Abstract

Finding a balance between centralization and decentralization of financial resources allocated between the branches of powers through the budget system is the pressing issue investigated in the current article. It demonstrates the advantages and disadvantages of centralization and decentralization of financial resources in a federal state. It is concluded that a balance of the federal system is important for a stable and equitable development of subordinate entities of a federation. This requires harmonization of interaction between the federal centre and subordinate entities of a federation in the allocation of financial resources. Tax competition and financial equalization are proposed as an instrument of harmonization. Usinga systematic approach to the analysis, the authors conclude that it is necessary to ensure a positive and negative feedback to find the balance of the federal system. The tax competition creates a positive feedback, providing a reinforcing effect on the federal system. Financial equalization creates a negative feedback, having a balancing effect on the federal system. The article proposes principles of harmonization of the interaction of the branches of powers in the allocation of financial resources.

Keywords: Decentralizationharmonizationbranches of powerfederalism

Introduction

The provision of public goods is an integral element of a state's activity. Financial resources created by society are allocated through the budget system of the state. The constitutions of federal states secure independent branches of powers vested with the responsibility for the provision of such goods and with powers to prepare and execute budgets independently.

The interests of representatives of various branches of powers in the distribution of resources do not always coincide. This is especially true during the crisis while the amount of financial resources is being reduced. It is therefore necessary to lay down the "rules of play", which would allow one to create conditions for balancing the interests of branches of powers in the formation of the budgets.

Taking into account that the mobilization of resources in the budget system of the state is carried out mainly by tax methods, an important role is played by the involvement of the taxpayers in issues of national and territorial values. This is the key to an effective replenishment of budgets.

For the purposes of this article, we will focus our attention on the harmonization of interaction of branches of powers in the allocation of financial resources in a federal state.

Problem statement

The issues of regulation of efficient allocation of limited resources between the branches of powers are the subject of the theory of fiscal federalism. It explains that there are different sub-national levels of government: "... fiscal federalism is an economic theory, and this theory tries to explain, in economic terms, the existence of different sub central levels of government" (Fossati, & Panella, 1999).

The main analytical task of fiscal federalism is to determine the respective powers and revenue sources, which should be assigned to the different levels of government. This is aimed to be an effective solution to the problem of allocation of limited resources through political mechanisms of collective decision-making.

There are empirical studies on finding of an optimal ratio of centralization and decentralization of financial resources as a condition for harmonizing the interests of federal and subfederal governments (Gemmell, & Kneller, & Sanz, 2013) etc. There is a large number of scientific pape rs, which state that the decentralization of revenue powers of government and management authorities contributes to the increase of public welfare Musgrave, (1961), Oates, (1972, 1968), Olson, (1969), Tiebout, (1956), Gilbert, & Picard, (1996), Bikker, & Linde,( 2015). However, there is no universal recipe to achieve a balance of branches of powers’ interest in the allocation of financial resources through the budget system of the state. Generally, the aggravation of the financial and social problems requires increased centralization. At the same time, the responsibility of subnational governments often includes social protection, educational services, housing and environmental protection.

Traditionally, Russian scientific literature considers fiscal relations in a federal state from the standpoint of inter-budgetary relations and places the main emphasis on the problems of income redistribution between the links of the budget system (Polak, 2012). In this formulation, the problems of fiscal relations are seen as part of the financial relations on the formation of budgets, and not as a financial relationship between the federal and sub federal levels of government concentrating the funds needed to ensure the financial functions of a federal state in their budgets.

The analysis of the financial maintenance of functioning of lower levels authorities, their interaction with the federal branches of powers on the formation of regional budgets is limited to the analysis of the following: the composition and the structure of the budget revenues, the peculiarities of financial equalization through the mechanism of inter-budgetary transfers, the achievement of the regions’ tax potential. As a result, the majority of researchers while formulating recommendations to improve fiscal relations do not take into account issues related with optimization of the structure of public goods, combination of tax interest of branches of powers, separation of taxation powersand the formation of the institute of financial equalization.

