Abstract

One criticism of the most of bilateral trade agreements is that they focus more on the

Keywords: Multinational CorporationsArbitrationHuman RightsBilateral TreatiesEncroachment

Introduction

The world is seeing a tremendous development inside of the last few decennary, in the outside venture, particularly in foreign direct investment (FDI). Generally, peregrine ventures are started by a passive or arrangement between the peregrine organizations or speculators in the host nation. Such common and two-sided assertion is tying between the gatherings included (Dolzer, & Stevens, 1995). This understanding speaks to those sorts of organizations of respective connection going for puncturing the business sectors of remote or host countries. In the present time, probably the most competent and strong agents on the world stage are not mandatorily administrations, but rather business substances and aggregates. For instance, in 2011, oil and gas behemoth ExxonMobil incited incomes of US$467 billion, which is the measure of Norway's whole economy. Another case, Walmart, the world's third-most cosmically colossal boss with more than 2 million specialists, has a workforce that sought after the militaries of the United States and China in size. Various ecumenical associations are continue running with the thought for the salubrity of the all-inclusive community whose lives they contact physically. Regardless, those cumbersome and executes misleading associations and infringed human rights conventions, thus on the harm the gatherings around them, their workers, and even the organizations under which they work. Most pickle lies with firms' practices themselves. While, keeping Multinational Companies (MNCs) duties towards the approvals and plans on human rights, these associations holds to Bilateral Investment Treaties (BITs) to protection their business and excitement actuating a dark licit framework to skip from its commitment.

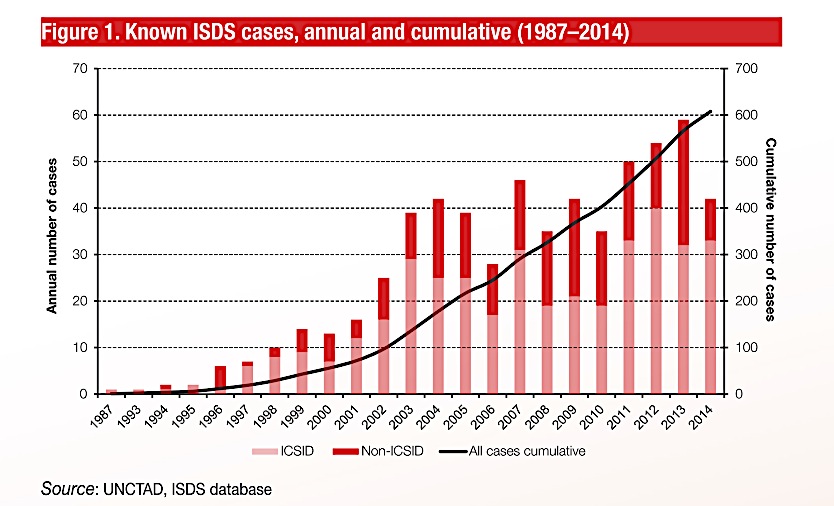

The UN meeting on exchange and improvement (UNCTAD) (Khalil, 2015)affirmed that the speculation procurements in organized commerce acquiescence oblige the administration's ability to work for her occupants, and informs that BITs were the real reason abaft the jump in instances of worldwide mediation(UNCTAD, 2014a). The report coordinated that 68% of nations experiencing the implicative hints of worldwide mediation were creating nations. BITs office to authorize nations to stand the tenets is underscored unjust conditions put by different organizations or nations to rampart their speculations or else get to be debilitated to be liable to worldwide discretion. While in 2014, 60 percent of all bodies of evidence were brought against creating and move economies, and the remaining 40 percent against creating nations. The part of bodies of evidence against creating nations was 47 for each penny in 2013(UNCTAD, 2014b)as appeared in Figure

Source: UNCTAD, ISDS database

As of now, there are around 3000 universal arrangements that have a procurement that endorses MNCs to sue apropos administrations. Out of these, 2700 are Bilateral Investment Treaties. Such arrangements have traversed quickly around the globe since the 1990s. From that point forward, more than 100 distinct nations have been sued more than 550 times. Interestingly, the majority of these nations are creating nations. The U.S. what's more, Canada have been sued under NAFTA, yet intriguingly Western European nations have been sued just a couple times and Japan never been sued.

This exploration has accumulated a database of 360 cases in which we can what unfold starting 2012. Of these, the state won 34 percent of the time.

