commit the fraud. According to Klynveld Peat Marwick Goerdeler (KPMG) (2013) surveys, fraud risk management discusses about the systems and processes to identify an organization’s exposure to fraud risk, and to apply controls, procedures and education to prevent, detect and respond to the key fraud risk. The development of a broad ranging fraud risk management program is an important step in managing the immeasurable risks posed by fraud and misconduct and organizations to fall and to improve a sound program endanger their future. In KPMG’s view, an effective approach to fraud risk management should focus on controls with following three objectives: 1) prevention 2) detection and 3) response. Prevention of fraud are very important nowadays because fraud has been a common culture of people and worker in the public sector and most companies thus it is vital to increase the awareness on fraud prevention. Therefore, this study emphasizes on fraud prevention awareness towards students’ ethical perception, internalization of objectivity, and internalization of professional responsibility.

Problem statement

The biggest problem that usually happen and get serious attention by management is fraud which can be occur in an organization or company. All parties within society must have the awareness of fraud prevention, especially those who are with accounting background. It is because they can minimize the percentage of fraud occurrence. According to the statistic of department of fraud perpetrator, the highest fraud cases occurred is in the accounting department which is 16.6% compared to other departments (ACFE, 2016). Accounting profession has shockingly shown the highest rate as fraud perpetrator cases for 3 consecutive years which are 22% in 2012, 17.4% in 2014, and lastly 16.6% in 2016 (ACFE, 2016). It might be because of the lack of awareness among the fraudster. It is important to have awareness on fraud prevention and this should be trained since university life as a student. Furthermore, fraud occurrence also tends to correlate with education as most of the fraud perpetrator. Educational level is university degree which their percent of cases is 47.3%. This figure is considered as high as it is nearly to 50% (ACFE, 2016). Students need to have early education and awareness on fraud prevention before entering the work environment. Therefore, this research is conducted to examine the awareness of fraud prevention among accounting students.

Purpose of Study

The research objectives of this study are as follow

To examine the relationship between students’ ethical perception and accounting students’ awareness towards fraud prevention.

To examine the relationship between internalization of objectivity and accounting students’ awareness towards fraud prevention.

To examine the relationship between internalization of professional responsibility and accounting students’ awareness towards fraud prevention.

Literature Review

Internalization is the process of which a person from a formal group takes on the beliefs, attitudes, ethics and perspective held by other member. Concept of unbiased mental which the attitude allows a person perform duties in the best interest is called as objectivity. Besides, professional responsibility is the area of legal practice which the duties are in professional manner. Internalization of objectivity and professional responsibility into learning process and to the accounting students may build students sensitivity to achieve their duties according to their best interest of the organisation. Students should learn to be objective, responsible, and have good ethical perception as they are highly likely will work in accounting field which are closely related to fraud occurrence (Istiningrum, 2014).

Awareness of fraud prevention.

Where there are weak internal controls, financial statement fraud cases would likely to happen. An effective internal control system which can prevent the fraud occurrence include segregation of duties among top management as well as between employees that responsible for performance and employees responsible for accounting and information system (Mohamed & Schachler, 2015). Awareness on preventing fraud may aid many organisations in solving their internal control problems where they may avoid the people of organisations to commit fraud. Awareness among all employees will be essential to reduce fraud activities in an organisation. In order to reduce the number of bribery and to tighten punishment for company doing fraud, a radical anti-corruption system is needed. There are several ways to prevent fraud such as establish and maintain a culture of high ethics, evaluate fraud risks and implement programs and controls to diminish identified fraud risks, and lastly develop suitable fraud oversight process (Istiningrum, 2014).

Fraudulent financial reporting is misrepresent financial statement transaction while taking company’s assets or resources without authorization is the example of misappropriation of firm resources (Efiong, 2012). The financial statement fraud usually committed by top management and it will caused misleading the decisions made by company investors, which resulted to diminish the accounting professional associated with it (Mohamed & Schachler, 2015). Throughout the globalised business sector, accounting fraud has occurred widely. This includes Malaysia as it is emerging as one of the many nations with high expanding rates of business deals. Therefore, bad perceptions have been created by public regarding fraudulent activities that occur in the country. An auditor should practice fair and true report in order to protect public interest even though the duty to uncover fraud is not on them (Koh, Arokiasamy, & Lee, 2009).

