Abstract

At the present stage of development of the Russian state its primary objective is to provide citizens with access to fully-fledged quality education conforming to their interests and abilities regardless of their material wealth, place of residence, nationality and health. The goal can be achieved if to develop state educational insurance. Establishment of the system of state educational insurance is possible if the process of shaping individuals’ knowledge, skills and abilities (competences) is improved. The result of the system operation is the process of capitalization aimed at ensuring continuous well-being of individuals, households, organizations and country in general. Capitalization of knowledge, skills, and abilities (competences) generates individuals’ financial interest associated with their education, i.e. interest in receiving education as a source of their future income. Financial interest, the subject of which is a man’s accomplishment, enables studying opportunities for establishing intercourse on ensuring individuals’ income, resulting from his accomplishment. This process, in its turn, initiates insurance of an individual’s rights and guarantees in the field of education. On the one hand, regular insurance financing of educational system, ensures its stability for future generations of the Russian society. On the other hand, it will establish the basis for sustainable creation of workforce.

Keywords: State educational insurancecapitalization of knowledgesystem of educationcreation of workforcecontinuous wellbeing

Introduction

Continuous wellbeing can be promoted only due to sustainable development of a man, society and economy, which is greatly determined by the system of education. Sometimes the modern stage of development of social reproduction is called «economy and society which are learning» (learning economy, learning society, learning organizations).

The unfolding situation was fixed in government documents, determining development of Russian education and giving special priority to business aspects of its modernization. The documents emphasize the importance of ensuring financial provision of citizens enabling their access to fully-fledged quality education conforming to their interests and abilities regardless of their material wealth, place of residence, nationality and health. The documents stress the need to improve investment attractiveness of education for both individuals and corporate structures. Whereby attracting extra non-budgetary funding in education is associated with the necessity to improve the present economic intercourse in this field.

A driver for modernization of education in Russia can be insurance as a market function. Consideration must be given to the fact that insurance is not just a financial mechanism but an essential instrument of the state aimed at modernizing the economic intercourse in education to ensure sustainable social and economic development of Russia. From the economic standpoint, insurance of education is the process of reallocation of public finances into education.

Modernization of the Russian education requires changing over to a budget-insurance model of financing. It definitely involves developing the national system of education insurance, as an important factor for promoting continuous wellbeing.

Therefore, the aim of our research is to prove the importance of the state educational insurance as a basis for continuous wellbeing of a man and society. To accomplish the purpose next tasks must be solved: to make a diagram of public interest as the main criterion of the state educational insurance; to reveal financial interest as an economic factor for ensuring continuous wellbeing of a man and society; to determine provision of continuous wellbeing of a man and society in terms of national educational insurance.

The methodological background of research is the economics of wellbeing. In the course of research general scientific methods were used: scientific abstraction used as a method for working out definitions of education insurance; analysis and synthesis; generalization, and other methods and approaches used to develop theoretical underpinning of creating sustainable wellbeing of a man and society on the basis of national educational insurance.

Public interest as a criterion of national education insurance

The result of operation of educational system is mainly a learning service, ensuring development and wellbeing of a man, society, and economy being initially a public benefit. It is almost impossible to limit consumers’ access to a learning service. The increase of consumers of a learning service does not result in the decrease of provided service utility. Understanding specifics of learning services as initial public benefit is of crucial importance, since creation and implementation of national educational insurance will provide continuous wellbeing of a man, society, and economy.

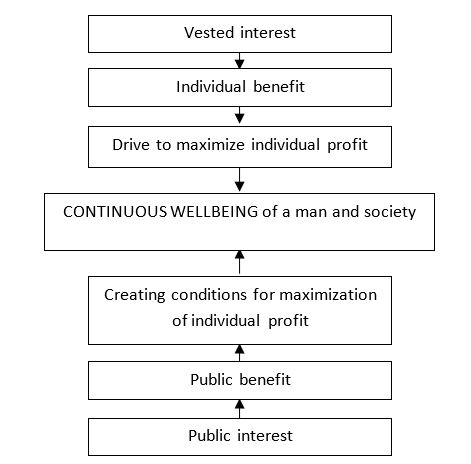

It must be noted that continuous wellbeing of a man and society is both subjective and common aim requiring man’s aspiration and government action. Therefore, the logics of a man’s rational behavior is reflected in public welfare, because a man for his benefit, must consider interests of other people, firstly, because he depends on them and cannot manage everything himself. Secondly, a man, by nature, is a part of community, without which he cannot either self-actualize or continue a family line. Thirdly, a man understands that public benefit is a guarantee of his continuous well-being, which must be sustained as a way to provide for his vital necessity. Finally, a reasonable man is able to acknowledge not only a larger but a superior benefit of his actions for the benefit and improvement of a human species at large, which is a man’s life purpose on Earth (figure

