Abstract

Research on the relationship engagement in Mergers and Acquisitions (M&As) is still unclear although this phenomenon has been explored in the global multi-business environment. Existing researches did not clearly demonstrate the importance of the relationship among M&A players in the amalgamation processes between an acquirer and the acquired firm. Thus, this paper attempts to highlight the influence of collegial leadership in initiating relationship engagement in the post M&A integration. Result shows that collegial leadership significantly influence the relationship engagement in M&A.

Keywords: Mergers and AcquisitionsRelationship engagementCollegiality

Introduction

Mergers and acquisitions (M&A) is a business phenomenon that is very commonly used as corporate development strategies. This is not a new phenomenon but as an organizational growth approach which has been used extensively as a means to international expansion by many multinational corporations (MNCs).

M&A offers value-creation opportunities through combining complimentary assets and liabilities from firms with different backgrounds. M&A also has disadvantages that are attributed to hubris, managerial incompetency in achieving projected economies of scale and the firms being strategically mismatched (Sinkovics, Sinkovics, Lew, Jedin, & Zagelmeyer, 2015). Lack of communication between top management and other managerial positions is also believed to add more hurdles to the amalgamation process. In fact, previous studies have confirmed that almost 50-70% of M&A failed to create value for the acquiring firm’s shareholders, although at first glance the strategy would seem to be the most perfect way to improve a firm’s value and enhance its capabilities through better access to resources (Tetenbaum, 1999). This may be due to the nature of M&As that is likely to bring about complex events and many drawbacks compared to the advantage in organizational environments, especially post-integration (Larsson & Finkelstein, 1999).

One of the major challenges of the M&As integration process is the coordination and information flow in the merged difficulty involved in developing and exploiting skills and acquiring knowledge (Meschi & Metais, 2006). Furthermore, lack of compelling strategic rationale and unrealistic expectations of the possible synergies also create significant challenges. One of the ways to generate a better communication bridge is developing an integration infrastructure that has clear roles, responsibilities and expectations (Galpin & Herndon, 2007).

By adapting the resource-based view (RBV) and social capital theory as the framework foundation, this paper attempts to raise this issue on how to develop better relationship engagement among the acquirer and the acquired firms. Hence, this research seeks to initiate this line of enquiry by investigating how the managers of the acquirer and the acquired firms can work together in harmonies by adapting the collegiality leadership styles.

Literature Review

Collegiality Leadership in M&A

Although, collegiality concept is familiar in academic world but there are unknown interpretations in applying this concept in an organization. In organization, collegiality approach seems to be co-existing but more in competition wise which is rather different from the academic world. However, the competitive environments is controllable if the organization is equip with strong believe in a particular vision and objective. According to Freedman (Freedman, 2009), collegiality approach works in many ways from cooperative to governance committee activities which highlight a concept of shared power and authority among collegues.

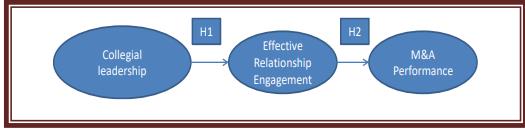

In fact, collegiality in M&A is an ideal initiative in order to develop sense of engagement among the staff and superior of the acquired firm and the acquirer. Most likely, the acquirer will appoint their managers to head the position in the acquired firm. In this situation, a role of collegiate and empathy would be advantage in order for both staff to improve their relationships and at the same time enhance the productivity of the combined firms. By applying the concept of collegiality engagement in M&A integration, the staff would be able to be more lateral rather than high in hierarchical which improve in the decision making process in an organization. In addition, this concept could avoid conflict and the feeling of foreignness among the staff that attached with acquired and acquirer firms. Therefore we propose the following hypothesis which considers collegiality as one of the factors that could facilitate relationship effectiveness among the staff in the M&A integration initiatives. Figure

H 1 (+): The higher the initiative of collegial leadership, the better the relationship engagement between acquirer and the acquired firm.

2.2 Effectiveness in Relationship Engagement

Another important outcome is the close relationships between the staff and managers of both firms (acquiring and acquired). The relationships between the managers are essential to avoid misunderstandings in communications and above all to ensure that the M&A integration activities are kept on track in order to allow an outstanding M&A performance. Additionally, this outcome would hopefully retain staff rather than encouraging them to move to other organizations. Losing these valuable managers are not the only a main concern but to lose the thinkers and hardworking managers would be a potential risk of losing key customers attached to those managers.

