Abstract

Structural socio-economic transformation of company town supposes the complex process of planning and implementing on the basis of development of complex investment plan of company town modernization. The analysis of investments into company towns for the recent 5 years shows its concentration mainly in infrastructural projects. The government took the deliberate decision to create the conditions for further diversification missing the complex approach for the company town development. The author considers a diversification infrastructure as complex term defining conditions of company town development. In this paper it is derived the concept and the basic elements of company town diversification infrastructure including social, productive and financial elements of infrastructure and its differences in stakeholders, institutions, resources and networks. The author conducts the research of investments into the infrastructure for company town diversification in Yurga, Kemerovo region and concludes that the plan is reaching the emerging goals of local authority avoiding complex restructuration of company town.

Keywords: Company towndiversificationinfrastructuresocial infrastructureproductive infrastructurefinancial infrastructure

Introduction

Company towns represent the settlements with extremely high concentration of production and human resources within the core industry. According to official statement Russia comprised 313-319 company towns during last two years. Potentially this amount of company towns may reach 400-500 settlements but due to governmental program for company town support the settlement should meet the certain criteria, so it sharpens the final list of towns. On the other hand, company towns are located within its regions and it reflects in its similarity and core industries coherence. Kemerovo region comprises 24 company towns and urban villages. Almost all towns in region have single industry specialization excepting the municipal capital – Kemerovo, to be exact 19 from 20.

As to compare with international practice: USA comprises more than 3500 company towns including outstanding example of town bankruptcy in Detroit in spite of the massive investments and enormous programs of development since the fifties of the previous century. The more successful example of company town diversification is Ruhr Metropolitan in Germany with deindustrialized economy embracing 53 settlements focused in service sector including tourism. Glasgow, UK implemented the same type of economy restructuration with service sector instead of shipping and heavy machines what were in deep crisis in the end of the previous century. In all successful processes of company town diversification the government took considerable part during planning and investing it. Meeting to the lack of financial resources the government and the municipal authorities are focused mainly on the infrastructure projects to create the attractive conditions for private investors. Taking into consideration the mission of the town development stated as constant improvement of the local population wellbeing the author believes that the most considerable effect of the company town diversification reflects in social infrastructure transformation that should be studied as a part of general infrastructure for diversification.

Problem statement

In the literature the infrastructure is considered in response with the regional development for more than a quarter of century. Giaoutzi (1990) researching the influence of telecommunication into regional development came to the conclusion of low effect by the infrastructure on the economic output due to the service level. Priemus (2008) insists on the unbreakable bond between urban planning and infrastructure development especially in transportation. Singh & Bhanumurthy (2014) found ‘a strong positive correlation between infrastructural development and level of state domestic product’. It allowed the author concluding about the high importance of infrastructure on regional development. Nevertheless, the core element between regional development and infrastructure is investment.

Rietveld (1989) defines two strategies for infrastructure and private investments: according to passive strategy infrastructure is following the private investments, whereas active strategy implies that infrastructure is leading private investments where the most important think is sufficient response from the private sector. On the contrary to the state financing, Berg & Horrall (2008) research external seed funding for establishing the institutions focusing mainly on infrastructure regulation. These external investors represent the international organizations and the donor countries that become the core elements in cross-country collaboration.

The active strategy of internal investments is currently dominating in diversification process in Russia, so it can be illustrated in the following: 99 from 319 Russian company towns are in disastrous social and economic conditions and have no inner financial resources for infrastructure design as well as development except state funding. According to monitoring results conducted by the Ministry of Industry and Trade during 2015 in Russia 59 town-forming enterprises (25 companies in metallurgical industry and 11 in timber industry) are under bankruptcy or declining in production. The latter makes these territories unattractive for private investments and fosters the government support them.

The analysis of investments into Russian company towns for the recent 5 years shows that the investments concentrate mainly in infrastructural projects. In 2010-2011 in Russia 49 company towns have got the state support of 24 billion rubbles and at more than 70% was assigned for engineering and municipal infrastructure. On the one hand, the effectiveness of the state financing became extremely low due to the most number of company towns that are incapable to elaborate the sufficient strategic plans and develope the financial resources received from the state. On the other hand, taking the deliberate decision to support the infrastructure for further diversification, the government is missing the complex approach for the company town development. So, the infrastructure for diversification process should involve not only roads and manufacturing facilities but the balanced complex of social, productive, and financial spheres of company town development. In this case the author supposes to define the concept of the infrastructure for company town diversification, its basic elements and types that will allow assessing the effectiveness of company town diversification infrastructure and the degree of its completion for investments absorption and further social wellbeing progress.

