Abstract

Near field communication (NFC) mobile payment system allows users to make payment on goods instantly. There is a significant lack of previous study in Singapore to review the reasons why NFC mobile payment system is underutilized. This research is therefore conducted to investigate key factors contributing to the current low user acceptance of NFC mobile payment system and recommend ways to motivate perpetual consumer usage of the NFC mobile payment system. This study is targeted to all residents in Singapore, regardless to their citizenship. The data was collected within Singapore. Questionnaires were sent to 500 randomly selected respondents. Key user acceptance factors such as performance expectancy, effort expectancy, and social influence, facilitating condition, hedonic motivation, price value and habit are examined. The results of this study show that NFC mobile payment system is still in the early stage of implementation in Singapore. Many consumers are yet to adopt NFC mobile payment system. Some of the Singaporean consumers even do not know much about NFC mobile payment system and they wonder how this payment system may help them in making payment efficiently on mobile devices. As the results of this study also show that Singaporean consumers are more conservative and higher requirements towards the security and efficiency of NFC payment system, practical managerial recommendations have been provided to assist mobile business industry to promote NFC payment system among consumers. This study aims to understand user acceptance into NFC mobile payment in their daily life.

Keywords: Near Field Communication (NFC)smart phoneuser acceptance

Introduction

Infocomm Development Authority of Singapore (IDA) deployed a nationwide interoperable Near Field Communication (NFC) system for mobile payment. A Call-For-Collaboration (CFC) has been granted to a consortium comprising seven companies – Gemalto Pte Ltd, Citibank Singapore Ltd, DBS Bank Ltd, EZ-Link Pte Ltd, M1 Limited, SingTel Mobile Singapore Pte Ltd and StarHub Mobile Pte Ltd. NFC system had been formally made available in the middle of year 2012 with more than 30,000 retail points and taxis around Singapore has stated to adopt NFC system for mobile payment (IDA, 2011). This system, up to date, is only making available for consumers who own Near Field Communication (NFC) enabled mobile phones in Singapore (IDA, 2011). Gemalto had been appointed as a Trusted-Third Party in mobile payment infrastructure development and operation (IDA, 2011).

In collaboration with multiple payment service providers and mobile providers, consumers can now use their NFC mobile wallet application to pay for goods and services across 30,000 retail points in Singapore (IDA, 2011). Other than retail points, IDA will also work with LTA (Land Transport Authority) to allow commuters to use this system on transit in conjunction with the move to replace EZ-link cards. Based on survey done by Experian Marketing Services, NFC system will become one of the most important systems in Singaporean daily life. Also, a recent report by IDC Financial Insights forecast that the purchases made via mobile devices via NFC system will grow up to $1 trillion over the world by year 2017.

Problem Statement

With the presence of NFC system, making payment via mobile will never be the same as previously (Baptista, & Oliveira, 2015). The customers would no longer need to use cash in payment, where they could easily tap on their mobile devices, using it in shops and transportations. Nevertheless, there are some barriers associated with the current user adoption of NFC system in making payment. Despite the growing popularity of NFC system in Singapore, key factors affecting the adoption of this system is understudied both locally and internationally. One of the main barriers of NFC adoption is that the consumers may wonder how does NFC system may help in providing better payment solution or bring up what kind of benefits to them (Mahzan & Lymer, 2014). The consumers hope to put in minimal efforts to use this system as they are not willing to spend so much time in exploring and learning the system (Mahzan & Lymer, 2014). Another possible barrier of NFC adoption is the resistance of friends and family. Most of the consumers may not willing to adopt NFC mobile payment system because their friends and family are currently non-adopters, however, this hypothesis is yet to be proven by any of the previous study. On the other hand, consumers might expect certain level of assistance from the technical side when they faced any difficulties. Fun factor, price and habit are another factors which deserve serious consideration prior to the adoption of this new payment system, however, all these factors are yet to be studied by any past literature on NFC mobile payment adoption.