Enron Corporation, Global Crossing, and Adelphia have been collapse after they were found to be misleading in the financial accounts had affected the confidence of investors and led to legislative responses These scandals have raised the questions regarding the reliability of the financial information (Mohamed & Schachler, 2015). In context of Malaysia, a survey conducted by PWC Malaysia (2016) stated that 1 in 3 Malaysian respondents believe that their companies will experience bribery or corruption in the next two years and 13% of Malaysian fraud victims experienced financial losses in excess of USD 1 million.

Awareness among accounting students.

Fraudulent activities can take many forms and encountered by organizations all over the world. Various scandals, confidence in the dependability and the objectivity of the financial statements of involved parties that has been significantly reduced are the reasons of fraud occurrence (Zager, Malis, & Novak, 2016). Educational system play major role in creating, interpreting and strengthen social values through knowledge delivered to the students because students represent the upcoming manpower potential of any country (Efiong, 2012). Education system can participate in preventing fraud by creating students’ awareness towards fraud. Students need to have awareness to determine the negative effect of doing fraud and by doing so, they are expected to prevent fraud in their future working environment. Besides that, accounting students must be built with ethical perception in order for them to prevent fraud. The ethical perception can be built by two approaches which are integration of ethics education into the curriculum and inclusion of at least one stand-alone ethics course within the curriculum. Accounting lecturers can also assist in creating the ethical perceptions among accounting students by internalizing all fundamentals principles into accounting learning process in the class (Istiningrum, 2014).

Hypotheses Development

Student’s ethical perception.

According to Adkins and Radtke (2004), it was suggested that students' perception towards accounting ethics education is important and even the students themselves agree to the statement that accounting ethics is important for their future accounting profession. Ismaili, Imeri, Ismaili and Hamiti (2011) stated that the results of their study shows students do not have enough ethics knowledge. However, a significant percentage of students believe that ethics education has significantly improved ethnic relations as well as the level of education will grow. Continuous learning has been perceived as the most important skill for future careers by students (Kavanagh and Drennan, 2008). Students are aware that employer nowadays expects for an accounting graduate with an excellent soft skills, analytical skills and awareness and also knowledge of the working environment. Therefore, the first hypothesis is:

H1: There is a significant relationship between student’s ethical perception and accounting students’ awareness towards fraud prevention.

According to Gaffikin and Lindawati (2012), as a member of society public accountants must have a professional ability to involve in the development of moral reasoning as an ethical decision maker. Based on Istiningrum (2014), accountants must provide high quality service in preventing fraud which the characteristics of high quality are lack of bias and high objectivity. Khanna and Arora (2009) stated that education and training are the ways to prevent fraud. Education are able to increase the employees capabilities by develop their skills, knowledge, and commitment not to commit fraud. Therefore, the higher objectivity that is internalized to accounting students, the higher the awareness of students to prevent fraud.

The second hypothesis is:

H2: There is a significant relationship between internalization of objectivity and accounting students’ awareness towards fraud prevention.

A reason of fraud occurrence in organizations is mainly due to lack of professional responsibility among employees and employers. According to Ienciu, (2012), it is expressed that there is a certainty of a significant link between the efficiency of the board of directors, fundamental characteristic of the corporate governance and the ethical behaviour of companies. Based on Pospisil and Vomackova (2016), graduates of economic must be able to recognize the sign of economic crime by obtaining economic knowledge, civil law, and also corporate governance in order to take steps to prevent economic crime. Corporate governance purpose is to achieve responsible and responsiveness companies (Mahdavi & Daryaei, 2017). According to Gaffikin and Lindawati (2012), a formal morality would be created by an awareness of moral development. It will contribute to the adherence of conscience of the individual, comprehensive and universal. Nordin, Takim and Nawawi (2013) in their study stated that corruption is related to human behaviour including individual obedient behaviour to follow the law and behaviours of greed, boast, dishonest, and jealousy. Therefore, the third hypothesis is:

H3: There is a significant relationship between internalization of professional responsibility and accounting students awareness towards fraud prevention.

Research Methods

Population and sampling.

The target population for this study is students from accounting background. This research is conducted in University Tenaga Nasional, Sultan Haji Ahmad Shah Campus. Accounting students were chosen as sample because they are more likely to work in accounting profession which requires them to have awareness of fraud issues as it is stated previously, that most of the fraud cases takes place from those who come from accounting background profession and most of them are university graduates. Thus, they need more exposure on reality and awareness of preventing fraud activities that they might encounter in working life later on. Total number of population is 944 accounting students. Out of 944 accounting students, 285 students are taken as sample for this study.

