Abstract

Sustainability is an approach adopted by more and more companies. The importance of sustainable development is reflected in the company's financial results. The circular economy is a key to sustainable development. The circular economy requires resources to be used for as long as possible, extracting the maximum value and then recovering and regenerating the materials at the end of each lifetime. Regenerative cost accounting framework offers managers the tools and critical thinking skills necessary to succeed in business while taking into account the costs of regeneration right from the beginning of the production processes. The role of regenerative management accounting model is to help companies lower the operational and regeneration costs. How can an economic entity large or small control its costs of production and maximize its profit while tackling a green approach trough a circular economy model? The aim of this paper is to identify how regenerative managerial accounting is used for a sustainable economic development in the context of a circular economy. Applying circular economy models business owners or managers can improve cash flows, create master budgets that advertize the longevity of products by using circular models that reduce the company s cost and save them money while analyzing necessary and unnecessary cash expenditures.

Keywords: Regenerative management accounting, costs, circular economy, decision making, resources

Introduction

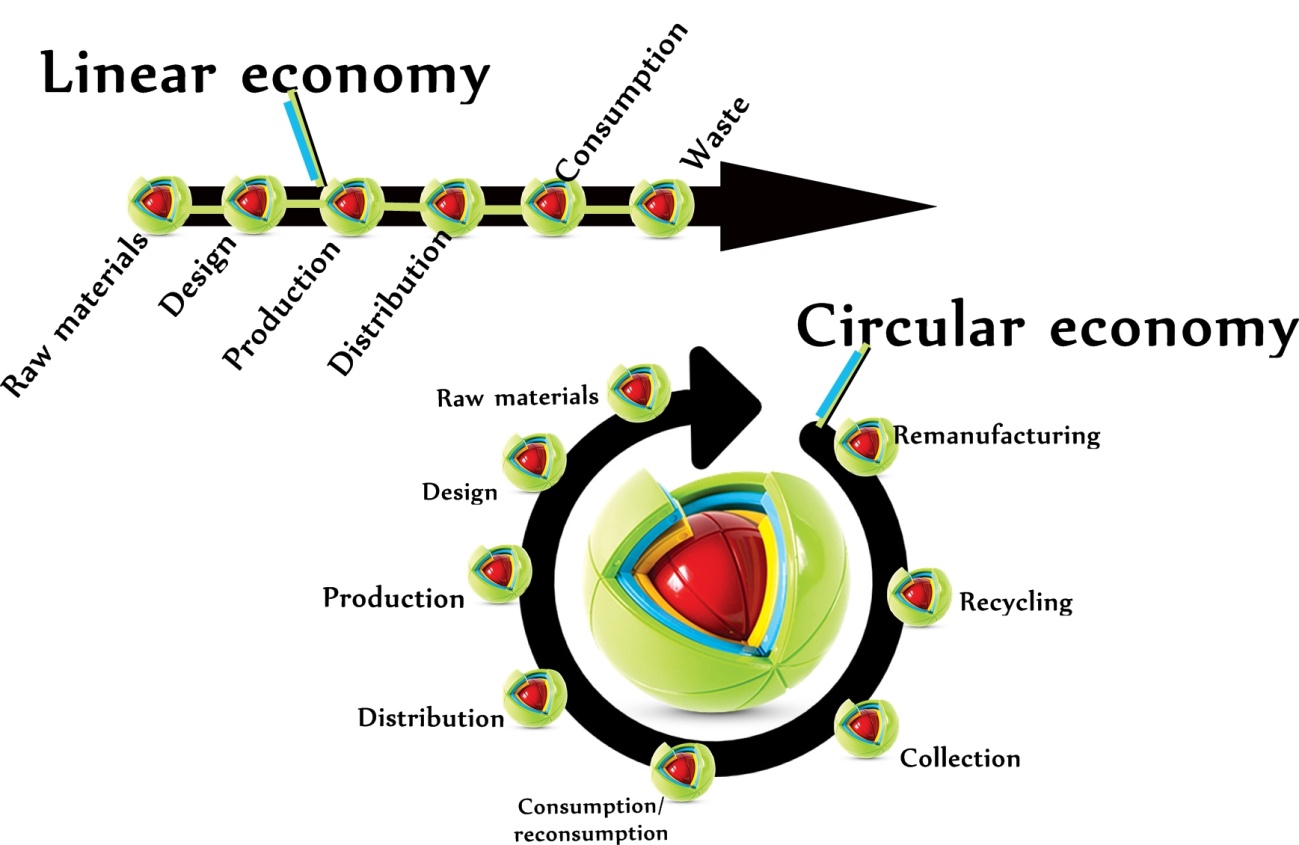

In the last decade the scarcity of economic resources and the inefficient business model of using resources, making products and generating wastes have brought to consumer attention the need of a more green and sustainable business and regenerative development (Owen, 2008; Mirza et al., 2011).

