Abstract

Karabük has a historical and significant impact and importance in Turkish iron and steel sector. The aim of this research is to investigate the future perspectives of steel producing companies in Karabuk. Kardemir Inc. as the first integrated iron and steel factory of the country and (30) rolling mills operating in Karabuk compose the universe of this research. A descriptive research model was used in the study. For this purpose, data that would be the basis for (Strengths, Weaknesses, Opportunities, Threats) SWOT analysis were obtained through interviews. Datas obtained were analyzed with descriptive analysis method. As a result of the research, it may be expressed that the enterprises in Karabük have an extensive iron and steel culture, achieved product diversity success were able to gain competitive advantage through product differentiation in exports. However high energy, raw material and logistics costs, fluctuations in foreign exchange and raw material prices, terror and political instability in neighboring countries are considered to negatively affect the rapid growth of the sector in the future.

Keywords: Iron and Steel SectorSWOT Analysis

Introduction

The iron and steel industry has great impacts on development of national economies. It is the locomotive sector in both global and national level economies. In parallel to the growing demand for many iron and steel products especially in construction, automotive and white home appliances sectors, the iron and steel industry grows steadily. There are three main production categories in iron and steel industry. These are main products, intermediate and byproducts. This classification is shown in Table

In 1990s, dramatic changes occurred in the production, consumption and trade of iron ore and steel in the world. The predominance of United States of America (US) and Eastern Europe at steel production passed to far east countries. China, India, South Korea and Taiwan became growing economies in both production and consumption of iron ore and steel products. Australia and Brazil are still leaders in iron ore production and exports (Labson, 1997).

China is one of the most influential countries in the world iron and steel market, because of its huge steel production capacity and as an important iron ore and steel importer. Australia has a competitive advantage as a primary iron ore exporter to China due to its geographical position and vast iron mines (Labson, Gooday and Manson, 1995).

In addition to global challenges about production, consumption and market conditions, energy supply and environmental problems also play an important role in iron and steel sector. The iron and steel industry is an energy intensive one. Since the energy demand in the sector is mainly met by coal use, greenhouse gas emissions constitute an environmental threat, and measures to be taken in this regard require additional costs. As of 2002, greenhouse gas emissions in China accounted for 14% of the total global emissions (Ma et al., 2002).

Compared to the past Turkey has a better rank among the crude steel producer countries. Turkey focuses on efforts to increase exports to Middle East countries in addition to European Union (EU) countries. Turkey is still dependent partially on iron ore and almost fully on scrap metal for steel production. In iron and steel sector Turkey’s import is more than its export. Among the resons of this status are inadequate domestic iron ore supply and inadequate production of flat and high quality steel (IGEME Sector Report, 2016).

Literature Review and Theoretical Framework

In this section, the literature research strategic aspects of iron and steel industry both in global and national level and SWOT analysis as a tool of strategic analysis techniques.

Turkey and Global Iron and Steel Industry

The global challenges in the iron and steel industry are almost common for many countries. Primary challenges are excess capacity, insufficient domestic and foreign demand for products, technological modernization needs in production processes, high energy and raw material costs (www.ekonomi.gov.tr1 IGEME 2016 Sector Report). According to the World Steel Assosiciation (WSA) statistics, in 2015, a total of 1620 million tons of crude steel were produced in the world. The countries that produce the most in the world are shown in Table

In iron and steel sector, scrap or iron ore is used as raw material. Since the capacity surplus in the global industry, ore prices have been low until the second half of 2016 and after this period, prices started to have upward trend again. Our country is dependent on scrap metal as input. Turkey ranks first in global scrap metal imports. China has been the determining factor in global crude steel supply for the last fifteen years. China's production capacity is around 1.2 billion tons per year and due to structural problems it plans to reduce its capacity to 800 million tons per year by 2020. The largest market in the global steel trade is the European Union (EU) countries and flat products are in the first place in the imports of these countries. Most countries are taking protection measures to protect national industries (Çevik, 2017).

