Abstract

The Asnaf Economic Development Program is a proactive initiative by the Selangor Zakat Board (LZS) aimed at helping to increase the potential of the asnaf in the entrepreneurial sector. However, a domino effect occurred, particularly in the business sector, due to the COVID-19 pandemic threat in 2020 and the subsequent imposition of the Movement Control Order (MCO). Therefore, this study aims to evaluate how the COVID-19 epidemic has affected Selangor's zakat asnaf business owners' ability to survive. To investigate the hypothesized connections, content analysis was done on the LZS yearly reports (2020–2021) as well as information and figures concerning the effect of COVID–19. The study found that COVID-19 has affected the survival of nearly 800 people, or 76% of all registered asnaf entrepreneurs in Selangor. LZS, through Bantuan Zakat Selangor Peduli, has allocated various assistance to increase the competitiveness of asnaf entrepreneurs. Therefore, asnaf entrepreneurs need to take advantage of all the opportunities provided, such as capital assistance, technology, and marketing, to ensure the survival of their business, especially in facing the impact of Digitization and the Industrial Revolution 4.0.

Keywords: Asnaf entrepreneurs, COVID-19, life wellbeing, survival

Introduction

The Coronavirus Disease 2019 (COVID-19) pandemic and the Movement Restricted Order (MCO) implementation coincided with significant changes in the country's economic picture, bringing Malaysians to a new norm as well. Bank Negara Malaysia (BNM) expects the Malaysian economy to grow at a moderate rate of -2.0 percent to 0.5 percent in 2020 due to the negative impact of the COVID -19 contagion as well as low commodity prices such as crude oil. As a result, the Malaysian Institute of Economic Research (MIER) estimates that Malaysia's Gross Domestic Product (GDP) for 2020 will contract from 4.0% to -2.9%. In addition, a total of 2.4 million workers are also estimated to lose their jobs, with 67% being unskilled workers. On the other hand, Fitch Ratings projects a contraction in Malaysia's GDP for 2020 at 8.93% and 9.21% in 2021. This is because the sectors most affected by the Great Lockdown crisis are the national income from commodity export sources, manufacturing, intermediate goods, and tourism and aviation sectors. This forecast results from the Great Lockdown's six primary effects, specifically the recession's direct effects on the nation's most essential industries: aviation, tourism, and hospitality. Second, a sharp fall in international trade resulted from supply chain disruption caused by government orders. The subsequent decline in consumer and investor confidence, as well as the government's ongoing execution of MCO, was what caused the stock market to plummet. Last but not least, the cash flow issues brought on by MCO resulted in the layoffs of both permanent and temporary employees and the decline in domestic demand and expenditure brought on by unemployment (Asyraf, 2020).

To stop the spread of COVID-19, MCO is being enforced in Malaysia. It is believed to impair financial closure efforts and have psychological repercussions like despair, anxiety, and tension. This condition develops when people cannot conduct business, social distance is valued, there is no connection between the seller and the customer, and there is a disturbance in the delivery of the goods (Ghani, 2020). At the same time, the majority of people lost their jobs due to a decreased workforce across all economic sectors. Due to movement control orders, the small company sector in Malaysia is most severely impacted (Azman, 2020). Kuriakose (2020) asserts that as small and medium-sized firms (SMEs) account for 98.5 percent of all businesses, the direct influence is primarily felt in this sector. Therefore, various approaches are required to help rural traders affected by COVID-19 overcome their challenges.

By implementing the Economic Development Program, the Selangor Zakat Board (LZS) has taken the initiative to sustainably improve the asnaf group's economic potential and way of living (EDP). A large distribution of funds has been allocated each year for the success of this program, namely RM7,036,890 in 2015, RM4,892,685 (2016), RM2,568,730 (2017), RM3,752,951 (2018) and RM3,208,171 (2019). This Group Entrepreneur Project is an LZS initiative to polish the entrepreneurial talent and potential in each selected asnaf through capital injection, courses, training, and systematic monitoring from LZS officers. The distribution of funds and support assistance is expected to help the asnaf remain viable in the face of current challenges. However, the bulk of asnaf entrepreneurs participating in the initiative has been impacted by the COVID-19 pandemic danger. On that basis, LZS has announced emergency fund assistance amounting to RM12.1 million as an additional injection to help asnaf entrepreneurs cope with this challenging situation (Lembaga Zakat Selangor, 2021). This study will examine the effects of the COVID-19 epidemic on their ability to survive in Selangor.

