Abstract

The Islamic capital market has been revolutionized following the emergence of sustainable and responsible investing (SRI) Sukuk. SRI has also facilitated the growth of social impact bonds and green bonds, thereby promoting responsible and sustainable investment worldwide. Hence, this study sought to contribute to the existing literature of SRI Sukuk by offering an overview of SRI Sukuk as a novel Islamic financial instrument alternative that envisions social impact financing. This paper examines the academic contributions to research on SRI Sukuk and social impact financing, as well as the structure of SRI Sukuk in Malaysia, using the Khazanah SRI Ihsan Sukuk as a main reference. The present study aims to assess the viability of SRI Sukuk and its underlying mechanisms according to the SRI Sukuk Framework which was mandated by the Security Commission of Malaysia. Drawing upon the literature review, the current study highlights the prominent mechanisms of SRI Sukuk and social impact bond. Due to the novelty of SRI Sukuk, this study hopes to add to the expanding body of knowledge on Islamic finance in general and SRI Sukuk in particular.

Keywords: SRI Sukuk, social impact bond, Islamic finance

Introduction

The growing recognition of Islamic investment as a viable aspect of sustainable development (SD) and financing options has created opportunities for the substantial growth of the Islamic capital market. This is especially true in stimulating the growth of innovative financial instruments for financing SD initiatives. Several initiatives within the Islamic capital market ecosystem envision the SD. Amongst others is the novel Sustainable and Responsible Investment (SRI) Sukuk. Since the SRI Sukuk Framework was introduced by the Securities Commission Malaysia in 2014, sukuk has grown in favour of SRI instruments as a financing mechanism globally and especially in Malaysia. Malaysian Capital Markets (Capital Markets Malaysia 2 [CMM2]) (2022). Affordable housing, educational impact, social enterprises, financial inclusion, waste management, renewable energy, and water treatment are amongst the ventures that can benefit from SRI's ability (Chamberlain, 2013), while satisfying the financing needs of investors that are interested in social impact as well as financial return (Kassim & Abdullah, 2017). A new age has commenced in the Islamic capital market following the introduction of SRI Sukuk, which has also facilitated the advent of social impact bonds and green bonds. These events have enhanced responsible and sustainable investing worldwide. In 2014, the SRI Sukuk frameworks were introduced, laying the groundwork for sustainable finance, green financing, and social impact financing. Nonetheless, the literature is still scarce, especially from Islamic finance viewpoints, which necessitates greater discussion. Hence, current study aimed to enrich the existing body of knowledge on SRI Sukuk by providing an overview of SRI Sukuk as a novel Islamic financial instruments alternative that envisions social impact financing; by reviewing SRI Sukuk literature; and by analysing the structure of SRI Sukuk in Malaysia with reference from Khazanah SRI Ihsan Sukuk.

Review of Literature

The sustainable responsible investment (SRI) Sukuk

Sukuk is a plural form of “Sakk” – an Arabic word that denotes "to strike." In terms of Islamic finance, a Sukuk is described as a certificate of equivalent value that, once subscribed to, received, and utilised as intended, exemplifies the possession of joint ownership in usufructs, tangible assets, equity or services of a project or a specific form of investment (AAOIFI, 2008). There are essentially three participants involved in a Sukuk arrangement: the issuer of the Sukuk (the originator); the issuer of the sukuk certificate (the Special Purpose Vehicle (SPV)); and the buyer of the sukuk certificate (the investor). As described by the Islamic Financial Services Board (IFSB) (2009), the sukuk process involves three main steps: (i) asset origination (loans and other receivables in conventional finance, Shari'ah-compliant assets like those at issue in Ijarah in Islamic finance); (ii) the process of transferring ownership of assets to the SPV formed for the exclusive purpose of issuing securities (Sukuk); and (iii) the issuance of the securities to the buying public (investors).

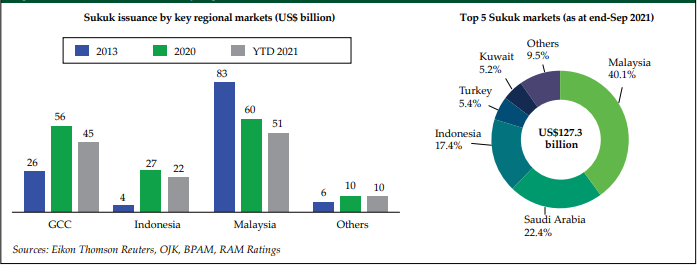

Since its inception, Malaysia has been the undisputed leader in the international Sukuk market. Sukuk issuance reached US$51.02 billion by the end of 2021, positioning it at the forefront of the global Sukuk market and accounting for 40.1% of the overall market share as refer to Figure 1 that was adopted from Ming (2022).

