Chief Financial Officers and Environmental, Social and Governance: Preliminary Evidence From Malaysia

Abstract

Environmental, social and governance (ESG) continues to be the most significant risk facing the world in the next decade. Failure in climate change adaptation and mitigation, extreme weather, loss of biodiversity, erosion of social cohesion, livelihood crises and infectious diseases were among the major concerns being highlighted in the recent World Economic Forum’s survey. Countries around the globe have been working together to address these risks by responding to the 2030 Agenda for Sustainable Development and continuous monitoring of its 17 goals since September 2015. In a similar vein, there have been many calls for the chief financial officers (CFOs) to lead their organisational journey towards sustainability. The launching of CFO Principles on Integrated SDG Investments and Finance in year 2020 and CFO Coalition for the SDGs recently have cemented the significant role of CFOs in sustainability. In Malaysia, the national accounting regulatory body – Malaysian Institute of Accountants (MIA) – have set ESG high on its agenda and it is to be embraced by all its members. Drawing upon upper echelons perspective and resource-based theory, this research presents preliminary evidence on the relationship between CFO characteristics and ESG ratings among public listed companies in Malaysia. Based on the analysis of 252 companies for the year 2022, we observed the influence of CFO professional qualification, ethnicity, and tenure. This research focuses on a topic which has not been extensively investigated by the past researchers. Furthermore, it offers practical implications on matters related to CFOs in ensuring corporate sustainability.

Keywords: Chief financial officer, ESG, sustainability, upper echelons perspectives, resource-based theory, Malaysia

Introduction

Since year 2006, the World Economic Forum (WEF) has been documenting global risks based on their likelihood of occurrence and severity of the potential impact. In its first publication, oil price shock (category: economic), influenza pandemic (societal), terrorism (geopolitical) and climate change (environmental) represented the four major risk scenarios (WEF, 2006). Economic and geopolitical risks continued to be a major concern for a decade (WEF, 2015) before societal and environmental rose up the rank dominating the list from year 2016 (WEF, 2016). In the most recent survey, environmental- and societal- related risks accounted for 80 percent of global risks with the most severe impact in the next decade (WEF, 2022). Figure 1 depicts the findings of the survey.

The initiatives by the United Nations (UN) have been instrumental as the world are taking actions to address these risks. On 25 September 2015, 193 UN members have unanimously adopted the 2030 Agenda for Sustainable Development with its 17 goals – famously known as Sustainable Development Goals (SDGs) - at the UN Sustainable Development Summit in New York. Collectively, there are 169 targets being set to be achieved by the year 2030. Until now, there were 3,508 events conducted, 1,326 publications released and 6,535 actions towards achieving SDGs (UN, 2022). Furthermore, in combating climate change, various agreements have taken place under the UN Framework Convention on Climate Change (UNFCCC) including the Copenhagen Accord in year 2009, the Paris Agreement in 2015 and more recently the Glasgow Climate Pact in 2021. As one of the countries adopting the 2030 Agenda and party to UNFCCC, Malaysia is committed to sustainability agenda, particularly in the areas of low carbon practices, environment and biodiversity, community empowerment, and sustainability sukuk (MOF, 2021). On 27 January 2022, the Honourable Prime Minister launched the MySDG Fund with initial contribution of RM20 million to support the national medium- and long- term SDG targets (MOF, 2022).

Failure to manage sustainability issues were costly to organisations. The Deepwater Horizon oil spill, the Volkswagen dieselgate scandal, and Facebook personal data privacy scandal are some of the high-profile cases involving billion-dollar losses (Principles for Responsible Investment [PRI], 2022b). These huge losses impacted shareholders greatly, hence the concept of responsible investing which incorporates “environmental, social and governance (ESG) factors in investment decisions and active ownership” (PRI, 2022b) has been increasingly important over the years. According to KPMG (2019), sustainable investing assets were worth $30 trillion in year 2018 with a 34-percent increase in two years. The emergence of socially responsible investment (SRI) indexes such as the Dow Jones Sustainability Indices, the FTSE4Good Index Series, and MSCI ESG Indexes further support the implementation of ESG strategies and initiatives by companies. In Malaysia, FTSE4Good Bursa Malaysia (F4GBM) Index was launched in December 2014 to support investors in making investments based on ESG criteria. The criteria, assessed by FTSE Russell, comprised 14 ESG themes with more than 300 indicators (Bursa Malaysia, 2022b). As of 20 June 2022, there were 87 companies made up the constituents of F4GBM Index (Bursa Malaysia, 2022c).

The significant impact of ESG mismanagement and the increasing trend of SRIs call for the proactive role of person whose responsibility is to manage the financial affairs of the organisation, often known as the chief financial officer (CFO). In relation to ESG, CFOs are expected to consider sustainability in making decisions that will create economic values to the organisation (MIA, 2018). This is also consistent with International Federation of Accountants (IFAC)’s (2013) recommendation in describing the role of CFOs as the “integrator and navigator” in the context of corporate reporting to the stakeholders (p. 15). As SDGs are rising up boardroom agendas (Association of Chartered Certified Accountants [ACCA], 2017), such integration and navigation are inevitable. Furthermore, on 21 September 2020, UN Global Compact introduced CFO Principles on Integrated SDG Investments and Finance as a support to companies in their transition towards and financing of sustainable development (UN Global Compact, 2020). On 29 March 2022, UN Global Compact launched CFO Coalition for the SDGs to steer more private sector investment towards sustainable development (UN Global Compact, 2022b). Within two months since its launching, the Coalition has 69 members involving 36 industries across five regions with collective market capitalisation worth US$1.5 trillion and approximately US$500 billion of SDG-aligned investments between year 2021 and 2025 (UN Global Compact, 2022a).