There is always a situation where a new computer or mobile system is underutilized (Davis et al. 1989). This research aims to find out the reason behind why people are not using the NFC system and how can motivate them further. Moreover, a study conducted by Leong et al. (2013) only managed to investigate the determinants of NFC mobile credit card payment in Malaysia by using the Technology Acceptance Model (TAM). Leong et al. (2013) suggested that future researchers can adopt the Unified Theory of Acceptance and Use of Technology (UTAUT) model in studying the factors affecting NFC mobile payment adoption in Asia Pacific region. Thus, this study is the among one of the pioneer study in this region that use UTAUT model to understand more about the user acceptance of NFC system in Singapore and how willing are they in using smart phones to pay instead of cash.

This study is highly relevant as the user acceptance in NFC mobile payment is still relatively low compared to other payment mode in Singapore. There is an urgent need to figure out the reasons that hold up this new payment system.

This study is important to provide more insights to the practitioners to increase the user acceptance and decision to adopt NFC mobile payment in Singapore. As the user acceptance is still remain low in Singapore, it is critical to find out the reasons behind the low adoption. As mobile payment is still at the infant stage in Singapore and the consumers are more conservative compared to western countries, they are very conservative and reluctant to accept new technology.

NFC mobile payment ought to bring convenience and many other supporting benefits to consumers such as seamless payment experience, e-wallet (reduce the physical items in wallet), and more. All these benefits aimed to individual consumers. However, there are currently very limited literature on the user acceptance of this payment system. This study attempts to fill the research gap of the previous researches by focusing on Singapore smart phone users’ towards using NFC system in mobile payment.

Research Questions

-

How is the user acceptance into NFC mobile payment in their daily life?

-

What is the user point of view and user decision to adopt this mobile payment system as one of the payment mode during shopping?

Purpose of the Study

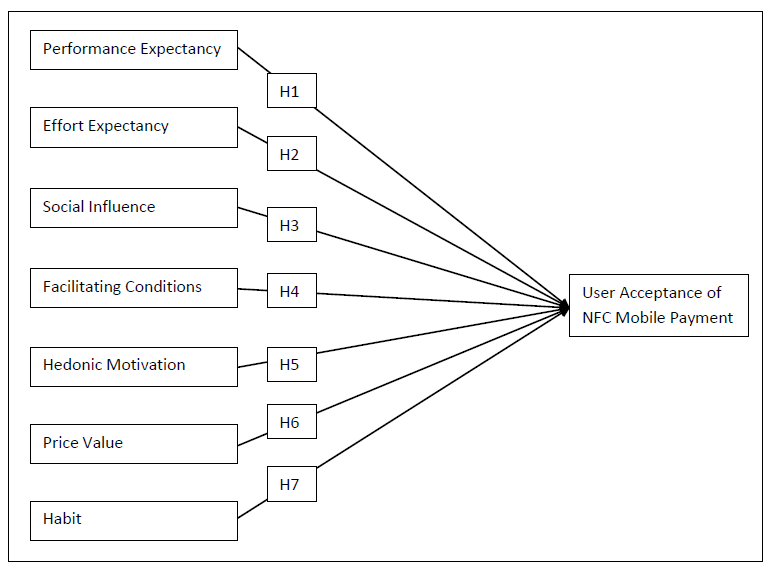

This study aims to understand user acceptance into NFC mobile payment in their daily life. The user point of view and user decision to adopt this mobile payment system as one of the payment mode during shopping will be discussed and analyzed. This study is targeted at the smart phone users in Singapore, regardless to their citizenship. UTAUT model is used to investigate the relationship between user acceptance and the independent variables namely performance expectancy, effort expectancy, social influence, facilitating condition, hedonic motivation, price value and habit. The main objective of this study is to examine the key factors affecting user acceptance of NFC system in mobile payment. By conducting this study, the reasons behind user acceptance of NFC system can be analyzed and understood further.

Literature Review

User Acceptance

Users get many exposures to new technology or system every day. Technology or system is changing constantly to meet and satisfy human demand and expectation. Many factors may contribute to their acceptance and determine how willing for them to use the new system or technology. According to López-Nicolás, Molina-Castillo, and Bouwman (2008), social factors had very strong influence on user acceptance for advanced mobile system, as user will be easily affected by friends and relatives’ opinion. The basic concept underlying user acceptance model is derived by a person reaction to use the technology or system, then it is link to user acceptance to use the technology or system and then move to the actual use of technology or system (Venkatesh et al. 2003). User experience can determine whether the user can accept technology or otherwise. After the first experience, if it is favourable, then it will link to the user acceptance to use the new system. This will depends on the purpose of using and follow by moving the behaviour to stable stage where they make it permanent usage. In general, user acceptance.