Research questions

Infrastructure as a concept can be considered narrowly as capital assets serving for public interests including transport, telecommunications, gas, energy and water supply. The infrastructure forms the essential part of economic activity and should be regulated at the state level. More widely infrastructure represents the set of industries, enterprises and organizations creating conditions for production, goods circulation, and human activity. In this case there are two basic types of infrastructure: social and productive.

Nijkamp (1986) defines transport, communication, energy supply, water, environment, education, health, urban, sport and tourism, social, cultural, and natural endowment as the elements of infrastructure. Rietveld (1989) assumes transport, facilities, and recreation in the list of infrastructural objects. Glossop, Harrison, Nathan & Webber (2007) consider the infrastructure as a factors for production along with transport, skills, markets, capital, and economic opportunities. Berg & Horrall (2008) assume the following types of regional infrastructure: telecommunications, energy, water or sanitation, and transport. Rovolis & Spence (2002) differentiated two major categories of ‘productive’ and ‘social’ infrastructure to categorize public capital. These two types of infrastructure are common with the work by Tiwari (2016) who points out physical (road, energy, water) and social infrastructure (education and health) that may be accompanied by organizational and governance issues, government polices, infrastructure for tourism and financing of infrastructure.

The mission of town development assumes the constant improvement of living quality and wellbeing of the local population; nevertheless, the diversification process calls for the appropriate conditions for the brand new and existing business growth. It makes the author to conclude that productive and social infrastructures are the core types for diversification of company towns. Preqin (2014) defines social infrastructure as ‘long-term physical assets that facilitate social services – typically schools, medical facilities, state or council housing and courthouses, among others’. In this case the social infrastructure for diversification of company towns may be analysed through investments into the objects of social service – in building construction and reconstruction, communal infrastructure, social transport and roads, hospitals, schools and other social institutions.

The productive infrastructure for diversification process of company town should comprise all necessary assets for diversification implementation such as transport for industrial purposes and energy networks, the system of information and communication, industrial zones and other aspects of engineering infrastructure. The specific element of the diversification based on the innovative processes is the special type of institution as business incubators.

In general economy theory the productive infrastructure includes even environmental and recreational infrastructure. The green infrastructure concept is currently widely spread in literature. Liu, Holst, & Yu (2014) are looking for the balance between social-economic development and green infrastructure management. Aleti & Talacheeru (2015) introduce the term ‘green infrastructure’ underlining the importance of urban environmental infrastructure focusing on the energy usage. The idea of green infrastructure bears to the U-city (ubiquitous city) project involving the informational technologies infrastructure with the aim to facilitate the comfort of town population (Yang et al., 2013). The new structure of company town economy should consider the requirements of modern ecological standards and way of life in harmony with the nature that becomes a key factor of life quality improvement and lifelong wellbeing.

Apart from social and productive infrastructure the author has strong belief that the diversification process requires the specific financial infrastructure. Mandell & Wilhelmsson (2015) research the ability of local financial infrastructure represented by banks to induce the house values; likewise the architecture of financial infrastructure will stimulate the diversification process. This type of infrastructure for company town restructuration should include the financial institutions for state and local investments as well as private investments, credit organizations and the system of financial support of small and medium business.

Taking all aspects of the infrastructure into consideration the author supposes to systemize all types of the infrastructure into the following groups: social, productive, and financial. These types of the infrastructure in complex will allow describing the current state of the company town infrastructure and analyzing its transformation due to investments.

Research methods

In this paper it is chosen the complex approach to elaborate the system of the diversification infrastructure for company, which will allow considering all stakeholders of diversification proses, types and elements of the infrastructure. The author differentiates the following types of infrastructure for company town diversification: social, production, and financial. The analysis of the current researches on infrastructure allows detecting the following elements of infrastructure: stakeholders, institutions, resources, and network. Due to the elements and the types of the infrastructure for company town diversification in this paper it is systemized existing examples of actors during the process of diversification.

The structural changes of infrastructural investments in company town are estimated in dynamics on the basis of data of Yurga of Kemerovo region. This town elaborated the Complex Investment Plan of Company Town Modernization (CIPCM) where stated the directions of investments and its results. It is considered the period of 2011-2015 when the town was receiving the state financing for infrastructure creation. The detailed analysis of the stricture and composition of designed infrastructure of chosen company town will help to conclude the effectiveness of infrastructure creation.