The MNC won 31 percent of the time. The case settled before achieving the last judgment 34 percent of the time, which legal counselors celebrate of as a win for the MNC(Farrell, 2015). By the discontinuance of 2014, the general number of finishing up cases achieved 356. Out of these, roughly 37 for each penny (132 cases) was ruled for the State, and 25 for every penny (87 cases) finished for the financial specialist. Roughly 28 percent of cases (101) were settled and eight for each penny of cases (29) were ended for reasons other than settlement (or for obscure reasons). In the staying two for every penny (seven cases) an arrangement break was found, however, no fiscal payment was recompensed to the financial specialist.

Today, as organizations win billions in harms, insiders verbally express it has become unsafely crazy. Following 2000, many peregrine financial specialists have sued more than a moiety of the world's nations; asserting harms for an extensive variety of administration activities that they verbally express have undermined their benefits. In 2006, Ecuador crossed out an oil-investigation contract with Houston-predicated Occidental Petroleum; in 2012, after Occidental documented a suit up to a universal venture tribunal, Ecuador was definitively commanded to pay a record $1.8bn – generally indistinguishable equivalent to the nation's wellbeing spending plan for a year. Ecuador, as indicated by Kennard (2015), has held up a solicitation for the choice to be invalidated (Provost, & Kennard, 2015).

Relevant Theories

Reality, the BITs is one of the most important means of regulating the liberated investment mechanisms in the contemporary time (Allee, & Peinhardt, 2014). While, multinational companies are the clearest form of growing economic liberalization (Blomstrom, 2014). Principally, the paper relies in the explaining the Bilateral Investment Treaties (BITs) to MNCs on the economic liberalism theory that emerged as a critique of mercantilism (Hirst, 2013). As a developing vendor class tested the force of the European rulers in the eighteenth century, liberal political scholars, prominently John Locke dismisses the Hobbesian idea of an absolutist state and contended that the state existed exclusively to advance individual freedom. Liberal economists, especially Adam Smith and David Ricardo, tried to establish that free markets, liberated by state regulation, would bring about the best flourishing for all (Burt, 1997).In their perspective, the state's part ought to be constrained to ensuring private privileges of property and contract (Rubin, 1994) and amending any failure in the market (Frieden, & Lake, 2002). Progressivism tries to protect the business sector from legislative issues and supports a self-governing lawful framework to ensure private property against state obstruction and to implement expected (Paul, & Amawi, 2013) trades in the business sector. Liberal financial matters as created by Smith and Ricardo pushed an approach of organized commerce that allows every state to work in the generation of merchandise and administrations in which it has a relative favorable position, and after that exchange its items for others that it needs yet can't deliver as proficiently (Södersten, & Reed, 1994) . Through financial aspects of specialization and scale, a state amplifies its profitability. Thus, progressivism has been connected with an arrangement of fair drove development (Rapley, 1997). Progressivism additionally has advanced the free flow of capital cross different countries (Tolometi, 2015).

Bilateral Investment Treaties and Investors' Protection

A comprehensive multilateral set of investment rules has never been conclusively established. It was due to this that multiple failures in developing a multilateral investment treaty prompted developed countries to initiate efforts by negotiating bilateral investment treaties with individual developing country (Salacuse, & Sullivan, 2005).

Host countries sought to protect their respective interests by entering into bilateral, regional and multilateral investment-related agreements. Today, there are many bits that have been established between developed and developing countries (Yackee, 2008). BITs are the most important sources of the contemporary investment law (Schreuer, 2009). The purpose of the BITs is to attract foreign investment by providing security to foreign investors; primarily in developing countries where fear of expropriation might otherwise deter investment BITs exclusively govern the investment relation between two signatory countries. Zachary Elkins, et

Under the BITs, peregrine financial specialists are guaranteed sundry rights, including however not compelled to; to one side of payment in the event that the speculation is confiscated, a good fit for the peregrine venture to favorable procurements, ideal for the speculation to be concurred support and security, and the peregrine speculators right to move capital and money starting with one nation then onto the next. In addition, BITs withal accommodate procedural rights which qualify peregrine financial specialists for sue the host state without looking for earlier assent from their home administrations. By, one might verbalize that peregrine speculators procure locus stand to be subjects of worldwide law for purposes of venture mediation alone. This is verbalized to be the weightiest development brought by BITs (Gantz, 2003).

