Abstract

Most countries in Europe have started using renewable energy source for electricity over decades now even though it’s not investment friendly. That is why most countries have introduced different types of measures or mechanism to support investors and household consumer who are interested in using these polluted free renewable energy source. Recently, Russia was among the countries that signed the Paris Agreement contract and are hoping to execute their part in reducing the emissions greenhouse gas in the country even though Russians are oil producing country and most of the energy come from this. The article analyzes the mechanisms of tax incentives for renewable energy and energy efficiency currently used in European countries. Also the possibilities of investing in in research studies pertaining to energy. The article also analyse the reason for stimulating demand for electricity companies for energy-efficient equipment. Conclusions were made about disseminating their experience for effectiveness and ability for adaption in Russia.

Keywords: Taxes incentivesproduction tax creditinvestment tax creditVATrenewable energy

Introduction

Global investment trends indicate the likely change in the structure of the world's energy system in the coming decades towards the use of renewable energy sources. According to the work of Kitzing and co (Kitzing et al., 2012) National policy-makers are continuously implementing, changing and improving their support for RES-E in their country - and in that process, most national policy supports become increasingly similar. Studying the experience of leading countries in the development of alternative energy allows us to select and adapt to the most effective mechanisms for the development of investment programs for federal and regional level in order to improve energy efficiency. Also the work of T Dietz, and P.C. Stern of programs for reducing household carbon-dioxide .was considered (Dietz et al., 2013). Most European countries have initiated their own programs for the support of alternative energy and increment of energy efficiency since the early 1990s and also got actively involved in the work of various tax incentives mechanisms for the development of "green" technologies. It should be noted that one of the major tax incentives for alternative energy producers in the United States is the investment tax credit. This investment tax credit is contrast with investment tax credit in Russia and some other countries (here it simply acts as a form of changing the terms for execution of tax liability with subsequent payment of the loan principal and interest). In the United States, tax incentives measures reduce the tax on investment in the purchase of land, basic equipment and power installation for the production of electricity from alternative sources. That is, it serve as tax investment privilege. In some European countries, there different measures of tax systems to stimulate investment in alternative energy of various forms and scopes, but they are also intended to achieve the same effect – to stimulate high-risk investment in energy facilities with a long payback period, which are highly profitable (table

The tax deduction in Belgium is on all electricity that is being generated by renewable energy source though there are speculation to increase or return it to the normal rate.

Characteristics of production tax credit (PTC) and investment tax credit (the ITC)

Tax credits for producers (Production Tax Incentive) of electricity from alternative sources are also quite popular abroad for measuring tax incentives. It should be noted that this concept is not found in Russian practice. The production tax credit is granted in the form of deduction from tax base, or in the form of a loan at a fixed rate per kilowatt-hour by using renewable energy

This tax incentives mechanism was first introduced by the United States. The production tax credit (PTC) and investment tax credit (ITC) differ in that the PTC reduces the payments on the federal income tax based on the amount of electricity produced as output (measured in kilowatt-hours), and ITC - based on the capital investment volume (measured in monetary units). ITC benefits can only be received when the equipment is already put into operation (David et al., 2005).

In some European countries to encourage the development of alternative energy, they use property tax deduction, which can eliminated up to 100 % of tax amount for properties, lands and fixed assets used for the production of renewable energy. Reducing property taxes may be particularly important stimulus for capital-intensive technologies such as wind power generation and conversion of solar energy into electricity. After all, property taxes often lead to a higher tax burden on kWh of energy produced for capital-intensive power generation technologies from alternative sources than for the less capital-intensive conventional energy technologies. Therefore, the reduction of the property tax could help to create a tax parity between alternative energy and traditional technologies. According to statistical data (KPMG, 2014), countries currently using this type of tax incentives, are presented in table

Many countries basically are not using corporate income tax but value added tax (VAT) deduction to stimulate production of energy from renewable sources. It should be noted that these kinds of taxes can have a particularly painful effect on alternative energy producers that may be chargeable on the capital investment in the manufacturing process, rather than the power generated (Table

