Abstract

Several works have focused on the factor of household behaviour in accumulating debt, particularly for individual countries. However, the factors that affect household debt from the macroeconomic perspective remains scarce. Hence, the present study presents a systematic literature review on the determinants of household debt from the macroeconomic perspective. The present study integrates multiple research designs, and the review is based on the publication standard known as ROSES (RepOrting standards for Systematic Evidence Syntheses). This study selects articles based on two leading databases, Scopus and Web of Science. Several main themes arise using the thematic analysis: 1) income, 2) interest rate, 3) inflation, 4) demographics, 5) consumption, 6) housing price, 7) financial sector, 8) employment and 9) income inequality. The study reveals that housing prices and the financial sector are among the leading factors that influence rising household debt. Several policy implications are suggested since household debt cannot be avoided or curbed, however, it can be managed, controlled or monitored to reduce its risks. The reviewed articles have some limitations, hence, future research should consider other key factors such as interaction term, the use of nonlinearity effect and income quintile regression as alternative estimation methods.

Keywords: Macroeconomic factors, household debt, systematic literature review

Introduction

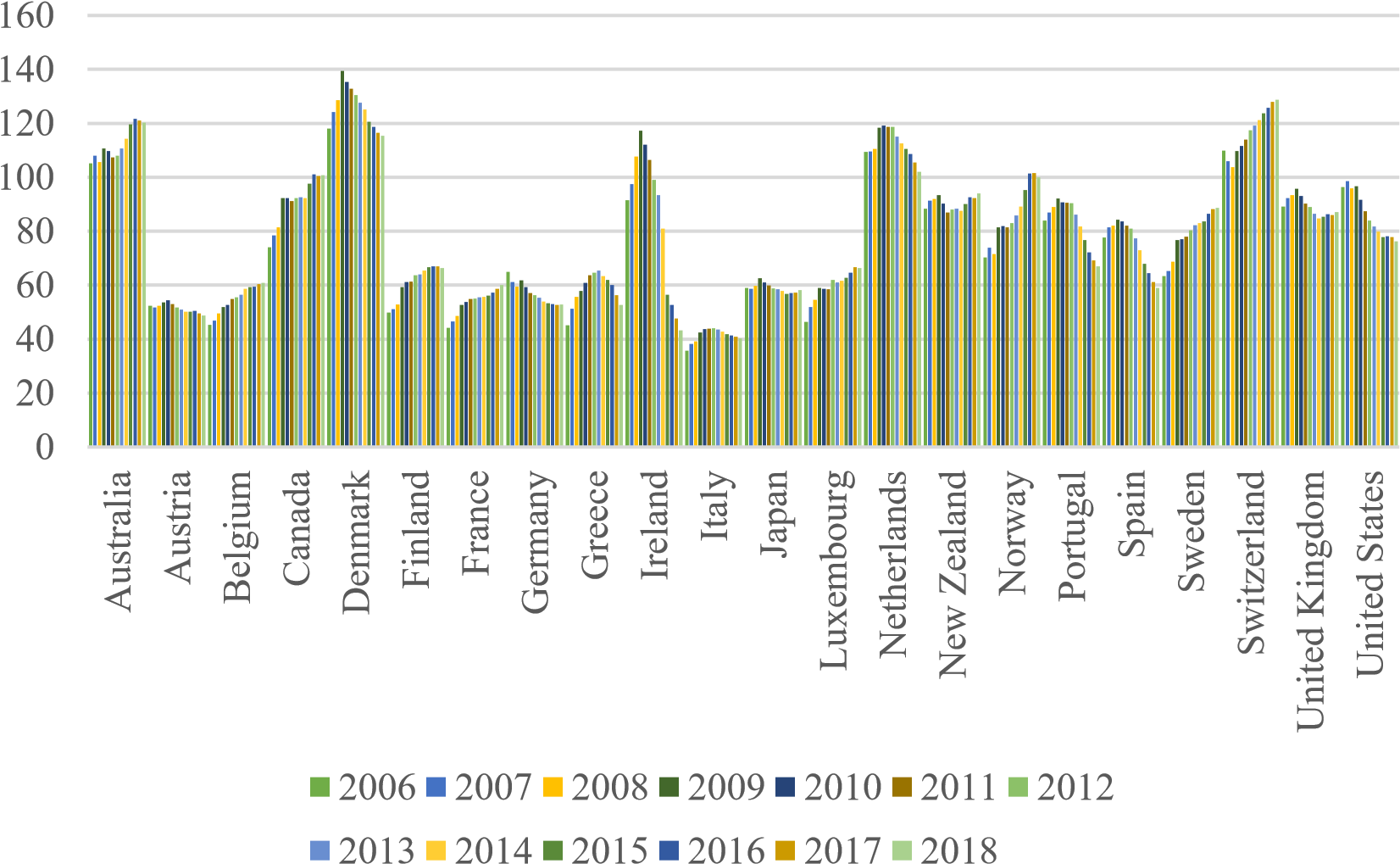

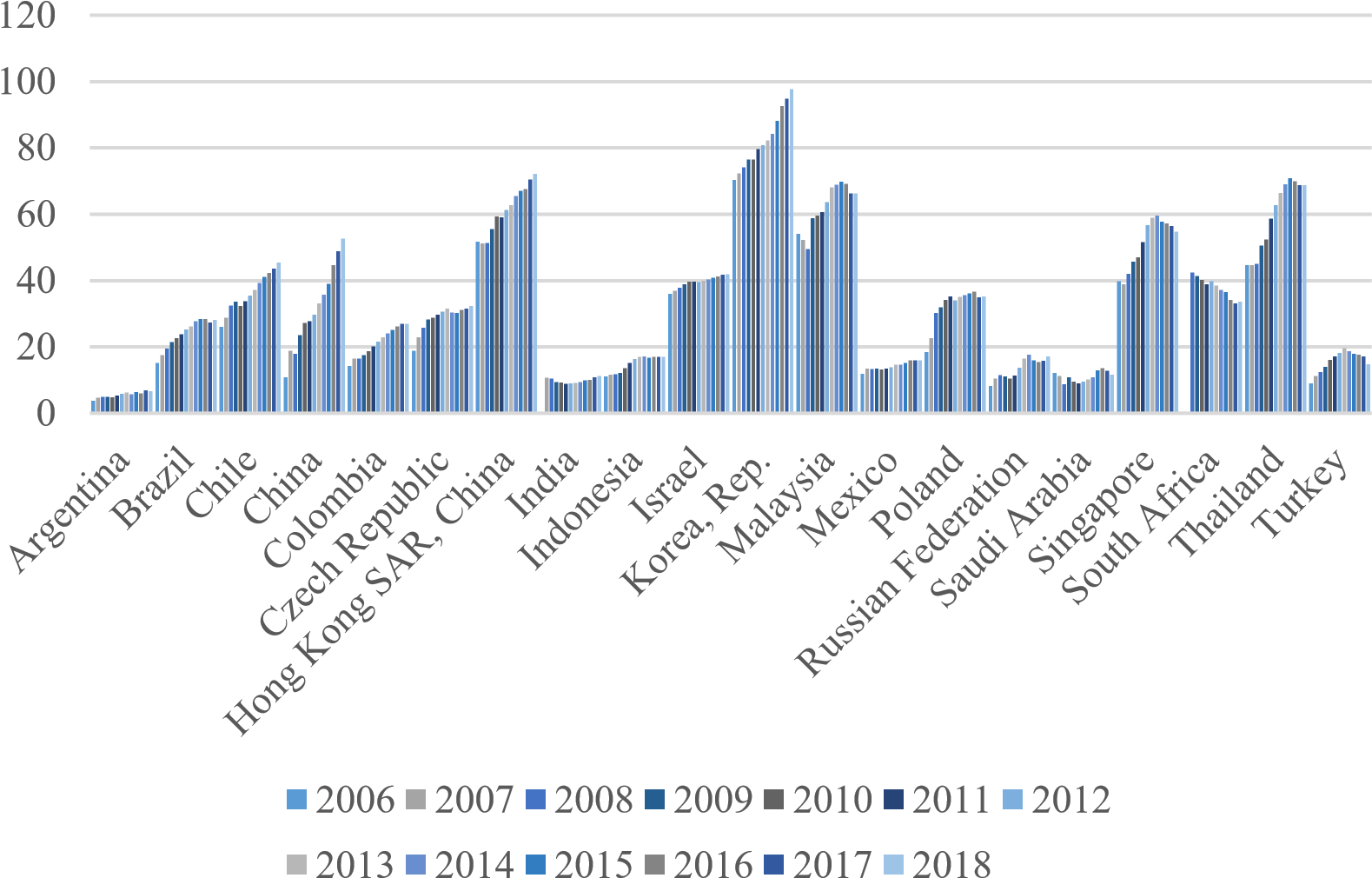

