Abstract

The article reveals some aspects concerning the categorical certainty of the concept of "public -private partnership (PPP)". Contemporary forms and mechanisms of the organization of public -private partnership have a long-term historical development both in Russia and abroad. The sources of the interaction between business and authority, in its modern sense, are traced in Russia even in the second half of the 17th century. The evolution of SPP beginning from the period of formation of Ancient Russia and up to the present moment is studied. Particular attention is paid to the consideration of modern problems in the sphere of implementing the directions of social partnership, in particular, the contractual arrangement. Key elements of the social partnership system in the Russian Federation are also analyzed. As a result of the study mutual dependencies and regularities of the development of SPP are determined; the generalized characteristic of each historical stage of the interaction is given; the basic forms, as well as mechanisms and conditions of the interaction are singled out retrospectively.

Keywords: Public-private partnershipfinancingsocial partnership, regularities of the development of PPP

Introduction

Globalization processes provided the understanding of the essence of terms: competitiveness, public-private partnership. There is not just the blurring of boundaries and distinctions between sciences but also the active use of concepts, approaches, theories, and terms of one science within the boundaries of the others.

The first theoretical approaches to understanding of the competitiveness essence began their development in XVIII century. Smith (1776) stated the factors that determined the absolute advantages of countries in the international trade in his work “An inquiry into the nature and causes of the wealth of nations”. He pointed out such factors as land, capital, natural resources and labor.

Later D. Ricardo developed the theory of Smith (1776) in his works and gave the term of country comparative advantages concerning production conditions of certain commodity groups (Avtonomov, 2002).

As a result, competitiveness was firmly considered as the capability of some economic entities and entire countries to provide goods and services with lower prime costs than other entities for a long period. (Izotkina, 2016).

Developing this idea, it is easy to agree with the thesis that one of the factors contributing to cost reduction of goods and services is full-fledged infrastructure. Therefore, these researchers were the first to identify the relation between infrastructure health and country competitiveness.

It follows that under the conditions of transition to postindustrial economy, the influence of infrastructure state on competitiveness of regional economies will only increase (Gershanok & Mingaljova, 2012; Pytkin & Balandin, 2013), which, in turn, predetermines the necessity for application and further development of public-private partnership mechanisms.

In recent years, a characteristic trend in infrastructure development in many countries has become the active cooperation of the state and private business in order to improve management effectiveness, as well as the problem of limited budget financing. This type of cooperation was called "public-private partnership" (PPP). The essence of this cooperation is to attract private investments to strategically important sectors when the state has a dominant role

Problem Statement

Nowadays, there is a wide variety of definitions of the term PPP in the literature. In particular, special attention should be paid to the wording of international institutions and their activities that are related to the development of PPP (Nijkamp & Poot, 1993).

Firstly, it should be noted that the term PPP was firstly introduced in English and formulated as "public-private partnership (PPP)", which means "public/public-private partnership" in literal translation.

The International Bank gives the following definition: "PPP is a partnership style of the interaction in infrastructure projects, when, unlike the "customer-supplier" relation, either each party takes full responsibility for a particular area of work, or both parties are responsible for everything. In this case, PPP involves joint acceptance of risks, responsibilities and impact, but it leads to the fact that taxpayers' money is spent more efficiently" (Kwak, 2009).

Marketing strategy in the market

Hot scientific discussions unfold about the question of which stakeholder groups should build valuable relationships between the company. Kiseleva notes that in our time, companies in order to succeed in the market should build privileged relationships with customers, employees, external organizations, suppliers and "needy" (Kiseleva et al., 2016b). Relationship marketing is a modern paradigm, which is based on building, maintaining and developing high-level relationships with customers, especially the key, as well as employees, external organizations, suppliers and "needy", by addressing a broad range of real needs and demands of society (Kiseleva et al., 2016a). We propose to designate another important stakeholder - the state.

