The Impact of Attitude and Perceived Service Quality on Zakah Compliance Behavior: The Mediating Effect of Trust

Abstract

The obligation to pay zakah is one of the five pillars in Islamic faith. Its contribution to Muslims socio-economic development could not be denied by any parties. This development could be improved through incremental of zakah fund. However, the zakah collection including zakah on income is still found to be unsatisfactory due to a low level of zakah compliance. While a great deal of researches had been undertaken in the area of taxation, little is known about zakah compliance behavior and its determinants. The objective of the paper is to propose a research model for examining the influence of attitude and perceived service quality towards zakah compliance behavior, taking into consideration, trust as a mediator for those relationships. Four hypotheses were drawn for this paper to be tested regarding the influence of selected variables to zakah on income compliance behavior. Moreover, theoretical and practical implications of the study, as well as suggestions for future research were also discussed.

Keywords: zakah compliance behaviourattitudeperceived service qualitytrust

Introduction

Known as the third pillar of Islam, zakah is the religious claim on Muslim individuals who are qualified in terms of income, ownership and property holdings. Throughout Islamic history, zakah was the centerpiece of the Islamic economic system (Mujaini, 2012). Zakah is an important obligation, prescribed by Allah SWT with the ultimate aim to provide a balance economic growth by redistributing the wealth in society, in order to ensure every individual a minimum means of livelihood (Mohd Aidil & M Hussin, 2013; Nur Barizah, 2007).

Besides being a unique economic tool for the purpose of economic growth, zakah is also becoming a life-changing tool to eight specific groups in society as stated in the

Despite tremendous efforts taken by the zakah institutions to increase its collection, the amount of zakah gathered is still unsatisfactory. While low zakah collection can be attributed to various factors, such as the weakness of zakah management (Hairunnizam, Sanep & Radiah, 2009; Eza Ellany, Mohd Rizal & Mohamat Sabri, 2014). However, previous studies showed that the main root of the problem is caused by the compliance behavior where the zakah compliance level is still low (Kamil, 2002; Hairunnizam, Sanep & Mohd Ali, 2007; Nur Barizah & Hafiz Majdi, 2010). For example, Hairunnizam,

Review of literatures in the zakah environment showed several studies have been conducted to understand zakah compliance behavior. However, these studies only examine the direct relationship between variables in understanding why Muslim people refuse to pay zakah and most of them were just focused on the intention to comply, but not on the compliance behavior. Thus, this paper is different in two folds. First, unlike the previous studies, the current study will propose a model which can provide an understanding on the compliance behavior rather than the intention to comply. Second, this paper will proposed about the impact of variable of trust as a mediator to attitude and perceived quality service variables on zakah compliance behavior. The importance of trust as a mediator has not being described in previous studies, while studies in other areas such as taxation (Murphy, 2004) and the use of information technology (Khalil & Pearson, 2007) explained that belief in the organization is an important mediating factor in determining the behavior of an individual. Therefore, it is a high time for a study to be conducted to examine the factors that influence zakah compliance behavior, in order to build a comprehensive model of compliance behavior. This will provide a new contribution to zakah research area especially zakah compliance behavior.

Literature Review and Hypotheses Development

According to Fishbein and Ajzen’s expectancy-value model of attitudes (Fishbein & Ajzen, 1975), attitudes develop reasonably from the beliefs people hold about the object of the attitude. In the case of attitudes toward behavior, each belief links the behavior to a certain outcome or to some other attribute such as the cost incurred by performing the behavior (Ajzen, 1991). Moreover, Baron and Bryne (2000) stated that attitude is an important factor to be studied because attitude is a strong influence on social thought and is considered to have a significant impact on the behavior of a person.

Several studies have been done to investigate the relationship between the attitude and compliance behavior of zakah payment. Raedah, Noormala and Marziana (2011) in their study of the relevant factors that affect the academicians’ intention to pay zakah found that attitude is the most important factor and gives a significant influence on the intention to pay zakah among academicians. This view was also supported by the findings of Mohamad Nizam, Amirul, Hardi, and Che Nurul (2011) which found that attitude variable towards zakah has a significant and positive effect on the non-compliance behavior of zakah on income.

In this study, attitudes towards the zakah compliance, refer to a state of mental and physical readiness for the zakah payer to pay zakah to the zakah institution, which is legitimately elected in accordance with law. Based on the previous studies, the study will be done regarding the effect of attitudes towards zakah compliance behavior. Therefore, the following hypothesis has been proposed.