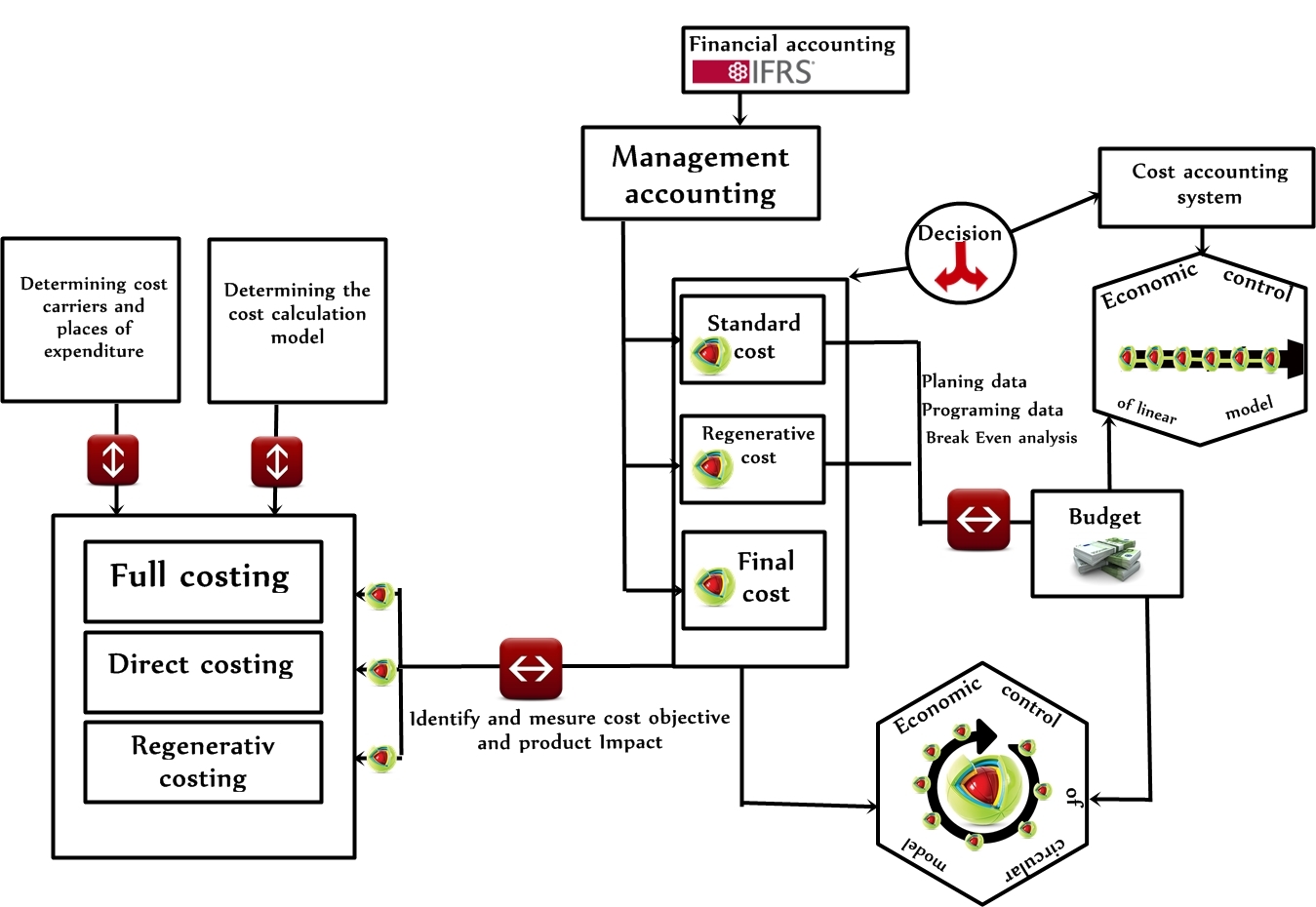

The aim of this paper is to identify how regenerative managerial accounting is used for a sustainable economic development in the context of a circular economy. Regenerative cost accounting framework offers managers the tools and critical thinking skills necessary to succeed in business while taking into account the costs of regeneration right from the beginning of the production processes (Mirza et al., 2011).

Controlling and calculating regenerative costs serves managers, offering information regarding the efficiency of the product they are launching and overall regarding the efficiency of the economic entity they are managing. Calculating regenerative costs has applicability in production and service industries (Cioca et al., 2014). The information system on witch regenerative management in a circular economy operates is a system which generates outputs using the inputs and processes necessary to satisfy the objectives specific to circular economy.

Regenerative cost analysis bases upon a flexible system based on three management objectives:

- To offer information regarding the regeneration cost and life cycle of products, projects and services

- To supply information regarding the process of planning, developing, evaluating and acting regarding the production or service process.

- To supply information in order to sustain the decision making process.

The objectives presented above illustrate that manager, shareholders, policy makers, third parties and other users need regenerative computing accounting framework but most importantly they desire the tool for interpreting and using the information supplied by regenerative cost analysis.

Research Questions

How can an economic entity large or small control its costs of production and maximize its profit while tackling a green approach trough a circular economy model?

Is it possible that regenerative management accounting takes into consideration the three major environmental footprints in the Deming circle process regarding the lifecycle of a product?

Will regenerative computing accounting framework support managers, shareholders, policy makers and other users in the decision making process?

Can management accounting tools for calculating direct and indirect costs help provide information about regenerative costs in the production, distribution and recycling faze of a product lifecycle?