The interaction of private and public sector

The core objective for the public sector of a PPP programme is to harness private sector skills in support of improved public sector services. This is achieved by moving away from the direct procurement by the public sector of physical assets and towards the procurement of services from the private sector under public sector regulation/contract. In the context of infrastructure projects, PPPs are therefore often characterised by the public sector:

Entering into contracts to acquire services, rather than procuring an asset;

Specifying the service requirement on the basis of outputs, not inputs;

Linking payments to the private sector to the level and quality services actually delivered;

Often requiring a ‘whole life’ approach to the design, building and operation of project assets;

Seeking optimal risk transfer to the private sector, based on the principle that risks should be managed by the party to a transaction best able to manage the relevant risk;

Requiring the private partner to be responsible for raising some or all of the investment finance required for the project;

Utilising diverse payment mechanisms, such as market revenue, shadow tolls, capacity availability payments and so on.

Research Questions

The interaction of the state and business has a long history. The state played a different role in creating various forms of organizational and economic relations in different historical epochs and in different countries. It was from the complete non-interference in the economic system to the total control over it (Akatov, 2009).

The very notion of "partnership" appeared only in XIX century, and it meant one participant in the relation with another / other participants in business activities (Gladov, 2008). In contemporary understanding, the first elements of public-private partnership of this term can be found in the Ancient East.

Thus, in the Code of Hammurabi in Babylon (XVIII century BC) there were provisions for leasing, credit, concession analogues. The land allotments that the tsar vested in his soldiers could be inherited by the descendants of the male lineage and not be alienated (even by creditors) (Lihachev, 2009).

In Ancient Greece, the lease of lands that belonged to the state was commonly widespread for a long time (from 10 years to perpetual lease). In fact, it was a forced measure on the part of the state, because budget revenues from wars and taxes were not enough to cover the growing costs (Lihachev, 2009).

The elements of PPP also existed in the late Middle Ages and Modern Age, for example, in the trade campaigns of Columbus, Russian-American and East-Indian campaigns. It was a common practice when the private sector acted as the initiator of such a campaign. It invested a certain part of its own funds and carried out the expedition itself. Therefore, the state provided much of the financing and a number of preferences in exchange for its right to secure the newly separated territories.

The principles of PPP were also used in the construction of the Suez Canal. The Frenchman Ferdinand de Lesseps received a concession from the King of Egypt to construct the canal. In modern terms, to implement the project a special project company "The General Company of the Suez Canal" was created, in which 44% of the capital belonged to the government of Egypt, 53% to the government of France and 3% to some other countries. It is worth noting that the construction took 11 years instead of the planned 6 years and it was spent 576 million francs instead of the initial 200 million French francs.

In Russia, one of the first examples of the use of PPP elements is the construction of the first military factories by the Demidovs in the Urals. At the beginning of the XVIII century, Peter the Great gave the Demidovs a number of military factories on the condition that the weapons produced by them would be supplied to the Russian army at lower prices than the imported analogues. In the future, the Demidovs frequently asked for the royal permission to build new factories on their own funds on state lands.

The active interaction with the state is indicated by the fact that on October 20, 1899, at the time of the economic crisis, an interventional exchange syndicate was created at the initiative of the Minister of Finance S. Yu. Witte in order to maintain the price quotations of Russian securities on the Saint Petersburg Stock Exchange (Bugrov, 2002). The banks and bank offices that entered it pledged to the state to support the exchange rate of Russian securities from the weakening - but only "of such enterprises, whose viability does not cause doubts". At the same time, the Ministry of Finance asked for the permission from Nicholas II to buy state securities of joint-stock companies at the amount of 25 million rubles, as well as to issue loans to Russian companies for their shares and bonds (Bugrov, 2002).

Thus, PPP in the pre-revolutionary period was widely used, although it had mainly a compulsory nature and unequal rights and obligations of the parties. This is evidenced by the fact that by the mutual agreement, the losses of the syndicate were charged to the account of joint-stock banks, and the profit was equally shared between them and the State Bank, with the deduction in the favor of the last mentioned 6% for the advanced amounts. If the syndicate was unprofitable, its participants had to refund the amount of losses for the State Bank, but without the accruing interest (Bugrov, 2002).

After the October Revolution in 1917, during the new economic policy the decree "On Concessions" (1920) was passed. Over this period, more than 350 foreign concessions (German, English, American and Norwegian) were organized. Thus, with the growth of the Command and Administrative system they were earlier terminated and the last foreign concession (Japanese) was terminated in 1944 (Varnavsky, 2005).

