Abstract

Zakat collection from Moslem business owners who pay their zakat through the zakat institutions are still very low and a huge potential is untapped from the business zakat payment that either goes directly to the recipients or simply unpaid. The objective of this paper is to propose a research conceptual framework for examining the trust towards zakat institution from the Moslem business owners’ point of view. Antecedents to trust namely shared value, communication, non-opportunistic behavior and perception on distribution of zakat, among Moslem business owners are hypothesized to provide grounds for discussion in future research.

Keywords: Business zakattrustzakat institutioncommitment-trust theoryMalaysia

Introduction

Zakat is one of the five main pillars in Islamic teachings and has been stated 30 times in the Qur'an and 27 of them were mentioned alongside with the command for prayers (Al Qardawi, 2000). It also demands for Moslems to interact with the public in order to fulfill its obligation. Zakat literally means clean, pure, grow, multiply, and mercy (Al Qardawi, 2000) also known as blessing, holy and fertile (Syed Adwam, Md Hussain, & Hanafiah, 2005). Zakat has two main objectives namely to physically help the underprivileged and cleanse the soul of the tax payers as mentioned in Surah At-Taubah 103 (Al-Quran, 1994). At the early reign of Caliph Abu Bakr al-Siddiq, he had ordered the army to fight those Moslems who refused to pay zakat, as it is a religious obligation, which was implemented during the life of Prophet Muhammad (Peace be upon him) (Ibrahim & Musaini, 2010). Proceeds from the collection of zakat can be used to help the Moslem community in reducing economic disparities and improve social relationships (Md Hairi, Kamil, & Ram Al Jaffri, 2012; Patmawati, 2008; Wahab & Rahman, 2013).

Zakat plays a critical role in helping to achieve justice and socio-economic status of Moslems, particularly the poor from being isolated from the general population (Patmawati, 2008). This effort has certainly helped the poor and indigent to get financial resources and improve their lives overall (Suprayitno, Kader, & Harun, 2013). The privatization of zakat institutions has improved the zakat collection and distribution (Muhammad, Yahya, Hussin, Razak, & Awang, 2015; Wahid, Mohd Noor, & Ahmad, 2005). Along with various means of zakat payment such as online transfer, salary deduction and even short messaging services (SMS), it has raised the collection amount among salaried individual zakat payers. Unfortunately, despite all the advances made, only a small percentage of Moslem business owners paid their zakat to the zakat institutions. The collection of zakat for the whole country on average covers only 20% of overall revenue potential zakat (Alias, 2013). In Johor, only 4.5% or 3,983 of 87,617 Moslem business owners pay zakat through the state’s zakat institution in 2012 (Razaly, Mustaffa, Zakaria, Mearaj, & Fadil, 2014). The problem of low zakat payment is also evident in the Federal Territory with only 30% paid their zakat formally (Bernama, 2013). Despite such problem, available options to address such issue are still limited (A. A. Wahab & Borhan, 2014). Thus, this paper aims to propose a research conceptual framework for examining the trust towards zakat institutions amongst Moslem business owners in Malaysia.

The paper is structured as follows: Section

Literature Review and Hypothesis Development

Zakat Practices and Issue of Trust

Zakat, consistent with the other four pillars of Islam (shahadah, prayer, fasting and pilgrimage) contain elements of the relationship with God (hablum minallah). It also requires interaction amongst Moslems (Singer, 2013). Zakat is levied on money, investments (for income generation), animals, agriculture, trade and business. Zakat on business income which is the focus of this paper is levied on the business net asset at the rate of 2.5 percent (Jabatan Zakat Negeri Kedah, 2015). Proceeds from the collection of zakat is one of the methods in Islam to confront and improve the welfare of the community (Johari et al., 2014). The practice of zakat is in indeed in line with Malaysia’s Government Transformation Plan (GTP) to propel the nation towards a developed and high-income country (PEMANDU, 2011). Thus, the obligatory contribution does not only fulfill the religious obligation but also contribute to the overall prosperity of the country.

Although total zakat collection has been steadily increasing, zakat payment through the formal channel among Moslem business owners remains less convincing. In 2012, zakat collected from the business segment amounted to RM470 million and was the second largest contributor of the total zakat collection. But, this accounts merely 20% of its potential zakat revenue from this segment (Alias, 2013). The remaining 80% of uncollected business zakat or about RM1.88 billion remains as a huge potential for the authorities to have their share. One of the possible causes for the low collection is due to some Moslems businessmen who opt to pay directly to the recipients. As specified in the Quran, Surah at-Taubah verse 60 “Zakat is for the poor and the needy and those who are employed to administer and collet it, and for those whose hearts are to be won over, and for the freeing of human beings from bondage, and for those who are overburdened with debts and for every struggle in God’s cause, and for the wayfarers: this is a duty ordained by God, and God is the All-Knowing, the Wise” (Al-Quran, 1994).

