Abstract

This paper, which is conceptual in nature, discusses the relationship between several factors that may affect the acceptance of Qardhul Hassan financing in Nigeria. The proposed variables under examination are attitude towards Qardhul Hassan financing, knowledge of Qardhul Hassan financing, perceived benefits, perceived government support and religious obligations. If validated, the work would serve as a proposed financing model to the government, policy makers, regulators, practitioners and other stakeholders vis-à-vis cubing the negative effect of financial exclusion in various jurisdictions of the emerging markets.

Keywords: Qardhul HassanIslamic FinanceEmerging marketsNigeria

Introduction

Islamic finance offers alternative solutions to conventional finance that comply with the principles of Islamic jurisprudence (Shari’ah). Shari’ah strives to promote moral and ethical values in establishing an economic system that prohibits the payments and receipts of interest (

An Overview of Islamic Banking in Nigeria

The contentious implementation of Islamic Banking System and the growth of Islamic finance asset globally has attracted the attention of attracted the attention of Nigerian government policy makers and other stakeholders to implement the Islamic banking in Nigeria in 2011 (Ibrahim & Mustafa, 2011). This equally has to do with the Nigeria’s overwhelming Muslim population that was put at more than 50% of the 170 million people (Aliyu, 2012) of the total population. The efforts to establish Islamic banking in Nigeria dates back to the 1990s when the idea was first mooted and subsequently, two licenses were granted in 1992. Unfortunately, none could commence operation until 1999 when the former Habib Nigeria Bank Limited (now Bank PHB) started a an Islamic banking window (Daud, 2011; Dauda, 2013). However, it is imperative to note that the promulgation of the Banks and Other Financial Institutions Decrees (BOFID) 24 and 25 of 1991, beckoned a new dawn for banking operation in Nigeria (Daud, 2011). This decree made new provisions for the establishment of non-Interest banking in the country thereby leading Central Bank of Nigeria in 2010 to issue a guideline for the regulation and supervision of Non-Interest (Islamic) Financial Institutions (NIFI) that pave way for proper establishment of Islamic banking in Nigeria. This new banking model categorized non-interest banks as specialized banks which could be national non-interest bank with the capital base of N10 billion and shall operate in every state of the federation including the Federal Capital Territory (FCT). The second category is regional non-interest bank with capital base of N5 billion and shall operate in a minimum of six states and maximum of twelve contiguous states of the federation (Aliyu, 2012; Ibrahim & Mustafa, 2011). According to this guideline, a NIFI is defined as: “a bank or Other Financial Institution (OFI) under the purview of the CBN, which transacts banking business, engages in trading, investment and commercial activities as well as the provision of financial products and services are in accordance with Shari’ah principles and rules of Islamic commercial jurisprudence” (CBN, 2011). There were many permissible products under the Islamic banking system such as Murabahah, Salam, Istisna, Ijarah, Musharakah, Mudarabah, Sukuk, Qardhul Hassan etc introduced in the Nigerian banking system.

Empirical Evidences on Qardhul Hassan Financing (QHF)

Qardhul Hassan refers to the loans that are free from any benefit or return to the lender and is more commonly referred to as interest- free loan (Bhuiyan, Siwar, Islam, & Rashid, 2012). (Obaidullah & Khan, 2010) refers Qardhul as zero-return loans that the Qur’an encourages Muslims to make available to the needy. Banks are allowed to charge borrowers a service fee to cover the administrative expenses of handling the loan. The fee should not be related to the loan amount or maturity. Furthermore, Qardhul Hassan to poverty approach means a beautiful loan. It is a loan granted by the lender without expectation of any return on the principal. The following verses from the holy Qur’an reveal the importance of this instrument:

Who is he that will loan to Allah a beautiful loan, which Allah will double unto his credit and multiply many times? It is Allah that giveth (you) Want or plenty, and to Him shall be you”. (Al-Quran Suratul Baqarah: 245)

Verily, those who give sadaqa, men and women and lend to Allah a qardhul hassan, it shall be increased manifold (to their credit) and theirs shall be an honorable good reward (Al-Quran Suratul Hud, Verse No. 57).

