The Role of Reputation, Satisfactions of Zakat Distribution, And Service Quality in Developing Stakeholder Trust In Zakat Institutions

Abstract

Zakat is one of the five basic pillars in Islam and it is obligatory to all Muslims. Zakat is a system that can alleviate poverty in order to decrease the gap among rich and poor. If zakat can be managed effectively, the collection of zakat can be maximized compared to income tax collection. Thus, this article is an early study proposing a research model to examine the factors that influence stakeholder trust in zakat institutions. This is due to the lack of previous studies about stakeholder trust in zakat perspective. An extensive literature review method was utilized to identify and analyze the relevant literature in order to propose the model. This paper is discussing three factors which are reputation, satisfaction of zakat distribution, and service quality. Theoretical and practical of the paper as well as suggestions for future research were also discussed.

Keywords: Trustzakat institutions; reputation; satisfaction of zakat distribution; service quality

Introduction

Zakat plays an important role for the Muslims. The word of zakat can give various meanings and purposes such as purity, grace, growing, thriving, success, improved, peace, charity and praise (Mujaini, 2012). The main goal of zakat is to reduce the gap between poor and rich (Hairunnizam, Radiah, & Sanep, 2012; Mujaini, 2009; Shamsiah, Asmak, & Sharifah Hayaati, 2010). Therefore, zakat institution is a perfect system that can eliminate poverty and sustain socioeconomic justice (Patmawati, 2008; Razali & Rohayu, 2011). According to the estimated census data in the year 2014, 61.3% from 30.1 million of Malaysians are Muslim, making them as the largest population in Malaysia (Jabatan Perangkaan Malaysia, 2014). However, the huge number of Muslims has yet to represent a significant and potential number of actual zakat collections.

At 2013, the statistic of zakat collection recorded had reached 2.1 billion, compared to the year 2012 which is only RM1.9 billion. This data shows that the zakat collection had increased more than RM2 million or 10.53% (Pusat Pungutan Zakat Wilayah Persekutuan, 2014). Although the institutions of zakat were successful in increasing the zakat collection year by year, but the issue of trust continues to be a concern. This issue arises because of some problems that happened such as inefficiency in the distribution of zakat as well as the surplus of zakat funds that are not distributed to the eligible asnaf (Hairunnizam et al., 2012; Md Hairi, 2009; Raudha et al., 2011; Sanep & Hairunnizam, 2005b). The issue of zakat fund surplus that is not fully distributed has contribute to the negative perceptions and effect level of trust among zakat payers(Hairunnizam, Sanep, & Radiah, 2009; Nur Barizah & Hafiz Majdi, 2010). However, when the level of trust among the stakeholder declined, the problem of zakat leakage is rising because they are more willing to give the zakat directly to the local asnaf and neglecting others (Hairunnizam, Sanep, & Radiah, 2010). (Sargeant & Lee, 2002) also reveal that if a community has a low level of trust towards a non-profit agency, then their desire to donate and support that institution will decrease. This is because trust is considered as a license to guaranty an organization can move forward.

Consequently, the collection of zakat funds should be enhanced by retrieving stakeholders’ trust. This is because zakat is one of the tools that can help the government in combating poverty through the Government Transformation Program (GTP) and National Key Result Areas (NKRA) by increasing the living standards of low household income (“Program Transformasi Negara,” 2011). Most of the studies conducted on zakat in Malaysia concentrated in various areas including theoretical (Mujaini, 1995; Mujitahir, 2003), legal and compliance (Kamil, 2002; Mohd Yahya, Fidlizan, & Ahmad, 2013), accounting (Rahim, 2003) and Muslim awareness and payment behavior (Kamil & Ahmad Mahdzan, 2002; Mohd Ali, Hairunnizam, & Nor Ghani, 2004; Ram Al Jaffri, 2010; Sanep & Hairunnizam, 2005a). However, there are very limited studies that observe the trust in zakat institutions. Moreover, study of Nigerian Zakat Institutions and Role of Governance on Zakat Payers’ Trust had done by past researcher (Abioye, 2012). So, it can be seen that there is still limited study that comprehensively examines the stakeholder trust in Malaysian zakat institutions. Hence, this study tries to fill this gap by embarking a study focusing on the factors that contributes to the stakeholder trust in Malaysia’s zakat institutions with the hope to contribute towards an improved level of trust among zakat stakeholders in Malaysia.