The tremendous increase of household debt, unexpectedly deemed to be one of the reasons that led to the 2008 global financial crisis, has attracted the attention of economists. Household debt can stimulate economic growth up to an extent as long as the final ratio is within a threshold of 36–70% of GDP (IMF, 2017). However, the ratio of household debt to GDP has been gradually increasing, reaching more than 60–70% in many advanced economies. A similar trend can be seen in emerging economies with household debt reaching more than 40% of GDP (see Figures 1 and 2), which is a cause of concern. This tremendous progression of household debt thus prompts the question of why do people tend to accumulate debt in the first place?

Falling into debt is important for some people to finance their personal constraints. According to Becker (1974), the desire to be on par with others may induce individuals to seek credit from various sources. For instance, the craving for a lucrative lifestyle leads to consumption that demands more credit. Those seeking credit are also more confident about repaying their debt since they foresee themselves with a stable flow of income in future (see Friedman, 1957). According to Fisher (1933), insufficient earning to funding consumption causes households to borrow money.

Modigliani and Brumberg (1954) provided a compelling explanation for why some households can borrow to cover their expenses. The life cycle hypothesis (LCH) states that in people’s younger years, households will have a desired or required level of consumption that exceeds their current income. This shortfall can be filled by consumer borrowing, which will be repaid with future earnings, as grounded in Friedman’s (1957) permanent income hypothesis (PIH). PIH argues that individuals are driven to make consumption decisions based on their projected earning rather than their current earning, especially when it is minimal.