Iron and steel sector is considered as one of the important indicators of the real economy in the national economies. It is the most important supplier of the construction, automotive and white home appliances industries, which are the main elements of the real economy during the economic growth periods (Bakırcı et al., 2014).

Technologically developed countries tended towards the production of high value added steel products, while developing countries have preferred the tendency to produce more in quantity. 75% of Turkey's final product is long product. In 2010, 6% of long product exports were made to the EU countries and 50% to Middle East and Gulf countries (Ersöz et al., 2015).

Iron and steel industry is the locomotive sector in Turkish economy. Today, approximately 31 thousand businesses operating in the iron and steel industry where 150 thousand people were employed at. About three quarters of iron and steel production is produced in electric arc furnace plants and the rest in integrated plants. The integrated facilities of Turkey are the factories of Kardemir, Erdemir and Isdemir. The basic raw material of integrated plants is iron ore, while the raw material of arc furnace plants is scrap metal. In 2015, the capacity utilization rate in iron and steel sector in Turkey was 63%. Fluctuations in global scrap metal prices have increased the importance of integrated plants that use iron ore as raw material. In developed iron and steel producer countries, the flat product rate in total steel production is 60% and the long product rate is around 40%. The ratio of flat product to total product in our country is 26.3% in 2015. Flat products are high value added steel products. Lately Isdemir increased investments in flat steel production and those new investments contributed to the increase in flat/long product ratio. Among the problems experienced in Turkey’s iron and steel exports are political instability in the Middle East region, fluctuations in scrap metal prices, international protection laws and measures to protect national industries abroad and insufficient demand. High-energy costs, uncontrollable raw material costs, poor quality and low-priced imported iron and steel products that lead to unfair competition are among main threats sector-wide (IGEME Sector Report, 2016).

In 2016, Turkey generated $ 9.1 billion in revenues, with a total of about 16 million tons of steel exports. The biggest share of Turkish exports is the Middle Eastern and North African countries, then the EU countries. In the same year, semi-finished flat steel import decreased by 43%, while long product semi finished steel import increased by 10%. In 2016, overall iron and steel products imports increased by 1% to 11.9 million tons (Kaya, 2017).

With the Free Trade Agreement signed between Turkey and European Coal and Steel Community (ECSC) in 1996, customs were mutually abolished and comparing to past a growth strategy based on exports became possible for the sector (Yaşar, 2009).

Turkish Ministry of Development aims to increase crude steel production capacity to 67 million tons and the production to 53 million tons, with an expectation of 34 billion dollars of export revenue until the end of 2018 as stated in Tenth Economic Plan period. Turkey aims to be the leader in Europe and 7th largest steel producer in the world. Turkey’s projections in this sector is to become a net exporter of flat rolled products and to start producing stainless steel as well as more alloyed steel. Among the challenges in reaching the targets specified are competition with China, particularly on production costs, R & D activities and related costs, producing more value added products and maximizing recycling of domestic scrap (Ersöz et al., 2017).

Karabük and Turkish Iron and Steel Sector

In Atatürk era Turkey intended to develope its industry principally with state funds since private sector didn’t have enough capital for industrial investment. In 1934 with the First Five-Year Industrial Plan mining sector including iron-steel industry was planned to be founded by the state funds (Özçelik & Tuncer, 2007). In Divriği iron mines were explored in 1937 and Karabük Iron and Steel Factory was established in 3.4.1937. This factory’s production was started on 9.9.1939. The Karabük Iron and Steel Factory has a significant historical impact on the region’s and the country’s economy (Kaştan, 2003).