Data collection procedures.

In this study, the data used is primary data. The questionnaire was adapted from previous research to explore and evaluate the accounting students’ awareness towards fraud prevention in UNITEN. The questionnaire was adopted from Istiningrum (2014). The questionnaire consists of five parts. In the first part, it is regarding respondents' demographic information. The second part analyse whether the respondents are aware of fraud prevention. This situation measures on how the respondents respond to fraud if they come across one in future working life. The third part focuses on the respondent's ethical perception where it measures the accounting students' perception on ethics. In the fourth part, the question focuses on internalization of objectivity. Respondents are questioned about the action or activities that an auditor or an accountant are allowed or not allowed to do. The fifth part of the questionnaire focuses on internalization of professional responsibility which focuses on professional responsibility of an auditor and accountant. The questionnaire are based on an interval scale rated from 5- this type of behaviour is strongly agree to 1 – this type of behaviour is strongly disagree.

Findings

Descriptive analysis.

From the Table

Based on the rule of thumb of Miles and Shevlin (2001), they specify that suitable range for Skewness and Kurtosis is from -1 to +1, which was used in this research. After conducting the normality test it disclosed that Skewness were exceeding -1 and +1 which can be defined the data were not normal. Consequently, amendments must be conducted since the information was not normal. One method was selected in order to correct the data to be normal. The method is Van Der Waerden by Cooke (1998). According to Cooke (1998), Van Der Waerden was an effective method to normalize all variables by allocating ranks to the information that is not normal and change the ranks with number on normal distribution. After the variable has been normalized, for the distribution of Skewness and Kurtosis for this research, it shows that the variables were in the acceptable range between -1 to +1.

Based on the Table

Based on Table

While for the internalization of objectivity and accounting student’s awareness towards fraud prevention there a significant positive relationship because the p-value less than 0.05. Thus, the hypothesis (H2) was accepted. This shows that internalization of objectivity influence accounting students awareness towards fraud prevention. This also shows that accounting students are aware to prevent from commit any fraud. This is consistent with the previous research result from Khanna and Arora (2009) which shows that education are able to increase the employees capabilities by develop their skills, knowledge, and commitment not to do fraud whereas Istiningrum (2014) stated that accountants must provide high quality service in preventing fraud which the characteristics of high quality are lack of bias and high objectivity.

As for internalization of professional responsibility, the result shows that there is significant positive relationship between internalization of professional responsibility and accounting students awareness towards fraud prevention since the p-value is less than 0.05. Thus, the hypothesis (H3) was accepted where internalization of professional responsibility influence accounting students awareness towards fraud prevention. This is consistent with the previous research result of Gaffikin and Lindawati (2012) that shows formal morality would be created by an awareness of moral development and will contribute to the adherence of conscience of the individual comprehensive and universal while Nordin et al. (2013) stated that corruption is related to human behaviour including individual obedient behaviour to follow the law and behaviours of greed, boast, dishonest, and jealousy.

Conclusion

Table

Limitations and Recommendation.

Limitations do occur in all research where several limitations identified throughout the research. Firstly, the research was limited within accounting student in UNITEN, KSHAS. Thus, the results are in the specific setting and cannot be generalised to other institutions. Secondly, the sample size of the research is only 285 respondents and it is from students who are undergraduates of accounting course only. This made the research to be complex to measure awareness among undergraduates from other courses as it is complicated to perceive their opinion on this area. Besides that, the limitation in preparing this research was level of fraud awareness among the respondents. Since some of them were lacking of fraud awareness it was difficult to process the collected data as it may be answered without understanding the nature of the questionnaire because respondents' respond are hard to control.

There are some recommendations that can be made based on the outcome of the study. Firstly, the study can be extended to other private and public institutions around Malaysia. This will help future researchers to get a precise feedback and it avoids bias. Secondly, it is recommended for the future researchers to run a bigger sample size of respondents as this would enable them to get a much appropriate opinion from both the private and public institutions. Not only that, they should also include students from other courses to measure their awareness of fraud as conducting such research will be a way to spread awareness among non-accounting students.

Thirdly, besides survey, future researcher may also proceed with other research method which includes interviews and conversations because those one to one techniques may be structure to offer completely beneficial information. This one to one technique is very useful as the researcher will be able to give a verbal elaboration on the questions they intend to ask and it will give the respondents an understanding of the issue being discussed. By doing this, the respondents may query researchers on which ever questions that they do not understand and the researchers need not worry about being answered without understanding the questions.