Accordingly, Ando and Modigliani’s (1963) LCH, which is the evolution of the earlier LCH, contends that many individuals save at an earlier age, accumulate wealth during the middle age and spend during retirement. Households accumulate wealth, particularly those who own assets for investments; thus, debt becomes a necessity to finance the budget constraint for wealth as well. LCH and PIH consider debt as an apparatus for a person’s stable life cycle consumption and highlight that households take loans when earnings are lower than expected.

Nevertheless, some researchers challenge that no agreed determinants of household debt exist since LCH and PIH only present the theoretical foundation for understanding household savings and consumption.

Subsequently, increasing research have considered the factors that affect household debt from the macroeconomic perspective. In this setting, the present study conducted a systematic literature review on the macroeconomic determinant of household debt from individual and cross-country analysis. A methodological approach based on a systematic literature review is proposed for this purpose to provide an overview of the current state of research, as well as to present the challenges and future research directions.

The remainder of this paper is organised as follows. Section 2 explains the methodology employed to assess the existing state of knowledge. Section 3 examines the findings using the studied variables. Section 4 summarises the current state and problems. Section 5 provides the research agenda for practitioners and researchers. Finally, Section 6 presents the conclusion of this paper.

Methodology

The review protocol – ROSES

The conducted study follows the RepOrting standards for Systematic Evidence Syntheses, or the ROSES review protocol. The ROSES review protocol has been designed for systematic review by ensuring that the process includes high quality reports. The aim is to standardize their methods to attain the highest possible standards (Gusenbauer & Haddaway, 2020). Although ROSES is intended for the environment management field, it is also applicable across multiple disciplines as opposed to the Preferred Reporting Items for Systematic Reviews and Meta-Analyses (PRISMA; Moher et al., 2009). PRISMA is not optimal for non-health fields since it lacks necessary details, does not accommodate the latest methodological developments (such as systematic maps) and only focuses on internal validity during the critical appraisal (Estoque et al., 2019).

Through the ROSES review protocol, the SLR is formulated by first determining the appropriate research questions. This is followed by the next step which is to explain the systematic searching strategy that consists of three main sub-processes: identification, screening (inclusion and exclusion criteria) and eligibility, as suggested by Shaffril et al. (2020). The review proceeds to appraising the quality of selected articles, describing the strategy employed in retaining the quality articles to be reviewed. The final process includes the process of data abstraction as well as data validation and analysis.

Formulation of research questions

Formulating the research questions for this study is crucial to ensure suitable questions for review. Hence, the objectives of this study are to analyse the macroeconomic factors that cause a surge in household debt using cross-country analysis. Several research questions (RQ) have been designated, as follows:

RQ1. How much research have discussed household debt from the macroeconomic perspective?

RQ2. Which journal articles have led to this research topic?

RQ3. What are the significant factors that cause household debt to rise?

Systematic search strategies

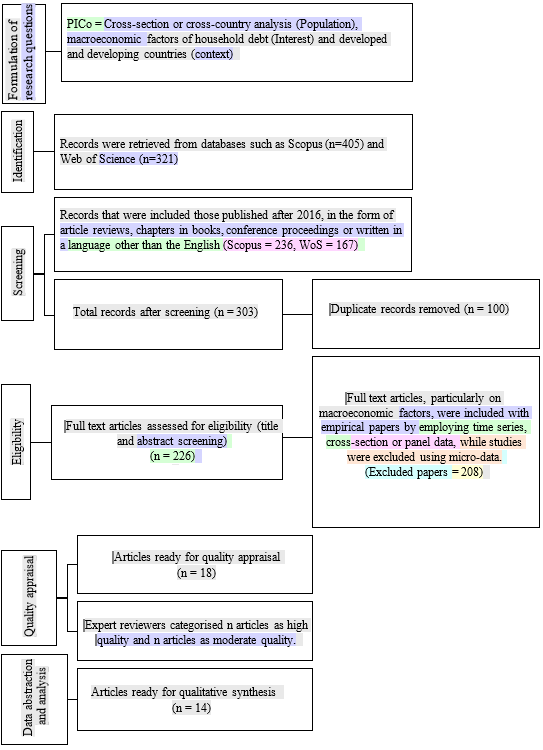

There are three main processes in the systematic search strategy: identification, screening and eligibility (refer to Figure 3).

Identification

Identification is the method of looking for synonyms, similar names and variations of the study's main keywords (Shaffril et al., 2020), explicitly, macroeconomic determinants and household debt. It offers the possibility for a specific database to identify more articles linked to the review. The keywords, according to Okoli (2015), are based on the research questions with the use of an online thesaurus, keywords from previous research, keywords from Scopus and keywords from experts. Through this process, the existing keywords can be enhanced to develop a full search string. The search was performed on Web of Science (WoS) Core Collections and Scopus, which are the most widely used scientific literature databases (Hook et al., 2020). Scopus covers a broader selection of journals which is helpful when looking for keywords (Falagas et al., 2008). Alternatively, the World of Science (WoS) is a massive archive of journals, including topics in social and environmental sciences (Englund et al., 2017; Jurgilevich et al., 2017;). An academic work recently demonstrated that WoS alone can be used as a basis for a major systematic analysis (Runting et al., 2017). Hence, these two databases have the potential to be combined and become the leading databases for systematic literature review due to their advantages, such as advanced searching capabilities, robust databases (indexing more than 5000 publishers) and controlled quality of multi-disciplinary articles including research on environmental management (Gusenbauer & Haddaway, 2020; Martín-Martín et al., 2018). The search string was composed in Scopus and WoS word scanning where truncation, wild card and field code functions are all built on the Boolean operator. Table 1 presents the results with a total of 405 and 321 articles from Scopus and WoS, respectively.