This approach enables us to describe development of a man, society, and economy on the basis of national education insurance as a general act, resulting in maximization of individual wellbeing according to the next diagram: PUBLIC INTEREST → PUBLIC INSURANCE OF EDUCATION → LEARNING SERVICE → DEVELOPMENT OF A MAN, SOCIETY, AND ECONOMY → INDIVIDUAL’S PROFIT → INDIVIDUAL’S WELLBEING → INDIVIDUAL’S FINANCIAL INTEREST→ INDIVIDUAL’S WELLFAIR.

The economics of wellbeing (Bator, 1957) can be used as methodological rationale for national educational insurance to promote continuous wellbeing of a man and society. As the basis for analysis it is assumed that every individual acts so as to maximize the expected value of utility function (Samuelson, 1956). If we assume that utility has something to do with income then expenses on ducation are accidental deductions from this income. What interests us is the anticipated value of income utility after deduction of education expenses. It must be noted that income after deduction of education expenses is an opportunity to spend money on other goods which bring satisfaction. We think that being uneducated (i.e., lack of education or its insufficiency) is rather a source of dissatisfaction than satisfaction. Thus, ignorance must be included into utility function as a separate variable. The principle of expected utility is the most suitable for determining financial interest in education insurance. Further, it is assumed that individuals usually avoid risk. In terms of utility it means that they have diminishing marginal utility of income. It follows that if an individual has a choice between probable incomes distribution with the given average value “M” and risk-free equivalent “M”, he will prefer the latter. Let us assume that a large insurance company or government is ready to offer insurance against educational expenses in accordance with right actuarial calculations. In other words, if educational expenses were a random variable with the average value “M”, a company would charge a premium “M” and would agree to reimburse an individual for all educational expenses. In the circumstances, a man is likely to accept a policy and, thus, gain wellbeing. Hence, we have a public gain, in case an agent does not suffer any public losses. If to assume that educational risks of different people are mainly independent, their pooling would reduce the insurer’s risk to a comparatively inconsiderable amount. Within these limits losses in wellbeing, even supposing risk aversion of some insurers, are to vanish. Furthermore, there is public net gain, which can be rather big. In fact, pooling risks does not reach potential limits: there is a finite number of risks, and risks can be somehow interrelated due to progress in science and technology and unemployment. However, if the insurance premium is just above the actuarial expectation, it must be sufficient to compensate for losses in wellbeing. From an individual’s point of view, as he prefers an actuarially equitable policy, he will, nevertheless, keep an actuarially inequitable policy as his preference, provided that it is not too inequitable.

Thus, when a man insures education, there is a public net gain, i.e. permanent financing of education system by society guarantees its sustainability, not only for an individual, but also for future generations. It will, in return, secure every man’s rights and guarantees in the field of education to satisfy his educational needs, ensure sustainable development of the society, and, eventually, continuous wellbeing of a man and society.

Financial interests as an economic factor to ensure continuous wellbeing of a man and society

Education can be viewed as a resource, a learning resource as a body of competences (knowledge, skills, abilities, actions and motivations), allowing producing economic good. In economic research (Marx, 1977, Sen, 1976, Bator, 1958) resources are production factors. Consequently, a learning resource can be considered as both an educational production factor and, in the long run, as a source of income (factor income). As individuals are involved into the system of education, they develop competences, i.e. a form of capital used by an individual, households, organizations, and country in general as a way to gain profit, which, eventually, ensures continuous wellbeing of a man and society from the economic standpoint.

Capitalization of competences and, in the long run, competency in general, generates individuals’ financial interest, related to their education, i.e. interest to acquiring education as a source of income.

Individual’s financial interest resulting from capitalization of his competency with the aid of a learning service can be described with K. Marx’s (1977) general formula of capital M – C – M':

M – LS – M', (1)

where M and M' – individual’s income before and after capitalization of his competency;

LS – a learning services, allowing capitalizing individual competency.

Initially, the advance value is not only kept intact by an individual while capitalizing his competency, but also changes, adding surplus value, i.e. increases. Thus, competency is converted into capital. Like a common circulation of commodities it’s a two-stage process. The first stage, M – LS, i.e. purchasing of a learning service to capitalize competency, is conversion of money into competences. The second stage, LS – M' is a reverse conversion of competencies into money in the course of employment. Both stages are united by flows, where money is converted into competences followed by competences converted back into money, i.e. a learning service is purchased to maximize economic benefit. Maximization of an individual’s economic benefit in the course of employment due to capitalization of his competences in the field of education can be presented as follows:

M – ILA1 – COMPETENCY – ILA2 – M', (2)

where ILA1 – an individual’s learning activity;

ILA2 – an individual’s labor activity.

