Abstract

Business ties between Asia and Europe force improvement in logistics performance of countries that lie on the path between those continents. Logistically improved infrastructure is a key success factor in increasing trade and efficiency of international logistic operations. The new silk road initiative is an opportunity to develop logistic performance and thus improve strategical management of resources in a long Eurasian supply chain. The northern branch of this route leads through following countries: China, Kazakhstan, Russia, Belarus, Poland, and Germany. Logistical performance varies from country to country and moreover is dynamic in its nature. Many factors influence the speed and costs of transportation operations performed in a specific environment. Thanks to the analysis of the historical data gathered by World Bank it is possible to examine progress made by the particular country. The time period from the first diagnosis publicized in 2007 to recent research in 2016 serves as a measurement of potential accomplishment in the logistic performance of the country. The efficient land connection between Europe and Asia is a great opportunity for international supply chains to improve agility and responsiveness to market needs. The purpose of this paper is to present the changes over time, measured by the logistic performance index. That helps to create the path of progress in achieving the desired performance. The result visualize a potential to improve in each country and effectively may improve an efficiency of the whole northern route.

Keywords: International LogisticsSupply chain managementLPI index

Introduction

The gravity of both European and Asian regions creates a pressure to improve ways of communication between them. Building the solid fundament for trade is possible thanks to effective ways of exchange. For international supply chains, it is critical to rely on fast and effective transportation operations especially in a rapidly changing market environment. Europe as an important market and consumption center is a valuable opportunity for Asian industry, capable to source many international supply chains. From the other hand, Asia is still an important trade partner for EU countries and seen as a potential opportunity in trade and investment strategy (Malmström, 2015). It will allow UE to strengthen presence in Asia and speed up the EU-China investment agreement.

The market competitiveness forces supply chain to operate faster and with constant pressure on cost. Looking for effective connections between Europe and Asia is, in fact, opening perspective for business partners to cooperate in more efficient way. Time-based competition increase risk for an efficiency of prolonged transportation operations. Since it takes 45-60 days for transport operation using a maritime connection from Shanghai to Hamburg, it opens a possibility to compete using other means of transportation. For example, railway transport from the time of loading in Chengdu (Sichuan province) to the rail terminal in Lodz (Poland) takes 14 days (Michalik, 2016). From there it takes three days to distribute merchandise across Germany, France, and the UK.

Problem Statement

Euro-Asian cooperation

Trade exchange among regions shows three dominant players in the world of 2016. Europe represented by EU-28 takes first significant place in this comparison. With well-balanced export and import, Europe shows both profitable opportunities as a developed market and simultaneously advance in delivering a variety of products as a keen exporter. The second largest power in this comparison, China represents Asia. Companies from Japan, Taiwan, Hong-Kong and South Korea play a dominant role in China's processing trade. The China works as a production hub allowing to assemble imported components and then export as finished products. The Chinese government and the European Commission signed a Memorandum of Understanding on the EU-China Connectivity Platform to enhance synergies between China's "One Belt One Road" initiative and the EU's connectivity initiatives such as the Trans-European Transport Network policy. (EU Commission, 2014).

The silk route initiative promotes achieving easy access to the markets of the countries involved. Drawing the corridor between Europe and Asia connect two from three important trade regions in the world. Thanks to investment and support of the project there is a great chance to build a modern infrastructure for transport and logistic operations. Helping supply chains to control and efficiently move its resources means to reduce cost and uncertainty of delivery (Acar, & Gürol, 2016). That may influence competitiveness on final markets where customers appreciate timeliness and cost of products.

LPI development of countries of the northern corridor the New Silk Road

A Northern corridor leads from China through Kazakhstan, Russian Federation, Belarus, Poland to the central part or EU - Germany. It is one of the main routes of the New Silk Road. Thanks to historical data gathered by World Bank it is possible to examine progress made by the particular country (World Bank, 2016). The time period from the first diagnosis publicized in 2007 to recent research in 2016 serves as a measurement of potential accomplishment in the logistic performance of the country. For some, it is an important logistic strategy often followed by investment plans and advanced development of infrastructure. Others struggle with years of negligence and lack of potential for positive change. The effort in improving lpi index is observed in six categories. From building an transportation infrastructure to changes in law helping logistic operators operate quickly without delays. That forms an aggregated information about the logistic potential of the certain location. To achieve a balanced level of logistic performance along the route it is critical to point out potential threats and locate it on a map of the corridor. Thanks to that general view it is attainable to employ additional forces to help improve an observed logistic performance.