Screening

The screening process is involved in filtering the chosen articles based on the criteria automated by the sorting function in the database. Kitchenham and Charters (2007) suggested that the criteria is chosen based on the research question. Okoli (2015) further noted that researchers should determine the optimum duration they can review by narrowing the number of articles since it is impossible to review all available articles. Higgins et al. (2019), on the other hand, stated that restrictions on timeline publication should be activated if it is known when related studies were reported during a specific time period. This study set the timeline between 2016 and 2020 as the numbers of articles retrieved within this timeline are adequate and in line with the concept of study maturity, as suggested by Kraus et al. (2020). Only articles with empirical data and published in a journal are included in this study to ensure the quality of the review. This review is limited to articles published in the English language to avoid any language gap, confusion and bias. This study focuses on macroeconomic factors implemented using various econometric analysis such as time series, cross-section or panel series (Table 2). This process excluded 236 articles (in Scopus) and 167 (in WoS) since they did not fit the inclusion criteria. Moreover, 100 duplicate articles were removed from WoS. The remaining 226 articles were used to determine eligibility.

Eligibility

Eligibility is the third process in which the remaining articles are manually scrutinised after the second process (screening) in accordance with the criteria established by the authors. The articles were analysed through their title and abstract.

Appraisal of quality

Quality appraisal is the evaluation of efficiency known as critical appraisal. The process of systematically reviewing scientific data to determine its validity, outcomes and significance before using it to make a decision is known as critical assessment (Hill & Spittlehouse, 2003). It is a process to ensure that only quality papers are assessed in the following steps. The quality of each paper was evaluated based on Petticrew and Roberts (2006). Experts should classify the remaining papers into three content categories: strong, moderate and low. Only publications in the high and moderate categories should be reviewed. The experts concentrated on the papers' methods in order to rank the content of the articles. The authors had to reach a mutual agreement for an article to achieve the moderate rank and be included in the analysis. Raised issues and discrepancies were discussed prior to forming the decision of whether or not papers should be included in the study. Through this process, 18 articles were ranked as high or moderate and determined as eligible for review, while 4 were excluded for not meeting the required standards.

Data extraction and analysis

The qualitative method was chosen for this analysis. The researchers carefully read all 18 papers, paying special attention to the abstract, findings and conclusion. Table 3 presents the extracted and organised data from the examined papers which address the research questions. Next, the researchers applied thematic analysis to classify the themes and sub-themes in the extracted data by noting the trends, clustering, counting, apparent similarities and relationships (Braun & Clarke, 2006). Thematic analysis is the most appropriate method for synthesising a mixed study design (integrative) (Flemming et al., 2018). It is defined as a descriptive method for reducing data in a versatile way which can also be combined with other data analysis techniques (Vaismoradi et al., 2013). The generation of themes is the first step in a thematic study. The authors attempted to recognise the trends from the extracted data for all reviewed papers during this phase. Data similarities were pooled in a group. Nine key groups were eventually created, as shown in Table 4.

Results and Discussions

Results

Overview of articles

14 articles were selected through the review selection method, as shown in Table 3. Khan et al. (2016), Catherine et al. (2016) and Mazibaş & Tuna (2017) analysed the data in their articles using time series. Other articles were analysed using static and dynamic panel data analysis. 7 articles were conducted in developing countries such as Malaysia (Khan et al., 2016; Catherine et al., 2016), Asia, Asia-Pacific, the Association of Southeast Asian Nations (ASEAN) (Catherine et al., 2016; Kusairi et al., 2019; Hamid & Yunus, 2020), Turkey (Mazibaş & Tuna, 2017) and emerging countries (Samad et al., 2020a). Another 6 articles were conducted in developed countries such as those participating in the Organisation for Economic Co-operation and Development (OECD) (Wildauer & Stockhammer, 2018; Moore & Stockhammer, 2018; Park & Lee, 2019) and the European Union (EU) (Borowski et al., 2019; Coletta et al., 2019; Slintáková & Klazar, 2018). The remaining 2 articles, by Rashid et al. (2017) and Igan & Tan (2017), studied the panel data of 55 and 33 countries, respectively, including developing and developed countries.

Categorisation of themes

The subject matter of household debt was discussed in these articles, also referred to as credit to household, consumer debt or mortgage debt. Subsequently, several themes were identified based on the thematic analysis as shown in Table 4. These themes were established as factors that determine rising household debt: 1) income, 2) interest rate, 3) inflation, 4) demographics, 5) consumption, 6) housing price, 7) financial sector, 8) employment and 9) income inequality.

