Abstract

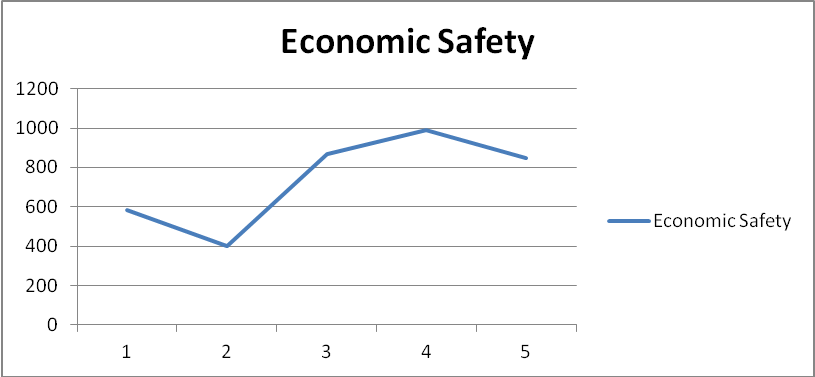

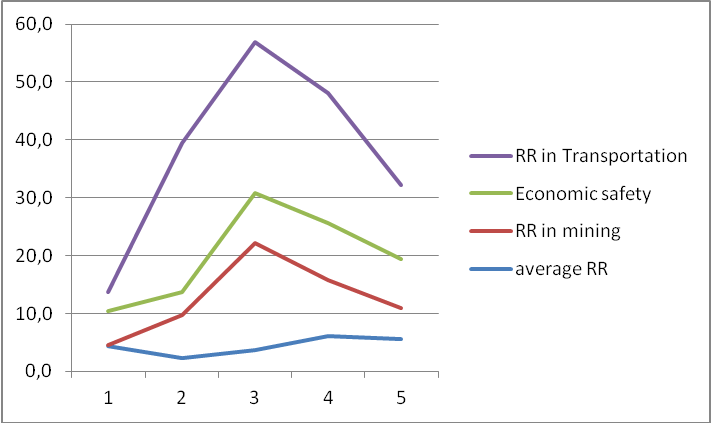

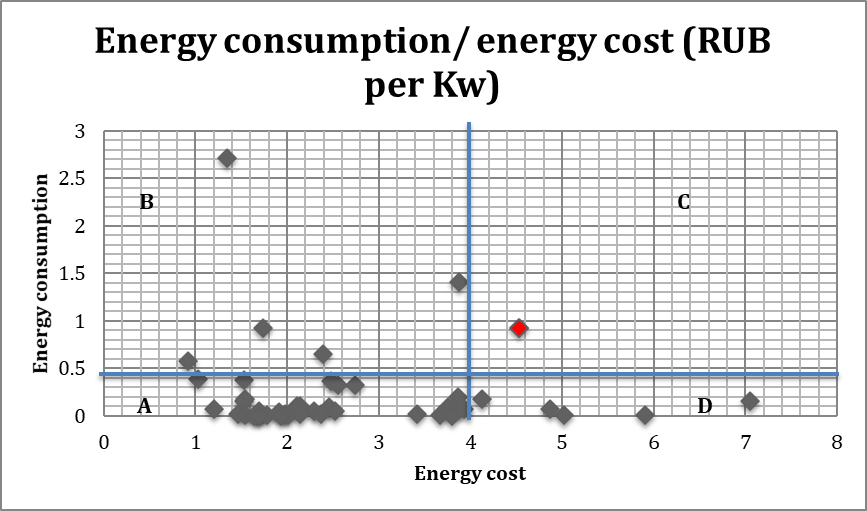

The article explores the issue of economic safety and the method of measuring it through the gross regional product structure, GRP being the main indicator of economic performance of a region. The GRP structure is being analyzed through rates of return in the regional specialization industry. The regional specialization is assessed through location quotients. Main theoretic concepts are argued and illustrated by the example of Transbaikal region of Russia, a region in extremely unsafe economic conditions. Economic safety of Transbaikal region is declining and correlates with performance of specialization industry, which is mining. The hypothesis of energy costs influence on regional economic safety is explored. Regions with high energy costs in the structure of total production costs are backward in economic performance, which is influenced by the energy-output ratio and access to cheap energy sources. The idea is illustrated by allocation of regions of Russia on a plot chart of energy cost to consumption.

