The extent of applying the International Public Sector Accounting Standards by the Jordanian Public Sector

Abstract

This research paper examines the extent of applying the International Public Sector Accounting Standards (IPSAS) by the Jordanian public sector. Since the Jordanian public sector is recently applying these standards, so the research will examine how effectively these standards were applied, also how the Jordanian public sector activate these standards in Jordan. In order to achieve the purpose of the study the SPSS package were applied in addition to other statistical measures. Finally, the study concluded that, the Jordanian public sector is applying the International Public Sector Accounting Standards in weakly form and the research study recommended that these standards should be applied in a wide manner in collaboration with competent authorities; raise the efficiency of monitoring regarding the applying procedure, and keep up with the IPSAS updates.

Keywords: International Public Sector Accounting Standards (IPSAS), Public Sector, Economic System, Government Accounting

Introduction

Over the years, every country in the word have its own accounting system , however the accounting system needs a specific accounting standards for the purpose of internal audit and disclosure of financial statements, to take advantage of them in many ways like: the statement of financial position.

Most of the countries tried to issue unified standards to avoid misunderstanding of the financial statement that disclosed to the concerned parties. Many economic systems worldwide have two sectors: public sector and the private sector, for that reason the International Public Sector Accounting Board (IPSAB) issued the International Public Sector Accounting Standards (IPSAS), to unify the economic systems for the public sectors in these countries.

International Public Accounting Standards (IPSAS) are (31) standards issued by the International Public Accounting Board (IPSAB), to be able to treat the financial transactions in the public sector specifically and to converge between the International Public Sector Accounting Standards (IPSAS) and the International Financial Reporting Standards (IFRS), therefore the table below shows the converge between the (IPSAS) and the (IFRS):

There is 107 countries have been applying the International Public Sector Accounting Standards (IPSAS) 8 of them are Arabic countries and the Hashemite kingdom of Jordan is the ninth. The notable Talal Abu Ghazaleh and the president of the accounting divan gave recommendations to apply the International Public Sector Accounting Standards in Jordan by the vision of to keep up with the economic development, the president of the accounting divan has put a strategic plan for the years ( 2011-2015 ) to apply the International Public Sector Accounting Standards (IPSAS); because these standards are one of the best methods of the financial controlling and internal auditing for these public governmental institutions.

Study problem

Because the International Public Sector Accounting Standards (IPSAS) were issued to unify the economic systems in the world on a specific standards on a statically way in the public sector, so the strategic plan of Hashemite kingdom of Jordan that issued by the president of the accounting divan for the years (2011-2015) is to seek to apply the International Public Sector Accounting Standards ( IPSAS ) to keep up with the economic development and to contribute in the financial reform in the kingdom, since this current year is in the implementation period of this strategic plan, we will study in this research if these standards were applied in Jordan in the best way or not and what is the extent of this applying if these standards were applied.

Study importance

Since the Hashemite Kingdom of Jordan is in a transition period to apply the International Public Sector Accounting Standards (IPSAS), we should study these standards, how to deal with these new standards, how these standards have contribute in the financial reform in the previous three years (2011–2014), to confirm on the Realism vision for the financial stability in Jordan, the extent of efficiency of the strategic plan issued by the president of the accounting divan, how the public sector has take advantage of it in the monitoring system and how efficiency it is to achieve the most important goal which is achieve the financial stability to unify its economic system with the worldwide economic systems to develop economically in Jordan.

Study objectives

This research study aims to achieve the following objectives:

a) The efficiency of the International Public Sector Accounting Standards.

b) The extent of applying the International Public Sector Accounting Standards inJordan.

Study hypothesis

H0: The Jordanian Public Sector don’t apply the International Public Sector Accounting Standards.

Previous studies

(Cohen, Karatzimas, Venieris 2014), “The Informative Role of Accounting Standards in Privatizing State-Owned Property: Comparing Greek Governmental Accounting Standards and IPSAS”.

This paper examined the suitability of different accounting bases in providing useful information to support privatization decisions of state-owned property. More specifically, a comparison is conducted between the recently adopted Greek Governmental Accounting Standards (GGAS) that follow a modified cash basis and accrual-based IPSAS with reference to state-owned property. Within this realm, the study tried to shed light on how accounting could assist governments in better informing their decision-making processes. The findings suggest that even though GGAS seem to be influenced in several cases by IFRS, and therefore present similarities with IPSAS, they do not sufficiently account for information relevant to privatization decisions under the idiosyncratic circumstances that govern state-owned property in Greece. Nevertheless, although IPSAS appear to be significantly more informative, an information gap is recognized in the case of state-owned assets registration regarding assets that face considerable legal shortcomings that relate to violations or claims by third parties.