The region has many ancient cities and historical monuments. Safranbolu was recognized as a 'World Heritage City’ by UNESCO in 1994. Karabük started to grow rapidly in 1935 with the opening of Zonguldak Ankara railway and the establishment of Iron-Steel factory (Alkış & Temizkan, 2010). Parallel to the growing iron and steel industry Karabuk flourished and expanded rapidly and was administratively evolved and announced as a city by the government in 1995 (Şengün & Temiz, 2007).

Historically iron ore production in Turkey was carried out according to the capacity of Karabük Iron and Steel Factory for a while. During the Second World War iron ore output showed significant declines (Tamzok, 2003). In 1980s when privatization efforts started as a government policy, overall Turkish Iron and Steel Enterprise was categorized as ‘Second Priority to be privatized Public Economic Enterprise’ (Demirbaş & Türkoğlu, 2002).

Karabuk Iron and Steel Factory continued to operate as a profitable public economic enterprise until 1989, but thereafter it began to suffer inadequate profitability. According to a privatization method applied for the first time in Turkey, the ownership of premises were transferred to Kardemir Inc. with a contract dated 30.03.1995 at a symbolic price of 1 Turkish Lira. After privatization, a large investment and modernization initiative was launched. In the first two years, sales increased by 55%, and the company gained a sum of profit 27 million $ in 1996 and $ 42.9 million $ in 1997. At the same time, a significant increase in production was observed, especially in liquid steel production (Ersöz, Özdemir, Yavuz, Akgeyik, & Şenocak, 2003).

As of today Kardemir Inc.'s product range includes round, profile, ribbed steel, bloom, billets, angles, rails, pig iron, coke, mine poles, profile drafts, granulated slag, ammonium sulphate, crude benzol, tar, creosote, liquid Argon, nitrogen, oxygen, press naphthalene, lead tar and tar paint (Kardemir Product Groups, 2017).

Kardemir AŞ continues to make new investments as part of its growth strategies. Bar and coil rolling mill was established for the production of qualified steel (coil-rod) in 2016. The rail wheel production unit was planned to be operational in 2017 with a target of producing 200,000 units annually according to the strategic goal of production of high added value products. In addition, investments aiming hardened rail production and capacity increase in liquid steel production are still in progress Kardemir Investments, 2017).

In 2017, Kardemir determined the production target as 2.5 million tons (www.kardemir.com7). Kardemir has the vision of producing new products in Turkey, having global competitive power and producing at least 3 million tons of crude steel. Its mission is to meet stakeholders' expectations at the highest level and to produce high value added products (Kardemir Vision and Mission, 2017).

Kardemir is the sole producer of profiles wider than 300 mm in Turkey. It’s the 34th most successfull company in Turkey according to Istanbul Chamber of Industry "Top 500 Industrial Establishments" 2015 list. Together with its affiliates, a total of 4,500 people were employed at Kardemir (www.kardemir.com9). In 2016 Kardemir's net salable total final product was 2.076.736 tons (Kardemir Audit Report, 2017).

Beside Kardemir approximately 110 companies operate as iron and steel related businesses. These companies are operating dependently to Kardemir. About (30) of them are rolling mills which produce final steel products by processing steel blooms. Their processes include; manufacturing hot and cold drawn flat steel, bar, rod, steel profile, iron casting, ribbed plates, sandwich panels, iron doors, windows and pipes (Members, 2017).

Competency in iron and steel sector requires outstanding performance, sustainable profitability, managing environmental concerns and costs successfully and contributing to social development in which being operated. Iron and steel producers suffer from domestic and foreign raw material supply, financial difficulties, inadequacy of demand to the products, global unfair competition pressure, marketing problems, technological problems, difficulty in finding qualified personnel and fluctuations in foreign exchange and energy costs (Doğan, 2013).