H1Attitude has a significant positive relationship with zakah compliance behavior.

Perceived Service Quality

Service quality is an important factor to be tested in identifying the behavior of compliance because it relates directly to the satisfaction of customers. In this study, perceived service quality by the potential zakah payer on service delivered by zakah institution is considered to plays an important role in the compliance of zakah payment to zakah institution. It is assumed that service quality is critically determined by the difference between customers’ expectations and their perceptions of the service actually delivered (Parasuraman, Zeithaml & Berry, 1985).

In this study, customers are known as zakah payers. The contribution from satisfied zakah payers would help to increase zakah collection. In zakah behavior research area, there is lack of study done to highlight the importance of this variable. Kamil (2002) found that in the relation to service quality, the degree of compliance would be higher if any zakah payer is satisfied with the service that he received from the zakah institutions. Moreover, Hairunizam and Sanep (2014) found that the corporate image factor provides the highest contribution to the service quality of Lembaga Zakah Selangor (LZS).

The literature on service quality of zakah institution is not yet rich enough to provide a sound conceptual foundation for investigating service quality, therefore it is very important for this study to explore the relationship between perceived service quality to zakah compliance behavior. The zakah payers’ perceptions on service quality provided by a zakah institution is a factor that is able to influence the satisfaction of the zakah payers and thus will increase their compliance behavior in fulfilling their obligation in paying zakah. In order to clarify the relationship between the perception of zakah institutions service quality and zakah compliance behavior, the following assumption is established:

H2Perceived service quality has a significant positive relationship with zakah compliance behavior.

Trust

When researching about compliance behavior, many researchers would include trust as a core premise of a positive relationship in various contexts, which is found to boost the confidence level of public citizens or consumers to certain organization. Trust is defined as a belief that one party will act, as expected, in a socially responsible way, even in the absence of constant auditing and will meet the expectation of another party that trusted them (McKnight & Chervany, 2001; Nunkoo, Ramkissoon & Gursoy, 2012). As a multi-faceted concept, trust has been studied in various areas such as in infomation technology service (Min, Dingtao & Yan, 2015); retail banking industry (Fatma, Rahman & Khan, 2015); and schools (Gupta & Kumar, 2015). Moreover, trust was also found to mediate the relationship between trustworthiness and internet banking usage (Pay, Balaji & Kok, 2015).

The variable of trust also is found in several zakah studies, but mostly as an independent variable. For instance, a study has been done by Hairunizam & Sanep (2014) in examining the factors influencing the trust level of the zakah distribution in Selangor. The finding shows that the level of trust towards the zakah institution is dependent on the other three main factors, namely the corporate image of LZS, zakah collection and zakah distribution.

Meanwhile, Htay & Salman (2014) pointed out that the trust or confidence of the zakah payers on the process of zakah collection and distribution performed by the zakah institutions is important in order to increase the collection of zakah. When the institutions perform well, they generate trust among the public, but if the performance is poor, it will create distrust and skepticism among the public (Hairunizam & Sanep, 2014). This study will take another approach in examining the variable of trust as a mediator between the attitude and perceived service quality with zakah compliance behavior. Therefore, the following hypotheses will be tested:

H3 Trust mediates the relationship between attitude and zakah compliance behavior.

H4 Trust mediates the relationship between perceived service quality and zakah compliance behavior.

Zakah Compliance Behavior

According to Kamil (2002), the question of compliance has been long and widely discussed in the field of taxation but still rare in the study field of zakah. He discussed the zakah compliance based on the adaptation of tax compliance, where zakah compliance is referred to as the payment of zakah according to the rulings and regulations enacted by the zakah authorities.

Several studies discussed zakah compliance in terms of paying zakah through official channels (Sanep, Nor Ghani, & Zulkifli, 2011; Nur Barizah & Hafiz Majid, 2010). The concept of zakah is the compliance of human behavior (Muslim community) to make a decision (to comply or not comply) to pay zakah (official or unofficial channels) according to the enactment and law implementation to achieve satisfaction in this life and the hereafter (

For this study, zakah compliance behavior as a dependent variable, is refers to the behavior of Muslim individuals in performing their obligation to pay zakah on professional income to official channel (formal zakah institutions) according to the rules, regulations and guidelines that have been established.

