Abstract

The main objective of the Romanian economy is to increase the standard of living of the population by maintaining the prices stable. During the last few years, in Romania, a generalized increase of the prices has been recorded, which has led to the emergence of the inflationist phenomenon. The National Bank of Romania (NBR) has acted by means of monetary policies meant to eliminate the distortions on the level of the prices and to stop the process of erosion of the economy. So, an anti-cyclical conduct has been adopted, both before and after the emergence of the global financial crisis, a process aiming to maintain the financial stability and assure an optimal framework for re-establishing the economic equilibriums. This case study offer to all the people interested the possibility to know and understand as well as possible the macroeconomic analysis framework and implicitly the fundaments of the monetary policy decisions adopted by NBR to assure and maintain the stability of the prices. In this context, the present research would like to determine the optimal degree of involvement of the monetary authorities in the economy, focusing in this approach on the in-depth study of the monetary policy transmission mechanisms and on the complex processes assuring the transit of the monetary policy decisions’ effects towards the macroeconomic variables envisioned.

Keywords: Monetary policymacroeconomic variableseconomic growthglobalization

Introduction

In a market economy, economic growth can be determined by the economic and social policies that has been elaborated and applied. To stimulate the long-term economic growth, the monetary policy acts must be by management of the liquidity on the monetary market, by modifications in the sense of the increase/diminution of the monetary policy interest rate, of the minimal obligatory reserves rate and by targeting the exchange rate for foreign currency.

Along with the monetary policy, the fiscal policy acts by the system of taxes and taxation, public investments and social protection.

An economy in full development adopts structural policies, in order to assure the good operation of the market mechanisms by the stimulation of the investments in certain sectors, but also by a restructuring of the non-performance companies and a reformation of the labour market.

In the various current economic thinking that approaches the major problems of monetary policy there are which investigates the existing relationship between monetary impulses signified by the rate of monetary expansion and the subsequent evolution of economic activity: the structural modeland the simplified model. (Mishkin, F., Bordes, C., Hautcœur, P.C., Lacoue-Labarthe, D., 2007).

In accordance with the structural model, the increase of the nominal money supply leads to decreasing the nominal interest rate as a result of the liquidity effect.

The adepts of the simplified model elaborated by monetarists believed that the decisive element for economic growth and price trends is the quantity of money in circulation and that the inflation is due to excessive monetary growth, and that the unbalance in the evolution of monetary supply is the cause of economic fluctuations.

Implementation of monetary policies designed to determine economic growth

Thus, by the application of the structural policies one can reduce the unemployment rate and can increase the performance of the labour force and the quality of the enterprises, contributing to the efficient functioning of the economy. Regarding the short- and medium-term economic growth as a cyclic process, determined by periodical fluctuations, it is optimal for the economic policies, especially the monetary policy, to act adopting an anti-cyclical conduct. Thus, in the stage of expansion of the economic cycle, characterized by the appearance of inflationist pressures, it is optimal to adopt a restrictive monetary politic, whereas during the recession stage of the economic cycle, characterized by the lack of inflationist pressures generated by the existence of unused resources, it is beneficial to apply a stimulative monetary policy. Nevertheless, the decision to adopt an optimal monetary policy becomes difficult in the context in which the offer is dominant, a situation specific of the emerging economies.

The situation is different in the case of the developed economies, where in order to reduce the risk of deflation, the rates of the monetary interest policies were brought near zero. A first step towards the evolution of the economic growth can be realized by the application of a mix of economic policies, in increasingly varied arrays, because no state uses “pure” economic policies anymore.

Another modality of intervention refers to the stimulation of the aggregate re-launch in order to re-launch the economy.

Setting monetary policy on inflation targeting

Regarding the role of the monetary policy, this is concretized in welfare maximization, implicitly contributing to supporting the sustainability of the economic growth by assuring the stability of the prices and of the national currency. Considering the instruments available to it, the monetary policy can determine the inflation level in the economy, yet it cannot directly influence the GDP level in the long term.

To determine the inflation level in the Romanian economy, NBR has adopted the strategy of directly targeting the inflation, reducing its level to one comparable to the European level, despite some trend variations.