(Cardoso , Aquino , Pigatto, 2014), “Brazilian Governmental Accounting Reforms: IPSAS and Accrual Accounting Adoption”

The purpose of the paper was to point out that the Brazilian governmental accounting is affected by two reform processes: the implementation of accrual accounting and convergence with the International Public Sector Accounting Standards (IPSAS).The paper analyzed the origins, the process and preliminary outcomes of such reforms. In order to characterize the Brazilian accounting system. The paper found out that the accounting reform has two origins: the need to prepare cost accounting information (year 2000) and the requirement to converge towards IPSAS (year 2009). Reform affects both central government and subnational governments, and is being coordinated by the Treasury’s central government. In the process, the Treasury has required the adoption of some sophisticated accounting policies that were beyond the capacity of IT platform installed on either central and local governments, and has had to postpone aspects of their implementation. Treasury has used this as a convenient opportunity to select which IPSAS requirements to implement, taking into account political agendas (e.g. avoiding the recognition of deficit). For these and other reasons, some states’ courts of accounts do not require compliance with some of the standards issued by the Treasury, which impairs the comparability of accounting information prepared by different Brazilian public sector entities.

(Ijeoma. Oghoghomeh. 2014), “Adoption of international public sector accounting standards in Nigeria: Expectations, benefits and challenges”

This study examined the expectations, benefits and challenges of adoption of International Public Sector Accounting Standards (IPSAS) in Nigeria. The objectives of this study are determining the impact of adoption of IPSAS on the Level of Accountability and Transparency in the Public Sector of Nigeria and to ascertain the contribution of adoption of IPSAS in enhancing comparability and international best practices. Primary source of data was employed to generate the data of interest. From the findings of the study, it was observed that adoption of IPSAS is expected to increase the level of accountability and transparency in public sector of Nigeria. It was found that the adoption of IPSAS will enhance comparability and international best practices. Also, it was denoted that adoption of IPSAS based standards will enable provide more meaningful information for decision makers and improve the quality of the financial reporting system in Nigeria. In addition, it was found that adoption of IPSAS by Nigerian government will improve comparability of financial information reported by public sector entities in Nigeria and around the world. Hence, we conclude that the adoption of IPSAS in Nigeria is expected to impact operating procedures, reporting practices thereby strengthening good governance and relations with the government and the governed.

(Ijeoma, 2014), “The Impact Of International Public Sector Accounting Standard (IPSAS) On Reliability, Credibility And Integrity Of Financial Reporting In State Government Administration In Nigeria”

This study evaluated the impact of International Public Sector Accounting Standard (IPSAS) on reliability, credibility and integrity of financial reporting in State Government Administration in Nigeria. The purpose of the study was to ascertain the impact of International Public Sector Accounting Standard (IPSAS) on reliability, credibility and integrity of financial reporting in State Government administration in Nigeria. The findings of this study showed that implementation of IPSAS will improve the reliability, credibility and integrity of financial reporting in State Government administration in Nigeria. Also, it was observed that implementation of IPSAS based standards can facilitate efficient internal control and result based financial management in the public sector of Nigeria. Equally, it was found that implementation of IPSAS can enhance Federal Government’s goal to significantly deliver services more effectively and efficiently. Accountability is no doubt the hallmark for good governance, if Nigeria is to be a member of the twenty most developed nations of the world by the year 2020, political office holders, citizens and all stakeholders in the Nigerian project should embrace integrity, transparency and accountability in the management of public funds. Furthermore, it concluded that implementation of IPSAS by public sectors in Nigeria will not only impact positively on reliability, credibility and integrity of financial reporting but is expected to pave way for a uniform chart of financial reporting by the three tiers of Government in Nigeria.

(Vanhee, Manes-Rossi, Natalia, 2013), The Effect of IPSAS on Reforming Governmental Financial Reporting: an International Comparison”.