Considering the growing expectation on CFOs towards corporate ESG/sustainability agenda, it is of importance to examine whether there is a link between ESG attributes and the characteristics of the CFO. Such a relationship can be expected, at least, from two theoretical perspectives. According to Hambrick and Mason (1984) who introduced upper echelons perspective, organisation (and its outcomes) reflects its top management. Furthermore, Barney’s (1991) firm resource model of sustained competitive advantage, famously known as resource-based theory, postulates the importance of organisational resources to sustain competitive advantage. In this context, CFOs are deemed both top management and organisational resource. However, there has been a dearth of empirical literature examining the association between CFO and ESG and/or sustainability. Of these studies, there is a predominance of research examining the relationship in the US context (Guo et al., 2021; Wang et al., 2021; Sun et al., 2015; Sun & Rakhman, 2013). Therefore, the CFO-ESG relationship in other countries with different institutional settings remains an interesting question for investigation.

This research aims to examine the relationship between CFO characteristics and ESG performance in Malaysia. Specifically, we investigate the role of CFO gender, educational background, professional qualification, ethnicity, international experience, directorship, age, and tenure on FTSE Russell’s ESG Ratings. In so doing, we contribute to the body of knowledge by addressing the gaps in the literature on the role of corporate finance function towards ESG/sustainability in a developing country’s setting. The research offers practical and policy implications particularly in the context of important CFO attributes that can help organisations in their corporate sustainability agenda and the need to revisit policies pertaining to CFO competency and composition.

The remaining sections of the paper are structured as follows. Section 2 reviews the related literature and discusses the theories and hypothesis development. Section 3 describes the research methods. Section 4 presents the findings. Section 5 provides the conclusion, research implications, limitations, and recommendations for future research.

Literature Review and Hypothesis

Overview of ESG

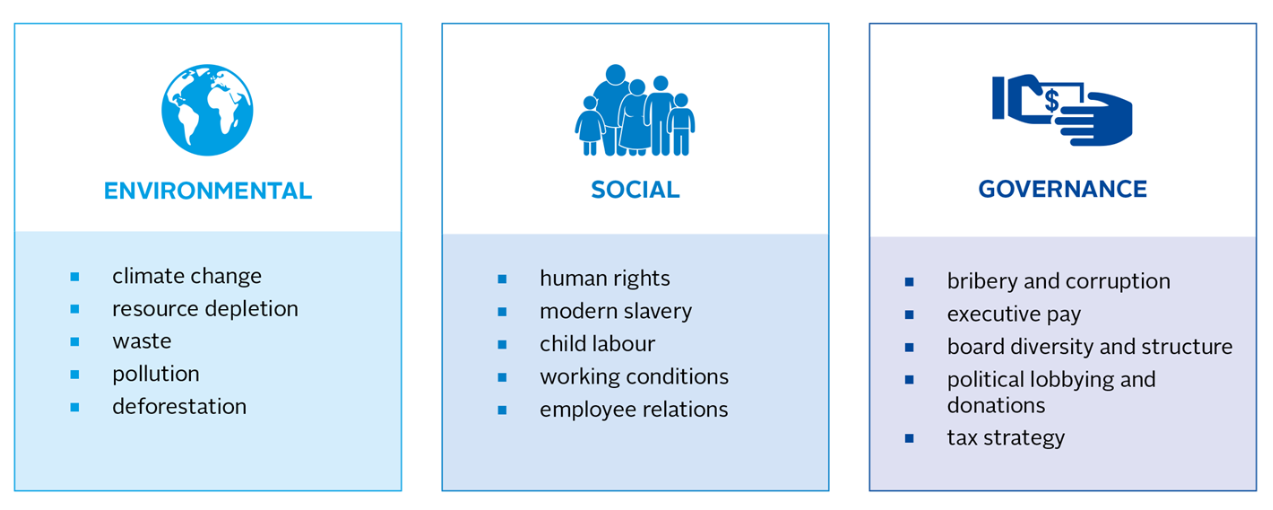

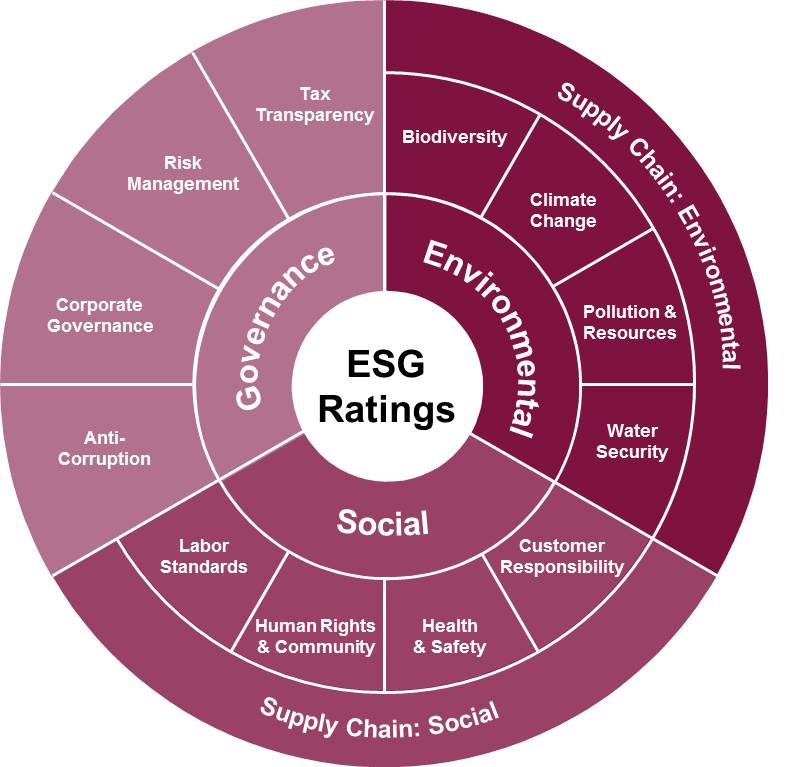

The concept of ESG has started to gain popularity since the launch of the Principles for Responsible Investment by the PRI Association, a London-based global organisation that promotes responsible investment practices, in year 2006 (PRI, 2022b). The PRI laid down six principles emphasising on the need to implement and report on initiatives promoting environmental, social and governance matters (PRI, 2022a). There is no general definition of ESG; however, Figure 2 provides examples of ESG issues to be integrated in investment decision making (PRI, 2022b). In assisting the investors to make ESG-informed decisions, various rating agencies have been established which set the ESG criteria, including S&P Global for Dow Jones Sustainability Indices, FTSE Russell for FTSE4Good Index Series and MSCI Inc. for MSCI Indexes. Figure 3 depicts the scope of assessment used by FTSE Russell, which indirectly defines what constitutes ESG.