Zakat and poverty eradication

Most of the world's emerging nations struggle greatly with poverty and unemployment. Due to economic inequalities and growing social divides, the government's top priority is eradicating poverty through sustainable economic growth. Following the tragedy of May 13, 1969, which saw the escalation of conflict and friction between races because of pre-existing economic disparities, this initiative in Malaysia started to attract significant attention (Thillainathan & Cheong, 2016). As a result, the New Economic Policy (NEP) was established to alleviate socioeconomic gaps by enacting numerous policies and programs to enhance the quality of life for the population, particularly the B40 group. In this light, the zakat institution also contributes as a crucial institution to improving the standard of living for Muslims in Malaysia. Due to its capacity to meet the needs of asnaf through either self-sufficiency (regular monthly aid) or productivity, zakat acts as one of the tools to end poverty (capital injection). Self-help is a temporary solution to help dependents maintain their way of life by taking care of necessities like food, rent, clothing, monthly guidance, and medical care. To help the asnaf improve their quality of life, productive contribution refers to long-term service through capital investments such as money and equipment (Amirul, 2020).

For asnaf who are interested in entering the business world, zakat institutions have introduced capital support to transform asnaf from a self-sufficient group into a productive group. The achievement of the poverty eradication strategy motivates this effort because the issue of poverty necessitates continuing rather than periodic attention (occasionally). According to Yusrinadini et al. (2020), the first zakat institution to introduce such aid in Malaysia was the Negeri Sembilan Islamic Religious Council in 2004. Later, other zakat organizations, including Selangor, the Federal Territory, and Terengganu, continued this initiative. Due to the increased zakat revenues collected and the availability of staff members with the necessary resources and expertise to manage this asnaf entrepreneur program, Selangor and the Federal Territories are perceived to be more aggressive in executing this program (Firdaus et al., 2021). Through the implementation of the EDP, LZS has taken the initiative to significantly and sustainably raise the asnaf group's economic potential and level of living. The newly established asnaf entrepreneur transformation model seeks to identify asnaf talent and potential for entering the entrepreneurial sector. This strategy is more valuable as an addition to the monthly self-help. Each asnaf can now use their initiative and independence to enhance their family’s quality of life and financial situation without relying on zakat handouts.

Economic development program (EDP)

LZS has launched the Economic Development Program to give asnaf a platform to raise their quality of life and standard of living. This program is broken into two parts by LZS: the Group Economy Program and the Entrepreneurship Program. The assistance this entrepreneurship program provides consists of a minimum of RM5,000 and a maximum of RM50,000 in additional capital injections as well as start-up capital. Since the financial aid is not refundable, a thorough screening process is used to choose the participants. As a result, only asnaf, who is qualified, will be selected to avoid fraud and abuse of the aid offered (Firdaus et al., 2021). The overall allocation, which is close to RM10 million annually, demonstrates LZS's commitment and foresight in pursuing its goal of transforming the asnaf group in Selangor. Depending on the potential and form of the proposed enterprise, the LZS will offer two types of capital support, including start-up funds, the purchase of fixed assets (such as machinery), and renting space. For small-scale businesses selling cakes and beverages run by asnaf fakir, miskin, and mualaf, the restricted capital aid is capped at RM 5000.00. For large-scale companies, such as restaurants, launderettes, traditional food businesses, auto repair shops, etc., the maximum capital aid is RM 5,000.00 up to RM 50,000.00. LZS also provides training and courses to participants in entrepreneurship-related activities to help them become more self-motivated, self-assured, and business-savvy. Through this program, asnaf business owners can get ongoing guidance and oversight to ensure their operations are successful (Nor Hayati et al., 2018).

Asnaf Development Blueprint (ADB), a new strategy, was unveiled by LZS on September 25th, 2019, to guarantee that the development and transformation plan of asnaf may be organized. ADB is a strategic project that involves Selangor's zakat stakeholders and aims to increase asnafs' capacity for self-sufficiency and quality of life improvement. Providing this group with the opportunity to come out while maintaining their status as asnaf through encouragement and stimulation paves the way for them to contribute to the zakat eventually. If improved, the Economic Development Program can be implemented to carry out these eight key initiatives without precluding the use of alternative development initiatives. This agenda can be a valuable addition to all asnaf development initiatives run by LZS, helping to further asnaf transformation and advance the creation of the kind of bold, competitive human capital the government has envisioned. The change in asnaf recorded in 2019 shows the efficiency of this initiative; a total of 3,372 poor and needy asnaf households have emerged from the asnaf cocoon. This remarkable accomplishment demonstrates the steadfast dedication of numerous parties, particularly LZS and Selangor's zakat producers.

Asnaf entrepreneur

Entrepreneurial success factors typically concentrate on the internal features of the entrepreneurs and external components of the company environment and business structure (Martinelli, 1994). The lifestyle and culture of the traditional association are internal traits that can influence a person's entrepreneurial inclination. According to Kets de Vries (1977), an entrepreneur's personality is shaped by the difficulties they face. This challenge fuels the drive for advancement that an entrepreneur needs. According to Delmar (2006), personal qualities include the capacity to manage risk, self-control, assurance, and independence. According to Martinelli (1994), cultural considerations and institutional support are examples of outside variables that can promote the emergence of entrepreneurs. Ilyana and Adib concur with this viewpoint (2018). They discovered that business expertise, attitude, success motivation, and understanding of capital and input materials all impact business performance and entrepreneurship success. As a result, Menzies et al. (2003) defined an entrepreneur as someone who can bring about change in a business through innovation, incorporate new resources, dare to take risks, be able to detect problems and enhance operations. Entrepreneurs need to master innovation, according to Littunen (2000), which entails developing novel goods and qualities, inventing novel processes, incorporating new market segments and resources, and structuring an organization.