Income

Mazibaş and Tuna (2017) found household debts were mostly determined by the income level measured using GDP and based on causality analyses. According to PIH and LCM, households take loans when earnings are lower than expected. They would therefore set aside money in the event of an unexpected rise in income, with the goal of allocating it to the best possible consumption over the course of their lives. Samad et al. (2020a) and Rashid et al. (2017) agreed that households resort to debt when their income is negative. Even when there is a slight increase in income, borrowing takes place to purchase properties since it is appealing (Barnes & Young, 2003). Guerrieri and Lorenzoni (2017) argued that households borrow money due to temporary income changes. They anticipate an increase in their future income, which subsequently leads to the inclination of increasing their current level of consumption by acquiring consumer credit. Based on the analyses conducted on 23 EU countries by Borowski et al. (2019), it was discovered that there is evidence of a positive relationship between GDP per capita and consumer credit volume. In other words, for catching-up economies, the comparatively low-income households suppress creditworthiness and impede consumer lending. This effect outweighs the permanent income, resulting in household consumer loans to be issued for smooth spending in the expectation of a gradual rise in per capita income. Similarly, Park and Lee (2019) showed that countries with higher income tend to have larger household debt based on the findings that proved the positive relationship between GDP growth and household debt. Catherine et al. (2016) also found that when disposable income and household savings increase, each household is in a better financial position to acquire assets, thus increasing the level of debt. Hence, income has either a positive or negative relationship with household debt. However, changes in fixed income levels, such as the salary, have little effect on the aggregate spending rate or the household loan rate according to the study of Wildauer and Stockhammer (2018).

Housing price

A family is attracted to owning a house which may lead them to acquiring a loan. The dynamic change of household debt can be attributed to changes in housing prices. A decision to accumulate assets for investments results in household indebtedness (Samad et al., 2020a). Wealth accumulation explains the behaviour of household demands for the housing sector. Asset has a value which increases over time, thereby increasing the value of holding the asset. LCM posits that as a household accumulates wealth, especially by owning an asset for investment, debt becomes increasingly necessary to meet the wealth budget constraint. The increase in projected future earnings allows an individual to borrow for asset accumulation or asset investment. Thus, the house price is a key element of wealth which explains the surge in household debt. The key determinant of household debt is the changes in house prices since mortgages have been shown to be contributors to the growth of household debt in developed countries (Borowski et al., 2019; Coletta et al., 2019; Moore & Stockhammer, 2018; Park & Lee, 2019; Slintáková & Klazar, 2018; Wildauer & Stockhammer, 2018). There is similar evidence which shows that inflated house prices does cause household debt to increase in the analyses involving developing countries (see Catherine et al., 2016; Hamid & Yunus, 2020; Khan et al., 2016; Kusairi et al., 2019; Samad et al., 2020a).

Consumption

The fundamental explanation of household debt lies in the basic consumption function of LCM which emphasises that households take loans to finance their consumption needs, both in durables and non-durables. Samad et al. (2020a) further stated that other than financing durable expenditures (i.e., assets for investment), household debt is also used to smoothen consumption due to a significant gap between income and expenditure. The decision of a household to spend either on necessities or luxuries may tempt them to use credit cards which may cause a shortage of income over time. It was empirically proven that household consumption is part of the household debt model which was found to positively affect household debt (Khan et al., 2016; Kusairi et al., 2019; Samad et al., 2020a). Likewise, Wildauer and Stockhammer (2018), who used private final consumption, also found a positive relationship between these two variables. This indicates that their personal and collective expenses will eventually affect their credit health. The more they spend, the more likely they will acquire loans.

Demographics

LCM posits that young households are more likely to be involved in financial borrowing with the assumption that they are in the starting point of their working lives with a negative income. The empirical evidence in the study conducted by Borowski et al. (2019) showed that young people in the population lean towards an increase in consumer credit since they are actively involved with financial accessibility to smoothen out their consumption. Hence, it is argued that young individuals are expected to have higher levels of debt during their working age since they anticipate that their income will grow while accumulating wealth during their middle age. Accordingly, Khan et al. (2016) showed that household debt is positively affected by the working age population. Being indebted is unavoidable and a normal occurrence for working people or households. In contrast, Catherine et al. (2016) found a negative link between the working population and household debt. The aging people dominates the working population. Consequently, Slintáková and Klazar (2018) found that the increase in household debt is explained by the lower percentage of the aging population in consideration of the family taxpayer model in EU countries.

Interest rate

Most reviewed articles have used lending interest rate as one factor for determining the changes in household debt. Lending interest rate refers to the cost of holding loans or borrowing from the bank. Lower lending rates cause the demand for household debt to increase. An increase in the interest rate on loans will distract agents from borrowing. As such, lending interest rate is a crucial factor in determining household debt. Most studies have argued that the lending interest rate plays an essential role in explaining the changes in household debt from the supply side. Extensive empirical findings are in line with the fundamental foundations which highlight a negative relationship between interest rate and household debt (Borowski et al., 2019; Hamid & Yunus, 2020; Wildauer & Stockhammer, 2018). Nevertheless, some studies found a positive link between these two variables (Catherine et al., 2016; Igan & Tan, 2017; Park & Lee, 2019; Samad et al., 2020a). The link is that during the pre-global financial crisis, emerging markets were impacted by foreign trade shocks, but local asset investment was in high demand since households were able to benefit from the price margin to offset slower aggregate demand caused by trade openness. As a result, households with strong credit profiles can receive standard-interest-rate loans, while households with poor credit profiles can obtain sub-mortgage credit, which increases the debt servicing burden and carries a high interest rate (Mian & Sufi, 2009; Samad et al., 2020b).