ESG provides many benefits to organisations. According to McKinsey (2019), ESG leads to higher growth, cost reductions, lower tendency of regulatory and legal interventions, increased productivity and optimisation of investment and assets. This is further evident in the findings of empirical research. ESG was found to be associated with improved firm performance (Brooks & Oikonomou, 2018; Friede et al., 2015; Huang, 2019), lower cost of capital (Atan et al., 2018; Wong et al., 2021) and better countries’ economy as a whole (Tanjung, 2021).

CFO and prior empirical research

MIA (2018) defines CFO as,

“…the most senior person involved in the finance function of an organisation whose primary role normally includes being overall responsible for managing all financial aspects of the organisation including assessing financial risks and controls, managing budgets, preparing financial statements, and providing financial information. CFOs are normally authorised by the Board of Directors to sign the statutory declaration on the correctness of the financial statements of an entity in accordance with the Companies Act 2016 in Malaysia” (p. 6).

The traditional role of CFOs has been on managing the financial affairs of organisations; hence sustainability was always deemed to be outside their job scope. Over the years, increased realisation of the significant financial implications from ESG mismanagement and the growing interest towards responsible investing have expanded the role of CFOs in organisations. CFOs are expected to be effective organisational leaders by taking into consideration sustainability factors while making decisions and creating values to the organisations (MIA, 2018; IFAC, 2013). Furthermore, they have been a number of discussion papers by the accounting professional bodies and consulting firms calling their members to have a sustainability mindset in discharging responsibilities (Chartered Institute of Management Accountants [CIMA], 2010, 2011; Deloitte, 2021, 2020; Ernst & Young, 2022; 2011; Institute of Management Accountants [IMA], 2018; Institute of Singapore Chartered Accountants [ISCA], 2017; KPMG, 2021;).

The literature examining the role of CFOs on various accounting practices is burgeoning. For example, Habib and Hossain (2013) presented a review of studies linking CFO (and CEO) characteristics with financial reporting quality, emphasising on CFO turnover, managerial confidence, and gender. In another review paper, Alrazi et al. (2021) found that the most examined CFO characteristics were gender, age, education, tenure, professional qualification, and directorship. However, studies on ESG/sustainability are still limited. Table 1 provides a summary of these studies. Based on the table, several observations could be made. Firstly, majority of the studies focused their examination on the US environment; hence, the understanding of CFO-ESG relationship in other countries is relatively underdeveloped. It is well established in the literature that differences in country settings have resulted in different findings (see, for example, Dangelico et al., 2020; Piwowar-Sulej, 2022; Sandhu et al., 2019; Song et al., 2018). Secondly, professional qualification, age, outside hiring, gender, education, and tenure of the CFOs were found to be significant factors.

Apart from the studies listed in Table 1, there are also empirical research in Malaysia linking CFO characteristics and earnings conservatism and quality of corporate reporting. Based on 1,004 firm-year observations, Ismail et al. (2021) found the influence of CFO gender, age, education level, and ethnicity. Moreover, Alrazi and Mat Husin (2021) on their assessment of 78 winners and non-winners of the National Annual Corporate Report Awards (NACRA) between year 2016 and 2020 found the influence of CFO international experience, particularly their overseas studying experience.

Hypothesis development

The basic premise of upper echelons perspective is organisations are reflective of their top management. In essence, “organisational outcomes – strategic choices and performance levels – are partially predicted by managerial characteristics” (Hambrick & Mason, 1984, p. 193). In fact, upper echelons perspective is the most frequently cited theory in explaining the relationship between the characteristics of top management/executives and a wide array of corporate behaviour (Abatecola & Cristofaro, 2020; White & Borgholthaus, 2022). The original contribution of the model proposes the influence of psychological characteristics, namely cognitive base and values as well as observable characteristics, namely age, functional tracks, other career experiences, education, socioeconomic roots, financial position, and group characteristics (Hambrick & Mason, 1984). Over the years, the list of characteristics has grown to include tenure, leadership style, race, and gender (Abatecola & Cristofaro, 2020). Apart from CEO, CFO is another key personnel in an organisation, often term as C-suite (Groysberg et al., 2011). Furthermore, MIA (2018) has identified six roles of a CFO to ensure his/her effectiveness as depicted in Figure 4 below. This makes the function of CFO central to the organisational choices and performance.

Competitive advantage can be sustained subject to the resources available to and owned by the organisations. Furthermore, the resources must be valuable, rare, and neither imitable nor substitutable (Barney, 1991). They include “all assets, capabilities, organisational processes, firm attributes, information, knowledge, etc.” (Barney, 1991, p. 101). The appointment of a CFO is often after meeting the recruitment criteria; hence their knowledge, experience, and other attributes are under scrutiny. It is in this sense that a CFO could be a valuable resource to an organisation in sustaining their competitive advantage. Since knowledge and expertise are intangible (Branco & Rodrigues, 2006), CFO capabilities are deemed difficult to imitate and substitute until he/she leaves the organisation for another job. The focus of this research is on ESG in which the performance of organisations being assessed by a third-party organisation which clearly provides competitive advantage over the other competitors. Taking all these arguments into consideration, we hypothesise that,

H1 = There is a significant difference in corporate ESG performance across CFO characteristics.