Research Questions

Logistics performance index asses many logistical factors involved in creating an actual performance of a particular country. To name them all: customs, infrastructure, international shipments, logistics competence, tracking & tracing, timeliness. All of them makes reliable transport operation possible or difficult to realize and to control. Therefore it is worth observation: how logistic performance fluctuate in given country over time? In a modern supply chain, the risk of delays influences strongly the efficiency and furthermore delivery to the final customer. In markets where a lifetime of a product is constantly shorter, such delays transform into a cost of operations and increase the risk or logistics operations between international partners. Connecting Europe and Asia involves many countries within. Therefore problems in maintaining a certain level of logistic performance in one country may quickly influence the outcome of transportation operations in both directions. That is the reason for answering a question: where along the corridor Europe-Asia are located areas, critical for the performance of the whole corridor? Observing and comparing an outcome of achieving logistic performance in each country along the corridor, helps to focus attention on critical points. That also promotes successful strategies to improve existing infrastructure and other fundamental factors for reliability and efficiency of Europe-Asia route.

Purpose of the Study

In this analysis, it is aimed to observe the dynamic development of LPI index within time period 2007-2016, along the path leading from China through Kazakhstan, Russian Federation, Belarus, Poland to Germany.

Research Methods

Sample and Data Collection

A Northern corridor leads from China through Kazakhstan, Russian Federation, Belarus, Poland to the central part or EU - Germany. It is one of the main routes of the New Silk Road. Thanks to historical data gathered by World Bank it is possible to examine progress made by the particular country. The time period from the first diagnosis publicized in 2007 to recent research in 2016 serves as a measurement of potential accomplishment in the logistic performance of the country. The collected data represent level of advances in six fields affecting overall Logistic Performance Index (LPI): customs, infrastructure, international shipments, logistic competence, tracking & tracing and timeliness.

Analyses

A score of the LPI index for each country was compared over the period of nine years of research conducted by Word Bank. Thanks to that it was possible to observe progress in the development of the logistic performance of each individual country and to compare it in the exact order of the Eurasia corridor for transport. Complementary static comparison of LPI index in the year 2016 revealed present advances in developing transport corridor.

Findings

The corridor begins on important junction station in Horgos. This place located on China border opens a new perspective for economic development of western part of this country. Already finished high-speed Lanxin railway, linking Urumqi in Xinjiang with Xining in Qinghai along the New Silk Road is a sign of advanced development in this area (Hsu S., 2015). The Chinese industry clusters were rather located on the east coast, thanks to better access to ports and international marine trade routes. That created imbalance in the spatial development of China. Therefore advance in building the new silk route as a land route to Europe may in plans draw the bigger attention of investors in locations in middle and west part of this country. Additionally opening a route in a western part of China decrease necessity to use two different modes of transportation as it is popular now. Many producers transport finished goods firstly to the ports using trains or trucks and then reload it on transoceanic ships. In a comparison of transshipment costs, the western land route may be faster and still cost effective. The region located at the Kazakhstan border focus attention thanks to its logistic development. Creating a special economic zone with cross-border transport hub will ease access to the corridor, especially because northern and central path may use this passage. Kazakhstan government finance this project with a total cost of 1249 m$. Plans include logistics infrastructure 200 m$, dry port for 226 m$ and private investment estimated on 823 m$. That should allow increase traffic through the junction to expected 4,4 m tons in the year 2020 (Alpysbayev, 2015). Industrial clusters in Hohhot, Lanzhou, and Urumqi may increase the tempo of growth with easy access to a land connection to Europe. China and Kazakhstan agreement create the Horgos International Border Cooperation Centre. The free land port of Horgos facilitates customs procedures. The integrated trade center covers 1,85 square km on the Kazakh side and 3,43 square km on the Chinese side. Moreover, traders can use 30 days visa free stay in the border cooperation center. Further plans for development consist the construction of highways, railways, logistics centers and passenger terminals.

