Abstract

A company’s performance is frequently connected with a high level of Human Capital (HC). HC has long been agreed as a value creator to companies. There are suggestions to quantify and recognise the HC to help in making a better decision, by neither the management nor the investors. This process is known as Human Resource Accounting (HRA), which has gaining interest at international level. However, there is an issue on the quantification of Human Resources (HR) costs as there is no agreement on the model to be used. In Malaysia, there are disclosures about the HC, but the quantification of HC being ignored. The primary objective of this study is to discover the reason for non-practicality of HRA in Malaysia. This study used qualitative approach, employed semi-structure interview. The respondents are practitioner accountants. The study revealed significant result where the HRA is still distant in current practise and not ready to be applied in Malaysian context.

Keywords: Intellectual capitalHuman capitalHuman resource accounting

Introduction

The organisational value drivers have shifting from tangible assets to intangible assets, resulted from the emerged of new economy. From accounting perspective, these intangible value drivers is called as Intellectual Capital (IC). From IC concept, another important component has emerged, which is Human Capital (HC). HC emerged as the most important element and the core concept of IC (Bontis & Richardson, 2000; Tayles & Sofian 2007).

In today knowledge intensive economy, HC plays a significant role to drive value creation for the economy. Even in Malaysia, the role of HC is recognised as essential tools to the development an excellent capital market (Muhammad & Ismail, 2009). Accordingly, the development of HC is one of the areas targeted under the Ninth Malaysian Plan. It development will mirror intellectual capacity of a nation. The rise and fall of nations as well as factor in determining individual income, is explained by the development of HC (Becker, 1991).

HC is believed to be the most vital asset that exists within a firm. The combination of intelligence, skills, knowledge, aptitudes and expertise represents the human factor in an organisation, which directly contributes to its unique characteristics (Bontis & Richardson, 2000; Tayles & Sofian, 2007). These characteristics shall add to better organisational performance (Gazor & Rastegari, 2013). Thus, it also becomes a major driver for the company’s profitability (Hurwitz & Schmidt, 2002). High performing firms holds experienced managers and skilled employees because the capabilities of the manpower can bring the firm into a success full play (Bontis & Richardson, 2000).

Due to its significant, the debate about the importance of HC disclosure has been started as early as the 1960s. There was an argument to quantify and recognised the HC. The cost incurred by companies in the process to recruit, select, hire, train and develop human capitals shall be quantified and recognised. The process to quantify and recognise these costs is defined by Flamholtz (1985) as Human Resource Accounting (HRA). The academic debate on HRA is mostly to quantify and recognise in attempted to bring HC into the balance sheet (Johanson, Martensson, & Skoog, 2001).

However, the major weakness of the HRA movement is measuring the monetary value of HC. Companies are failed to see the human resource as an asset. This has limited the application of HRA to disburse information to users. The application of HRA in organisations should produce beneficial results by providing valuable input to management about the employees and the returns expected from the employees. However, it has been ignored. Due to the important of HRA, this topic is always being debated to find the most suitable treatment and disclosure. In fact, Parker (2007) stressed that HC shall be a major area for further study in accounting field.

Problem Statement

For the first time in 1968, Brummet, Flamholtz, and Pyle (1968) introduced the term “Human Resource Accounting” (HRA). The definition given by the American Accounting Association (2005) to HRA is the process of identifying, measuring and communicating information about human resources in order to facilitate effective management within an organisation. The definition considers HRA as the process of recognition and the quantification of human resources for the purpose of assisting the effective management of an organisation.

Ojokuku and Akintola (2015) described that HRA itself is a way of communication between people in organisation. Their role is considered valuable on the basis of their contribution to the company’s development, and that role is subject to the evaluation. The effective communication shall affect positive decisions and lead to effective human resource management practices in the organisation (Ojokuku & Akintola, 2015).

Ripoll and Ripoll (1994) had pointed out at least two reasons for inclusion of human resource in accounting. First, the valuable resource to a firm shall be quantified even it is human. Second, the value of resource especially human is depends largely on management style which will influence the resource value. Therefore, the inclusion of appropriate human resource information in financial reporting would probably add more meaningful data for future prediction of firm’s performance (Lal, 2009).

Islam, Kamruzzaman, and Redwanuzzaman (2013) highlighted the major benefits of HRA are that it develops effective managerial decision making, management quality, prevention of misusing resources, increases in productivity of human asset, inspire employee creativity, improve employee morale and job satisfaction. HRA is also could be the important source of information for external user like investors. In fact, Bratton and Gold (2003) claimed that HRA information seem to be even greater for the external decision-makers than for the company's management.

