Abstract

The purpose of this conceptual paper is to address the link between corporate governance mechanisms such as board size and managerial ownership have somehow influence the performance of the firm’s operations from the context of inventory performance. This paper highlight a total new approach whereby as for as concern to inventory decision will be solely handled by the low level management or the agent who act as manager. Best practices through effective corporate governance mechanism somehow tight up in deciding to minimize operational cost through the effort of reducing the asset called inventory that is accounted for almost 70 percent of total manufacturing cost. Therefore, this paper address the idea behind the scene of best practices reflects on corporate governance mechanisms will therefore have an impact on inventory performance.

Keywords: Corporate GovernanceBoard SizeManagerial OwnershipOperations ManagementInventory Performance

Introduction

Enhancing organizational efficiency is one of the companies approach to face stiff competition most likely will slow down if the measure for quick action and strategy is not in place. The area need for further scrutiny and challenges is the operations activity that if it not in control will directly affect the operations performance of the company. In order to stay competitive and to enhance organizational efficiency is to relook on the management activity that plays a crucial role and critical success factor towards administrative excellence by deploying best practices through engaging corporate governance. Malaysian corporations basically been entrusted to managers to fully functional as agents for the owners (shareholders) to run the operations activity. Agency theory recall the problem may arise between the shareholder as the principal and the managers as an agent. This problem can be solved if the agents who act as managers being transparent to the principal as the owners of the corporation and the fairness bestowed to the stakeholders (Al-Faki 2006). The performance of the firms largely depends to the agents who run the operations base on the financial resources and non-financial are available to a business. As for the non-financial resources such as inventory perspective if it is not been monitored or control will affect the operations performance directly. For corporation listed in Malaysia especially the manufacturing companies when been entrusted to the agent (managers) to run the operation most likely ending up having high operational cost if it is not been monitored and controlled. Therefore operations performance dictate from the inventory management specifically involve in the optimizing the resources such as stocks is important whereby it postulate the way and how many stock to keep meaning to say to high inventory will affect the profitability of the company triggered by high operational cost. Sachs (1998)

Issues

The main focal point when the performance of the firm depends solely on good practices derived from strong corporate governance compare to poor corporate governance. As far as concern to corporate governance mainly emphasize on financial measurement for assessing the performance of the firms but did not address from the context of operations performance that will focus on inventory measurement as a base for this paper. Therefore, this area seems to have gap that require for further research. To address the issues whether corporate governance mechanisms has an effect towards inventory values and performances of the manufacturing companies

Literature Review

Operations Performance (Inventory)

Company having shouldering high operational costs that associate to high inventory value that estimate to almost 60 to 70 percent of the total manufacturing costs. Therefore, major focus to minimize the cost that been contributed due to high inventory that definitely affecting the profit margin of the companies. Chopra and Meindl (2003) claim that the function of managing operations is to act in a way to control towards reducing inventory by minimizing it directly will reduce the total operational costs. On top of that the involvement of executives that do recognize the effort towards inventory reduction by means through the effort dealing with effective inventory control and sufficient stock available for better value.

Corporate Governance Variables

Board Size

Company will have an impact when members in the board depends sizeable numbers will basically come from effective decision making, monitoring and to extend on the controlling (Monks and Minow ,1995. But, MCCG never make as policy on the numbers of board members means the board size limit to the listed companies. Therefore, companies allowed to have their numbers of members in board whereby they are perfectly able to run the company. Agency problem may occur if larger board size. Jensen (1993) and Yermack (1996). This issue basically tells that larger board size may leads to agency problem whereby the difficulty to come up with common decision making, communication eventually leads to more agency problems.

Managerial Ownership

The directors such as executive directors directly involved in the operations of the company and there a some cases whereby the agents (managers) may hold certain number of outstanding share and become part of the ownership. This drives the quality of decision making and better flow of communication may take place. As refer to agency theory when the weightage of ownership is most likely the non-participative will become lesser and proactive to deal for improvement for the sake of the company will become better eventually operations performance will become enhance. Meaning to say behavioral aspect from compromising on non-value becomes lesser (Bowen, Rajgopal & Venkatachalam, 2008). Cheng, Warfield & Ye (2011) reported that the ownership structure will leads in solving the separation of ownership and issues in who should be in control.