The purpose of the study was to explore the past 25 years significant of New Public Management (NPM) reforms, particularly towards accrual accounting, have characterized the public sector in many countries. The diversity in public financial information systems created a need for harmonization, resulting in the elaboration of International Public Sector Accounting Standards (IPSAS). Despite their relevance, little is known on the adoption process of IPSAS. This study aimed to examine the extent IPSAS-inspired accrual accounting is adopted in central / local governments worldwide as well as to investigate which factors affect the differing level of their adoption. The study revealed an important move to accrual accounting, particularly to IPSASaccrual accounting whereby there still remains a level of reluctance mainly in central governments, especially in countries where businesslike accrual accounting has been developed. The study revealed that the transition towards IPSAS necessitates a long period of implementation whereby existing local business accounting regulations hinder jurisdictions to implement international standards.

(Vanhee, Manes-Rossi, Natalia, 2012), “Application of IPSAS Standards to the Vietnamese GovernmentAccounting and Financial Statements”

The purpose of the study was to point out that the Vietnamese government has implemented a reform of public financial management in a realm of government accounting. The current government accounting regime has met requirements of budget management. However, it provides very little information of financial position and performance. Furthermore, in the context of the increasing international integration and requirements of public sector management reform, the Vietnamese government accounting needs to be improved with applying full accrual accounting based on IPSAS standards. The IPSAS are encouraged by the IPSAS Board as well as international financial organizations. And many countries have adopted the IPSAS or are in a progress adapting them. The questions are that whether or not the Vietnamese government accounting should apply the IPSAS, and to what extent apply them in current conditions of Vietnam so as to make use of advantages and overcome challenges of the IPSAS. So the research aimed to evaluate comprehensively the usefulness and feasibility of the IPSAS for the Vietnamese government accounting and financial statements.

Literature review

Public sector includes the general government sector (often briefly referred to as government) and public sector corporations (Bergmann, 2009, p.3). Most countries have different levels of government such as federal, state, regional, central, local level. Government levels implement either activities decentralized or ones contracted with other agencies and organizations. Governments are elected by citizens to make collective decisions on their behalf to provide goods and services which cannot readily be provided by private firms, and for social welfare purposes. Their provision is funded collectively through taxation levied on citizens rather than through sales of products to them.

The IPSASB (formerly Public Sector Committee (PSC)) is a Board of IFAC formed to develop and issue under its own authority International Public Sector Accounting Standards (IPSASs). IPSASs are high quality global financial reporting standards for application by public sector entities other than Government Business Enterprises (GBEs). The IPSASB’s Consultative Group is appointed by the IPSASB. The Consultative Group is a non-voting group. It provides a means by which the IPSASB can consult with and seek advice as necessary from a broad constituent group. The Consultative Group is chaired by the Chair of the IPSASB. The IPSASB comprises 18 members, 15 of whom are nominated by the member bodies of IFAC and three of whom are appointed as public members. Public members may be nominated by any individual or organization. The objectives of the IPSASB are to serve the public interest by developing high quality public sector financial reporting standards and by facilitating the convergence of international and national standards, thereby enhancing the quality and uniformity of financial reporting throughout the world.

The IPSASB achieves its objectives by:

- Issuing International Public Sector Accounting Standards (IPSASs);

- Promoting the acceptance and the international convergence to these standards;

- Publishing other documents which provide guidance on issues and experiences in financial reporting in the public sector.

- The IPSASs are the authoritative requirements established by the IPSASB. Apart from developing IPSASs, the IPSASB issues other non-authoritative publications including studies, research reports and occasional papers that deal with particular public sector financial reporting issues .( Hayfron. Aboagye 2013)

Are a set of accounting standards issued by the IPSAS Board for use by public sector entities around the world in the preparation of financial statements. These standards are based on International Financial Reporting Standards (IFRS) issued by the International Accounting Standards Board (IASB). (http://en.wikipedia.org/wiki/International_Public_Sector_Accounting_Standards)Annual periods beginning on or after January 1, 2008.

To set out the manner in which general purpose financial statements shall be prepared under the accrual basis of accounting, including guidance for their structure and the minimum requirements for content.

Periods beginning on or after July 1, 2001.

To require the presentation of information about historical changes in a public sector entity’s cash and cash equivalents by means of a cash flow statement that classifies cash flows during the period according to operating, investing and financing activities.

Annual periods beginning on or after January 1, 2008.

To prescribe the criteria for selecting and changing accounting policies, together with the accounting treatment and disclosure of changes in accounting policies, changes in accounting estimates, and corrections of errors.