Performance Expectancy

In new system adaptation, performance expectancy plays a strong influence towards acceptance and it is often related to expected outcomes in information system according to UTAUT model (Moghavvemi and Akma Mohd Salleh, 2014). Nevertheless, performance expectancy is still the important measuring factor in both mandatory and voluntary setting. An individual will be motivated to use a system if the system would help them to improve job performance. In a study regarding CAATTs (computer-assisted audit techniques and tools) adoptions, performance expectancy had been identified as one of the most relevant factor in affecting user acceptance (Mahzan & Lymer 2014). In addition, performance expectancy is also proven to have a strong relationship with the acceptance in using e-government service (Weerakkody, El-Haddadeh, Al-Sobhi, Shareef, and Dwivedi, 2013). As long as the user feel that the system is very helpful and benefit them in many aspects, they will not feel hesitate to use it.

In another study aimed at the user acceptance of rural tourism services, the result discovered a positive relationship between performance expectancy and online purchase acceptance (San Martín and Herrero, 2012). While for mobile banking sector, performance expectancy has proven to have important effect on user adoption. Given that mobile banking provides many conveniences to consumers, the acceptance rate seems to be increasing (Zhou, Lu, and Wang, 2010). Mobile applications in universities libraries is also tested by Chang (2013), and performance expectancy showed positive influences towards user acceptance. Thus, the following hypothesis is developed and tested in this study:

Effort Expectancy

Effort expectancy is also correlated to the user acceptance. Effort expectancy is defined as the total number of efforts needed to use an information system (Davis et al. 1989). The level of effort expectancy will affect the user likelihood of using information system. The minimum amount of efforts used to adopt information system will significantly accept the likelihood they will use the system, and vice versa. Thus, high level of effort expectancy will reduce the user acceptance according to Moghavvemi and Akma Mohd Salleh (2014). On the other hand, the lower level of effort expectancy will bring the user acceptance to higher level. In a survey conducted by Im et al.(2011), effort expectancy influence on the user acceptance of a new system is much higher in USA than in Korea. The research was done by using MP3 and internet banking as the testing ground. However the limitation is that the target respondents were mostly youngsters and part-timers.

Even in rural area, people started to accept new technology slowly and the acceptance pattern is positively correlate with the efforts that they had spent to adopt the system. According to a study by San Martín & Herrero (2012), the rural people are able to accept new information technology as long they do not need to spend too much efforts like previous. While in a separate study on user acceptance of library mobile applications in university libraries, effort expectancy has also shown a positive relationship (Chang, 2013). Thus, the following hypothesis is developed and tested in this study:

Social Influence

Social influence can be defined as the degree of how an individual perceived others playing important role in affecting their decision in regards to the user acceptance of a new information system (Moghavvemi and Akma Mohd Salleh, 2014). Social influence is proven to be able to affect acceptance in using mobile shopping services. Other consumers’ comments, feedback and opinions is relatively important to affect user adoption in technology (Yang 2010). Social influence is also proven to be an important variable that bringing some effects to user adoption in mobile banking, according to Zhou et al. (2010). Zhou et al. (2010)’s study was carried out in China on the assumption that mobile banking services and user acceptance in China remain constant over the past few years. In another study conducted to understand user acceptance of using library mobile application, social influence is identified as one of the important variables that has a positive relationship towards user acceptance (Chang 2013). Thus, the following hypothesis is developed and tested in this study:

Facilitating Condition

Facilitating condition such as supportive environmental condition will increase the user acceptance of a new system (Moghavvemi & Akma Mohd Salleh, 2014). Thus, technical support and availability infrastructure is very important in this manner (Moghavvemi and Akma Mohd Salleh, 2014). In a research about mobile shopping services, Yang (2010) mentioned that facilitating condition play an important role in technology adoption. The internet-enables mobile phones or smart phone and user knowledge will be one of facilitate conditions that trigger them to use such technology. According to a conducted by Oliveira, Faria, Thomas, and Popovič (2014) in Portugal, facilitating condition has direct impact onto the user acceptance to use mobile banking. This study has proven that the gadgets and facilities play a very critical stake in influencing the user to adopt a new system. However, the actual knowledge of mobile banking is still not sufficient as the users do not really know the differences between online banking versus mobile banking.