Purpose of the Study

The aim of this paper is to identify how regenerative managerial accounting is used for a sustainable economic development in the context of a circular economy. Regenerative cost accounting framework offers managers the tools and critical thinking skills necessary to succeed in business while taking into account the costs of regeneration right from the beginning of the production processes (Baleanu et al, 2014). Regarding circular economy model, regenerative cost accounting must take into consideration the three major environmental footprints (Carbon Footprint, Water Footprint and Ecological Footprint) while using the Deming quality improvement model regarding the lifecycle of a product (Bebbington et al., 2014).

The purpose of this paper is to identify if regenerative management accounting models provide solid information which are not limited to production economic entities but can be applied to all type of economic entities whatever they are in production, commerce or services.

Research Methods

Research methods consist of a fundamental positive and constructive research, using empirical, and statistic models. Our objective consists of a positive and constructive research to further deepening the researched field of circular economy and regenerative accounting system, relying on empirical and statistic models. The topic of regenerative management system in the context of a circular economy most definitely is on the path of the current global economic research priorities in term s of circular economy.

Findings

The role of regenerative management accounting model is to help companies lower the operational and regeneration costs. Applying circular economy models business owners or managers can improve cash flows, create master budgets that advertise the longevity of products by using circular models that reduce the company s cost and save them money while analyzing necessary and unnecessary cash expenditures.

The entire range of regenerative cost accounting information users do not use the information given regarding financial costs and environmental regenerative costs in raw state, only those who have previously passed the accounting information system and processed, measured, analyzed and administered and synthesized in financial-accounting registers (Malsch, 2013).