The UK and Serbia have a very low rate of VAT though basic price per Kwh of paid is high in UK (Eurostat statistics explained 2014)

Investment tax incentives are not often applied to small consumer-oriented and service companies that are not manufacturers, but consumers of energy and energy saving technologies. These incentives tend to be focused on the intensification of certain practices for installation of generation or cogeneration equipment for heating, lighting and ventilation of residential and commercial buildings. Often, tax deductions apply not only to the amount of equipment, but also to the amount of its installations, so that installation of a cogeneration system can in some cases be commensurate with the cost of equipment. These measures can stimulate the individual house owners and companies to purchase cogeneration plant. Also need to be noted that some European countries have abolished the practice of production tax credits due to the fact that it requires constant monitoring of companies production activities which lead to high administrative costs. Tax deductions for the purchase and installation of cogeneration and energy-saving equipment achieve the same goal as the production credit tax but the administrative expenses for their sales is much lesser. Since 1997 (the entry into force of the Kyoto Protocol), countries such as the UK, France, Germany, Spain, Norway, Finland, the Czech Republic and Sweden, have increased taxes on oil and oil products. Denmark introduced a tax on carbon dioxide emissions before 1997. But, paradoxically, in some European countries, taxes on oil and oil products have increased significantly in accordance with the requirements of the Kyoto Protocol but coal taxes (much more "dirty" energy source) does not increased at all.

Some European countries uses different VAT apart from the standard VAT set by the EU policy (table

One reason for reduced policy rate by the governments of these countries, is there concern about the low income household owners that spend a larger share of their salaries or income on energy. That is why some countries have a reduced rate on residential heating fuel. Iceland stipulates itself on the standard VAT and electricity from fuel oil (OECD, 2015). Despite the significant result of these tax incentives on renewable energy in some countries, other countries prefer to use other incentives, for example, in Germany the basic government support for renewable energy instrument are guaranteed tariffs for the supply of electricity from alternative sources within the network. Depending on the location and some technical terms of the government's program Renewable Energy Sources Act guarantees a 20-year sponsorship rate from 9.20 to 5.02 cents per kWh for generators installed before 01.01.2010. The program also provides a bonus of 0.5 cents per kWh for improved network integration of wind systems.

Wind energy efficiency

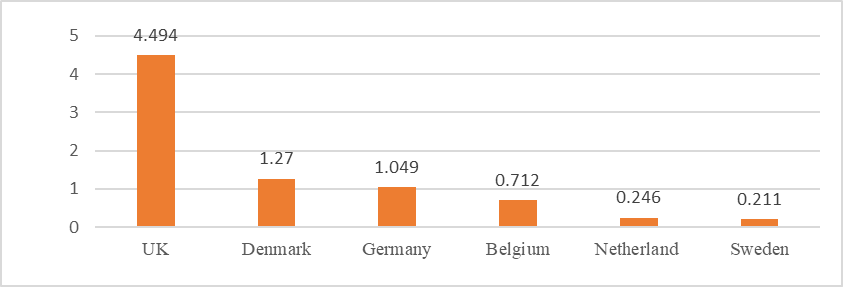

As a result of the integrated use of tax incentives for alternative energy measures, tax disincentives against traditional energy (petroleum, gas and dirty energy source) industries, as well as other measures of state support (guaranteed tariffs on energy supply network) European countries have achieved very impressive results in wind energy development, solar power, energy generation technologies of biomass and energy efficiency technologies. Close to 5 megawatts of wind power in Europe increase from 2013 to 2014 (GWEC, 2014).