Problem Statement

At present, the monetary policy of the central banks is faced with some challenges determined by the financial globalization phenomenon, on the background of an economy is marked by three coordinates, which have a substantial evolution, due to their dimension and implications: deregulation, disinter-mediation, departmentalization. All this creates asymmetries between financial systems and the impact of monetary policy. The international specialty literature has a series of theoretical studies to the monetary policy, under the impact of financial globalization, yet it has in view three possible mechanisms by which financial globalization can attack the efficiency of the monetary policy: economic activity level worldwide, international liquidity level and interest rates.

Due to the economic and financial changes caused by globalization, the central banks have targeted a main objective, namely price stability, therefore, of the objectives of unemployment reduction or production stimulation.

Some developed countries (Canada and Sweden) use, as a direct objective of monetary policy, a foreseen level of inflation without keeping track of this objective amongst other intermediate objectives, in terms of independence of the Central Bank (Zăpodeanu, 2002).

The monetary policy in the context of financial globalization

The central banks have been given an impetus by the financial globalization, in implementing successful internal monetary policies. These policies have been substantiated in an increasing number of academic studies, which concluded that financial globalization does not diminish the central national banks’ capacity to control the inflation (Mureșan, Chirleșan, Roman, 2011).

The evolution of the economic activity worldwide has been marked by the uncertainties regarding the world economic increase and the divergence of the monetary policies of the main central banks, uncertainties that accentuated the global risk, a risk to which Romania is exposed as well.

The evolutions that occurred on the international financial markets have been characterized by a decrease of the volatility of the capital market in the European area (the volatility index of the European capital market, VSTOXX, descended for a short period under the value of 20%, for the first time since 2007) and of the risk prime for the titles emitted by the State, the aggravation of the geopolitical tensions, the divergence between the conducts of the monetary policies of the principal central banks of the world and the evolution of the oil price.

The recent and future macroeconomic context from the perspective of the monetary policy decision

At this moment, the perspectives of the economic-financial activity internationally reflect an improvement of the macroeconomic conditions, yet this improvement has not been constant regionally. This economic growth on a global level was 4 % and the estimate is 4.6% for the year 2016.

On the European level, a slight consolidation of the economic growth has been forecasted, these forecasts being for the following year of about 2%.

The community authorities have set as a goal for the year 2016, a more significant support of the economic growth, this objective becoming a priority. As principal measures of action, on the community level, in the framework of the exercise of coordination of the economic-financial policies have been proposed: a more invigorating bank crediting; a form of fiscal consolidation more useful to the economic growth; a promotion of a sustainable economic-financial growth; a reform on the public administration level.

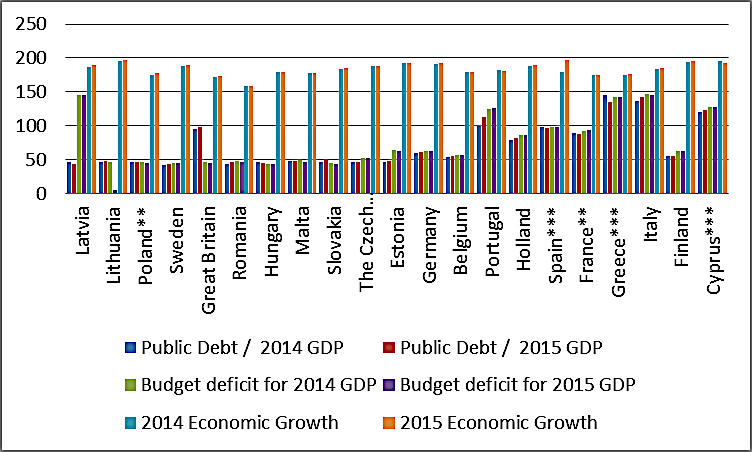

In this context, the European Community States undertook, beginning with 2014 and 2015, a series of programmes, whose aim was to increase the economic growth and also employment. Yet, these programmes have been conceived in relation to the continuation of the fiscal adjustments, according to the Stability and Growth Pact and the funding agreements concluded with IMF and the European Union.

Five EU Member States have funding agreements with the International Monetary Fund of the type: (i) extended funding facility in States such as Cyprus, Greece and Portugal; (ii) credit line in the case of Poland and (iii) preventive stand-by for Romania. Ireland, a country that in December 2013 finished the funding agreement with the international funding institutions, is at present during the period of post programme surveillance until it reimburses at least 75% of the 85 mld. Euro received.