Keywords: Economic safetyregional developmentregional specialization

Introduction

The notion of economic safety has been viewed mostly from the point of microeconomics and bankruptcy risks, employment and living standard or even protection from criminal issues. At the regional level, economic safety has been either associated with competitiveness or has not been explored at all. This paper attempts to explore the notion of regional economic safety and its measurement resulting in a definition of regional economic safety and factors influencing it. Economic performance of a region is viewed as the main indicator of economic safety. The need for such definition and measurement is urgent due to the fact that regional authorities seeking a course of economic policy often highlight the goal of ensuring economic safety, though there is lack of consistency as to what indicators to choose or what measures to attain. Thus, there has to be a common understanding of the term ‘regional economic safety’ and, more importantly, there has to be a method of defining main threats to it.

Review of literature and choice of terminology

This paper specifically uses the term ‘economic safety’ with reference to a regional economy, avoiding the term of economic security. Though apart from economics, the two terms ‘safety’ and ‘security’ could be used interchangeably, the issue of correctness of their usage has been urgent in some other areas for decades.

Individually, two words ‘safety’ and ‘security’ have the following definitions in the dictionaries:

Three dictionaries out of three define safety as a state and two of them define security as protection or protective measures (or activities); two dictionaries specify the relationship between the two terms which we can explain as follows: security implies the measures taken to ensure safety, safety is defined as a state of being free from danger of any kind.

This idea was proved by analyses conducted in specific fields of study, apart from economics, i.e. A. Burns, et al., (1991) consider the distinction between the terms 'safety' and 'security' in computer technology. In terms of differences in the causal structure and in terms of differences in the degree of harm caused, they found that the difference between security and safety lies within the fact that ‘security’ implies protection or defense.

It should be noted that in economics, the term ‘safety’ is underused, and most of the research papers and other types of publications explore ‘economic security’ at three basic levels - an individual, an enterprise, and a territory (mainly a nation).

Hirschman (1945) and Baldwin (1980) viewed a nation’s economic security as security from manipulation by other governments and economic insecurity as vulnerability to other states. Kahler (2006) argues that security is a state of being free from harmful effects of globalization.

Hacker, et al., (2012) claim that economic security is the degree to which individuals are protected against hardship causing economic losses. Liutak, and Kravchuk (2013) use the terms interchangeably at the corporate level, implying the state of being protected from external risks.

Thus we can conclude that, regardless of field and level, the term ‘security’ has the connotation of ‘protection’ from harm, danger or risk, namely, the state of being protected or the measures to ensure that protection and safety are the overall state of being free (not necessarily absolutely exempt but most probably ‘protected’) from harm, danger or risk. We will employ these differences and use the terms ‘economic safety’ and ‘economic security’ separately but in the same equation:

Economic safety is the state of an economic system of being free (or protected) from threats. Economic security is the way to ensure the economic safety. Threat is an aggregate of conditions and factors preventing the realization of economic interests.

Thus economic safety is the state of an economic system characterized by an aggregate of conditions and factors favorable for realization of economic interests.

And if economic interests range from economic survival, to economic stability and economic prosperity, so the threats can vary depending on realization of the kind of interest they can be an obstacle to. So we can classify the threats into three levels, also depending on the extent of their influence. A phenomenon resulting in a drastic drop of basic economic indicators is a serious threat if the indicators change negatively but not sharply, it is a threat to stability; and if a threat hinders the growth, it is a threat to development (or growth).

We assume this terminology applicable for every level of economic activity: individual, corporate, and national. But we also assert that there should be other levels – regional or global, depending on the territory over which the economic system extends. So we are going to use this terminology at the regional level, regional economy being a part of national economy.

Methods

Currently, there are two main approaches to measure regional economic safety: criterial assessment (Abalkin, 1994) and assessment of main economic indicators (Orlov, 1995). Both methods use an integrated index of multiple factors including economic, social, and demographic indicators.

Orlov (1995), defines them as follows:

-economic indicators: GRP per capita, investment activity, R&D activity, budget balance, and trade balance.

-social indicators: poverty rate, social gap, unemployment rate.

-demographic indicators: life expectancy, migration balance.

On the one hand, this kind of assessment seems to be too complicated and, on the other hand, the point in time for different indicators may be different. Here, to measure economic safety, we will have to refer to two time periods: short-term economic safety, defined by immediate yearly measurements (GRP and investment), and long-term economic safety, defined by long-standing indicators (social and demographic).

For a short-term analysis, it is necessary to use a yearly indicator of economic performance of a region. In this paper, we claim that the economic performance of a region over time is the main indicator of economic safety. Threats tend to disrupt the economic performance, thus, lower economic safety is indicated by low measures of economic performance indicators. Identifying the threats and their level of influence is a key step in stabilizing regional economies. The basic indicator of regional performance is agreed to be the gross regional product (GRP) and GRP per capita altogether with growth patterns over a period of time. Overall economic activity, the number of enterprises, employment, average salary, and investments also have been viewed as indicators of economic performance.