On the other hand, facilitating condition also has important impact on the user adoption of mobile banking in China market (Zhou et al. 2010). China consumers are ready to start accepting mobile banking services when sufficient facilitating condition is in place.

Meanwhile, another study conducted by Chang (2013) indicated that facilitating condition is positively related to user acceptance towards the acceptance of library mobile applications in university libraries. Thus, the following hypothesis is developed and tested in this study:

Hedonic Motivation

Hedonic motivation is referred to as perceived enjoyment in many research (Qiu and Li, 2008; Yang, 2010) and is found to be one of the important constructs. It is also related to intrinsic motivation, which means the inner motivation that drives one’s action. In the user acceptance of an information system, the intrinsic motivation could be referred as the level of enjoyment of using a particular technology based on experience. For example, if a person have a favourable or joyful experience using internet, then he or she will be continue using it as enjoyment can contribute to work productivity and efficiency (Qiu and Li, 2008). In another study by Yang (2010), the hedonic performance and effort expectancy are found to be positively related. In that study, hedonic factor is a vital component that can affect the user acceptance of a mobile technology more than other factor such as utilitarian. Yang also mentioned that hedonic motivation or entertainment element play major important role in the user acceptance of mobile shopping services.

In another research that investigates user acceptance in using mobile applications, hedonic motivation was identified as the most important indicators. Hedonic motivation appears to be the main reason why they keep using mobile applications, while user satisfaction is directly related to the benefits that they obtained using the mobile applications (Xu, Peak, and Prybutok, 2015). Baptista and Oliveira (2015)’s research on the user acceptance of mobile banking discovered that hedonic motivation is an important variable corresponding to user acceptance. The same result was found in another study which investigated the user acceptance of mobile applications by Hew, Lee, Ooi and Wei (2015). The mobile applications which is accompanied with the element of fun and entertainment such as games, social network related are most welcomed by users. Users are highly affected by their feelings and emotions (Hew, Lee, Ooi and Wei, 2015). Thus, the following hypothesis is developed and tested in this study:

Price Value

Price value is the main concern for the people in a previous study that examines user acceptance of mobile internet as they tend to think that the cost of using mobile internet is much greater than the benefit that technology may bring to them (Fuksa 2013). This is supported by another study on broadband user acceptance. Price value has become a very sensitive factor for broadband subscription as the user acceptance of internet is moving towards mobile platform where 3G/4G/5G data services is more important compared to traditional home broadband (Tsai & LaRose, 2015).

Price value will be the most significant variable that affecting user acceptance decision of a breakthrough and costly system. Ramirez-Correa, Rondan-Cataluña, and Arenas-Gaitán (2015) found that the price value and the acceptance to use mobile internet is having direct relationship in a study conducted to predict the user acceptance of mobile internet. Thus, the following hypothesis is developed and tested in this study:

Habit

Habit can be cultivated by repeated user acceptance or action. It can be user acceptance or non-acceptance of a new technology which is controlled by our brain. In a study conducted in Portugal which targeted at college students, user habit in using LINE for daily communication purpose is proven to have a positive relationship with user acceptance (Economics et al. 2014). Online buying behaviour can become habitual in affecting buying acceptance according to Escobar-Rodríguez and Carvajal-Trujillo (2014), if consumer keep repeating the same buying behaviour for many times and the overall experience is good. In a study on online purchasing acceptance through low cost carrier website, it is found that consumer habit is a very important factor as the tendency to buy flight ticket online is greater if the consumer has bought the same ticket before. Consumer behaviour will eventually become a habit which leads to actual buying decision after they had done it for a few times. Same result was obtained by Baptista and Oliveira (2015) where habit was found to have significant relationship on the user acceptance of mobile banking adoption. If there is positive feelings or emotions derived from the first few attempts in using mobile banking, users will be more likely to continue using the new system due to habitual behavior. Thus, the following hypothesis is developed and tested in this study:

Research Framework

As depicted by Figure

Research Methods

Sampling Method

The data was collected within Singapore in the fourth quarter of year 2016. Questionnaires were sent to 500 randomly selected respondents. Simple random sampling method is used in this study. Simple random sampling is the basic sampling technique where a group of smart phone users in Singapore with more than 1 year experiences of using smart phones were selected from the overall population. The selection of sample is totally by chance and everyone stand the equal chance to be select.