The paper structured as follows. Section

Literature Review

Trust in zakat institutions

In Malaysia, the zakat is managed by zakat institutions that established in every state wherein a whole there are 14 zakat institutions. According to the Malaysian Constitution, Clause 97 (3), management of zakat in each state is under the jurisdiction and responsibility of the respective states (Perlembagaan Persekutuan, 2006). Majlis Agama Islam Negeri (MAIN) is responsible for collecting and distributing zakat funds. The issue of “pay zakat outside the local area” and “pay zakat directly to the asnaf” arise because there is no legal provision stipulated that the payer must pay to the authority where they earn income. Furthermore, there is no legal provision that prevents them to pay directly to eight asnafs..

As mentioned in The Quran, Surah at-Taubah verse 60 “Zakat is for the poor and the needy and those who are employed to administer and collect it, and for those whose hearts are to be won over, and for the freeing of human beings from bondage, and for those who hearts are overburdened with debts and for every struggle in God’s cause, and for the wayfarers: this is a duty ordained by God, and God is the All-Knowing, the Wise”(Syarif, 2000). This phenomenon can create an imbalance between other states. One of the reasons that contribute to this phenomenon is the low on trust in zakat institutions. The trust issues arise due to several things like inefficient distribution of zakat, zakat fund surplus that has not been distributed to eligible recipients, tarnished reputation and low quality of service (Abratt & Kleyn, 2012; Hairunnizam et al., 2010; Kantsperger & Kunz, 2010; Nur Hafizah & Selamah, 2013; Sanep & Hairunnizam, 2005b).

Reputation and Trust in Zakat Institutions

Reputation is the overall perception of stakeholders in the performance of the company from time to time (Richard & Zhang, 2012) .Therefore, reputation can be achieved through information from people around or other sources. This is because the client does not have direct experience of the organization nor the seller. Positive information can enhance the trust of customers. This is the same with (Abratt & Kleyn, 2012) which states that the past experience of the product and the company's reputation will establish consumer trust in a company. Therefore, the reputation of a company is the final determinants in meeting the expectations and demands of consumers (Abratt & Kleyn, 2012) and as an assessment to what extent an organization is highly regarded by them. Past research by (Moorman, Deshpande, & Zaltman, 1993) supports that the institution's reputation and efficiency are fundamental of the trust. The finding shows that there was a significant relationship between reputation and trust supplier. In another field, the research about internet banking also found that consumers consider the reputation of the bank before using the services provided (Moorman et al., 1993). Therefore, this proves that the reputation is the most important factor for trust. When the reputation of a bank is highly regarded, then they will be more trusted and the consumers will like to use the services offered. On the contrary, when the reputation is underestimated, then the user will not use the service. Thus, we can conclude that the reputation can be used as a measure of trust. In an environment of zakat, positive attitude of society towards zakat institutions can increase the number of total collections of zakat payers. However, negative attitudes cause people to pay zakat to informal channels (Eza Ellany & Mohd Rizal, 2011). So the researchers assume that the reputation is a factor to build the trust of consumers to the institutions of charity. Hence the following hypothesis is formed as below.

H1 Reputation should have a significant positive relationship with stakeholder trust in zakat institutions.

Satisfaction of zakat distribution and trust in zakat institutions

According to (Kotler & Amstrong, 2009) customer satisfaction is the level of expectation and buyers hope towards a product. Hence, satisfaction is a feeling of happy or sadness arising from the comparison between the perceptions and expectations of the customers (Kotler & Amstrong, 2009). Apart from that, to maintain the performance of the zakat, the satisfaction of the distribution must be improved in order to encourage the Muslim to pay zakat through zakat institutions (Eza Ellany & Mohd Rizal, 2011). Based on the previous research, there are several findings regarding the satisfaction of distribution (Sanep & Zulkifli, 2010).

According to (Kamil & Ahmad Mahdzan, 2002), distrust towards zakat institutions, especially in terms of transparency and inefficiency of distribution management led to non-compliance. The higher of satisfaction to zakat institutions, the higher of zakat compliance. Consistent with the above arguments, it is expected that a stakeholder who has a high level of satisfaction on the zakat distribution would contribute to a greater trust in zakat institutions and vice versa. Therefore, the following hypothesis is offered:

H2 Satisfaction of zakat distribution should have a significant positive relationship with stakeholder trust in zakat institutions.