Annual periods beginning on or after January 1, 2010.

To prescribe the accounting treatment for an entity’s foreign currency transactions and foreign operations.

Periods beginning on or after July 1, 2001.

To prescribe the accounting treatment for borrowing costs.

Annual periods beginning on or after January 1, 2008.

To prescribe requirements for preparing and presenting consolidated financial statements for an economic entity under the accrual basis of accounting. Also how to account for investments in controlled entities, jointly controlled entities and associates in separate financial statements.

Annual periods beginning on or after January 1, 2008.

To prescribe the investor’s accounting for investments in associates where the investment in the associate leads to the holding of an ownership interest in the form of a shareholding or other formal equity structure.

Annual periods beginning on or after January 1, 2008.

To prescribe the accounting treatment required for interests in joint ventures, regardless of the structures or legal forms of the joint venture activities.

Periods beginning on or after July 1, 2002.

To prescribe the accounting treatment for revenue arising from exchange transactions and events.

Periods beginning on or after July 1, 2002.

To prescribe specific standards for entities reporting in the currency of a hyperinflationary economy, so that the financial information (including the consolidated financial information) provided is meaningful.

Periods beginning on or after July 1, 2002.

To prescribe the accounting treatment for revenue and costs associated with construction contracts in the financial statements of the contractor.

Annual periods beginning on or after January 1, 2008.

To prescribe the accounting treatment of inventories, including cost determination and expense recognition, including any write-down to net-realizable value. It also provides guidance on the cost formulas that are used to assign costs to inventories.

Annual periods beginning on or after January 1, 2008.

To prescribe, for lessees and lessors, the appropriate accounting policies and disclosures to apply in relation to finance and operating leases.

Annual periods beginning on or after January 1, 2008.

To prescribe:

‐When an entity shall adjust its financial statements for events after the reporting date.

‐ Disclosures that an entity should give about the date when the financial statements were authorized for issue, and about events after the reporting date.

Annual periods beginning on or after January 1, 2008.

To prescribe the accounting treatment for investment property and related disclosures.

Annual periods beginning on or after January 1, 2008.

To prescribe the principles for the initial recognition and subsequent accounting (determination carrying amount and the depreciation charges and impairment losses) for property, plant and equipment so that users of financial statements can discern information about an entity’s investment in its property, plant and equipment and the changes in such investment.

Periods beginning on or after July 1, 2003.

To establish principles for reporting financial information by segments to better understand the entity’s past performance and to identify the resources allocated to support the major activities of the entity, and enhance the transparency of financial reporting and enable the entity to better discharge its accountability obligations.

Periods beginning on or after January 1, 2004.

To prescribe appropriate recognition criteria and measurement bases for provisions, contingent liabilities and contingent assets, and to ensure that sufficient information is disclosed in the notes to the financial statements to enable users to understand their nature, timing and amount. IPSAS 19 thus aims to ensure that only genuine obligations are dealt with in the financial statements. Planned future expenditure, even where authorized by management, is excluded from recognition, as are accruals for self-insured losses, general uncertainties, and other events that have not yet taken place.

Annual periods beginning on or after January 1, 2004.

To ensure that financial statements disclose the existence of related party relationships and transactions between the entity and its related parties. This information is required for accountability purposes and to facilitate a better understanding of the financial position and performance of the reporting entity.

Annual periods beginning on or after January 1, 2006.

To ensure that non-cash-generating assets are carried at no more than their recoverable service amount, and to prescribe how recoverable service amount is calculated.

Annual periods beginning on or after April 1, 2009.

To prescribe disclosure requirements for governments which elect to present information about the general government sector (GGS) in their consolidated financial statements. The disclosure of appropriate information about the GGS of a government can provide a better understanding of the relationship between the market and non-market activities of the government and between financial statements and statistical bases of financial reporting.

Annual periods beginning on or after June 30, 2008. There are several transitional provisions.

To prescribe requirements for the financial reporting of revenue arising from nonexchange transactions, other than non-exchange transactions that give rise to an entity combination.

Annual periods beginning on or after January 1, 2009.

To ensure that public sector entities discharge their accountability obligations and enhance the transparency of their financial statements by demonstrating compliance with the approved budget for which they are held publicly accountable and, where the budget and the financial statements are prepared on the same basis, their financial performance in achieving the budgeted results.