Research Conceptual Framework

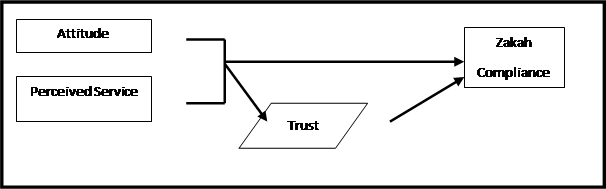

This paper aims to develop a conceptual framework to determine the relationship between the independent variables of attitude and perceived service quality towards the dependent variable which is the zakah compliance behavior. Moreover, this paper also posits trust as a mediating variable.

The research conceptual framework is illustrated in Figure

Conclusion and Implication

This paper proposed the relationship between attitude and perceived service quality towards the compliance of zakah payment. From the literature, it is found that zakah payers would fulfill their zakah obligation to the zakah institution when they believe the zakah fund is managed efficiently. Besides fulfilling their obligation, zakah payers are also able to help improve the livelihood of the zakah recipients and inculcate the habits of lending a helping hand to others in order to create a caring and tolerant society.

This paper has both theoretical and practical contributions. The paper adopts several behavioral models and theories such as zakah on the employment income behavioral model by Kamil (2002), social exchange theories, in order to develop a new model in the zakah research area. Thus, it will provide a new perspective in the zakah behavioral research area where majority of the previous studies applied the Theory on Planned Behavior (TPB). Meanwhile, the trust factor is introduced as a mediator to test the effect of the relationship between attitude and perceived service quality on zakah compliance behavior. This study might be able to expand the zakah compliance behavioral model and provide new insight to this research area.

There are also several practical contributions, especially to zakah institutions, where the administrators are able to plan and revise the strategies to increase the future collection of zakah when they understand the relationship between attitude, perceived service quality and trust to zakah payment compliance to zakah institutions. Moreover, the State Islamic Religion Council (SIRC) will be able to increase their knowledge and also to understand the potential zakah payers’ behavior. On the other hand, it is hoped that the result of this study is able to become a useful input for other researchers that involved in zakah research area.

References

- Ajzen, I. (1991). The Theory of Planned Behavior. Organizational Behavior And Human Decision Processes, 50(2), 179-211.

- Baron, R.A. & Byrne, D. (2000). Social Psychology: Understanding human interaction. 9th ed. Boston, MA: Allyn & Bacon.

- Eza Ellany, A.L., Mohd Rizal, P. & Mohamat Sabri, H. (2014). Prestasi Kecekapan Agihan Kewangan dan Bukan Kewangan di Kalangan Institusi Zakat di Malaysia. Jurnal Ekonomi Malaysia, 48(2), 51–60.

- Fatma, M., Rahman, Z. & Khan, I. (2015). Building company reputation and brand equity through CSR: the mediating role of trust. International Journal of Bank Marketing, 33(6), 840 – 856.

- Fishbein, M. & Ajzen, I. (1975). Belief, Attitude, Intention, and Behavior: An Introduction to Theory and Research. Reading, MA: Addison-Wesley.

- Gupta, M. & Kumar, Y. (2015). Justice and employee engagement. Asia-Pacific Journal of Business Administration, 7(1), 89–103.

- Hairunnizam, W. & Sanep, A. (2014). Faktor Mempengaruhi Tahap Keyakinan Agihan Zakat: Kajian Terhadap Masyarakat Islam di Selangor. Jurnal Ekonomi Malaysia, 48(2), 41 – 50.

- Hairunnizam, W., Sanep, A. & Radiah, A.K. (2009). Pengagihan zakat oleh institusi zakat di Malaysia: Mengapa masyarakat Islam tidak berpuas hati? Jurnal Syariah, 17(1), 89-112.

- Hairunnizam, W., Sanep, A. & Mohd. Ali, M.N. (2007). Kesedaran Membayar Zakat Pendapatan di Malaysia. Islamiyyat, 29, 53-70.

- Htay, S.N.N. & Salman, S.A (2014). Proposed Best Practices of Financial Information Disclosure for Zakat Institution: A Case Study of Malaysia. World Applied Sciences Journal, 30, 288 – 294.

- Kamil, M.I. (2002). Gelagat Kepatuhan Zakah Pendapatan Gaji Di Kalangan Kakitangan Awam Persekutuan Negeri Kedah. Unpublished Ph.D. Thesis. UUM.

