Abstract

The article deals with the issue of credit crime which is considered through the connection of statistical indicators on individuals’ loan debts (including arrears) with the indicators of committed felonies in Russian federal districts. It deals with the problems of the reasons for credit crime, analyzed the statistic data, which illustrate the size of the loans and the level of crime in the Russian Federation regions. It`s give graphical data correlation crime and debt the size of loans in the federal districts of the Russian Federation. It`s give the argument that the crimes committed by debtors on loans, represent a major threat to many regions of Russia, and that there is a link between the high crime rate and the size of loans in the subjects of the Russian Federation. Poverty in the region is an important factor in forcing people to live in debt. Debt is pushing people to commit crimes. Often, these citizens commit crimes against life and health, as well as economic crimes. Several examples from judicial practice illustrating crimes committed by people because of arrears, show how topical the problem is.

Keywords: Credit crimeloan debtfederal districtseconomic welfaredefendant

Introduction

Nowadays bank loans have become the norm in the financial and credit policy of the state. People are told that consumer loans and mortgage can help to achieve economic prosperity. But people are not told that banks and other credit institutions put them in a kind of information vacuum when signing a loan or mortgage contract to conceal other ways of getting a loan. Therefore, borrowers do not take seriously legal and economic consequences of non-payment or late repayment of loans. These legal and economic consequences lead people to crime and beget a new kind of credit crime.

The media are constantly spreading a lot of information about debtors committing crimes.

In Smolensk, a convict committed 20 thefts, including 9 burglaries because his family was in a difficult financial situation and had an outstanding loan (The appeal decision of the Judicial Board on criminal cases of Smolensk Regional Court, 2011). In Nizhnevartovsk, a person R. robbed a bank with a gun because he had outstanding loans of 1 400 000 rubles (Fedyuhina, 2011). In Moscow, while bailiffs were taking inventory of property the debtor shot one of the bailiffs right in the apartment (Debtor killed creditor, 2012). In Zavolzhye, a town in Nizhny Novgorod region, a debtor came to a credit institution department and stabbed an office clerk into the neck; she died at her desk (Debtor killed employee of the credit institution, 2012).

We can endlessly enumerate similar news reports. There are more and more criminal stories in the media these days that in this or that region of the Russian Federation a debtor committed a crime due to insolvency. Moreover, in recent years the number felonies committed by debtors has increased, with robbery and murder included.

The reason for credit crime

Unfortunately, in Russia there are no overall records of crimes committed by loan debtors, therefore, there are no statistical data on such acts in the present time. But we know that in many cases criminals had large arrears, some of the loans were outstanding.

According to statistics of the Central Bank of the Russian Federation, in February 2016 in Russia loans debts were 10 578 864 billion rubles, and the arrears were 879.961 billion rubles (Information on loans granted to individuals, 2016). Sums are enormous, it means that every citizen of the Russian Federation (the population of the country is 146.3 million people), including infants, has 72 309 rubles of loan debts; if just the working-age population is considered, it will be 146 270 rubles. At the same time the average wage in Russia is 30,306 rubles a month (The main results of the socio-economic situation in Federal Districts, 2015). Obviously, such a large debt will be a good motive for a person to commit a felony, in order to somehow secure their shattered financial well-being.

Thus, in 2015, a defendant, together with her friend, being in need of cash, decided to take part in drug trafficking and delivering drugs to hiding places in Tyumen city. In this way they had managed to package and deliver 115 grams of drugs before they were arrested. In court she repented of what she had done and explained that in July had seen an ad on the Internet which offered a job of drug courier. She had been out of work for about 4 months and had had trouble paying her mortgage, utilities and medicine. For this criminal job she was offered from 100 000 to 200 000 rubles (The decision of the Kalinin district court in Tyumen, 2016).

This example illustrates what people are ready to do in order to survive in difficult economic conditions, when the arrears, especially mortgage, push people to commit violent crimes. Unfortunately, not every borrower is ready to realize criminal and legal consequences of such impetuous acts. This young girl was sentenced to four years' imprisonment in a penal colony. It should be noted that Tyumen region is not in the leading position for the number of loan debts including outstanding debts.