Periods beginning on or after January 1, 2011. Earlier application is encouraged.

To prescribe the accounting and disclosure for employee benefits, including short-term benefits (wages, annual leave, sick leave, bonuses, profit-sharing and non-monetary benefits); pensions; post-employment life insurance and medical benefits; termination benefits and other long-term employee benefits (long-service leave, disability, deferred compensation, and bonuses and long-term profit-sharing), except for share based transactions and employee retirement benefit plans.

Periods beginning on or after April 1, 2009. Earlier application is encouraged.

To prescribe the procedures that an entity applies to determine whether a cashgenerating asset is impaired and to ensure that impairment losses are recognized. This Standard also specifies when an entity shall reverse an impairment loss and prescribes disclosures.

Periods beginning on or after 1 April 2011.

To prescribe the accounting treatment and disclosures for agricultural activity.

Periods beginning on or after 1 January 2013.

To prescribe principles for classifying and presenting financial instruments as liabilities or net assets/equity, and for offsetting financial assets and liabilities.

Periods beginning on or after 1 January 2013.

To establish principles for recognizing, derecognizing and measuring financial assets and financial liabilities.

Periods beginning on or after 1 January 2013.

To prescribe disclosures that enable financial statement users to evaluate the significance of financial instruments to an entity, the nature and extent of their risks, and how the entity manages those risks.

Periods beginning on or after 1 April 2011.

To prescribe the accounting treatment for intangible assets that are not dealt with specifically in another IPSAS.

Periods beginning on or after 1 January 2014.

To prescribe the accounting for service concession arrangements by the grantor, a public sector entity.

IPASB provides countries with the option to adopt either cash and or accrual basis depending on the specific needs and systems of financial operation in place for the government or the countries in question.

The cash basis allowed providers of external assistance, particularly providers of development assistance to follow a variety of accounting practices. Many recipients of external assistance therefore maintain their accounts on the cash basis of accounting and the development of a cash basis standard was therefore a step in the right direction.

Accrual accounting focuses on revenue, cost, assets, liabilities and equity – instead of cash flows only. The capitalization of assets, such as computers and machines, makes it possible to calculate depreciations and account for them in each period during which the machine is used. Most of the IPSAS are based on accrual basis which is in line with IFRS (Aboagye, Hayfron 2013).

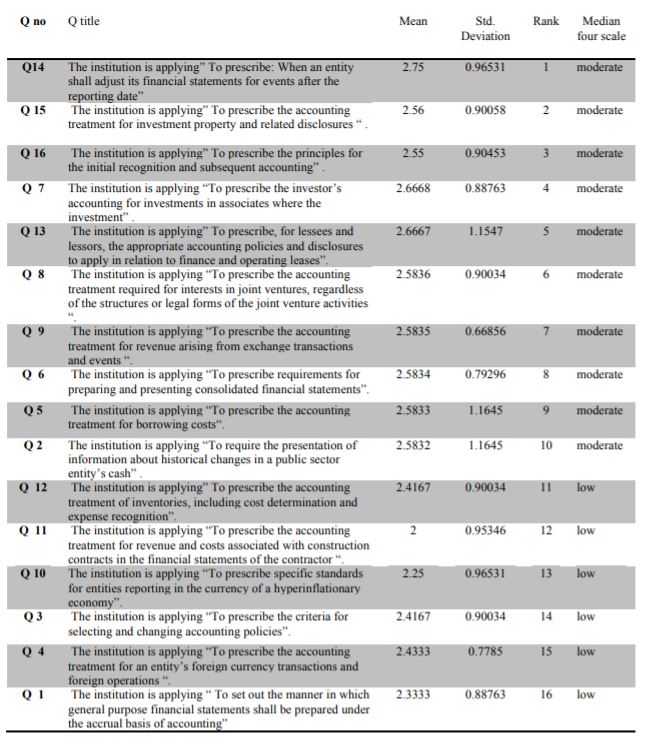

Study Community

The study community is formed out of two (2) different institutions listed in the Jordanian public sector. A questionnaire has been developed and distributed among different management levels. Total of sixteen (16) questionnaires was distributed, Twelve (12) was recovered, which means that, Seventy five percent (75%) of it was valid for analysis, Tables below shows these results:

For the purpose of description and analysis of the study data , generally many statistical measures is used to analyze the questionnaires such as , arithmetic mean , standard deviation , frequencies , t test , percentages , and cornbrash alpha: the latest measure used to test the reliability , and the credibility of the study.