- Khalil, M.N., & Pearson, J.M. (2007). The influence of Trust on Internet Banking Acceptance. Journal of Internet Banking & Commerce, 12(2), 1-10.

- McKnight, D.H. & Chervany. N.L. (2001). Trust and distrust definitions: One bite at a time, Trust in Cyber-societies: Lecture Notes in Computer Science, 2246, 27-54.

- Min, L., Dingtao, Z. & Yan, Y. (2015). TOE drivers for cloud transformation: direct or trust-mediated? Asia Pacific Journal of Marketing and Logistics, 27(2), 226-248.

- Mohamad Nizam, J., Amirul, A., Hardi, A. & Che Nurul, S. (2011). A Study on The Factors Attribute to Non-Participation of Zakat Income Among The Muslim Community in Selangor. 2nd International Conference on Business and Economic Research (ICBER) Proceeding. 450 – 461.

- Mohd Aidil, A.A. & M.Hussin, A. (2013). The Comparison between Zakat (Islamic Concept of Taxation) and Income Tax: Perception of Academician in the State of Perak. The 2013 IBEA, International Conference on Business, Economics and Accounting, 20-23 March 2013, Bangkok Thailand.

- Mujaimi, T. (2012). Zakah al Mal al Mustafad Amalan dan Pengalaman di Malaysia. Malaysia: Pusat Pungutan Zakah.

- Murphy, K. (2004). The Role of Trust In Nurturing Compliance: A Study Of Accused Tax Avoiders. Law And Human Behavior, 28(2), 187-209.

- Nunkoo, R., Ramkissoon, H. & Gursoy, D. (2012). Public Trust In Tourism Institutions. USA Annals of Tourism Research, 39(3), 1538–1564.

- Nur Barizah, A.B. & Abdul Rahim, A.R. (2007). A Comparative Study of Zakah and Modern Taxation. Journal of King Abdul Aziz University: Islamic Economics, 20(1), 25-40.

- Nur Barizah, A.B. & Hafiz Majdi, A.R. (2010). Motivations of Paying Zakat on Income : Evidence from Malaysia. International Journal of Economics and Finance, 2(3), 76–84.

- Nur Barizah, A.B. & Hafiz Majdi, A.R. (May 15, 2014). Lebih 60% umat Islam Wilayah Persekutuan tunai zakat pendapatan. Bernama. Retrieved from http://www.themalaysianinsider.com/bahasa/article/lebih-60-umat-islam-wilayah-persekutuan-tunai-zakat-pendapatan

- Nur Barizah, A.B. (2007). A Zakat Accounting Standard (ZAS) for Malaysian Companies. The American Journal of Islamic Social Sciences, 24(4), 74-92.

- Parasuraman, P., Zeithaml, V.A. & Berry, L.L. (1985). A Conceptual Model of Service Quality and Its Implications For Future Research, Journal of Marketing, 49(3), 41-50.

- Pay, L.Y., Balaji, M.S. & Kok, W.K. (2015). Building trust in internet banking: a trustworthiness perspective. Industrial Management & Data Systems, 115(2), 235 – 252.

- Raedah, S., Noormala, A. & Marziana, M. (2011). A Study On Zakah Of Employment Income: Factors That Influence Academics’ Intention To Pay Zakah. 2nd International Conference on Business and Economic Research (2nd ICBER 2011) Proceeding, 2492-2507.

- Sanep, A., Nor Ghani, M.N. & Zulkifli, D. (2011). Tax-based modeling of Zakat Compliance (Permodalan Kepatuhan Zakat berasaskan cukai). Jurnal Ekonomi Malaysia, 45, 101-108.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

22 August 2016

Article Doi

eBook ISBN

978-1-80296-013-6

Publisher

Future Academy

Volume

14

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-883

Subjects

Sociology, work, labour, organizational theory, organizational behaviour, social impact, environmental issues

Cite this article as:

Noor*, A. M., & Saad, R. A. J. (2016). The Impact of Attitude and Perceived Service Quality on Zakah Compliance Behavior: The Mediating Effect of Trust. In B. Mohamad (Ed.), Challenge of Ensuring Research Rigor in Soft Sciences, vol 14. European Proceedings of Social and Behavioural Sciences (pp. 376-381). Future Academy. https://doi.org/10.15405/epsbs.2016.08.53