References

- ACFE. (2016). Report to the Nations on Occupational Fraud and Abuse.

- Adkins, N., & R.Radtke, R. (2004). Students’ and faculty members’ perceptions of the importanceof business ethics and accounting ethics education: Is there an expectations gap? Journal of Business Ethics 51, 279-300.

- Cooke, TE (1998). Regression analysis in accounting disclosure studies, accounting and business research. Routledge Taylor & Francis Group, 36, 209-224.

- Efiong, E. J. (2012). Forensic Accounting education: An exploration of level of awareness in developing economies - Nigeria as a case study. International Journal of Business and Management, 7, 26-34.

- Gaffikin, M., & Lindawati, A. (2012). The moral reasoning of public accountants in the development of a code of ethics: the case of Indonesia. Australasian Accounting and Finance Journal, 6, 3-28.

- Ghazali, M. Z., Rahim, M. S., Ali, A., & Abidin, S. (2014). A preliminary study of fraud prevention and detection at the state and local government entities in Malaysia. Procedia Social and Behavioural Sciences 164, 437-444.

- Ienciu, I.A. (2012). Corporate Governance and Ethical Behaviour :A National Perspective. The Romanian Economic Journal, 45, 89-68.

- Ismaili, M., Imeri, D., Ismaili, M., & Hamiti, M. (2011). Perceptions of ethics at education in university level. Procedia Social and Behavioral Sciences, 15, 1125-1129.

- Istiningrum. (2014). Antecendents and Impacts of students's ethical perception in accounting learning proocess. Jurnal Akuntansi dan Keungan Indonesia, 11, 222-247.

- Kavanagh, M., & Drennan, L. (2008). What skills and attributes does an accounting graduate need? Evidence from student perceptions and employer expectations. Accounting and Finance, 48, 279-300.

- Khanna, A., & Arora, B. (2009). A study to investigate the reasons for bank frauds and the implementation of preventive security controls in Indian banking industry. International Journal of Business Science and Applied Management, 4, 1-21.

- Koh, A. N., Arokiasamy, L., & Ah Suat, C. L. (2009). Forensic accounting: Public acceptance towards occurrence of fraud detection. International Journal Of and Management, 4, 145-149.

- KPMG. (2013). KPMG Malaysia Fraud, Bribery and Corruption Survey.

- Mahdavi, G., & Daryaei, A. A. (2017). Attitude toward business environment of auditing, corporate governance and balance between auditing and marketing. Contaduria y Administracion, 62, 1019-1040.

- Miles, J. N. V. and Shevlin. M. E. (2001). Applying Regression and Correlation. A Guide for Students and Researchers. London: Sage Publication

- Mohamed, N., & Schachler, M. H. (2015). Roots of Responsibilities to financial statement fraud control. Procedia Economics and Finance 28, 46-52.

- Nordin, M. R., Takim, R., & Nawawi, A. H. (2013). Behavioural factors of corruption in the construction industry. Procedia Social and Behavioral Sciences, 105, 64-74.

- Pospisil, J., & Vomackova, H. (2016). Education as a prevention of fraud. International Journal of Human Sciences, 13, 1133-1140.

- PWC Malaysia. (2016). Economic Crime from the Board to the Ground. Malaysia: PWC.

- Zager, L., Malis, S. S., & Novak, A. (2016). The role and responsibility of auditors in prevention and detection of fraudulent financial reporting. Procedia Economics and Finance, 39, 693-700.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

31 July 2018

Article Doi

eBook ISBN

978-1-80296-043-3

Publisher

Future Academy

Volume

44

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-989

Subjects

Business, innovation, sustainability, environment, green business, environmental issues, industry, industrial studies

Cite this article as:

Azman, N. A. N. N., Selahudin, N. F., Karim, A. H. A., Vijayan, K. N. M., Wotravathy, S., Ka, N. L. K. M. R., Azman, B., & Wotravathy, S. (2018). Accounting Students’ Awareness TowardsFraud Prevention: A Case Of Government-Linked University. In N. Nadiah Ahmad, N. Raida Abd Rahman, E. Esa, F. Hanim Abdul Rauf, & W. Farhah (Eds.), Interdisciplinary Sustainability Perspectives: Engaging Enviromental, Cultural, Economic and Social Concerns, vol 44. European Proceedings of Social and Behavioural Sciences (pp. 12-21). Future Academy. https://doi.org/10.15405/epsbs.2018.07.02.2