Investing into education aimed at capitalization of competency as well as the process itself find their measure and sense in the aim outside this process, i.e. in satisfaction of educational needs, in consumption of information (knowledge) for one’s personal development. Therefore, capitalization of competency in the course of education has a social aspect (public interest).

What are the social externalities of capitalization of individual’s competences in the system of education? Firstly, education intensifies civil responsibility, thus contributing to stability and democracy of society. Another positive externality often associated with education is social and economic growth. Considering «new theory of growth», education not only improves efficiency of educated people but also their colleagues’ and neighbors’ efficiency. Thirdly, educated workforce is vitally important for development and adaptation of requirements of new social reality. Fourthly, «in many countries there is a positive correlation between level of education and level of happiness» (Powdthavee, 2010). Being happier an educated man «obtains a more substantial benefit in the course of work. He is more creative, less tired, and his enthusiasm generates a higher income, the value of which determines his happiness» (Antipina, 2012).

Therefore, capitalization of population competence must result in increase of social and economic growth rate followed by a higher growth rate of per capita income. «The objective meaning of this message (capitalization of individual’s competency – authors) is expansion of value is his subjective aim. Since increasing appropriation of abstract wealth is the only driving force of his actions, because, and only to that extent, he operates as a capitalist, i.e. as an impersonate capital having will and mind. Therefore, value in use cannot be viewed as a capitalist’s immediate aim. Equally, his aim is not a single profit but its constant floating (i.e. capitalization of competency aimed at maximization of social and economic profit – authors)» (Marx, 1977). This individual’s ambition to maximize social and economic profit due to capitalization of his competency is his financial interest in constant rise in the cost resulting from allocation of finances into education. If the process is interrupted, a man will get a loss (L) equal to the difference between income value after capitalization of competency (M') and income value prior to capitalization of competency (M):

L = M' – M (3)

Consequently, income or any other benefit, lost by an economic agent (individuals and corporate structures, as well as state or region) due to insufficient education is to be considered as a loss. Loss resulting from insufficient education of an economic agent can be assessed with the following criteria:

L = (Sw-Sb) × ΔGDP × C, (4)

where L – loss associated with an educational factor;

Sw – an average period of studies of the general proportion of white-collar workers;

Sb – an average period of studies of the general proportion of blue-collar workers;

ΔGDP – increase in GDP resulting from a one-year increase in education length;

C – correlation coefficient between educational level and income.

To minimize loss resulting from an individual’s insufficient education a state must actively support and adjust investment in education.

Importance of national education insurance to guarantee continuous wellbeing of a man and society

Financial interest the subject of which is man’s education brings us to consider opportunities for establishing relations on insuring individual’s income, conditioned by his education. Furthermore, it suggests that individuals’ rights and guarantees in the field of education must be insured. Current socio-economic conditions also necessitate it. Thus, reforms, moreover, crisis accompanying them, brought new phenomena. First of all, it’s growing unsustainability and uncertainty in education causing a man’s serious concern. Permanent uncertainty in the system of education negatively affects an individual and threatens to violate his rights and guarantees in the field of education.

This problem, i.e. providing safeguards for individuals’ rights and guarantees in the field of education must be solved by a state, using organizational and legal forms – state welfare, based on the state budgetary model of financing education, adopted under conditions of the USSR economy. To adjust it to new market conditions Education Act of the Russian Federation was passed in 1992. It gave educational establishments real independence when dealing with creative issues and opened a prospect for developing fee-based education. Market usage of this organizational and legal form of safeguarding rights and guarantees of individuals in the field of education with implanted legally commercial functions proved to be inefficient.

Considering current inefficient state of affairs in the field of education a new Education Act of Russian Federation (Federal Law of December 29, 2012, No 273-FZ, 2012) was passed in 2012, whereunder two basic Russian laws were substituted: Education Act and «Concerning Higher and Postgraduate Vocational Education».

Education Act inspired us to rethink and reform the present organizational and legal forms of safeguarding rights and guarantees in the field of education. We mean a new notion of social security of people’s rights and guarantees in the field of education, grounded on the concept of national educational insurance.

Education has important economic and social functions, which benefit the society at large: contribution of education into economic growth, ensuring national security; increasing flexibility of the labor market; generation, storage and transfer of scientific knowledge to subsequent generations; preparing citizens for active business and political activity, etc. It conditions moral and spiritual order of the society and wellbeing of its citizens.