Even though the acquirer and the target firm have combined, relationship gaps between them will still exist. Staff attached to the target firm will always be vulnerable to any decisions made by the new owner of the combined firm. Therefore, quick action is needed to bridge this gap by enhancing good relationships in order to avoid the loss of dedicated staff and, more importantly, to eradicate feelings of discrimination amongst the staff. The acquirer needs to develop good flows of communication by having a lot of informal discussions and disseminating new information to all staff including those from the acquired firm. This is important to avoid irrational rumours which could cause the collapse of the newly-built firm. This can be addressed by improving the commitment to business relationships so that associates are ultimately made to feel important. Relationship gaps among the managers of the acquired and the acquirer firm, particularly in M&As are not tangible, but need long term attention as relationships take time to develop. Therefore, we hypothesize:

H 5 (+): The greater the staff relationship engagement, the better the M&A performance.

2.3 M&A Performance

Various studies that focus on M&A performance in the integration phase consider the perspectives of financial performance after the M&A (Homburg & Bucerius, 2006; Zollo & Meier, 2008). Another striking study by Colombo et al. (2007) highlights five components of M&A performance, namely market share, profitability, competitive positioning, market coverage and customer satisfaction. This study that looks at M&A performance. Hence, the present study attempts to highlight the role of collegiality leadership that could rejuvenate the relationship engagement in M&A integration thereby improving the M&A performance.

Research Methodologies

The survey was conducted in 2014. We look at M&A transactions undertaken by the Malaysian firms, within the period of seven years (2006-2013). This period was also applied by Sinkovics et al. (2015) in the M&A studies. However, the scope of this study was limited to Malaysian contexts. The M&A cases were gathered from the Bursa Malaysia database.

Out of the 428 M&A cases listed in Bursa Malaysia from the period of January 2006 until Disember 2013, we identified 385 cases of Malaysian firms involved in M&As with a transaction value of above US$1 million. From this sample, we managed to collect 72 responses.

All of the items in the questionnaire were measured using seven-point Likert scales (1= Strongly disagree/very infrequent/very low, 7 = strongly agree/very frequent/very high, respectively. The measurement of the collegial leadership were adapted from Singh (Singh, 2013). Next, we introduce one further variable in the effectiveness of the relationship engagement between the staff in the acquired and acquiring firm. This measurement was taken from Jedin and Saad (2012). The final division is performance outcomes, which were adapted from (Sinkovics, et al., 2015).

3.1 Results and Analysis

Majority of the firms were found to engage in Banking and financial institutions, telecommunications, software and other services. The data were analysed using the partial least squares method (PLS), applied using the SmartPLS 2.0 M3 software package (Ringle, Sven, & Alexander, 2005). Item reliabilities were assessed by examining the outer loadings of each item Most of the outer loadings are above the recommended threshold of 0.7 (Henseler, Ringle, & Sinkovics, 2009). Figure

Figure

Discussions

This study indicates that the collegial leadership has a highly significant, positive influence on the relationship engagement. In other words, it appears that, if both the acquirer and the target firm work together to improve their relationship by enabling to share important position and decision making processes in the combined firms, they will be able to enhance M&A performance. It is not necessarily that important position is controlled by the leaders from the acquirer but some positions in the combined firm need the existing leaders from the acquired firm. This is due to the nature of the position and additionally the leaders who managed that position have huge knowledge and experiences in that particular position. Thus, managers and leaders need to cultivate sharing and apply a rotation basis on their responsibilities in order to initiate healthy relationships which at the same time developing successful M&A integration. Furthermore, this could generate a fair agreement among the managers and highlight to those who have perform better in a particular position in improving the new combined firm.

A strong relationship among the leaders enables the combined firms to rejuvenate quick liquidity. More importantly both of the combined firms could develop sustain business environment with dynamic and passionate colleagues. In addition, the rotation basis on position approaches give more opportunity to both acquirer and acquired staff to maintain their personal developments and reduce feeling of retrenchment and uncertainty in the amalgamation (Covin, Kolenko, Sightler, & Tudor, 1997). In fact, according to Meyer (2001) both firms need to develop sharing environment and fostering relationships through balance power among the decision makers. Thus, clearly, a leader in the amalgamation processes needs to play a pivotal role to develop a collegial relationship among the managers to cultivate a sustainable integration environment.

