Abstract

Capacity of a government to finance it expenditure depend on the ability of tax system to generate adequate revenue, and the ability of tax system to generate significant revenue depend on the tax administration efficiency and effectiveness, however in most of the developing economies, tax administration is characterized by inefficiency and ineffectiveness. The objective of this paper to develop a model which will guide developing countries to reform their tax administration toward tax revenue promising. To achieve this, several previous tax administration models as well as theory of governance and that of performance were review and analyze. Moreover, the modernize tax administration model developed in this study consists of four components namely inputs, transformation process, output, and outcome, the paper concludes that significant reform means working through the entire modernize tax administration model. The limitation of the paper is that the model is not been tested.

Keywords: Tax administrationrevenue generationefficiencyeffectivenessmodel

Introduction

Government expenditure mostly in form of the provision of economic, political and social infrastructure of given country depend on the amount of revenue generated by the government. One way of generating adequate revenue is through well-structured tax system. Taxes plays a vital role in every nation economy (Abata, 2014) and constitutes primary sources of revenue for developed countries (Centre for tax policy and administration, 2006). But in most developing economies, revenue from tax has been moderately low because the countries are characterized by in adequate personal and modern facilities (Ogbonna, 2012).

Furthermore, the weak and unproductive tax revenue in most developing countries is as a result of so many reasons among which include: inefficient tax administration; as well as corruption and distrust from tax administration; and inefficient outcome that change taxpayers’ attitude toward compliance (Bird, 2015). Several studies among which include (Ogbonna, 2012; Aminu, 2014) suggested that lower tax revenue can be addressed by tax administration reform.

Tax administration reform is a process by which government change the existing administration, pattern, tax laws, and principles in order to achieve tax revenue collection (Owens, 2006). Several governments around the world embarked on tax administration reforms in order to increase government tax generated revenue (Taliercio, 2004). For instance, major tax administration reforms undertaken in various developed countries such as USA, Canada, France, Germany, Japan, Spain, and United Kingdom. To be specific, a new administration was instituted with professional staff and organizational structures at Germany in the year 2000. These improvements brought about the fruitful implementation of the tax reform program and a dramatic advancement in tax collection (OECD, 2009). In addition, experience from Spain confirmed that with the higher tax administration efficiency, higher revenue could be generated or maintained. To be specific, enforcement, prosecution, and tax auditing in Spain, have resulted in an increase in the number of taxpayers from 1.7 million to 2.8 million between 1988 and 1991 (Hogue, 2000).

In Argentina, tax administration reform on taxpayers monitoring in 1993 resulted to huge increased in tax revenue by significant percentage. The reform started with a pilot test that monitored the behavior of 800 major taxpayers. The system is currently applied all over the country’s taxpayers, and is adequate and efficient enough of monitoring around 100, 000 taxpayers (Owens, 2006). France also increased its tax administration efficiency and revenue productivity through simplification of tax structure (James, 1997). The study further state that, there is no reason for France to reform it existing tax system without simultaneously improving the tax administration. France believe that removal of loopholes, concessions, and exemptions can simplify tax administration and reduce evasion.

In the other hand, experience from developing countries affirm that most of the previous reforms were on tax policies. For instance, in 2015 alone, Nigerian tax reforms on educational tax, company income tax, and VAT; Malaysia also introduced goods and services tax; South Africa and Uganda review their company income tax policies to mention a few. However, despite the previous tax system reforms embarked by developing economies, tax revenue still remain insignificant. This is because, most of the reforms were on tax system. According to (Bird, 2015) a good tax system cannot produce excellent result without proper implementation. Proper implementation of tax system relied on tax administrators (Gill, 2000). On this ground the present study will propose a model that will for reforming tax administration in developing countries toward revenue generation.