Inflation rate

The rise in home ownership and lower inflation levels in the 1990s are primarily responsible for the longterm increase in debt relative to income (Tudela & Young, 2005). Low inflation, according to some reports, may lead to increased household debt since it relieves financial constraints (Debelle, 2004). Lower interest rates are a result of lower inflation, meaning that less revenue is required to make the reduced scheduled payment which facilitates lending. Hence, lower inflation erodes the principal more slowly. Empirically, several studies have found that lower inflation rate increases household debt (Hamid & Yunus, 2020; Igan & Tan, 2017; Samad et al., 2020a). In contrast, other studies found that inflation has a positive influence on household debt (Catherine et al., 2016; Coletta et al., 2019).

Unemployment

The sudden shock of losing a job may influence one's debt decision. Household debt increases following a low rate of unemployment. This is signalled by a good labour market, indicating a strong ability to pay off debt obligations due to the generation of stable household income. Hence, unemployment is one of the pivotal factors that determines the changes in household debt. During the economic boom, lower unemployment rates indicated a high number of households with stable jobs, creating positive income and cash flow. Those with stable jobs tend to consume more and use credit to finance their budget constraints. Many studies have confirmed that unemployment rate negatively explains household debt (Borowski et al., 2019; Kusairi et al., 2019; Park & Lee, 2019; Rashid et al., 2017; Samad et al., 2020a). However, Mian and Sufi (2009) found a high correlation between unemployment and household leverage in the US in relation to the US subprime mortgage crisis. Subsequently, Coletta et al. (2019) showed a link between increasing household debt and higher rates of unemployment. Catherine et al. (2016) further indicated a mixed relationship between unemployment and household debt in various Asian countries.

Income inequality

The Gini index coefficient is used to calculate the size of the income difference between high- and lowincome levels. Wildauer and Stockhammer (2018) noted that according to the expenditure cascades theory, rising inequality causes lower-income groups to mimic the spending habits of their wealthier peers, causing them to go into debt to keep up with the Joneses. Hence, households reacted by increasing their leverage to increase their happiness and be at par with their social circles. Rashid et al. (2017) demonstrated that household debt rises as the income gap widens. Correspondingly, Borowski et al. (2019) found that income inequality leads to higher consumer credit. Lucrative lifestyles lead to consumption which demands more credit for lowincome earners. Ironically, indebted households continue to borrow more to maintain their consumption (Kumhof & Rancière, 2011). Wildauer and Stockhammer (2018) were unable to empirically prove the consistency of the expenditure cascades hypothesis for OECD countries.

Financial sectors

Financial sectors are responsible for a large amount of household debt, according to well-known literature. The simpler it is for individuals to gain access to financial services, the more financing they will be able to receive. Financial access indicates the ability of individuals and companies to obtain financial services (Svirydzenka, 2016). The banking sector's development is more important for household credit growth (Borowski et al., 2019; Igan & Tan, 2017). The bank’s leniency towards borrowing as well as the increases in the deposit base of financial institutions have all contributed to the rapid rise in household debt (Kim et al., 2014). Hence, financial development is the most significant variable for explaining the measured household debt using the financial development index, liquid liability and private credit deposit to bank (Samad et al., 2020a). Countries with financial institutions and financial markets that are well-developed and have an integrated support system in terms of scope, access and efficiency often mean that they can monitor and handle moral hazards and risk efficiency. This boosts trust and makes it easier to provide more financing to households. Wildauer and Stockhammer (2018) noted that the relationship between household borrowing and credit deregulation is statistically important.

Conclusion

The objective of this study is to conduct a systematic literature review on the macroeconomic determinants of household debt from the individual and cross-country perspectives. This study applied the ROSES review protocol which offers a thorough and systematic search on related existing articles, provides cross comparison on the studies conducted and outlines the limitations and suggestions for future research. Several research questions were posed in the first phase to fit into the method employed. The systematic search strategies were then categorised into identification, screening and eligibility during the second phase, detailing the criteria of suitable articles in line with this research. The final selection of articles was conducted in the third stage. Fourteen articles were selected through quality appraisal. This was followed by the final stage of the thematic process where data from selected articles were extracted and categorised into several themes. The identified themes are: 1) income, 2) interest rate, 3) inflation, 4) demographics, 5) consumption, 6) housing price, 7) financial sector, 8) employment and 9) income inequality. Through various analyses and specifications, the increase in housing price and the development of the financial sector are two main factors for rising household debt as compared to the other identified determinants. Therefore, several policy implications were created based on the output of the reviewed articles, highlighting the urgency to formulate, monitor and regulate monetary policies related to financial liberalisation and lax lending regulations. This study outlines the gaps and limitations identified from the reviewed articles which can be considered as a proposal for future studies to consider. These limitations consist of the household debt model which can be extended for future research to include interaction terms, non-linearity effect of house prices and the application of different estimation methods, such as income quintile.