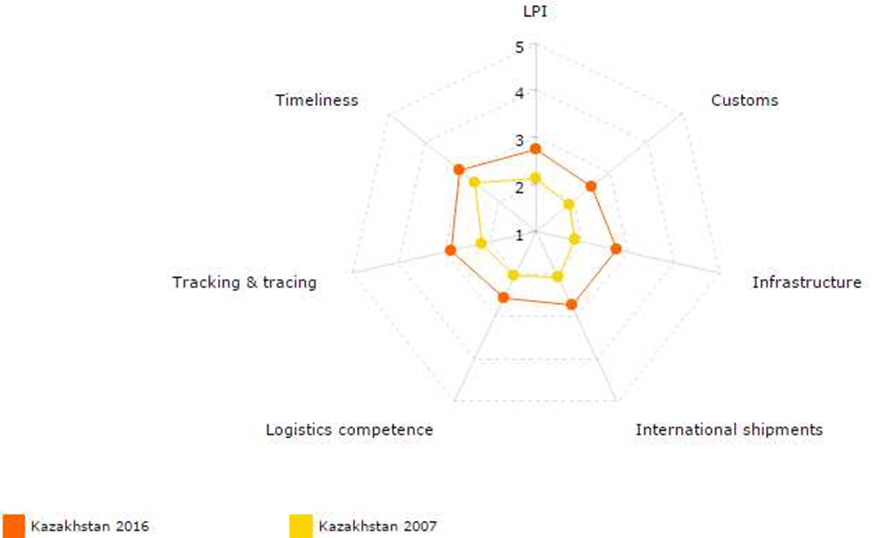

The economy of Kazakhstan is in the process of integration into the Eurasian Economic Union. Since signing the treaty in 2015 there are hopes that this will help to improve its logistic performance (Acar et al., 2015). The main increase over a period of nine years in noted in infrastructural development. After that comes a positive change in both categories: tracking & tracing and international shipment. The smallest increase in score shows in logistic competence although, in comparison with other countries, it is still impressive change (tab

After leaving Kazakhstan, the corridor leads to Russian Federation. As an important consumer for Chinese products, Russia plays a significant role in creating its transport strategy. Additionally, another country along the route is Belarus. Both countries plan close cooperation and opening an economic zone for the Silk Road with an industrial park. This idea may work as a catalyst for the development of Euro-Asian corridor (Pale, 2015). The exact path or the corridor may lead along existing Western Europe-Western China Project. The connected Kazakhstan cities beginning from the China border are Almaty, Korday, Taraz, Shymkent, Kyzylorda and Aktobe. Russian path begins with Orenburg, Kazan then Nizhny Novgorod and then capital of Russian Federation Moscow and Saint Petersburg or Minsk. The total length of the route is 8,445 kilometers, 2,233 kilometers of which run through the territory of Russia, 2,787 kilometers through Kazakhstan, and 3,425 kilometers of the territory of China (Turezhanova, 2013). The transport infrastructure will consist of newly design roads and roadside infrastructure. Availability of Internet access may improve control of the cargo and additionally weather forecast helping to adjust the tempo of transport. With The World Bank loan of $2.125 bn, it is expected that this project will be concluded in the year 2017 (Fedorenko, 2013). The speed of transportation operations is a critical factor in comparing different routes connecting Europe and Asia. The cargo may reach Central Europe in 10 days in comparison with 14 days using Trans-Siberian Railway or 45 days by passing marine route through the Suez Canal. Additionally, the tempo of transportation among the Eurasian Economic Union will be even higher which in fact is an additional argument for involving Russian Federation for supporting this project. Therefore this country joined the Asian Bank of Infrastructure Investments with funds estimated on $100 bn. Thanks to being representative from Asia, Russian Federation would also receive privileged status (Pale, 2015).