SWOT as a Strategic Analysis Tool

SWOT analysis is one of the important techniques which supports decision making by analyzing the organization and its environment. An organization determines its strengths or weaknesses in terms of people, technology, market, financing and management. SWOT analysis is an effort to identify and implement strategic objectives so that an organization can achieve its objectives (Ener and Yelkikalan, 2004). SWOT enables managers to determine appropriate strategies to gain competitive advantage by identifying the strengths and weaknesses of their organization to avoid threats and benefit from opportunities in the market. SWOT is an abbreviation composed of the initials which represents the words of ‘strengths, weaknesses, opportunities and threats’ respectively (Tabak, 2003). SWOT analysis establishes a basis for future applications by enabling the verification of problems at organization. Trying to predict the future actually targets the sustainability of organization’s competitive advantage (Kuşat, 2014).

SWOT analysis defines organization’s internal and external environments. Businesses usually don’t have a capability to control their external environment. Instead it is in their favor to recognize the changes in their external environment in time to ensure adaptation. The organization’s external environment may be categorized in two groups; general environment and competitive environment. In their competitive environment companies should confront and cope with many threats arising from rivals, suppliers, customers, substitute goods and intense competition. Organization’s general environment also affects strategies and have six dimensions as; demographic, sociocultural, political / legal, technological, macroeconomic and global (Miller ve Dess, 1996).

SWOT is defined as the process of assessing the organization’s experience, strengths and weaknesses and then adaptation to external environment (Dinçer,2013). By using SWOT analysis, managers compare competitive strategies to determine the appropriate ones to gain competitive advantage. These strategies are functional, business, corporate or global level strategies and must be compatible with each other (Hill, Jones ve Schilling, 2015).

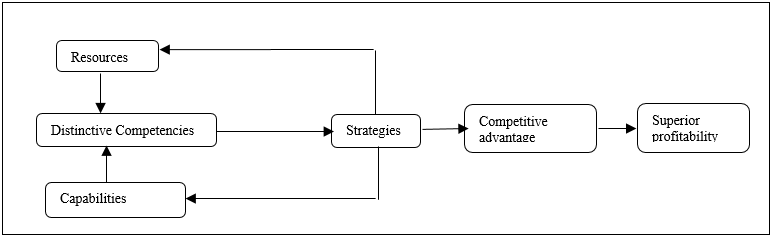

Internal analysis is concerned about the resources and capabilities of the organization. Competitive advantage depends on profitability of the company more than the average profitability of the rivals. Sustainable profitability provides the organization competitive advantage. The distinctive competencies of an organization mean so specific capabilities which are unique to the company that those abilities enable the company either produce unique products or services or obtain cost advantages compared to competitors. Companies should have unique resources and capability to take advantage of efficiently using those resources to achieve organizational goals. Figure

Research Method

The Purpose and the Scope of the Research

The aim of the research is to predict and analyze the current status and future of the iron and steel sector in Karabük by the SWOT analysis by verifying the opinions and determinations of the managers or owners of companies operating in this sector. The scope of the research was composed of Kardemir Inc. as the main actor of the sector in Karabük and rolling mills which are capable of steel production in this sector.

Sample and Data Collection

In this research, a descriptive research model was used to express the present state of an object or phenomenon (Altunışık et al., 2010). For this purpose, the datas to be the basis of SWOT analysis as an important tool for strategic management, were obtained by interview method. The semi-formal interview type was preferred. Semi-formal interviews are much more flexible type of interviews which enable the interviewer inquire different dimensions of the subject based on the respondent's interest and knowledge (Altunışık et al., 2010).

The universe of the research was made up of 30 rolling mills in the iron and steel sector in Karabük and Kardemir Inc. as one of Turkey's total 3 integrated iron and steel mills. For sampling ‘simple random sampling method’ was used to choose from rolling mills and ‘deliberate sampling method’ was used to add Kardemir Inc.. A total of 7 respondents were interviewed for about 30 minutes each. The following 4 questions were asked to the respondents and detailed comments as answers based on respondents’ interest and experience were not interfered;

1. What are the characteristics of your business in the iron and steel sector which makes your company stronger than the rivals?