There are evidences on the growth of interest and contributions toward the development of HRA in a number of countries (Bullen & Eyler, 2010). Bullen and Eyler (2010) argued that is a signal of potentially encourages for consideration of alternative measurement and reporting standards with the strong growth of international financial reporting standards (IFRS). Hence, the non-traditional measurements such as the value of HR using HRA methods shall lend some possible support to the future of financial reports.

HRA is measured in terms of human resource cost or in terms of human resource value. Flamholtz (1999) gives two major categories in explaining the human resource costs, acquisition costs and learning costs. Acquisition costs shall include the direct recruitment costs such as selection, hiring and placement, and the indirect costs of promotion or hiring from within the firm. Whereas, learning costs are the direct costs of formal training and orientation and on-the-job training. Accordingly, from accounting perspective, some these costs shall be reported as capital asset as it can brings future economic benefits.

However, in current practices, mostly human resource development treated as a cost in income statement rather than investment. This due to the absence of a comprehensive model for appraising human resources and factors obstructing the implementation of HRA (Mahmoodi, Babae, & Mohamade, 2013). It being stressed out by Islam et al. (2013) that there is need for a proper valuation of human resources technique and accounting treatments for this purpose.

In Malaysia, a study by Mohan and Mohd Rizuan (2017) found Malaysian companies did disclosed information about HC in annual report as being suggested, but is not yet about the HRA. There was no detailed disclosure has been made about HC investment and the return from this investment. Although Huang, Abidin, and Jusoff (2008) found evidences that Malaysian investors do value HC information for their decision making, but beyond the norm of HC reporting, detailed report has not been made to quantify and recognise the human resource investment. It can be said that the HRA is not being practices in Malaysia.

Research Questions

This study is designed to identify the practicality of HRA from Malaysian perspective. Accordingly, this study is designed to answer the following questions:

Why the HRA approach is not applied into practise by the Malaysian companies?

Do accountants agreed on the underlying theory of HRA that has been suggested to be practiced?

Purpose of the Study

The purpose of the study is to explore accountants’ perspective about the practicality of HRA in Malaysia. Alongside, this study intends to explore the reasons for non-practicality of HRA in Malaysia and possibility of the practice of HRA in future. The study focused on practitioner’s perspective, which are also accountants and relate very much with HC.

Currently, there is very limited research done on HRA practicality, especially in Malaysia. To understand the motivation or phenomena for practicality of HRA concept, qualitative study is the most suitable approach as it helped to provide an exploration for the phenomenon. Thus, this study shall provide the reason for the non-practicality of HRA and make suggestion on how to make Malaysian companies practiced the HRA.

Finally, from the feedback gathered, it might be a starting point for the researcher and authorities to consider and redesign necessary approach to make the HRA method workable in Malaysia. As being discuss by Bullen and Eyler (2010) HRA is important and it practice is growth over the time. Thus, Malaysian companies should take part and make their operating more useful.

Research Methods

Semi structured interview was deployed to assess the extent and perception towards HRA practicality. The semi structured interview is a phenomenological qualitative approach of study; explore the perceptions and knowledge of the practitioners regarding subject matter. Phenomenology is used to explore a phenomenon that is difficult to observe or measure (Wilding & Whiteford, 2005). This shall include in the area of study with limited resources such as in HRA.

Purposive sampling is used to select the interviewees. A purposive sampling is designed to pick a small number of cases that will yield the most information about a particular phenomenon (Bickman & Rog, 2009). They were chosen from few backgrounds. The diversity of background in the interviews are important to deter the research from being biased and avoid one sided analytical practices (Pyett, 2003). In this study, the interviewees are Finance Directors, Partners of Accounting Firms and Financial Manager of Government-link Company. They are accountants and involved very much with HC development.

This study used atlas.ti software to analyse and organise the data. The process includes open coding through quotations and creating network from the codes (Rambaree, 2014). The perception of HRA information is extracted from the semi structured interviews and given an open codding. There is a sum of 5 coding were given based on the information extracted from the semi structured interview.