Following the previous literature, we examine CFO gender, education, professional qualification, ethnicity, international experience, directorship, age, and tenure.

Methods

Sample and data collection

The sample of this research consisted of public listed companies (PLCs) in FTSE Bursa Malaysia (FBM) Emas Index with ESG Ratings based on June 2022 review results (Bursa Malaysia, 2022a). FBM Emas Index represents companies from the FTSE Bursa Malaysia Top 100 Index and FTSE Bursa Malaysia Small Cap Index (Bursa Malaysia, 2022b). The ESG Ratings were issued by FTSE Russell based on more than 300 indicators covering the pillars of ESG. Companies were given the following ratings: (i) (Top 25% by ESG Ratings); (Top 26-50%); (Top 51-75%); and (Bottom 25%). The initial list comprised 267 companies.

The CFOs were identified from the annual/integrated reports for the year 2021/22. In particular, we examined the sections on profile of the directors and/or senior management. Additionally, consistent with the MIA (2018)’s definition of CFO, we also examined the statutory declaration accompanying the financial statements in the annual reports. The CFO characteristics – gender, education, professional qualification, ethnicity, international experience, directorship, age, and tenure – were hand collected from the profile sections of the reports, company websites and Bursa Malaysia website’s company announcements. Several companies were removed from the sample due to the absence of latest annual/integrated reports (two companies) and detailed information of CFOs (13). The final sample for analysis is 252 companies. Table 2 presents the distribution of sample according to industry.

Measurement of variables

The ESG ratings () were converted into numbers to enable statistical analysis, ranging from 1 (represents ) to 4 (). The measurement of CFO characteristics is based on prior literature. For this research, international experience follows the definition by Duan et al. (2020) who considered “overseas working experience, overseas studying experience, overseas permanent residence or foreign nationality” (p. 464). Furthermore, consistent with Muttakin et al. (2019), directorship considered both group and subsidiaries. Table 3 summarises the measurement of CFO characteristics.

Findings

Table 4 presents the descriptive statistics of the sample showing the frequency distribution for categorical data (i.e.,,,,,, and) and the measures of central tendency and dispersion for continuous data (i.e.,,, and). Based on the table, the average rating for ESG was 2.47 (with 1.00 being the lowest value and 4.00 being the highest). This is expected since FTSE Russell rated the companies along four ranges, namely Top 25%, Top 26-50%, Top 51-75% and Bottom 25%. The assessment of CFO found majority of them were male (69.8%), without advanced degree in business or related fields (79.8%), certified by professional bodies (71.4%), non-Malays (83.7%), having international experience (80.6%) and company directors (58.3%). On average, they were 51 years old and have been in the position for 5.78 years.

is 1 if the CFO is female, 0 if male. is 1 if the CFO has an advanced degree in business or related fields, and 0 otherwise. is 1 if the CFO has a CPA certification, and 0 otherwise. is 1 if the CFO is Malay, 0 if otherwise. is 1 if the CFO has international experience, and 0 otherwise. is 1 if the CFO serves on the board, and 0 otherwise. is ESG Ratings. is actual age of the CFO. is number of years the officer has been the firm’s CFO.

Although not tabulated, three of the CFOs had a postgraduate degree in non-business field (i.e., computer science and engineering) and 15.9 percent had Master of Business Administration (MBA) degree. In terms of professional qualification, the majority claimed to be members of ACCA (28.2%), followed by CPA Australia (18.7%), Malaysian Institute of Certified Public Accountants (MICPA - 13.5%), CIMA (8.3%), and Institute of Chartered Accountants in England and Wales (ICAEW - 4.4%). Other professional qualifications make up about 7.1 percent from the CFOs, with about eight percent had more than one qualification. Chinese CFOs made up 76.6 percent of the sample, while Indian and other ethnic groups represented eight percent and four percent, respectively. On the international experience ground, majority of the CFOs gained such experience through studying (49.2%). About 27.8 percent have had experience working overseas, while 6.3 percent were CFOs with foreign nationality, namely Australia (3 CFOs), Singapore (3), India (2), Taiwan (2), the Philippines (2), France (1), German (1), Norway (1), and South Korea (1). Based on the profile disclosed, none of the CFOs were stated to have permanent resident status from a foreign country. Finally, of the 58.3 percent of the CFOs who served the board, 56 (or about 38.1%) were the directors of the sample PLCs, while the remaining were serving the boards of either subsidiaries or other companies.

In order to examine whether there is a significant association between the CFO characteristics and ESG ratings, and were divided into two groups using median value as the basis of classification. CFOs with values greater than the median were assigned one (1) and zero (0) if otherwise. Consequently, 119 CFOs being assigned to the ‘older’ group (‘younger’ = 133), while 126 CFOs to the ‘longer tenure’ group (‘shorter tenure’ = 126). Table 5 presents the result of Mann-Whitney U test.

(1) is 1 if the CFO’s age is above the median, 0 if otherwise. (1) is 1 if the CFO’s tenure is above the median, 0 if otherwise. Other variables were defined in Table 4. *** is significant at the 0.01 level. *** is significant at the 0.05 level. * is significant at the 0.10 level. All tests were two-tailed.