According to the National Council of Fatwa, it is mandatory for Moslems to pay their zakat to the zakat institutions while any direct distribution of zakat to the eligible recipients is permissible but considered as sinful, for disobeying the country’s Islamic government decision. Yet, this failed to curb the practice of direct distribution as zakat payers have been dissatisfied with the inefficiency of zakat distribution by the institutions (Wahid, Ahmad, & Kader, 2009). This has prompted some individuals to take action to pay their zakat directly to the recipients (Wahid et al., 2009; Wahid, Ahmad, & Kader, 2010). If this trend is unchecked, it will further jeopardize the institutions’ reputation in carrying out their responsibilities. For example, leakages due to the direct distribution of tithe (zakat fitrah) in Selangor within the past 16 years (1995-2011) have increased from RM1.8 to RM5.2 million which has spiraled to almost 300% (Muhammad et al., 2015). It can be implied that zakat payers are trusting less the institution to fulfil the former’s objective of helping the poor and destitute (Sinar Harian, 2014).

From the sociological perspective, trust is defined as a dependency of a party towards the behaviour of the other party to perform a particular task (Sztompka, 1999). This interpretation is also suitable to describe the roles and responsibilities of the zakat institutions in collecting and distributing zakat to the eligible recipients. When the trust became suspect, zakat payers will eventually choose to transfer their contribution to the indirect channel (Muhammad et al., 2015; Ahmad, Wahid, Nik Soh, & Zainal, 2011; Ismail, Ali, & Mohamad, 2011). The National Audit Department has reported a sum of RM13.85 million from a state’s zakat institution was used as a preliminary payment for the construction of an office building complex (Jabatan Audit Negara Malaysia, 2010). This has certainly caused a concern about the integrity of the institution in managing public’s fund. Humans are rationale, observant and learned from past experience (Bandura, 1986), and the outcome of their interaction enable them to pass judgement about the service provider’s trustworthiness. Zakat institution must come up clean as a trust towards an institution greatly influences contributors’ confidence to continuously contribute and remain committed in supporting the entity (Torres-Moraga, Vásquez-Parraga, & Barra, 2010).

2.2 Hypothesis Development

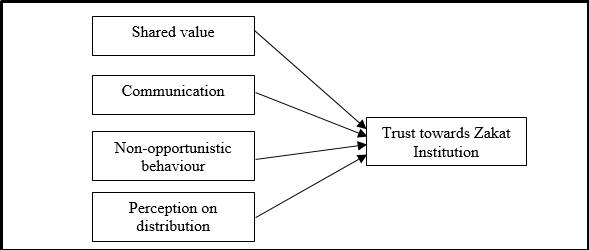

Trust has received wide coverage from a variety of disciplines ranging from a very broad holistic perspective of economic and social aspects to a very specific issue. It is described as an element that functions like a lubricant in public relations and very instrumental in people's everyday life (Putnam, 2000). Based on the review of relevant literatures, this paper suggests four antecedents of trust namely shared value, communication, non-opportunistic behavior and perception on distribution of zakat, amongst Moslem business owners toward zakat institution. The following subsections propose the antecedents of trust toward zakat institution that form the framework for the not-for-profit sector based on the commitment-trust theory (MacMillan, Money, Money, & Downing, 2005).

2.2.1 Shared Value

Shared values has been proposed as being a direct precursor to both trust and relationship commitment that are commonly accepted to both supplier and dealer in terms of behaviours, goals and policies (Morgan & Hunt, 1994). Ethical value has been dominantly influential in the development of trust and commitment on both parties. An identical result is also evidenced when existence of shared values drive funders to trust and place commitment towards their preferred nonprofit organizations (MacMillan et al., 2005).