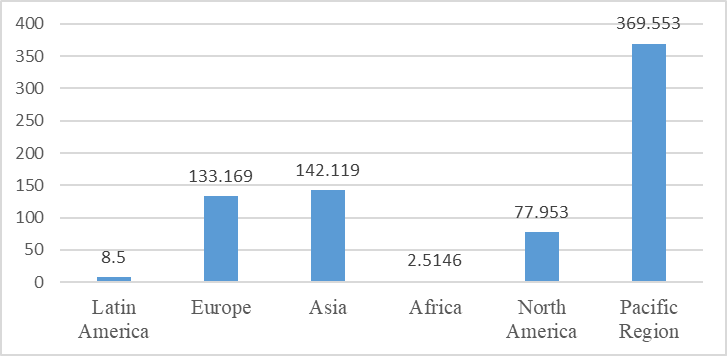

The most dynamic sector of alternative energy in Europe is offshore wind energy (fig. 2).

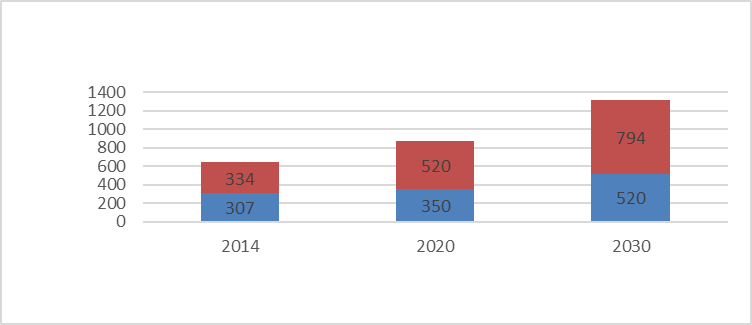

According to European Wind Energy Association (now known as wind Europe) (EWEA, 2015) in times of economic recession, the wind power sector in 2010 employed around 238,000. In the future the number of jobs could increase to 520,000 in 2020 and 794,079 in 2030.

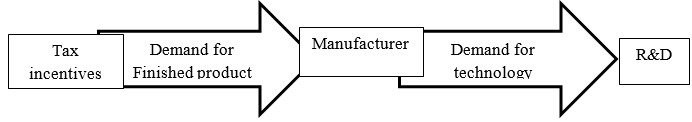

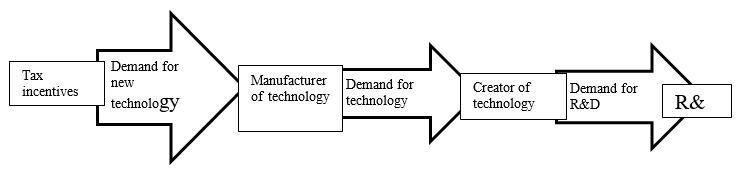

Nevertheless, tax and other incentives for alternative energy cannot be regarded as a substitute for the basic requirements for core business commercial effectiveness and its technological base. For example, in the case of bioethanol, production of new generation biofuel is associated with federal support for specialized research and development, rather than with companies' business of producing bioethanol, due to the fact that technological safety and commercial efficiency of this technology is not yet proven. On the other hand, the production of hybrid vehicles, wind and solar energy is possible thanks to the production tax credit, which solve many technological problems, increase their commercial efficiency, production capacity and gradually gaining energy market. Unfortunately if we talk about the amount of investments in profiling research and development, then it will be impossible to clearly assess whether the tax control measures is affecting the corporate R & D. However, due to lack of statistical data one can definitely say that the stimulation of consumer or corporate demand for high-tech products and services naturally leads to an increase in the relevance of investment in R & D for the suppliers of goods and services. It should be noted that the greatest impact for federal measures reflect on the results of R & D when their direction fit into the main areas of corporate innovation. Furthermore, need to be considered, the specificity for activities of various tax incentives instruments for different sectors. Tax encouragement purchase of hybrids and other energy-efficient cars have a direct impact on the growth of corporate R & D (Fig. 4). This is also true for the production of energy-efficient household appliances, building materials and other sectors.

In the energy sector, such measures only indirectly affect the growth capacities of investment in R & D. The fact that the companies - electricity suppliers and service companies themselves are not the creators of the main technology and do not invest in R & D, but they are the platform of innovation. The same can also be said about the companies - producers of new forms of fuels. The main technological innovation in the energy sector are made by manufacturers of energy and power engineering equipment. Therefore, measures of tax incentives for energy efficiency need to first stimulate demand for electricity companies for energy-efficient equipment and then, for demand for new power engineering technologies (fig 5).