Government Revenue Generation

Revenue generation are ways through which government raise revenue for the purposes of meeting its capital and recurrent expenditure (Enahoro, 2012). According to Seera (2005) there are three main sources by which government raise revenue for the purposes of financing its expenditure these are tax sources, non-tax, and capital receipts. Tax sources comprises of revenue received by the government from all available components of tax in a given country (Okafor, 2012) while, non-tax revenue sources are aid from inter-governmental or another level of government (James, 1999). On the other hand, capital receipts include all revenue received by the government from investment made in other countries or investment within the country. Among these three sources, taxation is the most important because the level of government expenditure is to a great extend dependent on the ability and efficiency of tax administration to generate adequate revenue from taxation (Bird, 2005).

Taxation is one of the direct ways for government revenue generation. Bird (2015) expresses that one of the factors determining capacity of a country to generate adequate revenue from taxation is the tax administration competence and efficiency. The study of (Bird, 2007) further states that efficient tax administrators is the most vital instrument that can help government to raise tax revenue. In summary, this study conclude that taxation is the most viable or significant source of government revenue among the different sources.

However, despite the advantages of tax source over other revenue sources, there is no argument on the fact that the amount of tax revenue generated by a given country defend on the efficiency and effectiveness of tax administration. Several models were developed for tax administration purposes in order to maximize tax revenue generation as discuss in the following subsections.

2.1. System-Based Models

A system-based model has been widely used in the context of tax administration, the model requires the use of econometrics program logic (Australian National Office, 1998). In the model, a program is characterized as a grouping of objectives. According to the model, the fundamental steps included: Inputs, process, outcome, and impact.

Inputs stand for the required resources that will smooth the organizational efficiency and effectiveness, process are the activities involve in turning inputs to outputs. In the other hand, output are the results achieve by the organization, units and individuals while outcomes stand for the overall goals achieved form the previous stages. However, the system base model has not been break down issues in details and a result several questions may arise for instance what are inputs required for good tax administration among other things. The OECD (2008) expanded the logic model, According to OECD (2008) the thought of checking taxpayers’ compliance is directly significant to the terminology of ‘outputs and outcomes’ and ‘efficiency and effectiveness’ when utilized in the context of measuring revenue administration. As these terms are frequently confused and sometimes utilized interchangeably. The brief explanation on expanded the logic model is discussed in the next section.

2.2. Extended Sequence of Program Logic Model

To overcome some limitations of program logic model of administration measurement. OECD (2008) extended the model by bringing in efficiency and effectiveness in program logic model. The term ‘efficiency’ commonly relates to minimizing or reducing the utilization of available resources to produce or deliver a given level of outputs for instance, increasing the volume of outputs for a given level of inputs or on the other hand, increasing the number of completed audits cases for a given level of staffing, all things being equal, would reflect enhanced efficiency (Therkildsen, 2004).

Mansor (2012) expression ‘effectiveness’ is regularly connected with the degree to which ‘outcomes’ are being accomplished. In a tax administration context, the degree to which compliance for example payment, reporting, and filling has been enhanced as an result of tax administration activities would clearly be a sign of an tax administration’s effectiveness. But, a pattern of more positive attitude to, and view of, tax compliance could be seen as a positive indicator of a tax administration’s effectiveness.

In the long run, despite the fact that the extended model failed also to break down issues into more specific that will systematically identify accurate functions of tax administration. As a result a more details and comprehensive model called congruence model is considered more appropriate in tax administration functions.

2.3. Congruence model

Congruence model aimed to diagnose causes of revenue administration weaknesses, it was developed by (Seiler, 1967; Nadler, 1980). The model was further brought to tax administration area by (Gill, 2000; Gill, 2003) as a diagnostic model that links organization inputs and outputs, the model provide helpful classification of internal organization components while discussion on the interaction effects among them.