If you lend Allah a qardhul hassan, He will multiply it for you. Allah is the most appreciating, the most forbearing (Al-Quran Suratul Israiel, Verse No. 64)

Anas bn Malik reported that Allah's Messenger (PBUH) said:

"At night during which I was made to perform journey, I saw at the door of the Paradise written, 'A sadaqa is equivalent to ten like that (in reward) while lending has eighteen times reward.' I said, 'O Gabriel, what is the reason that lending is more excellent than Sadaqa?' He said, 'The beggar asks while he possesses it (money) while the one who demands loan does not demand it but because of his need.' [Trans. Muhammad Tufail Ansari, Kitab Bhaban, India, 2000, Vol. #3, p. 438, #2431.]

Qardhul Hassan is an important tool of providing loan for low income groups of the society in the framework of Islamic banking system of the country. Organizing and making this micro-credit instrument aimed at income redistribution among the community can create the necessary structure and background for the development of poverty alleviation programs and enhancing financial inclusion through proper planning and implementation of micro credit projects in the country (Mojtahed & Hassanzadeh, 2009). This paper emphasizes on the Qardhul Hassan because of its emphasis on the income redistribution aimed at reducing the gap between rich and poor populace in the society. To this end, the following determinants will be investigated.

Attitude towards QHF

Attitude towards the behavior refers to the individual’s favorable or unfavorable evaluations of the behavior (Vallerand, Deshaies, Cuerrier, Pelletier, & Et Al, 1992). Previous studies by (Amin, et. al., 2011) found that attitude influences the intention to use Islamic personal financing. They had discovered the positive relationship between attitude and Qardhul Hassan financing acceptance. In fact their study considered attitude as the key determinant of Qardhul Hassan financing acceptance in Malaysian context. Jaffar & Musa (2014) measured attitude towards Islamic financing among Halal-certified micro and SMEs in terms of equity, fairness, flexibility, beneficial and rewarding and found positive relationship. Consequently, this paper comes up with the following proposition:

P1: Attitude towards QHF will influence Qardhul Hassan financing acceptance

Knowledge of QHF

The study by Jaffar & Musa, (2014) measured the relationship between awareness and knowledge of consumers towards Halal-certified micro and SMEs in Malaysia. This paper adopts this variable as one of determinants of Qardhul Hassan financing acceptance in Nigeria. This will enable the researchers to determine the influence of knowledge of Qardhul Hassan financing on the Qardhul Hassan financing acceptance. Hence, the following proposition is developed.

P2: Knowledge of QHF will influence Qardhul Hassan financing acceptance

Perceived benefits

Perceived benefits as being measured by cost of products and rate-of-return, availability of credit with favourable terms, lower service charge, lower interest charge on loan, high interest payment on deposits and lower monthly payment (Jaffar & Musa, 2014). The cost benefits may be positively related to attitude towards Islamic financing which will in turn influence intention to adopt Islamic financing in business. Similarly, Ismail, (2014) found a positive relationship between the perceived usefulness and acceptance of mobile marketing services. Therefore, this paper intends to determine the influence of perceived benefits on QHF acceptance in Nigeria. Hence, the following proposition is developed.

P3: Perceived benefits will influence Qardhul Hassan financing acceptance.

Perceived government support

Previous study by Amin, et, al., (2011) found insignificant relationship between government support and customers intention to use Islamic personal financing in Malaysia while Ringim, (2014) found significant influence of government support on the perception of Muslims account holders in conventional banks towards Islamic bank. Consequently, this paper intends to determine how government support will influence QHF acceptance in Nigeria. Hence, the following proposition is developed.

P4. Perceived government support will influence Qardhul Hassan financing acceptance.

Religious Obligations

Previous studies by Amin, et, al., (2011); Jaffar & Musa, (2014); and Sun, Goh, Fam, Xue, & Xue, (2012) have found positive relationship between religious obligations and Muslims intention to use or accept Islamic financing products. On the other hand, available evidence has shown that consumers with low religious commitment are less consistent in their religious behaviours and easily influenced by externalities (Sun et al., 2012). The measures of religion obligation involve perception to comply with the underlying principles of Islamic jurisprudence (Shari’ah). This include perceptions fulfil the social aspect of religious obligation by investing in Qardhul Hassan fund and expecting reward in the hereafter. This will ensure income redistribution among the Muslims communities and in compliance with the dictates of Allah as contained in Quran suratul Baqarah, chapter 2:245 as cited above. Hence, the following proposition is developed.

P5: Religious obligations will influence Qardhul Hassan financing acceptance.