Service quality and trust in zakat institutions

Service quality has been defined by some researchers, but one of the most widely accepted definition is the difference between expectation and actual performance (Grönroos, 1984; Parasuraman, Zeithaml, & Berry, 1994)or an overall assessment of the advantages/preference of a product or services (Zeithaml, 1988). Initial results have shown that the good quality and consistent service will create trust among customers (Hazra, Kailash, & Srivastava, 2009; Kantsperger & Kunz, 2010). In addition, the trust is able to maintain a good long-term relationship between organizations and customers (Garbarino & Johnson, 1999; Morgan & Hunt, 1994). Therefore, consumer trust is a key element in maintaining and building relationships (Berry & Parasuraman, 1991; Ndubisi, Chan, & Ndubisi, 2007). In conclusion, high trust can be achieved through sincere and consistency (Grönroos, 1984).

According to a study by (Mohamad Noor Sahidi, 2013), the role of zakat institution in providing a service quality to the community is an important factor to attract and encourage entrepreneurs to pay zakat. He also stated that the quality of a service is considered as well when an organization meet the customer expectations before and after services. Moreover, (Ram Al Jaffri, Kamil, & Zainol, 2009) showed empirical evidence that by improving the service quality, compliance towards zakat will be better. In congruence with the above discussion, it is assumed that service quality of zakat institutions will determine the stakeholder trust in zakat institutions. Thus, the proposed hypothesis is:

H3 Service quality should have a significant positive relationship with stakeholder trust in zakat institutions.

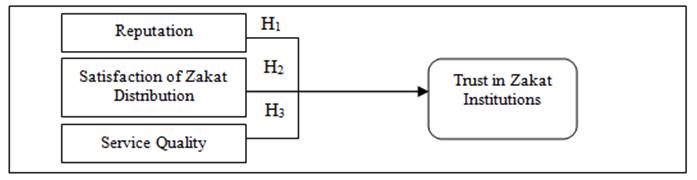

Conceptual model

Based on the hypotheses development in the previous subsection, the research model is then shown in Figure

Conclusion, Implication and Future Research

The purpose of this paper is to propose a research model of factors influencing stakeholder trust in zakat institutions. Review of the relevant past studies indicated that reputation, satisfactions of zakat distribution and service quality influence trust.

This paper has several implications for theory and practice. The theoretical implication of this paper is it integrates prior trust literature in sociology, management and economy as well as science politic to explain stakeholder trust in zakat institution. Another theoretical implication is the proposed research model can be used to conduct further research on this issue.

The practical implication is the information about the influencing factors can be utilized by zakat institutions to encourage eligible Muslim zakat stakeholder to increase the level of their trust. This is, in turn, would maximize zakat fund in the near future. This paper is conceptual in nature, therefore, no empirical evidence is provided. Further research could validate and examine the predictive power of the proposed model using mail survey approach. This approach is considered more appropriate compared to other approaches (for instance, case study) due to issues such as convenience, cost, time and accessibility.

References

- Abioye, M. M. O. (2012). Exploratory Study of Nigerian Zakat Institutions and Role of Governance on Zakat Payers’ Trust.

- Abratt, R., & Kleyn, N. (2012). Corporate identity, corporate branding and corporate reputations: Reconciliation and integration. European Journal of Marketing, 46(7/8), 104–1063.

- Berry, L. L., & Parasuraman, A. (1991). Marketing Services: Competing Through Quality. New York: The Free Press.

- Eza Ellany Abdul Lateff, & Mohd Rizal Palil. (2011). Faktor-Faktor Yang Mempengaruhi Pembayaran Zakat Pendapatan Di Malaysia. In Persidangan Ekonomi Malaysia ke VI(PERKEM VI) (Vol. 1, pp. 148–159). Retrieved from http://www.ukm.my/fep/perkem/pdf/perkemVI/PERKEM2011-1-1B6.pdf

- Garbarino, E., & Johnson, M. . (1999). The Different Roles of Satisfaction, Trust, and Commitment In Customer Relationships. Journal of Marketing, 63(4), 70–87.

- Grönroos, C. (1984). A Service Quality Model and its Marketing Implications. European Journal of Marketing, 18(4), 36–44.

- Hairunnizam Wahid, Radiah Abdul Kader, & Sanep Ahmad. (2012). Penerimaan Amil dan Asnaf Terhadap Penyetempatan Pengagihan Zakat di Malaysia. Jurnal Ekonomi Malaysia, 46(1), 39–51.

- Hairunnizam Wahid, Sanep Ahmad, & Radiah Abdul Kader. (2010). Pengagihan Zakat oleh Institusi Zakat Kepada Lapan Asnaf: Kajian di Malaysia. Jurnal Pengurusan JAWHAR, 4(1), 141–170.