2.What aspects of your business do you think should be strengthened to improve your competitiveness?

3. Are there any events or conditions you see as opportunities for your company in iron and steel sector at local, national or global level? If so, what?

4. Are there any risks or situations that could threat your profitability, competitive power or survival in iron and steel sector at local, national or global level? If so, what?

Analyses

In analyzing datas obtained by the research, descriptive analysis method which allows classification, summarization as well as researcher's comments about datas was used (Altunışık, 2010). The constraints of the research were excluding the businesses engaged in only trading at this sector and lack of comparison of the results with other regions of Turkey.

Findings

The datas obtained by the interview were examined and the findings were classified under four groups specified in parallel with the interview questions.

The Strengths of the Companies

It is perceived as an advantage to be familiar with iron and steel production culture for many years by the majority of enterprises. Businesses believe that they will be able to have demand for their products provided that they have wide product range. Businesses choose either differentiation strategy by offering a wide range product or aiming to sell less added value products in large quantities. The sector has a capability of flexible capacity in case of increase in demand. (#6 Respondent) explains it as; ‘%70 of our sales is generated from export. We don’t have any capacity increase problem in case of demand increase. We are able to find customers from North and South America, North Africa and Middle East countries. Our product diversity which ise over 200 products and export oriented policies significantly contribute to this success.’

New product development mainly depends on generating demand for it. (#5 Respondent) stresses on this as; "Our marketing team is in charge of product development activities by interacting with our customers in more than 100 countries continuously.’ (#3 Nolu Respondent) adds as;’ We are manufacturing unalloyed carbon steel needed in machine manufacturing. These products are high value-added steel'. Obviously thereis a new product development potential in the sector. For Karabuk, observed and expressed strengths of the companies which enable them to have competitive advantage in this sector are listed in Table

The Weaknesses Of the Companies

Generally the problems in the sector emerge as the companies’ weaknesses. The significant one among these problems is companies’s lack of chance to initiate low-cost marketing due to high transportation, supply and energy costs. Another disadvantage is lack of harbor in Karabuk which directly affects costs. (#1 Respondent) expresses this issue as; ‘The most important issue is the high cost of logistics.’ When Karabük Iron and Steel factory was founded, the rolling mills established relatively outside of the city those days. But today they are almost in the middle of the city and expanding their facilities is almost impossible. (#3Respondent) points out this fact as; 'There is another rolling mill just behind this wall attached to my facility and I do not have an inch to expand. Transferring facility somewhere else is a huge cost that I can’t afford.’

Although the product range is expanding, at branding the sector is not so successful. Qualified intermediate personnel is hard to find to employ. In order to overcome this problem, businesses choose to hire non-qualified staff and train them. The raw material supply from local sources are not enough. Companies have to buy most of the material they need either from other cities or import. The sector isn’t always satisfied with import raw material quality. Product differentiation and expanding the product range seem imperative the industry's future. The weaknesses and difficulties of the companies in the sector are listed in Table

Opportunities

The projected plan to open the Filyos Port which is close to Karabuk is seen as an opportunity sector-wide. Sector has an expectation of growth if exports to the Middle East and North Africa countries increase. Respondents all point out that their businesses are competitive because of their export orientation. (#2 Respondent) indicates this fact as;'We are able to produce thin-section quality materials in a wide range of sizes mainly for export. We focus on exportation.' Both rolling mills and Kardemir Inc. are export oriented. Since competition is intense in the sector, it has been observed that even with a low profit margin, companies insist focusing on markets abroad. (#5 Respondent) states; ‘In the past, producers worked with very high profit margins. Those days are gone. Now is the time of intense competition. We have to consent and survive with steady low profit margins. We try to keep up with external changes and grow with low profit.’ The issues perceived as opportunities at the regional, national and global level in the sector are listed in Table