We consider Gross Regional Product (GRP in Russian economic science terminology) or Nominal gross value added (GVA in European terminology) as a viable indicator of regional economic performance, for it demonstrates total economic efficiency of regional economy over time. It provides a value for the amount of goods and services that have been produced in the economy minus the cost of all inputs and raw materials that are directly attributable to that production. Thus, threats to economic performance are the factors that make GRP rise or fall, and these factors can be identified through factor analysis.

As GRP is the value of all final goods and services produced within a region in a given year, we should investigate why this value may decrease or why its growth has not been sufficient. Thus, we are coming to a conclusion about the following aspects or sources of threat. As viewed from the structure of the GRP, it is logical to assume that any decrease in an industry’s output will also be a threat to economic safety. But not any industry’s performance causes drastic changes in GRP. It should be viewed in connection with the industry’s share in overall economic performance. An industry which takes a substantial share of GRP can be solely responsible for a GRP change.

So, the decline in some industries’ performance can have much higher effect on overall economic performance of a region. Some industries can be extremely successful and still will have no effect on economic safety. The value created within some industries can be increased greatly when products are sold not on local markets but are exported. Such industries are the areas of regional economy specialization. Exporting industries are specialization industries, and the ones with product used only locally are local supporting industries or infrastructural industries.

Drastic changes in GRP may be also caused by insufficient value added measures in the above-mentioned industries. Added value is directly connected to profitability. If specialization industries do not create enough added value, it will also be a threat to economic safety of a region.

Results

If a Gross regional product is a combination of added value created in different industries, then economic safety depends on the structure of GRP. Russian statistics defines sixteen industries within an economy: agriculture, forestry and hunting, fishery, mining, manufacturing, utility, construction, retail and wholesale, hotels and restaurants, transportation and communication, financial activities, real estate, public administration and military office, education, healthcare and social care, other services, and households. These industries have different contribution to GRP. And these industries need to be grouped into specialization and local industries. Logically, GRP of a certain period of time should be higher than GRP of the previous period (discounted).

If a gross regional product is a sum of added values (

.(1)

But it is the structure of the GRP that is of importance in measuring economic safety (

= + + + ….+ ,(2)

where

ADVs are added value measures in certain industries, or as ADV depends on profitability, these will be

Introducing areas of specialization into the formula, we get the logic of measuring economic safety:

= +x ;(3)

> ,

Where

In the economic safety model, the weighs attributed to the industry indicators will be constant. Indicators will be grouped into three categories: local infrastructural industries (8 industries), potential specialization (agriculture and manufacturing) and mining (a specialization industry). These groups will have different levels of significance for regional economic safety; to show this significance the weight of the area of specialization will be multiplied by the average measures of their locality quotients:

= + x + x + x(4)

= 78.1 +5.7x +8.7 x +4.7 x ;(5)

= 78.1 + 5.7×1.7 +8.7×2.6 +4.7×0.36 . (6)

Variable measures in the model are the average rate of return data on industries in a given year. These industries average yearly rates of return as a measure of added value has not been stable over years (see Table

Comparing the dynamics of economic safety with dynamics of rates of return in industries, we can see that there is strong correlation between rates of return in mining and economic safety measure.

Thus, we can conclude that economic safety is closely related to economic performance of regional specialization industry and, namely, the average yearly rates of return of that industry.

Discussion

We need to explore deeper reasons behind the poor performance of mining in the region. Mining in the region depends on internal and external factors. External factors include first of all the world market prices on extracted resources, as well as some political and environmental issues and regulations within the industry at the national level. These factors may be threats to industry’s development, thus being threats to regional economic safety. These threats arise from both outer and inner environments of the economy, for instance political issues, legislation, international affairs etc., and they can be classified by their gravity and affectability. Therefore, they can cause very serious effects for the economy reflected in a drastic fall of basic economic indicators, they can be obstacles to realization of the economic potential of the industry and the region.

Climatic conditions affect the economic performance greatly, but we have noticed that this kind of influence does not come from every direction. Harsh though climatic conditions may be, the economy can still perform greatly and be highly independent and self-sufficient. In our opinion, the main economically perceptible effect of the climatic conditions is the following: economies based on production (with an area of specialization based on production of certain goods) depend on the supply and cost of energy. Regional economies may have different areas of specialization, but if the region specializes in a certain kind of industry with high energy consumption, then the region’s economy will depend on the cost of energy supply, which in turn depends on the availability of cheap energy sources (hydropower, nuclear power). The other way climate impacts the economy is also connected with energy consumption and costs, it is central heating infrastructure and subsequent costs. So in colder climates, heating constitutes a substantial part of GRP. This means regions with colder climates need to have an access to cheaper energy sources to survive, otherwise the economy will perform poorly, production costs for goods and services will be higher which will result either in lower rates of return or loss of competitiveness in outer markets.