The statistic data on loan debts in federal districts

If we make a study of individuals’ debts in regions, you can get the following results. In Central Federal District loan debts are 3,100,420 billion rubles, including overdue debts of 253,974 billion rubles (the leaders are Moscow, Moscow region and Voronezh region). In North-West Federal District loan debts are 1,162,394 billion rubles, including arrears of 83,462 billion rubles (the leaders are St. Petersburg, Leningrad region, Arkhangelsk region, Komi Republic). In Southern Federal District loan debts are 853,752 billion rubles, including arrears of 84,145 billion rubles (the leaders are Krasnodar region, Rostov region, Volgograd region). In North Caucasus Federal District loan debts are 287,813 billion rubles, including arrears of 30.945 billion rubles (the leaders are Stavropol, Dagestan Republic, the Republic of North Ossetia - Alania). In Volga Federal District loan debts are 1,925,733 billion rubles, including arrears of 156,666 billion rubles (the leaders are the Republic of Bashkortostan, the Republic of Tatarstan, Samara region). Urals Federal District loan debts are 1,208,322 billion rubles, including arrears of 89.091 billion rubles (the leaders are Sverdlovsk region, the Khanty-Mansi Autonomous District-Yugra, Chelyabinsk Region). In Siberian Federal District loan debts are 1,493,941 billion rubles, including arrears of 144,913 billion rubles (the leaders are Krasnoyarsk, Novosibirsk region, Irkutsk region). In Far East Federal District this sum is 537, 422 billion rubles, including 36,555 billion rubles of arrears (the leaders are Primorsky region, Khabarovsk region, the Republic of Sakha (Yakutia), in Crimean Federal District loan debts are 9,066 billion rubles, including arrears of 211 million rubles (The main results of the socio-economic situation in Federal Districts in 2015).

It is interesting that the least outstanding loans are in the city of Sevastopol (2,102 billion rubles), in the Republic of Ingushetia (3,954 billion rubles), in Chukotka Autonomous District (4,249 billion rubles), in Nenets Autonomous District (5,.443 billion rubles), in the Republic of Crimea (6,964 billion. rubles). The reason for such low debts can be either a small amount of population in these regions or geographical factors or the financial culture of ethnic groups. These phenomena require further research.

The statistic data about registered crimes in Federal Districts

Let us consider the status and dynamics of committed felonies in Russian regions by the beginning of 2016.

By January 2016 in Russia there had been committed 41,293 felonies including: Central Federal District (CFD) − 11,268 crimes; North-West Federal District (NWFD) - 3,963 crimes; Southern Federal District (SFD) − 3,685 crimes; North Caucasus Federal District (NCFD) - 1,647 crimes; Volga Federal District (VFD) – 7,195 crimes; Urals Federal District (UFD) – 3,377 crimes; Siberian Federal District (SibFD) – 6,326 crimes; Far East Federal District (FEFD) – 2,094 crime; Crimean Federal District (CrimeaFD) - 495 crimes (Crime in Russia in January 2016).

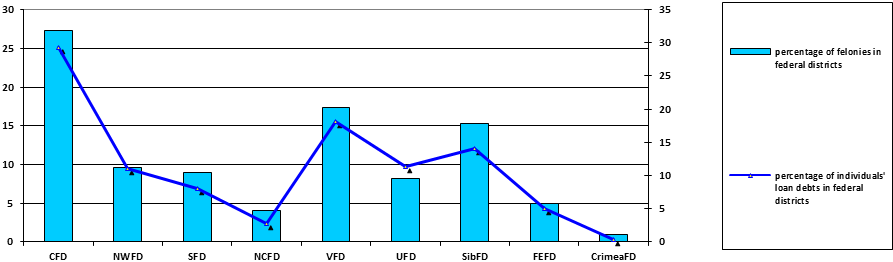

If we compare these two statistical reports, we can find out that the percentage of the given indicators is almost the same (Figure

Looking at the figure we can see a certain pattern; that is, the percentage of felonies and that of individuals’ loan debts is almost the same. Thus, the number of felonies, one way or another, is connected with the number of individuals’ loan debts. There is no doubt that the reason for such equal ration is the number of population in federal districts and their economic development level.

For example, if we compare the population percentage in Russia, by the end of 2015 it was: Central Federal District – 26.7%; North-West Federal District – 9.5%; Southern Federal District – 9.6%; North Caucasus Federal District - 6.6%; Volga Federal District – 20.2%; Urals Federal District – 8.4%; Siberian Federal District – 13.2%; Far East Federal District – 4.2%; Crimean Federal District – 1.6%.

Causes and consequences

There is no doubt that various types of crimes committed by loan debtors must be thoroughly analyzed in order to find out the relations between the economic development levels of the regions and the welfare level of the population with the level of individuals’ loan debts. But we must not forget that that many debtors deliberately undermine their economic well-being.