Purpose of the Study

Governments face an ever-increasing need to find sufficient financing to develop and maintaininfrastructure required to support growing populations. Governments are challenged by thedemands of increasing urbanization, the rehabilitation requirements of aging infrastructure, the need to expand networks to new populations, and the goal of reaching previously unservedor underserved areas. Furthermore, infrastructure services are often provided at an operatingdeficit, which is covered only through subsidies, thus constituting an additional drain on publicresources.

Combined with most governments’ limited financial capacity, these pressures drive a desire tomobilize private sector capital for infrastructure investment. Structured correctly, a PPP maybe able to mobilize previously untapped resources from the local, regional, or internationalprivate sector which is seeking investment opportunities.

The goal of the private sector in entering into a PPP is to profit from its capacity and experiencein managing businesses (utilities in particular). The private sector seeks compensationfor its services through fees for services rendered, resulting in an appropriate return oncapital invested.

The three main needs that motivate governments to enter into PPPs for infrastructure are:

to attract private capital investment (often to either supplement public resources or release them for other public needs);

to increase efficiency and use available resources more effectively; and

to reform sectors through a reallocation of roles, incentives, and accountability.

In Russia, the law on PPPs was firstly passed in St. Petersburg in 2006 at the regional level. In accordance with this law "PPP is a mutually beneficial cooperation between St. Petersburg and a Russian or foreign legal entity or individual, or the legal entity's acting without the formation a legal entity under a partnership agreement (joint operation agreement) by the association of legal entities to implement socially significant projects aimed at the development of education, health, social services for the population, physical culture, sports, culture, tourism, transport and engineering infrastructures, communications and telecommunications infrastructure in St. Petersburg, which is carried out by making and implementing agreements, which includes concession agreements. (On participation of St. Petersburg in public-private partnerships., 2006).

Research Methods

Nowadays, the world leaders in the field of public-private partnerships since the 1980s are France, Germany and the United Kingdom. The indisputable leader is Great Britain. The main factor was the "Private Finance Initiative" (PFI) program, which was adopted by the UK government in 1992 (Gafurova, 2013; Seleznev, 2009). By the end of 2013, the UK had 44 business transactions out of 112. It was 39% of PPP projects in the whole Europe. In 2013, 19 projects were implemented amounting to 1.8 billion euros in France. It was equal to 17% of the total number of European PPP projects. Germany takes the third position in this ranking - its share was 13%.

The development of PPP in our country began in the early 2000s and it is more experimental in nature. The main forms of public-private partnership in Russia today are the activities of the Investment Fund of the Russian Federation, concession agreements, the creation of special economic zones and clusters. The main task of the Russian PPP market is to find the stabilization point of the economy, increase the financing of the number of projects, and increase the interest in the Russian infrastructure of foreign investors and infrastructure companies, which will further improve the composition of investment in the country's economy (Murphy, 2008).