Sources: Ming (2022)

SRI Sukuk, like traditional Sukuk, have an issuer who solicits investors to buy the Sukuk in exchange for a coupon payment. However, it’s a one-of-a-kind financing instrument that must meet both SRI and Syariah compliance requirements. Hence, the SRI Sukuk is the remodelling of Sukuk instruments as an alternative financial instrument in which the proceeds of Islamic financing are used solely to fund activities or transactions related to eligible SRI projects (The Securities Commission Malaysia [SCM], 2019). The SRI investors with values and ethics aligning with community welfare will be interested to Sukuk that are employed to finance certain development projects such as vaccination programmes, renewable energy installations, educational initiatives, poverty, illiteracy and affordable housing programmes (Kassim & Abdullah, 2017). Consequently, SRI Sukuk issuances facilitate financial requirements for initiatives that correspond to the United Nations Sustainable Development Goals (SDGs), which broaden the investors' diversification who place a premium on SRI by providing varied alternatives (including green, social, sustainable, and waqaf properties).

Overview of sustainable and responsible investment (SRI) Sukuk in Malaysia

Given the affective and extensive history in the ancillary application of Islamic capital market and Islamic finance instruments, Malaysia is considered a model research location for Sukuk SRI. Malaysia is among the largest Sukuk (Islamic bonds) issuers worldwide as it has propelled the dynamic industry players and financial regulators as drivers of Islamic finance innovation. The country was placed on a trajectory of creating a favourable environment for SRI issuers and investors following the issuance of the SRI Sukuk framework by the SCM in 2014. The framework promotes sustainable and responsible investing that adheres to international standards and best practises that emphasise the significance of disclosure obligations' transparency. The launching of the SRI Sukuk framework aligned with the strategies outlined in the SCM Capital Market Masterplan 2 (CMP2), which is designed to facilitate responsible and sustainable financing and investing. These goals are consistent with the growing interest in green bonds and social impact bonds as aspects of the SCM’s developmental plan (SCM, 2019).

Following the first introduction of SRI Sukuk Framework in 2014, the worth of SRI Sukuk issued in Malaysia was estimated as RM 8.3 billion by the last quarter of 2021. About RM6 billions of this was certified as socially responsible investment (SRI) under the SRI Sukuk Framework and the ASEAN Green Bond Standards/ASEAN Sustainability Bond Standards. Malaysian issuances under the ASEAN Green, Social, and Sustainability Bond Standards accounted for around 18% of the total (CMM2, 2022). With a total issuance value of US$3.9 billion in SRI Sukuk across ASEAN by November 2021, Malaysia has emerged as the leader in SRI Sukuk issuance among its five ASEAN neighbours, namely Indonesia, the Philippines, Singapore, Thailand, and Vietnam (Ernst & Young, 2022). Several projects have been funded in Malaysia by SRI Sukuk, ranging from green buildings to mega-scale solar farms, and mini-hydropower plants. To date, low-carbon buildings and transportation projects, as well as renewable energy have been primarily financed by SRI Sukuk (CMM2, 2022).

Since its inception in 2018, the Green SRI Sukuk Grant Scheme has been a leading example among global models of incentive structures to assist SRI bond issuance, accelerating the growth of SRI Sukuk in the country. SRI Sukuk issuers are exempted from tax payment as a result of the Grant Scheme. Notably, the Grant Scheme being rename as SRI Sukuk and Bond Grant Scheme starting of January 2021. Grants are currently available for bonds and sukuk that adhere to the ASEAN Green, Social, and Sustainability Bond Standards (ASEAN Standards) and the SC's Sustainable and Responsible Investment (SRI) Sukuk Framework.

Social impact bond (SIB)

There is a prevalent understanding that the SIB model is related to the SRI Sukuk framework. Since then, it is generally accepted that SRI refers to any investment or strategy that has a positive social or economic impact, including environmental preservation (Marwan & Haneef, 2019).

SIB is a financing vehicle for mobilising capital to address societal issues. The Social Finance is a non-profit organisation based in the United Kingdom that is widely regarded as the impetus behind the creation of SIBs (Marwan & Haneef, 2019). Financially, SIBs are very similar to pay-for-performance schemes in that the service provider is only compensated for the results they produce (Bromberg, 2022). The first instances of SIB were documented in the UK during the early years of the 2000s. The UK Ministry of Justice introduced the first SIB initiative in 2010 to help rehabilitate male prisoners serving short sentences at Her Majesty's Prison (HMP) Peterborough (Azman et al 2022; Nagase, 2021). Afterword, the use of SIB models to reduce recidivism has gained traction in the United States (Nagase, 2021). Consequently, the SIB projects are implemented to address a wide range of societal issues such as those pertaining to lack of affordable housing, workforce development, child and familial wellbeing, health, youth development and educations, poverty, criminology, and the ecosystem (Azman et al., 2022). Therefore, the SRI Sukuk principles are the envisioned of the SIB to a certain extent, particularly in facilitating the funding of suitable SRI projects aimed at improving societal well-being.

Methodology

The current study analysed the previously published literature on SRI Sukuk frontiers and expanded its search to include literature on Sukuk and social impact bonds. Table 1 below lists some of the most prominent studies pertaining to the SRI Sukuk publication, extracted from the Scopus and WoS databases. Information was additionally verified via the Security Commission of Malaysia, Capital Market Masterplan 2, and the Malaysia Sustainable Finance Initiative websites to ensure its accuracy.

At present, there are only seven documents available from the Scopus search database that are solely focused on the SRI Sukuk using the key search phrase "SRI Sukuk". However, a search of the same keywords in the Web of Science (WoS) yielded only six documents. A Google Scholar search yielded a larger number of publications, with 284 documents across all publication years. However, discussion on SRI Sukuk from literature linked to the notions of Sukuk and social impact bond is available but remains limited.