Findings

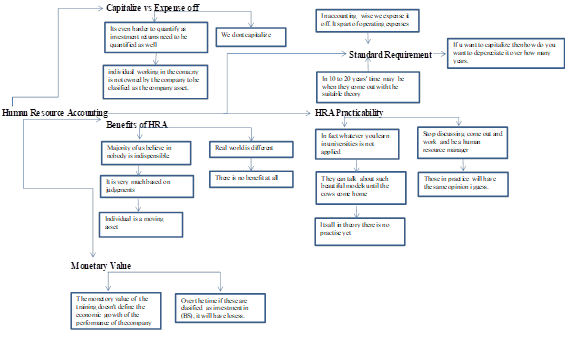

Findings evolved from manual transcription, active listening, and complete evaluation of the interview responses. The findings yielded several themes from arise from the codes of three-interview despondence: (a) standard requirement (b) not beneficial, (c) capitalise vs expense off, (d) impracticable, and (e) monetary value.

Theme one – Standard Requirement

The standard requirement influences the HRA approach. Two out of three participants noted that standard requirement is one of the major aspects for HRA disclosure. Without standard requirement guide placed accordingly accounting treatments cannot be made. For example, R1 stated, “In accounting wise we expense off because it is part of operating expense”. R2 stated, “If you want to capitalise than how you depreciate it over how many years and may be in 10 to 20 years’ time can be applied when suitable theory is formed”. Hence, the standard requirement is the reason why HRA approach is not applied into company practices.

Theme Two – Benefits of HRA

On the refection of HRA disclosure benefits, the respondents are seems to agree that there is no benefit on HRA disclosure. R1 stated, “there is no benefit in capitalising HRA because in real world it is different and an individual is a moving asset”. Therefore, the rationale behind the non-practicability of HRA practice lies on the no beneficial factors.

Theme Three – Accounting Treatment for HRA

Three participants described the

Theme Four – HRA Practicality

One out three participants explained on the impracticable of HRA which resist to the approach. R3 stated, “There can be a lot of beautiful models under discussion but not applied, discussion should be stopped and come out in to the real world as HR manager to see the real situation and so far everything is on theory only no practice yet.” HRA practicality is been only in theory that suggested by scholars all around the word so far nevertheless, accountants resists on the theory suggested.

Theme Five – Monetary Value

One out three participants outlined on the monetary value of HRA approach. R3 stated, “The monetary value of training does not define the economic growth of companies performance and over the time if these is classified as investment in balance sheet it will regard losses.” Thus, monetary value of HRA is not specified therefore, it is not considered into the practices by companies to date.

The five themes emerged during the interviews had answered clearly the research questions designed for this study. In answering the first research question, why the HRA is not applied into practise by Malaysian companies. The accountants agreed that no standard requirement make the HRA impractical. There are so many changes in Malaysian accounting environment such as the convergent to IFRS, the introduction of GST in 2015 and Companies Act 2016, which are more superior and needed more attention. The discussion about the HRA is not yet on the urgent lists of accountants.

The also respondents believed the HRA disclosure bring no benefit. Moreover, there is unclear guideline on the treatment of HRA. Thus, the accountants preferred to wait for the proper standard of HRA, rather than use their discretion on the HRA disclosure.

For the second research question, the study asked whether the accountants consensually agreed on the underlying theory of HRA to be practice in Malaysia. Based on the feedback from the respondents, the application of HRA is only in theory. From Malaysian perspective, it is not yet practice. However, the respondents do agreed on the important of HRA, especially on the reporting items which have the monetary values.

Conclusion

This study is significant because it described the perspective of practitioner accountant’s towards HRA practice. Specifically, the study explored the reason for non-practicality and possibility that HRA could be applied in Malaysian companies. This study reveals that no standard requirement is the main reason for not practising the HRA in Malaysia. HRA is still distant in current practise and not ready to be applied in Malaysian context.

Malaysian accountants raised the concern over the lack of model to quantify the HRA. To have proper HRA practices, standard with workable model is needed. On top of that, the accountants recognise the needs for proper HRA accounting treatment. However, they also claimed that the HRA is useful only if the companies can show a positive result, which will mirror the effectiveness of the HC

References

- American Accounting Association. (2005). A Statement of basic accounting theory, (Revised Edition) Evanston, IL AAA.

- Becker, J. (1991). Firm resources and sustained competitive advantage. Journal of Management, 17(1), 99-120.

- Bickman, L., & Rog, D. J. (2009). Applied Social Research Method (2nd ed.). California: Sage Publications.

- Bontis, N. C., & Richardson, S. (2000). Intellectual capital and business performance in Malaysian industries. Journal of Intellectual Capital, 1(1), 85-100.