Likewise, zakat institution should stress on creating the common shared values with zakat payers towards developing trust and commitment. When zakat payers perceived that the institution is not doing enough in helping the poor, they will cease to pay zakat through the formal channel and distribute them directly to the eligible recipients. Thus, the following hypothesis is proposed:

2.2.2 Communication

An effectiveness of a two-way communication has affected the level of trust among donors in the charity sector (Torres-Moraga et al., 2010). This can be even further strengthened when the donors are informed how the funds raised would be used (Kelly, 2012). A good communication flow would include the willingness of the charity to listen and seeking information about the funders needs through enthusiast frontline staff. A timely communication (Moorman, Zaltman, & Deshpandé, 1992) will also help to minimize any dispute or misunderstanding. In addition, a stronger relationship with donors is attainable when they are well-informed by the charity on the work undertaken and still undergoing (Bennett & Barkensjo, 2005).

At present, a lack of literature that explains communication between zakat institutions and zakat payers warrants a further investigation whether a good communication between both parties is more likely to increase the trust or vice versa. Thus, the following hypothesis is suggested:

2.2.3 Non-opportunistic Behaviour

This factor is based on the concept of opportunistic behavior reported in prior literature. It is also coined as “self-interest-seeking with guile” (Morgan & Hunt, 1994; Williamson, 1993). In this study, this factor is constructed oppositely as non-opportunistic behavior to reflect the positive side of such behavior (MacMillan et al., 2005). When a partner perceived to be engaging in a rightful (non-opportunistic) behaviour for a mutually beneficial long-term relationship, this will lead to a positive response by the other partner through higher level of trust in their dealings. Ultimately, a trust in partner helps not only to reduce the risk of opportunistic behaviour (Hödl & Puck, 2014) (Madhok, 2006), but also reduces cost-relating factors in dealing with the likelihood of opportunism (Dyer, 1997).

In view of this, Moslem businessmen expect that zakat institutions to uphold high standards of ethical practice in managing zakat fund and less likely to act opportunistically. Therefore, the suggested hypothesis is:

2.2.4 Perception on Distribution of Zakat

The distribution of zakat fund to the eligible recipients differs from the practice of other charity or nonprofit organization as the money collected must be distributed to eight different categories. Each category will received one-eighth of the zakat fund including zakat institution as the amil (administrator/caretaker). However, when there are cases of prevalent destitute and poor being highlighted in the local media, contributors are beginning to feel suspicious on the usage of their money intended to help the needy ones. Previous studies have indicated a problem of inefficiency in relation to the distribution of zakat recipients, giving rise to a negative perception of the zakat institution (Saad & Abdullah, 2014). In relation to this, it was reported that about 57.1% of tax payers were not satisfied with zakat institution especially in the distribution of alms to the needy (Ahmad & Wahid, 2005a; Wahid & Ahmad, 2014). In short, zakat payers’ perception on the distribution efficiency will determine the level of trust towards zakat institutions.

Thus, the developed hypothesis is:

Research Conceptual Framework

The research conceptual framework is illustrated in Figure

Conclusion and Implication

The purpose of this paper is to propose a conceptual framework for examining trust towards zakat institutions amongst Moslem business owners. The framework is developed using the commitment-trust theory. Review of relevant literatures found that shared values, communication, non-opportunistic behavior and perception on distribution are the factors that can influence trust towards zakat institutions.

This paper has several implications to theory and practice. The theoretical implication of this paper is that it integrates the commitment-trust theory to explain trust towards zakat institutions from the perspective of Moslem business owners. Most of prior studies utilized Theory of Planned Behaviour (TPB) as the underpinning theory to explain zakat phenomenon (Ajzen, 1991). This paper also expands zakat literature by suggesting the influencing factors on the trust. The factors were consistently reported in other non-profit organizations and charity-giving related studies (Sargeant & Lee, 2004; Sargeant & Woodliffe, 2007; Naskrent & Siebelt, 2011). The practical implication is information about the influencing factors can be utilized by zakat institutions to develop appropriate strategies to enhance the trust amongst the business owners. This is turn would encourage them to pay zakat through formal channel and increase the zakat collection. This paper is conceptual in nature, therefore, no statistical analyses and empirical evidence are provided. Further research could test the significant level on the influencing factors using mail survey approach. Such test is important to provide more conclusive empirical evidence on the issue studied.

References

- Ahmad, S., & Wahid, H. (2005). Persepsi agihan zakat dan kesannya terhadap pembayaran zakat melalui institusi formal. Jurnal Ekonomi Malaysia, 39, 53–69.

- Ahmad, S., Wahid, H., Nik Soh, N. S., & Zainal, N. (2011). Faktor Mempengaruhi Tahap Keyakinan Agihan Zakat Kajian Terhadap Masyarakat Islam Di Selangor. Jurnal Ekonomi Malaysia, 48(2), 41–50.