The support of peregrine speculators in the host nation is built up inside of the semi-institutionalized provision in BITs. There are three essential reasons which incentivize nations to ink a submissive with BITs. These include: forefending its nationals' interests in the regions of different nations; changing the business sector; and advancing internal speculations (Salacuse, & Sullivan, 2005).

Most partaking nations in FDI consider the financial specialists' aegis of its nationals as a noteworthy objective while working together in the host nation. Therefore, respective acquiescence would generally incorporate procurements on financial specialist support. As an outline of this, Salacuse (2015)and Newcombe (2011) recommended that the general principles of treatment of peregrine ventures and financial specialist incorporate the followings: Fair and impartial treatment, Full aegis and security, Intransigent or unfair measures, Expropriation, and Dispossession.

Investment Disputes and Arbitration

The most particular component in speculation defense arrangements is the speculator state question settlement instrument (Aleman, 2013). This is the thing that makes speculation arrangement exceptionally not quite the same as whatever other settlement. It sanctions peregrine financial specialists to arraign the host nation in advance of an arbitral tribunal on the off chance that they trust that the arrangement has been contradicted. The speculator state process endorses the financial specialists to challenge an extensive variety of legislative measures in a last and tying intervention choice.

There are withal special cases to bits that are relevant inside various circumstances. Harten contended that inside of BITs, there is a special case to the guideline of standard global law which obliges states to speak to its nationals on the off chance that the last has a case against another state (Van Harten, 2007). Be that as it may, peregrine financial specialists are vindicated from applying this inconvenient course and organization their cases specifically. The most everyday components incorporate mediation under the support of ICSID which offers supplemental office discretion and specially appointed assertion under the UNCITRAL intervention rules. It is through BITs that the present universal venture discretion framework was built up.

As of not long ago, AguasdelTunari, embedded that the global group has seen various cases testing the host states fundamental administrative capacities and some of the time states commitment to give open facilities to its natives. By Morris Asia Inhibited, the Commonwealth of Australia, state administrative measures on ecological issues, wellbeing and other settlement dissemination to the occupants have been proclaimed illegal for peregrine financial specialists'. By Gas Transmission Company the Argentine Republic, sometimes the fundamental capacity of the state; security and peacefulness is put in peril because of unequal BITs, decisions have constantly gone for peregrine financial specialists.

The Encroachments of MNCs

As iterated before the cosmically monstrous business is forming the early world request. This sustains the contention against globalization to be depoliticized, diminishing it to single issues of "moral exchanging" and "sets of accepted rules", and welcoming its co-alternative. Most importantly, one must be reminded that the state power in the west is speeding up”(Pilger, 2003)(Gudofsky, 2000).

The coordinating methodologies to check charge manhandle have not been exceptionally prosperous. Truth be told, such techniques might have negative results on human rights. The assets which administrations need to actualize such projects are all the time being refuted by expense manhandles. Hence, nations which don't take viable measure to check such misuse are also negating their global human rights commitments, completely with respect to financial, genial and social rights (Nagan, & Hammer, 2013. All nations have the commitment to expand their assets to understand the monetary, gregarious and social rights. A considerable part of the unlawful money related streams out of the creating nations is constituted. Kar, Cartwright-Smith, and Hollingshead, (2010) evaluated that around US 5.6 billion were confused to unlawful monetary streams from Egypt in the period from 2001 to 2010, and 80 percent of these surges coming about because of corporate assessment mishandle particularly through the unremarkable routine of exchange mispricing (Kar, Cartwright-Smith et al., 2010), but a great deal is perplexed to illegal duty avoidance, considerable misfortune happens through lawful' expense shirking and truculent strategies to minimize liabilities. Different techniques to attack charges incorporate non installment of expenses through acquiescence with administrations, the disintegrating basis of engendered by moving benefits to assessment asylums (nations with a 0% charge rate), and also exchange pricings and other common practices (Prosper Makene, 2014). The misfortune which creating nations bring about from assessment asylums is three times more than what they get through peregrine profit each year (OECD). This predominantly happens through what is kenned as exchange mispricing which happens when "two related organizations exchange with one another and misleadingly misshape the cost at which the exchange is recorded keeping in mind the end goal to minimize charges because of expense ascendant elements. For instance, by recording however much benefit as could be expected in an assessment safe house with low or zero duties" (Bastagli, 2015). Sixty percent of capital flight from Africa is assessed to account from exchange mispricing.

Understanding Why BITs is MNC’s Safe Haven

Joseph E. Stiglitz verbalized that the primary reactions of these agreements are the way that they are not vote based and gives more insurances to financial specialists that would be generally unattainable had.