Asnaf entrepreneurs are a group of asnaf who use business platforms to transition from unproductive asnaf to productive asnaf, focusing on the poor and needy. This group will get the help and instruction they need to launch their enterprises (Abang Abai et al., 2020). Yusrinadini et al. (2020) define asnaf entrepreneurs as individuals who must go through the process of opening a business to determine whether they can handle the responsibility that comes with being an entrepreneur and possess the confidence to do so with incentives in the form of support and encouragement from zakat institutions. Before this group can become an entrepreneur with the aid, support, and direction of zakat institutions in their various states, a particular phase or stage must be passed. However, some flaws and barriers that can obstruct this process must first be addressed by those involved, such as a lack of funding, a lack of management expertise, a lack of talented employees, a lack of talent, the inability to find expert services, and a lack of quality as a successful entrepreneur (Mahmood et al., 2020). The ability of asnaf entrepreneurs to overcome obstacles in the business sector and achieve success depends on their spirit, mental fortitude, and physical fortitude. It can take much work to comprehend an industry of business that has only recently been entered. The transition from poverty to the complicated realm of entrepreneurship is cultural. Therefore, it is not unexpected that the asnaf entrepreneurs could not form (Khairul & Umi, 2019).

Problem Statement

In the Malaysian context, a significant impact can be felt following the enforcement of various SOPs to curb the spread of this pandemic to become more serious. The economic sector is among those affected, given the restriction of movement activities and business interaction among the community. As shown in Table 1, the Department of Statistics Malaysia reported that 52.6% of respondents were affected by the Movement Control Order (PKP) implementation on March 18, 2020. The self-employed were the most affected group, with 46.6% reporting having lost employment opportunities. GLC and MNC employees are the least affected group, with only 0.4% affected by the stability and integrity of the company and organization.

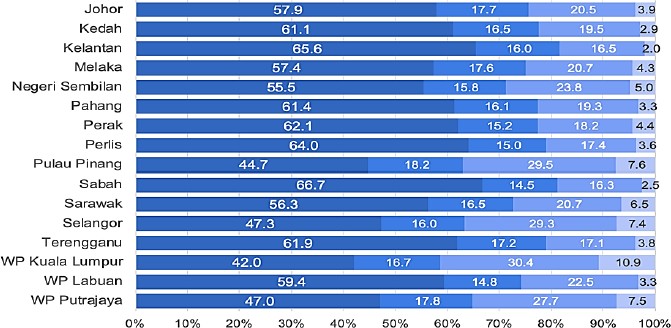

Sabah was reported as the state most affected by the outbreak of the COVID-19 pandemic and enforcement of PKP at 66.7%, followed by Kelantan (65.5%) and Perlis (64.0%). Selangor is ranked 13th, with the number of respondents affected at 47.3% (see Figure 1).

From an employment standpoint, the agricultural industry had the highest percentage of workers who were impacted (21.9%), followed by the services sector (15.0%) and the industrial sector (6.7 percent). As shown in Table 2, employees in the agricultural & plantation and fisheries sub-sectors lost their jobs by 33.0 percent and 21.1 percent, respectively, for the agriculture sector. Regarding the services sector, 35.4 percent of workers in the Food & Beverage Services sub-sector lost their jobs, followed by 18.7 percent in the transport & storage sub-sector. In addition, 71.4 percent of self-employed employees reported having only enough savings for less than one month, with 94.8 percent reporting a decrease in monthly revenue.

This situation also indirectly affects the survival of asnaf zakat entrepreneurs in Selangor. This is because most of the allocation under the Economic Development Program has been allocated to the Group Entrepreneur Project, which is RM7,036,890 in 2015, RM4,892,685 (2016), RM2,568,730 (2017), RM3,752,951 (2018), RM3,208,171 (2019), RM12,100,00 (2020) and RM10,300,000 (2021) (see Table 3). This Group Entrepreneur Project is an LZS initiative to polish the entrepreneurial talent and potential in each selected asnaf through capital injection, courses, training, and systematic monitoring from LZS officers. The distribution of funds and support assistance is expected to help the asnaf remain viable in the face of current challenges. The capital injections provided by LZS are generally based on the four sectors of enterprises conducted, namely business, fisheries, agriculture, and livestock.