Acknowledgments

This work is supported by the Universiti Teknologi MARA (UiTM) under Grant No. 600-RMC/GPM LPHD 5/3 (102/2022).

References

Ando, A., & Modigliani, F. (1963). The" life cycle" hypothesis of saving: Aggregate implications and tests. The American Economic Review, 53(1), 55-84.

Barnes, S., & Young, G. (2003). The rise in US household debt: assessing its causes and sustainability. Bank of England Working Paper No 206.

Becker, G. S. (1974). A theory of social interactions. Journal of Political Economy, 82(6), 1063-1093.

Borowski, J., Jaworski, K., & Olipra, J. (2019). Economic, institutional, and socio‐cultural determinants of consumer credit in the context of monetary integration. International Finance, 22(1), 86-102.

Braun, V., & Clarke, V. (2006). Using thematic analysis in psychology. Qualitative research in psychology, 3(2), 77-101.

Catherine, S. F. H., Jamaliah, M. Y., Aminah, M., & Arshad, A. (2016). Household Debt, Macroeconomic Fundamentals and Household Characteristics in Asian Developed and Developing Countries. The Social Sciences, 11, 4358-4362.

Coletta, M., De Bonis, R., & Piermattei, S. (2019). Household debt in OECD countries: The role of supply-side and demand-side factors. Social Indicators Research, 143(3), 1185-1217.

Debelle, G. (2004). Macroeconomic implications of rising household debt. BIS Quarterly Review, 3(153), 51-64. https://doi.org/10.2139/ssrn.786385

Englund, O., Berndes, G., & Cederberg, C. (2017). How to analyse ecosystem services in landscapes—A systematic review. Ecological Indicators, 73, 492-504.

Estoque, R. C., Togawa, T., Ooba, M., Gomi, K., Nakamura, S., Hijioka, Y., & Kameyama, Y. (2019). A review of quality of life (QOL) assessments and indicators: Towards a “QOL-Climate” assessment framework. Ambio, 48(6), 619-638.

Falagas, M. E., Pitsouni, E. I., Malietzis, G. A., & Pappas, G. (2008). Comparison of PubMed, Scopus, web of science, and Google scholar: strengths and weaknesses. The FASEB journal, 22(2), 338-342.

Fisher, I. (1933). The debt-deflation theory of great depressions. Econometrica: Journal of the Econometric Society, 337-357.

Flemming, K., Booth, A., Hannes, K., Cargo, M., & Noyes, J. (2018). Cochrane Qualitative and Implementation Methods Group guidance series—Paper 6: Reporting guidelines for qualitative, implementation, and process evaluation evidence syntheses. Journal of Clinical Epidemiology, 97, 79-85.

Friedman, M. (1957). A Theory of the Consumption Function. Princeton University Press.

Guerrieri, V., & Lorenzoni, G. (2017). Credit crises, precautionary savings, and the liquidity trap. The Quarterly Journal of Economics, 132(3), 1427-1467.

Gusenbauer, M., & Haddaway, N. R. (2020). Which academic search systems are suitable for systematic reviews or meta‐analyses? Evaluating retrieval qualities of Google Scholar, PubMed, and 26 other resources. Research synthesis methods, 11(2), 181-217.

Hamid, F. S., & Yunus, N. M. (2020). Bank-Lending Channel of Monetary Policy Transmission: Evidence from ASEAN. Global Business Review, 21(4), 892-905.

Higgins, J. P., Thomas, J., Chandler, J., Cumpston, M., Li, T., Page, M. J., & Welch, V. A. (Eds.). (2019). Cochrane handbook for systematic reviews of interventions. John Wiley & Sons.

Hill, A., & Spittlehouse, C. (2003). What is critical appraisal? Including: ten questions to help you make sense of a systematic review. Hayward Medical Communications, 2001. www.evidence-basedmedicine.co.uk

Hook, A., Sovacool, B. K., & Sorrell, S. (2020). A systematic review of the energy and climate impacts of teleworking. Environmental Research Letters, 15(9), 093003.

Igan, D., & Tan, Z. (2017). Capital inflows, credit growth, and financial systems. Emerging Markets Finance and Trade, 53(12), 2649-2671.

IMF. (2017). Household Debt and Financial Stability. In Global Financial Stability Report, October.

Jurgilevich, A., Räsänen, A., Groundstroem, F., & Juhola, S. (2017). A systematic review of dynamics in climate risk and vulnerability assessments. Environmental Research Letters, 12(1), 013002.

Khan, H. H., Abdullah, H., & Samsudin, S. (2016). Modelling the determinants of Malaysian household debt. International Journal of Economics and Financial Issues, 6(4), 1468-1473.

Kim, H. J., Lee, D., Son, J. C., & Son, M. K. (2014). Household indebtedness in Korea: Its causes and sustainability. Japan and the World Economy, 29, 59-76.

Kitchenham, B., & Charters, S. (2007). Guidelines for performing systematic literature reviews in software engineering.

Kraus, S., Breier, M., & Dasí-Rodríguez, S. (2020). The art of crafting a systematic literature review in entrepreneurship research. International Entrepreneurship and Management Journal, 16(3), 1023-1042.