There been an open and open examination and unendingly checked (Stiglitz, 2007). In addition, the venture bargains have withal offered a lift to a sizably voluminous number of questions. These incorporate ambiguities in the dialect use in the settlements which request arrangements to give careful consideration to the configuration of a well-suited system for debate determination. The Netherlands being the most charitable system of BITs on the planet is an exemplary illustration of this. The Dutch BITs are famously kenned to use extremely wide licit expressing and definitions. They overlook later and developing bits of knowledge that sweeping venture defense welcomes 'arrangement shopping,' where different nations have started inspecting and redesigning their BITs, the Netherlands sustains to pride them on their considerate speculation insurances, which are dubiously expressed and poorly characterized (Van Dijk, Weyzig et al., 2006) (Weyzig, 2013).

Apparently, the procedures for mediating debate have been an incredible worry to be the essential flaws of the bargains, where the coming of speculation arrangement discretion emerges, yet it was not proposed to forefend people in worldwide law, but rather as an odd and extraordinarily strong framework that forefends one class of people by obliging the administrations that sustain to speak to other people. On the opposite, the Western majority rule governments have built up an arrangement of norms worried due procedure including models of confirmation and methods intended to augment the probability of a reasonable result. The question settling forms in BITs frequently miss the mark concerning these "best practices." Interestingly, there are also sundry debate cases being kept mystery which gives no determination. Offers might furthermore be outlined, and there is no chance to get off determining conflicting choices; thus, since these kept debates are not distributed, different cases can't expand on the point of reference. Hence, this prompts more skeptical and fancy to the choices. BITs are planned to decrease irregularity and not the absolute opposite. There are withal grave worries with the way referees are winnowed. The way authorities are selected might open them to undue political weight. As Van Harten contends, “there can be no principle of law without an autonomous legal.”(Van Harten, 2010).

Conclusions

The International Covenants on Human Rights and the Declaration on the Right to Development set up that States are the essential commitment bearers of human rights and that, as a result, every State expected to manage peregrine speculation inside of its purview. It is basic to test for techniques for considering MNCs responsible and to manage their operations in order to advantage neighborhood groups and, in addition, the worldwide monetary framework. In such manner, the procedure includes subsisting global regulation executed and implemented broadly or universally. The household regulation inside of a given host nation is vital. The universal pledges on common and political rights are endorsed by numerous nations to force commitment on these administrations to control the behavior of MNCs inside of their ward keeping in mind the end goal to maintain the standards contained inside of them. This is foremost to control any future misuse of BITs between connecting with states.

References

- Aleman, A. R. V. (2013). Review of The Principles and Practice of International Commercial Arbitration by Margaret L. Moses.Berkeley Journal of International Law, 31(2), 461-471.

- Allee, T. &Peinhardt, C. (2014).Evaluating three explanations for the design of bilateral investment treaties. World Politics,66(1), 47-87.

- Bastagli, F. (2015).Bringing taxation into social protection analysis and planning, Overseas Development Institute WorkingPapers. London: Overseas Development Institute.

- Blomstrom, M. (2014).Foreign Investment and Spillovers (Routledge Revivals), Abingdon-on-Thames, U.K.: Routledge.

- Burt, E. M. (1997). Developing Countries and the Framework for Negotiations on Foreign Direct Investment in the World Trade Organization. American University International Law Review. & Pol'y, 12(6), 1015-1061.

- Dolzer, R. and Stevens, M. (1995).Bilateral Investment Treaties. Leiden, Netherlands: MartinusNijhoff Publishers.

- Farrell, H. ( March 26, 2015). People are freaking out about the Trans Pacific Partnership’s investor dispute settlement system. Why should you care? The WashingtonPost, pp 33.

- Frieden, J. A. & Lake, D.A. (2002).International political economy: perspectives on global power and wealth. Abingdon-on-Thames, U.K.: Routledge.

- Gantz, D. A. (2003). Evolution of FTA Investment Provisions: From NAFTA to the United States-Chile Free Trade Agreement, The. American. University. International Law. Review.19(4), 679-767.

- Gudofsky, J. L. (2000). Shedding Light on Article 1110 of the North American Free Trade Agreement (NAFTA) Concerning Expropriations: An Environmental Case Study. Northwestern Journal of International Law & Business. 21(1), 243-316.