Data Analysis

The study takes the deductive from, as it depends on the outcomes of the data analysis derived from the questionnaire.

Results and Testing Hypothesis

The study hypothesis stated that the Jordanian public sector is applying the International Public Sector Accounting Standards (IPSAS). Regression test has been made in order to figure out whether is the Jordanian Public Sector is applying the IPSAS or not.

Table above shows that F = 2.026, Sig. = 0.185 and the researchers assumed that a=0.05,as sig. (0.185) > a (0.05) and as table (4) shows the statistical median of four scale so F (2.026) considered as (Low), therefore we accept the null hypothesis (H0) and reject the positive hypothesis (H1), This means that the Jordanian public sector don’t apply the International Public Sector Accounting Standards.

Conclusions

As per the above data analysis, hypothesis testing and the median four scales presented in table (5), the study had concluded the following:

There is a problem in applying the International Public Sector Accounting Standards in the Jordanian public sector, this because of many reasons like:

- The Jordanian public sector is applying the International Public Sector Accounting Standards in a weakly form.

- The Jordanian public sector is not applying the International Public Sector Accounting Standards correctly.

- There is a problem in monitoring the applying procedures of these standards.

Recommendations

According to the study conclusions the researcher recommend the following:

- Apply the IPSAS standards correctly in collaboration with the competent authorities.

- Raise the efficiency of monitoring the applying procedures of the IPSAS.

- Raise the efficiency of the employees working with these standards.

- Keep up with the IPSAS updates.

- More research to be carried on the same field to ensure that the IPSAS standards will be applied perfectly in the future.

References

Delottie 2012 Edition IPSAS Summary February 20122 Prof. Dr. Frans van Schaik Email: fvanschaik@deloitte.nl

Lasse Oulasvirta, (2012). (Application of IPSAS Standards to the Vietnamese Government Accounting and Financial Statements).

Bergmann, A. (Ed.). (2009). Public sector financial management 1st ed.Pearson education limited.

Sandra Cohen, Sotiris Karatzimas, Georgios (George) Venieris (2014) “The Informative Role of Accounting Standards in Privatizing State-Owned Property: Comparing Greek Governmental Accounting Standards and IPSAS”

Ricardo Lopes Cardoso, Andre C. B. Aquino, José A. M. Pigatto (2014), “Brazilian Governmental Accounting Reforms: IPSAS and Accrual Accounting Adoption”.

Ijeoma. N. B., Oghoghomeh. T. (2014) “Adoption of international public sector accounting standards in Nigeria: Expectations, benefits and challenges”.

Ijeoma, N. B. (2014) “The Impact Of International Public Sector Accounting Standard (IPSAS) On Reliability, Credibility And Integrity Of Financial Reporting In State Government Administration In Nigeria”.

Christiaens, Johan. Vanhee, Christophe Manes-Rossi, Francesca. Aversano, Natalia (2013) “The Effect of IPSAS on Reforming Governmental Financial Reporting: an International Comparison”.

Trang, Le Thi Nha (2012) “Application of IPSAS Standards to the Vietnamese Government Accounting and Financial statements”.

Tudor. Adriana (2011) “Romanian public institutions financial statements on the way of harmonization with IPSAS”

G. Grossi, MichelaSoverchia (2011) “European Commission Adoption of IPSAS to Reform Financial Reporting”.

Pawan Adhikari, Frode Mellemvik (2010), “The adoption of IPSASs in South Asia: A comparative study of seven countries”.

Johan, Reyniers. Brecht, Rollé. Caroline (2008), “Impact of IPSAS on reforming governmental financial information systems: a comparative study“

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

07 May 2015

Article Doi

eBook ISBN

978-1-80296-003-7

Publisher

Future Academy

Volume

4

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-63

Subjects

Finance, accounting

Cite this article as:

Al-Zubi, Z. (2015). The extent of applying the International Public Sector Accounting Standards by the Jordanian Public Sector. In Z. Bekirogullari, & M. Y. Minas (Eds.), Business & Economics - BE-ci 2015, vol 4. European Proceedings of Social and Behavioural Sciences (pp. 47-63). Future Academy. https://doi.org/10.15405/epsbs.2015.05.8