Threats

Quality raw material supply is expressed as a sector-wide problem in Karabük. Since Kardemir Inc. itself mills final products and use some of its own raw material, other rolling mills have to find different suppliers. (#7 Respondent) emphasizes this issue as; 'We can only cover 10% of our raw material needs through Kardemir. Using alternative suppliers increases our costs.’ Uncontrolled import of cheaper products originating from China leads to unfair competition. Also political turmoil in the Middle East and North African countries is perceived as a threat for exports by the majority of businesses. It is also thought that the opening of production facilities abroad by Turkish entrepreneurs due to the savings in energy and labor costs negatively affects exports. Fluctuations in the prices of foreign exchange and raw materials price may affect financial balance (#2 Respondent) states as; ‘The serious change in the exchange rate between the time I make the sales contract and the time I deliver the order may lead to significant loss in this sector.’ The issues perceived as a threat in iron and steel sector at the local, national and global level are shown in Table

Conclusion and Discussions

Gurbuz et al. (2008) reported that Kardemir's capacity expanding investments, the new demands for high quality rail with government's new policy about fast train lines and the feasibility of electric arc furnaces in Karabuk provided opportunities for the sector, while lack of governmental incentive for Karabuk, the existence of environmental problems and monopolization tendencies in global markets posed threats (Gürbüz et al., 2008).

In Karabük, the iron and steel industry has an 80-year experience. This extensive experience and knowledge make an important contribution to the strengths of businesses. Businesses are highly flexible and successful in complying with intense competition conditions. Companies who focuses on wide product range and diversity instead of scale economics have made significant progress in exports. However, in order to be able to develop new products, marketing, demand creation and research and development efforts need to be intensified. In case of demand increase, companies are able to increase their capacity. In other words they still have excess capacity.

Input costs for the region are higher than others. The factors that increase the input costs are raw materials, energy and logistics costs. Lack of a port in proximity of Karabuk is disadvantageous for the sector. Since the industrial facilities stay in the city over time, it is difficult to expand the facilities and transferring the premises brings an excessive cost burden. It may be said that branding is needed even if the product variety is provided. Sector needs more qualified intermediate personnel to hire. The qualified human resource need These difficulties are attempted to be solved by hiring non-qualified personnel and train them on the job. element. The raw material supplied by Kardemir is inadequate for rolling mills and the extra demand is met by suppliers either from other cities or abroad.

The projected plan of Filyos port which is close to Karabuk is seen as a significant opportunity to reduce sector costs and to increase export. It is believed that even with low profit margins, export opportunities will let the sector continue growing. Possible settlement in political disputes in Middle East and North Africa regions is expected to stimulate imports and exports in this sector. Terrorism and political crises, especially in neighboring countries, are the factors that prevent the sector from growing faster.

Acknowledgments

This research was supported by Research Fund of the Karabuk University. Project Number: KBUBAP-17”.

References

- Alkış, H., & Temizkan, V. (2010). ‘İşletmelerin Kurumsallaşma Düzeylerinin Belirlenmesi:(Haddehaneler) Karabük Demir-Çelik Sektörü Örneği’, Ekonomik Yaklaşım, Cilt : 21, Sayı : 76, ss. 73-92.

- Altunışık, R., Coşkun, R., Bayraktaroğlu, S. & Yıldırım, E., (2010). Sosyal Bilimlerde Araştırma Yöntemleri, Sakarya Yayıncılık, 6.Baskı.

- Bakırcı, F., Shiraz, S. E., & Sattary, A. (2014). BIST'da Demir, Çelik Metal Ana Sanayii Sektöründe Faaliyet Gösteren Isletmelerin Finansal Performans Analizi: VZA Süper Etkinlik ve TOPSIS Uygulamasi/Financial Performance Analysis of Iron, Steel Metal Industry Sector Companies in The Borsa Istanbul: DEA Super Efficiency and TOPSIS Methods. Ege Akademik Bakis, 14(1), 9.