Proposed Theoretical Framework and Research Methodology

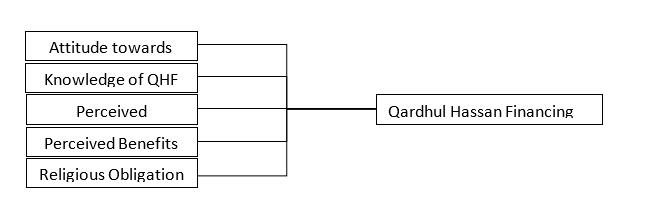

Based on the literature review discussed above, this paper proposed theoretical framework (See Figure

Conclusion

This paper has proposed the relationship between attitudes towards QHF, knowledge of QHF, perceived government support, perceived benefits and QHF acceptance in Nigeria. If the proposed hypotheses are validated, the finding may assist the government, policy makers, regulators and practitioners in Nigeria for one of the remedies to the untold hardship suffered by the teeming Muslims population due to the high level of financial exclusion. The findings will offer empirical evidence and justify the previously conducted studies on the relationship between attitude towards QHF, knowledge of QHF, perceived benefits, perceived government support, religious obligation and QHF acceptance in Nigeria.Similarly, the framework when validated may add to the existing literature on the practical application of the Theory of Reasoned Action (TRA) and Theory of Planed Behaviour (TPB) as they serve as the underlying theories for this paper.

References

- Abd Rahman, A., Asrarhaghighi, E., & Ab Rahman, S. (2015). Consumers and Halal cosmetic products: knowledge, religiosity, attitude and intention. Journal of Islamic Marketing, 6(1), 148–163.

- Ajzen, I., Netemeyer, R., Ryn, M. Van, Ajzen, I., Netemeyer, R., & Ryn, M. Van. (1991). The theory of planned behavior. Organizational Behavior and Human Decision Processes, 50(2), 179–211.

- Ali Khalifa, S., & Bardai, B. (2013). The feasible acceptance of Al Qard al-Hassan (Benevolent Loan) mechanism in the Libyan Banking system. Journal of Chemical Information and Modeling, 53, 1689–1699.

- Amin, H. (2013). Factors influencing Malaysian bank customers to choose Islamic credit cards: Empirical evidence from the TRA model. Journal of Islamic Marketing, 4(3), 245–263.

- Amin, H., Abdul Rahman, A. R., Sondoh, S. L., & Chooi-Hwa, A. M. (2011). Determinants of customers’ intention to use Islamic personal financing: The case of Malaysian Islamic banks. Emerald Insight, 29(5), 494–519.

- Amin, H., Ghazali, M. F., & Supinah, R. (2010). Determinants of Qardhul Hassan financing acceptance among Malaysian bank customers: An empirical analysis. International Journal of Business and Society, 11(1), 1–16.

- Amin, H., Rahman, A. R. A., & Razak, D. A. (2014). Theory of Islamic consumer behaviour: An empirical study of consumer behaviour of Islamic mortgage in Malaysia. Journal of Islamic Marketing, 5(2), 273–301.

- Amin, H., Rahman, A. R. A., Sondoh, S. L., & Chooi-Hwa, A. M. (2011). Determinants of customers’ intention to use Islamic personal financing: The case of Malaysian Islamic banks. Journal of Islamic Accounting and Business Research, 2(1), 22–42.

- Amin, H., Rahman, A. R. A., Sondoh, S. L., Chooi-Hwa, A. M., Abdul Rahman, A. R., Sondoh, S. L., & Chooi-Hwa, A. M. (2011). Determinants of customers’ intention to use Islamic personal financing: The case of Malaysian Islamic banks. Emerald Insight, 29(5), 494–519.

- Bhuiyan, A. B., Siwar, C., Islam, A., & Rashid, M. (2012). The approaches of Islamic and conventional microfinancing for poverty alleviation and sustainable livelihood. American Journal of Applied Sciences, 9(9), 1385–1389.

- Eanest&Young. (2015). Connecting Africa to the world of Islamic finance. In N. Mahomed (Ed.), (pp. 1–4). 2015 EYGM Limited.

- EFInA. (2014). EFInA Access to Financial Services in Nigeria 2012 Survey Key Findings, 2012 (November 2012), 1–71.

- Febianto, I., & Ashany, A. M. (2012). The Impact of Qardhul Hasan Financing Using Zakah Funds on Economic Empowerment (Case Study of Dompet Dhuafa, West Java, Indonesia), 1(1), 15–20.