Although, (Mansor, 2011) described congruence model as quite interesting and comprehensive that offered diagnose causes or revenue administration weaknesses and strengthens tax administration reform but however, there are few areas need further research. To be specific, there is need for more details model that will incorporate taxpayer’s inputs and outcome that will result to voluntarily compliance, furthermore the outcomes from the perspective of administrators need to be incorporated. Which the present study aimed to address

Modernize Congruence Model

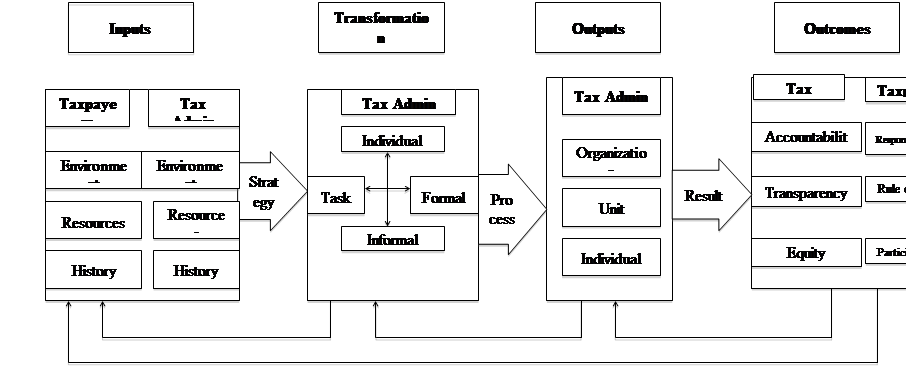

The modernize congruence model is based on critical review of literature, components of system based model; extended sequence of program logic model; congruence model;theory of governance; and performance theory form part of the modernize tax administration model developed in this study (as presented in figure

The modernize congruence model believe that in order to understand tax administration efficiency and effectiveness, we most to first of all appreciate tax administration as a system that involves of some basic components as: (1)The inputs from the perspectives of taxpayers and tax administration external and internal sources. (2) The strategy that tax administration adopts to define its vision about community results it plan to achieve i.e. when, how, and who to complete the vision. (3) The significant transformation process within which formal, informal, people, and task transforms inputs resources into outputs. (4) The output that is the individual, unit, and system results toward achieving the strategic objectives.

(5) The outcome from the perspectives of tax admin including accountability, transparency, as well as equity and from the view of taxpayers covering responsibility, follow the rule of law, and participatory.

3.1. Guidelines for Applying Modernize Congruence Model

The modernize congruence model is more comprehensive and promising about tax administration. Its exact value depend on the usefulness of a model to be able identify the root causes of weak revenue generation within a given tax administration. As stated earlier, it delivers a comprehensive starting point on the path to fundamental tax administration reform. It provides the conceptual model for a reform process that comprises collecting information on tax administration undertakings, harmonizing actual result against goals, identifying the roots of problem, developing and selecting actions plans, and finally executing and then evaluating the efficiency and effectiveness of those plans. The guidelines of using modernize congruence model for solving tax administration problems include the following steps:

Identify the inputs. As stated in (Abiola, 2012) the reason(s) for weak tax revenue generation in developing countries is as a result of poor efficiency and effectiveness of tax administration, keeping this in mind, the first step of modernize tax administration model is to gather critical information concerning both taxpayers and tax administration’s environment, resources, and history. The information collected will identify the tax administration’s overall objectives, core vision and mission, and supporting strategies.

Define the administration transformation components. This is the second step where analysis goes far beyond just recognizing revenue generation weaknesses and begins with a data collection process on each of the four transformation components of the administration. As stated in (Abiola, 2012; Mansor, 2010) some reasons of weak tax revenue generation may be as a result of lack of good integration between the transformation components of tax administration, therefore here data should be collected on the best way to enhance transformation process.

Define the output. The third step is to investigate the organization’s output, which is at the individual, unit, and organizational levels (Gill, 2000; Gill, 2003; 36]. Output analysis includes describing absolutely what output is required at every level to meet the general strategic goals and after that collecting data to measure accurately whether the output is sincerely being accomplished.

