Minimising Lending Risk From Small to Medium-Sized Enterprises by Understanding Sales Officer’s Intentions

Abstract

The non-availability of financing was one of the issues faced by Malaysian SMEs. However, the change of policy by Bank Negara Malaysia (BNM) has led to an increase in loan approval rates for SME’s. Unfortunately, the higher loan approval rates for SMEs have also had some unintended consequences on financial institutions, which showed an increase in Non-Performing Loans (NPLs). By better understanding the influence of different psychological factors on the bank sales officer’s intention to minimise risks from lending to SMEs, the banking industry may formulate even more effective training methods that could increase the efficiency of their sales force. This could result in the dual goal of increased profits and reduced NPLs. Recent updates to the Theory of Planned Behavior allows moderation effects for the predictors of intention to be studied. Consequently, the study proposes a framework to extend the understanding of the driving forces that are in play which encourages bank sales officers to form intentions to minimise repayment risks from SMEs. This enlarges the literature available around TPB, and offers options for banks to strengthen their risk minimization strategies around their human resources.

Keywords: Banking, lending risk, SME lending, non-performing loans, risk minimisation

Introduction

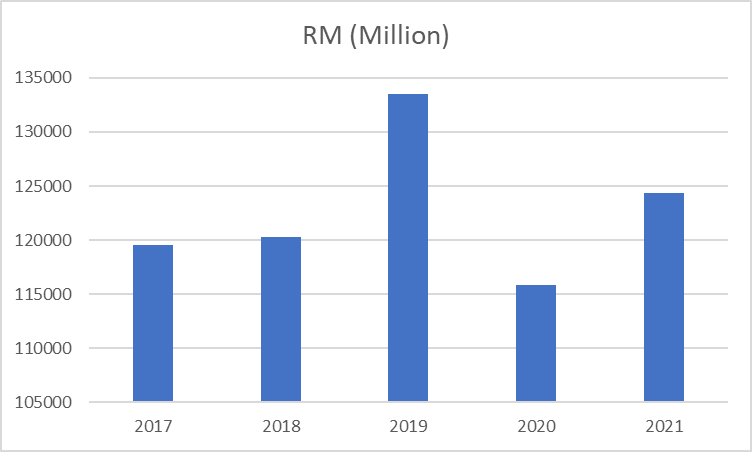

The non-availability of financing is one of the issues faced by Malaysian SMEs (Harif et al., 2011). According to Abdulsaleh and Worthington (2013), Malaysian SME’s experiences these challenges because of their organizational size, the high risk levels associated with lending to SME’s and a lack of information about their business (i.e., information asymmetry). However, the change of policy by Bank Negara Malaysia (BNM) had increased the loan approval rates for SME’s. As of 2019, the lending approval rate was in excess of 80%, while the loan approval rate approaching 91% (Wasiuzzaman et al., 2020). However, the higher loan approval rates for SMEs have also had some unintended consequences on financial institutions, which showed an increase in Non-Performing Loans (Figure 1).

In Malaysia, each SME lending application case is unique, and banks must perform a case-by-case evaluation of SME loan applications. This defeats the fast and uniform method of credit-score screening available for consumer lending like CCRIS and CTOS (Abdulsaleh & Worthington, 2013). Therefore, SMEs are required to provide sufficient documentation when making their loan applications, which includes collateral, financial statements with good cash flow, and proper business documentation – for example the business registration and a convincing project paper which explains the SME’s businesses and outlines the direction of those businesses (Zairani & Zaimah, 2013). In addition, the bank must also be convinced that the industries or businesses are viable, and that the SMEs must also have a good and continuous relationship with the bank, have a good repayment record along with the proper experience in their business or industry (Zairani & Zaimah, 2013). Indeed, Wasiuzzaman et al. (2020) found that creditworthiness is a key factor in influencing SME access to financing, especially the good character of the management team of the SME, especially considering the ability of the SME to repay the loan in the future.

This qualitative information can only be evaluated by trained and experienced bank officers. As Yong (2019) explained,

Therefore, the solution has to be that banks must be more skillful during the process of recommending the right financial products to its clients, and this responsibility falls on the shoulders of bank sales officers when they analyse the information that is available to them when considering those decisions. (pp. 2-3)

Yong further noted that the interplay between the bank sales officer’s obligations to the bank is a form of contract that is not commonly explored.