- Hairunnizam Wahid, Sanep Ahmad, & Radiah Abdul Kadir. (2009). Pengagihan Zakat oleh Institusi Zakat di MAlaysia: Mengapa Masyarakat Islam Tidak Berpuas Hati? Jurnal Syariah, 17(1), 89–112.

- Hazra, S. G., Kailash, B. L., & Srivastava. (2009). Impact of Service Quality on Customer Loyalty, Commitment and Trust in the Indian Banking Sector. ICFAI Journal of Marketing Management, 3(3), 75–95.

- Jabatan Perangkaan Malaysia. (2014). Statistik Jumlah Penduduk di Malaysia. Retrieved from https://www.statistics.gov.my/

- Kamil Md. Idris, & Ahmad Mahdzan Ayob. (2002). Peranan Sikap dalam Gelagat Kepatuhan Zakat Pendapatan Gaji, 9(1 & 2), 171–191.

- Kamil Md.Idris. (2002). Gelagat Kepatuhan Zakat Pendapatan Gaji di Kalangan Kakitangan Awam Persekutuan Negeri Kedah. Universiti Utara Malaysia.

- Kantsperger, R., & Kunz, W. H. (2010). Consumer trust in service companies: a multiple mediating analysis. Managing Service Quality, 20(1), 4–25.

- Kotler, P., & Amstrong, G. (2009). Principles of Marketing (3rd ed.). New Jersey: Person Education.

- Md Hairi Md Hussain. (2009). Keberkesanan Sistem Agihan Zakat: Suatu Pandangan Awal. In The 4th ISDEV International Graduate Workshop (INGRAW 2009) (pp. 1–14).

- Mohamad Noor Sahidi bin Johari. (2013). Penentuan Institusi Zakat Secara Menyeluruh. Jurnal Pengurusan JAWHAR, 7(2).

- Mohd Ali Mohd Nor, Hairunnizam Wahid, & Nor Ghani Md. Nor. (2004). Kesedaran Membayar Zakat Pendapatan di Kalangan Kakitangan Profesional Universiti Kebangsaan Malaysia. Jurnal ISLAMIYYAT, 2(26), 59–67.

- Mohd Yahya Mohd Hussin, Fidlizan Muhammad, & Ahmad, M. A. R. (2013). Kepatuhan Membayar Zakat:Analisis Kutipan dan Ketirisan Zakat Fitrah di Selangor. Jurnal Syariah, 21(2), 191–206.

- Moorman, C., Deshpande, R., & Zaltman, G. (1993). Factors Affecting Trust in Market Research Relationships. Journal of Marketing, 57(1), 81–101.

- Morgan, R. M. R., & Hunt, S. S. D. (1994). The commitment-trust theory of relationship marketing. The Journal of Marketing, 58(July 1994), 20–38. Retrieved from http://www.jstor.org/stable/1252308

- Mujaini Tarimin. (1995). Zakat Penggajian: Satu Penilaian Terbaru di Malaysia. Universiti Malaya.

- Mujaini Tarimin. (2009). Memantapkn Pelaksanaan Agihan Zakat oleh Institusi Zakat di Malaysia: Satu Saranan Penambahbaikan. Jurnal Pengurusan JAWHAR, 2(April 2009), 55–71.

- Mujaini Tarimin. (2012). Zakat Al-mal Al-mustafad Amalan dan Pengalaman di Malaysia. Kuala Lumpur: Pusat Pungutan Zakat 2012.

- Mujitahir, J. (2003). Perkaedahan Fiqh dalam Aplikasi Zakat Pendapatan. In Seminar Zakat Pendapatan.

- Ndubisi, N. 0., Chan, K. W., & Ndubisi, G. C. (2007). Supplier-customer Relationship Management and Customer Loyalty: the Banking Industry Perspective. Journal of Enterprise Information Management, 20(22), 222–236.

- Nur Barizah Abu Bakar, & Hafiz Majdi Abdul Rashid. (2010). Motivations of Paying Zakat on Income : Evidence from Malaysia. International Journal of Economics and Finance, 4(2), 249–258. Retrieved from http://www.ccsenet.org.sci-hub.org/journal/index.php/ijef/article/view/6087

- Nur Hafizah Ishak dan Selamah Maamor. (2013). Kajian Kecekapan Kutipan Zakat di Wilayah Persekutuan. In Prosiding PERKEM VIII (Vol. 1, pp. 414–425).

- Parasuraman, A., Zeithaml, V. A., & Berry, L. L. (1994). Alternative Scales for Measuring Service Quality:A Comparative Assessment Based on Psychometric and Diagnostic Criteria. Journal of Retailing, 70(3), 201–230.