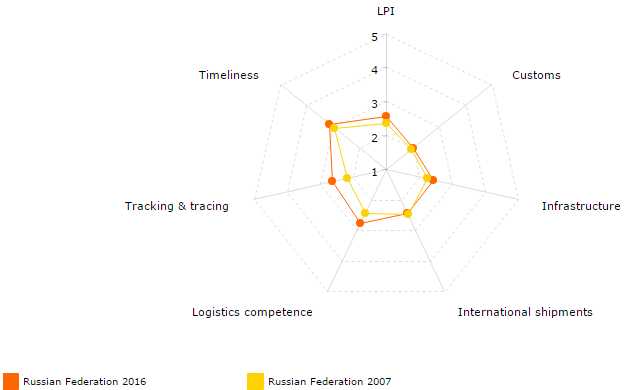

The changes in LPI index shows slow improvement. The biggest change for better is registered in tracking & tracing section. The runner up is timeliness and infrastructure. Surprisingly after 9 years of research Russian Federation stays at the same place in global LPI ranking (tab

The next country after Russian Federation is Belarus. As Avris observed, since 2012 those three countries Kazakhstan, Russia, and Belarus usually perform better in a scope of logistic performance than countries in the Central Asian region (Avris, Rastogi, 2014). That is probably due to former logistics standards which shape connections between former Soviet Union countries till now. Russian Market creates a great opportunity for Belarus serving as potential distribution hub connecting it with Western Europe. Logistic services are important for the economy of this country. More than 75% of total exports of services account for transport services (Niakrasava, 2016). Belarus territory includes Pan-European transport corridors West-East and North–South. Thanks to the availability of different transport modes it works as a transit area especially with customs union between Belarus, Russia, and Kazakhstan. That improve trade cooperation in the region and for simplifies the future logistic operation of international supply chains. Railway develops along many important directions and realized projects for development. Among them: Viking, the East Wind, Kazakhstan and Mongolian routes (Bentyn, 2017). There is also identified progress in warehousing. Existing 38 logistic centers improve the national standard and 11 of them include temporary storage warehouses, customs warehouses, and the customs clearance point. Multimodal operations are possible in 8 of logistic centers (Niakrasava, 2016).

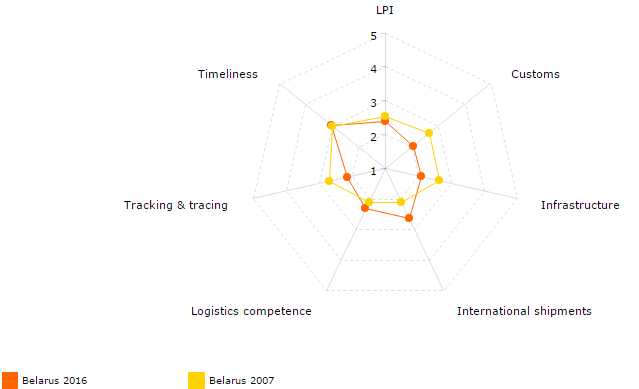

Nine year period didn’t help to increase Belarus's LPI score significantly. The most positive changes are noted in international shipments and increase of logistic competence. Customs and infrastructure decrease in value and it means that it will shortly need additional resources to renewal and improvement. Lower placement in ranking during researched period, by 46 places means that a negative tendency developed. In fact, all factors of logistics performance need radical improvement. (tab

A final country, closing northern corridor is Poland. As a member of European Union, it has a free access to all 27 other members without any restrictions. Free movement of goods, people, and capital open new areas of exchange and enable the use of the economic potential of the European continent especially with open connections to Asia. By accessing EU, Polish enterprises started work as links in European supply chains. In that year of accession, a significant part of Central Europe restores fairly easy access to the common European market. Foreign investors demanded improvement in logistic infrastructure. Thanks to European Cohesion Funds and years of development of highways, modernisation of railways and building distribution hubs and ports it was possible to improve both: international shipments and infrastructure. The whole region of Central East Europe began to work as an area of intensive logistic activities. Once called as Central European Boomerang by Gorzelak (Bentyn, 2016). With the support of community funds and private investments, there is a visible process of significant improvement of roads along designated by the European Commission corridors which may work as routes for implementing northern corridor. Ports organizations NAPA (North Adriatic Port Association) and BPA (Baltic Port Association) depends on supporting the development of the corridor mentioned as one of the ten corridors of the TEN-T, which is foreseen for funding in the 2014-2020 period (Novakova, 2013). In fact, at the entries to corridor Baltic-Adriatic, there is noted a growth in capacity of sea ports. Two important corridors of transport: East-West and North–South, cross in the middle of Poland close to city Stryków. This crossroad creates there an interesting spot for logistic hubs development. Both corridors are developed fast and used as important corridors for transport. Additionally, locations and proximity to high-density demographic areas help to locate there, modern distribution centers.