Findings

SRI sukuk framework

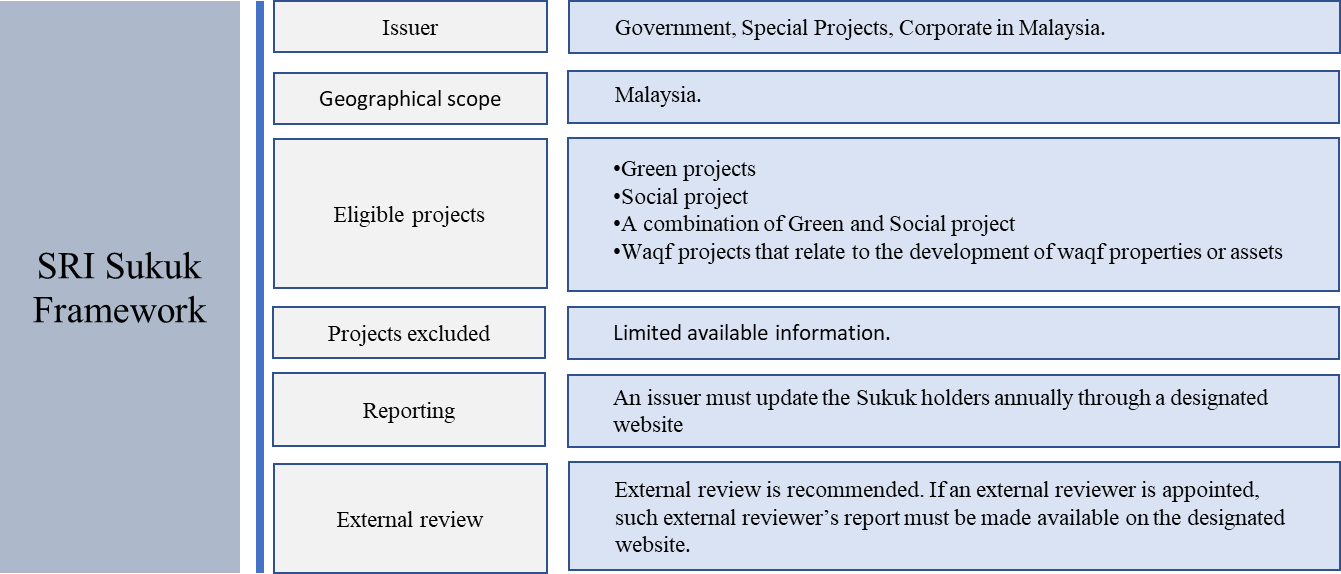

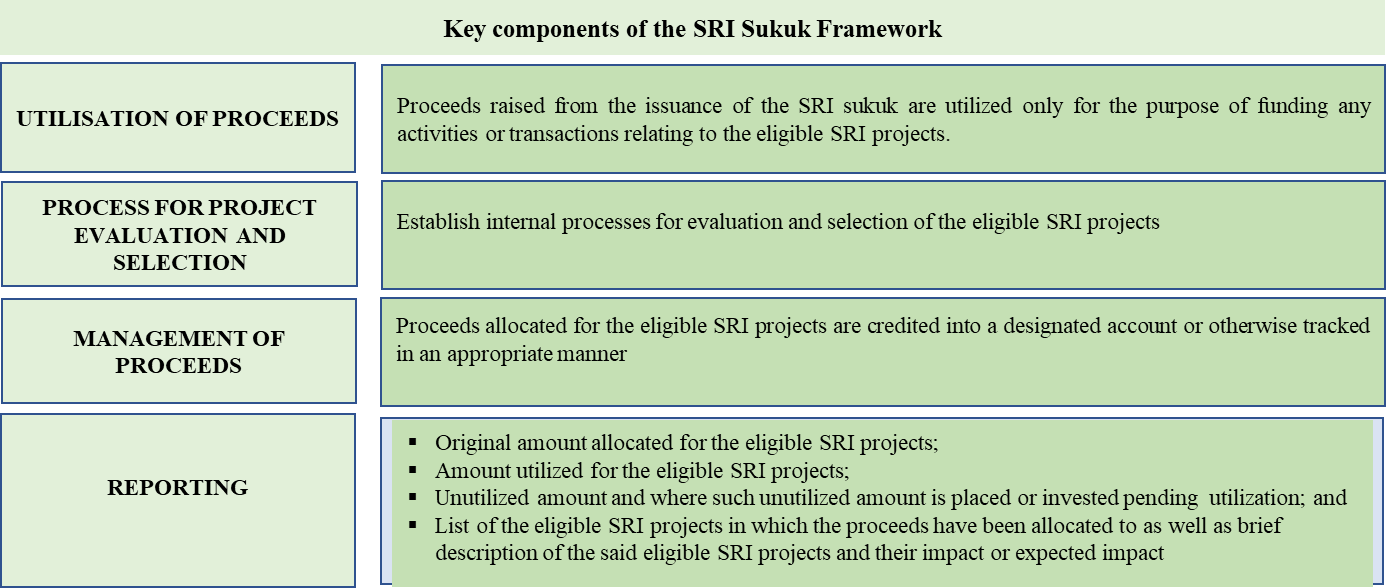

The framework for SRI Sukuk was introduced by SCM in 2014, which promotes prudent and sustainable investing for SRI issuers and investors. The SRI Sukuk Framework was revised in 2019 to produce a new version, which was designed to enhance reporting requirements, disclosure standards, and elucidate the role of external reviewers. The revised framework aligns with the requirements of SC and universally best practises and acknowledged principles that stress the significance of transparency in terms of disclosure requirements. Figure 2 depicts the framework, and Figure 3 depicts the key components of the SRI Sukuk framework that need to be adhered to all the SRI Sukuk issuances based on the publication by SCM (2019) for the overview of the SRI Sukuk framework.