Data Collection Method

Questionnaire were developing by using Google Form. Google Form is a tool that introduced by Google to help in event planning, conducting survey, study quiz, or other data collection purpose. Google Form is a very user-friendly tool where researchers could setup their questionnaires by selecting the type of questions, such as open remarks, checkboxes, dropdown option, scale, grid and more. Another reason why Google form was used was due to its ubiquity, where the researchers would be able to analyze and view the data at anywhere and anytime, and the data can be easily downloaded into excel imported into the statistical analysis software without any mistake. Besides Google form, hardcopies of the questionnaires were also distributed to respondents face-to-face in order to garner higher response rates.

Questionnaire Design

The questionnaire was broken down into few sections. The first section was about demographic profile, following by questions measuring the dependent variable, user acceptance, and questions measuring the seven independent variables of this study, namely performance expectancy, effort expectancy, social influence, facilitating condition, hedonic motivation, price value, and habit. Open ended question is used for the respondents to write down their name and their age. While for gender, nationality, status of employment, education level, numbers of smartphone owned, and other questions, multiple choice questions were used. In the second section of the questionnaire, Likert scale ranged from 1 to 5 (strongly disagree to strongly agree) was used to measure user agreement on statements measuring the independent and dependent variable of this study. Both face to face and google form questionnaire were conducted concurrently so that the respondents with language literacy problem can get the correct guidance and help to answer the questionnaires while other respondents can enjoy filling in the questionnaires at their own convenience. Although the time taken for data collection may be longer than usual, this will ensure the high quality and high accuracy of the collected data.

Findings

First, mean and standard deviation of all the independent and dependent variables of this study are analyzed.

Table

Table

Table

Table

Table

Table

Table

Table

Multiple Linear Regression

Multiple linear regression is used to predict the relationship between one independent variable and many dependent variables. The variable that the researchers wish to predict here is user acceptance of NFC mobile payment system (dependent variable) while the variables that used to predict the relationship is all the independent variables namely performance expectancy, effort expectancy, social influence, facilitating condition, hedonic motivation, price value and habit.

Table

Table

Table

On the other hand, facilitating condition and price value are not significant towards user acceptance of NFC mobile payment system (p>0.05). This result implies that consumers are willing to pay more and less concerned about the price if they think that the NFC mobile payment system is in good quality. Moreover, with the emergence of broadband internet service, consumers can easily seek for the advice and assistance from professionals around the world in a click of mouse, therefore, facilitating condition is no longer a key determinant of user acceptance of NFC mobile payment system in the era of information age and globalization.

Conclusion

There are few recommendations for future researches. Future research on user acceptance of NFC mobile payment system can be expanded to other Asian countries such as Malaysia, Thailand, Indonesia and China. Cross border comparison study can also be conducted to compare the user acceptance of NFC mobile payment system in a few countries. NFC mobile payment study is still a very new research area in Asian. Thus, this area is definitely worth exploring.

Other than that, future study may also examine the effect of the moderating variables such as age, gender and experience on the user acceptance of NFC mobile payment system.

Acknowledgments

The authors would like to thank all respondents of this study for their support and cooperation during the data collection period.

References

- Baptista, G. and Oliveira, T. (2015). 'Understanding mobile banking: The unified theory of acceptance and use of technology combined with cultural moderators', Computers in Human Behavior, 50, pp.418–430.

- Chang, C. C. (2013). 'Library mobile applications in university libraries', Library Hi Tech, 31, pp.478–492.

- Davis, F., Bagozzi, R., and Warshaw, P. (1989). 'User acceptance of computer technology: a comparison of two theoretical models', Management Science, 35, pp.982–1003.

- Economics, T., Suryana, L.A., and Economics, T. (2014). 'Factors affecting the use behavior of social media using UTAUT 2 model', August, pp.1–3.

- Escobar-Rodríguez, T. and Carvajal-Trujillo, E. (2014). 'Online purchasing tickets for low cost carriers: An application of the unified theory of acceptance and use of technology (UTAUT) model', Tourism Management, 43, pp.70–88.