- Ajzen, I. (1991). The theory of planned behavior. Organizational Behavior and Human Decision Processes, 50(2), 179–211.

- Al Qardawi, Y. (2000). Fiqh al zakah. Jeddah: King Abdul Aziz University.

- Alias, M. R. (2013). Business zakat : Compliance and Practices in Federal Territory.

- Al-Quran. (1994). Tafsir Pimpinan Ar-Rahman kepada Pengertian Al-Quran. (S. A. B. M. Basmeih & H. M. N. B. H. Ibrahim, Eds.) (Kesebelas.). Kuala Lumpur: Bahagian Hal Ehwal Islam, Jabatan Perdana Menteri.

- Bandura, A. (1986). Social foundations of thought and action: A social cognitive theory. New Jersey: Prentice Hall.

- Bennett, R., & Barkensjo, A. (2005). Relationship quality, relationship marketing, and client perceptions of the levels of service quality of charitable organisations. International Journal of Service Industry Management, 16(1), 81–106.

- Bernama. (2013). Peniaga kecil masih kurang bayar zakat. Sinar Harian.

- Dyer, J. H. (1997). Effective Interfirm Collaboration: How Firms Minimize Transaction Costs and Maximize Transaction Value. Strategic Management Journal, 18(7), 535–556.

- Hödl, M., & Puck, J. (2014). Asset specificity, IJV performance and the moderating effect of trust: Evidence from China. Asian Business & Management, 13(May 2012), 65–88.

- Ibrahim, M. F., & Musaini, S. (2010). Zakat dan Pelaksanaannya di Malaysia. Kota Kinabalu: Universiti Malaysia Sabah.

- Ismail, M., Ali, S. M., & Mohamad, M. S. (2011). Prestasi zakat dan agihan zakat di negeri Melaka. The World Universities 1st Zakat Conference 2011 (WU1ZC 2011), 1–13.

- Jabatan Audit Negara Malaysia. (2010). Laporan Ketua Audit Negara 2009 Negeri Melaka. Putrajaya. Retrieved from https://www.audit.gov.my/index.php?option=com_content&view=article&id=160:lkan-arkib-melaka&catid=109&Itemid=475&lang=en

- Jabatan Zakat Negeri Kedah. (2015). Jabatan Zakat Negeri Kedah. Retrieved July 15, 2015, from http://www.zakatkedah.com/

- Johari, F., Ridhwan, M., Aziz, A., Fahme, A., Ali, M., Ridhwan, M., & Aziz, A. B. (2014). A Review on Literatures of Zakat between 2003-2013. Library Philosophy and Practice (E-Journal), 0_1.

- Kelly, K. S. (2012). Effective Fund-Raising Management. Routledge.

- MacMillan, K., Money, K., Money, A., & Downing, S. (2005). Relationship marketing in the not-for-profit sector: An extension and application of the commitment-trust theory. Journal of Business Research, 58(6), 806–818.

- Madhok, A. (2006). Revisiting Multinational Firms’ Tolerance for Joint Ventures: A Trust-Based Approach. Journal of International Business Studies, 37(1), 30–43.

- Md Hairi, M. H., Kamil, M. I., & Ram Al Jaffri, S. (2012). Ketelusan di dalam tadbir urus institusi zakat. Seminar Isu-Isu Kontemporari Zakat Di Malaysia, 63–74.

- Moorman, C., Zaltman, G., & Deshpandé, R. (1992). Relationships Between Providers and Users of Market Research: The Dynamics of Trust Within and Between Organizations. Journal of Marketing, XXIX(August), 314–28.

- Morgan, R. M., & Hunt, S. D. (1994). The Commitment-Trust Theory of Relationship Marketing. Journal of Marketing, 58(July), 20–38.

- Muhammad, F., Yahya, M., Hussin, M., Razak, A., & Awang, A. (2015). Ketirisan Bayaran Zakat Fitrah Terhadap Institusi Formal Di Malaysia. Sains Humanika, 2010(5:1), 27–32.

- Naskrent, J., & Siebelt, P. (2011). The Influence of Commitment, Trust, Satisfaction, and Involvement on Donor Retention. Voluntas, 22(4), 757–778.

- Patmawati, I. (2008). Pembangunan ekonomi melalui agihan zakat: Tinjauan empirikal. Jurnal Syariah, 16(2), 223–244.