Determine outcome. The fourth step is to pinpoint what the entire process achieved at the end and to precise determine gaps and holes between planned and actual outcomes in order to recognize the related problems with each individual behavior, unit functioning, or organizational efficiency and effectiveness. Outcomes requires tax administrators to regularly account their actions in a transparent and equity manner (Mba, 2012).

Summary and Conclusion

In order for a given government to generate adequate revenue from tax system, tax administration is expected to work in the most effective and efficient manner, this paper developed a model called “modernize tax administration model” which aimed to guide developing tax administration in reforming existing tax administration. The modernize tax administration model developed in this study comprises of four main components namely inputs, transformation, outputs, and outcomes, it is important to note that transformation and outputs deals with tax administrators while inputs and outcomes deals with both taxpayers and tax admin. In order for the tax administration to generate adequate revenue components are expected to work in an integrated approach. Endlessly, tax administration must be vigilant for wrong fit among the components. Therefore, inappropriate fit among any of the tax administration components can lead non-achievement of objectives. For instance in the absence of good integration in the transformation components between informal structures and formal, between individuals and their task requirement etc. can create enormous problems. More so, reforming one or two components of the model while leaving others unreformed will bring about the others to fall. In conclusion, it is believe that tax administration can generate more revenue from tax system where modernize tax administration model is adopted. Moreover, the limitation of this study is the fact that the model is not been empirically test.

References

- Abata, M. A. (2014). The impact of tax revenue on Nigerian economy (case of Federal Board of Inland Revenue). Journal of Policy and Development Studies, 9(1), 109-121.

- Abiola, J., & Asiweh, M. (2012). Impact of tax administration on government revenue in a developing economy–a case study of Nigeria. International Journal of Business and Social Science, 3(8), 99-113.

- Afuberoh, D., & Okoye, E. (2014). The impact of taxation on revenue generation in Nigeria: a study of Federal Capital Territory and selected States. International Journal of Public Administration and Management Research, 2(2), 22-47.

- Aminu, A. A., & Eluwa, D. I. (2014). The impact of tax reforms on government revenue generation in Nigeria. Ekonomski i socijalni razvoj, 1(1), 1-10.

- Australian National Audit Office (1998). ‘Better practice principles for performance information’. Canberra: Australian National Office.

- Asaolu, T. O., Dopemu, S. O., & Monday, J. U. (2015). Impact of tax reforms on revenue generation in Lagos State: A time series approach. Research Journal of Finance and Accounting, 6(8), 85-96.

- Bird, R. M. (2004). Administrative dimensions of tax reform. Asia-Pacific Tax Bulletin, 10(3), 134-50.

- Bird, R. M. (2005). Is VAT the best way to impose a general consumption tax in developing countries?. Bulletin for International Taxation,60(7), 287.

- Bird, R. M. (2007). Tax challenges facing developing countries: a perspective from outside the policy arena. Available at SSRN 1393991.

- Bird, R. M. (2015). Improving tax administration in developing countries. Journal of Tax Administration, 1(1), 23-44.

- Enahoro, J. A., & Jayeola, O. L. A. B. I. S. I. (2012). Tax administration and revenue generation of Lagos State Government, Nigeria. Research Journal of Finance and Accounting, 3(5), 133-139.

- Gill, J. B. S. (2003). ‘The Nuts and Bolts of Revenue Administration Reform’, World Bank.

- Gill, Jit B.S. (2000). A Diagnostic Model for Revenue Administration, World Bank Technical Paper No. 472, Washington, D.C., IBRD. July 2015.

- Hogue, M., Hassel V.H., Olsson G., Sabbe F., Ott L. (2000). Comparative approaches to central and eastern European countries Tax Administration reform, Local government and public service reform initiative, Open society Institute.

- James, S. (1999). The future International tax environment and European tax harmonisation: A personal view. European Accounting Review, 8(4), 731-747.