This kind of dependence of economic safety on energy cost and consumption in the region can be shown on a scatter plot chart with energy costs marked on the horizontal axis and energy consumption marked on the vertical axis with resulting zones of scattered dots representing different regions of the Russian Federation.

The graph field thus can be divided into areas with different levels of threat from the energy factor; the area with high-energy costs and high-energy consumption will be the gravest threat to regional economy. The area with both indicators low will be a favorable condition.

Area A is extremely favorable; it combines cheap energy and low consumption. These are regions with warmer climates and advancement of less power consuming industries (e.g. Moscow and Moscow region).

Area B is less favorable; here there are regions with colder climate, but still developed power-consuming industries and access to cheaper energy (Tyumen region).

Area C is unfavorable, as it features high energy costs and power consuming industries (Transbaikal region).

Area D is also unfavorable; it features extremely high cost of energy altogether with energy efficient industries.

The C area is least favorable because it combines both high energy consumption and high energy cost. Industries in this area are less likely to succeed and companies in order to break through even have to raise the prices, thus making their goods uncompetitive.

The economy of Transbaikal region is in highly dangerous situation because there is no access to cheaper energy sources; all the energy produced in the region comes from coal burning power plants which is not only expensive but also ecologically unsound. At the same time, the area of specialization in the region is mining, namely metal ore mining and processing, and it is one of the most energy inefficient industries, besides the temperatures in the region are low most of the year (9 months) and so all kinds of premises need a lot of heating.

Moving from one energy factor area to another would be favorable and the key factor in moving is technology and investment. This dangerous situation has recently resulted in a chain of bankruptcies of specialization enterprises and rising levels of unemployment, population loss etc. Some mining enterprises even claim that the production costs of their goods are higher than those in global market, which makes their goods not only uncompetitive but even unprofitable.

References

- Abalkin, L.I. (1994). Economic security of Russia: threats and prevention. VoprosyEconomiki, 12, 4-13.

- Baldwin, D.A. (1980). Interdependence and Power: A Conceptual Analysis. International Organization, 34,471–506.

- Burns A., McDermid J., & Dobson J. (1991). On the Meaning of Safety and Security.The computer journal, 35(1), 3-15.

- Federal State Statistics Service of Russian Federation, Retrieved from http://www.gks.ru

- Hacker, J.S., Huber G., Nickols A., Rehm P., Schlesinger M., Valetta R.G., & Stuart.C. (2012). The Economic Security Index: A New Measure for Research and Policy Analysis. Federal Reserve Bank of San Francisco Working Paper Series, Retrieved from http://www.frbsf.org/publications/ economics/papers/2012/wp12-21bk.pdf

- Hirschman, A.O. (1980). National Power and the Structure of Foreign Trade. Reprint, Berkeley: University of California Press. nternational Economic Statistics Database. Retrieved from statinfo.biz

- Kahler, M. (2006). Economic security in an era of globalization: definition and provision. Globalisation and economic security in East Asia: governance and institutions. Routledge, 1, 23-39

- Liutak, O., Kravchuk, O. (2013). Economic security of enterprises in the Context of national safety of the state. Rocznik Bezpieczeństwa Międzynarodowego, 2013, 41-49.

- Longman English Dictionary Online. (2016). Retrieved from http://www.ldoceonline.com

- Merriam-Webster Online Dictionary. (2016). Retrieved from http://www.merriam-webster.com

- Orlov, A. (1995). Social sphere threats: diagnostics and prevention. Voprosy Economiki, 1, 107-119.

- Oxford Dictionary Online. (2016). Retrieved from http://www.oxforddictionaries.com

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

20 July 2017

Article Doi

eBook ISBN

978-1-80296-025-9

Publisher

Future Academy

Volume

26

Print ISBN (optional)

Edition Number

1st Edition

Pages

1-1055

Subjects

Business, public relations, innovation, competition

Cite this article as:

Maga, A. A. (2017). Measuring Regional Economic Safety: Evidence from Transbaikal Region of Russia. In K. Anna Yurevna, A. Igor Borisovich, W. Martin de Jong, & M. Nikita Vladimirovich (Eds.), Responsible Research and Innovation, vol 26. European Proceedings of Social and Behavioural Sciences (pp. 581-589). Future Academy. https://doi.org/10.15405/epsbs.2017.07.02.74