Sources: Malaysia Sustainable Finance Initiative (MSFI)

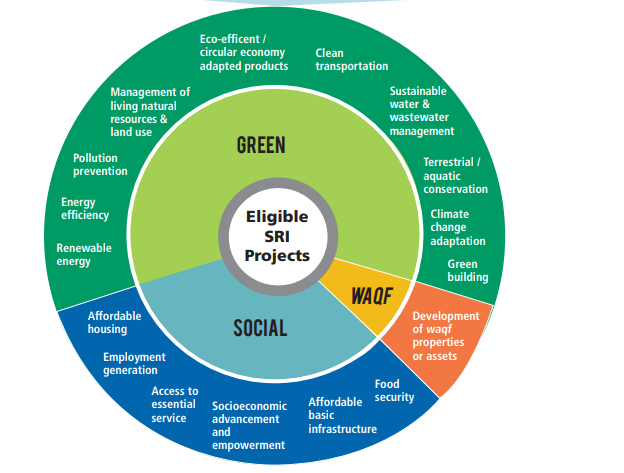

The framework posits that the earnings from SRI Sukuk issuance must be utilised entirely to finance qualifying SRI-related transactions and activities. The funding activities may include the following activities: (i) the purchase of Syariah complaints receivables resulting from the financing of a qualified SRI project; (ii) acquiring a firm that has an eligible SRI project or acquiring the project directly; (iii) refinancing of pre-existing debt or funding arrangements that were originally used to fund an eligible SRI project; or (iv) funding for supporting expenditures including more than one eligible SRI project but are nonetheless closely related (SCM, 2019) The initiative can be any one or a combination of the following eligible SRI projects: (i) environmental protection and natural resource preservation; (ii) reduced energy consumption; (iii) encouraging renewable energy consumption; (iv) reduction of greenhouse gas emissions;(v) improving the social condition of a specific group of people or the community at large, or addressing or mitigating a specific social concern; and (vi) increases in societal well-being. Figure 4 provides a summary of the SRI eligible projects (SCM, 2019).

Sources: The Securities Commission Malaysia (2019)

Another provision in the framework is for specific information be publicised by issuers via documents/prospectuses and other disclosure materials, including information and data regarding eligible SRI Project and its envisioned results, and a declaration stating that all ESG best practises and guidelines for a qualifying SRI Project were satisfied by the issuer. Additionally, the SRI project that meets the requirements may be subject to an independent third-party examination and report. Following approval by the issuer and the independent party, the report may be incorporated into the disclosure document. Nevertheless, an independent assessor is required to assess the potential SRI project for the SRI Sukuk presented to retail investors. An issued report has to be included in the disclosure prospectuses or documents (SCM, 2019). The issuer is obligated to provide yearly investor reporting. All of the following information must be included in the report: (i) The initial funding allotted for the eligible SRI projects; (ii) the amount of the authorised SRI project used; (iii) the amount that was not used and the pending utilisation – the location where it is invested; and (iv) the eligible SRI project's impact objectives, if feasible and possible (Syed Azman & Engku Ali, 2015).

The inclusion of waqf (endowment) properties/assets, which allows for SRI investments, is a unique feature of the SRI Sukuk framework. Historically, this approach has been employed in Egypt and Turkey to address pressing social issues, including poverty reduction (Syed Azman & Engku Ali, 2015). In order to realise the accumulated assets in establishing waqf projects, the Centre for Islamic Wealth Management (CIWM) (2015) recommended the use of per-square foot value certificates, cash and e-waqf funds, and Sukuk issuances. They provide an alternative means for investors to channel their resources towards projects with long-term social benefits and guaranteed returns (Syed Azman & Ali, 2016). Zain and Sori (2020) conducted a semi-structured interview and recommended that the most applicable SRI Sukuk model in Malaysia is Musharakah-based SRI Sukuk model. The researchers considered the model as the most suitable SRI Sukuk model to stimulate the growth of waqf assets and properties. They suggested a model for a waqaf Sukuk by considering the project's intended outcomes, characteristics, the type of Shari'ah contract to be used, the obligor, and the return mechanism.

