Abstract

The main purpose of this study is to propose the equilibrium price modelling for affordable housing in Malaysia. This paper examines whether the equilibrium price of affordable housing is strongly related with any affordable housing demand factors (house price, housing physical state, monetary status, population changes, location, and infrastructure amenities provided) and affordable housing supply factors (house price, cost of construction, land availability, population changes, location, and government interventions). The empirical data of housing prices are collected from Valuation and Property Services Department of the Ministry of Finance Malaysia from 1995 to 2015. Regression analysis is conducted to see the strength of relationship between the affordable housing demand and supply factors with the affordable housing equilibrium price. The paper is useful for buyer and private developers to know which factors lead to equilibrium price of affordable housing. This paper can serve as a guide for the government in controlling and stabilizing the affordable housing price.

Keywords: Affordable Housing MarketHousing DemandHousing SupplyEquilibrium PriceDemand and Supply Factors

Introduction

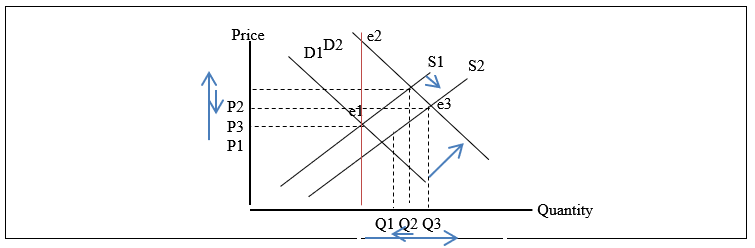

In recent decades, the affordable housing market has steadily increased all over the world until today. The increasing global population is not on par with the development of affordable housing especially in the city (Jenkins, 2007; Woods, 2007). The imbalance between demand (DD) and supply (SS) in the affordable housing market has caused the housing market price become imbalanced. Therefore, starting the year 2014, developers must build at least 20 percent low-cost houses and 20 per cent medium-cost houses in a housing project. The houses are open to first-time buyers with a monthly household income of RM3,000 for low-cost houses and a maximum of RM6,000 for medium-cost houses (Arman et. al., 2009).

Even though Malaysia has introduced some schemes to overcome this problem, the supply for affordable housing units still do not match the demand side. This happened because the developers more prefer to develop luxury properties instead of affordable housing projects (Shuid, 2011). Besides that, most of the private housing developers used the cost-based pricing method to determine the price of residential properties (Akhirudin, 2013). The cost-based pricing method is referring to the total up from the land cost, construction cost, and soft cost. Even though the local authorities had set the price ceilings for certain housing category but the developers still disobeyed the regulations. This is happen because the developers are forced to pay high amounts of constructions premium to the state government besides the soft cost, which act as a hidden cost in the housing development projects. Therefore, developers will include the addition costs when pricing the house (Hansen, 2009; Harvey, 1992).

As a result, our housing market will face surplus in high cost housing (NAPIC, 2014). The impact is, the buyer cannot afford to buy the house and the speculators will control the housing situation until the house price boomed like nowadays. Furthermore, effects from the uncontrolled housing prices nowadays bring a huge total number of squatters by each state across our country. Squatters will continue to be widespread among the low and lower middle-income households in urban areas as long as the issue of inadequate supply of affordable housing is still unresolved (Shuid, 2011).

Therefore, in such situations that already discussed by NAPIC, EPU,

Hence, this research is going to propose an EP model application to private developers in the affordable housing market in Malaysia. Four main objectives need to be achieved in order to reach the research aim. Firstly, to identify the series data for affordable housing price below RM300, 000 beginning year 1995 until 2015 from DD side. Secondly, to identify the series data for affordable housing price below RM300, 000 beginning year 1995 until 2015 from SS side. Next objective is to analyze the key factors from DD side contributing to the Ep in the affordable housing market. Last objective is to identify the key factors from SS side contributing to the Ep in the affordable housing market.

Literature Review

Every increase and decrease in housing price has pros and cons. Lower housing price can open up many opportunities to young households to buy house instead of renting them at a same time but in the same time it could hurt all homeownerships. Particularly in recent years, housing prices equilibrium have been in the limelight in various research areas. Affordable housing and housing affordability refer to different things. Generally, like any other goods in the market economy, housing price movement is also determined by the interaction of DD and SS factors (Harvey,1992). Five factors contribute to the demands of the housing market (Ostermeyer et.al., 2012). In Malaysia, factors that contribute to shifting demand are total population rate, household income, price of housing including taxation and property rights and housing preference itself (KRI, 2015). Currently, the housing demand factors in our country seem to be affected by the same previous factors. Demographic factors include growth in population, demographic profiles and number of households (KRI, 2015; NAPIC, 2015).