The business sector is the largest and most consistent recipient of distribution each year, amounting to RM6.482170 for 2015, RM1,640,024 (2016), RM681,637 (2017), RM3,981,396 (2018), RM1,558,871 (2019), RM90,000 (2020), and RM2,100,000 (2021). For other sectors, such as fisheries, livestock, and agriculture, aid distribution is only allocated for 2015-2016. It is not continued for subsequent years as the trustees have no application to run these enterprise sectors. The impact of the COVID-19 pandemic and the enforcement of the MCO will undoubtedly affect the stability and survival of these asnaf entrepreneurs, as the business, agriculture, and fisheries sectors are reported to be among the sectors directly affected throughout 2020. LZS says that the enforcement of the MCO has affected the survival of nearly 800 asnaf entrepreneurs, or 76% of the total number of asnaf registered with the Economic Development Program. Most of them need help to continue the business effectively, resulting in a decrease in daily income.

LZS has taken proactive steps by introducing a particular COVID-19 assistance scheme to reduce the unforeseen risks faced by these asnaf entrepreneurs. From March to December 2020, a total of RM12.1 million was distributed to a total of 25,544 asnaf whose sources of income are affected in Selangor, including hawkers, small traders, and workers with B40 status. This allocation has subsequently been increased to 80.6%, or RM62.5 million in 2021, which benefits a total of 64,151 asnaf in Selangor. In the same distribution, a total of 360 traders have received Business Capital Assistance for Affected Businesses amounting to RM1.1 million, in addition to 388 entrepreneurs having been allocated Capital Injection for Affected Entrepreneurs amounting to RM1.0 million. Both provisions aim to help reduce adverse risks in the aftermath of the COVID-19 pandemic and increase their businesses' survival ability. Therefore, asnaf business owners should take the necessary steps as soon as possible to ensure that their enterprises survive the COVID-19 pandemic's effects.

Research Question

This study focuses on the impact of the COVID-19 pandemic on the survival of asnaf entrepreneurs.

Thus, the research question of this study related to:

a) What is the impact of the COVID-19 pandemic on the survival of asnaf entrepreneurs in Malaysia?

b) What strategies need to be implemented to ensure the effectiveness of these asnaf entrepreneurs?

Purpose of the Study

This study aims to identify the impact of the COVID-19 pandemic on the survival of asnaf entrepreneurs in Malaysia. Specifically, this research is based on the Movement Control Order (MCO) effect on this asnaf entrepreneurship. The study concludes that the COVID-19 pandemic can influence the survival of asnaf entrepreneurship. Thus, this study aims to analyze the impact and propose solutions to improve the competitiveness of their businesses.

Research Methods

The data collection and analysis process in this study uses a qualitative approach. Qualitative research aims to gather non-numerical data that can give detailed information about the context (Cresswell, 2013). Without altering actual circumstances, qualitative research employs a natural way to comprehend the condition of phenomena in a particular environment (Patton, 2002). This study uses the content analysis approach to achieve the predetermined study objectives. In qualitative investigations, content analysis views more text as a personal, internal reading of meaning. According to Berg (1988), content analysis (qualitative) has a distinct benefit when assessing content in light of context and procedure. While the process component entails the systematic and recurring process of text interpretation, the context aspect is implicitly observed through the main content (latent content). Then, this information is processed inductively, beginning with in-depth observations of broad circumstances before generating more specialized opinions and ideas (Bennard, 2011). The problem or phenomena being examined is described using this method. Then, customized conclusions will be tailored to the circumstance under consideration using the research findings.

This study was conducted with LZS as a zakat institution that effectively implements the asnaf entrepreneur development program. In addition to the large allocation of funds for this program each year, LZS has also provided a systematic monitoring system to ensure the effectiveness and achievement of the program's objective. However, the threat of the COVID-19 pandemic is one factor that affects the business viability of asnaf entrepreneurs. Therefore, this study was conducted to evaluate the impact of the COVID- 19 pandemic and the enforcement of MCO on the survival of asnaf entrepreneurs in Selangor. A content analysis approach is made on the LZS Report on Collection and Distribution of Zakat for 2020 and 2021. Data and statistics on the distribution of aid allocated to asnaf entrepreneurs during 2020 and 2021 were analyzed to summarize LZS initiatives assisting the affected asnaf entrepreneurs. In addition, a written interview was also conducted via email with the LZS Chief Executive Officer to obtain information related to the survival of asnaf entrepreneurs during the enforcement of the MCO for 2020 and 2021. A set of questions were given to LZS regarding the distribution of zakat funds for the asnaf entrepreneurs, the impact of MCO enforcement on the survival of asnaf entrepreneurs, and the LZS initiative to reduce the impact of the pandemic on asnaf entrepreneurs. However, some information cannot be obtained due to its privileged status and for internal use only.

