Broker And Investor Financial Risks Assessment System As An Approach Of Their Financial Sustainability Increasing

Abstract

Development of evaluation and financial risk management methods of the stock exchange markets professional participants is important. There are gaps in approaches to assessment and risk management, which are generated by the broker's clients. We believe that assessment and financial risk management of broker company should be accomplished on an equal basis with clients risk management at any moment of the investment decision adoption and taking into account complex idea of broker and the investor financial risks set. We researched clients’ transactions data of the broker company on the selection of 100 investors with various size of the equity, which were randomly selected. During the researched period, investors used recommendations of system in 56% of cases. Investors with a small size of the equity to a lower extent considered recommendations of the system that determined the low income for the period. The problem of automation approach of the integrated investor and broker financial risk management is planned to develop in further research. Creation of the automation approach of the integrated investor and broker financial risk management system is a way to increase their financial sustainability. The current research objective consists in development of methodical approach to assessment of the broker company financial risks arising in the process of the activities implementation in the stock market, allowing to decrease investor losses, to increase management efficiency in the conditions of the unstable market with the help of derivatives and to increase the broker income.

Keywords: Brokerinvestorfinancial riskfinancial risk assessmentfinancial sustainability

Introduction

Development of evaluation and financial risk management methods of the stock exchange markets professional participants are one of the important tasks. At the moment there is no universal system of the analysis and risk management in a segment of broker companies that complicates an adequate risks assessment and negatively influences on their financial results. Each company uses borrowed practices from the bank sphere, or their own, which differ both by a technique, and by the generated results. The difference of the risk results measure values leads to the difficulties in estimation of broker activities risks level. Besides, there are gaps in approaches to assessment and risk management, which are generated by the broker's clients.

Problem Statement

In the existing approaches to the risks, generated by clients of the broker, management and assessment, there are a number of gaps. These types of risks scientists consider as uncontrollable. To some extent it is right, the broker can't control actions of the clients, but he can organize internal processes so that to minimize negative consequences from their trade actions. In particular, this problem is investigated in Ya. Mirkin's works, T. A. Popova, etc. Also according to reports of the analytical group "RA Expert", development of the financial markets in Russia significantly is interfered by the imperfection of a brokers risk control system.

Dynamics of the assets prices in the financial markets bears in itself, both for an investor, and a broker, a considerable range of risks. If a task of an investor is the choice of the most optimum portfolio of assets and control over possible losses, then the broker bears on himself risks of huge number of clients trade solutions (Angel, & McCabe, 2013). Moreover, he has to consider the risks connected with the using of marginal crediting, risks of liquidity and volatility of a set of clients’ positions. Therefore, the solution of the task of this group of risks management will allow contributing in broker companies and their investors’ financial stability increasing, and to promote the improvement of a financial system of Russia.

One of the tasks of a broker company is to analyze the activity of the clients at each moment and to form an adequate package of measures, which will allow minimizing the losses connected with their actions. The broker company as the financial intermediary when rendering services assumes a part of the risks transferred by clients when making the trade operations. Due to the specifics of a broker activity, to increase an income, the broker has to serve a part of these risks and assume the corresponding expenses (Adrian, & Etula, & Muir, 2014). Therefore, it is the most expedient to develop mechanisms of the reduction of the clients’ risks influence on a broker activity.

Research Questions

Research objectives are the following:

To analyze different types of a broker company financial risks.

To reveal a complex of specific risks of the investor which exert impact on financial stability of a broker company.

To offer approach to the accounting of financial risk, which would reflect specifics of broker activity and diversity of various approaches to a risk assessment.

To develop an algorithm of an assessment of financial risks based on the offered approach to the risk accounting.

To develop the decision-making support system by an assessment and management of financial risks of broker company allowing to analyze operations of clients and to define tools and methods of hedging of the total investment portfolio on the basis of derivative tools, to estimate efficiency of the used methods.

To make experiments on the basis of statistical data on quotations of securities of the Russian and world stock market for the analysis of efficiency of use of the developed decision-making support system in practice.

Purpose of the Study

The study objective consists in development of methodical approach to assessment of the broker company financial risks arising in the process of the activities implementation in the stock market, allowing decreasing investor losses, to increase management efficiency in the conditions of the unstable market with the help of derivatives and to increase the broker income (Kahneman, & Tversky, 1982, Antonova et al, 2016, Kiseleva et al, 2016a, Kiseleva et al, 2016b).

Besides it is necessary to develop an assessment algorithm of the broker and investor financial risks and to offer the decision support system of assessment and financial risk management of broker company, that allow to analyze clients transactions and to determine tools and methods of the total investment portfolio hedging on the basis of derivatives.

Research Methods

The hypothesis of the study is based on idea that assessment and financial risk management of broker company should be accomplished on an equal basis with clients risk management at any moment of the investment decision adoption and taking into account complex idea of broker and the investor financial risks set.