Results and discussions

According to Swanson (1992) the social infrastructure includes institutions, resources and network to facilitate ability to mobilize resources. These basic elements of the infrastructure can be broadened for the whole infrastructure for company town diversification. On the bases of the offered types of infrastructure for company town diversification the author systemizes the elements, the types and the actors of company town diversification process (Tabl. 1). The general list of actors of this process includes stakeholders and institutions that manage the resources in the created networks. The author considers the following diversification stakeholders: local population, local authority, town-forming enterprise, small business, and investors.

The interests of some stakeholders are opposite that explains the conflict of interests. Herod (2011) clarifies the conflict between social actors by the more power by some of them to impose their vision on the problem. Educing their mutual expectations and meeting the common advantages should solve the conflict between the stakeholders. The difference between the types of infrastructure according to the stakeholders list is basically within private investors’ interests that are focused on productive infrastructure through financial one.

Currently the basic intuitions for company town diversification are business incubator zone, territory of priority development that stand for productive infrastructure and the Bank for Development and Foreign Economic Affairs with The Foundation for Company Town Development. From the author’s point of view these structures are not enough to involve all feasible instruments of financial market and market infrastructure to align complex balanced system of investment attraction.

Recourses for the diversification are considered according to the general concept of their structure in the economy, nevertheless, it should be pointed out that human resources in company towns are featured by homogeneity in cultural, educational level and technical expertize. It can be explained by close interdependence between workers within core technological process of company town. In addition, the network of the diversification process is based on such an instrument as state and private partnership that implies the mutual participation within infrastructure creation of state and private investors.

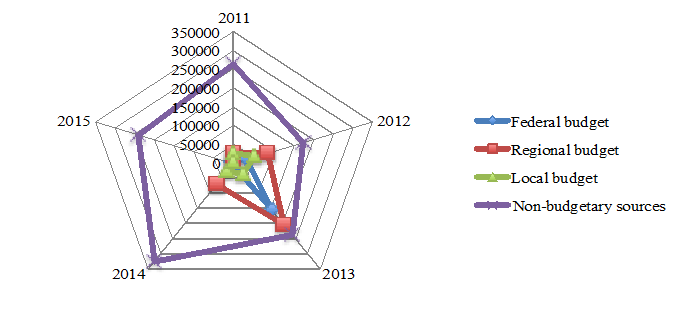

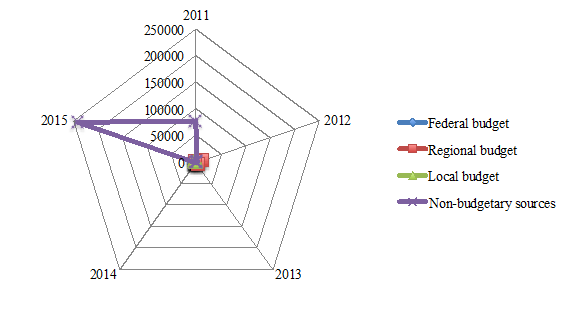

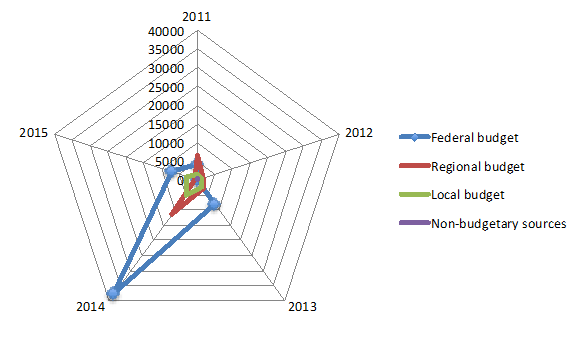

Company town Yurga became one of the first towns that received the governmental financing of infrastructural projects. These projects are focused on the creation the platform for industry diversification. During the research of structural transformations of infrastructural investments the author came to the conclusion of low balance between investments into social and productive infrastructure. Both types of infrastructures were financed mainly through non-budgetary sources reaching the pick in 2014-2015 (Fig.1-2). Regional and federal sources were notable only for social infrastructure whereas the productive one took rather low inflows. Financial infrastructure can be assessed in two ways. Firstly, according to the investment distribution through sources of different level as was previously done. Secondly, due to the structure of financial support in company town focusing on the small and medium sized companies (Fig. 3).