Sources: The Securities Commission Malaysia (2019)

SRI Sukuk envision social impact financing: Khazanah SRI Ihsan Sukuk

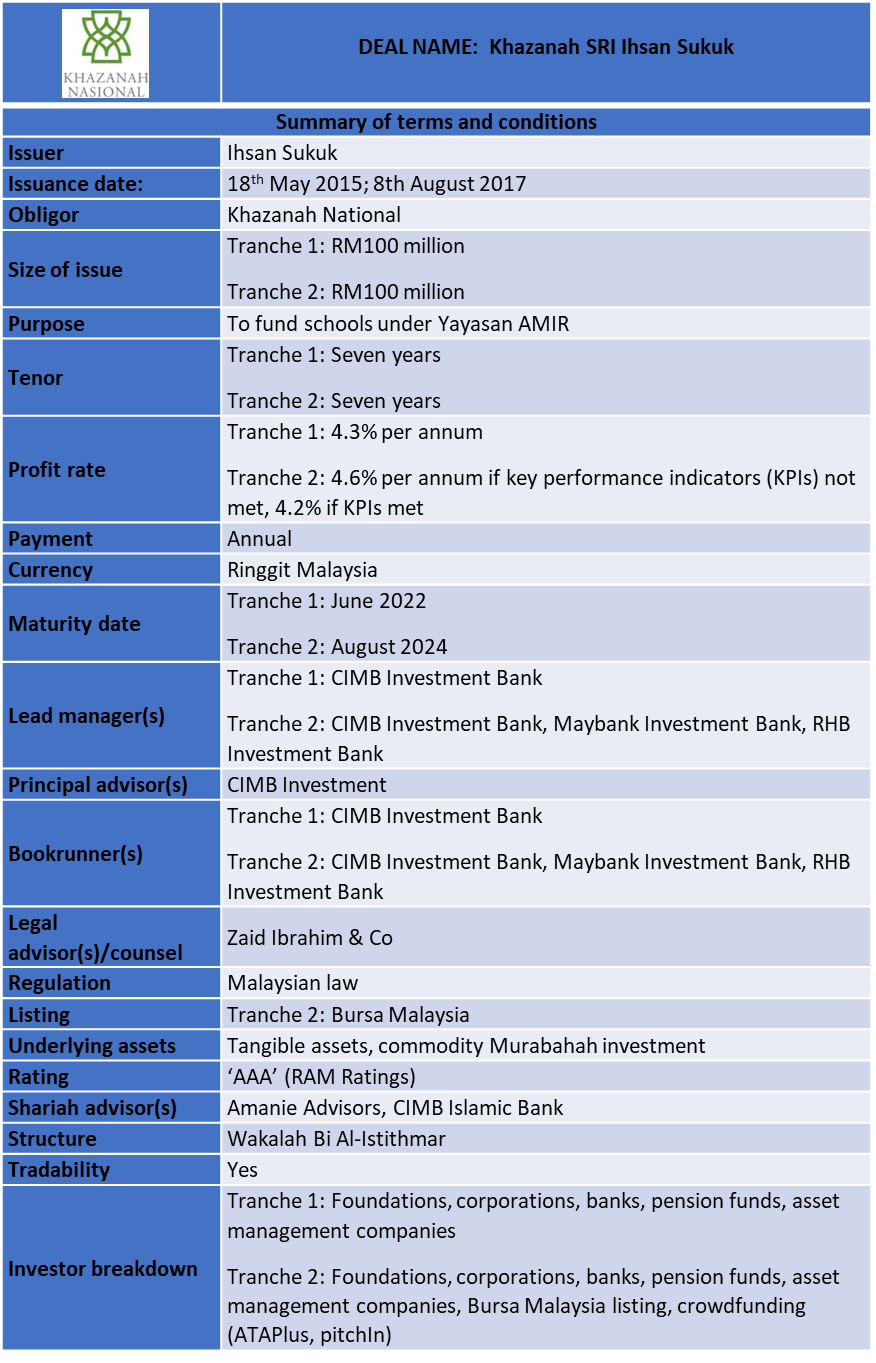

Khazanah Nasional, the Malaysian sovereign wealth fund, launched the Khazanah SRI Ihsan Sukuk as an aspect of its RM 1 billion (236.84 million United States Dollars) Sukuk programme, thereby marking the creation of the first SRI Sukuk worldwide. The SRI Sukuk is designated in the Malaysian ringgit and the initiative has raised a total of RM200 million (approximately 47.35 million USD). The Sukuk facility was created with a novel 'pay-for-success' structure to raise capital for educational purposes through the Yayasan AMIR fund (Kareem, 2022). The Sukuk was issued by the Malaysian-incorporated independent special purpose vehicle (SPV), known as Ihsan Sukuk Bhd. The detailed summary of the terms and conditions of the Khazanah SRI Ihsan Sukuk is depicted in Figure 5.

Since the program's inception in May 2015, Khazanah has issued two separate tranches: one in May 2015 and another in August 2017. Each of the two tranches was issued at RM100 million (US$23.67 million) and matured in seven years. The profit rate for the first and second tranche of the Sukuk was 4.3% and 4.6% annually for not fulfilling the key performance indicators (KPIs). Meanwhile, a profit rate of 4.2% annually was agreed upon if the KPIs are met. These KPI focus on areas such as the percentage of schools operating under the trust model; the students’ performance; and the effectiveness of the teachers and the school’s administration (Kareem, 2022). As discussed by bin Syed Azman and Ali (2016) and Ali et al. (2019), the Ihsan SRI Sukuk has a number of Key Performance Indicators (KPIs) to help gauge its success, including:

At the outset of the Trust Schools Programme, at least 20 schools will be chosen to participate in a 5-year intervention.