Experimental part of the research is based on data of the market prices and the trading volumes securities provided by PJSC Moscow Exchange, CJSC St. Petersburg Exchange, and on the data of real broker company clients trade actions and transactions.

Findings

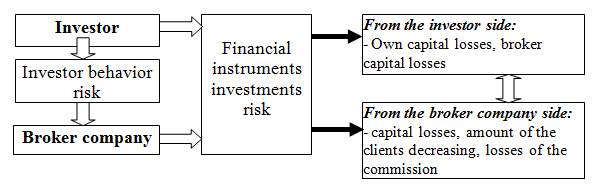

During the analysis of cross impact of the broker and investor activities, the contradiction for the benefit of the parties is revealed. The broker aims at income acquisition from the services that is expressed in the maximum possible prolongation of the clients’ trade and investment activity. At the same time, investors wish to gain higher income in the financial transactions making process that leads to the increased risks, application of high amounts of marginal crediting. Therefore, partial or complete loss of initial investments is possible (fig.

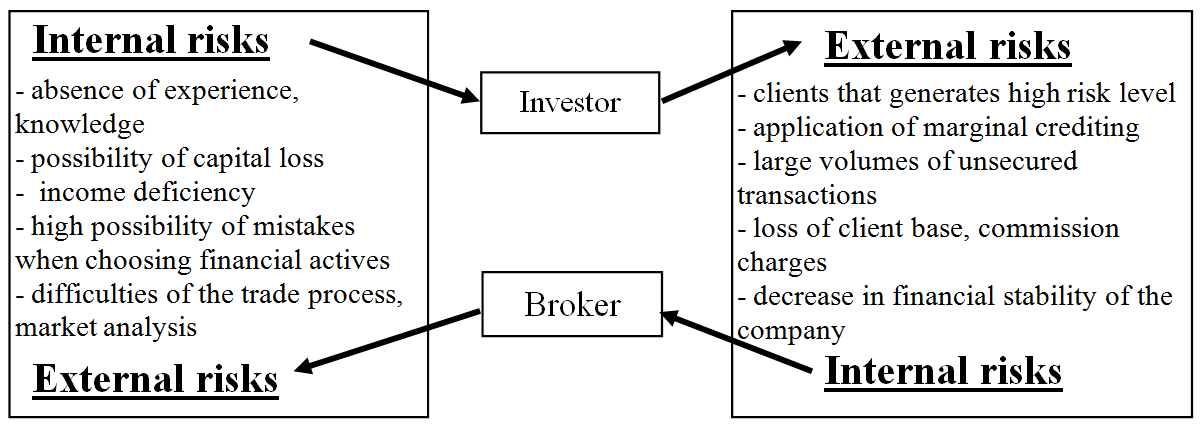

On the basis of investor purposes and characteristics hypotheses, set of financial risks which investors are exposed to when making any actions in the security market, is analyzed, and their financial risks that influence on the broker company activities are marked out. The interrelation of internal and external risks of the investor with risks of the broker is shown in the figure

Availability of bilateral transfer of financial risk caused the approach development, which has the system of the broker risk assessment, and management that provides simultaneous estimation and correction of investors’ risks. As the number of investors in the Russian stock market is small (about 1,5% of an economically active population) and in general has a downward tendency, the competition for investment resources attraction grows, therefore, the task of financial risk management of the broker shall include decrease in risks of investors, increase in reliability of investing activities (Barberis, & Thaler, 2003, Chuvakhin, Hurst, & Docherty, 2015, Mikhailova, 2011).

The analysis of the existing approaches to financial risks assessment (Izotkina at al., 2016) allowed gaining benefits from application of the fuzzy logic theory. As the broker and investor financial risks assessment task there are quality characteristics of some parameters, for example, when determine the level of investors’ knowledge, their attitudes towards risk, etc. which need to be transformed, for further comparison with quantitative indices.

For quantitative assessment of set of the risks generated by financial assets and for assessment of probability of emergence of risk as a result of trade actions of the investor, set of VaR-models is applied. It is offered to solve a problem of the investor asset portfolio modification with the help of limiting models of VaR (MVaR), VaR of an increment (IVaR) and an indicator of the expected losses (conditional VaR). Simultaneous calculation of these indicators allows planning risk management with a higher accuracy.

Approbation of approach is carried out on clients’ transactions data of the broker company on the selection of 100 investors with various size of the equity, which were randomly selected.