- Çevik, B. (2017), Demir Çelik Sektörü, Retrieved from https://ekonomi.isbank.com.tr/UserFiles/pdf/sr201703_demircelik.pdf

- Demirbaş, M., & Türkoğlu, M. (2002). Kamu İktisadi Teşebbüslerinin Özelleştirilmesi. Süleyman Demirel Üniversitesi İktisadi ve İdari Bilimler Fakültesi Dergisi, 7(1), 241-264.

- Dinçer, Ö., (2013). Stratejik Yönetim ve İşletme Politikası, Alfa Yayıncılık,İstanbul, 2013.

- Doğan, M. (2013). ‘Türkiye Sanayileşme Sürecine Genel Bir Bakış’. Marmara Coğrafya Dergisi, (28).

- Ener, M., & Yelkikalan, N. (2004). Çin’in Dünya Ticaret Örgütü’ne üyeliğinin Türkiye'nin tekstil ve konfeksiyon sektörüne etkileri-SWOT analizi yöntemiyle değerlendirilmesi.

- Ersöz, T., Düğenci, M., Ünver, M., & Eyiol, B. (2015). Demir Çelik Sektörüne Genel Bir Bakış ve Beş Milyon Ton Üstü Demir Çelik İhracatı Yapan Ülkelerin Kümeleme Analizi ile İncelenmesi. Nevşehir Bilim ve Teknoloji Dergisi, 4(2), 75-90.

- Ersöz, F., Ersöz, T., & Erkmen, İ. N. (2017). Dünyada ve Türkiye’de Ham Çelik Üretimine Bakış/Overview of Crude Steel Production in Turkey and the World. Erciyes Üniversitesi Fen Bilimleri Enstitüsü Dergisi, 32(2).

- Ersöz, Y. D. D. H. Y., Özdemir, A. G. S., Yavuz, Y. D. D. A., Akgeyik, T., & Şenocak, A. G. H. (2003). ÖZELLEŞTİRMEDE ÇALIŞANLARIN MÜLKİYET SAHİPLİĞİ: KARDEMİR ÖRNEĞİ. Sosyal Siyaset Konferansları Dergisi, (46), 3-42.

- Gürbüz, A. et al., (2008). Karabük İli Kalkınmasına Yönelik Mevcut Ve Alternatif Yatırım Alanları, Karabük Ticaret ve Sanayi Odası Yayınları, Karabük.

- Hill, C.W.L., Jones, G.R. ve Schilling M.A., (2015). Strategic Management Theory, Cengage Learning, 11th Edition, Canada, 2015.

- Hill, C.W.L. ve Jones, G.R., (2013). Strategic Management, An Integrated Approach,10th Edition, Canada,2013.

- IGEME Sector Report, (2016). IGEME 2016 Yılı Demir-Çelik, Demir-Çelikten Eşya Sektörü Raporu, Retrieved from ‘https://www.ekonomi.gov.tr/portal/content/conn/UCM/uuid/dDocName:EK-226609;jsessionid=YYxs0w27FUrZ0dqawSN-2tRKfWvZADb4dz2mm9orftdM1jRHUd2o!1662545728

- Kardemir Audit Report, (2017). Independent Audit Report, Retrieved from https://www.kardemir.com/yatirimci/Dosyalar/Yatirimci/Faaliyet/20161231_2016-12.pdf

- Kardemir History, (2017), Retrieved from https://www.kardemir.com/yatirimci/Default.aspx?Lng=en-US&b=33

- Kardemir Investments, (2017). Retrieved from https://www.kardemir.com/DevamEdenYat.aspx?s=YATIRIMLAR&i=1&Lng=tr-TR

- Kardemir Production Capacity, (2017). Retrieved from https://www.kardemir.com/Liste.aspx?yil=&s=DUYURULAR&i=207&Lng=tr-TR