A good example illustrating this idea is a criminal case where the defendant (who had previously been convicted for theft and robbery) was charged with death threats and beating the victim being intoxicated by alcohol. In court the defendant’s mother explained her son’s behavior by the fact that her son had recently become unemployed, had a lot of outstanding debts, drank alcohol, thus, became very aggressive. He had been in civil partnership with the victim since 2014. The defendant was characterized from the negative side, as an alcohol abuser, unemployed, previously convicted for crimes, registered in the police department as being on probation (The verdict of the magistrates’ judicial district №2, 2015).

In this case, the main causes for committing crimes were unemployment, loan debts, and, as a result, alcoholism. All those negative factors pushed the young man to commit crimes against other people’s property, and later against human health and life. One way or another, such factors, being combined, have a great impact on people’s lives and their economic well-being because thay undermine the basic life foundations.

Illustration

We must remember that loan debts lead to a difficult financial situation of a family and force the family members to break the law.

Thus, in 2013, a female resident of Neftekamsk was convicted for forgery. She forged a notarial power of attorney on behalf of her husband in order to get a pension as a veteran of military operations. It court, the defendant explained the causes of her criminal behavior by the following facts. “In 2008, her husband took a loan from a consumer cooperation in order to start his own business, but soon he went bankrupt. Later he took another loan in another bank in order to pay off the previous debts. At that time she was on maternity leave and had to discharge loan interest by her child care allowance. In April 2009, her husband went to another place looking for a job and was away till August 2010. During this period he sent money to his family just one time as he got injured at the construction site. After that he was unemployed. The woman decided to commit a crime (to forge a material power of attorney in order to get a pension) because her husband was out of work, had previously taken loans which she had to pay off (his debts were collected from her salary). Her husband spent his pension on expensive alcohol drinks. Besides, he committed shop robberies and had been put into prison for those crimes three times. The woman had to divorce him. After the divorce he told her that he had better spend time in prison than pay her alimony” (The verdict of Neftekamsk town court of Republic of Bashkortostan, 2013).

This example illustrates the problem that outstanding debts do not only undermine economic well-being of the population but also destroy the family. The woman had nothing to do but commit a crime for the sake of her family in order to escape poverty and loan debts. We can just guess how many families have been ruined or started to commit crimes because they had loans or outstanding loan debts.

Сonclusion

This study has shown that the percentage of individuals’ loan debts and the percentage of felonies are in proportion the number of population in region and federal districts of the Russian Federation. It is obvious that in the near future certain decisions need to be taken at both regional and federal levels. They must be targeted to reduce individuals’ loan debts in order to prevent people from committing crimes, and to reduce the level of crime in Russia in general.

There is no doubt that a lot more research should be done on the subject in order to reveal all causes of credit crime and to prevent society from such criminal deeds.

References

- Crime in Russia in January 2016. (2016) Retrieved from http://crimestat.ru.

- Debtor killed creditor, police officers came to take his property (2012). Retrieved from http://www.pravda.ru.

- Debtor killed employee of the credit institution. (2012). The News of Nizhny Novgorod. Retrieved from http://newsnn.ru.

- Fedyuhina, L. (2011, February 19) A man with a gun. The newspaper “The Local Time”, pp. 5-6.

- Information on loans granted to individuals. (2016). Retrieved from http://www.cbr.ru.

- Rospravosudie (2011). The appeal decision of the Judicial Board on criminal cases of Smolensk Regional Court 09.06.2011 in criminal case №22-1259. Retrieved from http://www.rospravosudie.com

- The decision of the Kalinin district court in Tyumen on criminal case №1-24/2016 (2016, February 5). Retrieved from http://sudact.ru.

- The main results of the social-economic situation in Federal Districts in 2015. (2015). Retrieved from: http://www.gks.ru.

- The verdict of Neftekamsk town court of Republic of Bashkortostan, criminal case №1-198/2013. (2013, September 20) Retrieved from http://rospravosudie.com.

- The verdict of the magistrates’ judicial district №2 Mozhga, Udmurt Republic, criminal case №1-22/15. (2015, May 5) Retrieved from http://rospravosudie.com

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

17 January 2017

Article Doi

eBook ISBN

978-1-80296-018-1

Publisher

Future Academy

Volume

19

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-776

Subjects

Social welfare, social services, personal health, public health

Cite this article as:

Almaz, A., & Vasilkova, E. (2017). Credit crime and economic welfare of the population: statistics. In F. Casati, G. А. Barysheva, & W. Krieger (Eds.), Lifelong Wellbeing in the World - WELLSO 2016, vol 19. European Proceedings of Social and Behavioural Sciences (pp. 1-6). Future Academy. https://doi.org/10.15405/epsbs.2017.01.1