Integrated Management System And Corporate Sustainability Performance: Stakeholders Theory Perspective

Abstract

Traditionally management is used to measure the impact and success of a company by focusing solely on the financial bottom line that is business profit. Nowadays, many businesses are keen to realize the triple bottom line (TBL) model, where the connection among environmental health, social well-being, and the financial success of companies is crucial to recognize their corporate growth and profitability. Although companies are aware, they are not necessarily reflected through positive Corporate Sustainability Performance (CSP). Unless they compel to safeguard an environmentally, and socially responsible issue, that is, to be accountable concerning their business environmental, and social influences, the measuring problem about the company’s performance on this matter will remain topical, and increasingly discussed among scholars and practitioners. To establish the reporting on sustainability performance commendably, companies may implement an Integrated Management System (ISM) that incorporates two or more Management Systems (MSs) of a company into one all-inclusive system with common objectives, resources, and practices. Hence, the aim of this paper is to develop a theoretical framework utilising the underlying concept to determine the relationship between the degree of Integrated Management System execution, and Corporate Sustainability Performance.

Keywords: Corporate sustainability performance, integrated management system, stakeholders theory

Introduction

Over the years, the world has been impacted by great environmental incidence and catastrophes such as floods, pollution, soil erosion, water scarcity, etc., as a result of climate change, deforestation, biodiversity loss, and others. Could these issues arise due to significant failures in sustainable policies globally? This matter is exacerbated by the report about the continuous decline of other species, and the increase in climate change emanating from the greenhouse emissions (Howes, 2017). It is reported that the biodiversity index has plummeted by more than 50% and this situation is a concern to scholars and policymakers who determine to ensure that companies play an important role in accomplishing the sustainability goals of a country including Malaysia.

Malaysia has the biggest resource, and waste management discrepancy, with 87% of Malaysian companies adopting waste reduction policies as identified by Refinitiv (2017). However, only 20% of the companies implement particular waste reduction goals to warrant that their policies can be achieved. Moreover, as far as promoting water efficiency is concerned, 63% of companies in Malaysia are identified to hold the policies, nevertheless only 11% provide precise aim, and objectives (Star, 2019). This situation implies that largely, Malaysian companies do not subscribe to the notion of sustainability as pertinent to sustain the resources that are inexistent currently, and must be available for future generations. At the same time, it can be implied that the awareness among Malaysians towards sustainability is still low and in an infancy phase.

In The World Economic Forum’s Global Gender Gap Report assessment, Malaysia has been ranked 104 out of 153 with a score of 68% only. This situation reflects that the performance of Malaysia in the sustainability performance ranking has not been remarkable. It is worth noting that the assessment report for 2020 takes into consideration the basis of the economy, politics, education, and health criteria in comparing the national gender gaps (World Economic Forum, 2020). Malaysia’s neighboring countries, Singapore, Thailand, and Indonesia were ranked 54th, 75th, and 85th, respectively. Furthermore, in Transparency International’s Corruption Perceptions Index 2019, Malaysia ranked 51 out of 198. Malaysia only manages to place itself on an average position with a score of 53% out of 100% in all criteria (Transparency, 2018). Seriously, the ranking and position reflect the level of perceptions of other countries towards Malaysia, compounded by the corruption issues that have been leveled by the World Bank to the nation expressing that it is one of the biggest threats to growth.

The Sustainable Development Summit of the United Nations in 2015 stipulated an action plan for people, the earth, and growth. The concept underlying social, economic, and environmental sustainability represents a three-pillar principle that expresses three intersecting circles with overall sustainability at the center (Purvis et al., 2019). The goal of sustainable enterprises is to produce a balanced, and integrated output across the three dimensions of sustainability by combining the economic, environmental, and societal interests. According to the Triple Bottom Line theory (TBL), sustainability can be divided into three parts (Elkington, 1998) comprising physical, social, and ecological (Morioka & Carvalho, 2016). All these three elements should be emphasized, and balanced to reach a sustainable level.