Conclusion

As predicted, the relationship engagement is significant and positively associated with the M&A performance. As mentioned earlier, relationship engagement is very important to all levels of staff in the combined firms as this is the one that manage the motivations and social supports at the workplace. Furthermore, a high motivated staff could perform their task at maximum levels. Relationship engagement in M&A is not only between the acquirer and the target firm but it also involves the customers, suppliers and stakeholders. Thus, relationship engagement is a must to ensure a better M&A performance. Thus, with these results we have achieved our main objective, demonstrating that the collegial leadership could cultivate better relationship engagement in M&A.

References

- Colombo, G., Conca, V., Buongiorno, M., & Gnan, L. (2007). Integrating Cross-Border Acquisition: A Process-Oriented Approach. Long Range Planning, 40, 202-222.

- Covin, T. J., Kolenko, T. A., Sightler, K. W., & Tudor, R. K. (1997). Leadership style and post-merger satisfaction. Journal of Management Development, 16(1), 22-33.

- Freedman, S. (2009). Collegiality matters: How do we work with others? Paper presented at the Charleston Library Conference.

- Galpin, T., & Herndon, M. (2007). The complete guide to Mergers and Acquisitions: Process Tools to Support M&A Integration at every Level (Second ed.). San Francisco: John Wiley & Sons.

- Henseler, J., Ringle, C. M., & Sinkovics, R. R. (2009). The Use of Partial Least Squares Path Modelling in International Marketing Advances in International Marketing, 20, 277-319).

- Homburg, C., & Bucerius, M. (2006). Is speed of integration really a success factor of mergers and acquisitions? An analysis of the role of internal and external relatedness. Strategic Management Journal, 27(4), 347-367.

- Jedin, M. H., & Saad, N. M. (2012). Identifying effective mechanisms to assist the marketing integration process for Malaysian acquirers. Contemporary Management Research, 8(2), 95-116.

- Larsson, R., & Finkelstein, S. (1999). Integrating Strategic, Organizational, and Human Resource Perspectives on Mergers and Acquisitions: A Case Survey of Synergy Realization. Organization Science, 10(1), 1-26.

- Meschi, P.-X., & Metais, E. (2006). International acquisition performance and experience: A resource-based view. Evidence from French acquisitions in the United States (1988-2004). Journal of International Management, 12(4), 430-448.

- Meyer, C. B. (2001). Allocation Processes in Mergers and Acquisitions: An Organizational Justice Perspective. British Journal of Management, 12, 47-66.

- Ringle, C. M., Sven, W., & Alexander, W. (2005). SmartPLS 2.0 (M3). from http://www.smartpls.de

- Singh, P. (2013). A Collegial Approach In Understanding Leadership As A Social Skill. International Business & Economics Research Journal, 12(5), 489-502.

- Sinkovics, R., Sinkovics, N., Lew, Y. K., Jedin, M. H., & Zagelmeyer, S. (2015). Antecedents of marketing integration in cross-border mergers and acquisitions: Evidence from Malaysia and Indonesia. International Marketing Review, 32(1), 2-28.

- Tetenbaum, T. J. (1999). Beating the Odds of Merger & Acquisition Failure: Seven Key Practices That Improve the Chance for Expected Integration and Synergies. Organizational Dynamics, 28(2), 22-35.

- Zollo, M., & Meier, D. (2008). What Is M&A Performance? Academy of Management Perspectives, 22(3), 55-77.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

22 August 2016

Article Doi

eBook ISBN

978-1-80296-013-6

Publisher

Future Academy

Volume

14

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-883

Subjects

Sociology, work, labour, organizational theory, organizational behaviour, social impact, environmental issues

Cite this article as:

Jedin, M. H., & Md Saad, N. (2016). Relationship Engagement in Mergers and Acquisition through Collegial Leadership. In B. Mohamad (Ed.), Challenge of Ensuring Research Rigor in Soft Sciences, vol 14. European Proceedings of Social and Behavioural Sciences (pp. 593-598). Future Academy. https://doi.org/10.15405/epsbs.2016.08.84