Findings

The COVID-19 outbreak had a devastating effect on every aspect of communal life, either directly or indirectly. The government imposes social restrictions on them, which start when they are sick and continue until there is a disruption in economic activity, which affects the income of rural people and businesses (Phillipson & Buffel, 2020). According to Dube and Kathende (2020), not all social groups can stay at home and do nothing to earn money to maintain their families while closure and social restraint orders are in effect. During that time, most communities—particularly those relying on the informal sector for survival—needed assistance to maintain their economic operations. Examples include small agricultural businesses that offer fruits, vegetables, household items, or merchandise. Katooro (2020) claims that social restrictions and closure policies, notably for people employed in the Small and Medium Industry (SMI) sector, have substantially impacted income decline, job loss, and insolvency. The main challenges dealers encounter are cash flow problems caused by the potential loss of daily income, operational disruptions, layoffs, and supply chain disruptions (Che Omar et al., 2020). Large organizations are more likely than small enterprises to recover swiftly from a pandemic and expand. This is according to Bartz and Winkler (2016). Microbusinesses in rural locations face significantly more difficult issues due to their location away from the town’s core, limited infrastructure, labor difficulties, and inadequate financial reserves (Fabeil et al., 2020).

Cook (2015) concluded that 75% of businesses run the danger of being negatively impacted three years after a disaster or crisis occurs. Most small- and medium-sized business owners, especially asnaf entrepreneurs, are the most affected and influenced by the pandemic danger; as a result, this issue requires a quick response. Their motivation and dedication to the firm have been affected by the uncertain potential of the enterprise and the ongoing, alarming pandemic situation. An individual's acceptance of a hazy, dangerous, and difficult challenge is known as tolerance of ambiguity (TOA) from the standpoint of entrepreneurship. When faced with challenging circumstances, those with low TOA frequently give up, become easily dejected, and make rash decisions (Okhomina, 2010). As a result, this TOA component is crucial in assessing an entrepreneur's skill level and reputation. The 2019 study by Azizuddin, Abdullah, and Dahlan on asnaf business owners in Kelantan concluded that TOA has little value in the face of the COVID-19 epidemic. Most asnaf business owners are hesitant to take chances since they are still concerned about the present circumstances.

Taking this into account, the government unveiled the PRIHATIN Economic Stimulus Package to help small and medium-sized firms continue to operate domestically and retain employment and investment. This money was distributed to needy people by acting as a mediator for various financial institutions. Additionally, the Special Assistance Facility (SRF) worth RM3.0 billion has been provided by the Central Bank of Malaysia (BNM) to assist SMEs with working capital and short-term cash flow (Office of the Prime Minister of Malaysia, 2020). For zakat institutions, as shown in the Table 4, over RM 155 million has been dispersed in 2020 to support the daily requirements and ongoing operations of asnaf across Malaysia. These modest dealers and hawkers typically make a meager living each day. Thus, their ability to conduct business is undoubtedly impacted when prohibited. As a result, the state’s zakat management has declared that it will offer exceptional zakat support to individuals whose daily livelihoods and commercial activities are affected.

COVID-19, particularly zakat assistance distribution in the Federal Territory, Kedah, and Selangor, is among the highest compared to other states. Based on the Laporan Zakat Selangor 2020, monthly financial assistance under the Program Pembangunan Sosial for 2020 recorded an increase of 6%, with a value of RM177.1 million compared to RM167.0 in 2019. However, this situation is different from the provision of business capital assistance under the Program Pembangunan Ekonomi, which recorded a significant decrease of up to 94%, which is only RM0.09 million for 2020, compared to RM1.6 million for 2019. The reduction in allocation for capital assistance is because most asnaf entrepreneurs need help in continuing their business operations, especially with stricter MCO enforcement in Selangor due to the high daily case infection rate (Saipolyazan, 2021). As a result, they had to stop the business they were running and apply for monthly financial assistance to cover the living needs of the affected.

Throughout the enforcement period of the MCO, several business sectors, such as carpentry, agriculture, marriage, services, and food, are faced with the problem of business continuity. Among the main issues entrepreneurs face are cash flow and daily profits due to factors such as orders to close the premises, limitation of the period of sales operations, customer presence, and increased operating costs (Abang Abai et al., 2020). At the same time, entrepreneurs face the challenge of paying supplier debt, premises rent, and employee wages. This situation will indirectly lead to business risks such as the threat of loss, closure of premises, and layoffs (Abang Abai et al., 2020). Although some entrepreneurs are starting to switch to the digital business segment, the reality that needs to be faced is that there are still some businesses, such as spa and hairdressing services, weddings, hospitality, and carpentry, that need to be carried out physically.