Elkington’s TBL is probably the most used methodology for sustainability evaluations and management in the corporate world. It is crucial for a company to preserve its life and sustain itself in the long term, hence according to Elkington, it is risky for companies to disregard the principle of TBL because by ignoring it, they would produce value losses. Although the regulatory climate positions businesses to change their course, at the same time, consumers have begun to expect and favor them to produce more sustainable goods and services globally.

Companies and countries internationally have been urged to discuss the idea, and philosophy of sustainability to heighten environmental efficiency, and reduce negative environmental impacts (Olsthoorn et al., 2001; Zhou et al., 2012). They need to evaluate and inspect their sustainability performance effectively, and efficiently to maximize their competitive advantages (Qorri et al., 2018). It is expected that sustainability as a major competitive factor will play a pertinent function, therefore assessing, and enhancing companies’ sustainability are key concerns that must be established by the companies (Cagno et al., 2019). To consider sustainable performance management, most studies use environmental, social, and economic indicators as the measurements (Giannakis et al., 2020). Under the 2030 Agenda by the United Nations, all of the three dimensions are aligned to the Sustainable Development Goals (SDGs).

Modern businesses face traditional risks while social and environmental risks are increasing. Sustainability reporting has been identified as an important tool for better risk management. However, the common report that most companies have been delivering does not permit the readers to comprehend the influences of their change, performance, and position, as necessitated by the Non-Financial Reporting Directive (Transparency, 2018). The report discovered that 54% of companies referred to information specified outside the report but did not specify direct links to it, and 71% of companies did not provide Key Performance Indicators (KPIs) in summarized statements.

Therefore, largely, companies did not succeed in providing any report that allows a stakeholder to comprehend the practice and obligation of companies in handling social, and environmental risks apart from the conventional risks. By relying on sustainability reporting, creditors, shareholders, analysts, and management may indulge in misjudging the capital market valuation. Thus, some judgments and decisions have been misled by the valuation while companies have been targeted for not providing true, and fair view reports, and labeled as committing mismanagement.

In developing countries including Malaysia, demands from stakeholders for sustainability practices, and performance appears to be increasing (Kasbun et al., 2016). This development is parallel with the increasing awareness of sustainability issues globally and it is favorable because it can boost the competitive advantage of the country. Nevertheless, since sustainability practices and reporting in Malaysia are still lacking, the evidence to show that companies’ sustainability practices and disclosure have enhanced their financial standing compared to the ones that do not practice is still insufficient.

Moreover, compared with the developed countries, it is found that sustainability practices in Malaysia are also inconsistent due to the implementation that is ineffective, and deficient (Bakar et al., 2017; Kasbun et al., 2016). What could be the reasons behind the ineffective sustainability practices implementation? It has been suggested that qualitative features of sustainability, absence of consistency with specific conventions, pointer possibility, questionable or inadequate data, information heterogeneity, and report limit are purposes behind insufficient supportability (Boiral & Henri, 2017).

Despite the ineffectiveness issue, 93% of CEOs as reported by the UN Global Compact-Accenture CEO Study on Sustainability believe that sustainability is important to the business’s future success. However, only 2% of sustainability programs are successful implying that the majority of the companies may be confronted with many obstacles to sustainability efforts that include lacking investments or resources, competing priorities, and challenges of culture change (UNGC Strategy Accenture, 2019). One particular action that can help companies to enhance their Corporate Sustainability Performance is by developing an Integrated Management System that guides, and rules the company’s operation through accredited policy, and standards surrounding the sustainability matter. Consequently, drawing on stakeholder theory, the essential target of this paper is to propose a theoretical framework to explore the connection between the degree of Integrated Management System execution and Corporate Sustainability Performance.

Literature Review

Corporate Sustainability Performance

United Nations (1987) characterizes sustainability as "addressing the requirements of the current age without compromising people in the future's capacity to address their issues''. For companies, this means that they can concentrate on enhancing their productivity in using the resources but at the same time minimizing all forms of environmental pollution generated by the business operations. Sustainability includes a drawn-out vision that shapes socially and environmentally conscious companies. Corporate sustainability (CS) is a unique business methodology that uses sustainability practices to meet investors' objectives and engage stakeholders' cooperation, and aspirations on social, and environmental issues plaguing the nation. This technique expects companies to lay out the undertaking of giving serious results that are trying while at the same time embracing environmental, social, and governance (ESG) measurements to emphatically impact firms' worth, and guarantee a decent open standing (Aksoy et al., 2020).