Therefore, in this case, the industrial investments in science, stimulates:

the dynamic markets;

a healthy competitive environment;

the conquered market positions of not losing to companies’ desire, only then do they get tax incentives.

Conclusions

Tax incentives mechanism are used to support renewable energy Research and Development programs in Europe for energy efficiency. Unfortunately, the development of alternative energy and energy-efficient engineering in Russia are given less attention. This creates risks of conservation for technological backwardness and even greater loss of the country's position in world markets of high technology products and services. The tax incentives mechanisms in this area are practically absent, apart from the cluster energy efficiency tax incentives for businesses and residents of "Skolkovo”.

The development of tax incentives mechanism for innovative energy technologies introduction in the energy region, taking into consideration the current state of the industry, is advisable to start from introducing of measures aiming at stimulating demand for energy-efficient technologies in the consumer sector: heating and cooling technologies housing, biogas stations, pellet heating systems.

They are present in the spectrum of innovative products and domestic manufacturers.

Acknowledgments

This work was performed by the author in collaboration with Tomsk Polytechnic University within the project in Evaluation and enhancement of social, economic and emotional wellbeing of older adults under the Agreement No.14.Z50.31.0029

References

- David, C., Lehman, M., Hamrin, J., & Wiser, R. (2005). International Tax Incentives for Renewable Energy: Lessons for Public Policy. The journal of Center for Resource Solutions San Francisco. Retrieved from http://resource-solutions.org/document/international-tax-incentives-for-renewable-energy-lessons-for-public-policy/.

- Dietz, T. Stern, P. C. & Webe, E. U. (2013) Reducing Carbon-Based Energy Consumption through Changes in Household Behavior. MIT press journals 142, 78-89. doi:

- Energy trends (2016). Retrieved from http://ec.europa.eu/eurostat/statistics-explained/index.php/Energy_trends

- Global Wind Energy Council (2014). Global wind statistic Retrieved from http://www.gwec.net/wp-content/uploads/2015/02/GWEC_GlobalWindStats2014_FINAL_10.2.2015.pdf.

- Kitzing, L., Mitchell, C. Morthorst, P. E. (2012) Renewable energy policies in Europe: converging or diverging? Energy Policy, 51, 192-201. Retrieved from http://www.sciencedirect.com/science/article/pii/S030142151200746X.

- KPMG International (2014) Taxes and incentives for renewable energy Retrieved from https://assets.kpmg.com/content/dam/kpmg/pdf/2014/09/taxes-incentives-renewable-energy-v1.pdf.

- Leysen, A. & Preillon P. Belgian Foreign Trade Agency. (2014). Belgium sustainable solution report. Retrieved from abh-ace.be

- OECD (2015) Tax energy use: A graphical analysis, OECD Publishing. Retrieved from https://www.oecd.org/ctp/taxing-energy-use-2015-9789264232334-en.htm.

- Solar Investment Tax Credit (ITC) (2015). Retrieved from http://www.seia.org/policy/finance-tax/solar-investment-tax-credit.

- Wind Europe (EWEA) 2014, The European offshore wind industry – key trends and statistics 2014. Retrieved from https://windeurope.org/about-wind/statistics/offshore/key-trends-2014/.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

17 January 2017

Article Doi

eBook ISBN

978-1-80296-018-1

Publisher

Future Academy

Volume

19

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-776

Subjects

Social welfare, social services, personal health, public health

Cite this article as:

Ogunlana, . O., & Goryunova, N. N. (2017). Tax Incentives for Renewable Energy: The European experience. In F. Casati, G. А. Barysheva, & W. Krieger (Eds.), Lifelong Wellbeing in the World - WELLSO 2016, vol 19. European Proceedings of Social and Behavioural Sciences (pp. 507-513). Future Academy. https://doi.org/10.15405/epsbs.2017.01.69