- Haneef, M. A., Pramanik, A. H., Mohammed, M. O., Bin Amin, M. F., & Muhammad, A. D. (2015). Integration of waqf-Islamic microfinance model for poverty reduction. International Journal of Islamic and Middle Eastern Finance and Management, 8(2), 246–270.

- IFSB. (2014). Prospects and Challenges in the Development of Islamic Finance for Bangladesh. Kuala Lumpur, Malaysia: Islamic Financial Services Board. Retrieved from www.ifsb.org

- Ismail, M. (2014). Factors Influencing Consumers’ Acceptance of Mobile Marketing Services. UUM 2014.

- Jaffar, M. A., & Musa, R. (2014). Determinants of Attitude towards Islamic Financing among Halal-certified Micro and SMEs: A Preliminary Investigation. Procedia - Social and Behavioral Sciences, 130, 135–144.

- Khan, M. S. N., Hassan, M. K., & Shahid, A. I. (2007). Banking Behavior of Islamic Bank Customers in Bangladesh. Journal of Islamic Economics, Banking and Finance, 3(Issue?), page? xx-xx

- Mansori, S., Kim, C. S., & Safari, M. (2015). A Shariah Perspective Review on Islamic Microfinance. Asian Social Science, 11(9), 273–281.

- Marcellus, I. O. (2009). Development Planning in Nigeria : Reflections on the National Economic Empowerment and Development Strategy ( NEEDS ) 2003-2007. Journal of Social Sciences, 20(3), 197–210.

- Mojtahed, A., & Hassanzadeh, A. (2009). The Evaluation of Qard-al-Hasan as a Microfinance Approach in Poverty Alleviation Programs, 1–32.

- National Commission Planning. (2010). Nigeria Vision 20: 2020. Abuja: NPC, (December).

- Obaidullah, M., & Khan, T. (2010). Islamic Finance Instruments and Markets. London, United Kingdom: CPI William Clowes, Beccles, NR34 7TL.

- Ringim, K. J. (2014). Perception of Nigerian Muslim account holders in conventional banks toward Islamic banking products. International Journal of Islamic and Middle Eastern Finance and Management, 7(3), 288–305.

- Sain, M. R. M., Rahman, M. M., & Khanam, R. (2013). Financial Exclusion In Australia: An Exploratory Case Study Of The Muslim Community. In 3rd Malaysian Postgraduate Conference (MPC2013) (pp. 265–280).

- Shahwan, S. H., & Mohd Dali, N. R. S. Bin. (2007). Islamic credit card industry in Malaysia: customers’ perceptions and awareness. In 3rd Uniten International Business Management Conference 2007, Human Capital Optimization; Strategies, Challenges and Sustainability

- Sun, S., Goh, T., Fam, K.S., Xue, Y., & Xue, Y. (2012). The influence of religion on Islamic mobile phone banking services adoption. Journal of Islamic Marketing, 3(1), 81–98.

- Vallerand, R. J., Deshaies, P., Cuerrier, J.-P., Pelletier, L. G., & Et Al. (1992). Ajzen and Fishbein’s theory of reasoned action as applied to moral behavior: A confirmatory analysis. Journal of Personality and Social Psychology. Volume? (Issue?), xx-xx page number?

- Warsame, M. H. (2009). The role of Islamic finance in tackling financial exclusion in the UK. Doctoral Thesis, Durham University. Durham University.

- Yumna, A., & Clarke, M. (2013). Does Qard ul-Hassan Enhance the Impact of Microfinance on Clients’ Income and Expenditure? Case Studies of Three Islamic Charity Based Microfinance in Indonesia. Deakin University.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

22 August 2016

Article Doi

eBook ISBN

978-1-80296-013-6

Publisher

Future Academy

Volume

14

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-883

Subjects

Sociology, work, labour, organizational theory, organizational behaviour, social impact, environmental issues

Cite this article as:

Zauro, N. A., Saad, R. A. J., & Sawandi, N. (2016). Determinants of Qardhul Hassan Financing Acceptance in Nigeria. In B. Mohamad (Ed.), Challenge of Ensuring Research Rigor in Soft Sciences, vol 14. European Proceedings of Social and Behavioural Sciences (pp. 775-781). Future Academy. https://doi.org/10.15405/epsbs.2016.08.109