Based on Table 5, higher ESG Ratings were associated with CFOs who were Malay (=0.000) and had shorter tenure (=0.004) as well as professional qualification (=0.098). The analysis was repeated using independent-sample-test and produced consistent results. A closer investigation on CFO ethnicity reveals that 78 percent of companies with Malay CFOs received either 3-star or 4-star ratings from FTSE Russel. This is in comparison to 41 percent for Chinese CFOs (=0.000), 62.5 percent for Indian CFOs (=0.106) and 60 percent for CFOs from other ethnic groups (=0.509). The positive impact of Malay executives, in this case CFOs, is consistent with the previous literature which found the presence/extent of Malay executives/directors led to greater voluntary disclosure (Haniffa & Cooke, 2002) and corporate social responsibility disclosure (Alazzani et al., 2019; Haniffa & Cooke, 2005), better accrual quality (Hashim, 2012), and more conservative approach in accounting (Ismail et al., 2021).

Holding the same position for a long period of time may compromise executives’ desire to demonstrate their personalities and abilities to stakeholders and make impactful decisions that create organisational values (Khan et al., 2021). In this research, we found organisations with shorter CFO tenure being rated higher than their counterparts (=0.004). This provides support to the prior research which found the association between shorter executive/director tenure with corporate social and environmental responsibility (Chen et al., 2019; Khan et al., 2020; Khan et al., 2021; Khan, Gang, Fareed, Quresh et al., 2021).

There is a significant, albeit weak, association between professional qualification of CFOs and ESG Ratings (=0.098). Based on Table 4 earlier, 71.4 percent of the CFOs in this research had professional qualification. We conducted additional analysis by qualification. Although ACCA was the dominant qualification, we found that it was ICAEW qualification that had a positive association with ESG Ratings (=0.009). About 82 percent of companies with CFOs having ICAEW qualification were in the 3-star or 4-star ratings category. We did not find significant association for other professional qualifications (i.e., CIMA, MICPA, CPA Australia, and others). Regardless, the finding highlights the importance of obtaining professional qualifications towards achieving ESG targets. It also provides support to Guo et al.’s (2021) study on corporate social responsibility disclosure and Sun et al.’s (2015) investigation on governance concerns.

Other CFO characteristics –,,,, and – were not significantly associated with ESG ratings. Since,, and consisted of several components, we broke down the analysis by each component. For, we conducted two additional analyses, namely if the CFOs have any postgraduate degree and if the CFOs have an MBA degree. We did not find any significant association. For, the experience was divided into (i) working, (ii) studying, and (iii) foreign nationality. The relationship between overseas studying experience and ESG Ratings is positive and significant (=0.051). This is consistent with the findings by Alrazi and Mat Husin (2021). Finally, for, we examined if becoming a director of the company (instead of subsidiaries or any other companies) had any impact on ESG Ratings. We found that companies with CFOs who were also their directors received lower ESG Ratings (=0.000). The finding, however, is contradicting with previous literature which found CFO directors improved financial reporting quality (Wang & Wan, 2019) and inclined towards accounting conservatism (Muttakin et al., 2019).

Overall, the findings are in line with the argument of upper echelons perspective that organisational outcomes (ESG Ratings) are reflective of the top managers’ (CFO) characteristics. Similarly, it also echoes the prediction that competitive advantage, as represented by ESG Ratings, is a function of resources available to or owned by the organisation, in this context CFO characteristics. Since not all characteristics were found to be significant, the findings provide partial support to the hypothesis developed.

Conclusion and Implications

The 2030 Agenda for Sustainable Development and its 17 SDGs have set 169 targets to be achieved by year 2030. For countries to achieve these targets, support from the business community is crucial. Contribution towards ESG can be a significant catalyst to steer a country’s journey towards sustainability. There has been increasing expectation for CFOs to step up and lead organisations in promoting sustainability agenda. Realising the pivotal role of CFOs, this research presented preliminary evidence on the association between CFO characteristics and ESG Ratings in Malaysia. Overall, we found that a good ESG rating is a function of CFO ethnicity, tenure, and professional qualification. From a theoretical perspective, this research contributed to the dearth of literature examining CFO and sustainability. In so doing, it enhances the discussion of CFO characteristics-ESG ratings from the perspectives of upper echelon and resource-based view.

As evident from the research, most CFOs were Chinese. Despite that, the findings hinted at the proclivity of companies with Malay CFOs to be more forthcoming on ESG matters. This unbalanced composition of accountants particularly in Malaysia had been a major concern in recent years with a statistic reported that Bumiputra accountants represented only eight percent of total accountants. The target was to increase the representation to 30 percent or 18,000 by the year 2020 (Annuar, 2015). Since the timeline has passed and the composition (based on the data for this research) remained below 20 percent, the government needs to take more aggressive measures to increase the number. The role of organisations such as Yayasan Peneraju Pendidikan Bumiputera, TalentCorp Malaysia, and National Higher Education Fund Corporation, to name but a few, needs to be strengthened to ensure more Bumiputra particularly Malay accountants could be produced and climb the corporate ladder. This could potentially help enhance ESG initiatives which are important in achieving the country’s SDG targets.

CFOs who have been in the same position for some time might have lost their abilities to make important decisions on ESG matters and desire for innovation. This scenario suggests the importance of job rotation in discharging responsibilities more effectively. At present, there is no specific requirement for how long an officer can hold the position, hence it is very much of a company’s discretion. Perhaps there is a need for intervention by either Bursa Malaysia as the national stock exchange or MIA which governs its members’ professional affairs to relook on this matter. Another potential mechanism is to ensure that these CFOs have trainings on ESG consistently and ESG to be incorporated into the compensation system. The Malaysian Institute of Corporate Governance (MICG) could also consider these elements in the corporate governance code.

Finally, this research also documented the importance of professional qualification. Although more than 70 percent of the CFOs had professional qualification, there were still many who without any qualification. Since companies who have CFOs with professional qualification fared better in ESG ratings, there is a need for MIA to consider whether having a professional qualification should be set as a requirement to be a CFO in the future. Over the years, accounting professional bodies have been playing their role in disseminating knowledge on sustainability through various mechanisms, including integration into syllabus, publication of surveys and relevant reports/viewpoints, training to members, sponsoring sustainability-related awards, and so on. Such exposures have enabled their members to enhance the awareness, knowledge, and expertise on ESG.