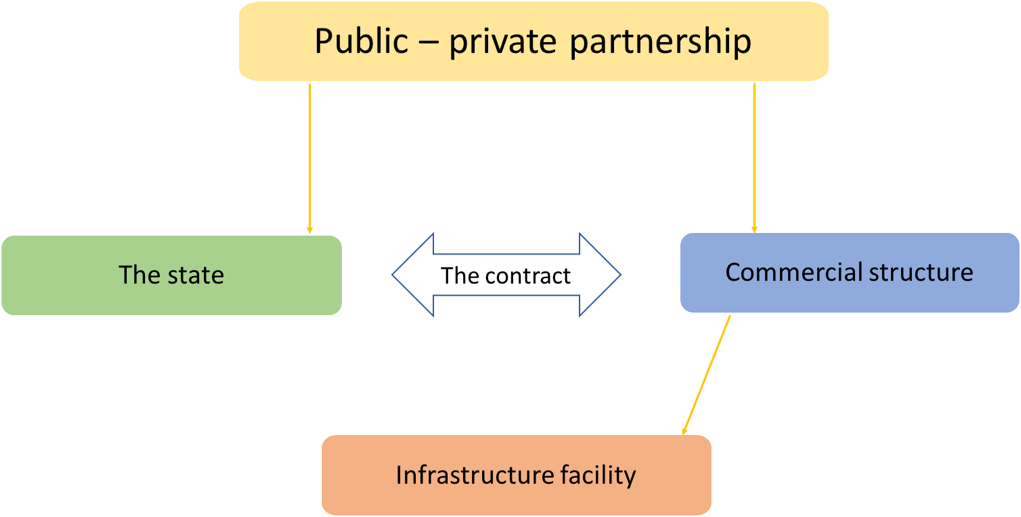

In accordance with the analysis of numerous publications in this field, the concept of partnership in public and private sectors suggests the development of the legislative framework and the use of new legal institutions. It should have the form of certain contract relations that regulate their cooperation in order to provide public services, create or modernize the infrastructure concerning the national interests on (Fig.

Today, the development of the PPP institution is being promoted not so extensive at the federal level, but mostly at the level of the territorial entities of the Russian Federation. Therefore, many entities began to develop their legal and regulatory framework independently with the aim of the development of PPPs in the absence of a federal law on public-private partnership. There are normative and legal acts regulating public-private partnership in Amur, Vologda, Tomsk, Omsk, Ivanovo, Kemerovo regions, the Komi Republic, Dagestan, Krasnodar, Kirov, Perm and Kaluga regions.

Findings

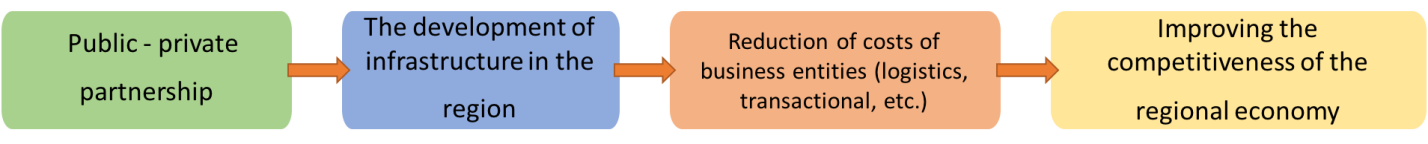

The basis of the concept for management of Russian economy competitiveness at the regional level of PPP application is the provision that the reduction of costs of economic entities leads to the improving competitiveness of the regional economics. It is achieved on the basis of the infrastructure development with PPP.

Therefore, PPP should be considered as a strategic competitive advantage of the regional economics (Fig.

-

Today, it is necessary to create conditions at the federal and regional levels for PPPs, which will provide the growth of the Russian economy in the future:

-

Growth of labour productivity at the created objects of infrastructure;

-

Promotion competition on the infrastructure market;

-

Extensive access to labour forces – new employment opportunities;

-

Increase in investments to national and regional GDP;

-

Progressive development of the territories and improvement of the living standards due to the high quality of services at the infrastructure facilities.

"According to Stanislav Voskresensky, the Deputy Minister of the Economic Development, there are more than 1600 PPP projects in Russia today, 700 billion rubles were invested in the projects of different levels at the stage of their establishment, such as: "

federal level – 17 projects;

regional level – 198 projects;

municipal level – more than 1200 projects.

There are several areas in the development of the Russian market of PPP projects in prospect for 2016 and 2017:

System planning of infrastructure development and market promotion for the application of PPP mechanisms.

Improvement of the quality and efficiency of PPP projects.

Availability of financing for PPP projects.

Development of the legislation in PPP and law enforcement practice for PPP projects.

Russia is at the very beginning of civilized relations establishment between the state and business entities in health care. According to the forecast for 2015, the average PPP level in Russia was 29.2%, the actual average was 4.8 percentage points lower and it amounted to 24.4%.

The main difficulty in the establishment of public-private partnership in Russia is the lack of legislative consolidation for this type of relations and its definition. All PPP projects not only do not save the state's funds, but also require additional financing, because their cost increases on average by 20% per year from the approved costs in the business plan. Moreover, when new infrastructure facilities are put into operation, they may not be claimed because of their payment, when there is a free alternative.

A number of territorial entities of the Russian Federation also did not show the expected growth in the implementation of PPP projects in 2015, the planned projects were never launched. Due to the slowdown in the growth rates of the Russian economy, investors' interest in long-term investments in infrastructure at the regional and municipal levels has decreased (Kiseleva & Anikina, 2015).