Traditionally, credit rating agencies more than novel quantitative sustainability performance measures consider the measurement of sustainability while commitment indicator is not considered at all in the credit rating process (Cubas-Díaz & Sedano, 2018). It is observed that managers need to position sustainability more centrally within the company’s strategy to pursue more non-financial objectives that benefit them through better credit ratings and at the same time be more sustainable, both economically, environmentally, and socially. By providing, and classifying sustainability information, investors will be benefited from utilizing the guidance to decide and select sustainable investments to expand their influence on the financial markets. Investors are concerned about sustainability information that is reliable, comparable, and easily digestible (Nagel et al., 2017). Moreover, it is crucial to provide documents on sustainability indicators that show the current status, and improvement on corporate sustainability or responsibility.

The need to expand the focal point of sustainability in business execution past monetary execution has additionally prompted the foundation of free warning companies to survey sustainability. These evaluations or guidelines are broad and numerous pointers to catch various aspects of supportability are incorporated (Engida et al., 2018). If the potential problems that result in the economic, environmental, and social aspects can be better ascertained, the sustainability level can also be improved (Hartini et al., 2018). Studies have shown that the majority of companies in the food, and beverages industry in Malaysia with high sustainable performance is making a great effort to establish their best practices to improve sustainability performance (Hassan et al., 2019)

Integrated Management System

Over the past decades, public attention has been drawn to general concerns regarding environmental conservation issues and the preservation of biodiversity worldwide. Different administration framework norms and rules address different corporate sustainability (CS) points of view, for example, the ISO 9001 on quality, the ISO 14001 on the climate, the OHSAS 18001 on wellbeing and security, the AA1000 series on responsibility affirmation, and stakeholder’s commitment, the SA 8000 on friendly responsibility and the ISO 26000 on corporate social obligation (CSR) (Gianni et al., 2017). Considering the glut of the management systems, as observed, the integration of the corresponding management systems is important to ensure better sustainability performance, and focusing on the purpose of implementing the systems is necessary (De Nadae et al., 2020).

The Integrated Management System is expected to improve companies’ performance, environmental outcomes, and mitigate the use of resources, and materials in the developed products. Overall, they are linked to the environmental, and economy of TBL actions. Besides, Integrated Management System are controlled however not surveyed and, corporate sustainability (CS) is evaluated yet not controlled (Gianni et al., 2017). It is contended that corporate sustainability and Integrated Management System coincide with regards to stakeholder concentration, creativity, and vulnerability. Potential collaborations are investigated in the radiance of shared characteristics and contending blemishes for the common benefit of consolidating the executive’s frameworks and authoritative sustainability. Generally, Integrated Management System can specify the vital thorough structure on corporate sustainability management (Gianni et al., 2017).

Sustainability management effectiveness includes a coalition of policy, structure, and management processes to synchronize the activities of companies established in the Integrated Management System application (Gianni et al., 2017). Theoretically, Integrated Management System was set up to constantly resolve stakeholder desires to complement the adoption with management practices (Gianni et al., 2017). Consequently, the operating efficiency of companies can be improved by Integrated Management System implementation and its tools have a significant effect on corporate sustainability success (Gianni et al., 2017).

Theoretical Framework - Stakeholders Theory

Stakeholder Theory is crucial in proposing a system that connects traditional firm execution, and the act of stakeholder the board by recommending to enterprises to use three standards: descriptive/empirical, instrumental, and normative (Donaldson & Preston, 1995). They group stakeholders by and large into public areas, social orders, appointive gatherings, business stakeholders, investors, sellers, clients, and laborers. They classify stakeholders generally into public sector, societies, electoral parties, business counterparts, shareholders, dealers, clients, and workers. The groups can be subdivided into two comprising primarily for those with formal or official contractual relationships with the company, and the secondary level for those without such contracts (Clarkson, 1995).