The main cause of surging prices of properties in Malaysia is the high amount of premiums that developers need to pay to the federal and state government for every housing project. Government need to cut down premiums payable by the developers so that their construction costs are lower which allow them to build more affordable homes. Oversupply of housing comes from the mismatch of housing needs that create the ‘goldfish phenomenon’. Goldfish phenomenon occurs when developers do not consider and ignore the higher actual demand for low cost housing compared to middle-cost demand (Osmadi et. al., 2015). That is why the supply still does not match the demand since there is a higher pressure of demand for low-cost houses but supply comes in the form of middle low-cost houses. As a result, the oversupply of housing will arise and distract the housing market equilibrium (Ostermeyer et.al., 2012). Like any other market, determinations of equilibrium prices are determined through the interaction of supply and demand or sellers and buyers in the marketplace. Graphically the market price is determined as the intersection of the demand and the supply curves at which

Level of Affordability in Malaysia Housing Market

Malaysia uses two different approaches as an indicator to housing affordability assessment. Data on median multiple and down market penetration are used as an indicator of affordability capabilities (Osland, 2013). Basically, median multiple is also known as price to income ratio that gives the ‘global norm’ based on rating housing affordability categories (KRI, 2015; Demographia, 2015). According to the Annual Demographia International Housing Surveys the ‘global norm’ for affordability was three times median gross annual household income to ensure the well-functioning housing markets (demographia,2015).

Based on the combination of several opinions of median multiple affordability outlined in Housing Buyers’ Association and 11th Malaysia Plan, it can be summarized that the appropriate threshold for the affordability of the nation’s housing market is three times the median multiple. The housing affordability for Terengganu, Kuala Lumpur, Pulau Pinang, and Sabah are over severe unaffordable compared to other state in Malaysia. However, only the Melaka stood out as under affordable in terms of housing affordability (Economic Planning Unit (EPU), 2015).

Previous Study

As affordable housing prices issues become highlighted around the world, there are some models developed by past researcher in order to solve the affordable housing prices issues that burden the household. Lancaster and Rosen proposed the hedonic price model based on the theoretical microeconomic framework. However, this model only stressed on the sphere of macroeconomics factors such as location and accessibility of neighbourhoods. The theory seems can only propose the macroeconomic factors theoretically and not empirically as it cannot design the method on how to set the appropriate price for affordable housing to low and middle-income group of households (Osland, 2013). From the previous literature review, it is clear that there is a need to study the equilibrium price for affordable housing in Malaysia presently, coinciding with current policy and socioeconomic condition. Literature on affordable housing that cover uncontrolled construction costs for affordable housing are like (Gao & Wang, 2007; Hansen, 2009; Osland, 2013). Many studies have agreed that finding equilibrium price for affordable housing is quite complex due to the macroeconomic and microeconomic changes KRI, 2015, Akhirudin, (2013), Osmadi et. al, (2015), Osland, (2013) and NAPIC (2014), and NAPIC, (2015). The paper has found many literature covering the shortage of affordable housing supply, performance indicators for affordable housing and effect of construction cost towards affordable housing price. Even though, there are some models and theories related to the achieving EP affordable housing model reviewed, the inherent differences between affordable housing prices and the low-cost housing prices may result in the ineffectiveness of these models. Therefore, the hedonic price model seems suitable to be applied in this research since it involved the macroeconomic determinants on the achieving real equilibrium price for housing.

Methodology

To achieve research aim and target, data collection method used in this research are document analysis and survey method. Both instruments will later be analyzed by using the Statistical Package for Social Sciences (SPSS) software. Results obtained will be presented in the appropriate way followed the research objectives targeted. In fact, this research shows the sequential relation between objectives as the first objective is related to the second objective, the second objective is related to the third objective, and the third objective relate to fourth objective. Hence, all the objectives need to be answered in order to develop an EP model for affordable housing market in Malaysia. A benchmark for housing data series set for objective one and two are set at a price range below RM300,000 since the year 1995 until 2015 from DD side and SS side respectively. Total DD and SS produced will be compared for each year before being regressed using SPSS software to obtain a regression value of DD and SS. Later, DD and SS curve will be developed to get the EP for affordable housing market in Malaysia. Later the data will be analyzed by using regression method using SPSS software to get the DD value from the following equations form:

QD = α-βP (3.1)

QS = α +βP (3.2)