The conducted analysis shows that the financial support of the small and medium sized companies are fulfilled in great range by the federal budget. It can be explained by the lack of proper financial resources of the town according to inter budgetary relations in Russian. The logical analysis adds the structural one. The analysis of CIPCM for Yurga, Kemerovo region allow concluding the following:

1) CIPCM for Yurga has no balance in the structure of investments with domination of social infrastructure investments throughout the rest types of infrastructure. It makes the author conclude that the local authority took the deliberate decision to execute its functions to the disadvantage of the diversification process. The obvious explanation of this is the lack of proper financial resources and absence of the acting financial infrastructure.

2) CIPCM for Yurga includes the regional and targeted funding that were stated previously and prayed from the other sources. These particular programs should be considered separately.

3) CIPCM for Yurga comprises the expenditures for labour market support, but there is no certain account of the expenditures that are focused on the training courses and the other events for the purposes of diversification.

The problems that were pointed out prevent the plan from being assessed on effectiveness clearly and needs to be corrected.

Conclusion

Considering all supposed elements of the infrastructure for company town diversification it should be pointed out that the researched company shows the unbalanced structure of the financing focused basically on the reaching the emerging goals of local authority. The further development of the strategic documents should detatch the expenditures that are focused on the diversification process itself. The balanced architecture of financial infrastrute with widen range of financial institutions as innovative stock exchange may stimilate the further process execution.

Acknowledgements

The reported study was supported by RFBR, research project No. 16-36-00294 mol_a “The dynamic approach to effectiveness evaluation of diversification of a company town economy”.

References

- Aleti, A. R., & Talacheeru, K. C. (2015). Green Infrastructure: Issues and Recommendations. In Cities and Sustainability. 253-264.

- Berg, S. V., & Horrall, J. (2008). Networks of regulatory agencies as regional public goods: Improving infrastructure performance. The Review of International Organizations, 3(2), 179-200.

- Giaoutzi, M. (1990). Telecommunications Infrastructure and Regional Development. In Infrastructure and the Space-Economy. 116-130.

- Glossop, C., Harrison, B., Nathan, M., & Webber, C. (2007). Innovation and the city: how innovation has developed in five city-regions. NESTA.

- Herod, A. (2011). Social engineering through spatial engineering: Company Towns and the geographical imagination. Company towns in the Americas: Landscape, power, and working-class communities, 21-44.

- Liu, W., Holst, J., & Yu, Z. (2014). Thresholds of landscape change: a new tool to manage green infrastructure and social–economic development. Landscape ecology, 29(4), 729-743.

- Mandell, S., & Wilhelmsson, M. (2015). Financial infrastructure and house prices. Applied Economics, 47(30), 3175-3188.

- Nijkamp, P. (1986). Infrastructure and regional development: a multidimensional policy analysis. Empirical Economics, 11(1), 1-21.

- Preqin (2014). Global Social Infrastructure Deal Flow. November 2014

- Priemus, H. (2008). Urban dynamics and transport infrastructure: Towards greater synergy. In Railway Development. 15-33.

- Rietveld, P. (1989). Infrastructure and regional development. The Annals of Regional Science, 23(4), 255-274.

- Rovolis, A., & Spence, N. (2002). Duality theory and cost function analysis in a regional context: the impact of public infrastructure capital in the Greek regions. The Annals of Regional Science, 36(1), 55-78.

- Singh, P., & Bhanumurthy, N. R. (2014). Infrastructure Development and Regional Growth in India. In Analytical Issues in Trade, Development and Finance. 321-341.

- Swanson, L. (1992). Rural social infrastructure. Foundations of Rural Development Policy. JN Reid (ed). Westview Press, Boulder.

- Tiwari, A. (2016). Themes in Urban Infrastructure Research in Ethiopian Cities. In Urban Infrastructure Research. 7-34.

- Yang, J. K., Lee, C. G., Jeon, J. H., & Lee, H. K. (2013). Selection and management factor analysis of urban infrastructure for U-City construction. KSCE Journal of Civil Engineering, 17(7), 1637-1643.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

17 January 2017

Article Doi

eBook ISBN

978-1-80296-018-1

Publisher

Future Academy

Volume

19

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-776

Subjects

Social welfare, social services, personal health, public health

Cite this article as:

Antonova, . S. (2017). Diversification Infrastructure of Russian Company Towns. In F. Casati, G. А. Barysheva, & W. Krieger (Eds.), Lifelong Wellbeing in the World - WELLSO 2016, vol 19. European Proceedings of Social and Behavioural Sciences (pp. 28-36). Future Academy. https://doi.org/10.15405/epsbs.2017.01.4