Irrefutably, stakeholders expect data to guide and help their financial navigation, subsequently, the detailed environmental information that isn't finished may hurt the reliability of environmental reporting as a medium to report companies' environmental performance (Mokhtar et al., 2015). Besides, the theory undertakes that stakeholder engagements can improve environmental protection, and economic performance (Latif et al., 2020). A multitude of stakeholders, including chief executives, customers, international organizations, regulators, and non-profit organizations, have highlighted the value of assessing, and evaluating the sustainability performance of a business (Silva et al., 2019), while stakeholder and institutional theories are utilized to explore and probe the Integrated Management System, and corporate sustainability notions and their connections (Gianni et al., 2017).

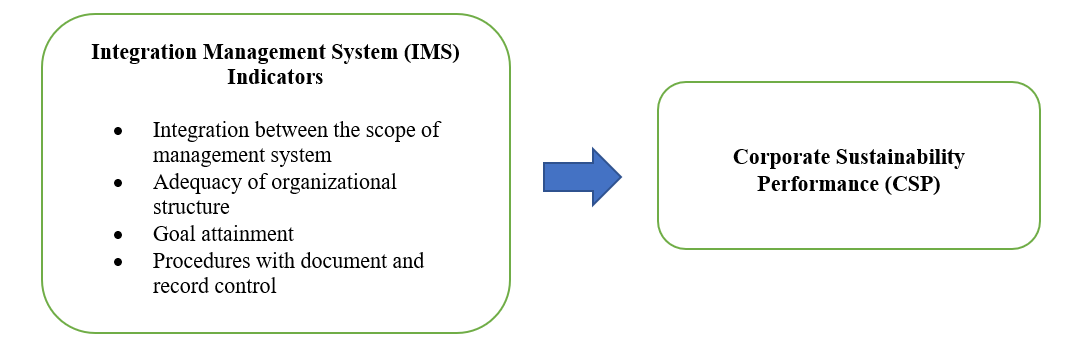

Stakeholder theory additionally perceives the organization' reliance on external, and internal stakeholders (Hillman et al., 2009). Besides, a structure is made to separate between middle outcomes, for example, advanced natural, and social execution, support public picture, expanded piece of the pie, and monetary results (Epstein & Roy, 2001). This can be accomplished through evaluating the reactions of seven stakeholder gatherings: financial backers explicitly investors, clients, workers and their relatives, local societies and residences, suppliers and traders, national and international communities, and past and future generations of co-operators (Epstein & Roy, 2001). Stakeholder theory also recognizes the company' reliance on external, and internal stakeholders (Hillman et al., 2009). Moreover, a framework is composed to differentiate between intermediate results, such as enriched environmental, and social performance, boost public image, increased market share, and financial outcomes (Epstein & Roy, 2001). This can be achieved via assessing the responses of seven stakeholder groups: investors, specifically shareholders, clients, employees and their family members, suppliers and traders, local societies and residences, national and international communities, and past and future generations of co-operators (Epstein & Roy, 2001). Furthermore, Gianni et al. (2017) proved that the Integrated Management System has been observed to show impact on stakeholders through fiscal, environmental, and social performance assessment on corporate sustainability. As shown in Figure 1, integration management system (IMS) indicators contain of integration between the scope of management systems, adequacy of organizational structure, goal attainment and procedures with documents and record control. Dragomir et al. (2013) agreed that Integrated Management System indicators can be adapted to identify the impact on Corporate Sustainability Performance.

Conclusion

This paper proposes a theoretical framework to examine the connection between Integrated Management System execution, and Corporate Sustainability Performance rehearses from the stakeholder’s theory viewpoint by conceptualizing the presence of an Integrated Management System that is not so much recognizable but rather more tangible, apparent, and quantifiable. Integration is underlined as a potential possibility to oversee and manoeuvre the different management disciplines that might cause irregularities in accomplishing a proficiency in the management focus to achieve the condition of environmental sustainability in a company. While companies seek after to turn out to be more open, and reasonable towards the steadily expanding environmental, and social anxieties, the integration of management systems into business executive, arrangement settling on or more all dynamic will consider more effective and competent environmental, social and economic decision-making.