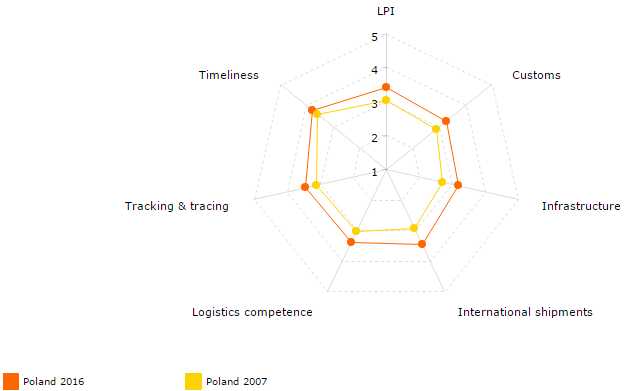

Noticeable improvement of logistics performance took place on the basis of expanding infrastructure and increase in managing international shipments (tab

Conclusion

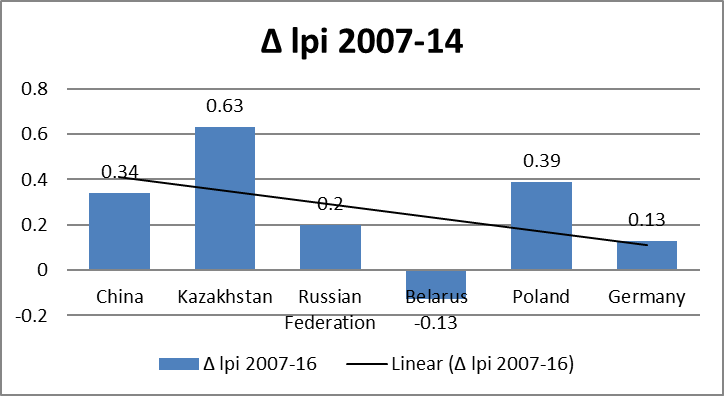

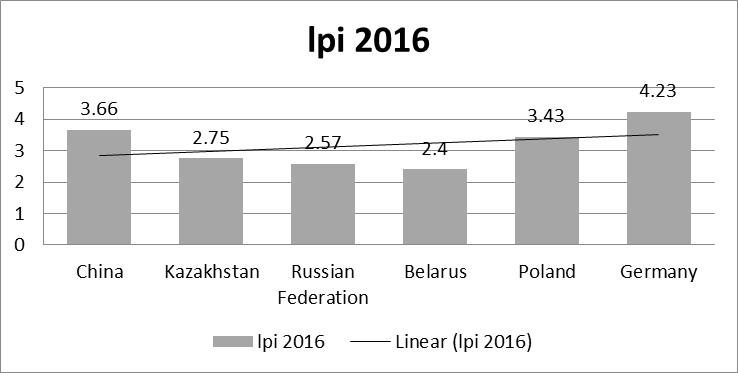

To build an efficient corridor connecting Europe and Asia, beneficial for all countries involved in the process, there is a need to improve their logistic performance. One of the conditions of competitiveness such a land bridge is to connect business partners in international supply chain faster and more efficient than it is achieved through a marine connection. Thanks to the analysis of dynamic growth in LPI index it was possible to find and compare advance in Poland and Kazakhstan to stagnation in Belarus or Russian Federation during last nine years. To see a change for better logistic competence is needed, which finally allows using provided infrastructure and technical equipment. By comparing this factor along the corridor we see improvement in all countries involved. The dynamic approach presented in fig.

The dynamic view may be supplemented by a static level of LPI index in all countries along corridor fig.

Strategic management of the resources in the long international supply chain requires a high level of logistics performance. Building an efficient land connection between Europe and Asia needs a common effort of many countries. Management of long Eurasian supply chains is a challenging task and all available logistic tools may improve it significantly. Analyzing the north corridor leading through Kazakhstan, Russian Federations, Belarus, and Poland helped to understand actual level of logistic performance in each of these countries. Additionally, supplementing this vision by adding growth in LPI index, noted in nine year period, commented effort made by each country to improve its logistics performance. That conclude research and focus attention on critical nodes along the corridor.