At least 50% of the Trust School teachers are rated at "Establishing level" by the end of the five-year intervention period. This means improving pedagogy (teaching methods and techniques), curricula and areas of knowledge, teacher preparation and effectiveness, collaborative and cooperative learning, and the ability to solve problems and think critically.

At least 50% of the Trust School Administrators are rated at "Establishing level" by the end of the five-year intervention period. They must demonstrate their ability to construct and communicate the school's vision; enforce the Trust School Standards; implement continuous school improvement; practise shared leadership; engage stakeholders appropriately; and practise strategic and curriculum-driven financial planning.

The Sukuk facility employs a "pay-for-success" framework, evaluating progress against a number of KPIs over the course of a five-year period. The Sukukholders stand to lose up to 6.22 percent of the Suk's nominal value if the KPIs are not satisfied at maturity. The Sukukholders are allowed to transform their investment to a donation regardless of time all through the tenure by a specific mechanism incorporated into the Sukuk facility (Kareem, 2022; Noordin et al., 2018). They can also achieve the above by employing their "option to waive." The sukukholders are provided a tax voucher in exhancge, which is equivalent to the nominal amount that was waived (Noordin et al., 2018).

According to the latest RAM report, Ihsan Sukuk Berhad has redeemed the RM100 million initial Sukuk Ihsan., which was issued on June 17, 2022 under its RM 1.0 billion Islamic Medium-Term Notes Sukuk Ihsan Programme (2015/2040). The redemption was rated as a success, which is considered a vital achievement by the Ihsan Sukuk programme. The Sukuk rating has been stable at AAA(s) since December 2021, and they currently have an outstanding RM100 million that is projected to mature by August 2024. Malaysia's first SRI Sukuk has come to a successful completion by completing the redemption. As the obligor, Khazanah receives a discount of 6.22% on the first Sukuk Ihsan's nominal value upon redemption based on the fulfilment of key performance indicators (KPIs). All Sukuk holders have been issued tax vouchers covering the amount of the devaluation (RAM, 2022).

Operating capital for schools in Malaysia will be funded by the Sukuk proceeds via private and public collaborations with the Malaysia’s Ministry of Education. This partnership is part of a non-profit foundation known as the Yayasan AMIR Trust School Programme. The objective is to improve the facilities and access to a high-quality school education in Malaysia (Kareem, 2022). For the Trust Schools Programme, the Sukuk facilities issued in 2015 and 2017 provide funding for 30 and 21 schools, respectively (RAM, 2022).

Sources: Kareem (2022)

Sources: adapted from CIWM (2015)

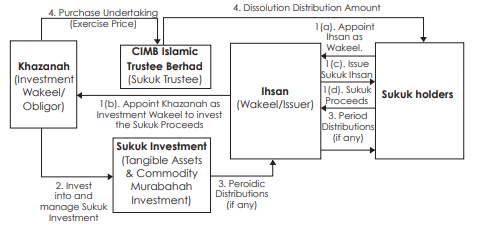

Based on this structure depicted in Figure 6, it was grounded on the principles of (investment agency contract); a concept of entrusting another person with the responsibility of managing and increasing the wealth; The structure suited the needs of the issuer, SPV, and obligor, and it was efficient in terms of the utilisation of the issuer's assets due to the issuer's ability to leverage both commodities and tangible assets (Azman et al., 2022). The researchers structured the transaction into four parts as presented below (CIWM, 2015) (Azman et al., 2022):

Ihsan is appointed by the Sukuk holders as (agent) to administer the Sukuk proceeds. Ihsan appoints Khazanah as the investment agent upon receiving the receipt of the funds. In exchange for proceeds, the issuer (Ihsan) concurrently issues SRI Sukuk to Sukuk holders.

Given its capacity as an investment agency, Khazanah invests the funds and completely manage the investment. Both tangible assets and commodity murabahah investment make up the Sukuk investment.

Sukuk holders receive their distributions on a periodic basis via Ihsan. The distributions are made (if any) based on a set of agreed-upon parameters.

Khazanah authorises the CIMB Islamic Trustee Berhad (Trustee) to participate in a purchase undertaking at the exercise price of the Sukuk. Upon the completion of the purchase agreement, the trust will be terminated;

Comparison of SRI Sukuk and SIB

Syed Azman and Ali (2016) analysed the compared SRI Sukuk and SIBs and concluded that both forms of investments complied with the Islamic finance philosophies of social responsibility and risk-sharing. On the other hand, Marwan and Haneef (2019) highlighted those philosophies of social responsibility and risk-sharing is best exemplified by the SIB, which is still absent in the present Islamic finance practises. The researchers proposed a model for social impact Sukuk that considers the most pertinent insights from Peterborough SIB, which emphasised quantifiable success indicators, societal impact, data and management systems, third-sector incorporation, flexible contracts, risk sharing, and supporting an innovating culture.

