Abstract

Intensification of competitive struggle in the market determines the topicality of the problem of competitive advantages of the social and economic policies of industrial companies via price formation and developing price strategies of the companies. In order to meet the requirements of the time, most modern concepts of competitive advantages related to development of methodology and the model of price differentiation are starting to gradually “grow” out of the limitations of traditional approaches used in perspective and strategy planning. To form the competitive advantages of the social and economic policies of an industrial company, we apply an economic-mathematical model in the given paper. Our choice of this model as the means of research is explained by the fact that this methodological approach based on the estimations of competitiveness levels of manufactured and competing production of innovative companies with application of automated tools is necessary and promising as, for the first time, it allows studying the issues of innovative development on the base of formalized description of consumer and producer behavior combining two large theories of modern economics – the competiveness theory and that of economic equilibrium. A model of engineering products consumption based on the method of price diversification is suggested. The method takes into account an actual price of a product, producer’s profit, usefulness of a product and the like. It serves as an indicator of competitive price reserve of an enterprise.

Keywords: The Model of engineering products consumptionthe stock price competitiveness of the enterpriseprice diversificationproducer’s profit

Introduction

Social and economic policy of a municipality is implemented with consideration to the concept of formation of the institution of social partnership between the companies, the population and the municipal authorities characterized by:

the population of the town as a domestic consumer of the whole complex of social services;

the domestic product of the municipal government – creating decent living conditions for the people in terms of meeting their social and domestic needs and ensuring a sufficient amount of jobs;

the basis for successful social and economic development of the social and production complex of the town is partnership of business entities, the municipal government and people.

An active introduction of social partnership requires synthesis of social and industrial policy in development of the municipality. The modern industrial policy of market economy involves creating an efficient innovative system (national, regional and, finally, municipal). That is why, the authors of the paper accepting the concept “social partnership of people, companies and municipal government” supposing direct constructive interaction between the owners, managers, workers of the company, citizens of the town, the municipal government to create the municipal industrial-innovative complex, besides the institution of social partnership, will also base on the method of competitive advantages formation of the industrial enterprises of the municipal industrial-innovative complex by means of:

differentiation of prices for the innovative products basing on the economic-mathematical model allowing determination of the price policy for the equal in quality goods depending on the paying capacity of consumers so as not to lose the market share and to have such total sales revenue that allows realizing the profit (Trifonov et. al., 2014);

organization of efficient interaction of the innovative company with the government regulatory agencies, business environment and educational institutions, improving the competitiveness of the economic entity and contributing to the company coming to the fore at the markets of innovations and goods (Loshchilova et. al., 2015).

Methods

Innovative-technological development creates the necessary objective opportunities for increasing the competitive advantages of industrial enterprises. Having the practical application in view which requires scientifically-based methodological recommendations to increase the efficiency of industrial enterprises potential application, accelerate their technological development, there is an objective necessity for business adaptation to the needs of the certain consumer groups.

Modern engineering enterprises introduce new products and technologies, re-equip production and improve human resources and social policy. Finding a competitive advantage, they increase their resistance to macro-economic changes and are able to operate on today’s market.

At the heart of industry competition is the desire of enterprises to obtain the maximum profit, to find the most profitable spheres of capital investment and to improve the quality of goods and services. The economic theory evaluates the level of compatibility of machine-building enterprises in a given market according to the quality and the price of their goods. In Russia, under the conditions of developing market relations, the majority of domestic machine-building enterprises are not ready for active competition not only in the world, but also in the home market. This situation is typical of many allied branches of engineering.

Authors of a number of works, devoted to competitive struggle of enterprises for markets (Prokopenko et. al., 2014; Tceplit et. al., 2014), propose an efficient management technology which consists in the industrial producer management based on a consumption pattern involving diversification of prices on engineering products. It is aimed at eliminating barriers to sales of enterprise products, increasing the market share and competitiveness of the enterprise and stimulating the demand for its products.

Results

Industrial producer management requires continuous monitoring of the solvency of consumers in the product market, the quality level of the goods and the financial costs spent to achieve this level. The information about the price of a product for different customers and its quality level can be determined by means of a “price-quality" P-Q econometric model.

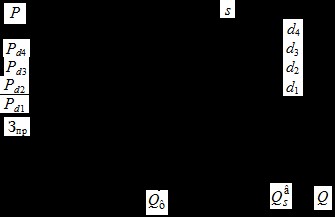

A graphical interpretation of the "price-quality" P-Q model shows that there is a variation in product costs according to product quality, which adequately corresponds to the enterprise rating (Figure

For a fixed level of quality, there is a real value range in which the value range is maximum. This suggests that it is possible to ensure products with fixed quality at different costs Pd1<Pd2<Pd3<<Pd4, if the product is equally competitive in different market segments for different consumers.

Since the variable is the production cost, variables are profit of the company in the range of product prices for different customers (various segments of the market), we can speak about the so-called competitive price reserve which allows profit planning. This fact is used to differentiate the prices of products depending on the solvency of customers and retain market segments. The following work sequence is suggested:

1)to choose the principle of price diversification;

2)to segment consumers according to the chosen principle of diversification;

3)to determine the quantity of the product supplied for each segment;

4)to determine the prices of the products for each segment.

The proposed model effectively provides selling the whole lot of products to consumers and allows the company to get the predetermined total income.

Therefore, it is advisable to sell the products at diverse prices so that the total profit would be less than the predetermined one.

The proposed model implies determining the price level for each segment of consumers by means of mathematic simulation:

1)a company determines the principle of diversification on the basis of actual manufacturing and marketing conditions. There are several diversification principles: price discrimination, geographical position, discount systems, sales volume, etc.;

2)consumer segmentation allows the company to set diverse prices for their products. Based on the diversification principle selected, it can be carried out according to various criteria: income, transport costs, for different categories of beneficiaries, price elasticity of demand, etc.