- .Hirst, P. (2013). Associative democracy: new forms of economic and social governance, Hoboken, NJ: John Wiley & Sons.

- Kar, D., D. Cartwright-Smith, et al. (2010). The Absorption of Illicit Financial Flows from Developing Countries: 2002-2006. Available at SSRN 2335028.

- Kerner, A. (2009). Why should I believe you? The costs and consequences of bilateral investment treaties. International Studies Quarterly,53(1), 73-102.

- Khalil, H. (2015). Above the State: Multinational Corporations in Egypt. Cairo: Egyptian Center for Economic & Social Rights,

- Nagan, W. P., & Hammer, C. (2013).I. Solving Global Problems: Perspectives From International Law And Policy: The Conceptual and Jurisprudential Aspects of Property in the Context of the Fundamental Rights of Indigenous People: The Case of the Shuar of Ecuador. NewYork Law School. Law. Review. 58(1), 875-931.

- Newcombe, A. (2011). General exceptions in international investment agreements.Sustainable Development in World Investment Law, Global Trade Law Series. U.K.: Kluwer Law International.

- Paul, D. &Amawi, A. (2013).The Theoretical evolution of international political economy: a reader. Oxford: Oxford University Press.

- Pilger, J. (2003). The New Rulers of the World, London: Verso.

- Provost, C. & Kennard, M. (June 10, 2015). The obscure legal system that lets corporations sue countries. The Guardian,

- Rapley, J. (1997). Understanding development: Theory and practice in the third world, Abingdon-on-Thames, U.K.: Psychology Press.

- Rubin, P. H. (1994). Growing a legal system in the post-communist economies. Cornell International Law Journal'27(1x), 1-x47x.

- Salacuse, J. W. (2015). The law of investment treaties, Oxford: Oxford University Press.

- Salacuse, J. W. and Sullivan, N.P (2005). Do BITs really work: An evaluation of bilateral investment treaties and their grand bargain. Harvard International Law Journal, 46(1), 67-130.

- Schreuer, C. H. (2009). The ICSID Convention: a commentary.., Cambridge: Cambridge University Press.

- Södersten, B. and Reed, G. (1994).The Determination of a Floating Exchange Rate. International Economics (pp.571-596), New York City: Springer.

- Stiglitz, J. E. (2007). Regulating Multinational Corporations: Towards Principles of Cross-Border Legal Framework in a Globalized World Balancing Rights with Responsibilities. American University International Law Review, 23(3), 451-484.

- Tolometi, R. N. (2015). Challenges of reduced refugee funding and possible mitigation efforts: a case study of Kenya. Nairobi: University of Nairobi.

- UNCTAD (2014a).International Investment Agreements - Issues Notes. (Investor-State Dispute Settlement: Review of Developments in 2014) [IIA Issue Note, No. 2, 2015]

- UNCTAD (2014b).Investor-State Dispute Settlement: Review of Developments in 2014 [IIA Issue Note, No. 2, 2015].

- Van Dijk, M., Weyzig, F., et al. (2006).The Netherlands: a tax haven? Amsterdam: SOMO.

- Van Harten, G. (2007). Investment treaty arbitration and public law. Oxford: OUP Catalogue.

- Van Harten, G. (2010). Investment Treaty Arbitration, Procedural Fairness, and the Rule of Law, International Investment Law and Comparative Public Law Oxford: Oxford University Press.

- Weyzig, F. (2013). Tax treaty shopping: structural determinants of Foreign Direct Investment routed through the Netherlands. International Tax And Public Finance, 20(6), 910-937.

- Yackee, J. W. (2008). Pacta Sunt Servanda and State Promises to Foreign Investors Before Bilateral Investment Treaties: Myth and Reality. Fordham International Law Journal, 32(5), 1550-1613.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

22 August 2016

Article Doi

eBook ISBN

978-1-80296-013-6

Publisher

Future Academy

Volume

14

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-883

Subjects

Sociology, work, labour, organizational theory, organizational behaviour, social impact, environmental issues

Cite this article as:

Elfakharani, A. M. A., & Abdulrahman, R. (2016). Are Bilateral Investment Treaties (BITs) a Safe Haven to Multinational Companies (MNCs)?. In B. Mohamad (Ed.), Challenge of Ensuring Research Rigor in Soft Sciences, vol 14. European Proceedings of Social and Behavioural Sciences (pp. 236-243). Future Academy. https://doi.org/10.15405/epsbs.2016.08.34