References

- Acar A.Z., Gürol P., (2016). An Innovative Solution for Transportation among Caspian Region, Procedia - Social and Behavioral Sciences, 229:78-87.

- Acar A. Z., Bentyn Z., Kocaoglu B., (2015). Turkey as a Regional Logistics Hub in Promotion of Revivaling Ancient Silk Route Between Europe and Asia. Journal of Management, Marketing and Logistics , 2 (2), 94-109.

- Alpysbayev, K. (2015). Investment Forum Silk Way: Creation of new logistics possibilities for trade between Europe and Asia., Silk Investment Forum, Dubai, 03.

- Avris J.F., Rastogi C., (2014). The Eurasian Connection, The World Bank, Washington D.C.

- Bentyn, Z.,(2017). Logistic performance development of the countries on the northern corridor of the new silk road, iss 63, European Transport-Trasporti Europei.

- Bentyn, Z., (2016). Poland as an regional logistic hub serving the development of northern corridor of the new silk route, Journal of Management, Marketing and Logistics, 3 (2), p. 135-144.

- Bentyn, Z., Majchrzak-Lepczyk, J. (2016). Poland as an example of economic development through participation in European supply chains in: Rynarzewski T., Szymczak M. (red.), Changes and Challenges in the Modern World Economy. Recent Advances in Research on International Economics & Business, Poznan University of Economics, Poznań, p. 261-277.

- EU Commission, (2015). Investment Plan for Europe goes global: China announces its contribution to invest EU , 28 .09.

- Eurostat, (2016). International trade in goods, 18.04, http://ec.europa.eu/eurostat/statistics-explained/index.php/International_trad_in_goods#Main_global_players_for_international_trade. (Accessed 30 June 2016).

- Fedorenko V. (2013). The new silk road initiatives in Central Asia, Rethink Institute, Washington D.C., Pap 10, 08.

- Gdowska, K.Z., Sala, D., Dospaeva, S., (2014). Rozwój logistyki w Kazachstanie, Logistyka 4/2014

- Hsu, S. (2015), Economic Zones and Infrastructure on China’s Silk Road , http://thediplomat.com, 21.01.

- http://trade.ec.europa.eu/doclib/docs/2015/october/tradoc_153844.PDF

- Malmström C., (2015). Trade for All: European Commission presents new trade and investment strategy, Brussels, 14, October.

- Michalik, K., (2016). Train China to Lodz, http://www.hatrans.pl/en/rail.html, 12.04.

- Niakrasava, A.S., (2016). Logistics services for transport systems of the Republic of Belarus in the globalized economy, Contribution to International Economy, York University Inc., vol.1, No.1.

- Novakova, H., (2013), Container terminal in Czech Republic and links to European Ports, Proceedings of MAC – TLIT, p.6.

- Pale S., (2015), New Silk Road: Pros and Cons for Russia, Neo Eastern Outlook, 10.07, http://journal-neo.org/2015/07/10/new-silk-road-pros-and-cons-for-russia/.

- Rajabova S., (2015), Kazakhstan's WTO accession, a long winding road it may be but hopes remain strong, Azernews, 26.02.

- Turezhanova M., (2013), Major Transport Corridor to Connect Kazakhstan, Russia, China by 2015, The Astana Times 20.02, http://astanatimes.com/2013/02/major-transport-corridor-to-connect-kazakhstan-russia-china-by-2015-2/.

- World Bank (2016). http://lpi.worldbank.org/international/scorecard/radar/254/C/KAZ/2014/C/KAZ/2007 (Accessed 30 June 2016).

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

20 December 2017

Article Doi

eBook ISBN

978-1-80296-033-4

Publisher

Future Academy

Volume

34

Print ISBN (optional)

--

Edition Number

1st Edition

Pages

1-442

Subjects

Business, business studies, innovation

Cite this article as:

Bentyn, Z. (2017). Development Of Eurasian Logistic Performance In Improving Management Of International Supply Chain. In M. Özşahin (Ed.), Strategic Management of Corporate Sustainability, Social Responsibility and Innovativeness, vol 34. European Proceedings of Social and Behavioural Sciences (pp. 340-351). Future Academy. https://doi.org/10.15405/epsbs.2017.12.02.29