References

Aksoy, M., Yilmaz, M. K., Tatoglu, E., & Basar, M. (2020). Antecedents of corporate sustainability performance in Turkey: The effects of ownership structure and board attributes on non-financial companies. Journal of Cleaner Production, 276, 124284.

Bakar, N., Abdullah, H., Ibrahim, F., & Jali, M. (2017). Green Economy: Evaluation of Malaysian Company Environmental Sustainability. International Journal of Energy Economics and Policy, 7(2), 139–143. Retrieved on September 2, 2020, from https://dergipark.org.tr/tr/pub/ijeeep/issue/31921/351190

Boiral, O., & Henri, J.-F. (2017). Is Sustainability Performance Comparable? A Study of GRI Reports of Mining Organizations. Business & Society, 56(2), 283–317.

Cagno, E., Neri, A., Howard, M., Brenna, G., & Trianni, A. (2019). Industrial sustainability performance measurement systems : A novel framework. Journal of Cleaner Production, 230, 1354–1375.

Clarkson, M. (1995), “A stakeholder framework for analysing and evaluating corporate social performance”, Academy of Management Review, 20(1), 92-117.

Cubas-Díaz, M., & Sedano, M. Á. M. (2018). Do credit ratings take into account the sustainability performance of companies? Sustainability (Switzerland), 10(11), 1–24.

De Nadae, J., Carvalho, M. M., & Vieira, D. R. (2020). Integrated management systems as a driver of sustainability performance: exploring evidence from multiple-case studies. International Journal of Quality and Reliability Management, 38(3), 800-821.

Donaldson, T., & Preston, L. E. (1995). The stakeholder theory of the corporation: concepts, evidence and implications. The Academy of Management Review, 20(1), 65-91.

Dragomir, M., Iamandi, O., & Bodi, S. (2013). Designing a roadmap for performance indicators in integrated management systems, Journal Managerial Challenges of the Contemporary Society, 5, 91-95.

Elkington, John (1998) Cannibals with Forks: The Triple Bottom Line of 21st Century Business. Journal of Business Ethics 23, 229–231 (2000).

Engida, T. G., Rao, X., Berentsen, P. B. M., & Oude Lansink, A. G. J. M. (2018). Measuring corporate sustainability performance– the case of European food and beverage companies. Journal of Cleaner Production, 195, 734–743.

Epstein, M. J., & Roy, M. J. (2001). Sustainability in action: identifying and measuring the key performance drivers. Long. Range Plan, 34(5), 585e604.

Giannakis, M., Dubey, R., Vlachos, I., & Ju, Y. (2020). Supplier sustainability performance evaluation using the analytic network process. Journal of Cleaner Production, 247, 119439.

Gianni, M., Gotzamani, K., & Tsiotras, G. (2017). Multiple perspectives on integrated management systems and corporate sustainability performance. Journal of Cleaner Production, 168, 1297–1311.

Hartini, S., Ciptomulyono, U., Anityasari, M., Sriyanto, & Pudjotomo, D. (2018). Sustainable-value stream mapping to evaluate sustainability performance: Case study in an Indonesian furniture company. MATEC Web of Conferences, 154, 1–7.

Hassan, M. G. Bin, Akanmu, M. D., Mohamed, A., Harun, N. H., & Nadzir, M. M. (2019). The role of benchmarking on sustainability performance in food and beverage companies of Malaysia. 2019 IEEE Jordan International Joint Conference on Electrical Engineering and Information Technology, JEEIT 2019 - Proceedings, 530–537.

Hillman, A. J., Withers, M. C., & Collins, B. J. (2009). Resource Dependence Theory: A Review. Journal of Management, 35(6), 1404-1427.

Howes, M. (2017). After 25 years of trying, why aren’t we environmentally sustainable yet? The Conversation Environment and Energy. Retrieved on June 2, 2020, from https://phys.org/news/2017-04-years-environmentally-sustainable.html

Kasbun, N., Teh, B., & Ong, T. (2016). Sustainability Reporting and Financial Performance of Malaysian Public Listed Companies. Institutions and Economies, 8(4), 78–93.

Latif, B., Mahmood, Z., San, O. T., & Said, R. M. (2020). Coercive, Normative and Mimetic Pressures as Drivers of Environmental Management Accounting Adoption. Sustainability, 12(11), 4506. MDPI AG.