Kumhof, M., & Rancière, R. (2011). Leveraging inequality. International Journal of Labour Research, 3(2), 189.

Kusairi, S., Muhamad, S., Musdholifah, M., & Chang, S. C. (2019). Labor market and household debt in asia Pacific countries: dynamic heterogeneous panel data analysis. Journal of International Commerce, Economics and Policy, 10(02), 1950011.

Martín-Martín, A., Orduna-Malea, E., Thelwall, M., & Delgado López-Cózar, E. (2018). Google Scholar, Web of Science, and Scopus: A systematic comparison of citations in 252 subject categories. Journal of Informetrics, 12(4), 1160-1177.

Mazibaş, M., & Tuna, Y. (2017). Understanding the Recent Growth in Consumer Loans and Credit Cards in Emerging Markets: Evidence from Turkey. Emerging Markets Finance and Trade, 53(10), 2333-2346.

Mian, A., & Sufi, A. (2009). The consequences of mortgage credit expansion: Evidence from the US mortgage default crisis. The Quarterly Journal of Economics, 124(4), 1449-1496.

Modigliani, F., & Brumberg, R. (1954). Utility analysis and the consumption function: An interpretation of cross-section data. Franco Modigliani, 1(1), 388-436.

Moher, D., Liberati, A., Tetzlaff, J., Altman, D. G., & Prisma Group. (2009). Preferred reporting items for systematic reviews and meta-analyses: the PRISMA statement. PLoS medicine, 6(7), e1000097.

Moore, G. L., & Stockhammer, E. (2018). The drivers of household indebtedness reconsidered: An empirical evaluation of competing arguments on the macroeconomic determinants of household indebtedness in OECD countries. Journal of Post Keynesian Economics, 41(4), 547-577.

Okoli, C. (2015). A guide to conducting a standalone systematic literature review. Communications of the Association for Information Systems, 37(1), 43.

Park, J., & Lee, Y. (2019). Corporate income taxes, corporate debt, and household debt. International Tax and Public Finance, 26(3), 506-535.

Petticrew, M., & Roberts, H. (2006). Systematic reviews in the social sciences: A practical guide. John Wiley & Sons.

Rashid, M. A. A., Sarmidi, T., Nor, A. H. S. M., & Noor, N. G. M. (2017). Does Income Gap Matter for Household Debt Accumulation?.Accumulation? Institutions and Economies, 9(1), 1-19.

Runting, R. K., Bryan, B. A., Dee, L. E., Maseyk, F. J. F., Mandle, L., Hamel, P., Wilson, K. A., Yetka, K., Possingham, H. P., & Rhodes, J. R. (2017). Incorporating climate change into ecosystem service assessments and decisions: a review. Global Change Biology, 23(1), 28-41.

Samad, K. A., Daud, S. N. M., & Mohd Dali, N. R. S. (2020a). Determinants of household debt in emerging economies: A macro panel analysis. Cogent Business & Management, 7(1), 1831765.

Samad, K. A., Daud, S. N. M., & Mohd Dali, N. R. S. (2020b). Early warning indicators for systemic banking crises: Household debt and property prices. Jurnal Ekonomi Malaysia, 54(1), 121-134.

Shaffril, H. A. M., Ahmad, N., Samsuddin, S. F., Samah, A. A., & Hamdan, M. E. (2020). Systematic literature review on adaptation towards climate change impacts among indigenous people in the Asia Pacific regions. Journal of Cleaner Production, 258, 120595.

Slintáková, B., & Klazar, S. (2018). Does the tax relief for homeownership have effect on household mortgage leverage? Economics and Management.

Svirydzenka, K. (2016). Introducing a new broad-based index of financial development. International Monetary Fund.

Tudela, M., & Young, G. (2005). The determinants of household debt and balance sheets in the United Kingdom. Bank of England Working Paper Series No. 266

Vaismoradi, M., Turunen, H., & Bondas, T. (2013). Content analysis and thematic analysis: Implications for conducting a qualitative descriptive study. Nursing & health sciences, 15(3), 398-405.

Wildauer, R., & Stockhammer, E. (2018). Expenditure cascades, low interest Rates, credit deregulation or property booms? Determinants of household debt in OECD countries. Review of Behavioral Economics, 5(2).

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

18 August 2023

Article Doi

eBook ISBN

978-1-80296-963-4

Publisher

European Publisher

Volume

1

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1050

Subjects

Multi-disciplinary, Accounting, Finance, Economics, Business Management, Marketing, Entrepreneurship, Social Studies

Cite this article as:

Abd Samad, K., Idris, N. H., Abd Rahman, N. H., Abdullah Sani, A., & Mohd Soffian Lee, U. H. (2023). Systematic Literature Review on the Macroeconomic Factors of Household Debt. In A. H. Jaaffar, S. Buniamin, N. R. A. Rahman, N. S. Othman, N. Mohammad, S. Kasavan, N. E. A. B. Mohamad, Z. M. Saad, F. A. Ghani, & N. I. N. Redzuan (Eds.), Accelerating Transformation towards Sustainable and Resilient Business: Lessons Learned from the COVID-19 Crisis, vol 1. European Proceedings of Finance and Economics (pp. 207-223). European Publisher. https://doi.org/10.15405/epfe.23081.18