The raw data about the housing sales performance beginning year 1995 until 2015 for housing price below RM300,000 will be analyzed by using SPSS software regression method to find the α and β value. Later, the α and β value will be substituted into their equations respectively. Therefore, the DD and SS value regressed by SPSS software can develop an Ep model application. Graphically the EP market price is determined at the intersection of the demand and the supply curves while in the mathematical terms this is the price at which:

Objectives three aim to find out which factors contribute the most to the formation of EP model for affordable housing market. Two types of group respondents were picked to answer a set of questionnaires. The first set of questionnaire from side SS will be deliver to private developer group and the second set of questionaire from DD side will be delivered to the household group. The data collected hence will be analysed by using SPSS software to get the regression value for each factors identified from DD and SS side respectively. All the results will be used to support the development of EP model from objective one and two. The b1, b2, b3, b4, b5 indicates as factors involved in developing the EP model.

Model DD = a+b1+b2+b3+b4+b5 (3.4)

Model SS = a+b1+b2+b3+b4(3.5)

Conclusions

The two variables are driven effects from many aspects and they are different according to countries based on previous studies. The factors identified as a contributor to the equilibrium price of affordable housing will be carried out. Hence, in order to get appropriate and nearly equilibrium house price, consumers, government, and developers should cooperate to ensure that the market works efficiently.

References

- Akhirudin, A. (2013). Pasaran Harta Tanah Kediaman Berdasarkan Implikasi Penentuan Harga Rumah Oleh Pemaju. Kajian Kes Nusajaya. Master’s Thesis. Universiti Teknologi Malaysia.

- Arman, M., Zuo, J., Wilson, L., Zillante, G & Pullen, S. (2009). Challenges of responding to sustainability with implications for affordable housing Ecological Economics, 68, 3034–3041.

- Gao, A.H. & Wang, G.H.K. (2007). Multiple transactions model: a panel data approach to estimate housing market indices. Journal of Real Estate Research. 29(3), 241-265.

- Hansen, J. (2009). Australian house prices: a comparison of hedonic and repeat-sales measures. Economic Record, 85,132 -145.

- Harvey, J. & Jowsey, E. (2004). Urban Land Economics. 6th ed. London: Palgrave Macmillan.

- Jenkins, P., Smith, H. & PingWwang, Y. (2007). Planning and Housing in the rapidly Urbanizing World: Housing, Planning and Design Series, London.

- Khazanah Research Institute (KRI) (2015). Making Housing Affordable. Kuala Lumpur: Creative Commons Attribution. Retrieved on January 18, 2016, from www.KRIinstitutes.org

- National Property Information Centre (NAPIC) (2014). Residential, Shops and Industrial Properties Market Status Report Q1 (2014). Kuala Lumpur: Valuation and Property Services Department. Retrieved on December 5, 2015, from www.napic.jpph.gov.my

- National Property Information Centre (NAPIC) (2015). Market Status Report (2015). Kuala Lumpur: Valuation and Property Services Department.

- Osland, L. (2013). The importance of unobserved attributes in hedonic house price models. International Journal of Housing Markets and Analysis, 6(1). pp. 63–78.

- Osmadi, A., Mustafa Kamal, E., Hassan, H & Abdul Fattah, H. (2015). Exploring the elements of housing price in Malaysia. Asian Social Science, 11(24), 26–38.

- Ostermeyer, Y., Salzer, C., Wallbaum, H & Zea, Z. Z. (2012) Indicator based sustainability assessment tool for affordable housing construction technologies. Ecological Indicators, 18, 353-364

- Parmeter, C. F. & Pope, J. C. (2009). Quasi-experiments and hedonic property methods in John, A. and Price, M.K. (Eds), Handbook of Experimental Economics and Environment, Edward Elgar, Englewood Cliffs, NJ.

- Wood, J. (2007). Synergy city: planning for a high density, supersymbiotic society. Landscape and Urban Planning, 83, 77-83.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

22 August 2016

Article Doi

eBook ISBN

978-1-80296-013-6

Publisher

Future Academy

Volume

14

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-883

Subjects

Sociology, work, labour, organizational theory, organizational behaviour, social impact, environmental issues

Cite this article as:

Ramli, F., Zainal, R., & Ali, M. (2016). Equilibrium Price Application Modelling for Affordable Housing Market in Malaysia. In B. Mohamad (Ed.), Challenge of Ensuring Research Rigor in Soft Sciences, vol 14. European Proceedings of Social and Behavioural Sciences (pp. 431-436). Future Academy. https://doi.org/10.15405/epsbs.2016.08.61