- Bratton, J., & Gold J. (2003). Human resource management, theory and practice. (3rd Ed) Palgrave MC. Milan, London.

- Brummet, R. L., Flamholtz, E. G., & Pyle, W. C. (1968). Human resource management: A challenge for accountants. The Accounting Review, 43(2), 217-224.

- Bullen, M.L., & Eyler, K.A. (2010). Human resource accounting and international developments: implications for measurement of human capital. Journal of International Business and Cultural Studies Human Resource Accounting, 1-16.

- Flamholtz. E.G. (1985). Human resource accounting, Jossey-Bass Publishers, San Francisco, CA.

- Flamholtz, E.G. (1999). Human resource accounting: advances, concepts, methods and applications, Boston, MA: Kluwer Academic Publishers.

- Gazor, H. K., & Rastegari, H. (2013). Impact of intellectual capital on performance in audit institutes. Asian Journal of Finance & Accounting, 60-70.

- Huang, C. C., Abidin, Z. Z., & Jusoff, K. (2008). External reporting of human capital in Malaysia. Asian Social Science, 4(8), 3-11.

- Hurwitz, J. L., & Schmidt, B. J. (2002 ). The linkage between management practices, intangibles performance and stock returns. Journal of Intellectual Capital, 3(1), 51–61.

- Islam, A., Kamruzzaman, Md., & Redwanuzzaman, Md. (2013). Human resource accounting: Recognition and disclosure of accounting methods & techniques. Global Journal of Management and Business Research Accounting and Auditing, 13(3), 1-11.

- Johanson, U., Mårtensson, M., & Skoog, M. (2001). Measuring to understand intangible performance drivers. European Accounting Review, 10(3), 407-437.

- Lal, J.J. (2009). Corporate financial reporting: theory and practice cases, University of Delhi. Taxmann Publications, 280-302.

- Mahmoodi, P., Babae, F. & Mohamade, J. (2013). Human resources accounting: from theory to practice. European online Journal of Natural and social science Europeans, 2(3), Available at www.eruopean.science.com retrieved on May 15, 2016.

- Mohan, T. & Mohd Rizuan, A.K. (2017). Preliminary Study of human capital disclosure for Malaysian public listed companies, Proceeding in International Symposium & Exhibition on Business and Accounting (ISEBA).

- Muhammad, N., & Ismail, M. (2009). Intellectual capital efficiency and firm’s performance study on Malaysia financial sectors. International Journal of Economics and Finance, 1(2), 206-212.

- Ojokuku, R.M. & Akintola, L. (2015). Human resource accounting and human capital valuation in Nigeria: prospects and challenges. International Journal of Economics, Commerce and Management, 3, 600-610.

- Parker, L.D. (2007). Financial and extrernal reporting research: The broadening corporate governance challenge. Accounting & Business research, 1, 39-54.

- Pyett, P. (2003). Validation of qualitative research in the "real world"', Qualitative Health Research, 13(8), 1170-1179.

- Rambaree, K. (2014). Three Methods of Qualitative Data Analysis Using ATLAS. ti:‘A posse ad esse’.

- Ripoll, V., & Labatut, G. (1994). La contabilidad de gestiony los costes de recursos humanos:implicaciones contables y fiscals de su activation. Técnica Contable publication.

- Tayles, M. P., & Sofian, S. (2007). Intellectual capital, management accounting practices and corporate performance: Perceptions of managers. Accounting, Auditing & Accountability Journal, 20(4), 522-488.

- Wilding, C., & Whiteford, G. (2005). Phenomenological research: An exploration of conceptual, theoretical, and practical issues. OTJR: Occupation, Participation and Health, 25(3), 98-104.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

31 July 2018

Article Doi

eBook ISBN

978-1-80296-043-3

Publisher

Future Academy

Volume

44

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-989

Subjects

Business, innovation, sustainability, environment, green business, environmental issues, industry, industrial studies

Cite this article as:

Kadir, M. R. A., & Mohan, T. (2018). Human Resources Accounting Disclosure: A Qualitative Study From Malaysian Perspective. In N. Nadiah Ahmad, N. Raida Abd Rahman, E. Esa, F. Hanim Abdul Rauf, & W. Farhah (Eds.), Interdisciplinary Sustainability Perspectives: Engaging Enviromental, Cultural, Economic and Social Concerns, vol 44. European Proceedings of Social and Behavioural Sciences (pp. 89-96). Future Academy. https://doi.org/10.15405/epsbs.2018.07.02.10