Research questions

Management levels are endowed with certain powers to carry out their constitutional tasks and functions. To ensure a stable and equitable development, the following triad should be taken into account: "function-powers-resources". In other words, each level of management should ensure the implementation of its functions, and for that, it should be given certain powers and have the necessary and sufficient resources.

A particular branch of power must be able to influence the sources of financial resources needed for the performance of its functions. This fact explains the need for decentralization of financial resources.

However, not all subordinate entities of a federation have sufficient potential to cover the costs from its own revenues. The federal centre provides them with non-repayable aid from the federal budget, centralizing the financial resources at the federal level. Due to large differences between the levels of socioeconomic development of the subordinate entities of a federation, no federal state can rule out financial equalization through the centralization of financial resources.

In this regard, the question on searching and finding the optimum ratio of centralization and decentralization of financial resources arises.

An important condition for improving the efficiency of the allocation of limited resources is to ensure equality of marginal utility of consumption of local public goods (pure local public goods) and marginal costs associated with the tax payment. Such approach brings up the issue of accountability and responsibility of the public authorities to their constituents for the results of economic activities within their territory. As a result, the problem of tax competition between branches of powers becomes urgent.

Purpose of the study

The purpose of this article is to identify the advantages and disadvantages of centralization and decentralization of limited financial resources in the budget system of a federal state.

In order to achieve fairness in the distribution of financial resources between thebranches of powers, mechanisms that ensure the harmonious combination of the federal centre’s and the subfederal governments’ interests in the formation of their budgets are necessary.

Research methods

To achieve the above-mentioned purpose in the process of the study, general scientific methods (system analysis, observation, description and generalization) and specific scientific methods (comparisonand grouping) were used.

Findings

The centralization of financial resources at the federal level allows one to neutralize the inequality at the level of household income and assets, and to ensure macroeconomic stability, particularly in times of crisis. The centralization helps to mobilize financial resources for the rapid recovery of the economy. This is proved by the following: the experience of industrialization in the Soviet Union, the implementation of the Marshall Plan in Europe after World War II, the advances of modern China.

The disadvantage of budget centralization is that the dependence of budget revenues on the tax bases is replaced by the dependence on non-repayable transfers.

A high degree of centralization of tax powers and revenues at the federal level prevents the development of tax competition. Due to this, excessive centralization of financial resources at the federal level does not create incentives to increase tax revenues at the subnational level.

Tax competition to attract mobile factors of production in certain areas encourages fair funding distribution policy. We can assume that tax competition is an instrument of harmonizing the interaction of branches of powers, as it allows laying down the "rules of play". Competition should not be taken as some kind of confrontation between the constituent parts of the federation. On the contrary, the competition for the taxpayer encourages branches of power to interact over the development, harmonization and coordination of tax policy.

There are three leading theories, exploring tax competition (Pinskaya, 2010):

1. The theory of tax competition basing on the neoclassical model of competition, originating from the theory of oligopolistic competition. According to the neoclassical model of tax competition priority should be given to the centralization of tax powers. Competition entails establishing the price for the good equal to marginal cost. In the context of tax competition, decentralization leads to an unjustified reduction of taxes to the level clearly lower than the cost of production of public goods.

2. The theory of “sorting by Tiebout” (Tiebout sorting), basing on the principles of neoinstitutional economy. The main conclusion of the sorting by Tie bout is the necessity of decentralization of financial resources. Decentralization allows subnational entities to adapt the offer of local public goods to the needs of voters, that is to create the conditions for an optimal "sorting".

3. The theory of "taming of Leviathan", basing on the idea of the neoinstitutional model of interaction of economics and politics. The "monster" Leviathan is known as an absolute ruler, omniscient dictator, wisely ruling the country in the interests of his subjects. Thomas Hobbes in his treatise of the same name represented the state as Leviathan. Proponents of this theory insist on decentralization of financial resources, which allows neutralizing the "pressure" on the government officials and politicians from investors.

The decentralization of financial resources allows neutralizing the financial dependency of sub federal governments on the federal government, since it establishes the dependence of the replenishment of budget income on taxpayers. By providing local public goods in exchange for tax payment, sub federal authorities are interested in the highest output from financial resources at their disposal.