In addition, there are other benefits associated with an improved understanding of the factors that may influence the officers, as explained by Ismail et al. (2017),

During economic downturn, unsettle loans problem may extremely arise due to problem of loan collections. Thus, this problem will reduce the ability of banks to grant more credits while cost of borrowings will increase too because of the bank’s high lending rate. (p. 696)

Ismail et al. (2017) further noted that minimizing lending risks could result in more profitable lending as well as reduced NPLs. To understand this further, this study utilized the Theory of Planned Behaviour (TPB) framework, and the following research questions were formulated:

RQ1: Could the bank officer’s attitude influence their intention to minimise lending risks from SMEs?

RQ2: Could the bank officer’s subjective norm influence their intention to minimise lending risks from SMEs?

Following Ajzen (2020), perceived behavioural control may facilitate or impede the performance of behaviour. These control factors include the required skills and abilities, availability or a lack of time, money or other resources as well as the cooperation of other people and so on.

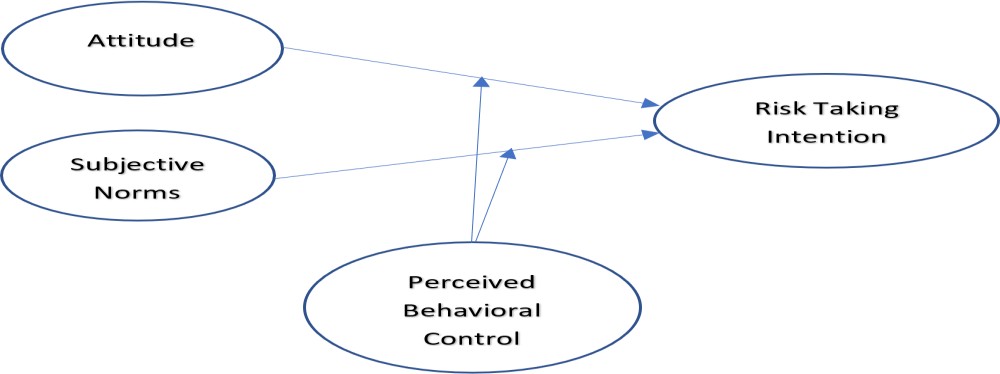

Following TPB, perceived behavioural control is now a moderator for the intention relationship to attitude and subjective norms (Ajzen, 2020). The reason a moderator variable is typically introduced is when an unexpectedly weak or inconsistent relationship between a predictor and dependent variable is expected (Baron & Kenny, 1986). Previous iterations of TPB had assumed that perceived behaviour control is another direct predictor of intention, with the same status with attitude and subjective norms (Ajzen, 1991, 2002). However, recent research by Earle et al. (2019) had shown evidence to support perceived behavioural control as a moderator, with some studies reporting no significant moderating effects (Earle et al., 2019, Kothe & Mullan, 2015) while others were reporting significant but inconsistent patterns of interaction (Castanier et al., 2013). Therefore, per Ajzen (2020), the following research questions are asked:

RQ3: Could perceived behavioural control of the bank officer moderate the relationship between Attitude and intention to minimise lending risks from SMEs?

RQ4: Could perceived behavioural control of the bank officer moderate the relationship between Subjective Norms and intention to minimise lending risks from SMEs?

Literature Review and Hypothesis Development

The role of bank officers in minimizing repayment risks

The traditional method of credit evaluation is based on the bank officer’s experience with, as well as knowledge of, their customers, which is built through years of customer relationships, the customer’s repayment track record and other intrinsic knowledge of the communities in which they serve in. These are considered “soft” information and is used in the recommendation decision for SME’s loan applications in Malaysia.

These methods stand in contrast with quantitative lending technologies (Boot, 2000). “Soft” information is acquired by the bank over time through multiple financial transactions with the borrower (Boot, 2000). Indeed, it is found that strong past lending relationships between bankers and clients significantly increase the probability of securing future lending (Bharath, Dahiya, Saunders and Srinivasan 2006, 2009).

However, such “soft” information cannot be easily transmitted within the banking organization or across organizations (Stein, 2002). Indeed, bank officers are professionally trained and duty-bound to follow proper lending procedures and it is unsurprising that bank officers will not proceed with an application if vital quantitative financial information about the potential borrower is missing.

Intention

In the TPB, the immediate antecedent of behaviour is the intention to perform the behaviour in question. The stronger the intention, the more likely it is that the behaviour will follow (Ajzen, 2020). Behavioural intentions are determined by three factors: attitude towards the behaviour, the subjective norm concerning the behaviour, and perceived behavioural control. A favourable attitude and a supportive subjective norm provide the motivation to engage in the behaviour, but a concrete intention to do so is formed only when the perceived control over the behaviour is sufficiently strong.