The findings should be interpreted with caution. Firstly, this research is cross sectional in nature. A longitudinal study providing the trend in CFO characteristics and ESG Ratings will provide better understanding of the relationship between these two variables. Secondly, it only considered several characteristics of CFO. Future studies may consider the CFO social ties (Kuang et al., 2022; Qi et al., 2017) and CFO compensation (Caglio et al., 2018; Profitlich et al., 2021). Thirdly, we only conducted bivariate analyses, hence did not consider other variables that could influence the ESG Ratings. Multivariate analyses incorporating factors such as firm size, profitability, leverage and audit firm (Alrazi & Mat Husin, 2021) will enhance the robustness of research and improve our understanding of the CFO-ESG relationship.

Acknowledgments

The authors would like to thank the Ministry of Higher Education Malaysia (MOHE) for the research grant received to undertake this research (FRGS/1/2019/SS01/UNITEN/02/3).

References

Abatecola, G., & Cristofaro, M. (2020). Hambrick and Mason’s “Upper Echelons Theory”: evolution and open avenues. Journal of Management History, 26(1), 116-136.

ACCA. (2017). The Sustainable Development Goals: Redefining Context, Risk and Opportunity, London: Association of Chartered Certified Accountants. https://www.accaglobal.com/content/dam/ACCA_ Global/professional-insights/The-sustainable-development-goals/pi-sdgs-accountancy-profession.pdf

Alazzani, A., Wan-Hussin, W. N., & Jones, M. (2019). Muslim CEO, women on boards and corporate responsibility reporting: Some evidence from Malaysia. Journal of Islamic Accounting and Business Research, 10(2), 274-296.

Alrazi, B., Husin, N. M., & Ali, I. M. (2018). Does CFO expertise matter? A case of corporate water reporting among Malaysian public listed companies. Global Business and Management Research, 10(3), 239. https://www.proquest.com/openview/3a22a18e79f75a504741cebd87aca8c4/1?pq-origsite=gscholar&cbl=696409

Alrazi, B., & Mat Husin, N. (2021). Chief financial officers‘ international experience and corporate reporting quality: Evidence from Malaysia. Global Business and Management Research: An International Journal, 13(4s), 1091-1111. http://www.gbmrjournal.com/pdf/v13n4s/V13N4s-94.pdf

Alrazi, B., Mat Husin, N., Mohd. Ali, I., Nik Azman, N. A. N., & Mohd Nor, M. N. (2021). Chief financial officers and corporate sustainability: A literature review and research agenda. IOP Conference Series: Earth and Environmental Science, 943, 012032.

Annuar, A. (2015). Wahid Calls for More Bumiputera Accountants, Govt to Produce 18,000 Professionals by 2020. The Edge Markets. https://www.theedgemarkets.com/article/wahid-calls-more-bumiputera-accountants-govt-produce-18000-professionals-2020

Atan, R., Alam, M. M., Said, J., & Zamri, M. (2018). The impacts of environmental, social, and governance factors on firm performance: Panel study of Malaysian companies. Management of Environmental Quality, 29(2), 182-194.

Barney, J. (1991). Firm resources and sustained competitive advantage, Journal of Management, 17(1), 99-120.

Branco, M. C., & Rodrigues, L. L. (2006). Corporate social responsibility and resource-based perspectives, Journal of Business Ethics, 69(2), 111-132.

Brooks, C., & Oikonomou, I. (2018). The effects of environmental, social and governance disclosures and performance on firm value: A review of the literature in accounting and finance. The British Accounting Review, 50(1), 1-15.

Bursa Malaysia. (2022a). ESG Ratings of PLCs assessed by FTSE Russell in accordance with FTSE Russell ESG Ratings Methodology. Bursa Malaysia. https://www.bursamalaysia.com/sites/5d809dcf39 fba22790cad230/assets/62b2c5195b711a178d2395dc/ESG_Ratings_of_PLCs_assessed_by_FTSE_Russell_n_Index_Constituents.pdf

Bursa Malaysia. (2022b). FTSE4Good Bursa Malaysia (F4GBM) Index. Bursa Malaysia. https://www.bursamalaysia.com/trade/our_products_services/indices/ftse4good-bursa-malaysia-f4gbm-index

Bursa Malaysia. (2022c). FTSE4Good Bursa Malaysia June 2022 Semi-Annual Review. Bursa Malaysia. https://www.bursamalaysia.com/sites/5bb54be15f36ca0af339077a/content_entry5c11a9db758f8d31544574c6/62a1d0c339fba243e5321d36/files/June9_2022_FTSE4GOOD_BURSA_MALAYSIA_JUNE_2022_SEMI-ANNUAL_REVIEW.pdf?1654779826

Caglio, A., Dossi, A., & van der Stede, W. A. (2018). CFO role and CFO compensation: An empirical analysis of their implications. Journal of Accounting and Public Policy, 37(4), 265-281. https://doi.org/10.1016/j.jaccpubpol.2018.07.002

Chen, W. T., Zhou, G. S., & Zhu, X. K. (2019). CEO tenure and corporate social responsibility performance. Journal of Business Research, 95, 292-302.

CIMA. (2010). Accounting for Climate Change - How Management Accountants Can Help Organisations Mitigate and Adapt to Climate Change. Chartered Institute of Management Accountants. https://www.cimaglobal.com/Documents/Thought_leadership_docs/cid_accounting_for_climate_change_feb10.pdf

CIMA. (2011). Sustainability Performance Management: How CFOs Can Unlock Value. Chartered Institute of Management Accountants. https://issuu.com/cimaglobal/docs/accenture-sustainability-report

Dangelico, R. M., Fraccascia, L., & Nastasi, A. (2020). National culture's influence on environmental performance of countries: A study of direct and indirect effects. Sustainable Development, 28(6), 1773-1786.