The prerequisites for decentralization of financial resources are pure local public goods which have limited benefit area. Only a part of the population living within a given territory has an access to these resources. If taxpayers are the same people who receive benefits from the local public goods provided by the government, decentralization of financial resources is justified. Another argument in favour of decentralization is the mobility of economic agents, their ability to choose the territory to live and work on, reasoning from the personal assessment of the benefits and costs.

Decentralization contributes to the increase of economic efficiency of the allocation of limited resources, on condition that taxpayers’ public control is enhanced. Control effectiveness is increased by the participation of the citizens in the implementation of projects of participatory budgeting. Participatory budgeting requires the participation of citizens in decisions about the choice of priorities of budget spending. The pioneers of Participatory Budgeting projects are residents of the Brazilian city of Porto Alegre (Wyngowski, 2013). Currently, these projects are being implemented in Azerbaijan, Argentina, Armenia, Vietnam, Germany, Iceland, Spain, Colombia, Peru, Poland, Portugal, Kyrgyzstan and China. In the Russian Federation, such projects have been developed since 2007. The support for civic initiatives is carried out in the form of budget subsidies provided from the subfederal budget on a competitive basis. The remaining amount needed for the project is contributed by the municipality, the business community and the citizens. Projects implemented as part of participatory budgeting include: the repairs of a roadway in a residential area, the installation of children's sports and playgrounds, the repairs of street lighting networks, fencing municipal waste landfills and others.

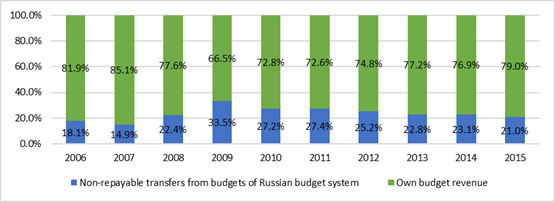

Harmonization of the interaction between levels of government is achieved not only at the expense of balancing the interests of the federal and sub federal governments, but also by financial equalization, that can neutralize differences in socio-economic development of the subordinate entities of a federation. Sub federal budgets are formed not only from their own income, but also from inter-budgetary transfers from the federal budget, and in the Russian Federation, the share of the latter is significant – about 1/5 of revenues on average (Figure

The more powers are entrusted to the federal authorities, the harder it is to balance the disparities in the levels of development of subordinate entities of a federation. The levelling of economic development of subordinate entities of a federation which are not homogeneous in their economic well-being should be based on financial equalization, not only vertically (through the inter-budgetary transfer mechanism), but also horizontally (through the allocation of the tax base for a certain branch of power). The institute of financial equalization makes it possible to even out the marginal utility of income at the inter-regional level. Such horizontal levelling systems initiate the increase of autonomy and responsibility of sub federal authorities in the formation of territory budgets.

To optimize the allocation of limited financial resources, it is expedient to adhere to the principle of subsidiarity in the formation and execution of budgets. The essence of this principle consists in the allocation of functions between branches of powers in such a way that the higher levels of government are only charged with those functions that they could perform better than the lower authority levels.

In this regard, we believe that the federal branch of power should deal with the issues of sustainable and equitable development or, in other words, of creating the conditions for macroeconomic stability and social justice. As a general rule, the establishment of taxes on mobile factors of production, natural resources and foreign trade is the prerogative of the federal government. Subfederal budgets are formed at the expense of taxes, the tax base of which is allocated uniformly on the territory of the state and is relatively stable and immobile. These taxes include first of all property tax and income tax.

The problems of adjustment of market mechanism disadvantages in the process of distribution of resources at the expense of satisfying individuals’ social wants other than their private wants should be solved at the subnational level of government. Tax dodgers cannot be excluded from the number of recipients of public benefits (in the form of educational and cultural services and social protection of the population). The increasing role of taxes in the formation of sub federal budgets forms the way for the so-called capitalization of the tax when taxpayers act as rational consumers: when they choose a place of residence (of economic activity) they compare the provided local public goods with the level of the tax burden.

It should be taken into account that the efficiency of the allocation of limited financial resources is directly dependent on the compliance of a specific type of tax with the nature of the problems to be solved at the sub federal level of government.