Attitude

Attitude has been defined by Ajzen (1991) as a psychological proclivity to prefer not to prefer a particular entity. Ajzen and Fishbein (1980) stated that due to this, attitudes allow human behaviour to be predicted and understood. In addition, Taylor and Todd (1995) added that attitude is an individual’s approval or disapproval of an action.

More recent studies from Han et al. (2017), Kianpour et al. (2017), Protogerou et al. (2018) and Norman et al. (2019) all indicated a strong relationship between attitude and intention. It is posited that Malaysian bank officers would tend to minimise repayment risks to their employers as a function of their training and risk awareness.

Therefore, this hypothesis was forwarded:

H1: Attitude has a positive effect on intention to minimise lending risks from SMEs

The subjective norm

Studies by Ajzen and Fishbein (1980) and Ajzen (1991) indicated that subjective norms evaluate the social pressure that may influence a person’s intention to carry out or not to carry out a specific act. Possibly, this is due to the person’s need to obtain the perceived approval of their referents towards carrying out an action (Becerra & Kargaonkar, 2009). Naturally, it is posited that Malaysian bank officers would tend to feel the perceived social pressure to minimise repayment risks to their employers at the workplace due to their training, perceived approval from supervisors and team-mates as well as expectancy to adhere to proper procedures.

Therefore, this hypothesis was forwarded:

H2: Subjective Norm has a positive effect on behavioural intention to minimise lending risks from SME’s

Perceived behavioral control

According to Ajzen (1991), Perceived behavioural control (PBC) is linked to a person’s confidence level in doing a defined job, which will then significantly affect their behaviour to perform the job or not. Taylor and Todd (1995) linked PBC to the subjective perceptions of the internal and external constraints on behavior (for example, time, skill or money) and mirrors the individual’s actual ability to perform the specific behaviour. This limitation seems to be based on a subjective evaluation of the chances of success in carrying out the behaviour (Ajzen & Madden, 1986).

In addition, people are more prone to perform the particular act if they believe they have the necessary resources and confidence to carry it out (Md Husin & Ab Rahman 2013). Conversely, if insufficient resources or information is available to start the act, the intention to carry out the act may be weaker, despite having favourable attitudes and/or subjective norms to carry out the act (Madden et al., 1992). Past iterations of TPB had treated PBC as a direct predictor of intention, with equal status to attitude and subjective norms (Ajzen, 2020).

However, many recent studies on the subject of the TPB - Ajzen (2020), La Barbera and Ajzen (2020) and Bosnjak et al. (2020) all stated that perceived behavioural control moderates’ attitude and subjective norm relationships. Baron and Kenny (1986) stated that a moderator could be a qualitative (sex, race, class) or quantitative variable, able to affect the direction and/or power of a relationship of an independent variable and a dependent variable.

Accordingly, the following hypotheses were proposed:

H3: The positive relationship between Attitude and Intention will be stronger when Perceived Behavioural Control is high

H4: The positive relationship between Subjective Norms and Intention will be weaker when Perceived Behavioural Control is high

Accordingly, Figure 2 shows the theoretical model of the study.

Research Methods

The sampling design

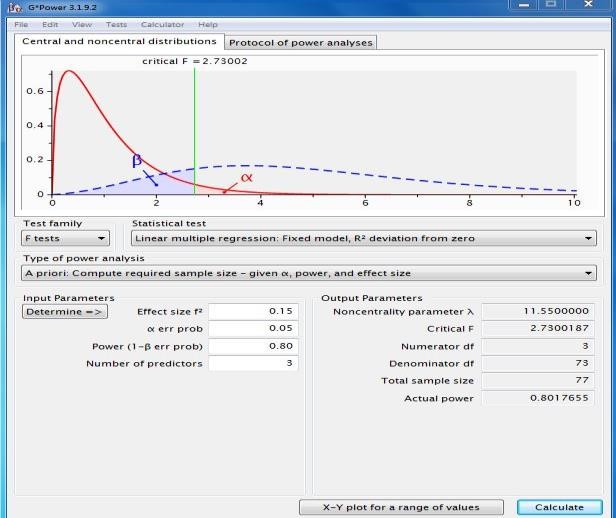

There are two commonly used sampling methods in the positivist research paradigm, probability and non-probability sampling (Sekaran & Bougie, 2016). Non-probability sampling via snowball sampling is suggested for this study for two reasons. First, the population of SME bank lending officers cannot be determined. To the best of the researcher’s knowledge, there was no census or complete list of such banking staff in the country. Second, the snowball sampling technique works like a referral system – once such banking officer is found, they may be asked to help forward the survey questions to other bank officers with the same role. Power analysis is used to determine sample size (Memon et al., 2020). This is illustrated in Figure 3 below. Following this study’s structural framework for power analysis, the minimum sample size necessary for this study is 78 (Figure 3, below).