- Kardemir Product Groups, (2017). Retrieved from https://www.kardemir.com/Urun.aspx?s=UGRUP6&a=1&Lng=tr-TR

- Kardemir Vision and Mission, (2017). Retrieved from https://www.kardemir.com/Yonetim.aspx?Sec=Sirket&b=2&Ani=yes&Lng=tr-TR&W=3

- Kaya, S. (2017). Sektör Raporu-Demir Çelik, Vakıf Yatırım, Retrieved from http://www.vkyanaliz.com/Files/docs/news_7829-636220563337542037.pdf

- Kaştan, Y. (2003). Atatürk Döneminde Sanayileşme ve Karabük Demir-Çelik İşletmeleri. Kastamonu Eğitim Dergisi, 11(2).

- Kuşat, N. (2014). Isparta Dış Ticaret Sektörünün SWOT Analizi Kapsamında Mevcut Durum Değerlendirmesi. Çankırı Karatekin Üniversitesi İktisadi ve İdari Bilimler Fakültesi Dergisi, 4(1), 299-324.

- Labson, B. S. (1997). Changing patterns of trade in the world iron ore and steel market: An econometric analysis. Journal of Policy Modeling, 19(3), 237-251.

- Labson, S., Gooday, P., & Manson, A. (1995). China Steel. China's Emerging Steel Industry and its Impact on the World Iron Ore and Steel Market.

- Ma, J., Evans, D. G., Fuller, R. J., & Stewart, D. F. (2002). Technical efficiency and productivity change of China's iron and steel industry. International Journal of Production Economics, 76(3), 293-312.

- Members, (2017). Inquiry of Members in Karabuk Chamber of Commerce and Industry in Iron and Steel Sector. Retrieved from http://uygulama.tobb.net/UyeBilgiSorgulama/fw_uyeBilgiServisi.do

- Miller, A. & Dess, G.G., (1996). Strategic Management, The McGraw-Hill, Second Edition.

- Özçelik, Ö., & Tuncer, G. (2007). ‘Atatürk Dönemi Ekonomi Politikaları’, Dumlupınar Üni., Sosyal Bilimler Dergisi, s.254-266

- Şengün, H., & Temiz, A. (2007). Afet yönetimi ve Karabük. TMMOB Afet Sempozyumu, Aralık, 273.

- Tabak, B. İ. (2003). ‘Türkiye’nin Uluslararası Pazar Fırsatlarının Belirlenmesinde Swot Analizi Uygulaması’. SDÜ, İİBF, C8, S1 : 221-234

- Tamzok, N., Odası, T. M. M., & Merkezi, S. A. (2008). ‘Osmanlı İmparatorluğu’nun Son Döneminden Çok Partili Döneme Madencilik Politikaları’, 1861-1948. Ankara Üniversitesi SBF Dergisi, 63(4), 179-204.

- WSA Statistics, (2016). World Steel in Figures, Retrieved from: https://www.worldsteel.org/en/dam/jcr:1568363d-f735-4c2c-a1da-e5172d8341dd/World+Steel+in+Figures+2016.pdf

- Yaşar, O. (2009). Türk imalat sanayinde lokomotif bir sektör: demir çelik sanayi. Marmara Coğrafya Dergisi Sayı: 20: 42-78

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

20 December 2017

Article Doi

eBook ISBN

978-1-80296-033-4

Publisher

Future Academy

Volume

34

Print ISBN (optional)

--

Edition Number

1st Edition

Pages

1-442

Subjects

Business, business studies, innovation

Cite this article as:

Karakaya, A., Yilmaz, K., & Ay, F. A. (2017). Future Perspectives in Iron and Steel Sector in Karabuk. In M. Özşahin (Ed.), Strategic Management of Corporate Sustainability, Social Responsibility and Innovativeness, vol 34. European Proceedings of Social and Behavioural Sciences (pp. 423-434). Future Academy. https://doi.org/10.15405/epsbs.2017.12.02.36