The main criteria for the division of taxes between the levels of the budget system can be: the uniform distribution of the tax base; the "risk potential" of the tax; the targeting of the tax (the ability of taxpayers to control tax revenue expenditures), the ability to export the tax burden from the territory.

Conclusion

Sustainable and equitable development of the subordinate entities of a federation in a federal state is ensured by the balance of the federal system. Such balance may be achieved through the interaction of branches of power. The tools of harmonization must, on the one hand, provide a reinforcing effect on the system, creating a positive feedback; on the other hand, they must have a balancing effect on the system, creating a negative feedback. Tax competition can provide reinforcing effects on regional initiative to strengthen their budgets, creating a positive feedback. The institute of financial equalization evens out the levels of economic development of subordinate entities of a federation in the federal state and therefore has a balancing effect on the federal system creating a negative feedback.

In order to harmonize fiscal relations, their formation should be based on the following principles:

development and implementation of management decisions to provide everybranch of power with the necessary and sufficient resources to carry out their functions;

coordinated and orderly operation of public entities in fiscal relations, including their cooperation and shared responsibility and a clear distinction between their tax and budgetary powers;

mutual coordination of interests and actions of the representatives of authorities on the formation of budget revenues;

respect for the rights of taxpayers by authorities and execution of duties by taxpayers in the mobilization of tax revenues in the budgets of the relevant public entities.

Acknowledgement

This article has been prepared under financial support of the Russian humanitarian scientific Fund (grant № 15-22-01004), which authors gratefully acknowledge.

References

- Bikker, J.A., & Linde, D. (2015). The optimum size of local public administration. Utrecht School of Economics,Discussion Paper Series, 23.

- Fossati, A., & Panella, G. (1999). Fiscal Federalism in the European Union. London-NewYork: Routledge, 302.

- Gemmell, N., Kneller, R. &, Sanz, I. (2013). Fiscal decentralization and economic growth: spending versus revenue decentralization. Economic Inquiry, 51 (4), 1915-1931.

- Gilbert, G., & Picard, P. (1996). Incentives and optimal size of local jurisdictions. European Economic Review, 40, 19-41.

- Musgrave, R. (1961). Approaches to a fiscal theory of political federalism. NBER, Public Finance: Needs, Sources and Utilization. NJ: Princeton University Press, Princeton, 97-133.

- Oates, W. (1968). The theory of public finance in a federal system. Canadian Journal of Economics, 1, 37-54.

- Oates, W. (1972). Fiscal Federalism. New York: Harcourt Brace Jovanovich, 256 .

- Olson, М. (1969). The Principle of "Fiscal Equivalence": The Division of Responsibilities among Different Levels of Government. The American Economic Review, 59 (2), 479-487.

- Pinskaya, M.R. (2010). The impact of tax competition on the formation of tax federalism models. Vestnik UGTU-UPI, 4, 138-143.

- Tiebout, C.M. (1956). A pure theory of local expenditures. Journal of Political Economy, 64, 416-424.

- Wyngowski, S. (2013). Local Participation in Brazil: Porto Alegreets in the r 21st Century Local Government. Journal of Communication, Culture and Technology, Georgetown University, December. Retrieved from http:// www.gnovisjournal.org/2013/12/11/local-participation-in-brazil-porto-alegres-model-for-21st-century-local-government/.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

20 July 2017

Article Doi

eBook ISBN

978-1-80296-025-9

Publisher

Future Academy

Volume

26

Print ISBN (optional)

Edition Number

1st Edition

Pages

1-1055

Subjects

Business, public relations, innovation, competition

Cite this article as:

Pinskaya, M., Goncharenko, L., & Donchenko, V. (2017). Harmonization Of Allocation Of Financial Resources In A Federal State. In K. Anna Yurevna, A. Igor Borisovich, W. Martin de Jong, & M. Nikita Vladimirovich (Eds.), Responsible Research and Innovation, vol 26. European Proceedings of Social and Behavioural Sciences (pp. 745-751). Future Academy. https://doi.org/10.15405/epsbs.2017.07.02.96