Azman et al. (2022) conducted a survey to compare SRI Sukuk and SIBs and found that both models were perceived differently and significantly by stakeholders. The specifically indicated that SRI Sukuk was not viewed as by stakeholders, but rather as distinct from SIBs. The requirements stated in the SRI Sukuk Framework proposed by SC and the United States’ Social Impact Bond (SIB) Act 2014 Guidelines were compared by Noordin et al. (2018). They conclude that the Guidelines on Sukuk appear to impose stricter requirements on what constitutes an eligible SRI Sukuk issuer than the US's SIB Act. They also draw the conclusion that the projects that qualify as SRI Sukuk are distinct from their conventional counterparts because of their adherence to Syariah standards. The significance for SRI guidelines to necessitate thorough disclosure and disclosure to participants of SRI Sukuk participants were highlighted. Furthermore, the study reflected the importance of, a third party in evaluating the impacts of SRI programmes.

Azman et al. (2022) and Noordin et al. (2018) also highlight the salient features of SRI Sukuk and SIBs, taking into consideration the SRI Sukuk Framework (SCM, 2014; 2019) and SIB literature depicted in table 2:

Discussion and Conclusion

This paper provides an overview of SRI Sukuk concepts by reviewing existing literature on SRI Sukuk and delving into its structure from Malaysian perspectives, using Khazanah SRI Ihsan Sukuk as a case study. By reviewing the Khazanah Sri Ihsan Sukuk, the "pay-for-success" framework implemented in Ihsan Sukuk is conceptually comparable with the SIB bonds as a tool that facilitates collaboration between government, business, and philanthropy to address pressing societal issues and produce measurable results (Marwan & Haneef, 2019). The setting of the KPI measurement that will determine the profit rate received by the Sukuk holder is in favor of the "commissioning mechanism" applicable in the SIB structure. The SIB’s social investors direct the initial investment in a social project and earn profits based on the outcomes or impacts of the project (Marwan & Haneef, 2019). In a social impact bond, investors pool their resources to finance a programme with the aim of improving a social outcome that is financially valuable to a government commissioner. The commissioner will refund the initial investment of the investors' with a return if the involvement leads to an improved social outcome. Investors are at risk of losing their investment should there be no improvements (Social Finance, 2016).

The merits of SRI Sukuk as a novel Islamic financial instrument are made apparent by imagining the social impact financing and other notable characteristics of Syariah philosophy Applying Syariah rulings to SRI Sukuk, such as the Wakalah principles that permit a purchase undertaking as a type of capital protection mechanism and financial risk sharing in the form of Kafalah principles, provides an effect analogous to a guarantee. Investors seeking a reasonable return with less risk might consider SRI Sukuk as a viable investment alternative. Additionally, good governance and investor confidence can both be fostered by the SRI Sukuk's rating requirement, which is a sound investment practise.

Notably, this study has some limitations given that prior literature reviews on SRI Sukuk served as the research background. For future research, an empirical analysis with extensive observation of the most important futures of SRI Sukuk and SIB is advised. Better insight may be gained from conducting follow-up interviews with shareholders, stakeholders, and the financial expert for each financing mechanism. Despite certain caveats, the current research sheds light on the ways in which these two major financial investment mechanisms are different yet having distinct similarity from one another.

References

Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI). (2008). Statute. http://www.aaoifi.com/media/document/AAOIFI%20Statute%202008%20(English).pdf

Ali, E. R. A. E., Azman, S. M. M. S., Zain, N. R. M., Hassan, R., & Kassim, S. (2019). Potential development of SRI sukuk models for higher learning institutions in Malaysia based on Wakalah and Waqf. Journal of Islamic Finance, 8, 090-106.

Azman, S. M. M. S., Ismail, S., Haneef, M. A., & Ali, E. R. A. E. (2022). An empirical comparison of sustainable and responsible investment ṣukūk, social impact bonds and conventional bonds. ISRA International Journal of Islamic Finance, (ahead-of-print). ISRA International Journal of Islamic Finance, Vol. ahead-of-print No. ahead-of-print.

Barclay, L., & Mak, D. (2011). A technical guide to developing a social impact bond: vulnerable children and young people. Social Finance. https://www.socialfinance.org.uk/sites/ default/files/publications/technical_guide_vulnerable_children.pdf

Bromberg, D. (2022). The Future of Financial Tools: Will Social Impact Bonds Yield Results? The Routledge Handbook of Policy Tools (1st ed., pp. 546-558). Routledge.

Capital Markets Malaysia2 (CMM2). (2022). Sustainable and Responsible Investment (SRI). https://www.capitalmarketsmalaysia.com/public-sri-sukuk/

Centre for Islamic Wealth Management (CIWM). (2015). Special Edition 2013-2015 Bulletin. In Centre for Islamic Wealth Management (Ed.). Lorong University A, Kuala Lumpur Malaysia: INCEIF and BNP Paribas.

Chamberlain, M. (2013, April 24). Socially Responsible Investing: What You Need to Know. Forbes. https://www.forbes.com/sites/feeonlyplanner/2013/04/24/socially-responsible-investing-what-you-need-to-know/?sh=2122ead23442

Ernst & Young. (2022). Trending: Sustainable responsible investment in Malaysia and the region, Retrieved on 2022, November. https://assets.ey.com/content/dam/ey-sites/ey-com/en_my/topics/climate-change/ey-trending-sri-in-malaysia-and-the-region-final-22022022.pdf

Hasan, R., Velayutham, S., & Khan, A. F. (2022). Socially responsible investment (SRI) Sukuk as a financing alternative for post COVID-19 development project. International Journal of Islamic and Middle Eastern Finance and Management, 15(2), 425-440.