One of the measures conceived as a solution was to transfer the fiscal burden that existed on the labour market towards domains such as real estate and environmental protection (in EC States such as Holland, Italy and France).

These efforts by which fiscal consolidation on the community level is desired have been substantiated in the exit, at the end of the year 2014 and the beginning of the year 2015, from the procedure of excessive deficit for six States (Bulgaria, the Czech Republic, Holland, Austria, Slovakia and Denmark).

It ought to be noticed that, at present there are 11 States (Graph

(2) beginning with September 2014, a negative nominal rate shall be applied to facilitate deposits and for the sums of the banks situated in accounts at the Central European Bank over the limit compared to the minimal obligatory reserve (the interest rate being of -0.2%) and by

(3) the use of a refunding programme also in the long-term for the credit institutions for the countries in the Euro zone (Targeted longer term refinancing operations TLTRO) which started on 18.09.2014, its aim being especially to stimulate the crediting of the real sector

Research Questions

The monetary policy realized by the National Bank of Romania has used an anti-cyclical behaviour, both before and after the beginning of the financial crisis on the global level, by which it oversaw the maintaining of the financial stability and the guarantee of an adequate environment for remaking the economic balances. Consequently, in times of economic expansion, NBR realized diverse operations in order to increase the rates of the minimal obligatory reserves and of the monetary policy interest, the severe change in the crediting conditions being characterized as a restrictive behaviour. On the other hand, in the economic recession stage, NBR turned to numerous decreases both of the monetary policy interest rate and of the minimal obligatory reserves rates, meant to encourage the aggregate demand.

According to econometric assessment, the interest rate of the bank loans is determined, by interest rate of deposits and by the minimum reserve ratio (Antohi, Udrea, Braun, 2003).

At present, the National Bank very carefully monitors the trajectory of the international economic-financial environment and eventual risks in relation to the financial sector, acting to maintain the prudential indicators of the national banking sector at a stable level.

One should note that any delay in the strong resuming of the economic-financial activities in the main States that are partners of Romania can trigger negative effects mainly on the level of the Romanian exports, in the context in which the market of the Euro zone will continue to remain in the future as well the sales market, as it represented for 2015 about 51%. Yet, lately, increases have been noticed regarding the diversification of Romania’s export markets; the national companies undertaking external trade activities continue to have a relatively good resistance to the eventual external shocks.

In the Romanian branches, the central bank continued to partially renew their funding lines, yet the process of disinter mediation, although under an intensified form, maintained its orderly character. A reduction of about 28% has been noticed for the period December 2014 - August 2015 to 12.6 billion. Euro of the exposure of the mother banks in relation to the headquarters of Romania.

This situation affected under a marginal form the crediting activity both of the population and of the companies, recording a reduced value, a value that was adjusted for the foreign currency exchange rate. One should note the fact that to register an intensity decrease for the disinter mediation process, it would be necessary to assure the access of the local banks to funding in foreign currency, especially in Euro, under the same form as the one granted to the mother banks.

The Romanian banks compensated the reduction of the funding sources from the outside by the increase of the resources attracted from the national level. The National Bank had in view to support the sustainable resuming of the crediting activity, which took place via monetary policies that aimed to: (1) decrease the minimal reserve rates for the deposits in national currency, (2) successively decrease the monetary policy interest rate down to 1.75%.

Purpose of the Study

In specialty literature are different approaches regarding the use of the transmission channels of monetary policy by the financial sector and the real economy through it. An example of a country in which empirical studies have identified one operation policy transmission channels of monetary policy is Germany, a modification of interest rate leading to a significant change of investment decisions (Siegfried, 2000).

The purpose of the study is the knowledge of the transmission mechanism of monetary policy of the central bank, tracking response of macroeconomic variables and market to changes in monetary policy, monitoring the dynamics and identify gaps temporary investigate quantity for the implementation and design an appropriate monetary policies.

In the present situation, the National Bank of Romania had the capacity to diminish the inflation rate by reducing the magnitude responses of different variables in terms of the monetary policy interest rate constantly transmitting signals to the banks regarding the cheaper crediting in national currency.