Model assessment

In order to assess the model, the SmartPLS software could be used, and the constructs are recommended to be modelled as reflective multi-items. As such, there are 3 main assessment criteria – internal consistency reliability, convergent validity (indicator reliability/outer loading and average variance extracted) and discriminant validity (Ramayah et al., 2018). Also, a structural model assessment via Collinearity assessment should be performed to ensure there is no bias in the regression results (Hair et al., 2011). Finally, the moderation analysis of Attitude and Subjective Norm and their relationship to Intention, moderated by Perceived Behavior Control should be performed to assess the moderation effects as postulated by the new Theory of Planned Behavior.

Conclusion

This study set out with a proposal to investigate the variables that might affect bank sales staff’s intention to reduce lending risks from their potential customers, the small and medium-sized enterprises (SMEs), and departed from the usual studies conducted using TPB in terms of respondents and also addressed an uncommon research topic in banking - the supply side of credit. Also, the recent updates to TPB allowed for moderation effects to be studied for the predictors of intention (previously in TPB, this was only possible for the relationship between Intention and Behaviour). Consequently, the study has the potential to extend the understanding of the driving forces that are in play which encourages bank sales officers to form intentions to minimise repayment risks from SMEs. This could enlarge the literature available around TPB, and offers options for banks to strengthen their risk minimization strategies around their human resources.

References

Abdulsaleh, A. M., & Worthington, A. (2013). Small and medium-sized enterprises financing: a review of literature. International Journal of Business and Management, 8(14), 36-54. DOI:

Ajzen, I. (1991). The theory of planned behaviour. Organisational Behaviour and Human Decision Processes, 50(2), 179-211. DOI:

Ajzen, I. (2002). Perceived Behavioral Control, Self-Efficacy, Locus of Control, and the Theory of Planned Behavior. Journal of Applied Social Psychology, 32(4), 665-683. DOI:

Ajzen, I. (2020). The Theory of Planned behaviour: Frequently Asked Questions. Human Behaviour and Emerging Technology, 2, 314-324. DOI:

Ajzen, I., & Fishbein, M. (1980). Understanding attitudes and predicting social behaviour. Prentice Hall.

Ajzen, I., & Madden, T. J. (1986). Prediction of goal-directed behavior: Attitudes, intentions, and perceived behavioral control. Journal of Experimental Social Psychology, 22(5), 453-474. DOI:

Baron, R. M., & Kenny, D. A. (1986). The Moderator – Mediator variable distinction in social psychological research: Conceptual, strategic and statistical considerations. Journal of Personality and Social Psychology, 51(6), 1173-1182. DOI:

Becerra, E. P., & Kargaonkar, P. K. (2009). Hispanics Information search and patronage intentions online. Journal of Electronic Commerce Research, 10(2), 76-93.

Bharath, S., Dahiya, D., Saunders, A., & Srinivasan, A. (2006). So what do I get? The bank’s view of lending relationships. Journal of Financial Economics, 85, 368-419. DOI:

Bharath, S., Dahiya, S., Saunders, A., & Srinivasan, A. (2009). Lending Relationships and Loan Contract Terms. Review of Financial Studies, 24(4), 1141-1203. DOI:

Boot, A. W. A. (2000). Relationship banking – What do we know? Journal of Financial Intermediation, 9, 7-25. DOI:

Bosnjak, M., Ajzen, I., & Schmidt, P. (2020). The Theory of Planned Behavior: Selected Recent Advances and Applications. Europe’s Journal of Psychology, 16(3), 352-356. DOI:

Castanier, C., Deroche, T., & Woodman, T. (2013). Theory of Planned Behavior and road violations: the moderating influence of perceived behavioural control. Transportation Research Part F: Traffic Psychology and Behavior, 18, 148-158. DOI:

Earle, A. M., Napper, L. E., LaBrie, J. W., Brooks-Russell, A., Smith, D. J., & de Rutte, J. (2019). Examining interactions within the theory of planned behaviour in the prediction of intentions to engage in cannabis-related driving behaviors. Journal of American College Health, 1-7. DOI:

Hair, J. F., Ringle, C. M., & Sarstedt, M. (2011). PLS-SEM: Indeed a silver bullet. The Journal of Marketing Theory and Practice, 19(2), 139-152. DOI:

Han, H., Meng, B., & Kim, W. (2017). Emerging bicycle tourism and the theory of planned behavior’, Journal of Sustainable Tourism, 25(2), 292-309. DOI:

Harif, M. A. A. M., Hoe, C. H., & Zali, S. K. M. (2011). Business financing for Malaysian SMEs: what are the banks’ determining factors? World Review of Business Research, 1(3), 78-101.