As we determine the role of regeneration costs regarding a product in the process of forming the final cost of production or service regenerative cost bearers can be final or intermediary.

In order for the RMA (regenerative management accounting) to work the most important aspect is the master data management system regardless if it is generic descriptive analysis, prescriptive analysis or cognitive computing. The system can use a lot of source data, such as supply data, sourcing agents to find out who is the best supplier for shipping and distribution process in order to improve overall profitability in the company.

RMS framework can architect the model for the economic entity in order to determine how the system functions and to calculate the output of the regeneration and recycling process in order to include this output in the final price of a product (Domil, 2014). By calculating direct and indirect costs regarding the production process trough regenerative management accounting managers can determine the required rate of return for the circular lifecycle of their own products or services (Hopwood, 2009; Gray, 2010).

Regenerative rate of return (RRR) can be calculated to determine and measure the growth rate of investing in a circular model within the economic entity. This RRR can be determined by the formula:

In order to determine the cost of regeneration of a product we can apply the indirect cost allocation process in which the cost of the regenerative activity can be determined by the formula:

Cost of regenerating activity

If we look at the circular economic model we can see that it is a long term process so it is very difficult to determine the productive consumption of regenerative and recycling costs expressed quantitatively. In order to achieve this goal we propose that the computational model the process of supplementing determined in classic form.

This process implies choosing a computational basis common to all products or services of the economic entity but different in size for each product or service separately. After we selected the computational basis we can calculate the supplementation factor using the formula:

Supplementation factor

Based upon the number and characteristics of the supplementing process we can determine globally the costs of regeneration or using differentiated coefficients or selective coefficients. Regenerative management accounting can improve the visibility and value of a company trough enhancing the goodwill thus increasing the overall intangible assets. Intangible assets represent assets without physical substance what means we cannot see or touch the asset therefore many managers don’t take into account these types of assets especially goodwill (Mates et al., 2012). Because they do not recognize the intangible assets within their own economic entities they are not aware of the future economic benefits these types of assets generate for the company (Thomson, 2014).

If we turn our attention to Renault car manufacturer how estimates that implementing circular economy to just EU countries alone could value around 630 billion dollars.

Conclusion

Regenerative management accounting can improve the decision making process trough reviewing each circular opportunity trough quantitative and qualitative analysis that in the end will transform in increasing financial returns.

By calculating direct and indirect costs regarding the production process trough regenerative management accounting managers can determine the required rate of return for the circular lifecycle of their own products or services. Regenerative management accounting can improve the visibility and value of a company trough enhancing the goodwill thus increasing the overall intangible assets.

By 2025 World Bank estimate that humans will generate 2 trillion kilograms of waste in urban areas alone most of which come from linear economy which does not recuperate a large amount of wastes that are being generated. Regenerative management accounting has a determining role in economic entitles in the new circular economy because it’s based on the creation of value. Trough circular economy economic entitles can create value for all parties starting from stakeholders who can obtain higher return on their investments, the employs who will have stable working environment in which they can grow and develop a career, to large public and customers who will have as a partner a fir which is social responsible and bases its strategy on a long term trough regenerating resources and creating a circular model of business in a world with so many limited resources. Regenerative management accounting can give higher value to customers at a lower expense of the supplier or employer due to the income generated from the regeneration and recycling process of all wastes created which are reusable up to 75%.

A real challenge is to implement this circular model in companies worldwide keeping in mind that global waste market is estimated at around 400 billion dollars. On the other hand circular economy will provide a market where products will be disassembled and materials reused in the production process which wills decrees the price of raw materials in some extent.

References

Baleanu, V, Irimie, S., & Irimie S. (2014). Corporate Social Responsibility in Romania: From Conceptual Frameworks to Concrete Actions, 4th Review of Management and Economic Engineering International Management Conference, 150-157.