- Patmawati Hj Ibrahim. (2008). Pembangunan ekonomi melalui agihan zakat: tinjauan empirikal. Jurnal Syariah, 16(2), 223–244.

- Perlembagaan Persekutuan. (2006). Percetakan Nasional Berhad.

- Program Transformasi Negara. (2011). Retrieved February 5, 2015, from http://www.epu.gov.my/goverment-transformation-programme

- Pusat Pungutan Zakat Wilayah Persekutuan. (2014). Laporan Zakat PPZ MAWIP 2011-2014. Kuala Lumpur.

- Rahim, A. R. A. (2003). Zakat on Business Wealth in Malaysia: Corporate Tax Rebate, Accountability, and Governance. IKIM, 11(1), 37–50.

- Ram Al Jaffri Saad. (2010). Gelagat Kepatuhan Zakat Perniagaan di Negeri Kedah Darul Aman.

- Ram Al Jaffri Saad, Kamil Md.Idris, & Zainol Bidin. (2009). Peraturan Pembayaran Zakat Kepada Institusi Zakat: Sikap Peniaga dan Kesannya Terhadap Gelagat Pembayaran Zakat Perniagaan. Jurnal Syariah, 17(3), 607–630.

- Raudha Md Ramli, Sanep Ahmad, Hairunnizam Wahid, Abdul Ghafar Ismail, Nik Sabrina Nik Soh, & Norzaihawati Zainal. (2011). Indeks Keyakinan Pembayar Zakat Terhadap Keupayaan Pengurusan Dana Zakat :Kajian Kes di Lembaga Zakat Selangor (LZS). In Zakat Conference 2011.

- Razali Othman, & Rohayu Abdul Ghani. (2011). Sektor Ijtimai: Ke Arah Pemantapan Sosio-Ekonomi Ummah Razali. Jurnal Pengurusan JAWHAR, 5(1), 99–130.

- Richard, J. E., & Zhang, A. (2012). Corporate image, loyalty, and commitment in the consumer travel industry. Journal of Marketing Management, 28(5-6), 568–593.

- Sanep Ahmad & Hairunnizam Wahid. (2005a). Penerimaan dan Tanggapan Masyarakat terhadap Sumber Zakat Harta yang Diikhtilaf, 27(1), 45–65.

- Sanep Ahmad & Hairunnizam Wahid. (2005b). Persepsi Agihan Zakat dan Kesannya Terhadap Pembayaran Zakat Melalui Institusi Formal. Jurnal Ekonomi Malaysia, 39, 53–69. Retrieved from http://www.ukm.my/penerbit/jurnal_pdf/JEM39-03.pdf

- Sanep Ahmad & Zulkifli. (2010). Model Gelagat Pematuhan dan Pengelakan Zakat: Suatu Tinjauan Teori. In Seventh International Conference – The Tawhidi Epistemology: Zakat and Waqf Economy (pp. 501–516).

- Sargeant, A., & Lee, S. (2002). Individual and Contextual Antecedents of Donor Trust in the Voluntary Sector. Journal of Marketing Management, 18(7-8), 779–802.

- Shamsiah Mohamad, Asmak Ab Rahman, & Sharifah Hayaati Syed Ismail. (2010). Kesejahteraan Ummah dan Agihan Semula Kekayaan Menurut Perspektif Islam. Retrieved from http://eprints.um.edu.my/3128/

- Syarif, M. K. al-H. asy S. al M. F. li thiba’at al M. ay (Ed.). (2000). Al-Quran dan Terjemahannya.

- Zeithaml, V. A. (1988). Consumer Perceptions of Price, Quality, and Value: A Means-End Model and Synthesis of Evidence. Journal of Marketing, 52(3), 2–22.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

22 August 2016

Article Doi

eBook ISBN

978-1-80296-013-6

Publisher

Future Academy

Volume

14

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-883

Subjects

Sociology, work, labour, organizational theory, organizational behaviour, social impact, environmental issues

Cite this article as:

Zainal, H., Abu Bakar, A., & Saad, R. A. J. (2016). The Role of Reputation, Satisfactions of Zakat Distribution, And Service Quality in Developing Stakeholder Trust In Zakat Institutions. In B. Mohamad (Ed.), Challenge of Ensuring Research Rigor in Soft Sciences, vol 14. European Proceedings of Social and Behavioural Sciences (pp. 524-530). Future Academy. https://doi.org/10.15405/epsbs.2016.08.74