Conclusion

During the researched period, investors used recommendations of system in 56% of cases. It can be explained with the fact that recommendations about risk of assets and optimization of an investment portfolio were generated by the system each 30 minutes, and the investor not always had an opportunity to track them in time. At the same time investors with a small size of the equity to a lower extent considered recommendations of the system that determined the low income for the period. The hypothesis that the risk assessment of assets and redistribution of a part of the equity from higher risk assets to lower risk assets improves a risk and profitability ratio is confirmed, and encourage decreasing in investors unprofitable transactions (tab.

Among small and medium investors, there are a number of those who received a bigger loss, than those who got profit following the results of the tested period. It is explained by the increased risk which investors allowed in decision making, a considerable deviation of the actual decisions from recommended by system, availability of restrictions on access to certain assets. The low average earnings gained by group of small investors following the results of the period are also explained by it. The result of large investors is more natural: the attentiveness to the system recommendations, an opportunity for bigger diversification of the equity and tendency to smaller risk allowed to gain higher income.

My further investigation will be connected with:

development of the approach to the organization process of investor risks partial acceptance in the broker activity,

research of the training technologies of investors and staff of broker companies to identify and manage risks,

automation of risks hedging process, the analysis of the investor actions at each stage.

These are the topics I want to discuss during the Summer School.

References

- Adrian, T., Etula, E., Muir, T. (2014) Financial Intermediaries and the Cross-Section of Asset Returns. Journal of finance, 69(6), 2557-2596. doi: 10.1111/jofi.12189

- Angel, J. J., McCabe, D. (2013) Ethical Standards for Stockbrokers: Fiduciary or Suitability? Journal of Business Ethics, 115(1), 183-193. doi: 10.1007/s10551-012-1362-y

- Antonova, I.S., Koptelova, K.S., Negodina, O.A., Spitsina, L.Y., Popova, S.N., Vavilov, D.D. (2016) Investment Attractiveness of Closed-end Real Estate Investment Funds in Russia: Factor Score Evaluation. In International Conference on Education, Management, Computer and Society. Atlantis Press, 37, 904-907. DOI: 10.2991/emcs-16.2016.221

- Barberis, N., Thaler, R. (2003) A survey of behavioral finance. Handbook of the Economics of Finance / ed. by G. M. Constantinides, M. Harris, R. M. Stulz. Amsterdam. 1B(18), 1053-1128. Retrieved from http://down.cenet.org.cn/upfile/36/200742411529168.pdf

- Chuvakhin, N. (2017) Efficient Market Hypothesis And Behavioral Finance – Is A Compromise In Sight? Retrieved from http://ncbase.com/papers/EMH-BF.pdf

- Izotkina, N., Trubchenko, T., Shaftelskaya, N., Krechetova, A., Krukova, E., Karelina, A., &Kalashnikova, T. (2016). Operational and Economic Requirements of Innovative Products Designed to Prepare Business Plans. In Innovation Management and Education Excellence Vision 2020: from Regional Development Sustainability to Global Economic Growth (pp. 2098-2104). Seville: IBIMA. Retrieved June 19, 2017, from http://www.ibima.org/SPAIN2016/papers/tnkt.html

- Hurst, G., Docherty, P. (2015) Trend salience, investor behaviours and momentum profitability. Pacific-Basin Finance Journal, 35, 471-484.

- Kahneman, D., Tversky, A. (1982) Judgment under Uncertainty: Heuristics and Biases. England: Cambridge. Cambridge University Press.

- Kiseleva, E., Yakimenko E., Sakharova E., Khmelkova N., & Neverov P. (2016a). The Universal Model of Stages of Customer Relationships as A Tool for Effective Managing with Personal Sales In the Context of Relationship Marketing. In Innovation Management and Education Excellence Vision 2020: from Regional Development Sustainability to Global Economic Growth (pp. 2821-2827). Seville: IBIMA. Retrieved June 19, 2017, from http://www.ibima.org/SPAIN2016/papers/eesk.html

- Kiseleva, E., Yeryomin, V., Filippova, T., & Yakimenko, E. (2016b). Personal Sales Focused on Improving the Psychological Wellbeing of Customers in the Context of Relationship Marketing. DOI:10.15405/epsbs.2016.02.36

- Mikhailova, P. (2011) Psychological aspects of human interactions through trading and risk management process. Perm Winter School. Retrieved from http://permwinterschool.ru/last_events_11.html

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

16 April 2018

Article Doi

eBook ISBN

978-1-80296-037-2

Publisher

Future Academy

Volume

38

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-509

Subjects

Social welfare, social services, personal health, public health

Cite this article as:

Tsibulnikova, V. (2018). Broker And Investor Financial Risks Assessment System As An Approach Of Their Financial Sustainability Increasing. In F. Casati, G. А. Barysheva, & W. Krieger (Eds.), Lifelong Wellbeing in the World - WELLSO 2017, vol 38. European Proceedings of Social and Behavioural Sciences (pp. 478-483). Future Academy. https://doi.org/10.15405/epsbs.2018.04.55