Mokhtar, N., Zulkifli, N., & Jusoh, R. (2015). The Implementation of Environmental Management Accounting and Environmental Reporting Practices: A Social Issue Life Cycle Perspective. International Journal of Management Excellence, 4(2), 515.

Morioka, S. N., & Carvalho, M. M. (2016). Measuring sustainability in practice: exploring the inclusion of sustainability into corporate performance systems in Brazilian case studies. Journal of Cleaner Production, 136(A), 134-146.

Nagel, S., Hiss, S., Woschnack, D., & Teufel, B. (2017). Between efficiency and resilience: The classification of companies according to their sustainability performance. Historical Social Research, 42(1), 189–210.

Olsthoorn, X., Tyteca, D., W., W., & Wagner, M. (2001). Environmental Indicators for Business: A Review Of The Literature And Standardisation Methods. Journal Of Cleaner Production, 9(5), 453-463.

Purvis, B., Mao, Y., & Robinson, D. (2019). Three pillars of sustainability: in search of conceptual origins. Sustainability Science, 14(3), 681–695.

Qorri, A., Mujkić, Z., & Kraslawski, A. (2018). A conceptual framework for measuring sustainability performance of supply chains. Journal of Cleaner Production, 189, 570-584.

Refinitiv (2017). Refinitiv’s Environmental, Social and Governance (ESG) Scores. Retrieved on April 6, 2020, from https://www.refinitiv.com/content/dam/marketing/en_us/documents/methodology/refinitiv-esg-scores-methodology.pdf

Silva, S., Nuzum, A., & Schaltegger, S. (2019). Stakeholder expectations on sustainability performance measurement and assessment. A systematic literature review. Journal of Cleaner Production, 217, 204–215.

Star, T. (2019). Environmental sustainability: How Malaysian companies’ fare?. The Star. Retrieved on June 3, 2020, from https://www.thestar.com.my/business/business-news/2019/11/02/environmental-sustainability-how-malaysian-companies-fare

Transparency, A. for C. (2018). Alliance for Corporate Transparency Project (2019). 2018 Research Report. Retrieved May 20, 2020, from https://corporatejusticecoalition.org/wp-content/uploads/2019/02/2018_Research_Report_Alliance_Corporate_Transparency-66d0af6a05f153119e7cffe6df2f11b094affe9aaf4b13ae14db04e395c54a84.pdf

UNGC Strategy Accenture (2019). The Decade to Deliver, a Call to Business - CEO Study on Sustainability 2019. UNGC Strategy Accenture, 43. Retrieved on July 25, 2020, from https://www.accenture.com/us-en/insights/strategy/ungcceostudy

United Nations (1987). Report of the World Commission on Environment and Development: Our Common Future. Retrieved on February 3, 2020, from https://sustainabledevelopment.un.org/content/documents/5987our-common-future.pdf

World Economic Forum (2020). Insight report. Retrieved on August 26, 2020, from http://reports.weforum.org/global-gender-gap-report-2020/dataexplorer

Zhou, L., Tokos, H., Krajnc, D., & Yang, Y. (2012). Sustainability Performance Evaluation In Industry By Composite Sustainability Index. Journal Clean Technologies and Environmental Policy, 14(5), 789.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

31 October 2022

Article Doi

eBook ISBN

978-1-80296-958-0

Publisher

European Publisher

Volume

3

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-802

Subjects

Multidisciplinary sciences, sustainable development goals (SDG), urbanisation

Cite this article as:

Abd Malek, Z., & Zulkifli, N. (2022). Integrated Management System And Corporate Sustainability Performance: Stakeholders Theory Perspective. In H. H. Kamaruddin, T. D. N. M. Kamaruddin, T. D. N. S. Yaacob, M. A. M. Kamal, & K. F. Ne'matullah (Eds.), Reimagining Resilient Sustainability: An Integrated Effort in Research, Practices & Education, vol 3. European Proceedings of Multidisciplinary Sciences (pp. 701-709). European Publisher. https://doi.org/10.15405/epms.2022.10.66