Deloitte. (2020). How CFOs Can Help Companies Weather Climate Change. Deloitte Development LLC. https://www2.deloitte.com/us/en/pages/finance/articles/cfo-insights-how-cfos-can-help-companies-weather-climate-change.html

Deloitte. (2021). The CFO as the Driver of Sustainability. Deloitte Development LLC. https://www2.deloitte.com/content/dam/Deloitte/de/Documents/finance-transformation/CFO-as-the-Driver-of-Sustainability.pdf

Duan, T., Hou, W., & Rees, W. (2020). CEO international experience and foreign IPOs. Economic Modelling, 87, 461-470.

Ernst & Young. (2011). Climate Change and Sustainability - How Sustainability Has Expanded the CFO’s Role. Ernst & Young LLP. https://www.sustainabilityexchange.ac.uk/files/how_sustainability_ has_expanded_the_cfos_role.pdf

Ernst & Young. (2022). Why CFOs are Key to a Sustainable Future. Ernst & Young LLP. https://assets.ey.com/content/dam/ey-sites/ey-com/pt_br/topics/cfo-agenda/why-cfos-are-key-to-a-sustainable-future.pdf

Friede, G., Busch, T., & Bassen, A. (2015). ESG and financial performance: Aggregated evidence from more than 2000 empirical studies. Journal of Sustainable Finance & Investment, 5(4), 210-233.

FTSE Russell. (2022). ESG Ratings. FTSE Russell. https://www.ftserussell.com/data/sustainability-and-esg-data/esg-ratings

Groysberg, B., Kelly, L. K., & MacDonald, B. (2011). The new path to the C-suite. Harvard Business Review, March, 1-10. https://hbr.org/2011/03/the-new-path-to-the-c-suite

Guo, J., Kim, S., Yu, Y., & Kim, J. Y. J. (2021). Does CFO accounting expertise matter to corporate social responsibility disclosure in 10-Ks? Journal of Applied Accounting Research, 22(5), 800-822.

Habib, A., & Hossain, M. (2013). CEO/CFO characteristics and financial reporting quality: A review. Research in Accounting Regulation, 25(1), 88-100.

Hambrick, D. C., & Mason, P. A. (1984). Upper echelons: The organization as a reflection of its top managers, Academy of Management Review, 9(2), 193-206.

Haniffa, R. M., & Cooke, T. E. (2002). Culture, corporate governance and disclosure in Malaysian corporations. Abacus, 38(3), 317-349.

Haniffa, R. M., & Cooke, T. E. (2005). The impact of culture and governance on corporate social reporting. Journal of Accounting and Public Policy, 24(5), 391-430.

Hashim, H. A. (2012). The influence of culture on financial reporting quality in Malaysia. Asian Social Science, 8(13), 192-200.

Huang, D. Z. X. (2019). Environmental, social and governance (ESG) activity and firm performance: a review and consolidation. Accounting & Finance, 61(1), 335-360.

IFAC. (2013). The Role and Expectations of a CFO - A Global Debate on Preparing Accountants for Finance Leadership. International Federation of Accountants. https://www.ifac.org/system/files/publications/files/Role%20of%20the%20CFO.pdf

IMA. (2018). Sustainability CFO: The CFO of the Future? The Association ofAccountants and Financial Professionals in Business. https://www.imanet.org/insights-and-trends/external-reporting-and-disclosure-management/sustainability-cfo-the-cfo-of-the-future?ssopc=1

ISCA. (2017). Chief Financial Officers for Sustainability Reporting - ISCA Sustainability Roundtable Report. Institute of Singapore Chartered Accountants. https://www.isca.org.sg/standards-guidance/sustainability-and-climate-change/thought-leadership/isca-sustainability-roundtable-report-chief-financial-officers-for-sustainability-reporting

Ismail, I., Shafie, R., & Ku Ismail, K. N. I. (2021). CFO attributes and accounting conservatism: Evidence from Malaysia. Pacific Accounting Review, 33(4), 525-548.

Khan, T. M., Gang, B., Fareed, Z., & Khan, A. (2021). How does CEO tenure affect corporate social and environmental disclosures in China? Moderating role of information intermediaries and independent board. Environmental Science and Pollution Research, 28, 9204–9220.

Khan, T. M., Gang, B., Fareed, Z., & Yasmeen, R. (2020). The impact of CEO tenure on corporate social and environmental performance: an emerging country’s analysis. Environmental Science and Pollution Research, 27, 19314-19326.

Khan, T. M., Gang, B., Fareed, Z., Quresh, S., Khalid, Z., & Khan, W. A. (2021). CEO tenure, CEO compensation, corporate social and environmental performance in China: the moderating role of coastal and non-coastal areas. Frontiers in Psychology, 11, 1-13.

KPMG. (2019). The Numbers that are Changing the World. KPMG LLP. https://assets.kpmg/content/dam/kpmg/ie/pdf/2019/10/ie-numbers-that-are-changing-the-world.pdf

KPMG. (2021). The Role of Finance in Environmental, Social and Governance Reporting. KPMG LLP. https://advisory.kpmg.us/articles/2021/role-of-finance-in-esg.html

Kuang, Y. F., Liu, X. K., Paruchuri, S., & Qin, B. (2022). CFO social ties to non-CEO senior managers and financial restatements. Accounting and Business Research, 52(2), 115-149.