Conclusion

At present, there is no clear understanding of the procedure for public-private partnership. In Moscow, for example, managers of budgetary funds do not implement projects under the PPP scheme due to the lack of the necessary legislative framework. In fact, there is no federal law on PPPs and, therefore, there is no single definition of this notion for a variety of conditions when the PPP market can be formed and develop actively. These so-called framework conditions are to protect private investment, monetary stability, price stability, an effective and independent system of justice and political continuity.

It is also important to note that the legislative consolidation of the definition for public-private partnership is at the level of the territorial entities of the Russian Federation. However, these definitions do not correspond to the federal legislation; they differ from each other and do not operate with legal concepts. Nevertheless, pilot projects have already started in some regions of the Russian Federation in health care, but still there are no successful projects in this sector.

Summarizing the above, we can conclude that the institution of public-private partnership has its own history, both in Russian and in foreign practice proved by the time. In order to form an innovative system at the national level, there is a need to develop a scientific and production base, improve the infrastructure, stimulate the production of new goods and services, and support the scientific sphere. We propose to use a valuable tool for determining the level of relations between the company and the state - the universal model of the stages of relationships (Kiseleva et al., 2016c). It is based on three factors - satisfaction, trust and involvement. It is important that the state is ready to provide private organizations with financial assistance, as well as to take risks. International experience shows that successful development of the mechanism for public-private partnership depends on many factors. That is why, it is very important to have an integrated approach to this issue.

Acknowledgments

This work was carried out by the author in cooperation with Tomsk Polytechnic University within the project framework on evaluation and improvement of social, economic and emotional wellbeing of elderly people in accordance with the Agreement No.14.Z50.31.0029.

References

- Akatov, N. B., Popov, E. V., Dobrolyubov, I. K. (2009). Innovative strategy of market relationships. Right. Management. Marketing, 12. Retrieved from http://transfer.eltech.ru/innov/archive.nsf/0d592545e5d69ff3c32568fe00319ec1/d834d4d5f6c86951c325787200319938?OpenDocument. In Russia

- Avtonomov, V. C. (2002). History of economic doctrines, Moscow: INFRA-M. Retrieved from http://www.alleng.ru/d/econ/econ149.htm. In Russia

- Bugrov, A. V. (2002). State Bank and stock exchange syndicates in Russia. Moscow: ROSSPEN. Retrieved from http://www.hist.msu.ru/Banks/papers/bugrov.htm. In Russia.

- Gafurova, G. T. (2013). Foreign experience of development of mechanisms of state-private partnership. Finance and credit, 48(576), 62-72 Retrieved from http://cyberleninka.ru/article/n/zarubezhnyy-opyt-razvitiya-mehanizmov-gosudarstvenno-chastnogo-partnerstva-1. In Russia

- Gladov, A. V., Martyshkin, S. A., Prohorov, D. V., (2008). Foreign experience of implementation of public - private partnerships: General characteristics and the organizational-institutional framework. Vestnik of Samara State University, 7(66), 36-54 Retrieved from http://cyberleninka.ru/article/n/zarubezhnyy-opyt-realizatsii-gosudarstvenno-chastnogo-partnerstva-obschaya-harakteristika-i-organizatsionno-institutsionalnye. In Russia

- Gershanok, G. A., Mingaljova Z. A., (2012). Sustainable regional development: innovation, economic security, competitiveness. Economy of the region, 3, 68-76 Retrieved from http://cyberleninka.ru/article/n/ustoychivoe-razvitie-regiona-innovatsii-ekonomicheskaya-bezopasnost-konkurentosposobnost. In Russia

- Izotkina N., Trubchenko T., Shaftelskaya N., Krechetova A., Krukova E., Karelina A., Kalashnikova T. (2016). Operational and Economic Requirements of Innovative Products Designed to Prepare Business Plans. In Innovation Management and Education Excellence Vision 2020: from Regional Development Sustainability to Global Economic Growth (pp. 2098-2104). Seville: IBIMA. Retrieved June 19, 2017, from http://www.ibima.org/SPAIN2016/papers/tnkt.html

- Kiseleva, E., Anikina, O. (2015). Modern Model of Competences of Personal Agents as Increase Factor of Clients’ Subjective Well-being. Procedia - Social and Behavioral Sciences, 166, 116-121. doi:10.1016/j. sbspro.2014.12.494