Therefore, Selangor Zakat Board (LZS) itself 2020 has allocated emergency assistance amounting to RM15 million to assist the needs and welfare of those affected during the MCO. The Covid-19 particular service also covers a financial contribution of RM12.1 million to 25,544 recipients among the B40, especially hawkers and small traders, with a maximum value of up to RM500. Allocations for these asnafs are channeled through three main categories: fakir, miskin, and fi sabilillah. In addition, assistance is distributed through business capital injections, purchase of raw materials and equipment, or exemption from rental payments for business premises. For the year 2020, assistance to these entrepreneurs is provided in general through the COVID-19 Special Assistance (BKC19) and Alternative Assistance for Affected People (BAIT) programs. This initiative will be continued in 2021 through the Selangor Peduli Zakat Assistance, offered to B40 individuals whose income is affected and who have lost their jobs other than registered asnaf. Through this program, LZS has distributed assistance of RM25.7 million, covering basic food and living necessities, involving 36,622 recipients. In addition, special assistance worth RM1.5 million was also allocated to 700 affected asnaf entrepreneurs as additional support to ensure their business continuity (Selangor Zakat Board, 2022).

The LZS project is believed to be successful in assisting the financially viable poor who have the potential to establish a business by giving them the capital to do so through the implementation of the Economic Development Program (EDP). The asnaf have the capacity and reputation for using their businesses as a source of income to escape poverty and establish themselves as reliable zakat payers for charitable purposes. Aside from the self-initiatives put into action, asnaf businesses also received extra boosts through funding and ongoing oversight thanks to the creation of the Asnaf Zakat Entrepreneurs Group (KUAZ). KUAZ acts as a platform for participants to establish business relationships and a forum for communication and information sharing so that they may face today's business difficulties jointly and not in isolation. To further expand the knowledge and abilities of asnaf entrepreneurs, collaboration has also been developed with organizations, such as the National Entrepreneurship Institute (INSKEN) and the Malaysian Islamic Training Institute (ILIM). The LZS designated agents and distributors assigned among the asnaf to promote the products locally and internationally. This allowed the items created by these participants to have a high marketability value and advance. Therefore, active zakat payers' assistance is crucial if the accumulated zakat money can assist these asnafs in escaping poverty (Selangor Zakat Board, 2022).

Even so, most of the asnaf business owners continue to operate in the conventional business sector, i.e., direct customer contact. Due to the multiple challenges they had to overcome, the COVID-19 pandemic threat impacted their firm’s viability. It is now time for these asnaf entrepreneurs to enter the digital business sector to maximize their potential and ensure the long-term viability of their companies. The government intends to launch a six-month economic recovery plan consistent with those objectives from June to December 2020. Through the recovery plan, the government and the private sector will grant more than RM140 million in cash to help and encourage SMEs to shift to digitalization or online commerce. Especially among small firm owners, the stakeholders in this turnaround plan can foster inventiveness and local venture capital talent. Business owners in Asnaf must take immediate action to ensure the continuation of their enterprises in the face of the COVID-19 pandemic's consequences. To turn all of the difficulties faced into possibilities that must be taken advantage of to increase competitiveness and business competence, Asnaf entrepreneurs need to be more inventive and creative. Due to these new rules, they must fundamentally alter themselves and the market segments they enter. Therefore, a more proactive paradigm shift is required to assist and direct them in adjusting to the new standards of living following the COVID-19 epidemic and the IR4.0 period. One of the effective platforms for addressing the COVID-19 pandemic's issues and achieving IR4.0's goals is an online business. However, several tactics must be used to guarantee this company's success, such as:

- Utilize online shopping sites like Shopee, Lazada, Grab, FoodPanda, and others to advertise and carry out business transactions.

- Promote products and business marketing via digital media platforms like Facebook, Whatsapp, Instagram, and Youtube.

- Use government programs to help SME entrepreneurs launch and expand their companies, including the Automation and Digital Fund (ADF), All Economic Sector Fund (AESF), Micro Business Rehabilitation Financing (MBRF), Special Relief Fund (SRF), and Micro Enterprise Fund (MEF).

- Offer more flexible and appealing payment solutions, like e-Wallets and cashback, to speed up business transactions.

- Applying the most recent techniques, methods, and abilities to revitalize products and businesses.

It is envisaged that by using this method, asnaf business owners will be able to compete once more and boost the success of their enterprises. Thus, the main objective of zakat, which is to turn the asnaf into successful businesspeople and zakat payers, can be accomplished. To guarantee that these asnaf entrepreneurs remain excited about running their unique firms, help from various stakeholders is also necessary.

Conclusion

The business activities of asnaf entrepreneurs in Selangor have been impacted by the COVID-19 threat. Considering this unexpected circumstance, they must decide whether to continue operating their long-running business. Therefore, ongoing initiatives are required to improve and transform asnaf's life. The LZS offers sufficient funding to expand this program's implementation further, allowing more competent asnaf to attempt to change their and their family’s fates. Improvements must be made to guarantee that this program succeeds in its mission of creating more prosperous asnaf businesses. Participants in the program benefit from LZS's encouragement, direction, and support as they work to better themselves and their businesses. Asnafs needs to seize this excellent opportunity by working harder and giving the company her all cooperation and devotion. The paradigm shifts of asnaf entrepreneurs to change their business model are anticipated to shape their mindset and credibility, making them more competent and competitive in dealing with the problems of COVID-19 and the IR4.0 digitalization era after the pandemic. This study aimed to investigate the potential effects of COVID-19 on the ability of asnaf entrepreneurs to survive. However, the MCO's enforcement has limited the scope of field study projects. Therefore, a comprehensive study must ascertain how COVID-19 has impacted asnaf enterprises. A thorough policy must be created to help them regain their footing and grow their already established firms.