- PEMANDU. (2011). Retrieved from http://www.pemandu.gov.my/gtp/About_GTP-@-GTP_Overview.aspx?lang=ms-my

- Putnam, R. D. (2000). Bowling Alone - The Collapse & Revival of American Community. New York: Simon & Schuster.

- Razaly, M. Z., Mustaffa, M. Z., Zakaria, M., Mearaj, M. B. S., & Fadil, S. A. B. S. (2014). Isu dan cabaran zakat perniagaan: kajian di negeri johor. In International Conference on Masjid, Zakat and Waqf (pp. 66–76). Kuala Lumpur.

- Saad, N. M., & Abdullah, N. (2014). Is Zakat Capable of Alleviating Poverty ? An Analysis on the Distribution of Zakat Fund in. Journal of Islamic Economics, Banking and Finance, 10(1), 69–95.

- Sargeant, A., & Lee, S. (2004). Donor trust and relationship commitment in the U.K. charity sector: the impact on behavior. Nonprofit and Voluntary Sector Quarterly, 33(2), 185–202.

- Sargeant, A., & Woodliffe, L. (2007). Building Donor Loyalty: The Antecedents and Role of Commitment in the Contet of Charity Giving. Journal of Nonprofit & Public Sector Marketing, 18(2), 47–68.

- Sinar Harian. (2014, February 25). Agihan zakat dipersoal. Sinar Harian. Kuala Lumpur. Retrieved from http://www.sinarharian.com.my/nasional/agihan-zakat-dipersoal-1.254402

- Singer, A. (2013). Giving Practices in Islamic Societies. Social Research, 80(2), 341–358.

- Suprayitno, E., Kader, R. A., & Harun, A. (2013). The Impact of Zakat on Aggregate Consumption in Malaysia. Journal of Islamic Economics, Banking and Finance, 9(1), 1–24.

- Syed Adwam, S. M. G. W., Md Hussain, M. N., & Hanafiah, M. H. (2005). Pengantar Perniagaan Islam. Petaling Jaya: Prentice Hall.

- Sztompka, P. (1999). Trust: A Sociological Theory. Cambridge: Cambridge University Press.

- Torres-Moraga, E., Vásquez-Parraga, A. Z., & Barra, C. (2010). Antecedents of donor trust in an emerging charity sector: The role of reputation, familiarity, opportunism and communication. Transylvanian Review of Administrative Sciences, (29 E), 159–177.

- Wahab, A. A., & Borhan, J. T. (2014). Faktor Penentu Pembayaran Zakat oleh Entiti Perniagaan di Malaysia: Satu Tinjauan Teori, 22(3), 295–322.

- Wahab, N. A., & Rahman, A. R. A. (2013). Determinants of efficiency of zakat institutions in Malaysia: A non-parametric approach. Asian Journal of Business and Accounting, 6(2), 33–64.

- Wahid, H., & Ahmad, S. (2014). Faktor Mempengaruhi Tahap Keyakinan Agihan Zakat Kajian Terhadap Masyarakat Islam Di Selangor. Jurnal Ekonomi Malaysia, 48(2), 41–50.

- Wahid, H., Ahmad, S., & Kader, R. A. (2010). Pengagihan Zakat oleh Institusi Zakat Kepada Lapan Asnaf: Kajian Di Malaysia. Jurnal Pengurusan JAWHAR, 4(1), 141–170.

- Wahid, H., Mohd Noor, M. A., & Ahmad, S. (2005). Kesedaran membayar zakat: apakah faktor penentunya? International Journal of Management Studies, 12(2), 171–189.

- Williamson, O. E. (1993). Calculativeness, Trust, and Economic Organization. Journal of Law & Economics, 36(1, Part 2), 453–486.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

22 August 2016

Article Doi

eBook ISBN

978-1-80296-013-6

Publisher

Future Academy

Volume

14

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-883

Subjects

Sociology, work, labour, organizational theory, organizational behaviour, social impact, environmental issues

Cite this article as:

Ghazali, M. Z., Saad, R. A. J., & Abd. Wahab, M. S. (2016). Proposing Factors Influencing Trust towards Zakat Institutions amongst Moslem Business Owners. In B. Mohamad (Ed.), Challenge of Ensuring Research Rigor in Soft Sciences, vol 14. European Proceedings of Social and Behavioural Sciences (pp. 651-658). Future Academy. https://doi.org/10.15405/epsbs.2016.08.92