- James, S. & Wallschutzky, I. (1997). Tax law improvement in Australia and the UK: The need for a strategy for simplification. Fiscal Studies, 18(4), 445-460.

- Klun, M. (2004). Performance measurement for tax administrations: the case of Slovenia. International Review of Administrative Sciences, 70(3), 567-574.

- Lawrence, P. R., & Lorsch, J. W. (1969). Developing Organisations: Diagnosis and Action. Addison-Wesley.

- Lorsch, J. W., and Sheldon, A. (1972). ‘The individual in the organisation: A systems view’, in J. W. Lorsch and P. R. Lawrence (Eds.), Managing group and intergroup relations. Homewood, III: Irwin-Dorsey.

- Mansor, M. (2010). Performance management for a tax administration: Integrating organisational diagnosis to achieve systemic congruence. UNSW Law Research Paper, (2010-56).

- Mansor, M. (2011). Application of a Model for Tax Administration Performance Management in Developing Countries: A Case Study in Malaysia (Doctoral dissertation, University of New South Wales).

- Mansor, M., & Tayib, M. (2012). Tax administration performance management: Towards an integrated and open system approach. International Journal of Trade, Economics & Finance, 3(2), 136-142.

- Mba, O. (2012). Transparency and accountability of tax administration in the UK: The nature and scope of taxpayer confidentiality. British Tax Review, (2), 187-225.

- Nadler, D. A. and Tushman, M. L. (1980). ‘A Model for Diagnosing Organisational Behavior’. Organisational Dynamics, Autumn, 35-51.

- OECD (2006). Tax Administration in OECD and selected Non-OECD countries: Comparative Information Series, Centre for tax policy and administration.

- OECD (2008). ‘Monitoring Taxpayers’ Compliance: A Practical Guide Based on Revenue Body Experience’. Forum on Tax Administration: Compliance Sub-Group, Centre for Tax Policy and Administration, 22 June.

- OECD (2009). ‘Tax Administration in OECD and Selected Non-OECD Countries: Comparative Information Series (2008)’. http://www.oecd.org/dataoecd/57/23/42012907.pdf, retrieved on 10 August 2015.

- Ogbonna, G. N., & Appah, E. (2012). Impact of tax reforms and economic growth of Nigeria: A time series analysis. Current Research Journal of Social Sciences, 4(1), 62-68.

- Okafor, R. G. (2012). Tax revenue generation and Nigerian economic development. European Journal of Business and Management, 4(19), 1905-1922.

- Owens, J. (2006). Fundamental tax reform: An international perspective tax policy & administration, The National Tax Journal, 59(1), 131-155.Owens J. (2006), The National Tax Journal, 59(1),

- Seera, P. (2005), Performance measurement in tax administration: Chile as a case study, Public Administration and Development, 25, 115-124.

- Seiler, J. A. (1967). Systems Analysis in Organisational Behavior. Homewood, III: Irwin-Dorsey.

- Taliercio, R. R. (2004). Administrative reform as credible commitment: the impact of autonomy on revenue authority performance in Latin America. World Development, 32(2), 213-232.

- Therkildsen, O. (2004). Autonomous tax administration in sub-Saharan Africa: the case of the Uganda Revenue Authority. In Forum for Development Studies, 31 (1), 59-88.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

22 August 2016

Article Doi

eBook ISBN

978-1-80296-013-6

Publisher

Future Academy

Volume

14

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-883

Subjects

Sociology, work, labour, organizational theory, organizational behaviour, social impact, environmental issues

Cite this article as:

Pantamee, A. A., & Mansor, M. B. (2016). A Modernize Tax Administration Model for Revenue Generation. In B. Mohamad (Ed.), Challenge of Ensuring Research Rigor in Soft Sciences, vol 14. European Proceedings of Social and Behavioural Sciences (pp. 281-288). Future Academy. https://doi.org/10.15405/epsbs.2016.08.40