Bebbington, J., & Thomson, I. (2013). Sustainable development, management and accounting: Boundary crossing. Management Accounting Research, 24(4), 277–283.

Bebbington J., & Larrinaga C. (2014). Accounting and global climate changes issues in Bebbington J. Unerman, & B. O’dwyer (Eds.), Sustainability accounting and accountability (2nd ed., pp. 15–29). Abbingdon: Routledge.

Cioca, L. I., Ivascu, L., & Rus, S. (2014). Integrating Corporate Social Responsibility and Occupational Health and Safety to Facilitate the Development of the Organizations, 4th Review of Management and Economic Engineering. The Management between Profit and Social Responsibility, 2-7.

Capital Institute, Online website. Available from http://capitalinstitute.org/ (accessed 20 March 2017)

Domil A. E. (2014). Impactul informaţiilor de mediu asupra contabilităţii. Editura Eurostampa, Timişoara.

European Commission. Report from The Commission to The European Parliament, The Council, The European Economic And Social Committee And The Committee Of The Regions. Retrieved from http://ec.europa.eu/environment/circular-economy/implementation_report.pdf (accessed 20 March 2017)

Ghicajanu, M., Irimie, S., Marica, L., & Munteanu, R. (2014). Criteria for Excellence in Business. 2nd Global Conference on Business, Economics, Management and Tourism, 23, 445-452.

Gray, R. (2010). Is accounting for sustainability actually accounting for sustainability and how would we know? An exploration of narratives of organisations and the planet. Accounting, Organizations and Society Journal, 35(1), 47–62.

Hopwood, A. G. (2009). Accounting and the environment. Accounting, Organizations and Society Journal, 34(3–4), 433–439.

National Institute of Statistics - Statistical Yearbook 2012, Agriculture and Forestry, Online Website. Available from: http://www.insse.ro/cms/en (accessed 20 March 2017)

Mateş D., Iosif A., Dumitrescu A., Domil A. (2012) Contabilitate financiară: concept de baza, tratamente specific, studii de caz, Ed. a 2-a rev. Editura Mirton, Timişoara.

Malsch, B. (2013). Politicizing the experience of the accounting industry in the realm of corporate social responsibility. Accounting, Organizations and Society Journal, 38(2), 149–168.

Mirza A., Holt G. (2011). Practical implementation Guide and Workbook for IFRS Third Edition Willez Ed. London.

Owen, D. (2008). Chronicles of wasted time? A personal reflection on the current state of, and future prospects for, social and environmental accounting research. Accounting, Auditing and Accountability Journal, 21(2), 240–267.

Report from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions on the implementation of the Circular Economy Action Plan, Brussels.

Thomson, I. (2014). Mapping the terrain of sustainability and accounting for sustainability. In J. Bebbington, J. Unerman, & B. O’dwyer (Eds.), Sustainability accounting and accountability (2nd ed., pp. 15–29). Abbingdon: Routledge.

European Commission. (n.d.). Circular Economy. Retrieved from http://www.acceleratio.eu/circular-economy/ (accessed 2 April 2017)

European Commission. (2012). Annual progress regarding implementation of the National Rural Development Program in Romania in 2011, MADR, 2012. Retrieved from http://ec.europa.eu/europe2020/pdf/nd/nrp2012_romania_en.pdf (accessed 10 April 2017).

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

27 June 2017

Article Doi

eBook ISBN

978-1-80296-948-1

Publisher

Future Academy

Volume

1

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-161

Subjects

Business, management, behavioural management, macroeconomics, behavioural science, behavioural sales, behavioural marketing

Cite this article as:

Ivascu*, L., Artene, A., Izvercian, M., & Ambruș, R. (2017). Regenerative Management Accounting in the Context of Circular Economy. In Z. Bekirogullari, M. Y. Minas, & R. X. Thambusamy (Eds.), Business & Economics - BE-ci 2017, vol 1. European Proceedings of Multidisciplinary Sciences (pp. 59-65). Future Academy. https://doi.org/10.15405/epms.2017.06.7