- Kiseleva, E., Yeryomin, V., Filippova, T., Yakimenko, E. (2016a). Personal Sales Focused on Improving the Psychological Wellbeing of Customers in the Context of Relationship Marketing. The European Proceedings of Social and Behavioural Sciences EpSBS, 7, 270-278. DOI:10.15405/epsbs.2016.02.36

- Kiseleva, E., Yeryomin, V., Yakimenko, E., Krakoveckaya I., Berkalov S. (2016b). The psychological portrait as a tool to improve the subjective well-being of the client in the context of personal sales. SHS Web of Conferences, 28, 01122. DOI:10.1051/shsconf/20162801122

- Kiseleva, E., Yakimenko, E., Sakharova, E., Khmelkova, N., Krukova, E. (2016c). The Universal Model of Stages of Customer Relationships as a Tool for Effective Managing with Personal Sales In the Context of Relationship Marketing. In Innovation Management and Education Excellence Vision 2020: from Regional Development Sustainability to Global Economic Growth (pp. 2821-2827). Seville: IBIMA. Retrieved June 19, 2017, from http://www.ibima.org/SPAIN2016/papers/eesk.html

- Kwak, Y. H., Chih, Y., Ibbs, C. W. (2009). Towards a Comprehensive Understanding of Public Private Partnerships for Infrastructure Development. California Management Review, 51(2), 51-78. DOI:10.2307/41166480

- Lihachev, V., Azanov, M. (2009). Practical analysis of modern mechanisms of state-private partnership in foreign countries, or how to implement PPP in Russia. Moscow: The Council of the Commonwealth of Independent States The Russian Federations. Retrieved from http://council.gov.ru/media/files/41d44f243d8be7603d1f.pdf. In Russia.

- Murphy, T.J. (2008). The case for public-private partnerships in infrastructure. Canadian public administration / Administration publique du Canada, 51(1), 99-126. Retrieved from http://www.mcmillan.ca/Files/TMurphy_caseforP3_Infrastructure_0508.pdf

- Nijkamp, P., Poot, J. (1993). Endogenous Technological Change, Innovation Diffusion and Transitional Dynamics in a Nonlinear Growth Model. Australian Economic Papers, 32(61), 191-213. DOI: 10.1111/j.1467-8454.1993.tb00058.x

- Pytkin, A. N., Balandin, D. A. (2013). Challenges in Developing Socially Oriented Strategy of Innovative Development of a Region. Retrieved from https://elibrary.ru/item.asp?id=22755676

- Smit, A. (1776). An inquiry into the nature and causes of the wealth of Nations. NY: MetaLibri. Retrieved https://www.ibiblio.org/ml/libri/s/SmithA_WealthNations_p.pdf

- Seleznev, P. L. (2009). International Experience and Prospects of Realization of State-Private Partnerships Is in Russia. Business in law. Economic and legal journal, 5, 341-351. Retrieved from http://cyberleninka.ru/article/n/mezhdunarodnyy-opyt-i-perspektivy-realizatsii-gosudarstvenno-chastnyh-partnerstv-v-rossii. In Russia.

- On participation of St. Petersburg in public-private partnerships. The law of Saint Petersburg (2006). № 627-100. Retrieved from http://economy.gov.ru/minec/activity/sections/privgovpartnerdev/doc20061225_01

- Varnavsky, V.G. (2005). Partnership between the government and the private sector: forms, projects, risks. Retrieved from https://elibrary.ru/item.asp?id=19762479

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

16 April 2018

Article Doi

eBook ISBN

978-1-80296-037-2

Publisher

Future Academy

Volume

38

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-509

Subjects

Social welfare, social services, personal health, public health

Cite this article as:

Berkalov, S., & Kiseleva, E. (2018). Social And Private Partnership Through Contractual Arrangement. In F. Casati, G. А. Barysheva, & W. Krieger (Eds.), Lifelong Wellbeing in the World - WELLSO 2017, vol 38. European Proceedings of Social and Behavioural Sciences (pp. 48-56). Future Academy. https://doi.org/10.15405/epsbs.2018.04.6