- Fuksa, M. (2013). 'Mobile technologies and services development impact on mobile internet user acceptancein Latvia', Procedia Computer Science, 26, pp.41–50.

- Hew, J. J., Lee, V. H., Ooi, K. B., & Wei, J. (2015). What catalyses mobile apps usage intention: an empirical analysis. Industrial Management & Data Systems, 115(7), 1269-1291.

- IDA (Infocomm Development Authority Singapore). (2011). Infocomm Usage -Households and Individuals. Retrieved November 7, 2011, from http://www.ida.gov.sg/Publications/20070822125451.aspx

- Im, I., Hong, S. and Kang, M.S. (2011). 'An international comparison of technology adoption: Testing the UTAUT model', Information and Management, 48, pp.1–8.

- Leong, L.-Y. et al. (2013). 'Predicting the determinants of the NFC-enabled mobile credit card acceptance: A neural networks approach', Expert Systems with Applications, 40, pp.5604–5620.

- López-Nicolás, C., Molina-Castillo, F.J. and Bouwman, H. (2008). 'An assessment of advanced mobile services acceptance: Contributions from TAM and diffusion theory models', Information and Management, 45, pp.359–364.

- Mahzan, N. and Lymer, A. (2014). 'Examining the adoption of computer-assisted audit tools and techniques: Cases of generalized audit software use by internal auditors', Managerial Auditing Journal, 29, pp.327–349.

- Moghavvemi, S. and Akma Mohd Salleh, N. (2014). 'Effect of precipitating events on information system adoption and use behaviour,' Journal of Enterprise Information Management, 27, pp.599–622.

- Oliveira, T. et al. (2014). 'Extending the understanding of mobile banking adoption: When UTAUT meets TTF and ITM', International Journal of Information Management, 34, pp.689–703.

- Qiu, L. and Li, D. (2008). 'Applying TAM in B2C e-commerce research: an extended model,' Tsinghua Science and Technology, 13, pp.265–272.

- Ramirez-Correa, P.E., Rondan-Cataluña, F.J. and Arenas-Gaitán, J. (2015). 'Predicting acceptance of mobile internet usage', Telematics and Informatics, 32, pp.834–841.

- San Martín, H. and Herrero, Á.́ (2012).' Influence of the user’s psychological factors on the online purchase acceptance in rural tourism: Integrating innovativeness to the UTAUT framework', Tourism Management, 33, pp.341–350.

- Tsai, H.S. and LaRose, R. (2015). 'Broadband Internet adoption and utilization in the inner city: A comparison of competing theories', Computers in Human Behavior, 51, pp.344–355.

- Venkatesh, V. et al. (2003). 'User Acceptance of Information Technology: Toward a Unified View', MIS Quarterly, 27, pp.425–478.

- Weerakkody, V. et al. (2013). 'Examining the influence of intermediaries in facilitating e-government adoption: An empirical investigation', International Journal of Information Management, 33, pp.716–725.

- Xu, C., Peak, D. and Prybutok, V. (2015). 'A customer value, satisfaction, and loyalty perspective of mobile application recommendations', Decision Support Systems, 79, pp.171–183.

- Yang, K. (2010). 'Determinants of US consumer mobile shopping services adoption: implications for designing mobile shopping services', Journal of Consumer Marketing, 27, pp.262–270.

- Zhou, T., Lu, Y. and Wang, B. (2010). 'Integrating TTF and UTAUT to explain mobile banking user adoption', Computers in Human Behavior, 26, pp.760–767.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

01 May 2018

Article Doi

eBook ISBN

978-1-80296-039-6

Publisher

Future Academy

Volume

40

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1231

Subjects

Business, innovation, sustainability, environment, green business, environmental issues

Cite this article as:

Yen, Y. Y., Ruey, G. S., Rasiah, D. A., Sin, T. K., Piew, L. K., & Ramasamy, S. A. (2018). User Acceptance Of Near Field Communication (Nfc) System. In M. Imran Qureshi (Ed.), Technology & Society: A Multidisciplinary Pathway for Sustainable Development, vol 40. European Proceedings of Social and Behavioural Sciences (pp. 142-156). Future Academy. https://doi.org/10.15405/epsbs.2018.05.14