Ismail, N., Azlan, N. D. A., Md. Husin, M., Ishak, I., & Md. Hashim, S. L. (2017). Bank efficiencies and Non-performing Loan of Commercial Banks in Malaysia. Journal of Humanities, Language, Culture and Business, 1(5), 34-40.

Kianpour, K., Jusoh, A., Mardani, A., Streimikiene, D., Cavallaro, F., Nor, K. M., & Zavadskas, E. (2017). Factors influencing consumers’ intention to return the end of life electronic products through reverse supply chain management for reuse, repair and recycling. Sustainability, 9, 1657-1679. DOI:

Kothe, E. J., & Mullan, B. A. (2015). Interaction effects in the Theory of Planned Behavior: Predicting fruit and vegetable cosumption in three prospective cohorts. British Journal of Health Psychology, 20, 549-562. DOI:

La Barbera, F., & Ajzen, I. (2020). Control interactions in the Theory of Planned Bahaviour: Rethinking the role of Subjective Norms. Europe’s Journal of Psychology, 16(3), 401-417. DOI:

Madden, T. J., Ellen, P. S., & Ajzen, I. (1992). A Comparison of the Theory of Planned Behavior and the Theory of Reasoned Action. Personality and Social Psychology Bulletin, 18(3), 3-9. DOI:

Md Husin, M., & Ab Rahman, A. (2013). What drives consumers to participate into family takaful schemes? A literature review. Journal of Islamic Marketing, 4(3), 264-280. DOI:

Memon, M. A., Ting, H., Cheah, J. H., Ramayah, T., Chuah, F., & Cham, T. H. (2020). Sample Size for survey research: Review and recommendations. Journal of Applied Structural Equation Modelling, 4(2), 1-10. DOI:

Norman, P., Webb, T. L., & Millings, A. (2019). Using the theory of planned behaviour and implementation intentions to reduce binge drinking in new university students. Psychology and Health, 34(4), 478-496. DOI:

Protogerou, C., Johnson, B. T., & Hagger, M. S. (2018). An integrated model of condom use in Sub- Saharan African youth: A meta-analysis. Health Psychology, 37(6), 586-602. DOI:

Ramayah, T., Cheah, J., Chuah, F., Ting, H., & Memon, M. A. (2018). Partial Least Squares Structural Equation Modelling (PLS-SEM) using SmartPLS 3.0 An Updated and Practical Guide to Statistical Analysis: Second Edition. Pearson.

Sekaran, U., & Bougie, R. (2016). Research method for business: A skill building approach (7th Ed). John Wiley and Sons Ltd.

Stein, J. C. (2002). Information production and capital allocation: Decentralised vs hierarchical firms. Journal of Finance, 57(5), 1891-1921. DOI:

Taylor, S., & Todd, P. A. (1995). Understanding Information Technology Usage: A Test of Competing models. Information System Research, 144-176.

Wasiuzzaman, S., Nurdin, N., Abdullah, A. H., & Vinayan, G. (2020). Creditworthiness and access to finance: a study of SMEs in the Malaysian manufacturing industry. Management Research Review, 43(3), 293-310. DOI:

Yong, W. K. (2019). Factors influencing bank officers into recommending financial products to SME’s: A Literature Review. International Journal of Innovation and Business Strategy, 12(2), 1-26.

Zairani, Z., & Zaimah, Z. A. (2013). Difficulties in securing funding from banks: Success factors for small and medium enterprises (SMEs). Journal of Advanced Management Science, 1(4), 354-357. DOI:

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

18 August 2023

Article Doi

eBook ISBN

978-1-80296-963-4

Publisher

European Publisher

Volume

1

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1050

Subjects

Multi-disciplinary, Accounting, Finance, Economics, Business Management, Marketing, Entrepreneurship, Social Studies

Cite this article as:

Yong, W. K., & Md Husin, M. (2023). Minimising Lending Risk From Small to Medium-Sized Enterprises by Understanding Sales Officer’s Intentions. In A. H. Jaaffar, S. Buniamin, N. R. A. Rahman, N. S. Othman, N. Mohammad, S. Kasavan, N. E. A. B. Mohamad, Z. M. Saad, F. A. Ghani, & N. I. N. Redzuan (Eds.), Accelerating Transformation towards Sustainable and Resilient Business: Lessons Learned from the COVID-19 Crisis, vol 1. European Proceedings of Finance and Economics (pp. 581-589). European Publisher. https://doi.org/10.15405/epfe.23081.51