Thus, the milestone in our reasoning on determining the structure of economic intercourse in the system of education, aimed at satisfying public interest and obtaining social rent from educational activity, is a necessity to redistribute its maintenance cost between consumers of leaning services and society at large under state control. With the increase of students and expansion of public sector of educational opportunities, programs and learning services, governments have to develop new forms of social partnership (government – business – an individual) to marshall resources necessary for financing education.

Implementation of social partnership to finance the system of education is possible with an insurance method. This is due to the fact that the basic insurance principle is communal material liability and solidarity before an individual, which can be viewed as a version of social partnership. An insurance method enables creating a special cash fund made of contributions from individuals and corporate structures (under voluntary educational insurance), and the state (under compulsory state insurance – non-budgetary fund) to finance educational activities for those in need. An insurance method for financing education is aimed at increasing the number of participants of the educational process and a more equal redistribution of both expenses and benefits. The idea of redistribution underlies insurance and enables to use it as an alternative economic instrument to finance education as a public sector. As a result, state financing is only a part, though a very important part, of investments into the system of education. Assets of the insurance fund will be spent directly on education according to differentiated per capita rates. It will execute the insurance principle of solidarity before an individual and, thus, imply not only voluntary but also compulsory educational insurance. Consequently, the system of education, as a socially essential field, must have two directions of insurance business. The first one – state insurance based on a mandatory principle – compulsory state educational insurance, and the second one – private insurance of individuals and corporate structures, based on the voluntary principle, i.e. voluntary educational insurance.

National educational insurance will be a system of financial security of citizens in case of disability resulting from decrease or lack, at a certain age, of sufficient educational level, the subject of which is population in general or certain social groups, differentiated according to social and occupational risks. Thus, educational insurance can be viewed as a possible organizational form of economic relations in the field of education, which will ensure sustainable development of a man, society, and economics under current conditions. It makes it necessary to make educational insurance a subsector of personal insurance, while а compulsory educational insurance is a branch of public insurance alongside with medical, retirement and social insurance.

Conclusions

A necessity to create and develop the system of state educational insurance to capitalize competency of agents of social and labor relations as a factor of continuous wellbeing is justified in the article. The field of education must be insured due to the following: firstly, due to involvement of individuals into the system of education where their body of knowledge, skills, and abilities (competences) formed and becomes a capital which is used for income generation by individuals, households, organizations, and country in general; secondly, capitalization of knowledge, skills, and abilities (competences) invokes individuals’ financial interest, connected with their education, i.e. interest in acquiring education as a source of income; thirdly, financial interest, the subject of which is man’s accomplishment, allows studying opportunities for insuring man’s income, resulting from his education; fourthly, it leads to insurance protection of man’s rights and guarantees in the field of education; fifthly, regular insurance financing of the system of education by society ensures its maintenance for a man himself, as well as for future generations, which provides the basis for sustainable creation of workforce.

References

- Antipina, O. (2012). Economics of Happiness as an Academic Research Discipline. Voprosy Ekonomiki, 2, 94-107

- Bator, F. M. (1957). The Simple Analytics of Welfare Maximization. The American Economic Review, .47 (1), 22–59.

- Bator, F. M. (1958). The Anatomy of Market Failure. The Quarterly Journal of Economics, 72(3), 351. doi:

- Education Act of the Russian Federation of December 29, 2012, Federal Law No 273-FZ (2012) Collection of legislation of the Russian Federation, 53, Article 7598

- Marx, K. (1977). Capital. A critique of political economy: The process of capitalist production as a whole. London: Lawrence and Wishart.

- Powdthavee, N. (2010). The happiness equation: The surprising economics of our most valuable asset. London: Icon Books.

- Samuelson, P. A. (1956). Social Indifference Curves. The Quarterly Journal of Economics, 70(1), 1. doi:

- Sen, A. (1976). Liberty, Unanimity and Rights. Economica, 43(171), 217. doi:

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

17 January 2017

Article Doi

eBook ISBN

978-1-80296-018-1

Publisher

Future Academy

Volume

19

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-776

Subjects

Social welfare, social services, personal health, public health

Cite this article as:

Oleg, ., Tatyana, F., Irina, C., & Boris, B. (2017). State Educational Insurance as a Basis for Continuous Wellbeing of a Man and Society. In F. Casati, G. А. Barysheva, & W. Krieger (Eds.), Lifelong Wellbeing in the World - WELLSO 2016, vol 19. European Proceedings of Social and Behavioural Sciences (pp. 209-216). Future Academy. https://doi.org/10.15405/epsbs.2017.01.28