![Influence of the monetary policy interest rate on the evolution of the inflation rate level]](https://www.europeanproceedings.com/files/data/article/58/2085/MEPDEV2016FA020.fig.002.jpg)

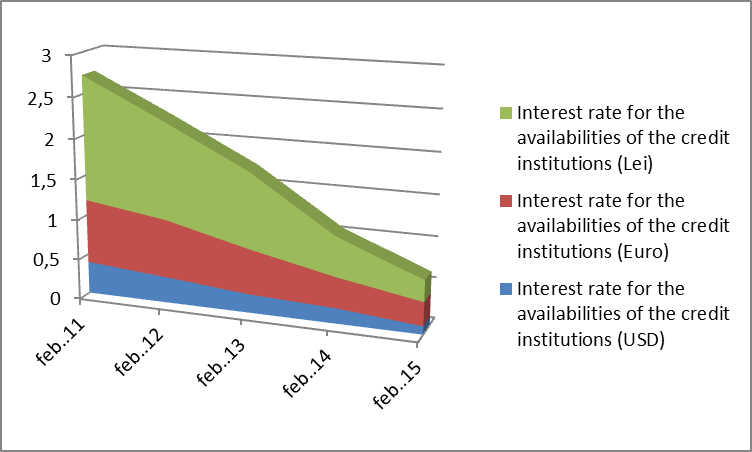

The analysis of the evolution of the interest rate for the availability of the credit institutions demonstrates the evolution in the same sense, i.e. decreasing, both for the national currency level and for the $ or € level.

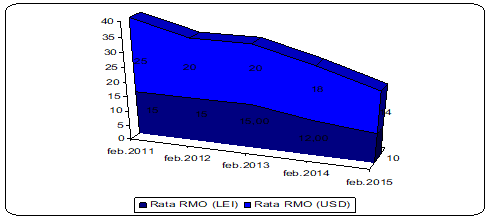

Thus, one can observe that in the above on the graph is mentioned that has been constant (15%), then in the year 2014 it went down by 3% reaching 12%, and in the year 2015 it reached the level of 10%.The most commonly-cited argument in the use of minimum reserve requirements is that this tool shows the precision with which the Monetary Authority controls the monetary supply, fulfilling its responsibilities and the maintenance of monetary stability (Dardac, Barbu, 2005).

Research Methods

The approach of this study is based on the characteristics of direct inflation targeting regime, the particularities and requirements necessary for its successful implementation. By comparing the results obtained with different models of inflation forecasting can be determined relatively good performance on a model semi-structural one get the additional value which he provides for makers of monetary policy embodied in the analyzes monetary policies previous periods in a frame. Why does the theoretical foundations and the possibility of performing experiments to identify the magnitude and direction of evolution of some macroeconomic variables to different shocks identifiable risk scenario.