Acknowledgments

This document is one of the research outputs produced to meet the requirements for the TEJA Research Grant for the project entitled, ‘Digital Entrepreneurship Literacy Among Asnaf Zakat Entrepreneurs’ numbered GDT2022/1-15.

References

Abang Abai, D. S., Awang, M. D., Mohd Yusoff, A. N., Ab. Majid, A., & Hamli, H. (2020). Bentuk Bantuan Modal Agihan Zakat Asnaf dan Pencapaian Usahawan Asnaf di Malaysia: Kajian Empirikal [Assistant type of capital Zakat distribution and achievement of asnaf entrepreneur in malaysia: an empirical study]. Malaysian Journal of Social Sciences and Humanities (MJSSH), 5(1), 93-99. DOI:

Amirul, A. M. (2020). Covid-19 Outbreaks Dissipates Misconception on Zakat. Empirical Economics Letters, 19(Special Issue), 1-12.

Asyraf, S. (2020). The Great Lockdown: Unjuran Baharu Ekonomi Malaysia. Terengganu Strategic & Integrity Institute.

Azman, F. (2020, April 4). Adakah Peniaga IKS Malaysia Bersedia Memasuki Ekonomi Digital? Astro Awani. http://www.astroawani.com/berita-malaysia/adakah-peniaga-iks-malaysia-bersedia-memasuki-ekonomi-digital-236786

Bartz, W., & Winkler, A. (2016). Flexible or fragile? The growth performance of small and young businesses during the global financial crisis — Evidence from Germany. Journal of Business Venturing, 31(2), 196-215. DOI: 10.1016/j.jbusvent.2015.10.002

Bennard, H. R. (2011). Research Methods in Anthropology: Qualitative and Quantitative Approaches. AitaMira Press.

Berg, B. L. (1988). Qualitative Research Method for the Social Science. Pearson Education Limited.

Che Omar, A. R., Ishak, S., & Jusoh, M. A. (2020). The Impact of Covid-19 Movement Control Order on SMEs’ Businesses and Survival Strategies. Malaysian Journal of Society and Space, 16(2), 139-150. DOI:

Cook, J. (2015). A Six-stage Business Continuity and Disaster Recovery Planning Cycle. SAM Advanced Management Journal, 80(3), 22–33.

Cresswell, J. W. (2013). Qualitative Inquiry and Research Design: Choosing Among Five Approach. Sage Publication.

Delmar, F. (2006). The Psychology of the Entrepreneur. In S. Carter, & D. Jones-Evans (Eds.), Enterprise and Small Business. Prentice Hall.

Department of Statistic Malaysia. (2020). Laporan Survei Khas Kesan Covid-19 Kepada Ekonomi Dan Individu. Department of Statistic Malaysia.

Dube, K., & Kathende, C. N. (2020, May 29). An Inclusive Response to COVID-19 for Africa’s Informal Workers. Africa Can End Poverty in World Bank Blogs. https://blogs.worldbank.org/africacan/inclusive-response-COVID-19-africas-informal-workers

Fabeil, N. F., Pazim, K. H., & Langgat, J. (2020). The Impact of Covid-19 Pandemic Crisis on Micro- Enterprises: Entrepreneurs’ Perspective on Business Continuity and Recovery Strategy. Journal of Economics and Business, 3(2), 38-52. DOI:

Firdaus, S., Ghafar, D., & Anuar, P. (2021). Pembangunan Asnaf di Selangor Melalui Program Latihan. International Journal of Islamic and Humanities Research, 1(2), 88-100.

Ghani, F. A. (2020, May 14). Impak Psikologi Akibat Wabak COVID-19. Astro Awani. http://www.astroawani.com/berita-malaysia/impak-psikologi-akibat-wabak-COVID-19-233648

Ilyana, M. A., & Adib, C. R. (2018). Pengagihan Dana Zakat Dalam Bentuk Pembiayaan Mikro Untuk Usahawan Miskin di Malaysia. Journal of Fatwa Management and Research, 13(1), 1-14.