McKinsey. (2019). Five Ways that ESG Creates Value. McKinsey & Company. https://www.mckinsey.com/business-functions/strategy-and-corporate-finance/our-insights/five-ways-that-esg-creates-value

MIA. (2018). Competency Framework for Chief Financial Officers (“CFOs“) in Public Interest Entities. Malaysian Institute of Accountants. https://mia.org.my/wp-content/uploads/2022/04/MIA_ Competency_Framework_for_CFO_in_Public_Interest_Entities.pdf

MOF. (2021). Budget Speech 2022. The Ministry of Finance, Malaysia. https://budget.mof.gov.my/pdf/2022/ucapan/bs22.pdf

MOF. (2022). Malaysia’s First MySDG Fund to Facilitate The Nation’s Sustainable Development Agenda. The Ministry of Finance, Malaysia. https://www.mof.gov.my/portal/en/news/press-release/malaysia-s-first-mysdg-fund-to-facilitate-the-nation-s-sustainable-development-agenda

Muttakin, M. B., Khan, A., & Tanewski, G. (2019). CFO tenure, CFO board membership and accounting conservatism. Journal of Contemporary Accounting & Economics, 15(3), 100165

Piwowar-Sulej, K. (2022). Sustainable development and national cultures: a quantitative and qualitative analysis of the research field. Environment, Development and Sustainability, 24(12), 13447-13475.

PRI. (2022a). What are the Principles for Responsible Investment? PRI Association. https://www.unpri.org/about-us/what-are-the-principles-for-responsible-investment

PRI. (2022b). What is responsible investment? PRI Association. https://www.unpri.org/an-introduction-to-responsible-investment/what-is-responsible-investment/4780.article#:~:text=Responsible%20 investment%20does%20not%20necessarily,when%20assessing%20risk%20and%20return

Profitlich, M., Bouzzine, Y. D., & Lueg, R. (2021). The relationship between CFO compensation and corporate sustainability: an empirical examination of German listed firms. Sustainability, 13, 12299.

Qi, B., Yang, R., & Tian, G. (2017). Do social ties between individual auditors and client CEOs/CFOs matter to audit quality? Asia-Pacific Journal of Accounting & Economics, 24(3-4), 440-463.

Sandhu, S., Orlitzky, M., & Louche, C. (2019). How nation-level background governance conditions shape the economic payoffs of corporate environmental performance. Management Decision, 57(10), 2714-2739.

Song, F., Montabon, F., & Xu, Y. (2018). The impact of national culture on corporate adoption of environmental management practices and their effectiveness. Economics, 205, 313-328.

Sun, L., Johnson, G., & Rahman, F. (2015). CFO financial expertise and corporate governance concerns: Evidence from S&P SmallCap 600 Index. International Journal of Law and Management, 57(6), 573-581.

Sun, L., & Rakhman, F. (2013). CFO financial expertise and corporate social responsibility – Evidence from S&P 500 companies. International Journal of Law and Management, 55(3), 161-172.

Tanjung, M. (2021). Can we expect contribution from environmental, social, governance performance to sustainable development? Business Strategy and Development, 4(4), 386-398. https://doi.org/10.1002/bsd2.165

UN Global Compact. (2020). United Nations Global Compact CFO Taskforce Launches Principles for Integrated SDG Investments and Finance to Focus Private Sector Investment on Sustainable Development. United Nations. https://www.unglobalcompact.org/news/4591-09-21-2020

UN Global Compact. (2022a). CFO Coalition for the SDGs. United Nations Global Compact. https://www.cfocoalition.org/

UN Global Compact. (2022b). UN Global Compact Launches CFO Coalition for the SDGs to Drive More Private Sector Investment towards Sustainable Development. United Nations. https://www.unglobalcompact.org/news/4887-03-29-2022

UN. (2022). Do You Know All 17 SDGs? United Nations. https://sdgs.un.org/goals

Wang, B., Wang, Z., Wen, J., & Zhang, X. T. (2021). Executive gender and firm environmental management: Evidence from CFO Transitions. Sustainability, 13, 3653.

Wang, S., & Wan, X. (2019). The influence of CFO directors on accounting information quality. Advances in Social Science, Education and Humanities Research, 376, 420-426.

WEF. (2006). Global Risks 2006. World Economic Forum. https://www3.weforum.org/docs/WEF_Global_Risks_Report_2006.pdf

WEF. (2015). Global Risks 2015 – 10th Edition. World Economic Forum. https://www3.weforum.org/docs/WEF_Global_Risks_2015_Report15.pdf

WEF. (2016). The Global Risks Report 2016 – 11th Edition. World Economic Forum. https://www3.weforum.org/docs/GRR/WEF_GRR16.pdf

WEF. (2022). The Global Risks Report 2022 – 17th Edition. World Economic Forum. https://www3.weforum.org/docs/WEF_The_Global_Risks_Report_2022.pdf

White, J. V., & Borgholthaus, C. J. (2022). Who’s in charge here? A bibliometric analysis of upper echelons research. Journal of Business Research, 139, 1012-1025.

Wong, W. C., Batten, J. A., Ahmad, A. H., Mohamed-Arshad, S. B., Nordin, S., & Abdul Adzis, A. (2021). Does ESG certification add firm value? Finance Research Letters, 39. 101593.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

18 August 2023

Article Doi

eBook ISBN

978-1-80296-963-4

Publisher

European Publisher

Volume

1

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1050

Subjects

Multi-disciplinary, Accounting, Finance, Economics, Business Management, Marketing, Entrepreneurship, Social Studies

Cite this article as:

Alrazi, B., Mat Husin, N., & Mohd Nor, M. N. (2023). Chief Financial Officers and Environmental, Social and Governance: Preliminary Evidence From Malaysia. In A. H. Jaaffar, S. Buniamin, N. R. A. Rahman, N. S. Othman, N. Mohammad, S. Kasavan, N. E. A. B. Mohamad, Z. M. Saad, F. A. Ghani, & N. I. N. Redzuan (Eds.), Accelerating Transformation towards Sustainable and Resilient Business: Lessons Learned from the COVID-19 Crisis, vol 1. European Proceedings of Finance and Economics (pp. 35-51). European Publisher. https://doi.org/10.15405/epfe.23081.4