Islamic Financial Services Board (IFSB) (2009). Capital adequacy requirements for sukūk, securitisations and real estate investment. Retrieved on 2022, November. https://www.ifsb.org/download.php?id=4363&lang=English&pg=/published.php

Kareem, M. (2022, April 11). Khazanah issues world’s first ringgit-denominated SRI Sukuk: A shift toward retail. Islamic Sustaible: Finance & Investment. https://islamicsustainable.com/khazanah-issues-worlds-first-ringgit-denominated-sri-sukuk-a-shift-toward-retail/

Kassim, S., & Abdullah, A. (2017). Pushing the frontiers of Islamic finance through socially responsible investment sukuk. Al-Shajarah: Journal of the International Institute of Islamic Thought and Civilization (ISTAC), 187-213.

Marwan, S., & Haneef, M. A. (2019). Does doing good pay off? Social impact bonds and lessons for Islamic finance to serve the real economy. Islamic Economic Studies, 27(1), 23-37.

Marwan, S., Ismail, S., Mohamed Haneef, M. A., & Engku Ali, E. R. A. (2022). Critical success factors of implementing sustainable and responsible investment (SRI) Sukuk for economic recovery from COVID-19 pandemic. Journal of Economic and Administrative Sciences.

Ming, S. S. (2022). Retail Sukuk in Malaysia: The market’s next growth catalyst? Islamic Finance News, https://www.ram.com.my/data/ckfinder/files/2022/Retail_Sukuk_in_Malaysia_The_market_s_next_growth_catalyst.pdf

Nagase, R. (2021). An exploration into effective public-private partnerships in Japan through an analysis of sib cases in the prisoner reentry field in the us., Harvard Program on U.S.-Japan Relations Occasional Paper Series, Harvard University, 2021-05. https://programs.wcfia.harvard.edu/files/us-japan/files/21-05_nagase.pdf

Nash, O. (2015). RE: Email Inquiry on Social Impact Bonds in the UK to the Centre for Social Impact Bonds, Cabinet Office, London.

Noordin, N. H., Haron, S. N., Hasan, A., & Hassan, R. (2018). Complying with the requirements for issuance of SRI sukuk: the case of Khazanah’s Sukuk Ihsan. Journal of Islamic Accounting and Business Research, 9(3), 415-433.

Rahman, M., Isa, C. R., Dewandaru, G., Hanifa, M. H., Chowdhury, N. T., & Sarker, M. (2020). Socially responsible investment sukuk (Islamic bond) development in Malaysia. Qualitative Research in Financial Markets, 12(4), 599-619.

RAM. (2022, June 17). Ihsan Sukuk Redeems RM100 Million First SRI Sukuk In Ma Ihsan Sukuk redeems RM100 mil first SRI sukuk. RAM Rating Services Berhad. https://www.ram.com.my/pressrelease/?prviewid=6016

The Securities Commission Malaysia (SCM). (2014). Guidelines on Sukuk, Securities Commission Malaysia, Kuala Lumpur

The Securities Commission Malaysia (SCM). (2019). Sustainable and Responsible Investment Sukuk Framework: An Overview. https://www.sc.com.my/api/documentms/download.ashx?id=84491531 -2b7e-4362-bafb-83bb33b07416

Social Finance. (2016). Development impact bonds: Introduction. Retrieved on 2022, December. https://www.socialfinance.org.uk/assets/documents/development-impact-bond-presentation.pdf

Syed Azman, M. M. S., & Engku Ali, R. A. E. (2015). Sustainable and Responsible Investment (SRI): Trends and Prospects. Jabatan Kemajuan Islam Malaysia (Jakim), 1.

Syed Azman, S. M. M., & Ali, E. R. A. E. (2016). Potential role of social impact bond and socially responsible investment sukuk as financial tools that can help address issues of poverty and socio-economic insecurity. Intellectual Discourse, 24. https://journals.iium.edu.my/intdiscourse/index.php/id/article/view/924

Zain, N. S., & Sori, Z. M. (2020). An exploratory study on Musharakah SRI Sukuk for the development of Waqf properties/assets in Malaysia. Qualitative Research in Financial Markets.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

18 August 2023

Article Doi

eBook ISBN

978-1-80296-963-4

Publisher

European Publisher

Volume

1

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1050

Subjects

Multi-disciplinary, Accounting, Finance, Economics, Business Management, Marketing, Entrepreneurship, Social Studies

Cite this article as:

Mohamad, N. E. A., Mohd Saad, N., & bin Mohamed, Z. (2023). An Overview of Sustainable and Responsible Investment Sukuk for Social Impact Financing. In A. H. Jaaffar, S. Buniamin, N. R. A. Rahman, N. S. Othman, N. Mohammad, S. Kasavan, N. E. A. B. Mohamad, Z. M. Saad, F. A. Ghani, & N. I. N. Redzuan (Eds.), Accelerating Transformation towards Sustainable and Resilient Business: Lessons Learned from the COVID-19 Crisis, vol 1. European Proceedings of Finance and Economics (pp. 327-341). European Publisher. https://doi.org/10.15405/epfe.23081.29