We introduce the following notations:

y – the volume of output;

p – the market price of a product;

m – the number of customer segments, corresponding to the selected principle of price diversification;

Ki – the total income level of an i-segment, i = 1 ... m;

Ri - the price set for a particular segment, i = 1 ... m;

yi – the product volume sold in the i-segment, i = 1 ... m.

Formally, the diversification of product prices can be presented as a ratio:

(P, y, Ki ... .Km) → (pi ... Pm; yi ... um),

when each product volume, market price and fixed segmentation of consumers is associated with the individual prices for each segment of consumers and the corresponding product supply.

The following assumptions are made about prices.

Firstly, because the price diversification is carried out under conditions of imperfect competition (monopolistic competition), we do not assume the price equilibrium. To be specific, it can be considered equal to marginal revenue. The only important thing here is that it is the price of the products for which they are sold in the real market.

Secondly, all prices for the i-segment at the same time can not be less than price рi, because it breaks the unprofitability principle. Therefore, it is assumed that prices in certain segments are higher than p.

Naturally, this refers to high income segments in which the demand is less price elastic. For consumers in these segments, it is prestigious to buy a better designed and promoted product at a higher price.

It should be noted that the sequence of diversified prices found this way is not the only one, i.e. while continuing the search, other diversified prices can be found, but each of them ensures selling of the whole batch of products and getting profit which is not less than the market price (Solovenko et. al., 2014).

We will demonstrate the application of the proposed methodology for calculating diversified pricing by the example of specific numerical data of “YurginskiyMashzavod”, ltd, which produces steel products.

Machined press forgings make up more than 80% of steel products of this machine-building enterprise (Prokopenko et. al., 2016). A market price of the forgings is 40 thousand rub. per tonne. A list of consumers of these products and the volume of consumption are given in Table

There are a few factories in Russia which produce products of similar steel grades and with similar mechanical properties. A list of major manufacturers of these products including their production volume and market share is shown in Table

As we can see from Table

Table

With the help of Excel software and mathematical modeling, we have found that when the prices are diversified, 1381 tonnes of products at the price of 40990 rubles are sold to the first segment of consumers which brings revenue equal to 56.607 million. The second segment buys 466 tonnes at the price of 38,000 rubles with revenues equal to 17.708 million rubles. The third sector buys 148 tons at the price of 37,000 rubles with revenues equal to 5.476 million rubles.

Thus, the benefits of differential pricing are obvious, since if the enterprise products are sold at the market price of 40.000 rubles to all the consumers, as the authors noted above, and it yields only 79.80 - 19.95 = 59.85 million rubles (see Table

Consumer segmentation allows the company to identify the diversity of prescribed prices for their products. Setting a price level for each product for consumer segment was carried out by means of mathematical modeling.

Conclusions

The proposed model of selling engineering products on the basis of price diversification is:

1) a technology of continuous monitoring of consumers solvency, product quality level and financial costs of producing the required quality. The cost of goods for different customers and the level of quality can be determined on the basis of an econometric model of "price-quality" P-Q

2) an indicator of the competitiveness and profitability of the enterprise, enablingthe company to pursue an active industrial strategy and secure a foothold in the sales territories of the product markets;

3) an effective technology of industrial enterprise management: to obtain the maximum profit and find the most profitable spheres of capital investment; to form stocks of orders for products in the region. Stocks of orders can be compared according to two criteria: profitability (mathematic forecasting of competitiveness) and a risk of refusing the product by consumers (dispersion). If we select a certain fixed level of competitiveness defined by specific consumer demands for product, we can create a stock of orders with minimal risk to the supplier company.

References

- Loshchilova, M., Lizunkov, V. & Zavyalova, A. (2015) . Professional Training of Bachelors in Mechanical Engineering, Based on Networking Resources. Procedia - Social and Behavioral Sciences. 206, 399-405.

- Prokopenko, S., & Ludzish, V. (2014). Problems of innovative development of the mining Enterprises of Russia Gornyizhurnal. Mining Journal 1, 47-49.

- Prokopenko, S., Kurzina, I., & Lesin, Yu. (2016). Prospects for improvement of mining machines’ cutting picks. IOP Conference Series: Materials Science and Engineering. 124, Article number 012134, 1-5.

- Solovenko, I., Trifonov, V., & Nagornov, V. (2014). Russian Coal Industry Amid Global Financial Crisis in 1998 and 2008. Applied Mechanics and Materials. 682, 586–590.

- Tceplit, A.,Grigoreva, A., & Osipov, Yu. (2014) .Developing the model for assessing the competitive-ness of innovative engineering products. Applied Mechanics and Materials 682, 623-630.

- Trifonov, V. ,Grichin, S., & Kovaleva, M. (2014). Price differentiation as economic and mathematical model of increasing the competitive power of a company. Applied Mechanics and Materials. 682, 606-612.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

20 July 2017

Article Doi

eBook ISBN

978-1-80296-025-9

Publisher

Future Academy

Volume

26

Print ISBN (optional)

Edition Number

1st Edition

Pages

1-1055

Subjects

Business, public relations, innovation, competition

Cite this article as:

Trifonov, V. A., Osipov, Y. M., Loyko, O. T., & Strekovtsova, E. A. (2017). Model Of Engineering Products Consumption Based On Price Diversification. In K. Anna Yurevna, A. Igor Borisovich, W. Martin de Jong, & M. Nikita Vladimirovich (Eds.), Responsible Research and Innovation, vol 26. European Proceedings of Social and Behavioural Sciences (pp. 962-968). Future Academy. https://doi.org/10.15405/epsbs.2017.07.02.124