Findings

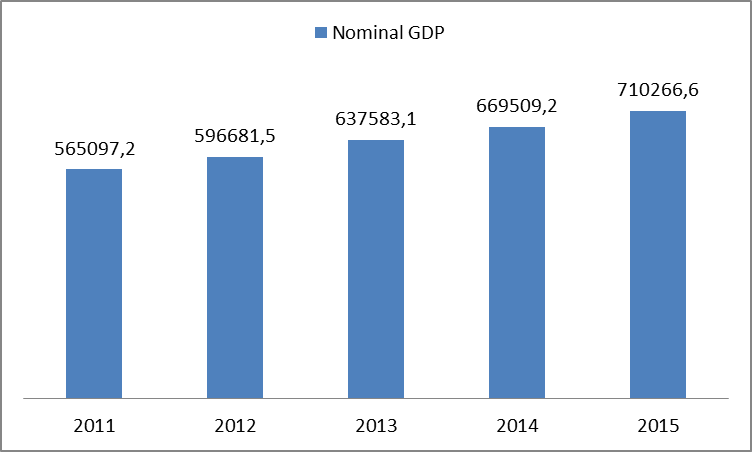

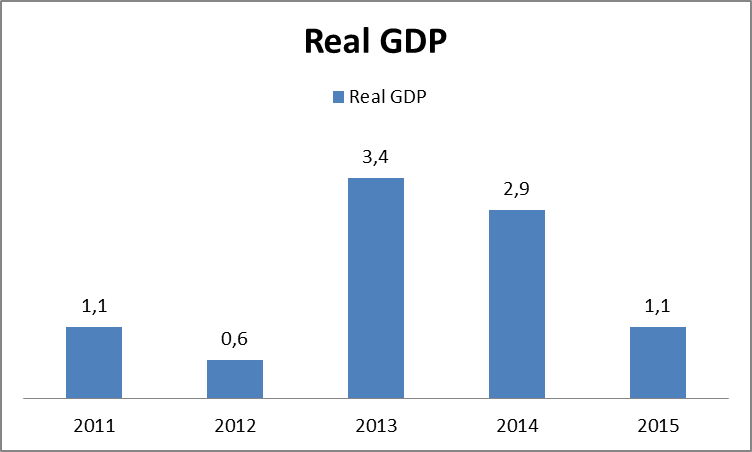

The model presented in case study can be substantially improved by adding the new variables that interact with the existing structure, variables of interest in terms of monetary policy makers. Consequently, one can affirm that by a control of the interest rate level by the monetary policy, of the minimal obligatory interest rates, of the exchange rate and by a management of the liquidity on the monetary market, the monetary policy can contribute to the economic growth. This growth can be analyzed following the evolution of the GDP level during the period 2011-2015.

The minimal rate of the obligatory reserve for the liabilities in lei of the credit institutions went down from 15% during the years 2011, 2012 and 2013 to respectively 12% in 2014, and 10% in 2015 and the rate of the minimal obligatory reserves applicable to the liabilities in foreign currency went down to 18% from 20%, recording a new reduction of 16% at the end of 2014 and the beginning of 2015, and respectively 14% in 2015, a fact that determined the increase of the volume of sources available to allot new credits in the economy.

Regarding the evolution of the nominal GDP, it records a growing trend during the period under analysis, reaches the value of 565097.2 million and finally, in the year 2015, attains the value of 710266.6 million Ron.

As one can notice in the figure below, the real GDP recorded a value of 1.1% in the year 2011, and then in the year 2012 it went down to 0.6%, while the maximum value was attained in 2013 with a positive dynamics, namely 3.4 %, the performance being increased compared to the previous years, continuing in the same sense in the year 2014 as well, 2.9% yet with a decrease compared to the previous year, and then recording in the year 2015 the same value as in the year 2011.

Conclusion

In order to assure a sustainable economic growth and to create a stable macroeconomic framework, it is imperatively necessary to realize a periodical and methodical re-evaluation of the components constituting the transmission mechanism of the monetary policy, permitting the fast adoption of efficient decisions.

Romania’s financial stability is not autonomous, but represents a part and a result of a macroeconomic policies mix. Their implications on the countries of the EU periphery, especially on the non-euro countries, can materialize in the short run in capital exits and have had an impact on the exchange rate.

The positive results recorded by the national economy in the year 2015 must be supported by the application of a consistent mix of new policies by the National Bank of Romania.

References

- Antohi, D., Udrea, I., Braun, H. (2003). Mecanismul de transmisie a politicii monetare în Romania –BNR - Caiet de studii. Retrieved from http://www.bnro.ro/Caiete-de-studii-484.aspx.

- Mishkin, F., Bordes, C., Hautcœur, P.C., Lacoue-Labarthe, D. (2007). Monnaie, banque et marchés financiers. Paris: Pearson Education .

- Dardac, N., Barbu, T. (2005). Monedă, bănci şi politici monetare. Bucureşti: Editura Didactică şi Pedagogică.

- Mureșan, M., Chirleșan, D., Roman, A. (2011). Băncile, politica monetară și stabilitatea financiară sub impactul crizei globale actuale. Iași: Editura Junimea.

- Siegfried, N.A. (2000). Monetary policy and investment in Germany: microeconomic evidence for a German credit channel. Quantitative Macroeconomic Working Paper Series, 1/2000, University of Hamburg

- Zăpodeanu, D. (2002). Politici monetare. Cluj-Napoca: Dacia Publishing.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

30 July 2017

Article Doi

eBook ISBN

978-1-80296-026-6

Publisher

Future Academy

Volume

27

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-893

Subjects

Teacher training, teaching, teaching skills, teaching techniques,moral purpose of education, social purpose of education, counselling psychology

Cite this article as:

Drăgoi, V. E., & Preda, L. E. (2017). Orientation Of The Monetary Policy Of The Nbr In Simulating Econonmic Growth. In A. Sandu, T. Ciulei, & A. Frunza (Eds.), Multidimensional Education and Professional Development: Ethical Values, vol 27. European Proceedings of Social and Behavioural Sciences (pp. 150-158). Future Academy. https://doi.org/10.15405/epsbs.2017.07.03.21