Katooro, P. B. N. (2020, October 02). Opinion: Support Rural, Women-led Entrepreneurs Amid the COVID-19 Pandemic. Devex: Global Views COVID-19. https://www.devex.com/news/opinion-support-rural-women-led-entrepreneurs-amid-the-COVID-19-pandemic-97030

Kets de Vries, M. F. R. (1977). The Entrepreneurial Personality: A Person at the Crossroads. Journal of Management Studies, 14(1), 34-57. DOI:

Khairul, A. M., & Umi, K. Z. (2019). Keberkesanan Program Pembangunan Ekonomi Asnaf Oleh Lembaga Zakat Selangor. e-Academia Journal, 8(2), 14-24. DOI:

Kuriakose, S. (2020, May 7). Reopening Malaysia’s Economy in a New Normal. East Asia & Pacific on the Rise in World Bank Blogs. https://blogs.worldbank.org/eastasiapacific/reopening-malaysias-economy-new-normal

Lembaga Zakat Selangor. (2021). Laporan Info Kutipan dan Agihan Zakat [Information Report on Zakat Collection and Distribution]. Lembaga Zakat Selangor

Littunen, H. (2000). Entrepreneurship and the Characteristics of the Entrepreneurial Personality. International Journal of Entrepreneurship Behavior and Research, 8(1), 34-47. DOI:

Mahmood, T. M. A. T., Mamun, A. A., & Ibrahim, M. D. (2020). Attitude towards entrepreneurship: A study among Asnaf Millennials in Malaysia. Asia Pacific Journal of Innovation and Entrepreneurship, 14(1), 2-14. DOI:

Martinelli, A. (1994). Entrepreneurship and Management. In N. J. Smelser, & R. Swedberg (Eds.). The Handbook of Economic Sociology. Princeton University Press.

Menzies, T. V., Brenner, G. A., & Filion, L. J. (2003). Social Capital, Networks and Ethnic Minority Entrepreneurs: Transnational Entrepreneurship and Bootstrap Capitalism. In H. Etemad, & R. W. Wright (Eds.), Globalization and Entrepreneurship: Policy and Strategy Perspectives. Edward Elgar Publishing.

Nor Hayati, S. M., Nor’Azam, M., Sharifah, N. S. Y., & Maheran, Z. (2018). Management Control System in Asnaf Entrepreneurship Development Program by Lembaga Zakat Selangor. Jurnal Pengurusan, 53, 13-22. DOI:

Office of the Prime Minister of Malaysia. (2020, April 2). Additional PRIHATIN SME Economic Stimulus Package (PRIHATIN SME+). Speech Text - Prime Minister Department. https://pmo.gov.my/2020/04

Okhomina, D. (2010). Entrepreneurial Orientation and Psychological Traits: The Moderating Influence of Supportive Environment. Journal of Behavioral Studies in Business, 3(2), 1-11.

Patton, M. Q. (2002). Qualitative Evaluation and Research Methods. Sage Publication Inc.

Phillipson, C., & Buffel, T. (2020). Developing Age-friendly Cities: Policy Opportunities and Challenges. Journal of Elder Policy, 1(1), 137-154. DOI:

Saipolyazan M. Yusop. (July 3rd, 2021). Zakat Selangor Peduli: LZS Peruntukan RM69.3 Juta Santuni Asnaf dan Golongan Terkesan. Lembaga Zakat Selangor. https://www.zakatselangor.com.my/ terkini/zakat-selangor-peduli-lzs-peruntukan-rm69-3-juta-santuni-asnaf-dan-golongan-terkesan/

Selangor Zakat Board. (2022). Majlis Agama Islam Selangor. https://www.zakatselangor.com.my/

Thillainathan, R., & Cheong, K. C. (2016). Malaysia's new economic policy, growth and distribution: Revisiting the debate. Malaysian Journal of Economic Studies, 53(1), 51-68.

Yusrinadini, Z. M., Nazmi, S., Syamsuriana, S., Hazrina, H., & Azwa, ,M. K. (2020). Asnaf Entrepreneurial Scheme: Evidence from Lembaga Zakat Negeri Kedah. 8th International Seminar of Entrepreneurship and Business (ISEB 2020), Faculty of Entrepreneurship and Business, Universiti Malaysia Kelantan.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

18 August 2023

Article Doi

eBook ISBN

978-1-80296-963-4

Publisher

European Publisher

Volume

1

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1050

Subjects

Multi-disciplinary, Accounting, Finance, Economics, Business Management, Marketing, Entrepreneurship, Social Studies

Cite this article as:

Meerangani, K. A., Abdul Hamid, M. F., Izza Hashim, S. N., Sharipp, M. T. M., Hassan, M. S., & Sharif, D. (2023). Impact of the Covid-19 Pandemic on the Survival of Asnaf Zakat Entrepreneurs. In A. H. Jaaffar, S. Buniamin, N. R. A. Rahman, N. S. Othman, N. Mohammad, S. Kasavan, N. E. A. B. Mohamad, Z. M. Saad, F. A. Ghani, & N. I. N. Redzuan (Eds.), Accelerating Transformation towards Sustainable and Resilient Business: Lessons Learned from the COVID-19 Crisis, vol 1. European Proceedings of Finance and Economics (pp. 590-603). European Publisher. https://doi.org/10.15405/epfe.23081.52