Corporate Governance and Operations Performance

Setharaman and Raj (2011) claim the performance of the firms could be seen from the angle of firm’s operation and financial. Gathering the claim by these authors this paper disclose the possibility connection of corporate governance seen from the angle of operations performance which mainly deal with performance of inventory.

Conceptual Model

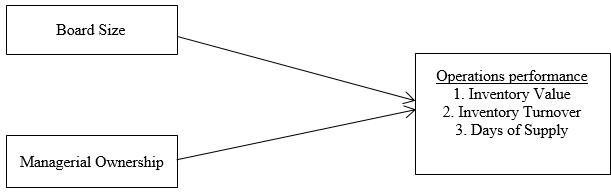

This rational behind the conduct of this study is to make confirmation of the proposition. As this paper emphasize on the causal relationship through the chosen variables of corporate governance and operations performance through quantitative approach refer to figure

Variable Definition and Measurement

Dependent Variable (Operations Performance)

Discussion and Implication

Basically there are many study focus mainly the link between company performance and corporate governance but the emphasize were on merely accounting numbers. Therefore this paper indeed in a way highlight the possibility link between inventories numbers instead. How the corporate governance mechanisms such as board size and managerial ownership have in a way influence in the inventory numbers that accounts for the operations performance? The executives have somehow involve in making decision towards improvement of the profit margin through the effort of controlling towards reducing stock and ensuring sufficient stocks can meet the production requirement. Base on this is the larger board size do influence the inventory decision or the other way round or the managerial ownership make differences in influencing inventory performance.

Conclusion

Best practices through effective corporate governance mechanism somehow tight up in deciding to minimize operational cost through the effort of reducing the asset called inventory that is accounted for almost 70 percent of total manufacturing cost. Therefore, this paper address the idea behind the scene of best practices reflects on corporate governance mechanisms will therefore have an impact on inventory performance.

References

- Al-faki M. (2006). Transparency & corporate governance for capital market development in Africa: The Nigerian case study. Securities Market Journal, Edition, 9- 28.

- Bowen, R.M., Rajgopal, S., & Venkatachalam, M. (2008). Accounting discretion, corporate governance and firm performance. Contemporary Accounting Research, 25, 351- 405.

- Cheng, Q., Warfield, T. D., & Ye, M. (2011). Equity incentives and earnings management. Journal of Auditing, Accounting and Finance, 26(2), 317-349.

- Chopra, S., & Meindl, P. (2003) Supply Chain Management: Strategy, planning and operations Upper Saddle River, New Jersey: Pearson Prentice Hall.

- Jensen, M.C. (1993). The modern revolution, exit, and the failure of internal control mechanism. Journal of Finance, 48, 831-880.

- Johari, N. H., Saleh, N.M., & Hassan, M.S. (2008). The influence of board independence, competency and ownership on earnings management in Malaysia. International Journal of Economics and Management, 2, 281-306.

- Monks, R., & Minow, N. (1995). Corporate Governance. Basil Blackwell, Cambridge.

- Sachs, J. (1998). Symposium on global financial markets: the post-bubble Japanese economy & prospects for East Asia. Journal of Allied Corporate Finance, 11, 16-29.

- Setharaman and Raj (2011). An empirical Study on the Impact of Earnings per share on Stock Prices of a Listed Bank in Malaysia. International Journal of Applied Economics and Finance, 5, 114-126

- Saleh, N.M., Iskandar, T.M., & Rahmat, M.M. (2005). Earnings management and board characteristics evidence from Malaysia. Journal of Management, 24, 77-103.

- Yermack, D. (1996). Higher market valuation of companies with a small board of directors. Journal of Financial Economics, 40, 185-211.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

22 August 2016

Article Doi

eBook ISBN

978-1-80296-013-6

Publisher

Future Academy

Volume

14

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-883

Subjects

Sociology, work, labour, organizational theory, organizational behaviour, social impact, environmental issues

Cite this article as:

Nadarajan, S., Chandren, S., Bahaudin, A. Y., Elias, E. M., & Abdul Halim, M. K. I. (2016). Corporate Governance: Board Size, Managerial Ownership and Operations Performance. In B. Mohamad (Ed.), Challenge of Ensuring Research Rigor in Soft Sciences, vol 14. European Proceedings of Social and Behavioural Sciences (pp. 184-188). Future Academy. https://doi.org/10.15405/epsbs.2016.08.27